Company Overview

Teva Pharmaceutical Statistics: Teva Pharmaceutical Industries Limited is a leading manufacturer of generic drugs, operating across 3 main business segments: the United States (formerly known as the North America segment), Europe, and International Markets. In addition to its extensive generic drug portfolio, Teva also develops and markets specialty and biopharmaceutical brands, primarily in Europe and the U.S. Approximately 20% of the company’s total revenue is derived from its branded portfolio, which includes patented therapies targeting central nervous system disorders (such as Austedo/Ajovy and Copaxone), cancer treatments (Bendeka/Treanda), and respiratory conditions (ProAir and Qvar).

Despite global competition driving the commodification of small-molecule generics, Teva’s portfolio rationalization has helped mitigate price erosion compared to its competitors.

Headquartered in Israel, Teva operates on a global scale with a robust presence in key markets such as the U.S., Europe, and other regions worldwide. With a network of capabilities spanning 57 markets, the company’s approximately 37,000 employees work relentlessly to advance scientific innovation and deliver high-quality medicines, improving health outcomes for millions of patients each day.

History of Teva Pharmaceutical Industries Limited

- 1901 – Teva’s journey began in Jerusalem, founded as a small wholesale drug business by Chaim Salomon, Moshe Levin, and Yitschak Elstein. The company was initially named Salmon Levin & Elstein Ltd (S.L.E.), after its founders.

- 1930–1940 – Israel’s pharmaceutical industry started to take shape, with the establishment of new manufacturing plants that gained momentum, setting the foundation for Teva’s future growth.

- 1940–1960 – The Israeli drug market expanded significantly, and Teva was among the growing number of local pharmaceutical manufacturers contributing to this development.

- 1960–1980 – During this period, the Israeli pharmaceutical industry began to consolidate, culminating in the creation of Teva Pharmaceutical Industries Ltd, solidifying its position in the market.

- 1980–1990 – Teva made a bold move into the international market, leveraging the Hatch-Waxman Act in the US to become a key player in the generics sector and setting the stage for a phase of rapid expansion.

- 1990–2000 – Teva further strengthened its global presence through strategic acquisitions, establishing itself as a leader in the US generics market and launching its first specialty medicine.

- 2000–2010 – The company continued its growth trajectory, becoming the largest generic pharmaceutical company in North America and expanding its global reach through acquisitions in Canada, the US, Europe, and Latin America. Teva also broadened its product pipeline, reinforcing its position in the industry.

- 2010 – Present – Teva has evolved into a global pharmaceutical powerhouse, providing daily medicines to approximately 200 million people With one of the most competitive operational networks in the industry, the company now manufactures 1,800 unique molecules and offers a portfolio of 3,500 products, spanning generics, specialty medicines, and over-the-counter treatments.

(Source: Company Website)

