Company Overview

Novartis Statistics: Novartis AG is a leading global healthcare company focused on developing, manufacturing, and commercializing innovative medicines that address some of the world’s most challenging diseases. The company’s operations span 5 major therapeutic areas: cardiovascular, renal and metabolic diseases; neuroscience; oncology; immunology; and established brands reflecting its commitment to advancing science and improving patient outcomes.

With a worldwide footprint, Novartis maintains a presence in over 40 countries and manages more than 30 production facilities strategically located across continents to ensure efficient global supply and accessibility. Its strong international network extends across regions such as Asia-Pacific, North America, Europe, the Middle East, Africa, and Latin America.

The company operates in a broad range of nations, including the United Kingdom, Germany, the United States, France, Australia, Italy, Japan, India, China, Canada, Brazil, South Korea, Singapore, and South Africa, among many others. Additional markets include countries across Europe (Austria, Spain, Belgium, Sweden, Poland, and the Netherlands), the Middle East (UAE, Qatar, Saudi Arabia, and Kuwait), and Africa (Ghana, Morocco, Egypt, and Zambia). Novartis’s extensive presence across developed and emerging economies highlights its global integration and ability to deliver innovative treatments to diverse patient populations worldwide.

Employee Analysis

- As of December 31, 2024, the company reported a total global workforce of 75,883 full-time employees across all operational regions.

- In the United States, the employee base reached 12,603, including 5,179 in marketing and sales, 5,083 in research and development, 1,323 in production and supply, 591 in operations, and 427 in administrative functions.

- Across Canada and Latin America, the organization employed 3,691 individuals, distributed as 1,707 in marketing and sales, 413 in research and development, 336 in production and supply, 1,062 in operations, and 173 in administration.

- In Europe, the region accounted for the highest employment share with 34,152 personnel, comprising 7,908 in marketing and sales, 8,923 in research and development, 11,823 in production and supply, 3,993 in operations, and 1,505 in administrative roles.

- Within Asia, Africa, and Australasia, the total headcount stood at 25,437, including 12,327 in marketing and sales, 4,204 in research and development, 2,717 in production and supply, 5,514 in operations, and 675 in administrative positions.

(Source: Novartis AG Annual Report)

