Viral Vectors and Plasmid DNA Manufacturing Market Infographics Description

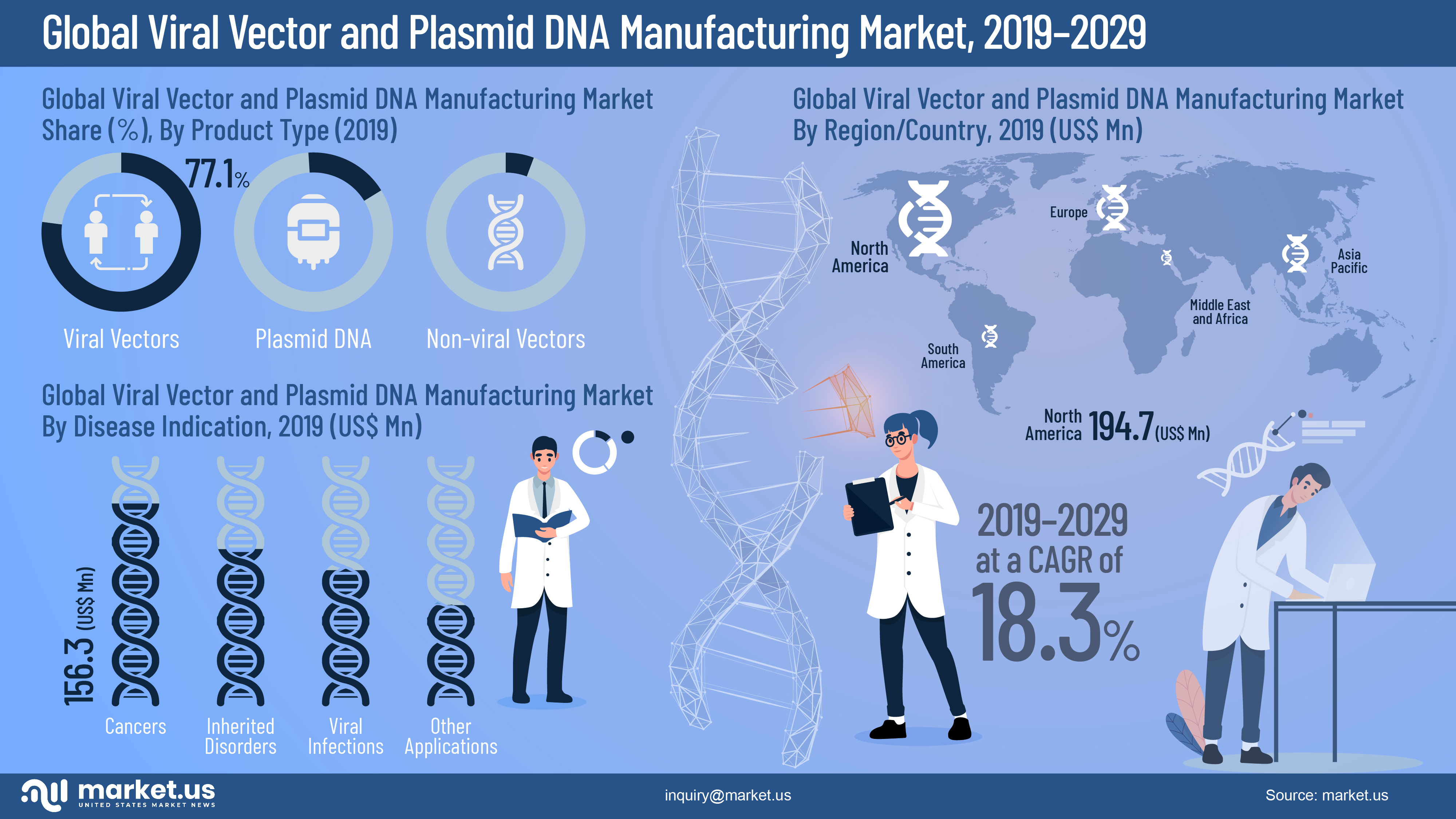

- The Global Viral Vectors and Plasmid DNA Manufacturing Market is valued at US$ 461.0 Mn in 2019.

