Quick Navigation

Overview

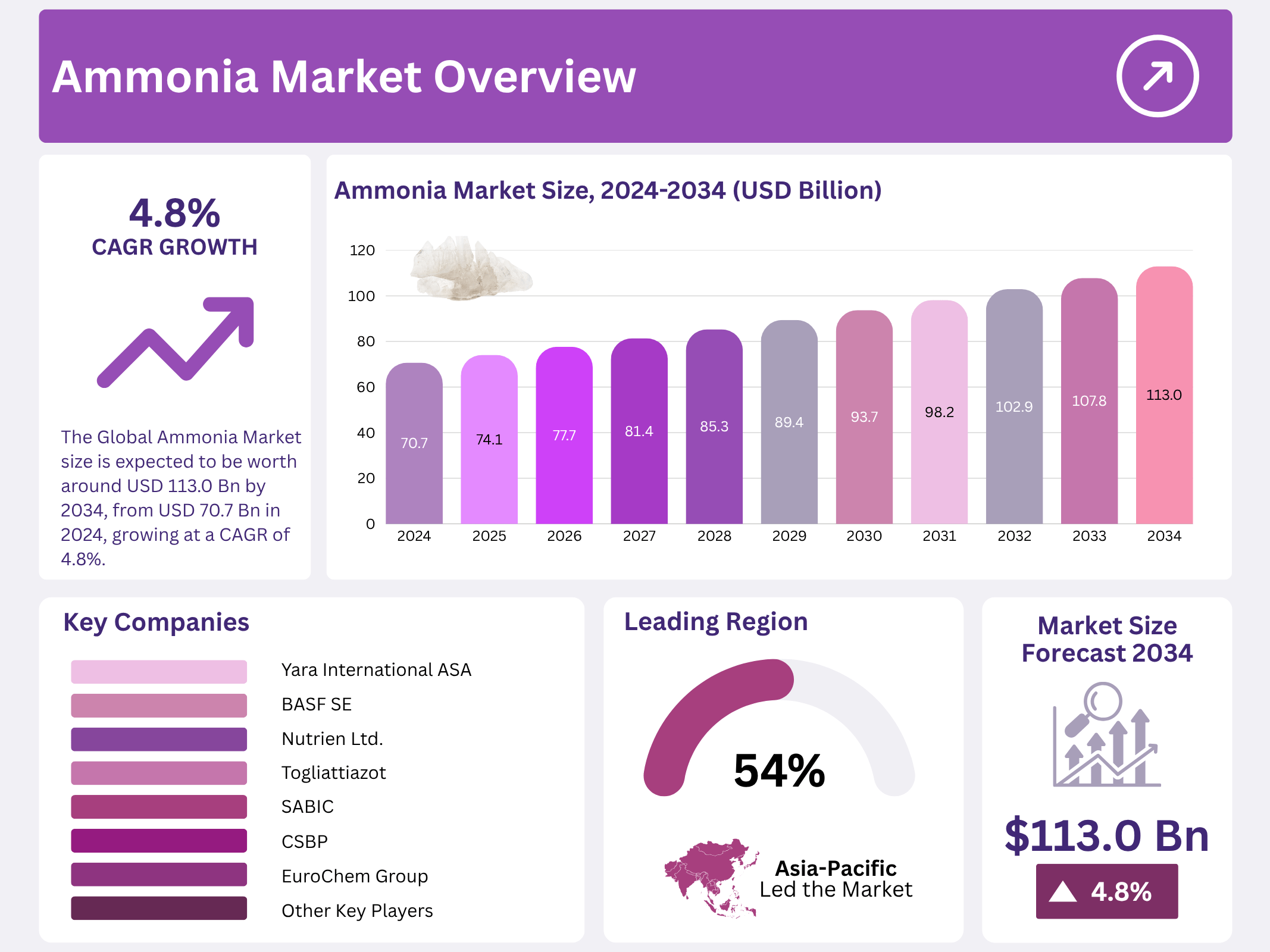

New York, NY – October 08, 2025 – The Global Ammonia Market is projected to reach USD 113.0 billion by 2034, growing from USD 70.7 billion in 2024, at a CAGR of 4.8% (2025–2034). The Asia-Pacific region dominated the market with a 54.2% share in 2024, generating around USD 38.3 billion in revenue.

Ammonia (NH₃) remains a cornerstone of the global chemical industry, primarily used as a key nitrogen source in fertilizers, which account for nearly 80% of its total consumption. Rising global food demand and the need for higher agricultural productivity are major growth drivers, supported by government initiatives promoting sustainable and high-yield farming practices. Beyond agriculture, ammonia is increasingly recognized for its clean energy potential, particularly as a hydrogen carrier in low-carbon fuel applications. Governments and private companies have committed over USD 50 billion toward green ammonia projects, which utilize renewable-powered electrolysis to eliminate carbon emissions.

