Quick Navigation

Overview

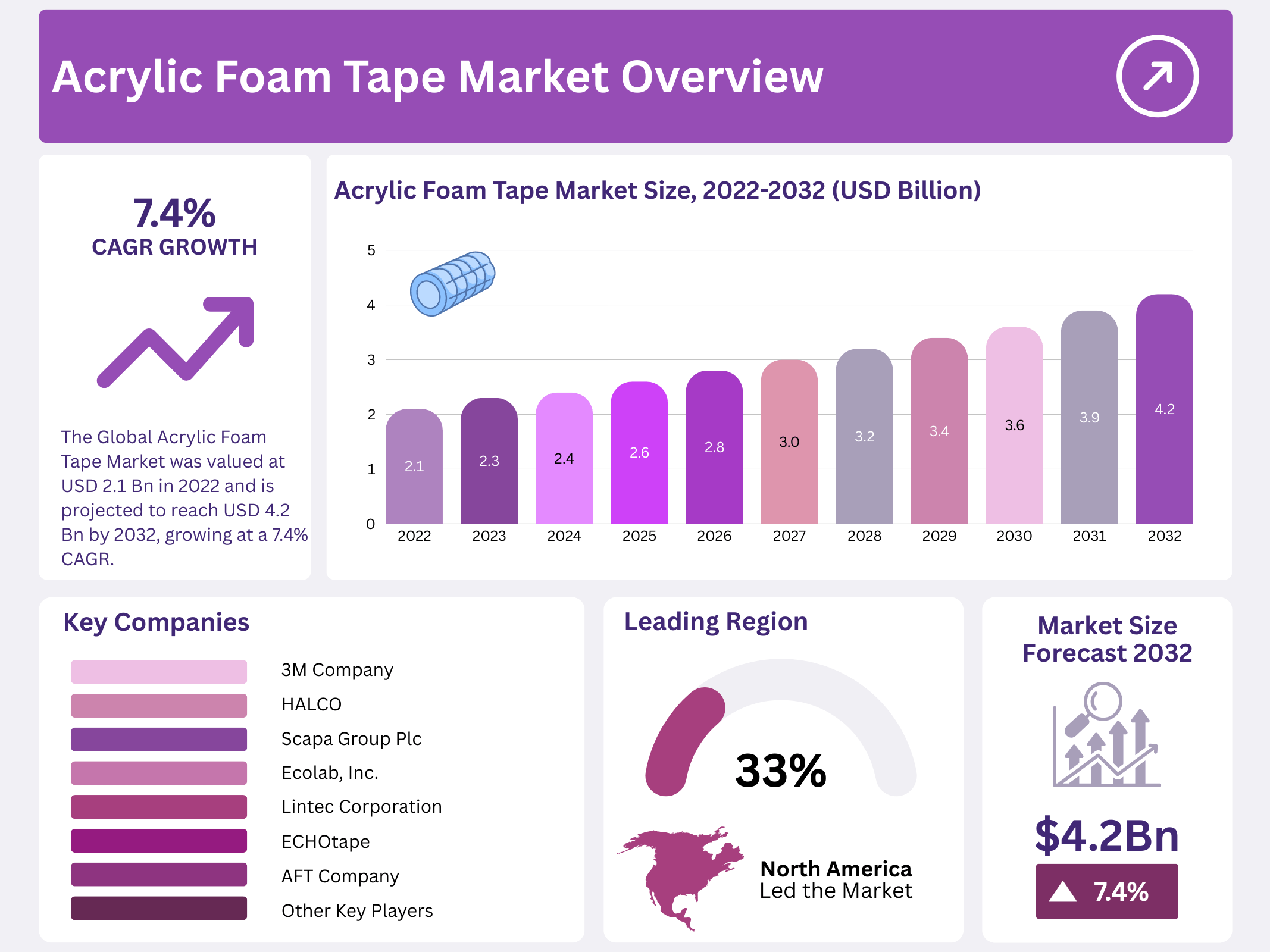

New York, NY – December 31, 2025 – In 2022, the Global Acrylic Foam Tape Market was valued at USD 2.1 billion and is projected to reach USD 4.2 billion by 2032, registering a CAGR of 7.4% from 2023 to 2032. Acrylic foam tapes are high-performance synthetic tapes designed to replace spot welds, liquid adhesives, mechanical fasteners, and other permanent bonding solutions across a wide range of industrial applications.

These tapes are particularly effective for bonding various substrates, including painted and unpainted metals, plastics with higher surface energy, and thicker conformable materials. They provide strong, reliable, and long-lasting adhesion among glass, wood, metals, composite materials, and plastics, making them a versatile choice for end users requiring durable bonding solutions.