- Worldwide Viral Vectors and Plasmid DNA Manufacturing Market is projected to reach US$ 2,436.2Mn in 2029 at a CAGR of 18.3% from 2020 to 2029.

- Amongst product types, the viral vectors segment in the Global Viral Vectors and Plasmid DNA Manufacturing Market is estimated to account for a majority revenue share of over 77.1% in 2019, owing to recent technological advancements in the research and biotechnology field.

- Among the disease indication segments, the cancer is expected to register the highest CAGR of over 20.4%, followed by inherited disorders, viral infections, and other applications

- The North America market is expected to dominate the Global Viral Vectors and Plasmid DNA Manufacturing Market. It is expected to account for the largest market revenue share than that of markets in other regions.

- Companies profiled in the report as Merck KGaA (Bioreliance), Gedeon Richter Plc, Lonza Group AG, Thermo Fisher Scientific, Inc., Kaneka Corporation, Mylan NV, Oxford Biomedica PLC, Finvector Oy, Fujifilm Diosynth Biotechnologies U.S.A, Aldevron L.L.C., uniQure NV, Molecular Medicine SpA, Biovian Oy, GeneOne Life Science, Inc. (VGXI, INC.), PlasmidFactory GmbH & Co. KG.) & other market players.

Report Overview

The Global Viral Vectors and Plasmid DNA Manufacturing Market is experiencing rapid growth and is expected to reach a remarkable value of USD 36.5 billion by 2033, up from USD 5.3 billion in 2023. This represents a strong compound annual growth rate (CAGR) of 21.3% over the forecast period from 2024 to 2033.

This growth is driven by the increasing demand for advanced gene therapies, vaccines, and cell-based treatments, which rely heavily on viral vectors and plasmid DNA. With advancements in biotechnology and a growing focus on personalized medicine, the market is becoming a cornerstone of modern healthcare innovation.

Viral vectors and plasmid DNA are critical tools in biotechnology and medicine, playing pivotal roles in gene therapy, vaccine development, and more. Viral vectors are engineered viruses used to deliver genetic material into cells, effectively altering cell functions or treating genetic disorders. Plasmid DNA, simpler and non-viral, is used similarly, often as a tool in genetic research and therapy development. Their manufacturing involves complex biotechnological processes aimed at producing high-quality, safe genetic products for various therapeutic and research applications.

The growth of the viral vectors and plasmid DNA manufacturing market is significantly driven by advancements in gene therapy. The ability to treat diseases at the genetic level, particularly genetic disorders and cancers, has spurred intense research and development in this field. The increasing prevalence of diseases treatable with gene therapies, like various types of cancer and inherited disorders, pushes the demand for these biological vectors. The drive is further supported by technological advances that improve the efficacy and safety of these therapies. The strategic collaborations between biopharmaceutical companies and research institutions are also pivotal, enhancing production capabilities and accelerating the development of new therapies.

Market demand for viral vectors and plasmid DNA is robust, with significant growth projected in the coming years. The COVID-19 pandemic highlighted the vital role of mRNA vaccines and gene therapies, which use these vectors extensively. Beyond infectious diseases, there is growing interest in using these technologies for cancer therapies, genetic disorders, and other medical applications. Market opportunities are expanding particularly in the realm of personalized medicine, where customized genetic treatments are developed for individual patient needs. Additionally, the rising healthcare expenditures in emerging markets like Asia-Pacific provide new opportunities for market expansion, with countries like China and India investing heavily in biotechnology.

