Quick Navigation

Overview

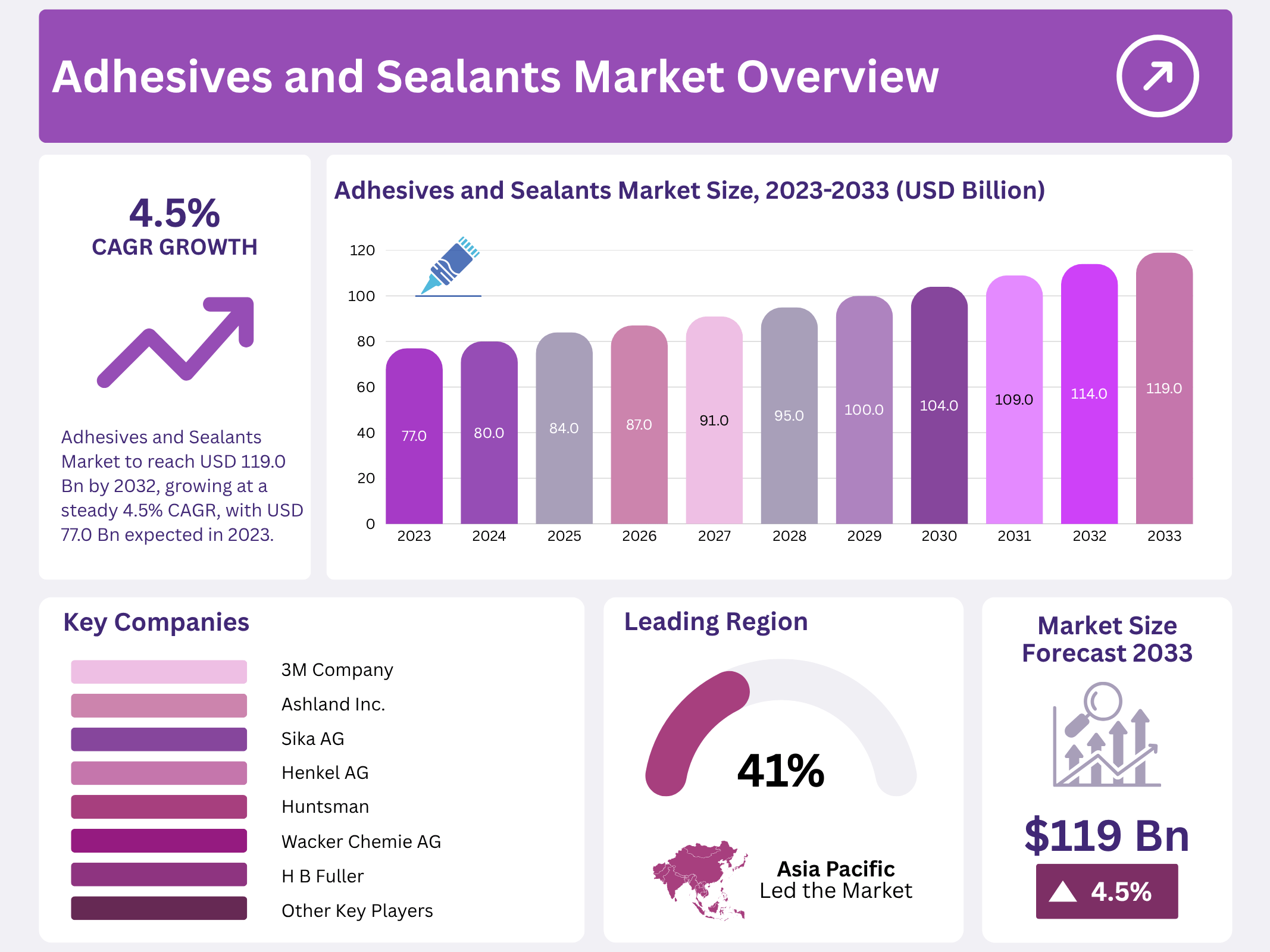

New York, NY – November 17, 2025 – The Global Adhesives And Sealants Market is projected to reach USD 119.0 billion by 2033, rising from USD 77.0 billion in 2023 and registering a steady 4.5% CAGR during 2023–2033. Adhesives and sealants remain essential materials across multiple industries, providing the foundational bonding and sealing functions that support product strength, durability, and long-term performance.

Their importance spans across major industrial sectors. In the automotive industry, adhesives support lightweight vehicle construction, improving overall fuel efficiency. In the construction sector, sealants ensure structural stability, prevent leakage, and enhance building lifespan. The electronics industry also relies heavily on these materials for precise component assembly and protection against moisture, dust, and other environmental impacts.

