Company Overview

Novo Nordisk Statistics: Novo Nordisk A/S is a global healthcare company engaged in the development, production, and marketing of biomedical and pharmaceutical medicines across diverse therapeutic areas. The company’s portfolio includes treatments for hemophilia and growth hormone disorders, alongside a strong focus on its two core business segments: Diabetes and Obesity Care and Rare Disease. Novo Nordisk maintains a presence in over 80 countries, spanning Europe, the Middle East and Africa, Mainland China, Hong Kong, Taiwan, and the United States, underscoring its extensive international footprint.

In 2024, the company’s U.S. distribution network was anchored by 3 major wholesalers, contributing approximately 23%, and 17% of total global net sales, compared to 22%, 17%, and 15% in 2023, and 19%, 14%, and 13% in 2022. These wholesalers distribute products across both Diabetes and Obesity Care and Rare Disease segments, reflecting Novo Nordisk’s integrated and strategically diversified sales structure.

Key Facts

- Novo Nordisk was founded in 1923 in Denmark and is headquartered in Bagsværd, near Copenhagen.

- The company specializes in diabetes care, obesity treatment, rare blood disorders, and hormone therapies.

- It is one of the world’s largest producers of insulin and pioneered modern insulin therapies for diabetes management.

- Novo Nordisk operates in more than 170 countries and employs over 60,000 people globally.

- The company’s mission is to drive change to defeat diabetes and other serious chronic diseases.

- Novo Nordisk’s product portfolio includes leading brands such as Ozempic, Wegovy, Rybelsus, and Levemir.

- The firm invests heavily in research and development, dedicating a significant portion of annual revenue to advancing metabolic and rare disease therapies.

- Novo Nordisk’s insulin production facilities serve millions of people worldwide every year.

- The company follows a unique “Triple Bottom Line” business principle, balancing financial, social, and environmental responsibility.

- Novo Nordisk’s sustainability efforts focus on achieving zero environmental impact and ensuring equitable healthcare access worldwide.