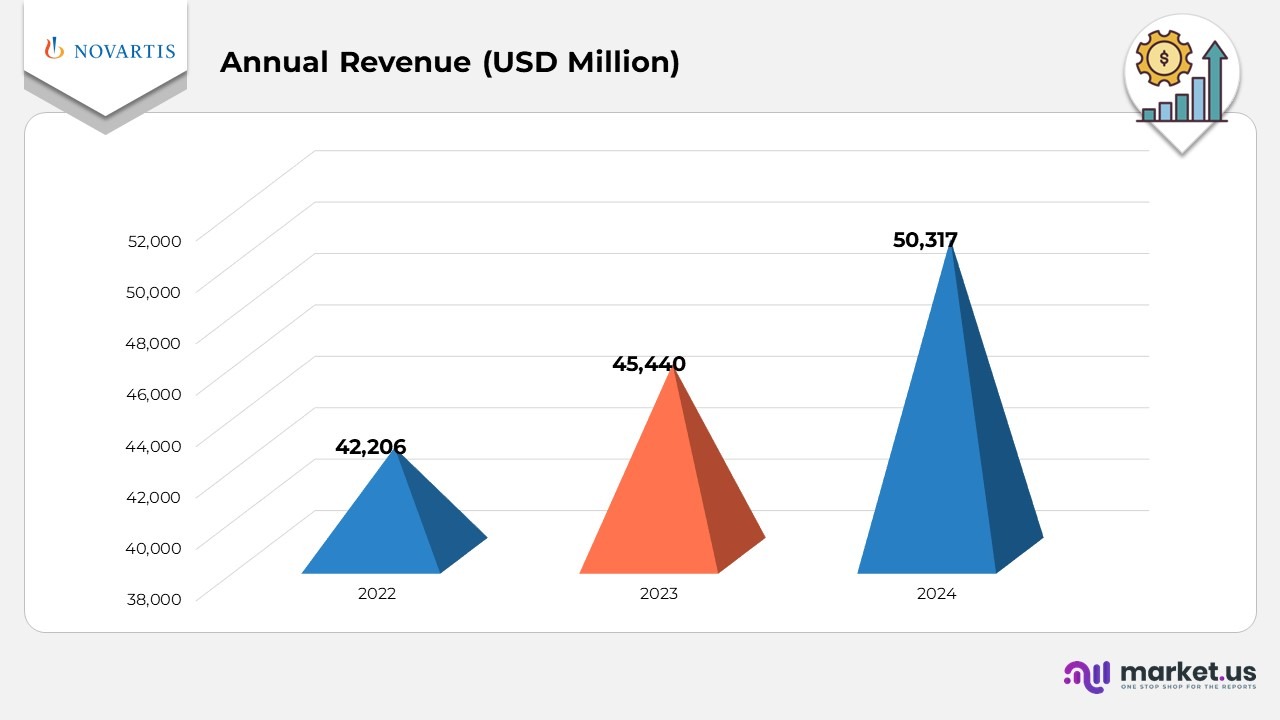

Financial Analysis

- In 2022, Novartis AG recorded an annual revenue of USD 42,206 million, marking a steady performance across its major therapeutic categories such as oncology, neuroscience, and cardiovascular care.

- By 2023, the company’s revenue increased to USD 45,440 million, supported by strong market uptake of newly launched drugs, portfolio optimization, and enhanced accessibility in developing regions.

- In 2024, Novartis reached a new peak with USD 50,317 million in annual revenue, underscoring its sustained growth momentum driven by innovation in biologics, expansion of specialty medicines, and higher global demand for its advanced healthcare solutions.

