Company Overview

Eli Lilly and Company Statistics: Eli Lilly and Company is a leading global pharmaceutical enterprise dedicated to discovering, developing, manufacturing, and marketing innovative human healthcare products. The company operates within a single core business segment focused on human pharmaceuticals, offering a diverse range of therapies across cardiometabolic health, oncology, immunology, and neuroscience.

Lilly manufactures and distributes its products through strategically located facilities in the United States (including Puerto Rico), Europe, and Asia, ensuring a strong global supply chain. Companies’ medicines reach patients in nearly 95 countries, underscoring their extensive international reach. By the end of 2024, the global company employed about 47,000 people, with nearly 25,000 based outside the U.S. and approximately 11,000 involved in research and development (R&D), reflecting its continued focus on scientific innovation.

About 23.8% of its workforce is dedicated to R&D, demonstrating a sustained investment in medical advancement. In 2023, the company reinvested 27.3% of its total sales, around US$9.31 billion, into R&D initiatives. Companies’ clinical research network extends across 55 countries, strengthening its position as a major contributor to global healthcare innovation.

The company has broad commercial operations throughout Europe, and Lilly maintains a significant R&D and manufacturing presence in 5 European countries and 9 additional international locations. Key European sites include Alcobendas, Spain (since 1968); Fegersheim, Kinsale (since 1981), France (since 1967); and Limerick (since 2022), Ireland; Fiorentino, Sesto, Italy (since 1959); and Alzey, Germany (since 2023). Each of these facilities plays a vital role in supporting Lilly’s global mission to deliver innovative and life-changing medicines.

History of Eli Lilly and Company

1900’s

- 1906: Lilly demonstrated its humanitarian values by replacing, at no cost, pharmaceutical supplies lost in the San Francisco earthquake to support relief efforts.

- 1917: In collaboration with the American Red Cross, Lilly established a medical field hospital in France, staffed by Indiana personnel, to treat wounded soldiers from multiple nations during World War I.

- 1923: The company launched Iletin, the world’s first commercially available animal-source insulin, providing an effective treatment for Diabetes, a previously fatal disease.

- 1928: Lilly introduced a liver-extract therapy for pernicious anemia, a breakthrough treatment that became the standard of care for decades; its discovery later earned a Nobel Prize for Lilly’s academic partners.

- 1937: Members of the Lilly family founded the Lilly Endowment, focusing on long-term philanthropic and charitable initiatives.

- 1940s: Lilly became one of the pioneers in developing methods for the mass production of Penicillin-G, marking a major advancement in the global fight against infectious diseases.

- 1955: The company became the first to manufacture and distribute the Salk Polio Vaccine globally, contributing to the worldwide eradication of the disease.

- 1957: Lilly executives served as co-chairs for the first Indianapolis United Fund drive, uniting charitable efforts across the community and laying the groundwork for future employee volunteer programs.

- 1958: The company launched Vancocin (vancomycin hydrochloride), an antibiotic used against infections caused by drug-resistant bacteria.

- 1961: Lilly introduced Velban (vinblastine), its first oncology drug derived from the Madagascar periwinkle plant, revolutionizing cancer treatment.

- 1982: The company unveiled Humulin, the world’s first human insulin produced using recombinant DNA technology, identical to natural human insulin.

- 1986: Prozac (fluoxetine hydrochloride) was introduced in Belgium as a treatment for clinical depression, becoming one of the most recognized antidepressants globally.

- 1996: Lilly launched Zyprexa (olanzapine) for schizophrenia and introduced Gemzar (gemcitabine hydrochloride) for pancreatic and non-small-cell lung cancers.

2000’s

- 2001: The Lilly Camp Care Package initiative began, donating over $25 million in insulin and supplies to diabetes camps, along with scholarships and educational support.

- 2003: Lilly established the Lilly MDR-TB Partnership to combat multidrug-resistant tuberculosis in underserved regions around the world.

