Quick Navigation

Introduction

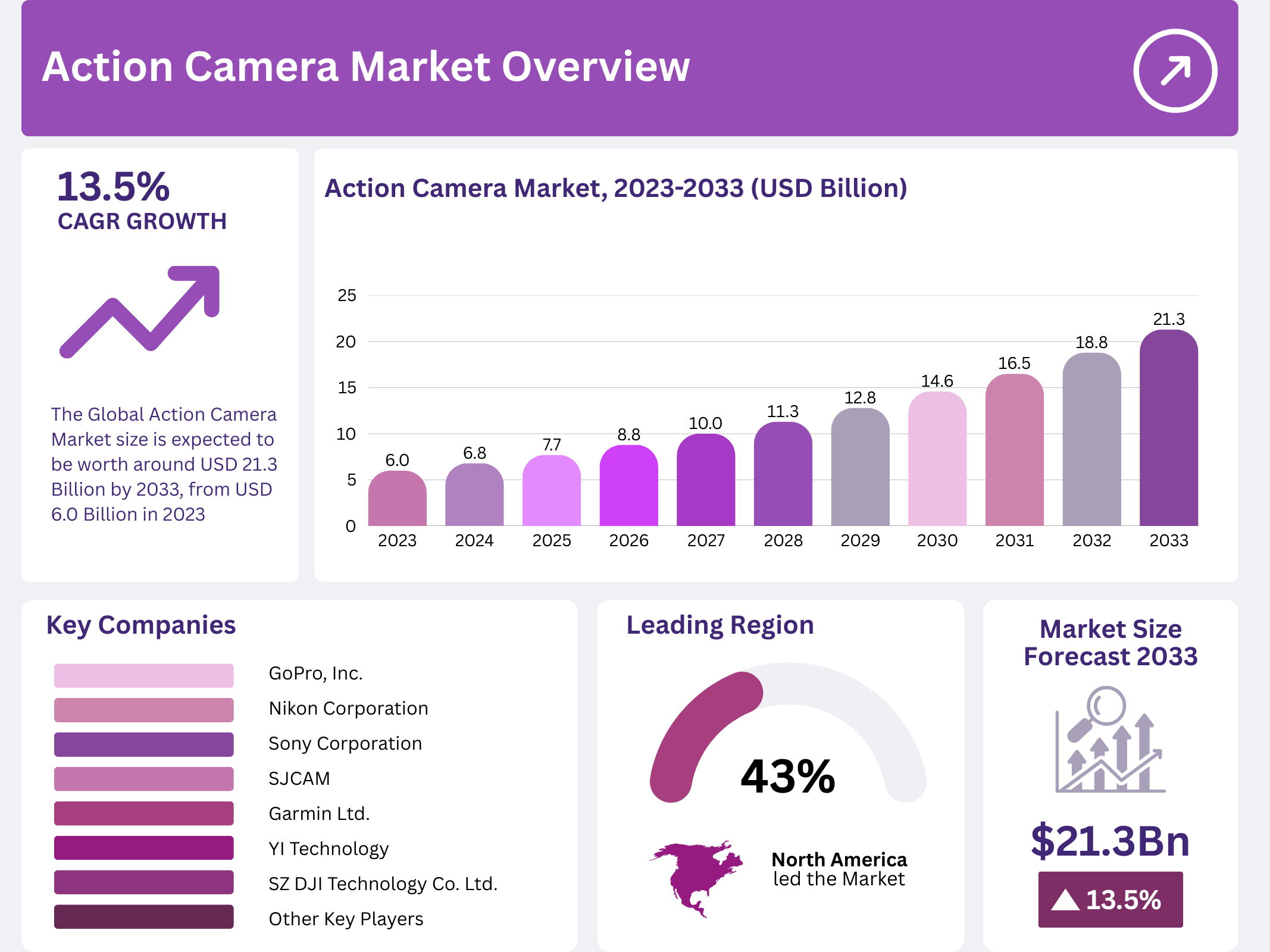

The global action camera market demonstrates remarkable momentum, projected to surge from USD 6.0 billion in 2023 to USD 21.3 billion by 2033. Furthermore, this expansion reflects a robust compound annual growth rate of 13.5% throughout the forecast period. Consequently, industry stakeholders are witnessing unprecedented opportunities as consumer demand intensifies across multiple segments.

Action cameras represent specialized compact devices engineered to capture premium video content during extreme activities. Moreover, these robust instruments have revolutionized how enthusiasts document their adventures, sporting achievements, and travel experiences. Additionally, their waterproof construction and versatile mounting capabilities distinguish them from conventional cameras in demanding environments.

Driving this market expansion, adventure sports participation continues gaining traction globally. Similarly, the outdoor recreation industry has experienced significant growth, with 168.1 million Americans engaging in such activities during 2022. Therefore, consumers increasingly seek reliable equipment to document and share their experiences across digital platforms and social media channels.

Technology advancement plays a pivotal role in market evolution. Notably, ultra-high-definition capabilities and 360-degree recording features have transformed content creation standards. Meanwhile, leading manufacturers like GoPro continue introducing innovative models equipped with HDR support and vertical video optimization for enhanced social media integration.

Competition intensifies as established players face emerging brands offering cost-effective alternatives. Nevertheless, market leaders maintain dominance through superior technology, brand recognition, and comprehensive accessory ecosystems. Subsequently, this dynamic landscape creates both challenges and opportunities for manufacturers targeting diverse consumer segments worldwide.

Regional variations significantly influence market dynamics. Specifically, North America commands 43% market share, generating USD 2.58 billion in revenue. Conversely, emerging markets in Asia-Pacific and Latin America present substantial untapped potential as rising incomes fuel consumer spending on recreational technology and adventure equipment.