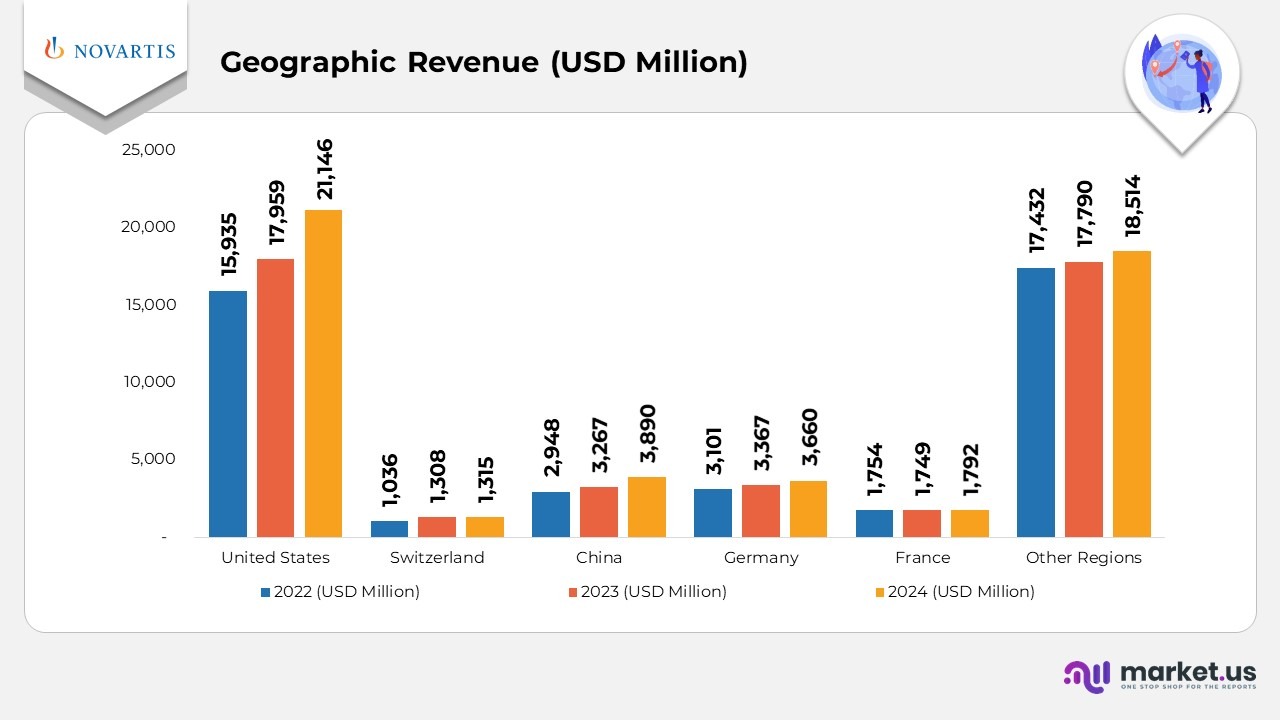

Geographical Revenue

- In the United States, Novartis’ net sales rose from USD 15,935 million in 2022 to USD 17,959 million in 2023 and further reached USD 21,146 million in 2024, highlighting strong product uptake and successful launches in major therapeutic areas.

- In Switzerland, sales showed steady growth, increasing from USD 1,036 million in 2022 to USD 1,308 million in 2023, and slightly advancing to USD 1,315 million in 2024, supported by stable market operations and domestic demand.

- In China, revenues climbed from USD 2,948 million in 2022 to USD 3,267 million in 2023, and further improved to USD 3,890 million in 2024, reflecting greater access to innovative drugs and growing healthcare collaborations.

- In Germany, net sales increased from USD 3,101 million in 2022 to USD 3,367 million in 2023 and reached USD 3,660 million in 2024, boosted by higher demand for neuroscience and cardiovascular products.

- In France, sales remained relatively consistent, at USD 1,754 million in 2022, slightly adjusting to USD 1,749 million in 2023, and modestly improving to USD 1,792 million in 2024, supported by product renewals and stable market share.

- Across Other regions, net sales grew from USD 17,432 million in 2022 to USD 17,790 million in 2023. They expanded to USD 18,514 million in 2024, underscoring Novartis’s diversified global footprint and strengthening presence in emerging economies.

(Source: Novartis Annual Report)