Industrially, ammonia is integral to plastics, textiles, pharmaceuticals, and explosives manufacturing, ensuring consistent demand. Meanwhile, the maritime industry is advancing ammonia as a zero-carbon marine fuel, reinforcing its strategic role in global decarbonization. Advances in ammonia cracking and hydrogen conversion technologies are accelerating its energy transition potential. With China accounting for nearly 30% of global production, and expanding applications across fertilizers, chemicals, and energy, the ammonia market is poised for sustained long-term growth driven by sustainability and innovation.

Key Takeaways

- The Global Ammonia Market size is expected to be worth around USD 113.0 billion by 2034, from USD 70.7 billion in 2024, growing at a CAGR of 4.8%.

- Anhydrous ammonia held a dominant market position, capturing more than 64.5% share of the ammonia market.

- Grey/Brown ammonia held a dominant market position, capturing more than 72.2% of the overall market share.

- Natural Gas held a dominant market position, capturing more than a 65.5% share of the ammonia market.

- Fertilizers held a dominant market position, capturing more than a 53.4% share of the ammonia market.

- APAC held a commanding share of 54.2%, valued at approximately USD 38.3 billion.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 70.7 Billion |

| Forecast Revenue (2034) | USD 113.0 Billion |

| CAGR (2025-2034) | 4.8% |

| Segments Covered | By Form (Aqueous, Anhydrous), By Type (Grey/Brown, Blue, Green, Turquoise), By Feedstock (Natural Gas, Coal, Oil, Hydrogen, Others), By Application(Fertilizers, Refrigerants, Transportation, Textile, Power Generation, Others) |

| Competitive Landscape | Yara International ASA, CF Industries Holdings, Inc., BASF SE, Nutrien Ltd., QATAR FERTILISER COMPANY, Togliattiazot, SABIC, Sumitomo Chemical Co., Ltd., CSBP, EuroChem Group, Group DF, ThyssenKrupp AG, Nel Hydrogen, Sinopec, Rashtriya Chemicals and Fertilizers Limited, Siemens AG, Other Key Players |

Key Market Segments

By Form

In 2024, Anhydrous Ammonia led the ammonia market, securing over 64.5% of the market share. Its dominance stems from extensive use in agriculture, particularly for fertilizer production, due to its high nitrogen content, which boosts soil productivity. The rising demand for agricultural products continues to drive this segment’s growth. Aqueous Ammonia, while holding a smaller share, is gaining traction in industrial applications such as water treatment, refrigeration, and chemical processes. Its growth is fueled by stricter environmental regulations and the shift toward sustainable industrial practices.

By Type

Grey/Brown Ammonia dominated in 2024, capturing over 72.2% of the market. Widely used in agriculture and manufacturing as a refrigerant and fertilizer, its cost-effectiveness, derived from fossil fuel-based production, sustains its market lead. Blue Ammonia is poised for significant growth, driven by carbon capture and storage (CCS) technologies, aligning with global efforts to reduce carbon emissions. Though a smaller segment in 2024, its market share is expected to expand with increasing environmental regulations.

Green Ammonia, produced using renewable energy sources like wind or solar for hydrogen production, remains in early commercialization but is gaining attention as a sustainable alternative. Its market share is limited in 2024, but is expected to grow. Turquoise Ammonia, produced via methane pyrolysis, is an emerging option with lower carbon emissions. Still in the R&D phase, it shows potential as a cleaner alternative to Grey/Brown ammonia.

By Feedstock

Natural Gas held a commanding 65.5% share of the ammonia market in 2024, favored for its efficiency and lower carbon footprint in the Haber-Bosch process. Its role in fertilizer production and other ammonia-based products supports its continued growth, driven by global agricultural expansion. Coal maintains a smaller, steady share, primarily in regions with limited or costly natural gas access.

However, its use is declining as industries shift toward more sustainable feedstocks. Oil plays a minor role in ammonia production, with its share continuing to decrease in 2024 due to the growing preference for natural gas and hydrogen-based methods. Hydrogen is an emerging feedstock, with growth expected as clean production methods gain traction in response to sustainability demands.

By Application

Fertilizers dominated the ammonia market in 2024, accounting for over 53.4% of the market share. As a critical component of nitrogen-based fertilizers, ammonia supports global food production amid rising population and agricultural needs.

Refrigerants represent a growing segment, driven by ammonia’s use in industrial refrigeration systems. Its low environmental impact compared to synthetic refrigerants supports its increasing adoption in 2024.

Transportation holds a smaller but expanding share, with ammonia used as an alternative fuel in compressed or liquid form. Growth is expected in 2024 and 2025, driven by demand for sustainable fuel options, though its share remains limited.

Textiles, utilizing ammonia in dyeing processes, maintain a modest market share with steady growth projected for 2024, supported by rising global textile demand and a focus on efficient, sustainable production.

