Company Overview

Danaher Corporation Statistics: Danaher Corporation is a global science and technology leader dedicated to advancing human health by harnessing the power of innovation. The company operates through more than 15 operating companies with strong leadership positions across the biotechnology, life sciences, and diagnostics sectors. It is structured into 3 core business segments: Biotechnology, Life Sciences, and Diagnostics.

The Biotechnology segment encompasses the company’s bioprocessing and discovery and medical businesses, offering a wide portfolio of equipment, consumables, and services that enable customers to accelerate the pharmaceutical, research, development, manufacturing, and delivery of biological medicines. Its solutions support a diverse range of biotherapeutics, including monoclonal antibodies, recombinant proteins, insulin therapies, and vaccines, along with emerging modalities such as cell, gene, mRNA, and nucleic acid therapies.

Further Analysis

The Life Sciences segment provides instruments, consumables, services, and software used to study the fundamental components of life, including DNA, RNA, proteins, metabolites, and cells, to understand disease mechanisms, discover new therapies, and develop advanced drugs, vaccines, and gene-editing technologies. This segment also supplies filtration and purification products used to remove contaminants from liquids and gases across multiple industrial and research applications.

The Diagnostics segment delivers clinical instruments, consumables, software, and services utilized by hospitals, physicians, laboratories, and critical care facilities to detect diseases and guide treatment decisions.

Danaher’s businesses operate in over 50 countries with a network of 700 global locations, including regional offices in Brazil, China, Dubai (UAE), India, and Saudi Arabia. The company’s corporate headquarters is based in the United States. As of December 31, 2024, Danaher employed approximately 63,000 associates, including 24,000 in North America,20,000 in Western Europe, 3,000 in other developed markets, and 16,000 in high-growth markets. Of this total, about 61,000 were full-time employees, and 2,000 were part-time, with 250 unionized, hourly-rated workers based in the United States.

Danaher Corporation Statistics and Facts

- Danaher Corporation is a global science-and-technology company focused on life sciences, diagnostics, and biotechnology.

- The company was founded in 1984 by brothers Steven and Mitchell Rales.

- Danaher is headquartered in Washington, D.C. and serves customers worldwide.

- Its business is structured into major platforms such as Biotechnology, Diagnostics, and Life Sciences.

- The company uses a proprietary operational methodology called the Danaher Business System (DBS), which emphasises continuous improvement, kaizen-style lean manufacturing and disciplined capital allocation.

- Danaher has grown significantly through strategic acquisitions and spin-offs, repositioning itself from a broader industrial group into a focused life sciences and diagnostics leader.

- Its portfolio includes world-recognised brands and businesses in laboratory instrumentation, bioprocessing, molecular diagnostics, and related consumables and services.

- Danaher associates number over 60,000 globally, and its revenues in recent years have approached US$24 billion.

- The company systematically spins off non-core segments in order to sharpen its strategic focus (for example, its industrial and environmental segments).

- Danaher emphasises global reach, delivering products and services across multiple regions with manufacturing, R&D, and commercial operations spanning major markets.

