Company Overview

Saudi Basic Industries Corporation (SABIC) is a global leader in the production and marketing of chemicals, polymers, agri-nutrients, and specialty materials. Its broad product portfolio includes monoethylene glycol, polyethene, polypropylene, polycarbonate, polybutylene terephthalate, methanol, MTBE, granular urea, polyetherimide, and a diverse range of engineering plastics and compounded materials. The company also delivers advanced engineering and color-matching services tailored to customer needs.

SABIC provides solutions across a wide spectrum of industries, including automotive, healthcare and hygiene, electrical and electronics, agriculture, consumer goods, packaging, and building and construction. Its business activities are organized into 6 major segments covering agriculture, automotive, building and construction, electrical and electronics, and healthcare and hygiene.

With a global customer base spanning more than 140 countries, SABIC maintains an extensive international manufacturing footprint across the Americas, Europe, the Middle East, and the Asia Pacific. The company operates in 43 countries, runs 60 manufacturing and compounding facilities, and supports innovation through 20 technology centers and service locations. SABIC’s research strength is backed by over 2,000 R&D professionals, enabling the continuous development of high-performance, sustainable material solutions. As of December 2024, the company had more than 11,000 patents and had introduced 135 new products.

History of Saudi Basic Industries Corporation

1900’s

- 1976: SABIC was created through a royal decree to transform natural gas into high-value chemical products.

- 1979: Hadeed was founded to manufacture steel under the SABIC umbrella, marking the beginning of metals production.

- 1980: The Al-Razi joint venture was launched, positioning the company as a global player in methanol production.

- 1980: Additional joint ventures were formed with Shell and ExxonMobil, strengthening global partnerships.

- 1981: A strategic joint venture was established with Mitsubishi to expand international reach.

- 1983: SABIC exported its first products outside Saudi Arabia, marking its entry into global markets.

- 1984: SABIC was listed publicly on the Saudi Stock Exchange (Tadawul) for the first time.

- 1990: The company entered the shipping and logistics space through National Chemical Carriers (NCC).

- 1992: Four affiliates in the Middle East achieved ISO 9002 certification, enhancing quality and compliance standards.

- 1994: The SABIC Technology Center opened in Riyadh, advancing R&D capabilities.

- 1996: SABIC became the Middle East’s largest joint-stock firm, achieving revenues equivalent to 18.9 billion USD.

- 1997: SABIC’s global petrochemical market share reached an estimated 5%.

2000’s

- 2000: SABIC’s product sales expanded into more than 100 countries globally.

- 2001: A major United Petrochemical Company (UPC) facility was inaugurated in Jubail.

- 2002: SABIC received global ranking recognition among leading petrochemical producers.

- 2003: DSM Petrochemicals was acquired, expanding the company’s polymers footprint.

- 2004: Yansab was founded as a major downstream affiliate.

- 2005: Yansab became the world’s fourth-largest petrochemical complex in capacity terms.

- 2006: SABIC ranked 331st on the Fortune Global 500 list.

- 2007: SABIC acquired GE Plastics, one of its most significant acquisitions, establishing SABIC as a leader in performance materials.

- 2009: A petrochemicals venture with Sinopec was launched in China, strengthening presence in Asia.

- 2011: SABIC announced its first publicly stated environmental commitments and published its initial sustainability report.

- 2012: SABIC Academy was launched to enhance employee development.

- 2014: A joint venture with SK Chemicals in South Korea expanded SABIC’s technology and customer reach.

- 2016: The Home of Innovation™ facility opened to showcase sustainable technologies.

- 2017: SABIC and ExxonMobil formed the Gulf Coast Growth Ventures partnership to develop a major U.S. petrochemical complex.

- 2018: SABIC acquired a 24.99% stake in Clariant AG, deepening its specialty chemicals presence.

- 2019: The TRUCIRCLE™ initiative launched, demonstrating SABIC’s commitment to circular polymers and recycling.

- 2020: Saudi Aramco acquired a 70% shareholding in SABIC, creating one of the world’s largest integrated energy-to-chemicals value chains.

- 2020: SAFCO rebranded as SABIC Agri-Nutrients Company, reflecting its expanded crop nutrition portfolio.

- 2020: SABIC and Saudi Aramco completed the world’s first shipment of low-carbon ammonia.

Later 2020’s

- 2021: SABIC pledged to achieve carbon-neutral operations by 2050.

- 2021: A new corporate headquarters building opened in Jubail.