Financial Analysis

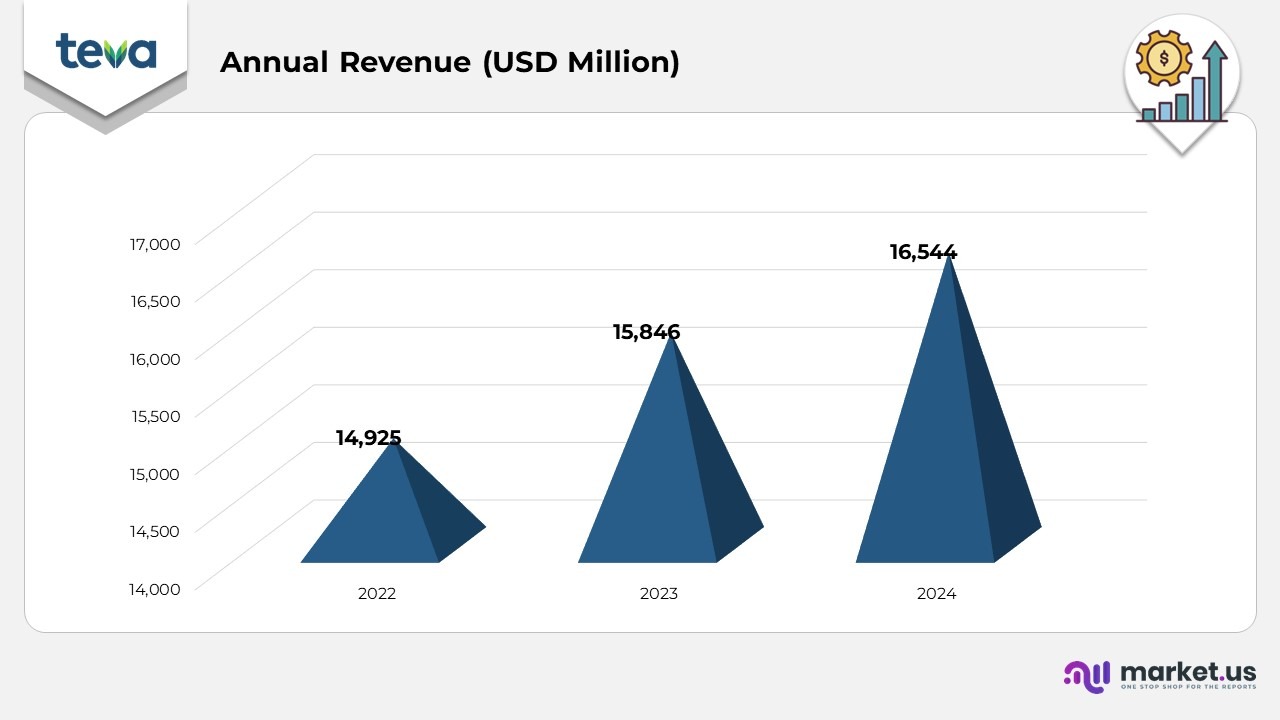

- In 2022, the company recorded an annual revenue of USD 14,925 million, setting the stage for steady growth within its industry.

- In 2023, the company’s revenue rose to USD 15,846 million, reflecting a 2% increase from 2022, driven by strong sales and successful market expansions.

- By 2024, the company’s revenue reached USD 16,544 million, marking a 4% growth compared to the previous year, with growth supported by new product launches and deeper market penetration.

- In 2024, the company reported revenues of USD 16,544 million, reflecting a 4% increase inU.S. dollars, or 6% growth in local currency terms compared to 2023.

- This growth was primarily driven by higher sales from generic products across all segments, notably lenalidomide capsules (generic Revlimid) in the U.S. segment.

- The company’s innovative products, including AUSTEDO, AJOVY, and UZEDY, also contributed significantly to the revenue increase.

- Additionally, the sale of certain product rights helped boost the overall revenue.

- However, the growth was partially offset by an upfront payment received in 2023 related to the collaboration on the duvakitug (anti-TL1A)

- Revenues from certain innovative products, particularly COPAXONE, BENDEKA, and TREANDA, declined, impacting overall performance.

- In 2024, the company reported a gross profit of USD 8,064 million, reflecting a 5% increase compared to 2023.

- The gross profit margin improved to 48.7% in 2024, up from 48.2% in 2023, driven by a more favorable product mix.

- The increase in gross profit margin was mainly due to higher revenues from AUSTEDO and lenalidomide capsules (the generic version of Revlimid®), which contributed significantly to profitability.

- Additionally, the sale of certain product rights boosted overall gross profit.

- However, the growth was partially offset by an upfront payment received in 2023 related to the collaboration on the duvakitug (anti-TL1A) asset.