Financial Analysis by Danaher Corporation Statistics

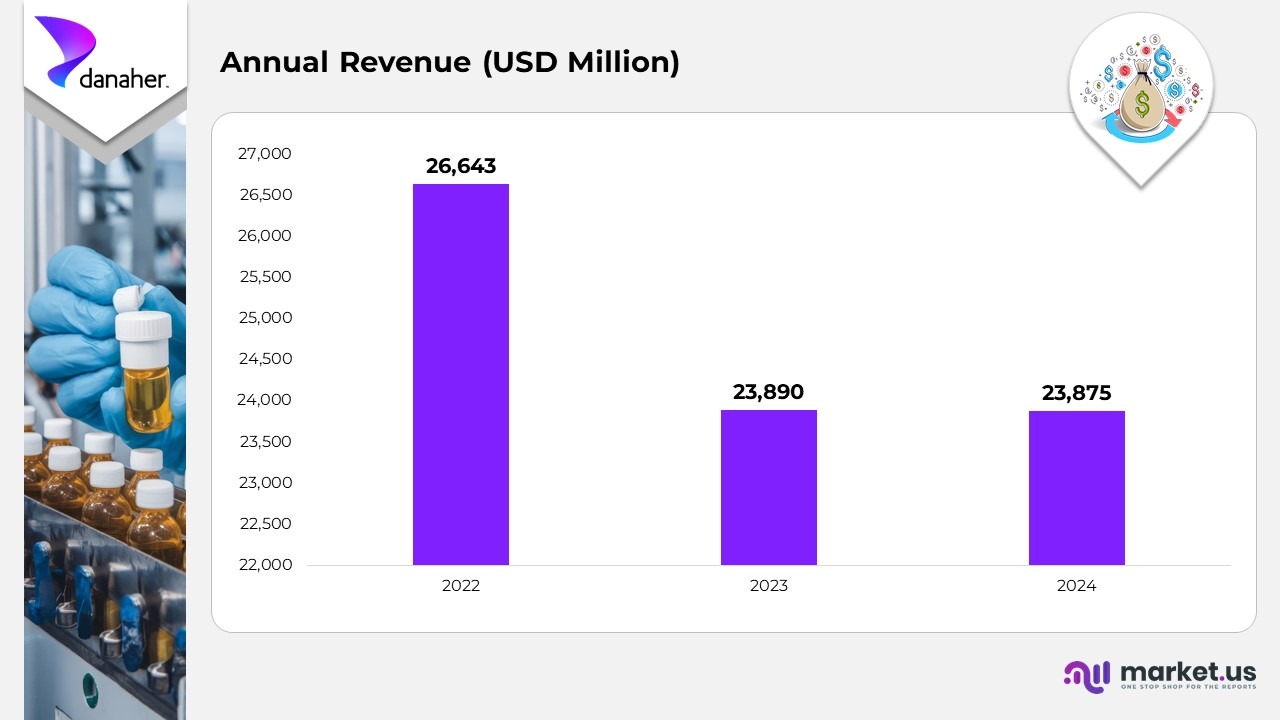

- In 2024, Danaher Corporation reported annual revenue of USD 23,875 million, remaining nearly stable compared with USD 23,890 million in 2023, and slightly below USD 26,643 million recorded in 2022.

- The year-over-year decrease in cost of sales in 2024 compared to 2023 was primarily attributed to lower sales volumes, reflecting a moderation in demand across several business segments.

- A key factor contributing to the reduction was the absence of USD 87 million in charges recognized in the second quarter of 2023, mainly related to inventory adjustments within the Biotechnology segment.

- However, this improvement was partially offset by an acquisition-related expense of USD 25 million incurred in 2024, tied to the fair value adjustment of inventory following the acquisition of Abcam, integrated within Danaher’s life sciences portfolio.

(Source: Danaher Corporation Annual Report)