- 2022: The BLUEHERO electrification initiative launched to support EV materials and technologies.

- 2022: SABIC fully acquired Scientific Design, strengthening its catalysts and process technology licensing business.

- 2023: Final reactors were installed at the world’s first electrified steam cracker demo unit in Ludwigshafen (with BASF and Linde).

- 2023: SABIC divested Hadeed as part of large-scale portfolio optimization.

- 2024: The Functional Forms business was divested to realign the portfolio around core strengths.

- 2024: SABIC launched its enterprise-wide transformation program to accelerate performance.

- 2024: SABIC completed the divestment of its stake in Aluminium Bahrain (Alba).

(Source: Company Website)

Share Performance

- The company consistently maintained 3,000 million registered shares each year from 2020 to 2024, with the same number eligible for dividend distribution annually.

- The share price at year-end stood at 67 in 2024, compared with 5 in 2023, 90.4 in 2022, 116 in 2021, and 101.4 in 2020.

- The highest share price reached 89 in 2024, following 4 in 2023, 141.4 in 2022, 136.6 in 2021, and 103.4 in 2020.

- The lowest share price recorded was 5 in 2024, lower than 75.3 in 2023, 79.2 in 2022, 97.9 in 2021, and 61.9 in 2020.

- Annualized volatility remained relatively stable at 5% in 2024, compared with 22.1% in 2023, and lower than the heightened volatility levels of previous years.

- Market capitalization at year-end was 201,000 million in 2024, down from 250,500 million in 2023 and 268,200 million in 2022, and earlier values of 348,000 million in 2021 and 304,200 million in 2020.

- In U.S. dollars, market capitalization totaled 53,600 million in 2024, compared with 66,800 million in 2023, 71,520 million in 2022, 92,800 million in 2021, and 81,120 million in 2020.

- The dividend declared per share amounted to 4 in 2024 and 2023, following 4.25 in 2022, 4 in 2021, and 3 in 2020.

(Source: Saudi Basic Industries Corporation Annual Report)

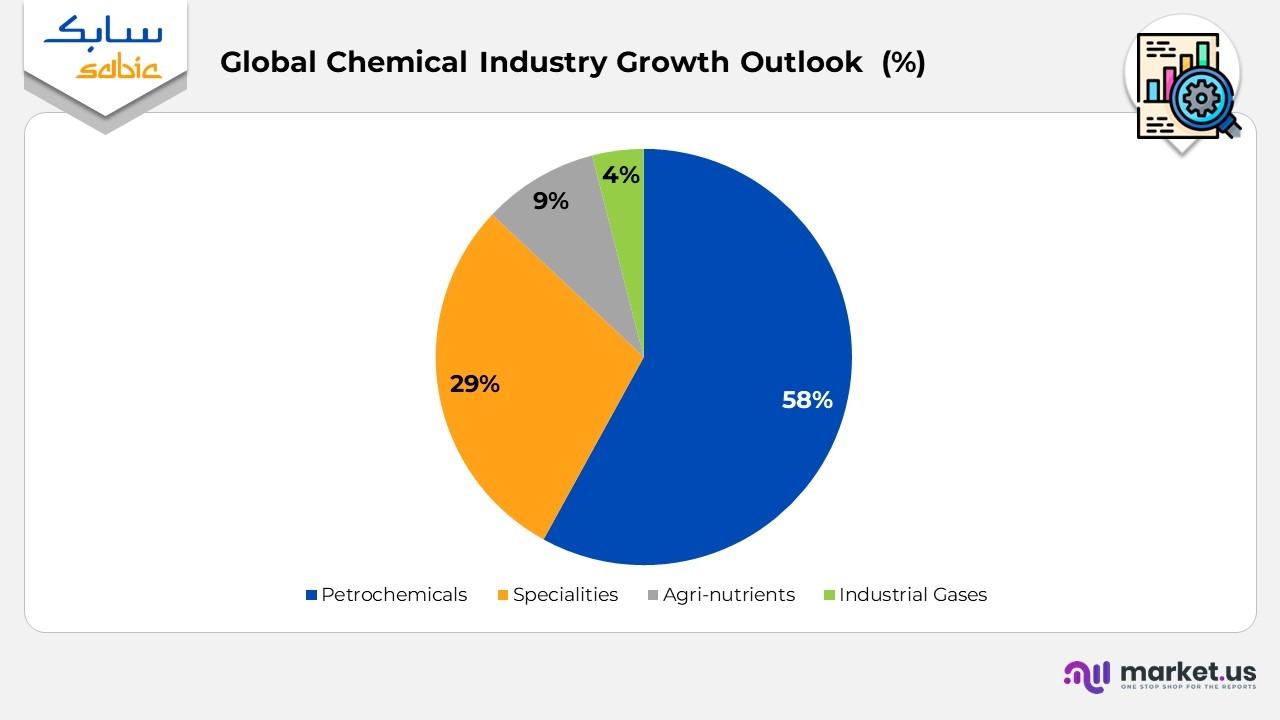

Global Chemical Industry Growth Outlook

- In 2023, petrochemicals accounted for 58% of the global chemical industry, making it the largest segment.