Novo Nordisk Statistics By Financial Analysis

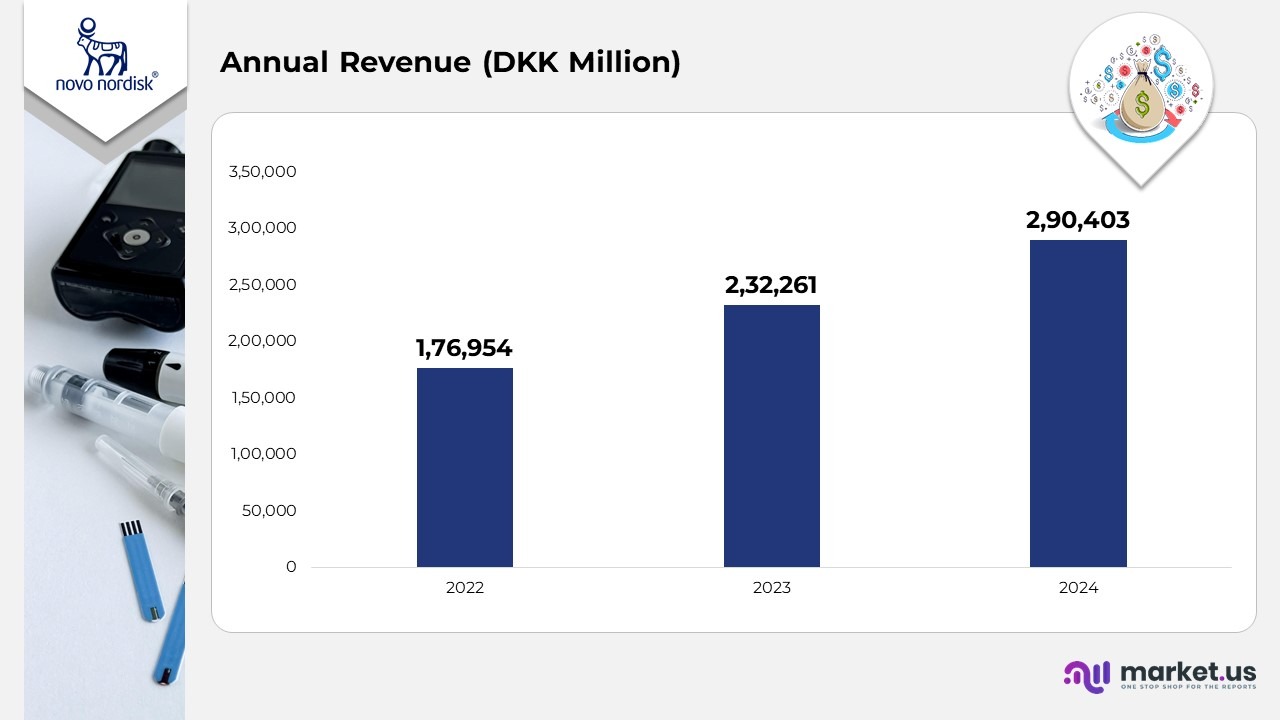

- In 2022, Novo Nordisk generated DKK 176,954 million in total revenue, reflecting strong performance driven by rising global insulin demand and expansion into metabolic disease therapies.

- In 2023, revenue increased significantly to DKK 232,261 million, supported by the accelerating uptake of GLP-1–based treatments, particularly semaglutide, and enhanced large-scale production capacity.

- In 2024, the company reported DKK 290,403 million in revenue, underscoring growth from obesity-care product adoption and deeper market penetration across Europe and North America.

- The firm sustained an average annual growth rate of 25%, highlighting robust operational execution, innovation-driven strategy, and well-coordinated global expansion.

- Novo Nordisk’s 2024 sales and operating profit at constant exchange rates (CER) remained within the projected range issued in November 2024, demonstrating consistent operational delivery.

- The company’s effective tax rate, capital expenditure, and depreciation, amortisation, and impairment levels were all aligned with prior guidance, indicating disciplined financial management.

- Free cash flow stood at DKK−14.7 billion in 2024, primarily affected by the USD 11.7 billion acquisition related to the purchase of three Catalent manufacturing facilities, marking a major strategic investment in production capacity.

(Source: Novo Nordisk A/S Annual Report)