Segmental Analysis Danaher Corporation Statistics

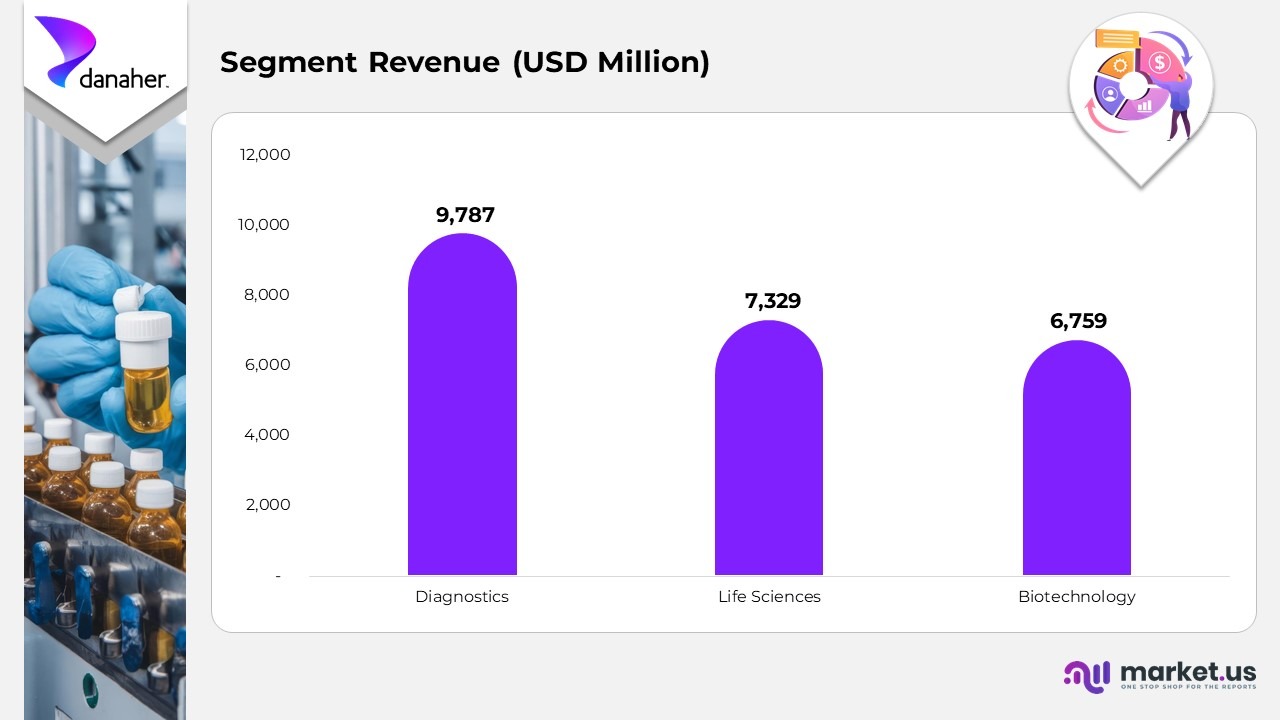

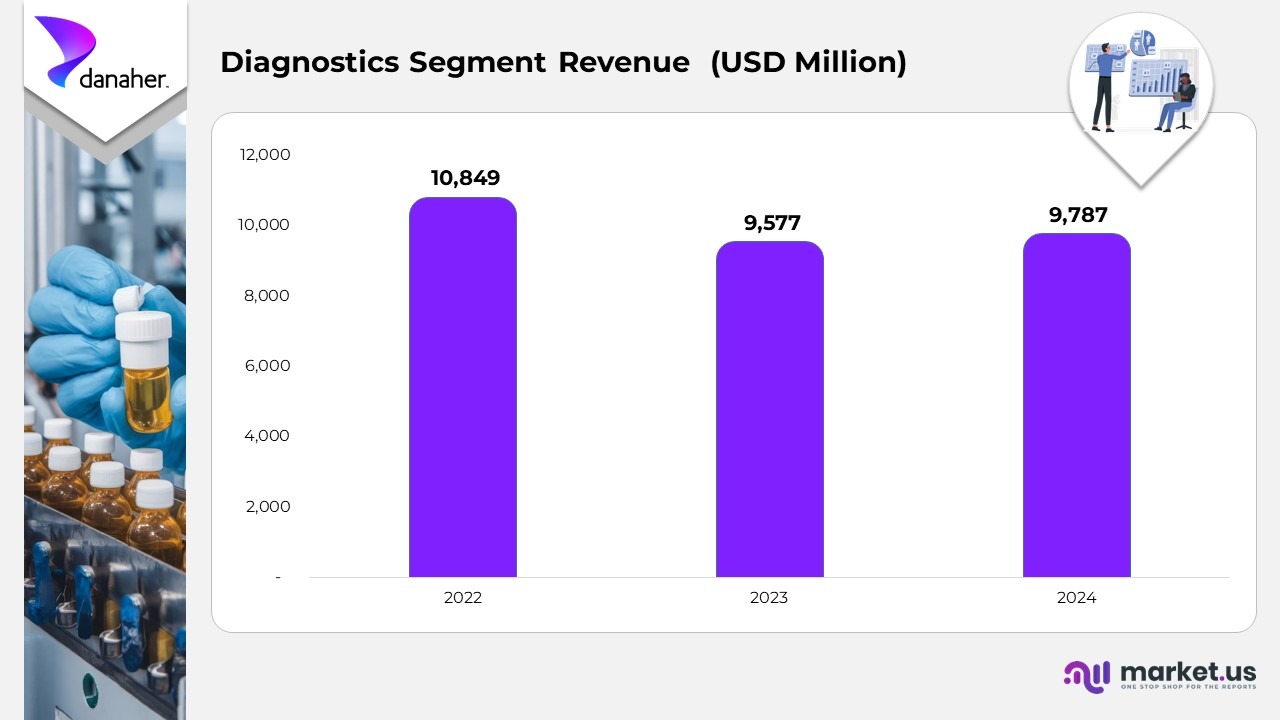

- In 2024, Danaher Corporation’s Diagnostics segment generated USD 9,787 million in revenue, driven by strong demand for diagnostic instruments, consumables, and software solutions widely used across hospitals, laboratories, and critical care