- Specialties represented 29% of the market, reflecting strong demand for high-performance and customized chemical solutions.

- Agri-nutrients contributed 9% to total industry segmentation, supported by global fertilizer and crop nutrient needs.

- Industrial gases accounted for 4% and served essential sectors such as healthcare, manufacturing, and electronics.

- Between 2023–2030, the petrochemicals segment is projected to grow at an annual rate of 7%.

- Specialties are expected to expand at 8% per year, driven by increased adoption of advanced materials.

- Agri-nutrients are forecast to grow at a moderate 9% annually.

- Industrial gases are anticipated to grow at a 2.8% annual rate, supported by the energy transition and industrial applications.

(Source: Saudi Basic Industries Corporation Annual Report)

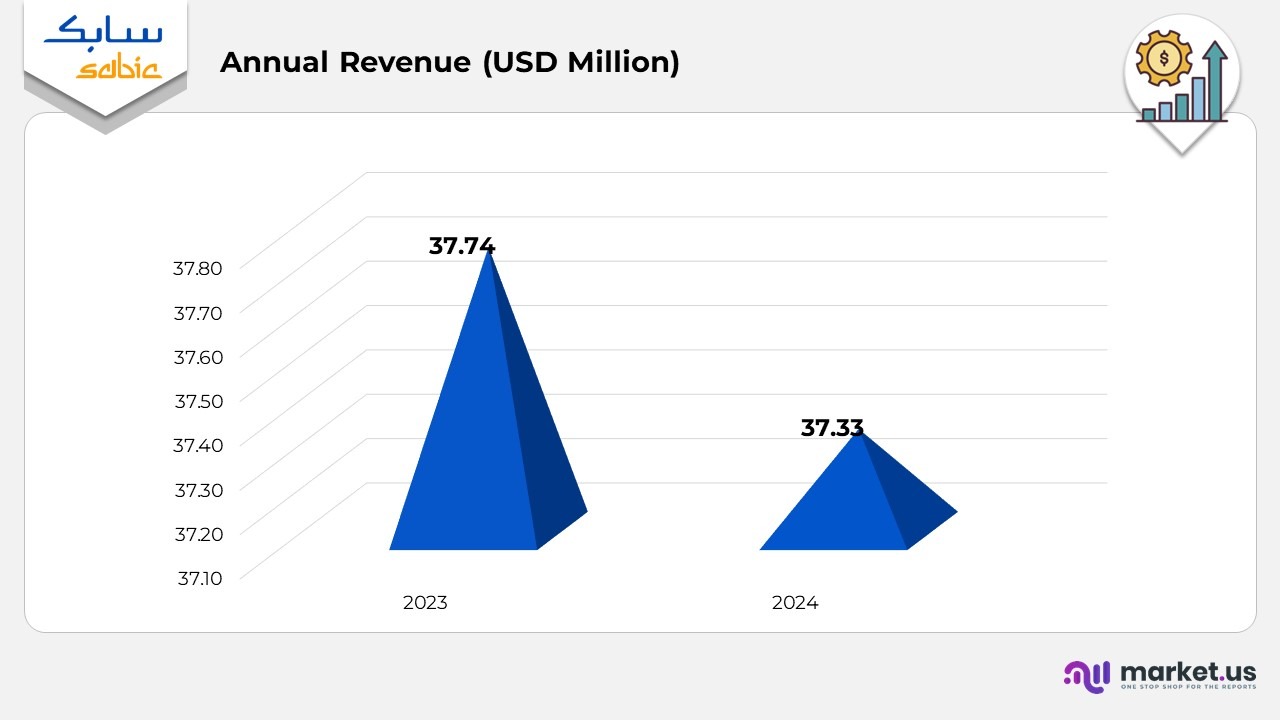

Financial Analysis

- In 2023, the company recorded an annual revenue of USD 37.74 million, reflecting stable performance supported by consistent market demand.