Segmental Analysis By Novo Nordisk Statistics

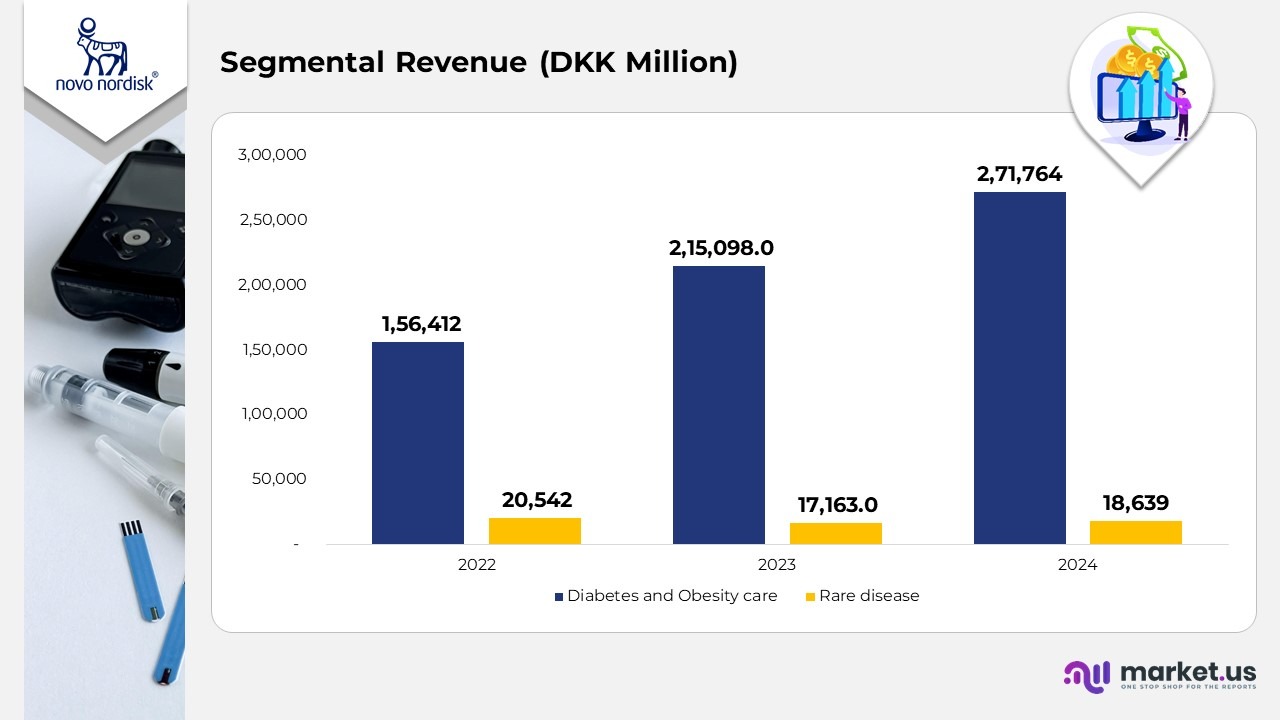

- In 2022, Diabetes and Obesity Care generated DKK 156,412 million, supported by robust insulin sales and early traction from GLP-1 therapies.

- The Rare Disease segment recorded DKK 20,542 million, maintaining steady performance in growth hormone and haemophilia treatments.

- In 2023, revenue from Diabetes and Obesity Care climbed to DKK 215,098 million, reflecting the rapid uptake of semaglutide-based products such as Ozempic and Wegovy. Meanwhile, Rare Disease declined to DKK 17,163 million, affected by portfolio streamlining and intensifying competition in biologics.

- In 2024, Diabetes and Obesity Care advanced further to DKK 271,764 million, reinforcing its role as Novo Nordisk’s dominant growth engine, driven by expanded global reach and higher manufacturing capacity. The Rare Disease division recovered slightly to DKK 18,639 million, showing stabilization and renewed growth in select niche therapies.

- Between 2022 and 2024, Diabetes and Obesity Care posted a 74% increase, whereas Rare Disease experienced a modest 9% decline, underlining Novo Nordisk’s strategic pivot toward large-scale metabolic and obesity-care markets.

(Source: Novo Nordisk A/S Annual Report)

Novo Nordisk Statistics By Geographical Analysis

- North America Operations registered a 30% sales increase, both in Danish kroner (DKK) and at constant exchange rates (CER), driven by strong demand for GLP-1–based therapies and expanding market penetration in the obesity-care segment.

- International Operations achieved 17% growth in DKK and 19% at CER, supported by accelerating uptake of metabolic and rare-disease treatments across emerging markets.

- EMEA (Europe, the Middle East, and Africa) posted a 19% rise in both DKK and CER, reflecting sustained momentum in key European markets and improved healthcare access initiatives.

- Region China delivered 11% sales growth in DKK and 13% at CER, propelled by the increasing adoption of next-generation diabetes therapies and a gradual rebound in healthcare utilization.

- Rest of World markets expanded by 19% in DKK and 23% at CER, underpinned by volume growth in Latin America and Asia-Pacific as Novo Nordisk strengthened its global distribution footprint.

Moreover

- In 2024, the United States accounted for 10% or more of Novo Nordisk’s total net sales, maintaining the same proportional contribution as in 2023, underscoring the country’s strategic importance in driving global revenue.

- The country of domicile, Denmark, forms part of the EMEA region, yet remains immaterial to overall sales, with 2% of total net sales generated outside Denmark in both 2023 and 2024, reflecting the company’s highly internationalized business structure.

- Sales allocation is determined based on the geographical location of customers, ensuring transparent reporting aligned with regional performance metrics.

- Total property, plant, and equipment (PPE) combined with intangible assets reached DKK 273,578 million in 2024, up from DKK 151,367 million in 2023, highlighting major capital expansion initiatives.

- Of these assets, DKK 177,471 million were located in Denmark in 2024 (versus DKK 82,274 million in 2023), reflecting intensified domestic investment in production infrastructure.

- In the United States, assets totalled DKK 57,141 million in 2024, compared to DKK 46,609 mi

- llion in 2023, indicating continuous reinforcement of the company’s North American operational capacity.

(Source: Novo Nordisk A/S Annual Report)

Employee Analysis By Novo Nordisk Statistics

- The average number of full-time employees increased steadily from 51,046 in 2022 to 59,552 in 2023, reaching 69,480 in 2024, reflecting Novo Nordisk’s continuous expansion of production capacity and global operations.

- The year-end count of full-time employees grew from 54,393 in 2022 to 63,370 in 2023, and further to 76,302 in 2024, indicating a strong workforce ramp-up aligned with rising demand for diabetes and obesity-care products.

- The total year-end headcount, including all categories of employees, climbed from 55,181 in 2022 to 64,319 in 2023 and reached 77,349 in 2024, underscoring Novo Nordisk’s strategic focus on scaling manufacturing, R&D, and commercial operations globally.