settings to enhance disease detection and treatment planning.

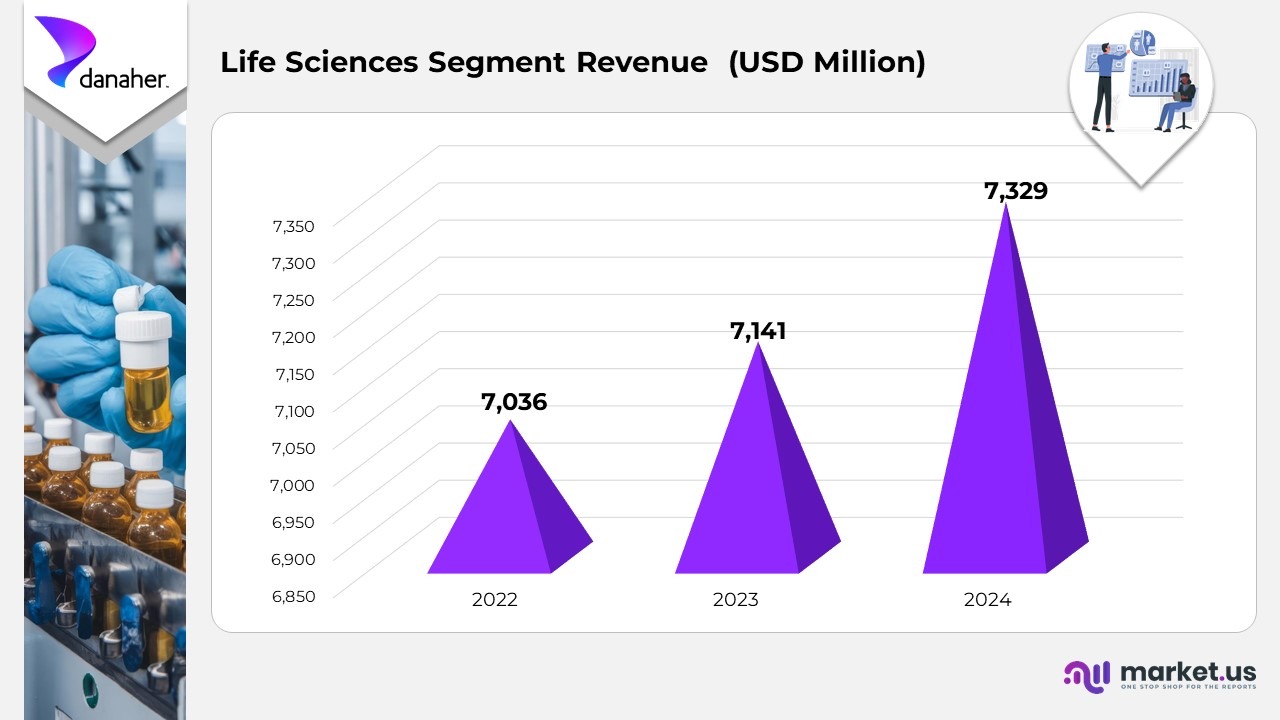

- The Life Sciences segment recorded USD 7,329 million in 2024, fueled by increasing utilization of research tools, laboratory consumables, and filtration systems that enable a deeper understanding of biological mechanisms and advance drug discovery and vaccine development.