- In 2024, annual revenue reached USD 37.33 million, a slight decrease from the previous year.

- The year-over-year change shows a revenue decline of 0.41 million USD, indicating a marginal contraction driven by softer market conditions or pricing adjustments.

- Overall, the revenue trend between 2023 and 2024 remains broadly stable, with a year-on-year variation of less than 1%.

(Source: Saudi Basic Industries Corporation Annual Report)

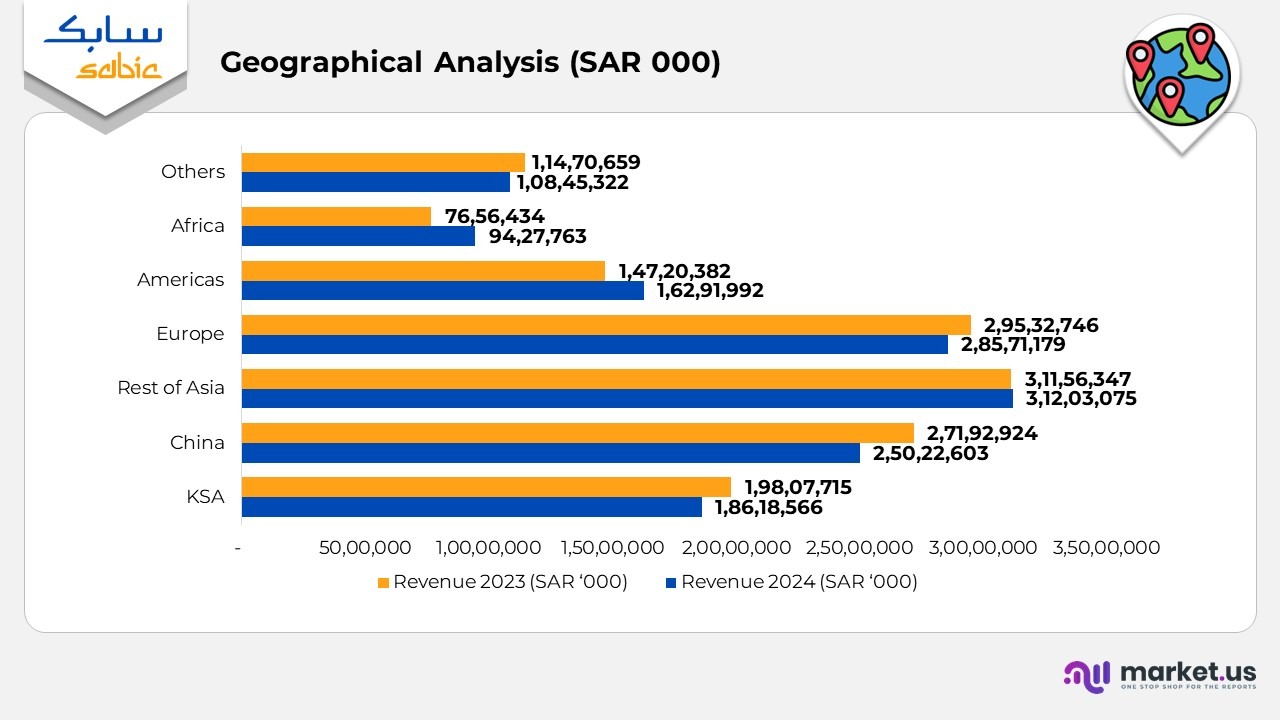

Geographical Analysis

- Revenue from KSA reached 18,618,566 in 2024, a slight decline from 19,807,715 in 2023, with the region’s share shifting from 14% to 13%.

- China generated 25,022,603 in 2024, down from 27,192,924 in 2023, while contributing 18% of total revenue, down from 19% in the previous year.

- The Rest of Asia recorded revenue of 31,203,075 in 2024, marginally lower than 31,156,347 in 2023, while maintaining a stable contribution of 22% in both years.

- Europe delivered 28,571,179 in 2024, down from 29,532,746 in 2023, representing 20% of total revenue, compared with 21% the year before.

- Revenues from the Americas increased to 16,291,992 in 2024 from 14,720,382 in 2023, with regional share rising from 10% to 12%.

- Africa reported revenue of 9,427,763 in 2024, up from 7,656,434 in 2023, raising its share to 7% from 5%.