- 2004: Cymbalta (duloxetine hydrochloride) was launched as a treatment for major depressive disorder, expanding Lilly’s neuroscience portfolio.

- 2008: The company inaugurated its Global Day of Service, now one of the largest single-day volunteer efforts by a U.S. corporation.

- 2011: Lilly introduced the Connecting Hearts Abroad program, sending employees to volunteer in healthcare and education initiatives across Africa, Asia, and Latin America.

- 2011: The company also founded the Lilly NCD Partnership, focused on addressing non-communicable diseases, particularly Diabetes, through global best practices.

- 2015: Continuing its legacy of philanthropy, Lilly contributed $13.2 million to United Way, reinforcing its community commitment.

- 2018: The company launched the Lilly Diabetes Solution Center to support U.S. patients struggling with insulin affordability.

- 2019: Lilly completed its largest-ever acquisition by purchasing Loxo Oncology, strengthening its cancer treatment portfolio with first-in-class and best-in-class therapies.

- 2020: In response to the COVID-19 pandemic, Lilly provided testing support, donated PPE, and developed innovative treatments, including the first antibody therapy for COVID-19.

(Source: Company Website)

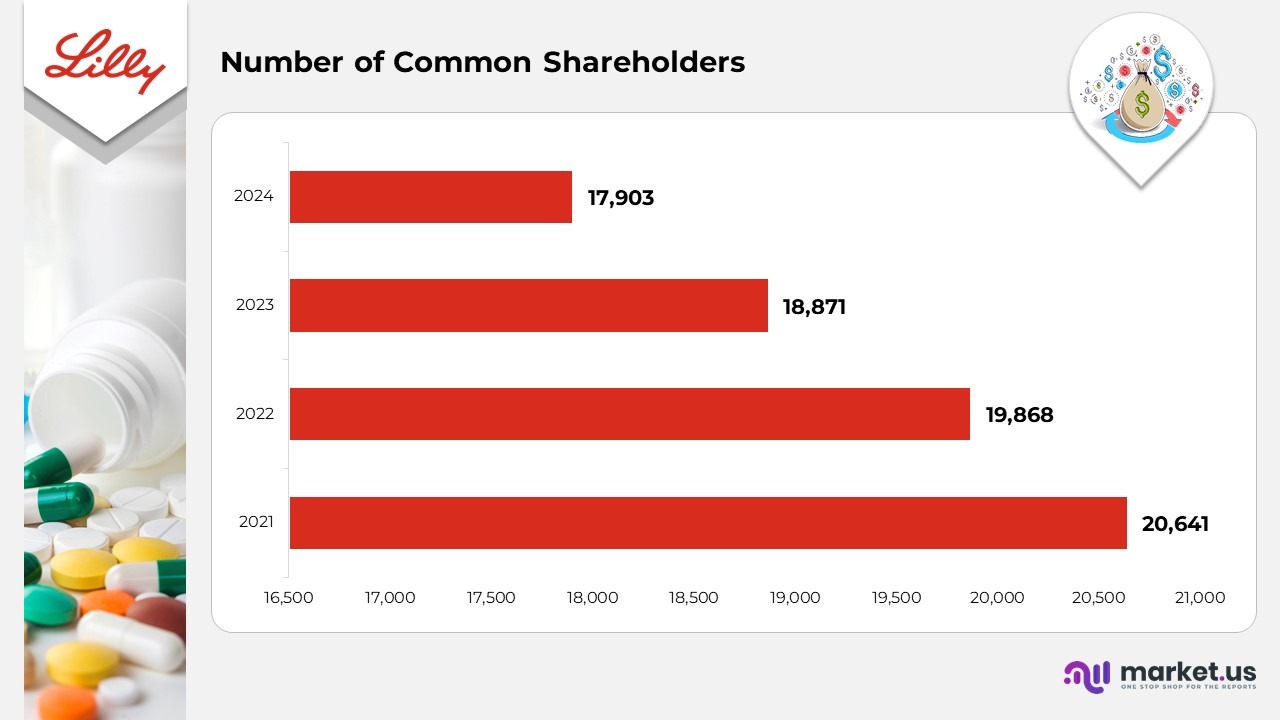

Eli Lilly and Company Statistics By Shareholder Analysis

- As of December 2024, Eli Lilly and Company had approximately 17,903 common shareholders, reflecting a slight adjustment in its overall investor base.