Acrylic foam tapes are widely used in sectors such as marine construction, steel fabrication, and window manufacturing due to their flexibility, conformability, and compressibility. In the automotive industry, they offer effective bonding for exterior and interior components, including door visors, side moldings, cladding, spoilers, and side-sills. Their high durability and excellent thermal resistance also make them suitable for both indoor and outdoor applications.

Key Takeaways

- The Global Acrylic Foam Tape Market was valued at USD 2.1 billion in 2022 and is projected to reach USD 4.2 billion by 2032, growing at a 7.4% CAGR.

- Double-sided tapes dominated the market with an 80.3% share in 2022, driven by strong adhesion, high energy strength, and dampening performance.

- Solvent-based technology led with a 40% market share, supported by superior chemical resistance and long-term durability.

- The 1–2 mm Thickness segment held the largest share, offering an optimal balance between bonding strength and flexibility.

- The Automotive Industry was the largest end-user with a 37.3% share, driven by applications in exterior and interior vehicle components.

- North America led the market with a 33.2% revenue share in 2022 and strong end-use demand.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2022) | USD 2.1 Billion |

| Forecast Revenue (2032) | USD 4.2 Billion |

| CAGR (2023-2032) | 7.4% |

| Segments Covered | By Type (Double-sided Tape, Single Sided Tape, and Self-Stick Tape), By Technology (Solvent-based, Water-based, Hot-melt-based), By Thickness (Less than 1 mm, 1.1 – 2 mm, 2.1 – 3 mm, Above 3 mm), By Application (Automotive, Building & Construction, Electrical & Electronics, Paper & Printing, Other Applications) |

| Competitive Landscape | 3M Company, Nitto Denko Corporation, Scapa Group Plc, Intertape Polymer Group, Inc., Lintec Corporation, Avery Dennison Corporation, HALCO, Saint-Gobain Performance Plastics, Tape-Rite Co. Inc., Fuji Chemical Industries Co. Ltd., American Biltrite, ECHOtape, AFT Company, Seal King Ind Co. Ltd., Avery Dennison |

Key Market Segments

Type Analysis

Double-sided tape dominates the global acrylic foam tape market due to its precise adhesive properties. By type, the global acrylic foam tape market is segmented into double-sided tape, single-sided tape, and self-stick tape. Among these, double-sided tape held an 80.3% share of the market in 2022, making it the clear market leader. This dominance is driven by its exceptional properties, including precise adhesion, high energy and strength, and excellent dampening capabilities.

Double-sided foam tapes are versatile, suitable for hole filling, packing, acoustic dampening, thermal insulation, and both temporary and permanent bonding applications. These tapes are manufactured in various thicknesses and are made from open-cell or closed-cell foams, coated with a range of pressure-sensitive adhesives (PSAs) to meet diverse performance requirements.

Technology Analysis

Solvent-based technology leads due to its superior chemical resistance and durability. Based on technology, the global acrylic foam tape market is divided into solvent-based, water-based, and hot-melt-based segments. In 2022, the solvent-based segment accounted for 40% of the market, reflecting its wide adoption.

Solvent-based foam tapes are preferred when high tensile strength, peel, and shear resistance, and long-term durability are needed. They are also temperature-resistant and chemically resilient, making them ideal for demanding industrial applications. Despite their advantages, there is a growing shift toward eco-friendly alternatives, which could influence future growth in the solvent-based segment.

Thickness Analysis

The 1–2 mm thickness segment dominates due to its ideal balance of strength and flexibility. The market is segmented into less than 1 mm, 1.1–2 mm, 2.1–3 mm, and above 3 mm. Among these, 1–2 mm tapes hold the largest market share, thanks to their suitability across a wide range of manufacturing applications.

This thickness offers a versatile balance between bonding strength and flexibility, enabling effective adhesion to diverse substrates, including metals, plastics, glass, and composites. The 1–2 mm range provides high bonding energy, excellent stress distribution, and conformity to irregular surfaces, making it ideal for multiple industries.

End-Use Analysis

The Automotive Industry is the largest end-user, driven by increasing applications of acrylic foam tape. By end-use, the market is segmented into automotive, building and construction, electrical and electronics, paper and printing, and others. In 2022, the automotive segment accounted for 37.3% of the market, reflecting strong demand for foam tapes in applications such as wheel flares, side mirrors, roof molding, and other automotive components. The growth is fueled by the automotive industry’s need for lightweight, durable, and high-performance bonding solutions that can withstand harsh environmental conditions while maintaining aesthetic appeal.