- The Others category generated 10,845,322 in 2024, compared with 11,470,659 in 2023, contributing 8% of total revenues, down from 9%

(Note: The given amounts in thousands of Saudi Riyals)

(Source: Saudi Basic Industries Corporation Annual Report)

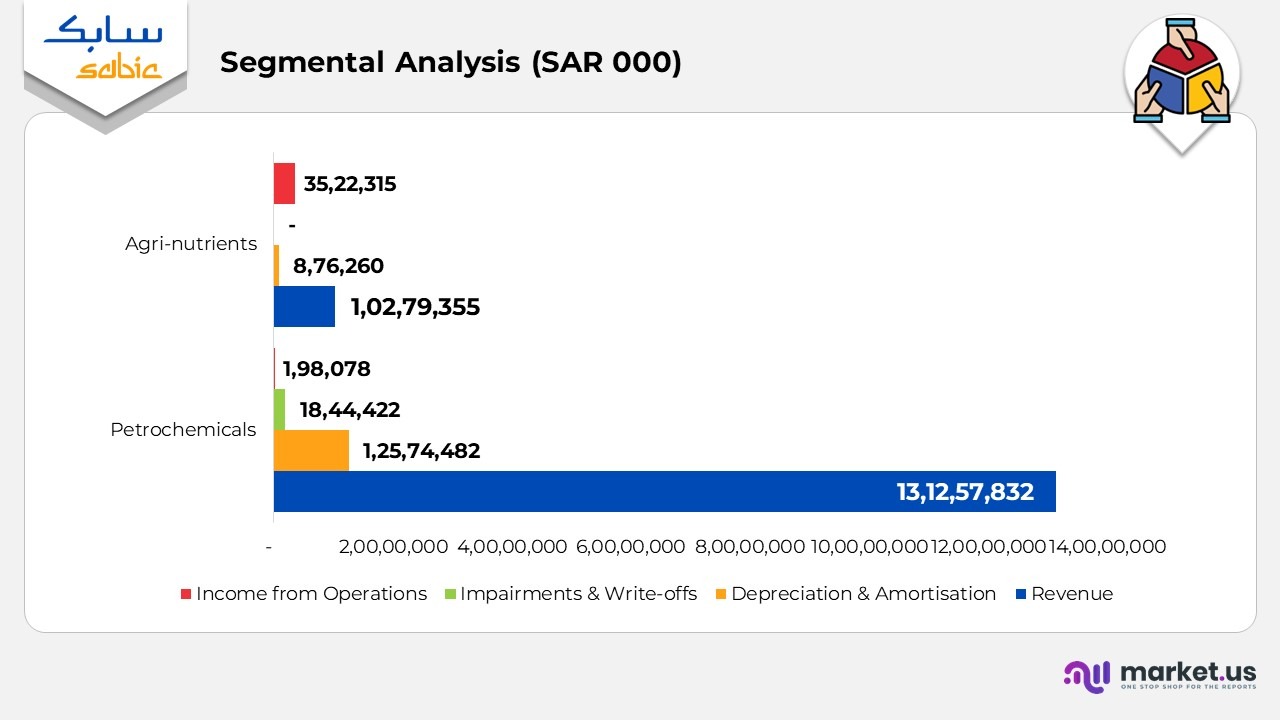

Segmental Analysis

- The Petrochemicals segment generated revenue of 131,257,832, while the Agri-nutrients segment contributed 10,279,355, resulting in total continuing operations revenue of 141,537,187.

- Depreciation and amortisation expenses amounted to 12,574,482 for Petrochemicals and 876,260 for Agri-nutrients, resulting in a combined depreciation of 13,450,742 under continuing operations.

- Impairments and write-offs totaled 1,844,422 for Petrochemicals, with no impairments recorded for Agri-nutrients, matching the total for continuing operations.

- Income from operations stood at 198,078 for Petrochemicals and 3,522,315 for Agri-nutrients, combining to 3,720,293 under continuing operations.

- The share of results from associates and non-integral joint ventures showed a loss of 819,201 for Petrochemicals but a gain of 610,744 for Agri-nutrients, resulting in a net loss of 208,457 for continuing operations.

- Finance income recorded under continuing operations amounted to 3,626,328, contributing positively to overall performance.

- Finance costs totaled 2,614,650, reflecting borrowing and financing-related expenses for the year.

- Overall, income before zakat and income tax for continuing operations reached 4,523,614, supported primarily by the Agri-nutrients segment.