- For December 2023, the company’s registered common shareholders rose to about 18,871, showing increasing investor confidence in its pharmaceutical and biotechnology expansion.

- In December 2022, the shareholder count was around 19,868, representing consistent participation from both institutional and retail investors amid key product milestones.

- As of December 2021, the company recorded nearly 20,641 shareholders, highlighting strong investor interest during a period of innovation and strategic growth.

(Source: Eli Lilly Company SEC Filings)

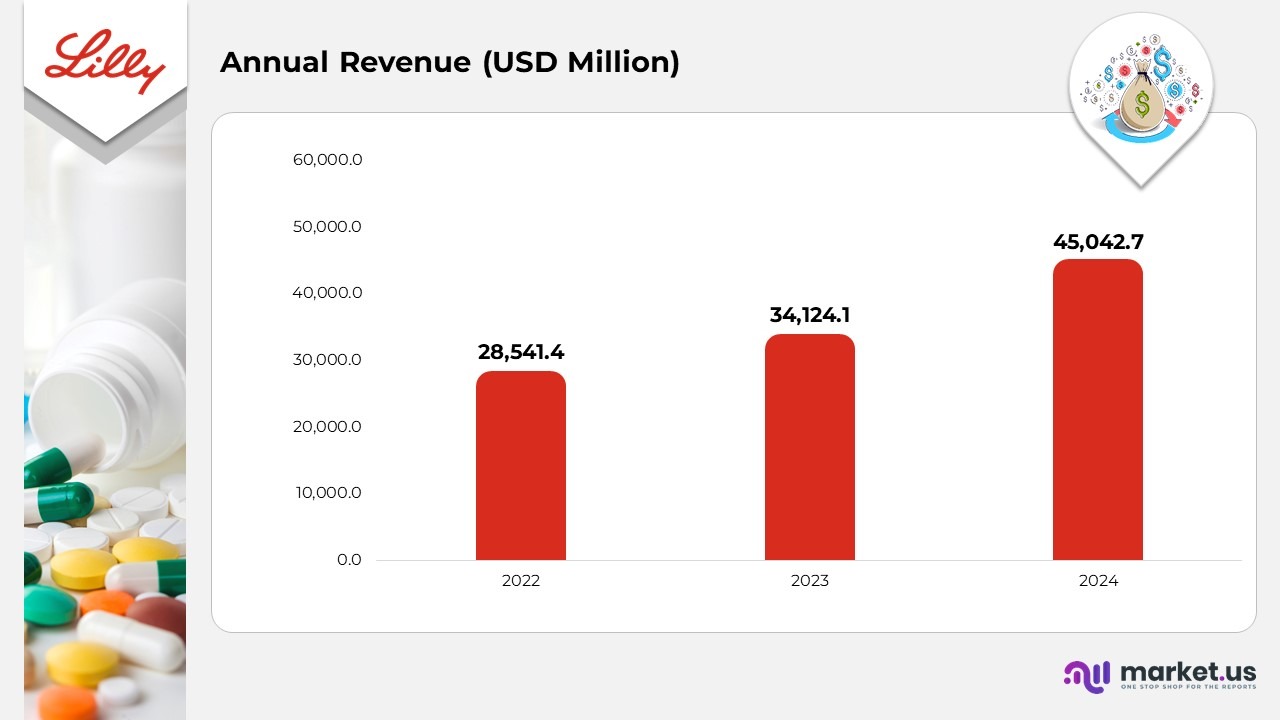

Eli Lilly and Company Statistics By Financial Analysis

- In 2024, Eli Lilly and Company achieved annual revenue of US$45,042.7 million, a sharp rise from US$34,124.1 million in 2023 and US$28,541.4 million in 2022, fueled by strong sales of leading therapies such as Mounjaro, Zepbound, and Verzenio.