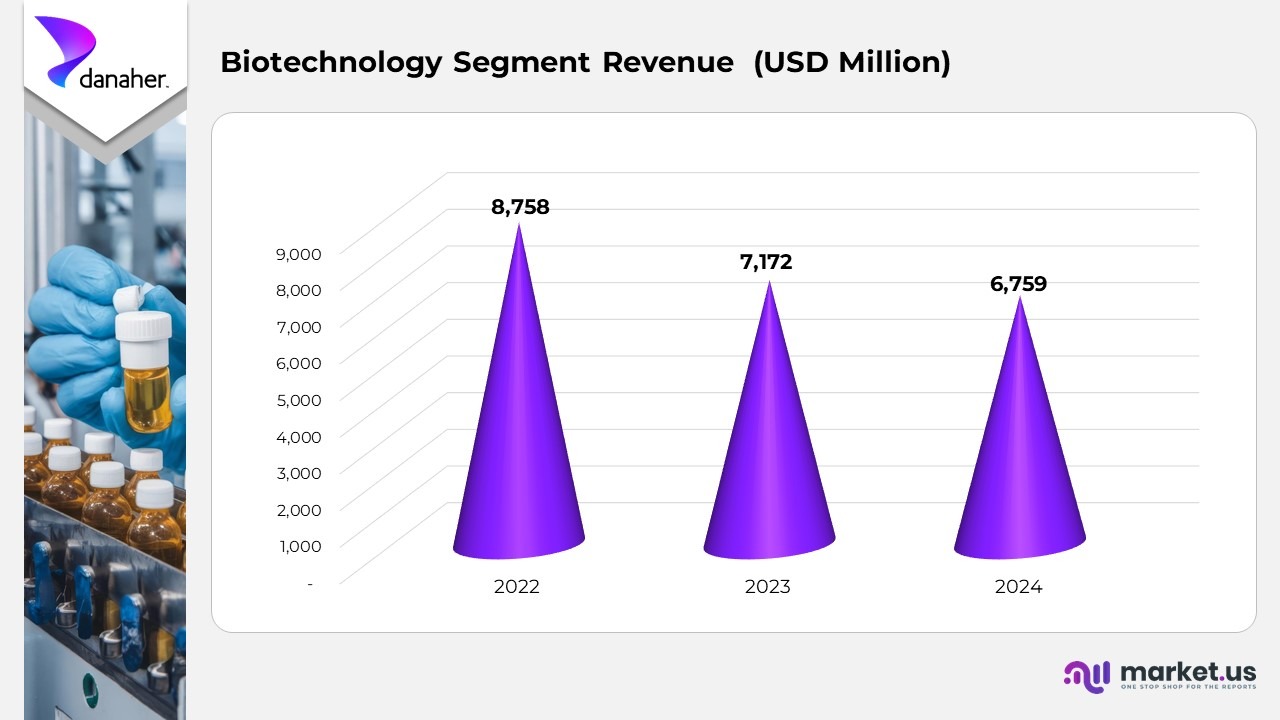

- The Biotechnology segmentposted USD 6,759 million in 2024, supported by robust demand for bioprocessing technologies and services that facilitate the development, manufacturing, and delivery of biologics, vaccines, and next-generation cell and gene therapies.

Diagnostics By Danaher Corporation Statistics

- In 2024, Danaher Corporation’s Diagnostics segment reported sales distribution by geographic destination as follows: North America – 50%, Western Europe – 16%, other developed markets – 4%, and high-growth markets – 30%. This diverse geographic mix underscores the company’s strong presence across both mature and emerging healthcare markets.