Regional Analysis

In 2024, the Asia Pacific region led the global ammonia market, capturing a 54.2% share, valued at approximately USD 38.3 billion. This dominance is driven by high demand for ammonia-based nitrogen fertilizers in agriculture, particularly in major producers like China, India, and Japan. The region’s need to support growing food production fuels its significant market presence.

Europe accounts for about 20% of global ammonia consumption in 2024. The region’s market is bolstered by stringent environmental regulations, encouraging the adoption of cleaner technologies like green ammonia. The European Union’s Green Deal and sustainability initiatives are expected to drive innovation and increase low-carbon ammonia adoption in the coming years.

North America holds a 15% share of the global ammonia market in 2024, with the United States as a key contributor. Demand for fertilizers and industrial chemicals drives production, while growing investments in sustainable ammonia production, supported by government incentives for clean energy, are shaping the region’s market growth.

MEA and Latin America represent smaller shares of the global ammonia market, focusing on industrial applications such as refrigeration and power generation. These regions are expected to experience gradual growth, driven by increasing industrialization and agricultural demands.

Top Use Cases

- Agriculture: Ammonia serves as a key ingredient in nitrogen fertilizers that boost crop yields and support food production worldwide. Farmers apply it to enrich soil with essential nutrients, helping plants grow stronger and faster to meet rising global food demands. This use drives agricultural efficiency and sustainability efforts in modern farming practices.

- Refrigeration: In industrial cooling systems, ammonia acts as an effective natural refrigerant for preserving food in warehouses and processing plants. Its high efficiency and low environmental impact make it ideal for large-scale operations like cold storage, reducing reliance on harmful synthetic alternatives while maintaining safe temperatures.

- Fuel for Shipping: Ammonia emerges as a clean fuel option for maritime vessels, enabling ships to operate with lower emissions and support decarbonization goals. Its carbon-free burning properties help the shipping industry transition from fossil fuels, promising a greener future for global trade and transportation logistics.

- Power Generation: Ammonia can be used in power plants as a hydrogen carrier to generate electricity without carbon emissions, aiding the shift to renewable energy sources. This application stores and releases energy efficiently, contributing to stable grids and reducing dependence on traditional fuels in the energy sector.

- Industrial Chemicals: Ammonia is vital for producing plastics, explosives, and synthetic fibers used in manufacturing everyday products. It acts as a building block in chemical processes, enabling the creation of materials for construction, textiles, and more, while fostering innovation in various industrial applications.

Recent Developments

1. Yara International ASA

Yara is actively developing clean ammonia projects to decarbonize shipping and agriculture. A key initiative is the clean ammonia project at its Sluiskil facility in the Netherlands, focusing on carbon capture and storage (CCS). The company is also a leading participant in the FIRST project at the port of Antwerp-Bruges, creating an open-access logistics hub for the import and distribution of renewable ammonia to European markets.

2. CF Industries Holdings, Inc.

CF Industries is executing a major decarbonization strategy by establishing a blue ammonia capacity. Its flagship project at the Donaldsonville Complex in Louisiana involves a CO₂ capture and sequestration system that will significantly reduce emissions. The company has also signed multiple MOUs to supply blue ammonia to partners in South Korea and Japan, positioning itself as a key future supplier of low-carbon energy and fertilizer to the global market.

3. BASF SE

BASF is pioneering the use of green ammonia as a carbon-free hydrogen source for its Verbund site in Ludwigshafen, Germany. The company is part of the “HySCALE100” project, aiming to demonstrate large-scale ammonia cracking technology to efficiently release hydrogen. This development is crucial for BASF’s strategy to replace fossil-based feedstocks with renewable alternatives in its chemical production processes, reducing the carbon footprint of its operations.

4. Nutrien Ltd.

Nutrien is advancing its role in the low-carbon economy by exploring the production of both blue and green ammonia at its Geismar, Louisiana, facility. The company aims to build the world’s largest clean ammonia facility, leveraging its ammonia production expertise and access to low-cost natural gas. This project is designed to supply clean ammonia for agriculture and emerging energy markets, including as a marine fuel and a hydrogen carrier.

5. QATAR FERTILISER COMPANY (QAFCO)

QAFCO continues to strengthen its position as one of the world’s largest single-site urea and ammonia producers. A key recent development is the successful start-up and ramp-up of its QAFCO 6 mega-train, which significantly increases its total production capacity for both ammonia and urea. This expansion consolidates Qatar’s status as a leading global fertilizer exporter and enhances supply security for its international customers.

Conclusion

Ammonia plays a central role in bridging the agriculture and energy sectors, powering sustainable food production through fertilizers while emerging as a clean fuel and energy carrier. As industries prioritize low-emission solutions, their versatile applications drive market evolution toward greener practices, fostering innovation and resilience in global supply chains.