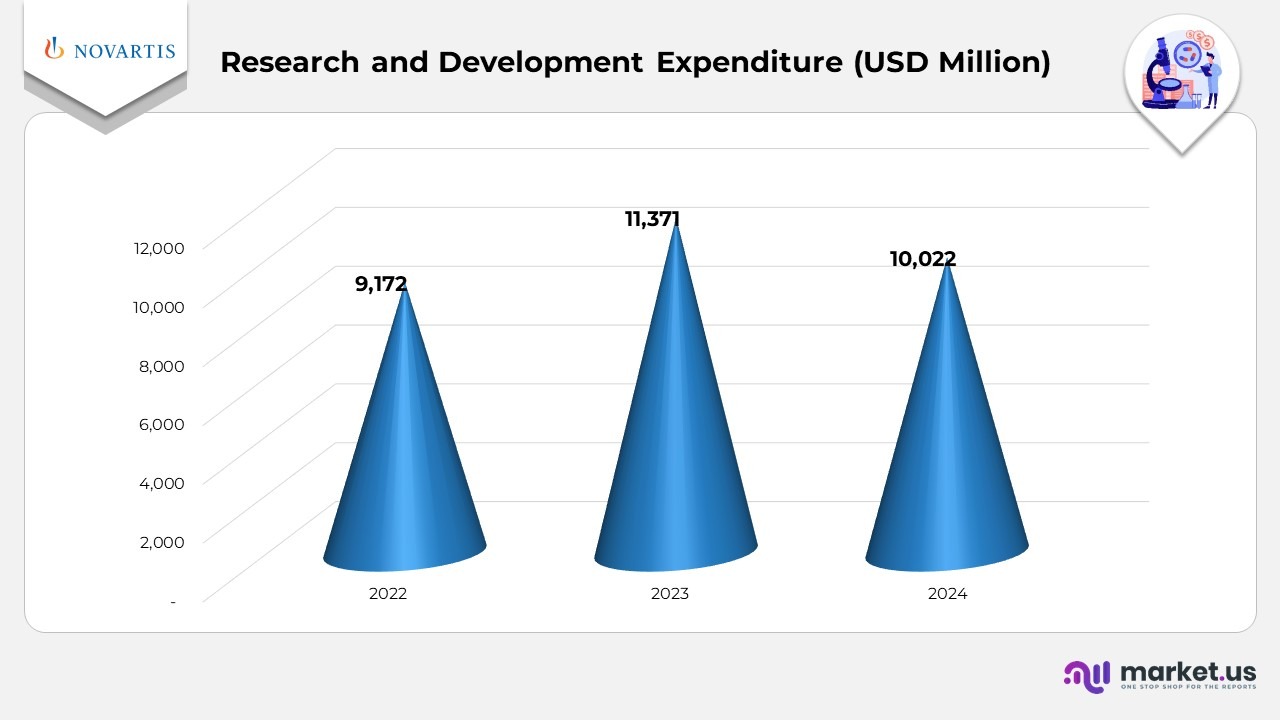

Research and Development Expenditure

- In 2022, Novartis allocated USD 9,172 million toward research and development, emphasizing the expansion of its innovative pipeline in core areas such as oncology, neuroscience, and immunology.

- In 2023, R&D spending rose to USD 11,371 million, representing a year-on-year increase of nearly 24%, driven by greater investment in advanced clinical programs, biologics development, and new therapeutic platforms.

- In 2024, the company recorded USD 10,022 million in R&D expenditure, showing a decline of around 11.8% compared to 2023, as it streamlined its portfolio, concentrated on high-impact projects, and improved operational efficiency across global research centers.

(Source: Novartis Annual Report)

