Quick Navigation

Introduction

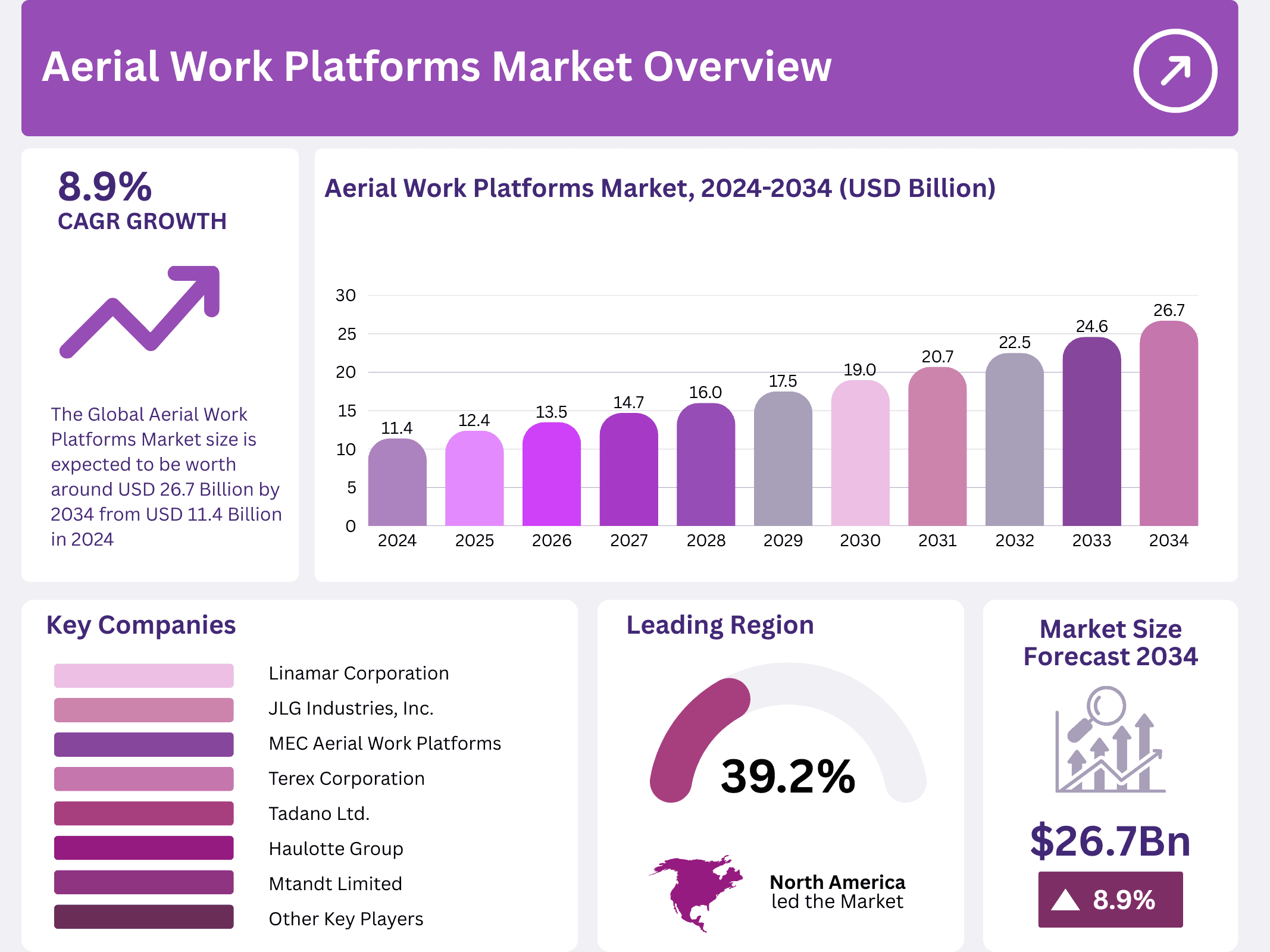

The Global Aerial Work Platforms Market demonstrates remarkable expansion, projecting growth from USD 11.4 billion in 2024 to USD 26.7 billion by 2034. This trajectory represents a compound annual growth rate of 8.9% throughout the forecast period. Consequently, the industry establishes itself as a cornerstone of modern construction and industrial operations.