- The 32% year-on-year revenue growth in 2024 underscores the company’s expanding global presence, driven by solid demand in the metabolic and oncology segments and enhanced patient access programs across key markets.

- The consistent revenue growth from 2022 to 2024 demonstrates Lilly’s commitment to high-impact innovation, successful commercialization of new products, and sustained investment in its R&D pipeline, strengthening its role as a global healthcare leader.

- Revenue growth in 2024 was mainly attributed to stronger product volumes and, to a lesser degree, improved pricing. The primary contributors to this increase were Mounjaro, Verzenio, and Zepbound, partially offset by lower sales of Trulicity.

- Net income and earnings per share also rose during 2024, supported by a higher gross margin. However, this gain was partially offset by greater research and development investments, increased marketing, selling, and administrative costs, and higher asset restructuring, impairment, and special charges.

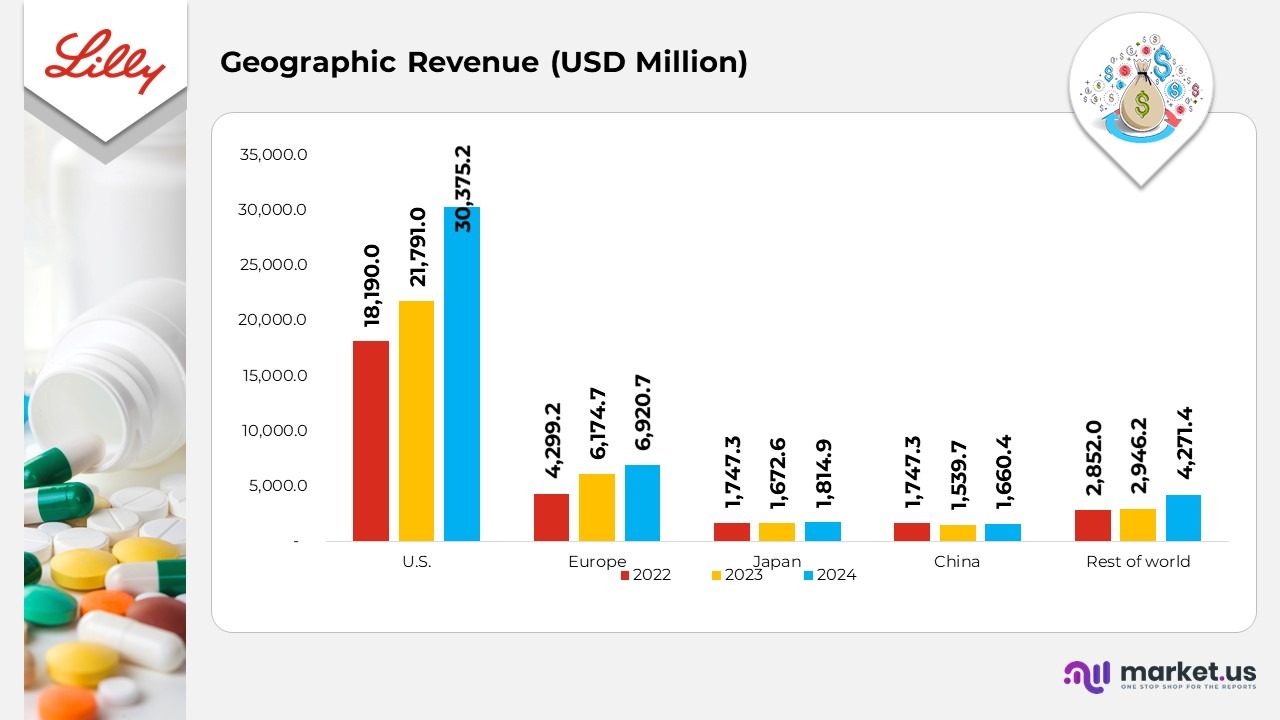

Geographical Revenue Statistics By Eli Lilly and Company

- In 2024, the S. market generated US$30,375.2 million in revenue, a sharp increase from US$21,791.0 million in 2023 and US$18,190.0 million in 2022, primarily fueled by strong sales of flagship therapies such as Mounjaro and Zepbound.