Segment Revenue Breakdown by Major Products and Activities

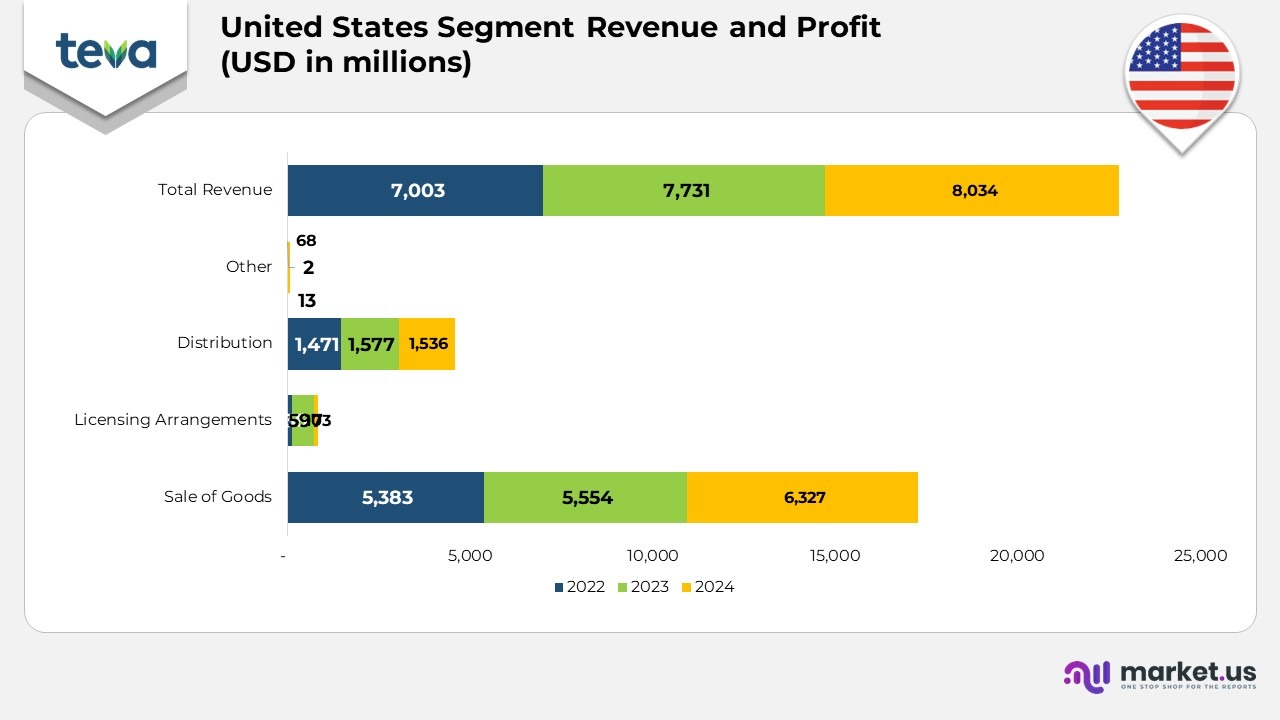

Teva Pharmaceutical United States Segment Statistics:

- In 2024, the United States segment generated USD 8,034 million in total revenue, reflecting a steady increase from USD 7,731 million in 2023 and USD 7,000 million in 2022. The revenue growth was primarily driven by the continued success of generic products, which contributed USD 3,599 million in 2024, marking an increase from USD 3,138 million in 2023 and USD 3,155 million in 2022. This growth in the generic portfolio was bolstered by key products like lenalidomide capsules (generic version of Revlimid).

- AJOVY, one of Teva’s key branded treatments for migraine prevention, brought in USD 207 million in 2024, slightly lower than the USD 211 million in 2023 and USD 210 million in 2022.

- The revenue from AUSTEDO, a treatment for tardive dyskinesia and chorea associated with Huntington’s disease, showed remarkable growth, reaching USD 1,642 million in 2024, a substantial rise from USD 1,225 million in 2023 and USD 963 million in 2022, highlighting the increased demand for this innovative treatment.

Moreover

- BENDEKA and TREANDA, both key oncology products, saw a decline in revenue to USD 168 million in 2024, down from USD 237 million in 2023 and USD 309 million in 2022, reflecting increased competition and market changes.

- COPAXONE, a prominent multiple sclerosis treatment, generated USD 242 million in 2024, continuing its decline from USD 297 million in 2023 and USD 359 million in 2022 as it faced competition from generics.

- UZEDY, a new treatment for schizophrenia, achieved USD 117 million in 2024, marking a strong start compared to USD 23 million in 2023 and no revenue in 2022.

- Revenue from Anda, which deals with the sale of generic products, contributed USD 1,536 million in 2024, slightly lower than USD 1,577 million in 2023, but still ahead of USD 1,471 million in 2022.

- Other product revenues, which include additional therapeutic areas, brought in USD 523 million in 2024, a decrease from USD 1,025 million in 2023, but a notable increase from USD 536 million in 2022.