- Overall, between 2022 and 2024, the company’s workforce expanded by over 40%, highlighting sustained organizational growth driven by increased investment in innovation and global supply-chain capability.

(Source: Novo Nordisk A/S Annual Report)

Novo Nordisk Statistics By Research and Development Expenditure

- Research and development (R&D) expenses rose by 48% in both Danish kroner (DKK) and constant exchange rates (CER), reaching DKK 48,062 million in 2024, primarily driven by intensified late-stage clinical trials, expanded early research programs, and impairment losses on intangible assets.

- R&D investments accounted for 6% of total sales, underscoring Novo Nordisk’s continued commitment to advancing its innovation pipeline across diabetes, obesity, and rare disease segments.

- Administrative costs grew by 9% year-on-year, amounting to DKK 5,276 million, reflecting higher operational and compliance-related expenditures associated with global expansion.

- Other operating income and expenses (net) recorded a loss of DKK 2,103 million in 2024, compared to an income of DKK 119 million in 2023, primarily due to increased restructuring charges and non-recurring operational adjustments.

(Source: Novo Nordisk A/S Annual Report)

Novo Nordisk A/S – Product and Device Patent Landscape Statistics

| Product / Device | Description | Patent Numbers (U.S.) | Patent Status / Notes |

|---|---|---|---|

| — | General biomedical medicines | 8,361,469; 9,574,011; 10,835,602; 9,795,674; 8,652,471 | Active patents covering core therapeutic formulations |

| Esperoct | Antihemophilic Factor (recombinant), GlycoPEGylated – lyophilized powder for IV use | 8,536,126; 9,150,848 | Active patents protecting the formulation and manufacturing process |

| Fiasp | Insulin aspart injection for SC or IV use | 8,324,157 → 11,311,679 (series including RE46,363 & D-patents) | Extensive portfolio covering insulin formulation and delivery devices |

| Glucagen | Glucagon injection for SC/IM/IV use | — | No unexpired patents |

| Levemir | Insulin detemir injection for SC use | 8,684,969 → 11,311,679 (series including RE46,363 & D-patents) | Patent family aligned with insulin analog technology |

| Norditropin | Somatropin injection for SC use | 8,684,969 → 11,311,679 plus D729,930, D765,833 | Active patents covering growth hormone formulation and pen design |

| Novoeight | Antihemophilic Factor (recombinant) lyophilized powder for IV use | 8,399,620; 9,982,033 | Active patents |

| Novolin 70/30, N, R | Human insulin formulations | — | No unexpired patents |

| Novolog | Insulin aspart injection for SC or IV use | 11,311,679 | Active patent coverage for aspart technology |

| Novolog Mix 70/30 | Insulin aspart protamine mix for SC use | — | No unexpired patents |

| Novoseven RT | Coagulation Factor VIIa (recombinant) lyophilized powder for IV use | 8,299,029 | Active patent |

| Ozempic | Semaglutide injection for SC use | 8,114,833 → 11,311,679 plus US 10,335,462 | Broad GLP-1 and delivery technology patent coverage |

| Prandin | Repaglinide tablets for oral use | — | No unexpired patents |

| Rebinyn | Coagulation Factor IX (recombinant, GlycoPEGylated) powder for IV injection | 7,138,371 → 8,791,070 | Active patents on PEGylation and formulation |

| Rivfloza | Nedosiran injection (80 mg – 160 mg) | 10,351,854 → 11,661,604 | Active patents on RNAi-based formulation |

| Rybelsus | Semaglutide oral tablets | 8,129,343 → 11,759,503 plus design patents | Extensive patents protecting oral semaglutide and tablet design |

| Ryzodeg 70/30 | Insulin degludec and aspart injection for SC use | 7,615,532 → 11,311,679 plus RE46,363 & design patents | Active patent portfolio on co-formulation technology |

| Saxenda | Liraglutide injection for SC use | 8,114,833 → 11,311,679 plus RE46,363 & D-patents | Active patents protecting GLP-1 analog composition |

| Tresiba | Insulin degludec injection for SC use | 7,615,532 → 11,311,679 plus RE46,363 & D-patents | Active patents cover ultra-long-acting insulin and device integration |

| Tretten | Coagulation Factor XIII A-Subunit (Recombinant) for IV use | 10,391,062 | Active patent |

