Quick Navigation

Introduction

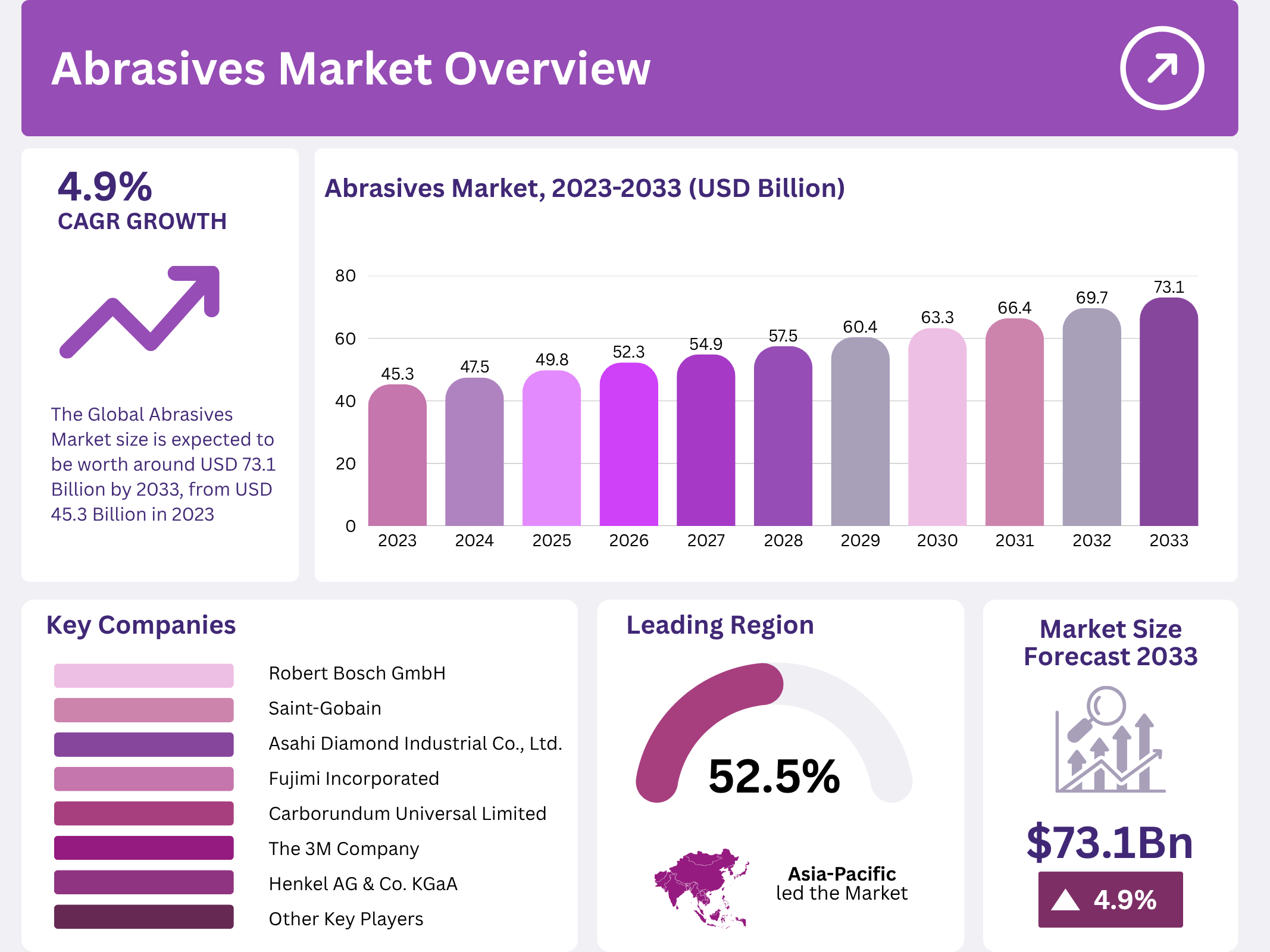

The Global Abrasives Market is witnessing steady growth, supported by strong industrial and manufacturing demand. Valued at USD 45.3 Billion in 2023, it is projected to reach USD 73.1 Billion by 2033, expanding at a CAGR of 4.9% from 2024 to 2033. This expansion is driven by rising applications across metalworking, automotive, and construction sectors.

Abrasives are critical materials used for shaping, grinding, polishing, and finishing surfaces, enabling precision and efficiency in production processes. The market includes a wide range of materials—bonded, coated, and super abrasives—serving industries such as automotive, aerospace, machinery, and electronics. Their essential role in enhancing manufacturing productivity continues to strengthen global market demand.

Furthermore, rapid industrialization, technological innovation, and government-led infrastructure development in emerging economies have accelerated market growth. The focus on eco-friendly and high-performance abrasive materials aligns with global sustainability trends, making the abrasives sector a key contributor to modern manufacturing evolution.

Key Takeaways

- The Abrasives Market was valued at USD 45.3 Billion in 2023 and is expected to reach USD 73.1 Billion by 2033, growing at a CAGR of 4.9%.