With rapid developments in automotive manufacturing, rising construction activities, and the growing complexity of electronic devices, the adhesives and sealants market continues to expand globally. Industry players are investing in advanced formulations and application technologies to meet changing customer expectations. Understanding these trends and innovations is crucial for stakeholders looking to navigate this increasingly dynamic market landscape.

Key Takeaways

- Market Size Projection: Adhesives and Sealants Market to reach USD 119.0 billion by 2032, growing at a steady 4.5% CAGR, with USD 77.0 billion expected in 2023.

- Dominant Product Type: In 2023, silicone led with over 35.6% market share. Acrylic, epoxy, polyurethanes, and specialized products also played vital roles.

- Leading Application: The Construction sector commands 35.7% market share. Packaging, automotive, consumers, and other applications contribute significantly to market dynamics.

- Regional Analysis: Asia Pacific led in 2023 with a 41.2% market share, driven by industrial development in China and India.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 77.0 Billion |

| Forecast Revenue (2033) | USD 119.0 Billion |

| CAGR (2024-2033) | 4.5% |

| Segments Covered | By Product (Silicone, Acrylic, Epoxy, Polyurethanes, and Other Products), By Application (Construction, Packaging, Consumers, Automotive, and Other Applications) |

| Competitive Landscape | 3M Company, Ashland Inc., Avery Dennison Corporation, H.B. Fuller, Henkel AG, Sika AG, Pidilite Industries, Huntsman, Wacker Chemie AG, RPM International Inc. |

Key Market Segments

Product Type Analysis

In 2023, the Adhesives and Sealants market was distinctly segmented by product type, with silicone leading the pack by securing over 35.6% of the market share. This dominance stems from silicone’s outstanding resistance to extreme temperatures, weathering, and chemicals, rendering it essential across construction, automotive, and electronics sectors. Its broad applicability in diverse environments solidified its top position.

The acrylic segment also achieved notable gains, driven by rapid curing times and robust bonding strength. These attributes make acrylic adhesives and sealants ideal for high-efficiency needs in packaging and assembly operations. Epoxy-based products maintained a strong foothold, valued for their superior strength and adhesion in high-stress applications within aerospace, marine, and automotive industries.

Polyurethanes captured a significant portion of the market, prized for their flexibility, durability, and moisture resistance. They are widely adopted in construction and automotive settings for creating resilient, long-term bonds in harsh conditions. The “Other Products” category showed encouraging growth, covering specialized adhesives and sealants for niche requirements. This segment is poised for increased innovation and diversification as industry demands evolve.

Application Analysis

In 2023, the adhesives and sealants market exhibited clear segmentation by application, with construction dominating at over 35.7% market share. This leadership reflects ongoing demand for adhesives and sealants in sealing, bonding, and insulation tasks, propelled by global infrastructure projects and urbanization. The packaging segment followed as a strong contender, where these materials ensure product integrity, security, and tamper resistance during transport and storage. Key contributions came from applications in food, pharmaceutical, and consumer goods packaging.

Geopolitical and Recession Impact Analysis

The adhesives and sealants market is highly sensitive to geopolitical shifts and economic cycles, with interconnected risks and opportunities shaping its trajectory. Geopolitical factors—including trade policies, tariffs, sanctions, and shifting alliances—directly influence supply chains, raw material costs, and market access. Recent trade disputes and regional tensions have introduced volatility, disrupting global sourcing and prompting price fluctuations.

Economic recessions further complicate the landscape. Downturns typically curb construction activity—a core demand driver—while reduced consumer and industrial spending dampens growth in automotive, packaging, and electronics. However, adhesives and sealants demonstrate notable resilience. Cost-conscious manufacturers increasingly favor these materials over mechanical fasteners, accelerating adoption during budget constraints. Additionally, the ongoing push for lightweighting in automotive and aerospace remains a recession-resistant growth engine.

To navigate these challenges, industry leaders should diversify supply chains and customer portfolios across regions and sectors, invest in R&D for cost-efficient and sustainable formulations, and leverage digital tools for risk forecasting. While geopolitical and recessionary pressures pose undeniable risks, the market’s adaptability—through innovation and strategic flexibility—can transform obstacles into competitive advantages.

Regional Analysis

In 2023, the global adhesives and sealants market revealed stark regional segmentation, with Asia Pacific commanding the lead at 41.2% market share, generating USD 31.5 billion in revenue. This dominance is fueled by rapid industrialization in China, India, and Southeast Asia, where surging construction, automotive, electronics, and packaging sectors drive explosive demand.