Aerial Work Platforms revolutionize workplace accessibility by delivering safe, efficient solutions for elevated operations. Moreover, these sophisticated mechanical devices eliminate traditional scaffolding limitations while enhancing operational productivity. Industries spanning construction, manufacturing, maintenance, and warehousing increasingly depend on these platforms. Subsequently, market demand continues accelerating across global regions.

Technological innovation drives transformation throughout the sector, particularly regarding electrification and automation capabilities. Furthermore, stringent workplace safety regulations mandate adoption of advanced lifting equipment across industries. Governments worldwide implement comprehensive safety standards, compelling organizations to modernize their equipment fleets. Therefore, regulatory frameworks significantly influence purchasing decisions and market dynamics.

Infrastructure development initiatives amplify demand for aerial platforms globally, especially in emerging economies experiencing rapid urbanization. Additionally, rental service models gain prominence, enabling cost-efficient access to premium equipment without substantial capital investments. Market consolidation accelerates through strategic acquisitions, exemplified by United Rentals’ $4.8 billion acquisition of H&E Equipment Services. Consequently, industry leaders strengthen market positions while expanding service capabilities.

Environmental sustainability emerges as a critical differentiator, with electric and hybrid platforms capturing increasing market share. Moreover, telematics integration enables real-time fleet monitoring and predictive maintenance capabilities. The industry experiences paradigm shifts as operators prioritize energy efficiency alongside operational performance. Thus, manufacturers innovate continuously to meet evolving customer expectations and regulatory requirements.

Regional dynamics reveal significant variations, with North America commanding 39.2% market share valued at USD 4.4 billion in 2024. Similarly, Asia Pacific demonstrates robust growth potential driven by infrastructure investments and industrialization. European markets emphasize sustainability initiatives, accelerating electric platform adoption. Therefore, geographic considerations profoundly impact product development strategies and market penetration approaches.

Key Takeaways

- The global aerial work platforms market is projected to expand from USD 11.4 billion in 2024 to USD 26.7 billion by 2034, growing at a CAGR of 8.9% during the forecast period (2025-2034).

- Scissor Lifts hold the largest share in the market, accounting for 46.2% of the total market share in 2024.

- Internal Combustion Engine (ICE) Aerial Work Platforms dominate the propulsion segment with a 61.2% market share.

- Aerial work platforms with a lifting height of more than 51 ft lead the market, capturing 45.1% of the share.

- The construction sector is the largest end-user, holding 56.4% of the total market share in 2024.

- North America is projected to dominate the global aerial work platforms market, holding 39.2% of the total market share, with a regional market value of USD 4.4 billion in 2024.

Market Segmentation Overview

By Product

Scissor Lifts dominate product segmentation, commanding 46.2% market share through versatility and cost-effectiveness across applications. These platforms excel in construction, maintenance, and warehousing environments where stability proves essential. Electric scissor lift adoption accelerates due to emission regulations and sustainability mandates. Consequently, manufacturers prioritize innovation in battery technology and compact designs for indoor operations.

Boom Lifts secure substantial market position by addressing high-elevation and extended-reach requirements across industries. Their superior mobility and flexibility make them indispensable for construction, telecommunications, and utility applications. Hybrid and electric boom lift development intensifies, driven by environmental considerations and operational efficiency demands. Therefore, this segment experiences continuous technological advancement and market expansion opportunities.

By Propulsion

Internal Combustion Engine platforms maintain dominance with 61.2% market share, primarily serving outdoor and heavy-duty applications. Their superior load capacity and extended operational range suit construction, infrastructure maintenance, and shipbuilding operations. However, environmental pressures gradually influence purchasing preferences toward cleaner alternatives. Subsequently, manufacturers enhance ICE efficiency while developing hybrid solutions for transitional markets.

Electric platforms demonstrate remarkable growth momentum, capturing increasing market share through zero-emission capabilities and reduced noise levels. Battery technology improvements and charging infrastructure expansion accelerate adoption, particularly in urban and indoor environments. Consequently, electric platforms increasingly compete with traditional ICE models across diverse applications and operational contexts.