- Europe reported revenue of US$6,920.7 million in 2024, up from US$6,174.7 million in 2023 and US$4,299.2 million in 2022, supported by broader product accessibility and favorable reimbursement frameworks across key markets.

- In Japan, revenue rose to US$1,814.9 million in 2024 compared with US$1,672.6 million in 2023 and US$1,747.3 million in 2022, reflecting steady market positioning and the rollout of new therapeutic introductions.

- China recorded revenue of US$1,660.4 million in 2024, up slightly from US$1,539.7 million in 2023 but below US$1,747.3 million in 2022, signalling a gradual recovery amid regulatory transitions and post-pandemic adjustments.

- The Rest of the World region achieved robust growth, reaching US$4,271.4 million in 2024 compared with US$2,946.2 million in 2023 and US$2,852.0 million in 2022, driven by expanding presence in emerging markets and strengthened global distribution capabilities.

(Source: Eli Lilly Company SEC Filings)

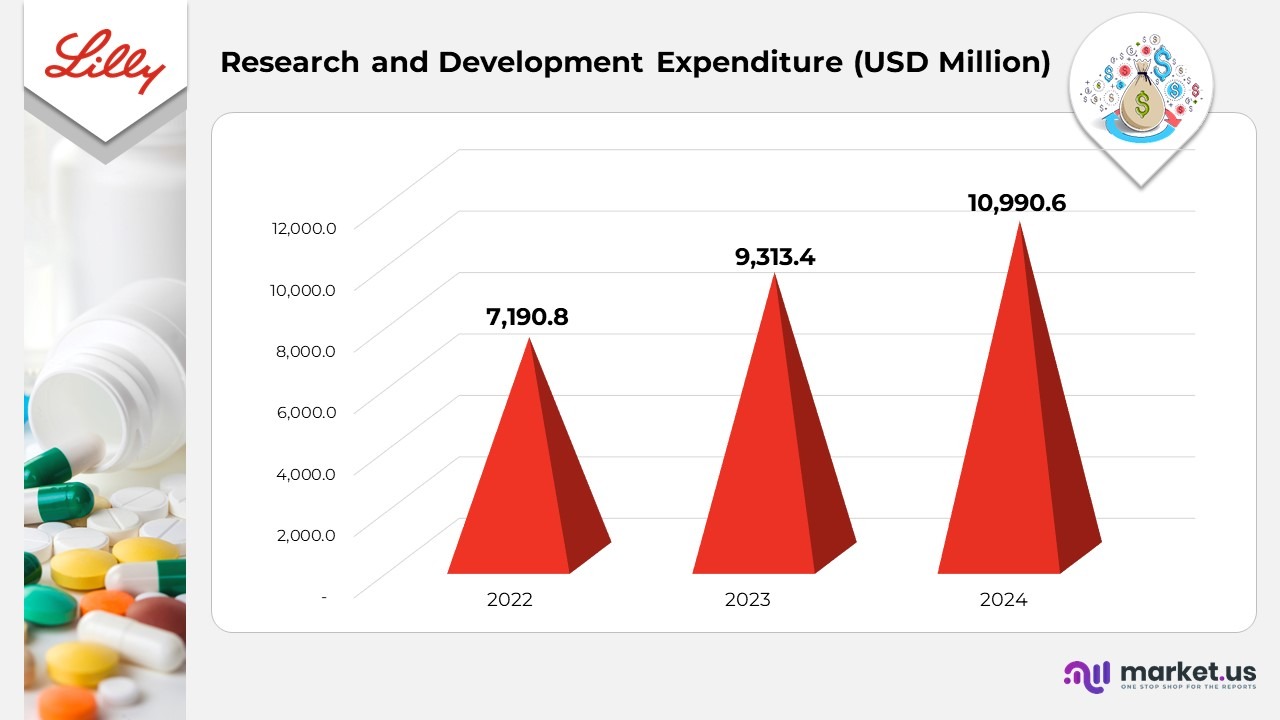

Eli Lilly and Company Statistics By Research and Development Expenditure

