Vapor Degreasing Solvent Market Infographics Description:

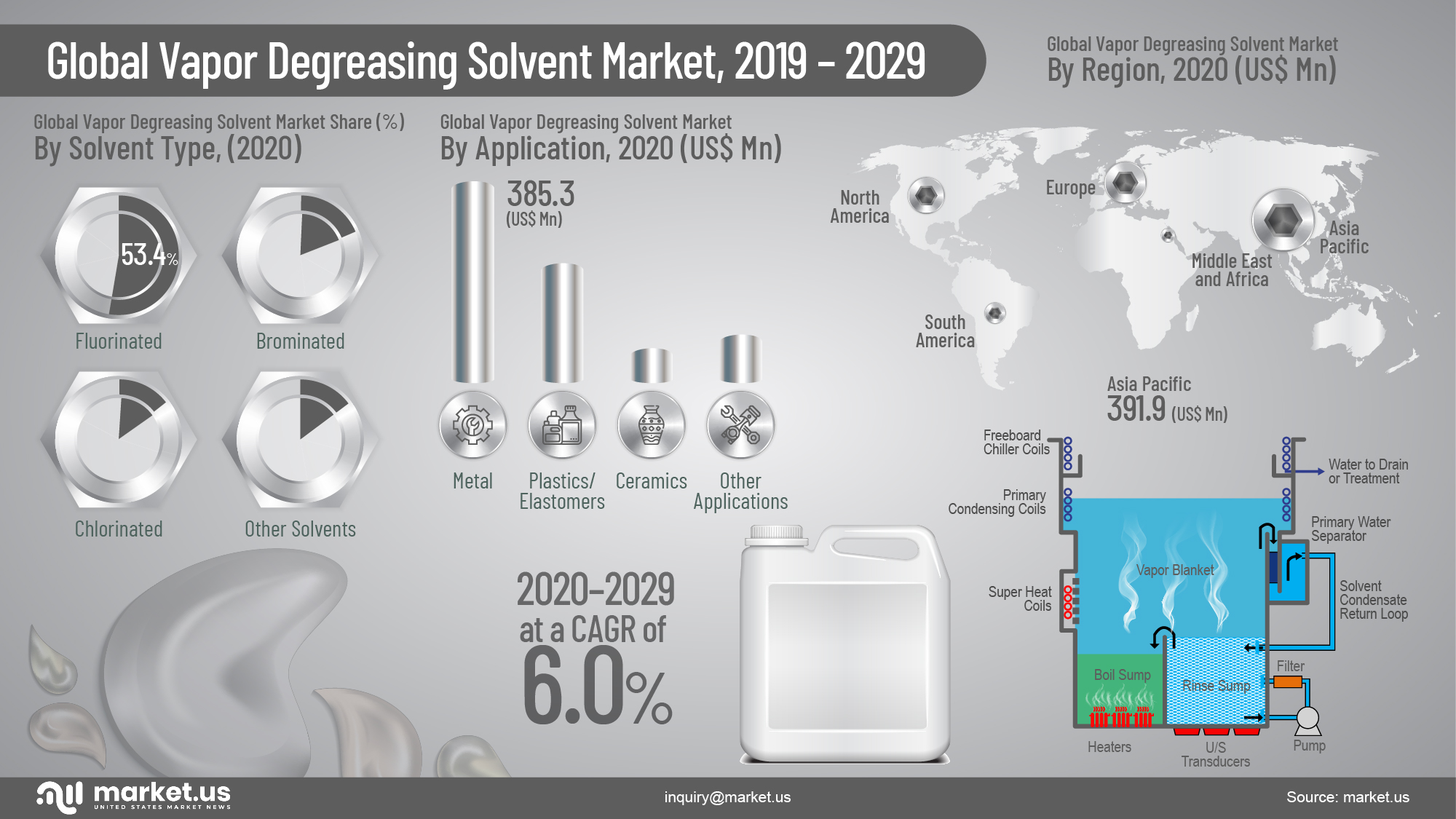

- The global vapor degreasing solvent market is estimated at US$ 967.4 Mn in 2020.

- The worldwide vapor degreasing solvent market is projected to reach US$ 1,629.2 Mn in 2029 at a CAGR of 6.0% from 2021 to 2029.

- Among all the solvent type segments, the fluorinated segment in the global vapor degreasing solvent market is expected to register the highest CAGR of over 7.5%, followed by brominated.

- Amongst application segments, the metal segment in the global vapor degreasing solvent market is estimated to account for a majority revenue share of 39.8% in 2020 end, followed by plastics/ elastomers.