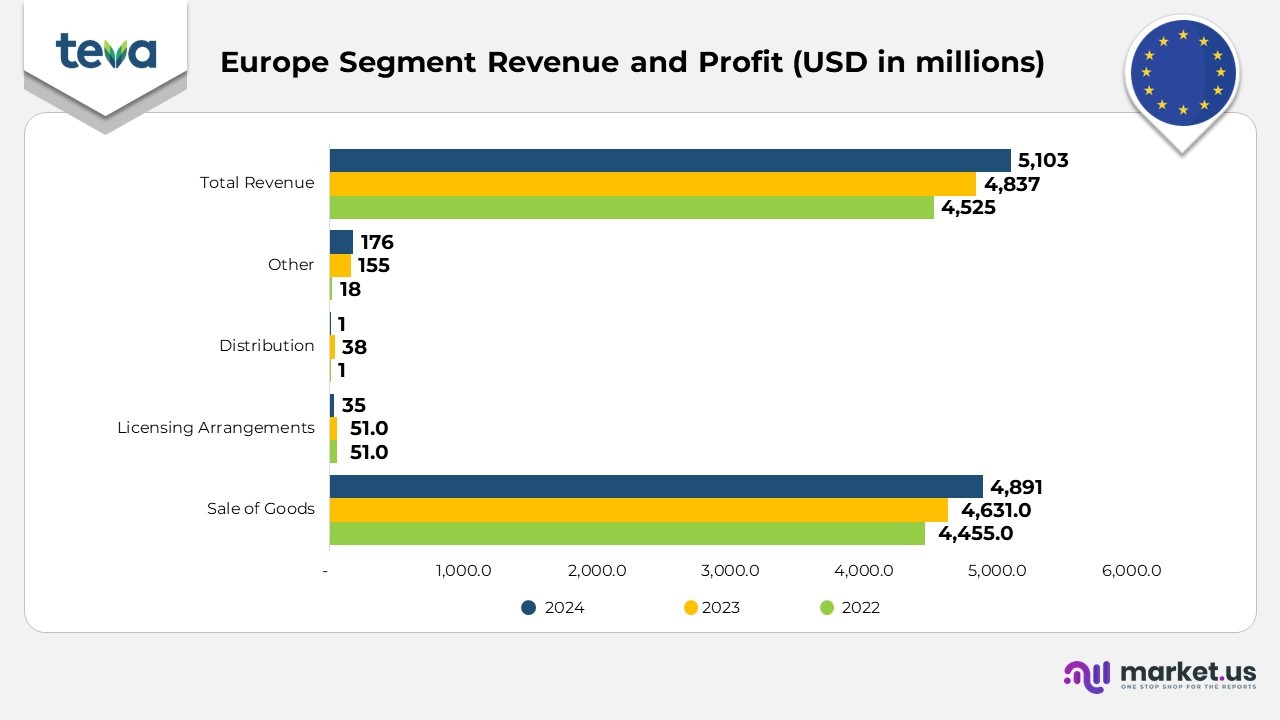

Teva Pharmaceutical Europe Segment Statistics:

- In 2024, the Europe segment generated USD 5,103 million in total revenue, an increase from USD 4,837 million in 2023 and USD 4,525 million in 2022. The revenue was driven by strong performance in the generic products (including OTC and biosimilars) category, which reached USD 3,926 million in 2024, up from USD 3,664 million in 2023 and USD 3,466 million in 2022.

- AJOVY contributed USD 216 million in 2024, a significant increase from USD 160 million in 2023 and USD 124 million in 2022, supported by expanded patient access and new indications.

- COPAXONE generated USD 213 million in 2024, slightly lower than USD 231 million in 2023 and USD 268 million in 2022, reflecting challenges from generic competition.

- Respiratory products, including medications like Qvar, brought in USD 244 million in 2024, a slight decline from USD 265 million in 2023 and USD 273 million in 2022, as competition increased in the respiratory space.

- Other products in the European segment, including several smaller therapeutics, contributed USD 504 million in 2024, down from USD 516 million in 2023, but an increase from USD 393 million in 2022.