Infrastructure megaprojects, urban expansion, and rising disposable incomes further amplify growth, positioning APAC as the market’s growth engine through the forecast period. Europe maintained a robust presence, propelled by stringent environmental regulations and a strong shift toward eco-friendly, low-VOC formulations. Sustainability mandates and consumer preference for green building materials bolstered adoption in construction and automotive applications.

North America secured a significant share, anchored by its leadership in aerospace, automotive, and high-performance manufacturing. Demand for advanced adhesives enabling lightweighting, fuel efficiency, and structural integrity remains a key growth pillar. Latin America exhibited steady expansion, driven by recovering construction and automotive industries, particularly in Brazil and Mexico. Meanwhile, the Middle East and Africa emerged as a high-potential region, with infrastructure investments and oil & gas projects spurring demand for durable, high-temperature sealants.

Top Use Cases

- Construction Bonding and Sealing: In building projects, adhesives and sealants hold together walls, floors, and roofs while filling gaps to block water and air leaks. They boost energy savings by improving insulation and make structures last longer against weather wear, helping builders create safer, more comfortable homes and offices with less hassle.

- Automotive Assembly and Lightweighting: Car makers use these materials to join metal, plastic, and composite parts, cutting down on heavy fasteners for lighter vehicles that save fuel. Sealants protect against vibrations and road chemicals, ensuring rides stay smooth and safe, while speeding up production lines for faster, greener cars.

- Electronics Protection and Miniaturization: Tiny devices like phones and laptops rely on adhesives to secure delicate circuits and screens without bulky screws. Sealants shield against dust, moisture, and heat, keeping gadgets running reliably in harsh spots. This helps pack more features into slim designs, making tech tougher and more user-friendly.

- Packaging Security and Sustainability: For boxes, labels, and wraps in food and shipping, adhesives ensure items stay sealed during travel, preventing spills or damage. Eco-friendly versions support recyclable materials, cutting waste while holding strong bonds. This keeps products fresh and secure, supporting busy e-commerce and retail needs.

- Aerospace Structural Integrity: Aircraft builders apply high-strength adhesives to fuse wings, fuselages, and interiors, reducing weight for better fuel use. Sealants guard against extreme cold, heat, and pressure changes, preventing failures mid-flight. These bonds enhance safety and performance, allowing planes to soar farther with less maintenance.

Recent Developments

1. 3M Company

3M continues to advance its adhesive technologies with a strong focus on sustainability and digitalization. A key development is the launch of new recyclable packaging tapes and labels designed for the circular economy, helping e-commerce and logistics customers reduce waste. Additionally, 3M is leveraging its digital platform to provide customers with enhanced tools for product selection and application guidance, improving efficiency and performance for industrial users.

2. Ashland Inc.

Ashland is focusing on bio-based and high-performance innovations. A significant recent development is the expansion of its Santolite MHP-U ultra-low VOC resin product line, which provides durable solutions for non-woven and construction applications while meeting stringent environmental regulations. They are also emphasizing sustainable sourcing and developing sealant technologies for the electric vehicle battery market, aligning with industry trends towards cleaner transportation and reduced environmental impact.

3. Avery Dennison Corporation

Avery Dennison’s recent developments are centered on smart labels and sustainable adhesives. The company is expanding its portfolio of AD Circular rPET and paper face stock products, which incorporate recycled content. Furthermore, they are driving innovation in RFID and functional adhesives that enable supply chain transparency and new customer experiences. These developments support brand owners in achieving their sustainability goals and enhancing operational efficiency through digital identification.

4. H.B. Fuller

H.B. Fuller has been actively expanding its capabilities in high-growth sectors like electronics and electric vehicles. A key move was the acquisition of Apollo, a manufacturer of industrial adhesives for the flexible packaging and hygiene markets in Europe. This strengthens their global footprint and product portfolio. Concurrently, they are launching new sustainable adhesive platforms, such as those with bio-based content, to help customers improve the recyclability of their products.

5. Henkel AG

Henkel is aggressively driving its sustainability agenda and innovation in key markets. The company launched its new Loctite HT 1000 series, a high-temperature silicone gap filler for EV battery thermal management. Simultaneously, Henkel is committed to making all its packaging reusable or recyclable and is increasing the proportion of renewable carbon in its consumer brands, significantly advancing the circular economy for adhesives and sealants.

Conclusion

The Adhesives and Sealants sector is a vital force in modern industry, quietly powering everything from sturdy homes to speedy vehicles and smart gadgets. Its real strength lies in smart shifts toward green, high-performing options that match rising calls for eco-friendly building and efficient manufacturing. With steady pushes in key areas like urban growth and online shopping, this field promises ongoing vitality, blending tough reliability with fresh innovations to meet tomorrow’s demands head-on.