- Danaher entered the diagnostics business in 2004 through the acquisition of Radiometer, marking the foundation of its presence in the global diagnostics industry. Over the years, the company strategically expanded this segment through a series of key acquisitions that strengthened its technological and regional footprint.

- Major acquisitions include Beckman Coulter (2011), Aperio Technologies (2012), Vision Systems (2006), Iris International and HemoCue (2013), Devicor Medical Products (2014), the clinical microbiology business of Siemens Healthcare Diagnostics (2015), and Cepheid (2016).

- These integrations enhanced Danaher’s capabilities across clinical diagnostics, acute care, pathology, and molecular diagnostics.

Further

- The Diagnostics segment today encompasses a comprehensive portfolio of clinical instruments, consumables, software, and services used by hospitals, physicians, laboratories, and critical care facilities. These solutions play a vital role in disease detection, patient monitoring, and informed treatment decisions, aligning with Danaher’s mission to improve healthcare outcomes through innovation and precision diagnostics.

- In 2024, Danaher Corporation’s Diagnostics segment generated USD 9,787 million in revenue, marking a 2% rise from USD 9,577 million in 2023. This growth reflects a gradual recovery supported by consistent demand for diagnostic instruments, consumables, and software solutions across healthcare settings.

- In 2023, revenue had declined from USD 10,849 million in 2022, primarily due to the tapering of pandemic-related testing activities. The rebound in 2024 highlights stronger momentum in Danaher’s core diagnostics portfolio and sustained sales from recurring consumables.

- Overall, the trend shows that while the segment continues to transition beyond the pandemic phase, the 2% growth in 2024 demonstrates the company’s resilience and strategic focus on innovation, enabling steady performance across laboratory and hospital-based diagnostic operations.

Danaher Corporation Statistics By Life Sciences

- In 2024, Danaher Corporation’s Life Sciences segment recorded revenue of USD 7,329 million, compared with USD 7,141 million in 2023 and USD 7,036 million in 2022, reflecting a 5% year-over-year increase driven largely by acquisitions, partially offset by softer core sales and unfavorable currency movements.

- Price adjustments contributed approximately 0% to the segment’s growth in 2024 compared to 2023. However, the decline in core sales was primarily attributed to weaker demand for equipment in mass spectrometry, lab automation and flow cytometry solutions, offset by higher sales of consumables and services.

- By geographic distribution, 2024 sales were led by North America (44%), followed by Western Europe (21%), other developed markets (7%), and high-growth markets (28%), underscoring Danaher’s balanced global presence.

- The Life Sciences segment encompasses a comprehensive portfolio, including lab automation and flow cytometry solutions, mass spectrometry, microscopy, protein consumables, filtration, and genomic medicines. These offerings support customers in studying DNA, RNA, proteins, metabolites, and cells, enabling breakthroughs in disease research, drug discovery, vaccine development, and gene-editing technologies.

- Danaher established its Life Sciences business in 2005 through the acquisition of Leica Microsystems and strengthened it through multiple strategic acquisitions, including AB Sciex and Molecular Devices (2010), Beckman Coulter (2011), Pall (2015), Phenomenex (2016), Integrated DNA Technologies (2018), Aldevron (2021), and Abcam (2023). These acquisitions have positioned Danaher as a global leader in advanced life sciences instrumentation and consumables.

Biotechnology By Danaher Corporation Statistics

- In 2024, Danaher Corporation’s Biotechnology segment reported sales distribution by geography as follows: North America – 33%, Western Europe – 34%, other developed markets – 5%, and high-growth markets – 28%. This global spread reflects the segment’s diversified customer base and balanced presence across mature and emerging biopharmaceutical markets.