By Lifting Height

Platforms exceeding 51 ft lifting height dominate with 45.1% market share, serving large-scale infrastructure and industrial projects. Telecommunications, oil and gas, and utility sectors particularly depend on these high-reach solutions for elevated workspace access. Their critical role in complex operations ensures sustained demand despite premium pricing. Therefore, manufacturers focus on enhancing safety features and operational efficiency for extreme-height applications.

Medium-height platforms ranging 21-50 ft serve versatile indoor and outdoor operations across warehousing and facility management sectors. Their balanced reach and maneuverability optimize performance for moderate elevation tasks requiring frequent repositioning. Subsequently, this segment maintains steady demand across commercial and industrial applications seeking operational flexibility.

By Application

Construction applications command 56.4% market share, driven by global infrastructure development and commercial building projects worldwide. Platform adoption enhances worker safety, operational efficiency, and accessibility during high-altitude construction tasks. Growing urbanization and infrastructure investments sustain robust demand throughout this dominant application segment. Consequently, construction remains the primary market driver influencing product development priorities.

Utilities sector adoption accelerates through increasing requirements for aerial access to power distribution, telecommunications infrastructure, and maintenance operations. These platforms ensure operational efficiency and worker safety when servicing overhead power lines, wind turbines, and utility infrastructure. Therefore, utility applications represent critical growth opportunities as renewable energy infrastructure expands globally.

Drivers

Urbanization and Infrastructure Development

Rapid urbanization fundamentally transforms global infrastructure requirements, creating unprecedented demand for aerial work platforms across residential, commercial, and public construction projects. Urban expansion necessitates sophisticated lifting solutions providing safe, efficient elevated workspace access while enhancing overall productivity. Consequently, aerial platforms become indispensable tools throughout modern construction practices, supporting diverse applications from building maintenance to electrical installations.

Substantial infrastructure investments by governments and private entities worldwide amplify platform demand across transportation networks, energy facilities, and public utilities development. These complex projects require advanced lifting equipment capable of operating at considerable heights while maintaining stringent safety standards. Infrastructure development remains a strategic priority across numerous regions, ensuring sustained aerial platform demand throughout extended project lifecycles and supporting continuous market expansion.

Technological Advancement and Safety Regulations

Stringent workplace safety regulations drive widespread aerial platform adoption as organizations prioritize employee protection and regulatory compliance. Enhanced safety features, including telematics integration, IoT connectivity, and automated monitoring systems, transform operational capabilities while reducing accident risks. Subsequently, manufacturers invest heavily in technology development, creating intelligent platforms offering real-time performance tracking, predictive maintenance capabilities, and comprehensive fleet management solutions.

Environmental sustainability initiatives accelerate electric and hybrid platform development, addressing emission reduction targets and operational efficiency goals simultaneously. Advanced battery technologies, energy management systems, and reduced noise pollution align with corporate sustainability commitments and regulatory requirements. Therefore, technological innovation serves dual purposes: enhancing operational performance while satisfying increasingly demanding environmental standards across global markets.

Use Cases

Large-Scale Construction Projects

High-rise building construction demands sophisticated aerial platforms capable of reaching extreme elevations while maintaining operational stability and safety protocols. Boom lifts and high-reach scissor platforms enable workers to access difficult structural elements, perform installations, and conduct maintenance across towering facades. These platforms dramatically reduce project timelines by eliminating cumbersome scaffolding requirements while enhancing workforce productivity through improved accessibility and maneuverability.

Infrastructure megaprojects, including bridges, stadiums, and transportation hubs, require versatile lifting solutions accommodating diverse operational environments and challenging terrain conditions. Aerial platforms provide essential access for steel installation, concrete work, electrical systems, and finishing operations throughout complex construction phases. Consequently, project managers increasingly specify advanced platforms as standard equipment, recognizing their critical contribution to schedule adherence, safety performance, and overall project success.