Technological innovation is a key factor propelling the viral vectors and plasmid DNA manufacturing market. Improvements in vector design, scalability of production methods, and purification techniques have enhanced the overall efficiency and quality of these products. Novel bioreactors and automated systems have reduced the time and cost of manufacturing, making treatments more accessible. Furthermore, advancements in genetic editing technologies like CRISPR-Cas9 have expanded the potential applications of viral vectors and plasmid DNA, creating more precise and effective therapeutic options.

Driver

Increasing Demand for Gene Therapies

One of the most compelling drivers for the viral vectors and plasmid DNA manufacturing market is the burgeoning demand for gene therapies. This surge is largely fueled by the expanding scope of clinical applications, from treating cancers to addressing neurodegenerative disorders. The use of technologies like CRISPR-Cas9 for precision genetic engineering enhances the efficacy and safety of these therapies.

Regulatory bodies are supporting rapid advancements by streamlining the approval processes, which encourages further development and adoption of gene therapies across the healthcare sector. This robust environment is nurtured by significant investments from the biopharmaceutical industry, aimed at improving drug production techniques and expanding the therapeutic applications of gene therapies.

Restraint

High Manufacturing Costs and Regulatory Challenges

Despite the growing demand, the viral vectors and plasmid DNA manufacturing market faces significant restraints, primarily due to the high costs associated with their production. The complex manufacturing processes of viral vectors require sophisticated equipment and highly skilled personnel, which substantially raises operational costs.

Additionally, stringent regulatory standards for gene therapy products impose further financial burdens on manufacturers. These factors are compounded by ethical concerns over genetic manipulation and equitable access to these advanced therapies, which can delay product launches and limit market growth. The high entry barriers and the rigorous approval process required for these biologics are significant hurdles that manufacturers must overcome.

Opportunity

Expansion in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the viral vectors and plasmid DNA manufacturing market. These regions are experiencing rapid advancements in healthcare infrastructure, combined with increasing government and private investment in biotechnology. For instance, countries like China and India are actively enhancing their capabilities in gene therapy, driven by growing local demand and supportive regulatory frameworks.

This expansion is not only increasing the accessibility of gene therapies in these markets but also driving the global expansion of viral vectors and plasmid DNA manufacturing capabilities. The growing prevalence of diseases such as cancer in these regions further amplifies the demand for innovative treatments, thus providing lucrative opportunities for market players.

Challenge

Technological and Operational Hurdles

The market is also confronted with challenges related to the technological and operational aspects of manufacturing viral vectors and plasmid DNA. One of the main issues is maintaining the quality and purity of these products, which is critical for their effectiveness and safety. The need for high-level purification processes to remove impurities and contaminants increases production complexity and cost.

Additionally, scaling up production to meet increasing market demand while ensuring consistent product quality is a significant challenge. The industry must also navigate the evolving technological landscape and integrate new bioprocessing techniques to improve yields and reduce costs. Keeping pace with rapid technological advancements and adapting to regulatory changes are crucial for companies to stay competitive in this fast-evolving market.

Маrkеt Ѕеgmеntѕ

Vector Type

- Adenovirus

- Retrovirus

- Adeno-Associated Virus (AAV)

- Lentivirus

- Plasmids

- Other Vector Types

Workflow

Upstream Manufacturing

- Vector Amplification & Expansion

- Vector Recovery/Harvesting

Downstream Manufacturing

- Purification

- Fill Finish

Application

- Antisense & RNAi Therapy

- Gene Therapy

- Cell Therapy

- Vaccinology

- Other Applications

End-user

- Pharmaceutical and Biopharmaceutical Companies

- Research Institutes

Disease

- Cancer

- Genetic Disorders

- Infectious Diseases

- Others

Market Key Players

- Merck KGaA

- Lonza

- FUJIFILM Diosynth Biotechnologies

- Thermo Fisher Scientific

- Cobra Biologics

- Catalent Inc.

- Wuxi Biologics

- Takara Bio Inc.

- Waisman Biomanufacturing

- Genezen laboratories

- Batavia Biosciences

- Miltenyi Biotec GmbH