Key Takeaways

- The Action Camera Market was valued at USD 6.0 billion in 2023, expected to reach USD 21.3 billion by 2033, with a CAGR of 13.5%

- Ultra HD resolution dominated in 2023, showing high growth due to demand for high-quality and immersive recording experiences

- Retail was the largest distribution channel in 2023, reflecting consumer preference for hands-on product testing before purchasing

- Sports applications led with the largest market share in 2023, highlighting demand for durable and high-performance recording equipment

- North America held 43% market share, generating USD 2.58 billion, supported by advanced technology adoption and outdoor activity trends

Market Segmentation Overview

Ultra HD resolution cameras dominate the market landscape, capturing substantial share through superior video quality. Indeed, these 4K-capable devices deliver four times the resolution of Full HD models, attracting professional videographers. Consequently, consumers prioritize exceptional clarity and detail for creating engaging, immersive content across digital platforms.

Retail distribution channels command the largest market share through direct customer engagement opportunities. Essentially, physical stores enable consumers to examine products firsthand before purchasing decisions. Additionally, knowledgeable staff and in-store demonstrations reinforce consumer confidence, maintaining retail relevance despite digital marketplace expansion.

Sports applications dominate usage scenarios, accounting for the largest application segment share. Specifically, action cameras excel at capturing high-motion activities including surfing, skiing, and mountain biking. Moreover, their robust construction and advanced features like motion sensors make them indispensable for professional sports filming.

Drivers

Increasing Popularity of Adventure Sports: Adventure sports participation continues escalating worldwide, fundamentally driving action camera demand. Activities such as skiing, surfing, and mountain biking require durable, portable cameras capable of capturing immersive footage. According to outdoor recreation statistics, participation grew 2.3% in 2022, demonstrating sustained interest. Furthermore, adventure tourism growth directly correlates with action camera adoption, as travelers desire professional-quality documentation of their journeys.

Growth in Content Creation and Vlogging: The vlogging and content creation industry significantly impacts action camera market expansion. Influencers and digital creators increasingly rely on action cameras for their versatility and exceptional video output quality. These devices have become essential tools for producing engaging content that resonates with audiences across YouTube, Instagram, and TikTok platforms.

Use Cases

Professional Sports Documentation: Action cameras serve critical roles in professional sports filming and training analysis applications. Coaches and athletes utilize these devices to capture detailed footage of performances, enabling comprehensive technique evaluation and improvement. The cameras’ high frame rates and motion sensors make them ideal for analyzing fast-paced movements in sports like snowboarding, skateboarding, and competitive cycling.

Travel and Adventure Documentation: Travelers and adventure enthusiasts extensively employ action cameras to chronicle their experiences across diverse destinations. These compact devices enable hands-free recording during activities such as hiking, scuba diving, and paragliding, capturing moments that traditional cameras cannot. The waterproof and shockproof characteristics ensure functionality in challenging environments, from underwater coral reefs to mountain peaks.

Major Challenges

Smartphone Competition: Modern smartphones equipped with advanced camera systems present formidable competition to action camera manufacturers. Contemporary mobile devices feature high-resolution sensors, sophisticated image stabilization, and comprehensive editing capabilities that rival dedicated action cameras. This convergence creates significant market pressure as consumers question the necessity of purchasing separate devices.

Rapid Technological Obsolescence: The accelerated pace of technological advancement creates substantial challenges for action camera manufacturers. New features, improved sensors, and enhanced capabilities emerge frequently, rendering previous models outdated rapidly. This obsolescence pressures companies to maintain aggressive innovation cycles, requiring significant research and development investments.

Business Opportunities

Emerging Market Penetration: Expanding into emerging markets presents substantial growth opportunities for action camera manufacturers. Regions including Asia-Pacific and Latin America demonstrate rising disposable incomes and increasing outdoor activity participation rates. These markets remain relatively untapped compared to saturated North American and European regions, offering significant potential for brand establishment.

AI Integration and Advanced Features: Integrating artificial intelligence and advanced editing capabilities represents transformative opportunities for market differentiation. AI-powered features including automatic scene detection, intelligent video stabilization, and facial recognition enhance user experience significantly. These technologies simplify content creation processes, making professional-quality production accessible to casual users without technical expertise.

Regional Analysis

North America Market Dominance: North America maintains commanding market leadership with 43% share, valued at USD 2.58 billion in the action camera sector. This dominance stems from robust consumer demand for outdoor activities and a deeply ingrained content creation culture. The region benefits from advanced technological infrastructure supporting both online and offline retail networks effectively.

Asia-Pacific Growth Potential: The Asia-Pacific region demonstrates rapid market expansion supported by increasing urbanization and rising disposable incomes. Countries including China and Japan lead growth trajectories, focusing on innovative camera features and technological advancement. Growing interest in adventure tourism and outdoor recreational activities drives consumer demand across diverse demographic segments.

Recent Developments

- Insta360 introduced the X3 in September 2022, a 360-degree sports camera capable of capturing 5.7K 360-degree films with AI-powered intelligent reframing technology

- Insta360 launched the ONE RS multi-lens antishake sporting camera in March 2022, featuring swappable lenses for different shooting needs

- AKASO Tech LLC released the Brave 8 action camera in October 2021, marking the company’s entry into the high-end action camera market

- FeiyuTech launched the FeiyuPocket 2S in August 2021, portable gimbal cameras featuring magnetically removable heads and handles

Conclusion

The action camera market trajectory indicates sustained growth driven by technological innovation, expanding consumer applications, and increasing global interest in adventure activities and content creation. Market valuation projections from USD 6.0 billion to USD 21.3 billion by 2033 underscore robust demand across diverse consumer segments and geographic regions.