- Research and development (R&D) expenditure reached US$10,990.6 million in 2024, reflecting an 18% year-over-year increase, primarily due to sustained investments in early-stage discovery programs and late-stage clinical trials.

- In 2023, R&D spending rose to US$9,313.4 million, up from US$7,190.8 million in 2022, underscoring Lilly’s strategic focus on expanding its innovation pipeline across therapeutic areas such as oncology, immunology, and metabolic disorders.

- The consistent upward trend in R&D spending highlights the company’s commitment to advancing next-generation therapies and strengthening its long-term competitive position in the global pharmaceutical market.

(Source: Eli Lilly Company SEC Filings)

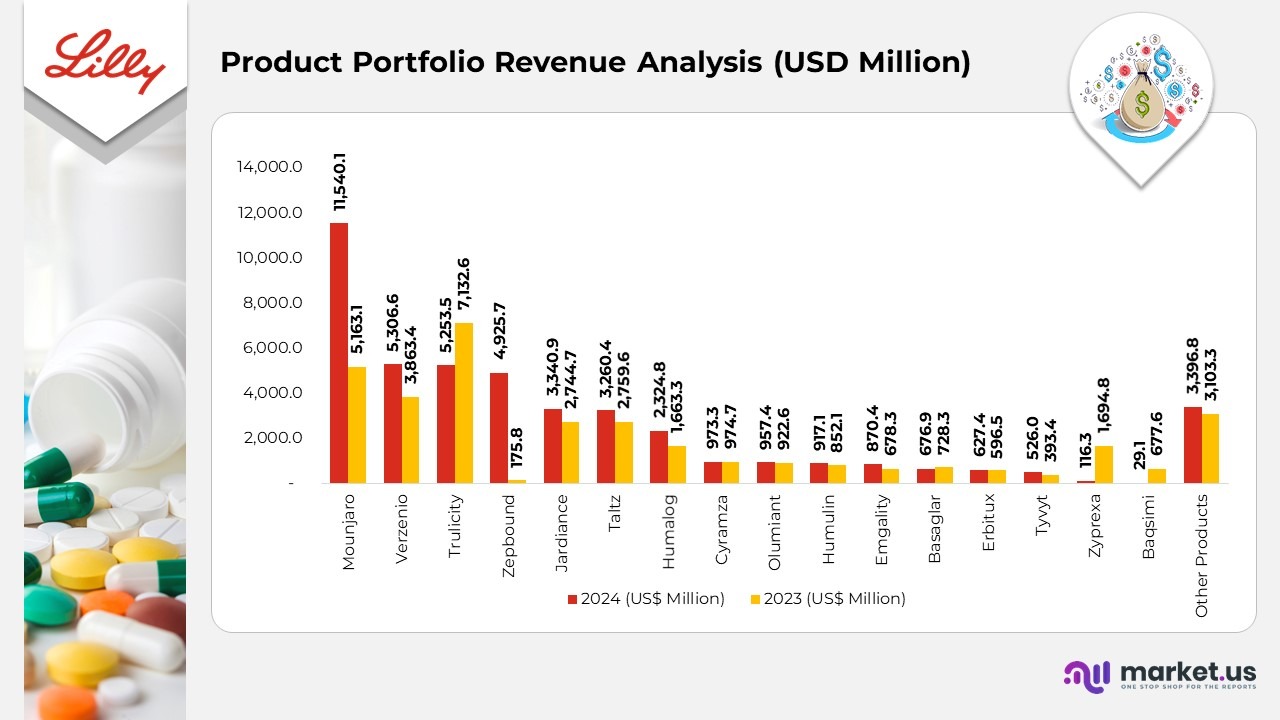

Product Portfolio Revenue Analysis

- Mounjaro’s revenue in the S. surged 85%, fueled by exceptional patient demand and improved supply availability. Revenue from international markets reached US$2.59 billion in 2024, up from US$328.9 million in 2023, reflecting strong volume growth in new launch regions.