(Source: Saudi Basic Industries Corporation Annual Report)

(Note: The given amounts in thousands of Saudi Riyals)

Saudi Basic Industries Corporation Patents

| Patent / Application No. | Title | Type | Filing Date | Grant / Publication Date |

|---|---|---|---|---|

| 9000200 | Process for the preparation of metallocene complexes | Grant | December 13, 2012 | April 7, 2015 |

| 8994014 | Ferroelectric devices, interconnects, and methods of manufacture | Grant | May 31, 2013 | March 31, 2015 |

| 8993468 | Catalyst for conversion of hydrocarbons – Ge zeolites | Grant | May 22, 2008 | March 31, 2015 |

| 8969232 | Catalyst for conversion of hydrocarbons – incorporation method | Grant | May 22, 2008 | March 3, 2015 |

| 8969506 | Amorphous high-Tg copolyester compositions | Grant | February 15, 2012 | March 3, 2015 |

| 8969643 | Method for conversion of aromatic hydrocarbons | Grant | May 23, 2013 | March 3, 2015 |

| 8961829 | Catalytic hydrogenation of CO₂ into syngas | Grant | April 23, 2008 | February 24, 2015 |

| 8962702 | Mixed-oxide catalyst for CO₂ conversion to syngas | Grant | December 8, 2011 | February 24, 2015 |

| 8946345 | Preparation of biodegradable copolyesters via Ti-based catalyst | Grant | March 29, 2012 | February 3, 2015 |

| 8946308 | Process to increase CO content in syngas | Grant | December 15, 2009 | February 3, 2015 |

| 8940953 | Conversion of lower aliphatic ethers to aromatics | Grant | May 9, 2013 | January 27, 2015 |

| 8933162 | Color-stabilized biodegradable copolyesters | Grant | March 28, 2012 | January 13, 2015 |

| 8933190 | Process for preparing a polyester | Grant | November 16, 2011 | January 13, 2015 |

| 8933238 | Aryloxy-phthalocyanines of Group III metals | Grant | March 5, 2014 | January 13, 2015 |

| 8927753 | Method for preparing di-organo-dialkoxysilanes | Grant | December 21, 2012 | January 6, 2015 |

| 8921257 | Dual-function oxidation catalyst for propane conversion | Grant | December 2, 2011 | December 30, 2014 |

| 8921631 | Selective catalytic hydrogenation of alkynes | Grant | December 15, 2009 | December 30, 2014 |

| 8916737 | Process for performing an endothermic reaction | Grant | June 25, 2008 | December 23, 2014 |

| 8901271 | Process for making polyethylene terephthalate (PET) | Grant | August 17, 2010 | December 2, 2014 |

| 8901243 | Biodegradable aliphatic–aromatic copolyesters | Grant | March 30, 2012 | December 2, 2014 |

(Source: Justia Patents)

Recent Developments

- In November 2025, SABIC introduced NORYL WM300G resin, a high-impact, high-strength material engineered without conventional impact modifiers that may release butadiene. This new grade helps customers get ahead of future drinking-water regulations while offering performance advantages over the widely used NORYL 713S resin.

- In October 2025, the company showcased its theme “Connecting Everyday Life” at K 2025, presenting collaborative innovations that support next-generation consumer and industrial products. The exhibit was organized into five experience zones – Live, Move, Work, Shop, and Care, demonstrating how the company’s technologies seamlessly integrate into daily applications.

- In October 2025, the company partnered with Zuyderland Medical Center in the Netherlands to convert used medical plastics into new, contact-sensitive packaging materials. Working alongside converters Coveris and ACE, and brand holders Mölnlycke Health Care and Artivion, the collaboration validated the feasibility of returning medical plastics into the medical materials loop through two successful pilot recycling projects.

- In August 2025, the company launched MEGAMOLDING, a platform designed to support the production of large thermoplastic parts across multiple sectors. By integrating advanced materials science with tooling, equipment, and processing expertise from value-chain partners, the initiative enables faster, more economical, and more sustainable alternatives to metal and thermoset manufacturing.

- In February 2025, the company teamed up with Branch Technology to develop lightweight exterior panels for the restoration of NASA’s early shuttle test article, Pathfinder. Using Branch Technology’s C-Fab cellular fabrication method and the company’s LNPTHERMOCOMP™ compound, 516 3D-printed composite panels were manufactured and later installed on the airframe. The restored Pathfinder, painted to resemble the Discovery shuttle, is now on display at the U.S. Space & Rocket Centre in Huntsville, Alabama.

(Source: Saudi Basic Industries Corporation Press Release)