Telecommunications and Utility Maintenance

Telecommunications infrastructure deployment and maintenance demand specialized aerial platforms capable of accessing elevated antennas, transmission equipment, and network installations safely and efficiently. These operations require platforms offering extended reach, precise positioning, and stable work environments at considerable heights. Boom lifts particularly excel in telecommunications applications, providing operators horizontal outreach and vertical elevation necessary for comprehensive equipment servicing and network expansion initiatives.

Utility companies depend on aerial platforms for power line maintenance, transformer servicing, and renewable energy infrastructure operations, including wind turbine inspections and repairs. These critical operations require reliable lifting equipment operating in challenging outdoor environments while maintaining stringent safety protocols. Therefore, utility sector adoption continues expanding as infrastructure modernization accelerates and renewable energy installations proliferate, creating sustained demand for specialized aerial access solutions.

Major Challenges

High Initial Investment Costs

Substantial capital requirements for aerial platform acquisition create significant barriers to adoption, particularly affecting small and medium-sized enterprises operating under constrained budgets. Initial purchase prices, combined with ongoing maintenance expenses, training requirements, and regulatory compliance costs, accumulate into considerable total ownership expenses. These financial challenges limit market accessibility, preventing numerous organizations from modernizing equipment fleets despite recognizing operational benefits and safety improvements.

Uncertain return on investment calculations further complicate purchasing decisions, especially for organizations undertaking irregular or short-duration projects requiring elevated access solutions. Alternative methods, including traditional scaffolding and ladder systems, remain attractive despite inferior safety profiles and reduced efficiency. Consequently, addressing these financial barriers requires innovative financing mechanisms, including flexible leasing arrangements, rental programs, and government subsidies encouraging equipment modernization while reducing financial risks for potential adopters.

Skilled Operator Shortage

The aerial platforms industry faces persistent challenges recruiting and retaining qualified operators possessing necessary technical skills, safety certifications, and operational experience. Advanced platform technologies, including sophisticated control systems, telematics integration, and automated features, demand comprehensive training programs ensuring safe, efficient equipment operation. However, workforce development initiatives struggle to maintain pace with industry expansion, creating operational bottlenecks and limiting equipment utilization across multiple sectors.

Regulatory requirements mandating operator certification and ongoing training further complicate workforce challenges, particularly in rapidly growing markets experiencing acute skilled labor shortages. Organizations must invest significantly in training programs, certification processes, and safety education initiatives, adding operational costs beyond initial equipment investments. Therefore, industry stakeholders increasingly emphasize operator training partnerships, certification standardization, and technology simplification efforts addressing workforce challenges while maintaining safety standards and operational excellence.

Business Opportunities

Emerging Markets Expansion

Rapid industrialization and infrastructure development throughout emerging economies create substantial growth opportunities for aerial platform manufacturers and rental service providers. Asia Pacific, Latin America, and Middle East regions demonstrate accelerating demand driven by urbanization initiatives, commercial construction projects, and industrial facility development. These markets present significant expansion potential as economic development accelerates and safety regulations strengthen, compelling organizations to adopt modern lifting equipment solutions.

Strategic market entry through localized manufacturing facilities, regional service centers, and rental networks enables companies to capture emerging market opportunities while addressing unique regional requirements. Establishing strong distributor partnerships, developing market-specific product configurations, and implementing competitive pricing strategies facilitate market penetration. Consequently, organizations prioritizing emerging market investments position themselves advantageously for long-term growth as these regions increasingly contribute to global market expansion and revenue generation.

Rental Service Model Growth

Equipment rental business models experience robust growth as organizations increasingly prefer flexible access over direct ownership, particularly for specialized or infrequently utilized platforms. Rental arrangements eliminate substantial capital investments while providing access to latest technologies, comprehensive maintenance services, and operational flexibility matching project-specific requirements. This trend particularly benefits small and medium enterprises, enabling competitive equipment access without financial burdens associated with ownership and ongoing maintenance responsibilities.

Technology integration enhances rental service value propositions through telematics-enabled fleet management, predictive maintenance capabilities, and comprehensive utilization tracking systems. These innovations optimize equipment availability, reduce downtime, and improve operational efficiency across rental fleets. Therefore, rental service providers investing in technology infrastructure, expanding equipment portfolios, and developing customer-centric service models capture significant market opportunities as rental preferences increasingly dominate across construction, maintenance, and industrial sectors globally.