Regional Analysis

North America held a leading position in the acrylic foam tape market, accounting for an estimated 33.2% revenue share in 2022, and is projected to grow at a CAGR of 7.5% over the forecast period. This steady expansion reflects strong and sustained demand across key end-use sectors.

The dominance of North America is largely supported by the deep penetration of acrylic foam tapes in the healthcare and automotive industries. These sectors rely on high-performance bonding solutions for applications requiring durability, vibration resistance, and long-term reliability, positioning the region as a major contributor to global market revenues throughout the forecast timeline.

Asia Pacific is expected to emerge as the second-largest market, registering a comparatively higher growth rate. Rapid industrialization in emerging economies such as India and China, rising construction activities, and increasing demand from the automotive manufacturing sector are key growth drivers. China, in particular, contributes a significant share to regional revenues.

Top Use Cases

- Automotive Exterior Bonding: Acrylic foam tape shines in the automotive sector by securely attaching trims, badges, and emblems without drilling holes. It withstands harsh weather, vibrations, and temperature changes, ensuring long-lasting bonds on vehicle exteriors. This makes it a go-to choice for manufacturers seeking reliable, rust-free assembly methods that enhance vehicle aesthetics and durability.

- Construction Panel Mounting: In building projects, acrylic foam tape is ideal for mounting siding panels and sealing skylights. Its strong adhesion handles outdoor elements like wind and rain, providing a clean, invisible bond. Builders appreciate how it simplifies installation, reduces labor time, and maintains structural integrity over the years without mechanical fasteners.

- Electronics Assembly: For appliances and gadgets, acrylic foam tape offers precise bonding of components like screens and casings. It absorbs shocks and vibrations, protecting sensitive parts from damage. This tape’s versatility allows for thin, flexible applications, making it essential for compact designs in consumer electronics where reliability and ease of use are key.

- Solar Panel Applications: Acrylic foam tape excels in renewable energy setups by mounting junction boxes on solar panels. It provides weatherproof seals that endure sun exposure and temperature swings, ensuring efficient energy transfer. Installers favor it for quick, secure attachments that boost system longevity and performance in outdoor environments.

- Industrial Sealing and Gasketing: In various factories, acrylic foam tape is used for sealing joints and gasketing in machinery. Its foam core cushions impact while the acrylic adhesive resists chemicals and moisture. This helps prevent leaks and maintains equipment efficiency, appealing to industries focused on durable, maintenance-free solutions.

Recent Developments

1. 3M Company

3M continues to advance its VHB Tape series, focusing on sustainability and performance for automotive, electronics, and construction bonding. Recent developments include tapes designed for bonding low-surface-energy plastics and lightweight materials in EV battery assembly, supporting vehicle electrification. 3M also highlights the tape’s role in enabling design for disassembly and recyclability.

2. Nitto Denko Corporation

Nitto is expanding its high-performance acrylic foam tape portfolio with products offering enhanced weatherability and adhesion for outdoor applications. Innovations include tapes for mounting solar panels and bonding facade elements in architectural projects. The company emphasizes product development that contributes to carbon neutrality and the circular economy through durable, long-lasting bonds.

3. Scapa Group Plc (Now part of SWM International)

Following its acquisition by SWM International in 2021, the former Scapa industrial tapes business now operates as part of SWM. The integration has focused on leveraging combined R&D for high-performance bonding solutions, including acrylic foam tapes for automotive, aerospace, and appliance markets, aiming to provide optimized material science and global supply chain strength.

4. Intertape Polymer Group Inc. (Now part of CTI Group)

IPG, known for its acrylic-based Mounting & Bonding Tape Solutions, was acquired by CTI Group. Post-acquisition, the focus is on integrating product lines and R&D to serve the automotive aftermarket, building & construction, and general industrial sectors with a robust portfolio of double-sided foam tapes, emphasizing innovation and supply chain reliability.

5. Lintec Corporation

Lintec’s recent developments in acrylic foam tape feature their LIFETACK series, designed for strong, permanent bonds on various surfaces, including painted and powder-coated metals. They are promoting tapes with excellent resistance to heat, cold, and UV exposure for automotive trim, signage, and industrial assembly, focusing on solving challenges in bonding dissimilar materials.

Conclusion

Acrylic Foam Tape is a versatile adhesive powerhouse, driving innovation across industries. Its ability to replace traditional fasteners with strong, weather-resistant bonds opens doors for lighter, more efficient designs in everything from cars to renewable energy. This tape’s growing adoption highlights its role in meeting demands for sustainability and simplicity in modern manufacturing.