- Verzenio revenue climbed 36% in the U.S., driven by robust demand, strategic wholesaler inventory movements, and slightly higher realized prices. Revenue from outside the U.S. rose 39%, supported by expanding market penetration and growing physician adoption.

- Trulicity experienced a 32% decline in U.S. sales, primarily due to lower volumes caused by increased competition and temporary supply challenges in early 2024. Revenue from international markets decreased 8%, impacted by similar competitive pressures and deliberate actions to balance demand.

- Zepbound achieved US$4.93 billion in U.S. revenue for 2024, a substantial rise from US$175.8 million in 2023, following its November 2023 launch for treating grownups with obesity or overweight conditions accompanied by comorbidities.

- Jardiance sales in the S. remained relatively stable, as lower average prices offset higher demand. Outside the U.S., revenue grew 52%, supported by stronger volumes and a US$300 million one-time payment related to an updated collaboration agreement with Boehringer Ingelheim, which realigned commercialization rights in select smaller markets.

- Taltz revenue in the S. increased 18%, driven by both higher realized prices from updated rebate and discount structures and increased patient uptake. Revenue outside the U.S. also rose 19%, supported by expanding demand and broader access across autoimmune indications.

Moreover

- Humalog climbed 40%, reaching US$2,324.8 million in 2024, boosted by higher sales in the S. (US$1,502.6 million) and international markets (US$822.2 million).

- Cyramza maintained steady performance with US$973.3 million in 2024, nearly unchanged from US$974.7 million in 2023, reflecting stable oncology segment demand.

- Olumiant revenue rose 4% to US$957.4 million in 2024 from US$922.6 million in 2023, supported by wider therapeutic adoption across major markets.

- Humulin registered US$917.1 million in 2024, up 8% from US$852.1 million in 2023, driven by consistent insulin demand in established regions.

- Emgality grew 28%, with revenue rising to US$870.4 million in 2024 from US$678.3 million in 2023, propelled by increasing adoption for migraine management.

- Basaglar declined 7%, totaling US$676.9 million in 2024 versus US$728.3 million in 2023, due to intensifying biosimilar competition.

- Erbitux revenue improved 5%, reaching US$627.4 million in 2024 compared to US$596.5 million in 2023, supported by steady oncology treatment demand.

- Tyvyt generated US$526.0 million in 2024, up 34% from US$393.4 million in 2023, driven mainly by non-U.S. market performance.

- Zyprexa revenue dropped 93%, to US$116.3 million in 2024 from US$1,694.8 million in 2023, impacted by generic competition and patent expirations.

- Baqsimi experienced a 96% decline, generating US$29.1 million in 2024 versus US$677.6 million in 2023, following portfolio restructuring initiatives.

- Other products collectively earned US$3,396.8 million in 2024, reflecting a 9% increase from US$3,103.3 million in 2023, supported by diverse contributions from mature brands.

(Source: Eli Lilly Company SEC Filings)