- The Biotechnology segment, established through the acquisition of Pall in 2015, was further strengthened by the acquisition of Cytiva in 2020, expanding Danaher’s leadership in bioprocessing, discovery, and medical technologies. The segment includes 3 key business areas: Bioprocessing, Discovery, and Medical, serving the end-to-end needs of biologics and life sciences manufacturing.

- Price increases contributed 2.5% to the segment’s year-over-year sales growth in 2024, partially offsetting overall revenue declines. Total Biotechnology segment sales fell by 6.0%, largely due to reduced core sales in the bioprocessing business and the negative effects of currency exchange fluctuations.

- The bioprocessing business experienced weaker performance during the first half of 2024 as customers reduced inventory levels and delayed new investments. However, core growth resumed in the second half of the year, supported by improved demand for consumables in both North America and Europe.

Moreover

- Core sales across most major regions declined year-over-year, with China showing particularly weak demand as biopharma customers adopted a cautious investment approach amid market uncertainty.

- In 2024, Danaher Corporation’s Biotechnology segment generated USD 6,759 million in revenue, down from USD 7,172 million in 2023 and USD 8,758 million in 2022, reflecting the continued normalization of market conditions following the post-pandemic slowdown in biopharmaceutical demand.

- The 2024 decline primarily stemmed from reduced customer spending in bioprocessing, as clients adjusted their purchasing cycles and worked through existing inventories, resulting in lower order volumes across key markets.

- However, by the second half of 2024, the segment showed signs of stabilization, driven by improving demand for consumables, especially in North America and Western Europe, as biopharma production and capacity utilization began to recover.

(Source: Danaher Corporation Annual Report)