- In 2023, Bonded Abrasives dominated the type segment with 42.3%, driven by extensive applications in grinding and polishing.

- The Automotive sector led the application segment with 37.4%, highlighting strong demand from vehicle manufacturing and maintenance.

- Asia Pacific dominated the global market with 52.5% share, supported by its robust manufacturing base and industrial expansion.

Market Segmentation Overview

The market by material type is segmented into Natural and Synthetic abrasives. Synthetic abrasives dominate this category, offering superior consistency and performance. Engineered from materials such as aluminum oxide and silicon carbide, they meet specific industrial needs for precision, durability, and efficiency, positioning them as the preferred choice in manufacturing applications.

By type, Bonded Abrasives lead the market with 42.3% share. Their strong structure, durability, and ability to handle high-pressure operations make them essential in automotive, aerospace, and metal fabrication industries. Technological advancements in bonding materials continue to enhance the lifespan and efficiency of these abrasives across multiple end uses.

By application, the Automotive sector dominates with 37.4% share, owing to high demand for abrasives in vehicle manufacturing and finishing processes. Abrasives enable high-quality polishing, grinding, and precision shaping of automotive components, ensuring enhanced performance, lightweight design, and improved safety standards across production lines.

Drivers

One of the primary drivers of the abrasives market is the expansion of the global metalworking and machinery industries. Abrasives are indispensable in cutting, grinding, and polishing metal components, facilitating efficient fabrication and finishing. This trend is further reinforced by rising industrial automation and precision engineering technologies.

Additionally, rapid growth in the automotive and construction sectors has amplified the need for advanced abrasives. As manufacturers emphasize quality, efficiency, and surface finishing, the demand for high-performance abrasives has surged. The continuous rise in vehicle production and infrastructure projects worldwide continues to propel market momentum.

Use Cases

In the automotive sector, abrasives are essential for shaping and finishing critical components like engine parts, brake systems, and body panels. They ensure precision in manufacturing processes while enhancing the aesthetic quality of vehicles. Abrasives also contribute to efficient maintenance and repair operations across automotive service networks.

In the construction industry, abrasives play a key role in cutting, grinding, and polishing building materials such as concrete, glass, and stone. From surface preparation to detailed finishing, they support high-quality outputs in architectural and infrastructure projects, enabling durability and aesthetic refinement in construction materials.

Major Challenges

A key challenge in the abrasives market is the rising cost of raw materials like aluminum oxide and silicon carbide. Price volatility directly impacts production expenses and reduces profit margins for manufacturers. This challenge is particularly acute in regions dependent on imports for raw materials.

Another challenge arises from stringent environmental and worker safety regulations. The generation of abrasive dust during manufacturing and application poses health and ecological concerns. Compliance with environmental standards requires significant investment in dust control and waste management technologies, adding operational costs for producers.

Business Opportunities

Emerging economies, particularly in Asia-Pacific and Latin America, offer abundant opportunities for market expansion. Rapid industrialization, infrastructure development, and urbanization have increased demand for metal fabrication and construction, driving greater consumption of abrasives. Manufacturers can leverage this growth through localized production and distribution networks.

Sustainability-focused innovations present another major opportunity. The development of eco-friendly abrasives—such as water-based, biodegradable, and recyclable products—is gaining traction. Companies that prioritize sustainable manufacturing practices and green technologies are well-positioned to capture long-term market advantages.

Regional Analysis

Asia Pacific leads the global abrasives market with a commanding 52.5% share, valued at USD 23.78 Billion. The region’s dominance is fueled by strong manufacturing output in China, India, and Japan. Rapid growth in automotive, construction, and electronics sectors, coupled with cost-effective production, underpins its leadership position.

In North America and Europe, market growth is driven by advanced manufacturing capabilities and demand for high-performance materials. The U.S. continues to lead in aerospace and metal fabrication applications, while Europe emphasizes sustainable abrasive production. Both regions benefit from strong R&D investments and technology-driven process improvements.

Recent Developments

- In October 2023, Tyrolit Group acquired Michigan-based Acme Abrasives, expanding its U.S. operations and product portfolio in steel, foundry, and rail sectors.

- In May 2023, SAK Abrasives of India acquired Jowitt & Rodgers Co., a U.S. abrasive product manufacturer, enhancing cross-continental production capabilities.

- In August 2023, Saint-Gobain reported a record recurring net income of USD 1.9 Billion for the first half of 2023, reflecting stable growth across its abrasive solutions business.

Conclusion

The global abrasives market continues to expand as industries demand higher precision, efficiency, and sustainability. With an expected valuation of USD 73.1 Billion by 2033, the sector’s trajectory reflects its integral role in global manufacturing and infrastructure development. Growth will be fueled by synthetic material innovations, automation, and environmentally conscious product advancements.

Furthermore, strategic acquisitions and capacity expansions by leading players are strengthening supply networks and accelerating technological innovation. As eco-friendly abrasives gain prominence, the market is set to evolve toward sustainable, performance-driven solutions that align with modern industrial requirements and global environmental goals.