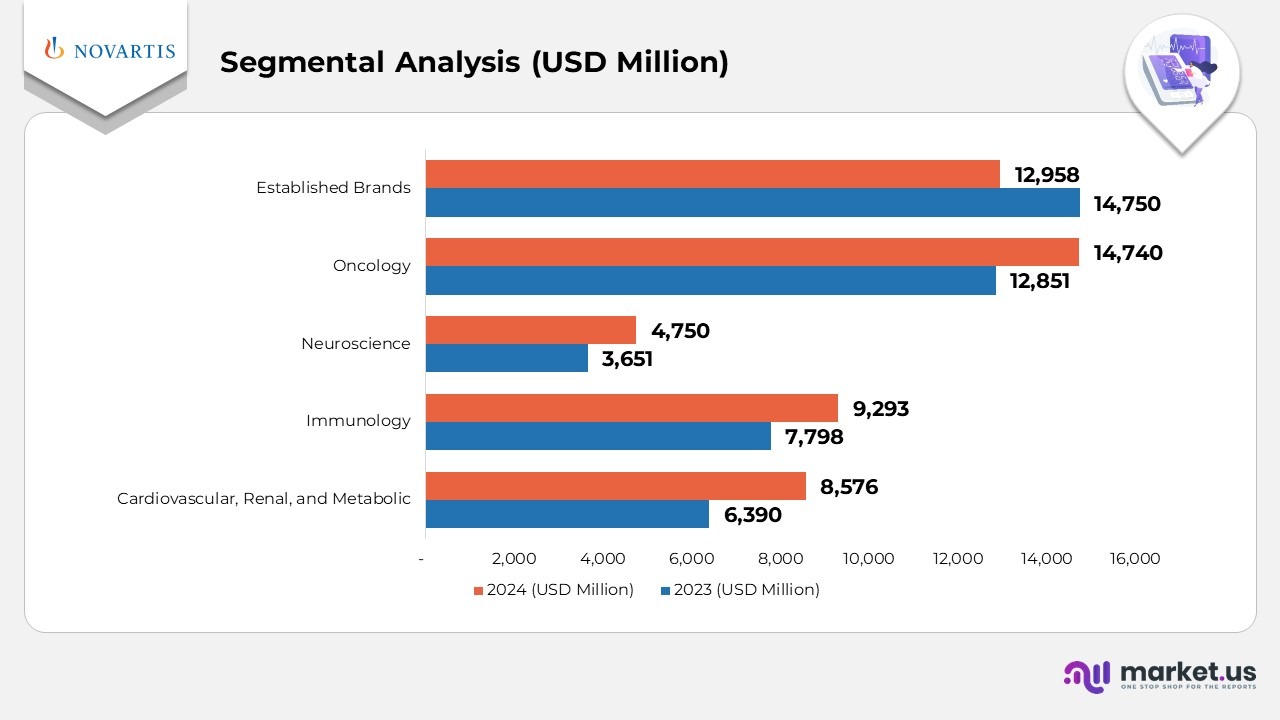

Segmental Analysis

- The Cardiovascular, Renal, and Metabolic segment earned USD 8,576 million in 2024, rising from USD 6,390 million in 2023, indicating a 2% year-on-year growth, mainly driven by the continued success of Entresto, which alone generated USD 7.8 billion in revenue. Strong adoption in the US and Europe was supported by guideline-based heart failure therapy. At the same time, growth in China and Japan was fueled by rising demand for hypertension and heart failure treatments.

- The Immunology segment reached USD 9,293 million in 2024, up from USD 7,798 million in 2023, registering a 2% annual growth rate. Growth was supported by new launches such as the HS indication and IV formulation in the US, along with strong performance in PsO, PsA, AS, and nr-axSpA. Xolair delivered USD 1.6 billion, driven by emerging markets, while Ilaris generated USD 1.5 billion, reflecting double-digit growth due to rising demand in periodic fever syndromes and Still’s disease.

Further,

- The Neuroscience segment reported USD 4,750 million in 2024 compared to USD 3,651 million in 2023, reflecting a 2% increase. Its strong efficacy, safety profile, and self-administration option accelerated patient uptake. Zolgensma contributed USD 1.2 billion, maintaining stable revenue, while Aimovig grew 17% to USD 0.3 billion, driven by increasing European demand for migraine prevention.

- The Oncology segment generated USD 14,740 million in 2024 versus USD 12,851 million in 2023, showing a 7% growth rate, supported by its expanded approval for early breast cancer and strong uptake in the US and EU. However, Promacta/Revolade slightly declined to USD 2.2 billion, following reduced promotional activity in most markets..

- The Established Brands segment posted USD 12,958 million in 2024, slightly lower than USD 14,750 million in 2023, marking a 1% decline. The Sandostatin Group contributed USD 1.3 billion, slightly down due to US generic entry. Lucentis posted USD 1.0 billion, reflecting a sharp drop of 29% outside the US amid competitive pressure. Exforge Group sales remained stable at USD 0.7 billion, while Galvus Group and Diovan Group each reported USD 0.6 billion, both showing minor declines due to generic erosion in Europe. Gilenya saw a significant fall of 40% to USD 0.6 billion, mainly from intensified competition in the US and Europe..

(Source: Novartis Annual Report)

Novartis AG’s Net Sales Performance by Therapeutic Area and Established Brands

- The Cardiovascular, Renal, and Metabolic portfolio emerged as one of Novartis’s strongest growth drivers between 2022 and 2024, with total sales increasing from USD 4.8 billion in 2022 to USD 6.4 billion in 2023, and further to USD 8.6 billion in 2024. This impressive expansion was primarily powered by Entresto, which reached USD 7.8 billion, and Leqvio, which more than doubled its sales within a year, reflecting growing adoption across major global markets.

- Within Immunology, revenues climbed steadily from USD 7.3 billion in 2022 to USD 7.8 billion in 2023 and further to USD 9.3 billion in 2024, demonstrating solid performance across key immunotherapeutic assets. Cosentyx remained the flagship brand, delivering USD 6.1 billion, bolstered by newer indications such as hidradenitis suppurativa and intravenous formulation launches in the US. Meanwhile, Xolair and Ilaris collectively reinforced the segment’s upward trajectory, benefiting from broader accessibility and high clinical demand.

- The Neuroscience division experienced remarkable momentum, with sales accelerating from USD 2.7 billion in 2022 to USD 3.7 billion in 2023 and reaching USD 4.8 billion in 2024, driven by breakthrough therapies targeting neurological disorders. Kesimpta spearheaded this growth, generating USD 3.2 billion in 2024, supported by increased global patient access and favourable safety outcomes. Zolgensma maintained steady demand at USD 1.2 billion, while Aimovig advanced with stronger migraine prevention uptake in European markets.