| Vagifem | Estradiol vaginal tablets | 7,018,992 | Active patent covering a hormone tablet formulation |

| Victoza | Liraglutide injection for SC use | 8,114,833; 9,265,893; 9,968,659; RE 41,956 | Active patents on GLP-1 analog composition |

| Wegovy | Semaglutide injection for SC use | 8,129,343 → 12,029,779 plus D952,835 | Active patents protecting obesity treatment formulation and delivery |

| Xultophy 100/3.6 | Insulin degludec and liraglutide injection for SC use | 7,615,532 → 11,311,679 plus RE46,363 & D-patents | Active patent family for fixed-dose combination therapy |

| Sogroya | Somapacitan-beco injection for SC use | 8,779,109; 9,695,226; 11,045,523 | Active patents cover growth hormone molecule design |

| Autocover | Injection device | 8,075,522 | Active device patent |

| Flexpen | Insulin delivery pen system | 9,265,893 | Active device patent |

| Flexpro | Insulin pen device | 8,684,969 → 11,311,679 plus RE46,363 & D-patents | Active patents for the pen mechanism and design |

| Flexpro Penmate | Pen attachment device | — | No unexpired patents |

| Flextouch | Insulin delivery pen | 8,684,969 → 11,311,679 plus RE46,363 & D-patents | Active device patents covering a user-friendly injection design |

| Novofine 32G / Plus 32G | Pen needle systems | — | No unexpired patents |

| Novopen Echo | Reusable pen system | D762,222 | Active design patent |

| Novotwist | Needle connector system | 7,654,986; D675,316 | Active device patents |

| Penfill / Penfill Cartridge | Insulin cartridge system | — | No unexpired patents |

(Source: Novo Nordisk A/S Company Website)

Fun Facts

- Novo Nordisk began with two small Danish companies competing to produce insulin; they later merged in 1989 to form the current global giant.

- The company manufactures about half of the world’s insulin supply, making it one of the most critical players in global healthcare.

- Novo Nordisk’s innovation in obesity drugs such as Wegovy and Ozempic transformed global discussions around metabolic health and weight management.

- The firm’s logo features the Apis bull, an ancient Egyptian symbol representing strength, vitality, and health.

- Novo Nordisk owns a large share of Novo Holdings, its parent foundation, which reinvests profits into life science innovation and global health initiatives.

- The company’s headquarters in Denmark is designed to be fully energy-efficient, reflecting its commitment to carbon neutrality.

- Novo Nordisk runs global education programs promoting awareness of diabetes prevention and early diagnosis.

- Its employees participate in “Changing Diabetes” community projects across multiple continents each year.

- The company often ranks among the world’s most sustainable corporations and top employers in the life sciences sector.

- Despite being nearly a century old, Novo Nordisk continues to lead in biotech innovation, combining heritage and modern science to address chronic diseases.

Recent Developments

- In October 2025, Novo Nordisk entered into a global licensing agreement with Omeros Corporation for the investigational drug zaltenibart (formerly OMS906), aimed at treating rare blood and kidney disorders. The deal grants Novo Nordisk exclusive worldwide rights to develop and commercialize the candidate across all therapeutic indications.

- Also in October 2025, the company acquired Akero Therapeutics, Inc., expanding its presence in metabolic disease research focused on patient populations with high unmet medical needs.

- In August 2025, the S. Food and Drug Administration (FDA) approved a new indication for Wegovy (semaglutide 2.4 mg), authorizing its use in treating noncirrhotic metabolic dysfunction-associated steatohepatitis (MASH) with moderate to advanced liver fibrosis (stages F2–F3), combined with lifestyle modifications.

- In May 2025, Novo Nordisk announced a strategic collaboration with Septerna, Inc. to discover, develop, and commercialize oral small-molecule therapies targeting obesity, type 2 diabetes, and cardiometabolic diseases, enhancing its next-generation treatment pipeline.

- In March 2025, the company entered into an agreement with United Laboratories International Holdings Limited (TUL) for UBT251, a triple receptor agonist (GLP-1, GIP, and glucagon) in early-stage clinical development for obesity and type 2 diabetes management.

- In January 2025, Novo Nordisk partnered with Valo Health, Inc. to leverage AI-driven discovery and human data analytics for the development of novel therapies in obesity, type 2 diabetes, and cardiovascular diseases, reinforcing its digital R&D capabilities.

(Source: Novo Nordisk A/S Press Releases)