Pharmaceutical Products and Associated U.S. Patents of the Company

| Product Name | Active Ingredient/ Type | Associated U.S. Patent Numbers |

|---|---|---|

| AMYVID | Florbetapir F 18 injection | U.S. 7,687,052; U.S. 8,506,929 |

| CYRAMZA | Ramucirumab injection | U.S. 7,498,414; U.S. 10,766,961 |

| EBGLYSS | Lebrikizumab-lbkz injection | U.S. 8,067,199; U.S. 8,088,618; U.S. 9,067,994; U.S. 9,605,065; U.S. 10,000,562; U.S. 10,597,446; U.S. 10,597,447; U.S. 10,947,307; U.S. 11,434,286 |

| EMGALITY | Galcanezumab-gnlm injection | U.S. 9,073,991; U.S. 9,505,838; U.S. 11,498,959 |

| JAYPIRCA | Pirtobrutinib tablets | U.S. 10,342,780; U.S. 10,464,905; U.S. 10,695,323; U.S. 10,918,622; U.S. 12,109,193; U.S. 12,220,401; U.S. 12,268,666 |

| KISUNLA | Donanemab-azbt injection | U.S. 8,679,498; U.S. 8,961,972; U.S. 11,312,763 |

| LYUMJEV | Insulin lispro-aabc injection | U.S. 9,439,952; U.S. 9,901,623; U.S. 9,993,555; U.S. 10,172,922; U.S. 10,925,931; U.S. 11,123,406 |

| MOUNJARO | Tirzepatide injection | U.S. 9,474,780; U.S. 11,357,820; U.S. 12,295,987; U.S. 12,343,382 |

| OLUMIANT | Baricitinib tablets | U.S. 8,158,616; U.S. 8,420,629; U.S. 9,089,574; U.S. 9,737,469; U.S. 11,045,474; U.S. 11,806,555 |

| OMVOH | Mirikizumab-mrkz injection | U.S. 9,023,358; U.S. 9,688,753; U.S. 12,152,072 |

| RETEVMO | Selpercatinib tablets | U.S. 10,112,942; U.S. 10,137,124; U.S. 10,172,851; U.S. 10,584,124; U.S. 10,786,489; U.S. 11,963,950; U.S. 12,138,250 |

| REYVOW | Lasmiditan tablets | U.S. 7,423,050; U.S. 11,053,214; U.S. 12,071,423; U.S. 12,257,246 |

| TALTZ | Ixekizumab injection | U.S. 7,838,638; U.S. 8,110,191; U.S. 11,634,485 |

| TAUVID | Flortaucipir F 18 injection | U.S. 8,932,557 |

| TRULICITY | Dulaglutide injection | U.S. 7,452,966; U.S. 8,273,854; U.S. 11,576,950; U.S. 11,890,325 |

| VERZENIO | Abemaciclib tablets | U.S. 7,855,211 |

| ZEPBOUND | Tirzepatide injection | U.S. 9,474,780; U.S. 11,357,820; U.S. 11,918,623; U.S. 12,343,382 |

(Source: Company Website)

Recent Developments

- In September 2025, Eli Lilly and Company expanded its Lilly Gateway Labs (LGL) site in San Diego, California, strengthening its network of innovation hubs that support early-stage biotechnology startups. The facility offers shared laboratory space and fosters direct collaboration between emerging biotech innovators and Lilly’s scientific teams.

- In September 2025, the European Commission (EC) granted presentation authorization for Kisunla (donanemab) for treating primary symptomatic Alzheimer’s disease (AD) in adults with mild cognitive impairment or mild dementia, confirmed amyloid pathology, and identified as ApoE4 heterozygotes or non-carriers, reinforcing Lilly’s leadership in neurodegenerative research.

- In September 2025, the S. Food and Drug Administration (FDA) permitted Inluriyo (200 mg tablets, imlunestrant), an oral estrogen receptor antagonist for the treatment of adults with ER-positive, HER2-negative, ESR1-mutated metastatic or advanced breast cancer who have experienced disease progression following at least one line of endocrine therapy, advancing Lilly’s oncology portfolio.

- In September 2025, the company announced the expansion of a US$6.5 billion manufacturing facility at Generation Park in Houston, Texas, marking its second of four new planned U.S. sites for the year. The state-of-the-art facility will produce small molecule active pharmaceutical ingredients (APIs) for therapeutic areas including cardiometabolic health, oncology, immunology, and neuroscience, with operations expected to begin within the next five years.

(Source: Eilly Lilly and Company Press Releases)