Regional Analysis

North America Market Leadership

North America commands dominant market position with 39.2% share valued at USD 4.4 billion in 2024, driven by robust construction activity, stringent safety regulations, and advanced rental infrastructure. The United States and Canada demonstrate strong demand across commercial construction, residential development, and infrastructure modernization projects requiring sophisticated lifting solutions. Well-established rental ecosystems, high equipment replacement rates, and substantial capital investments sustain market growth throughout the region.

Strategic industry consolidation, exemplified by United Rentals’ $4.8 billion acquisition of H&E Equipment Services, reinforces market leadership while enhancing operational efficiency and service capabilities. These consolidation trends create comprehensive service networks, expanded equipment portfolios, and improved customer access across diverse geographic markets. Therefore, North American market dynamics significantly influence global industry trends, technology development priorities, and business model innovations adopted throughout the aerial platforms sector worldwide.

Asia Pacific Growth Momentum

Asia Pacific emerges as the fastest-growing regional market, propelled by massive infrastructure investments, rapid urbanization, and expanding industrial sectors throughout China, India, and Southeast Asian nations. Government initiatives promoting smart city development, transportation infrastructure, and manufacturing facility expansion create substantial platform demand across multiple applications. Rising safety awareness, regulatory framework strengthening, and increasing equipment rental penetration further accelerate market adoption throughout the region.

The region’s expanding real estate development, coupled with growing construction activity in commercial and residential sectors, establishes sustained demand trajectories supporting long-term market growth. Local manufacturing capabilities, competitive pricing strategies, and product localization efforts enable effective market penetration while addressing unique regional requirements. Consequently, Asia Pacific represents critical growth opportunities as economic development accelerates and infrastructure investments intensify, positioning the region as an increasingly important contributor to global market expansion and revenue generation.

Recent Developments

- In March 13, 2025, Bell Textron Inc., a subsidiary of Textron Inc. (NYSE: TXT), revealed at VAI Verticon 2025 that it achieved a record number of aircraft orders in Latin America for FY2024. This marks the highest annual sales of Bell 429 helicopters in the region, highlighting the increasing demand for Bell’s advanced rotorcraft solutions.

- In March 2025, United Rentals, Inc. (NYSE: URI) and H&E Equipment Services, Inc. (NASDAQ: HEES) have entered into a definitive agreement for United Rentals to acquire H&E for $92 per share in cash. The transaction, valued at approximately $4.8 billion, includes H&E’s net debt of $1.4 billion, strengthening United Rentals’ market presence.

- In January 2, 2025, Tadano Ltd. successfully completed the acquisition of Manitex International, making Manitex a fully owned subsidiary. As a result, Manitex shares are no longer traded on Nasdaq. Tadano initially invested in Manitex in 2018 and expanded its ownership in September 2024 by acquiring the remaining shares.

- In May 8, 2024, Oshkosh Corporation (NYSE: OSK) announced a definitive agreement to acquire AUSACORP S.L. (AUSA), a global manufacturer of off-road equipment. The acquisition will integrate AUSA into Oshkosh’s Access segment, expanding its portfolio in construction, material handling, and specialty vehicle solutions.

Conclusion

The Global Aerial Work Platforms Market demonstrates exceptional growth potential, projecting expansion from USD 11.4 billion in 2024 to USD 26.7 billion by 2034 at 8.9% CAGR. Technological innovation, stringent safety regulations, and infrastructure development initiatives drive sustained market momentum across global regions. Electric and hybrid platform adoption accelerates, aligning with sustainability commitments while enhancing operational efficiency and reducing environmental impact.

Market dynamics reveal significant opportunities across emerging economies experiencing rapid industrialization, while established markets continue modernizing equipment fleets through strategic consolidation and technology integration. The rental business model gains prominence, democratizing access to advanced platforms while reducing capital investment barriers for organizations across all sizes. Therefore, the aerial work platforms industry positions itself for continued expansion, innovation, and transformation throughout the forecast period and beyond.