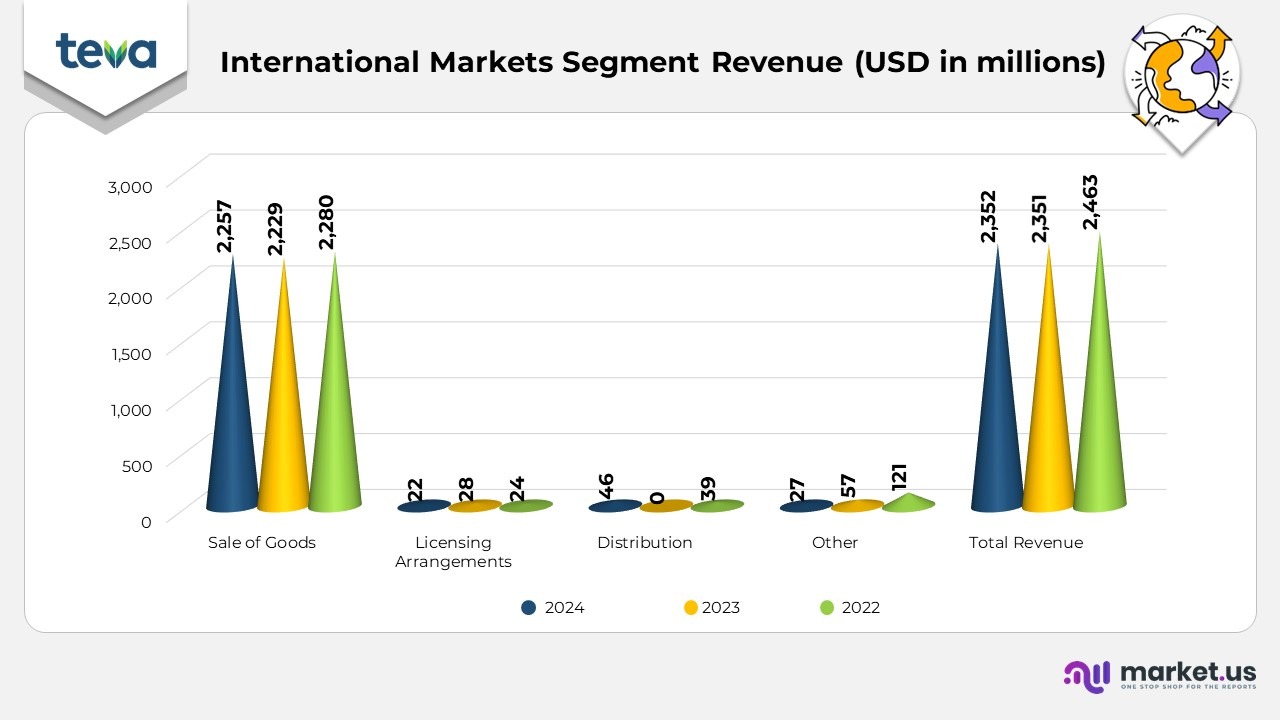

International Markets Segment Statistics:

- The International Markets segment reported USD 2,463 million in total revenue for 2024, showing a modest increase from USD 2,351 million in 2023 and USD 2,352 million in 2022. The generic products (including OTC and biosimilars) category remained the main contributor, bringing in USD 1,937 million in 2024, a slight increase from USD 1,932 million in 2023, but a slight decline from USD 1,980 million in 2022.

- AJOVY generated USD 84 million in 2024, compared to USD 63 million in 2023 and USD 42 million in 2022, reflecting growth driven by expanding market presence.

- COPAXONE sales declined to USD 48 million in 2024, down from USD 63 million in 2023 and USD 64 million in 2022, impacted by the increasing generic alternatives in international markets.

- AUSTEDO saw impressive growth in the international markets, reaching USD 46 million in 2024, compared to USD 15 million in 2023 and USD 8 million in 2022, as it became available in more regions.

- Other products in the International Markets segment contributed USD 349 million in 2024, up from USD 278 million in 2023 and USD 257 million in 2022, indicating broader growth in diverse therapeutic areas.