Moreover

- The Oncology segment, a cornerstone of Novartis’s portfolio, expanded from USD 10.4 billion in 2022 to USD 12.9 billion in 2023 and further to USD 14.7 billion in 2024, underscoring consistent double-digit growth. Key contributors included Kisqali (USD 3.0 billion), Jakavi (USD 1.9 billion), and Pluvicto (USD 1.4 billion), with robust performance following new approvals in early breast cancer and advanced prostate cancer treatments. Novel therapies such as Scemblix and Lutathera also gained strong market traction, while older brands like Promacta and Tasigna saw marginal declines amid lifecycle transitions.

- The Established Brands segment continued its structural decline, reflecting Novartis’s strategic pivot toward innovative therapies. Sales dropped from USD 17.1 billion in 2022 to USD 14.8 billion in 2023 and further to USD 13.0 billion in 2024. The erosion was driven by increasing generic competition affecting legacy drugs such as Gilenya, Lucentis, and Galvus Group. However, core products like the Sandostatin Group (USD 1.3 billion) and Exforge Group (USD 0.7 billion) maintained relative stability, supported by continued demand in niche markets.

- Collectively, Novartis achieved total net sales of USD 50.3 billion in 2024, up from USD 45.4 billion in 2023 and USD 42.2 billion in 2022, demonstrating sustained global growth. The company’s strategic focus on innovative pharmaceuticals, successful product launches, and expanding access to biologics and gene therapies cemented its leadership position in the global biopharmaceutical landscape.

(Source: Novartis Annual Report)

Recent Developments

- In September 2025, Novartis obtained FDA approval for Rhapsido (remibrutinib), designed for adults with chronic spontaneous urticaria (CSU) who continue to experience symptoms despite H1 antihistamine therapy, marking a key milestone in expanding its immunology portfolio.

- Also in September 2025, the company introduced a direct-to-patient (DTP) platform in the United States, effective November 1, 2025, allowing cash-paying patients prescribed Cosentyx (secukinumab) to purchase the treatment at a 55% discount from the list price. Novartis’ Cosentyx, top-selling biologic, is FDA-approved for multiple immune-mediated inflammatory conditions, including hidradenitis, psoriasis, suppurativa, and psoriatic arthritis.

- During September 2025, Novartis announced the acquisition of Tourmaline Bio, Inc., a strategic move to enhance its cardiovascular portfolio and strengthen its research focus on atherosclerotic cardiovascular disease.

- In July 2025, the company received Swissmedic approval for Coartem, expanding access to this essential antimalarial medicine for newborns and young infants, reinforcing its commitment to global child health.

- In June 2025, Novartis completed the acquisition of Regulus Therapeutics Inc., aiming to accelerate the development of a first-in-class treatment for autosomal dominant polycystic kidney disease (ADPKD), a leading genetic cause of renal failure.

- In April 2025, the FDA approved Vanrafia, a novel therapy for reducing proteinuria in grownups with primary immunoglobulin A nephropathy (IgAN) at risk of rapid disease progression, expanding the company’s renal care portfolio.

Further,

- In March 2025, Novartis secured FDA approval for Pluvicto, indicated for PSMA-positive metastatic castration-resistant prostate cancer (mCRPC) patients previously treated with androgen receptor pathway inhibitors (ARPI) and eligible for delayed chemotherapy.

- Also in March 2025, the company received FDA approval for oral Fabhalta, the first and only approved therapy for C3 glomerulopathy (C3G), providing a breakthrough treatment option for adults by reducing proteinuria levels.

- In February 2025, Novartis entered into a collaboration with Anthos Therapeutics, Inc., focused on advancing prevention strategies for stroke and systemic embolism in patients diagnosed with atrial fibrillation.

- In November 2024, the European Commission approved Kisqali in combination with an aromatase inhibitor (AI) for hormone receptor-positive, HER2-negative early breast cancer (EBC) at high risk of recurrence, further reinforcing Novartis’s oncology leadership.

- In August 2024, the FDA approved Fabhalta for the reduction of proteinuria in adults with IgA nephropathy (IgAN) at risk of rapid disease progression, underscoring Novartis’s continued innovation in rare renal disorders.

(Source: Novartis Press Releases)