- The market in Asia Pacific is expected to dominate the global vapor degreasing solvent market. It is expected to account for the largest market revenue share as compared to that of markets in other regions.

- Companies profiled in the report are Honeywell International Inc., 3M Company, Asahi Glass Co., Ltd. (AGC Inc.), Solvay SA, Chemours Company, Enviro Tech International, Inc., MicroCare Corporation, Reliance Specialty Products Inc., Florachem Precision Cleaning Products, and Tech Spray LP.

Report Overview

The Vapor Degreasing Solvents Market size is expected to be worth around USD 5883 Million by 2033, from USD 1173 Million in 2023, growing at a CAGR of 6.1% during the forecast period from 2023 to 2033. The market for vapor degreasing solvents is influenced by several factors including the need for precision cleaning in various industries like aerospace, electronics, and automotive.

Vapor degreasing solvents are specialized chemicals used in a process called vapor degreasing, which is a method for cleaning parts in manufacturing and repair operations. This process involves the use of solvents in vapor form to cleanse workpieces of oils, greases, and other contaminants without the use of water. The solvents used must have specific properties such as high solvency power, non-flammability, and stability under the conditions of use. Common solvents include n-propyl bromide, trichloroethylene, and perchloroethylene, though some of these are being phased out due to environmental and health concerns.

Key drivers for the vapor degreasing solvents market include technological advancements in solvent properties to enhance environmental compliance and worker safety. There’s a significant shift towards solvents that have lower toxicity and are less hazardous to the environment. The market is also driven by the growing electronics and automotive sectors where precision cleaning is crucial.

The demand for vapor degreasing solvents is robust, particularly in industries that manufacture high-precision components. This demand is further supported by the trend of miniaturization in electronics, where more compact and complex parts require advanced cleaning solutions that can reach intricate areas without damage.

Opportunities in the vapor degreasing solvents market lie in developing solvents that can provide effective cleaning with minimal environmental impact. Innovations in solvent compositions that are less volatile and have reduced global warming potential are particularly promising. The market also has opportunities in expanding to emerging economies where manufacturing sectors are growing.

Technological advancements are primarily focused on improving the safety and environmental profile of degreasing solvents. New formulations are being developed to replace traditional, hazardous solvents with bio-based and greener alternatives that are effective yet pose fewer risks to health and the environment. Innovations include azeotropic and co-solvent systems that enhance cleaning efficacy while being compliant with newer environmental regulations.

Key Takeaways

- The vapor degreasing solvents market is poised for significant growth, expanding at a robust 6.1% CAGR from 2023 to 2033. The market value is projected to soar from USD 1,173 million in 2023 to an impressive USD 5,883 million by 2033, driven by innovation, rising demand across industries, and a shift toward sustainable solutions.

- In 2023, fluorinated solvents held a commanding 31.2% share of the market. Their exceptional cleaning efficiency and versatility made them a preferred choice across industries, especially where precision is paramount. Despite rising concerns over environmental impacts, their utility keeps them in high demand.

- Metals dominated the application landscape in 2023, accounting for 41.4% of the market share. The reliability of vapor degreasing solvents in ensuring high-quality metal finishes is critical for sectors such as aerospace, automotive, and electronics.

- The automotive industry emerged as the largest end-use segment in 2023, thanks to its reliance on vapor degreasing solvents for precision manufacturing. From engine components to intricate assemblies, these solvents play a vital role in maintaining the industry’s exacting standards.

- Environmental concerns surrounding the use of traditional solvents have intensified scrutiny on manufacturers. While this presents challenges, it also opens doors for eco-friendly alternatives. Companies investing in sustainable solvent solutions and R&D initiatives are well-positioned to thrive in this evolving landscape.

- Asia-Pacific led the market with a 41.8% share in 2022, propelled by industrial growth in China and India. The region’s expanding manufacturing base continues to drive demand for high-performance cleaning solutions.

- North America exhibited strong growth, with an 8.2% CAGR, driven by advanced infrastructure and a shift toward safer, environmentally friendly solvents.

Key Market Segmentation

By Type

- Fluorinated

- Chlorinated

- Brominated

- Others

By Application

- Metal

- Pharma and Biotech

- Others

By End-User

- Automotive

- Electronics

- Aerospace and Defense

- Others

Market Key Players

- Honeywell International Inc.

- 3M Company

- Asahi Glass Co. Ltd. (AGC Inc.)

- Solvay SA

- Chemours Company

- MicroCare Corporation

- Reliance Specialty Products Inc.

- Florachem Precision Cleaning Products

- Tech Spray LP