(Source: Teva Pharmaceutical Annual Report)

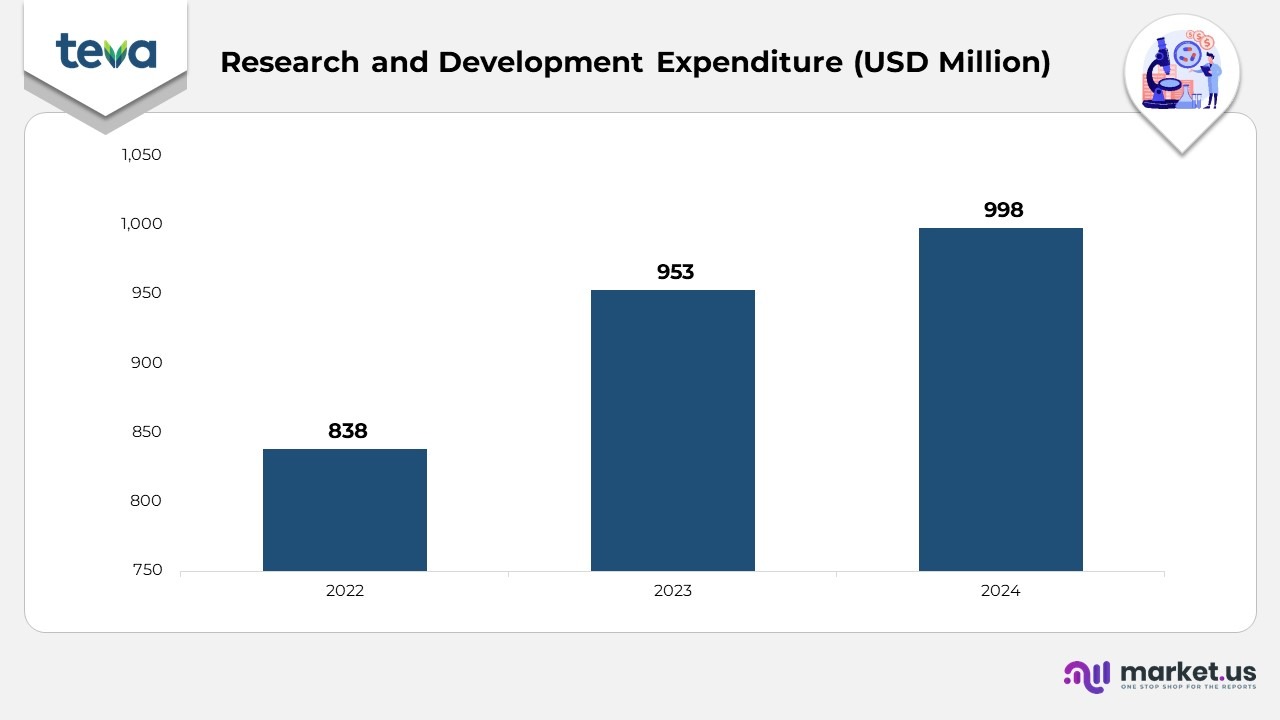

Research and Development Expenditure Statistics

- In 2024, the company’s R&D expenses totaled USD 998 million, reflecting a 5% increase compared to USD 953 million in 2023, as the company continues to implement its Pivot to Growth

- The rise in R&D expenses was primarily driven by increased investments in immunology and immuno-oncology, as well as advancing its late-stage innovative pipeline in neuroscience, particularly in neuropsychiatry, and the growth of its biosimilars pipeline.

- However, the increase was partially offset by a reduction in funding for certain generics projects.

- Additionally, reimbursements from strategic partnerships formed in 2023 and 2024 helped moderate the overall R&D expenditure.

- As a percentage of total revenues, R&D expenses remained steady at 0% in 2024, the same as in 2023, reflecting stable investment in research relative to revenue growth.

(Source: Teva Pharmaceuticals SEC Filings)

Recent Developments

- In October 2025, Teva Pharmaceuticals signed an agreement with Prestige Biopharma for the commercialization of Tuznue® (trastuzumab), a biosimilar to Herceptin®, across a majority of European markets.

- In October 2025, the company received the U.S. Food and Drug Administration (FDA) has approved UZEDY (risperidone) as a once-monthly extended-release injectable suspension as monotherapy or as adjunctive therapy to lithium or valproate for the maintenance treatment of bipolar I disorder (BD-I) in adults.

- In September 2025, the company received the U.S. Food and Drug Administration (FDA) granted Fast Track designation for Teva’s investigational therapy emrusolmin (TEV-56286) for the treatment of Multiple System Atrophy (MSA).

- In August 2025, the company received FDA approval and U.S. launch of a generic version of Saxenda®1 (liraglutide injection).

(Source: Teva Pharmaceuticals Press Releases)