Danaher Corporation Statistics By Geographical Analysis

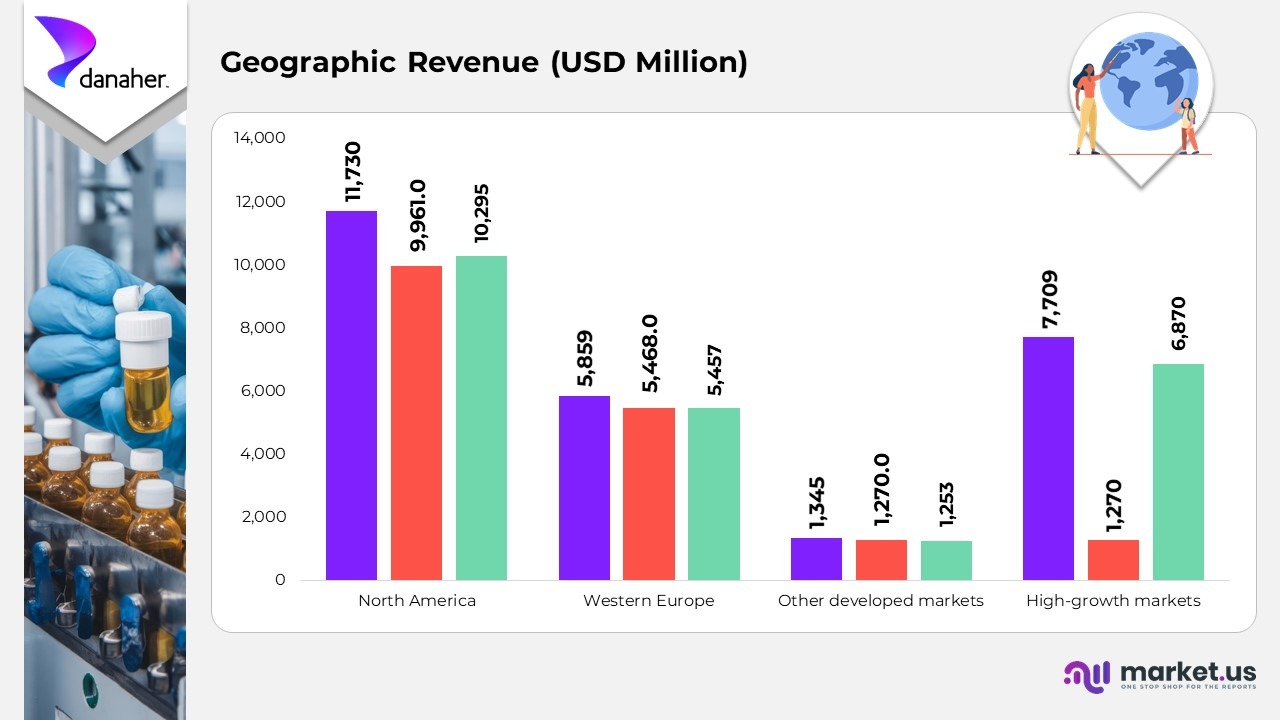

- In 2024, North America continued to be the leading revenue contributor for Danaher Corporation, recording USD 10,295 million, up from USD 9,961 million in 2023, though still below USD 11,730 million in 2022. The increase was primarily supported by stronger demand in the Diagnostics and Life Sciences segments, particularly across clinical laboratories and bioprocessing solutions.

- Western Europe reported USD 5,457 million in revenue in 2024, maintaining a level similar to USD 5,468 million in 2023, but slightly lower than USD 5,859 million in 2022. The region showed resilience in diagnostics and life sciences applications. However, growth was tempered by reduced capital spending in the bioprocessing market due to cautious investment sentiment within the pharmaceutical sector.

- In other developed markets, revenue stood at USD 1,253 million in 2024, compared to USD 1,270 million in 2023 and USD 1,345 million in 2022. The slight decline reflected a conservative purchasing environment, as healthcare providers in mature economies continued to streamline budgets and manage existing inventories efficiently.

- High-growth markets experienced a notable recovery, generating USD 6,870 million in 2024, a sharp increase from USD 1,270 million in 2023, nearing the USD 7,709 million achieved in 2022. This rebound was fueled by expanding healthcare infrastructure, rising adoption of molecular diagnostics and bioprocessing technologies, and robust demand from emerging Asian and Middle Eastern markets.

(Source: Danaher Corporation Annual Report)

Fun Facts

- The name “Danaher” is derived from Danaher Creek in western Montana — the Rales brothers reportedly came up with the name while fishing in that locale.

- One of the first US companies to deeply adopt the Japanese kaizen philosophy of continuous improvement, Danaher built its culture around lean methods relatively early in its history.

- The Danaher Business System (DBS) is so embedded that Danaher often acquires a company and quickly applies DBS to improve margins, speed, and performance, making it a frequent case study in value-creation.

- In the COVID-19 pandemic era, Danaher companies produced critical diagnostics and rapid-testing components, playing a direct role in global public-health responses.

- Danaher’s approach means that they will buy a business, apply DBS to improve performance, then sometimes spin it off later when it has reached a different growth stage—thus creating multiple waves of value for shareholders.

- Despite being a large company, Danaher retains a strong “entrepreneurial” culture inside many of its operating companies, where scientists, engineers, and commercial teams work in smaller business-unit style environments.

- The company’s acquisition history is extensive: from buying diagnostics firms, life-sciences tool suppliers, and bioprocessing companies, Danaher has transformed the way therapeutics are discovered, developed, and manufactured.

- While many people associate Danaher with life science tools and diagnostics labs, in its early decades, it operated more broadly in industrial manufacturing and instrumentation before the strategic shift to healthcare science.

- Danaher often ranks among the top companies in recurring revenue, high-margin tools & consumables for labs, and has built strong lock-in effects because many of its products are consumables or embedded in workflows (meaning customers buy again and again).

Recent Developments

- In May 2025, Danaher Corporation announced a strategic partnership with AstraZeneca to develop and commercialize innovative diagnostic tools and tests aimed at enhancing clinical decision-making in precision medicine. The collaboration focuses on helping physicians identify patients most likely to benefit from targeted therapies, strengthening the integration of diagnostics and therapeutics in personalized healthcare.

- In January 2025, Danaher partnered with Danaher Diagnostics LLC and Danaher Ventures LLC to create a unified patient record system designed to identify care gaps, assess patient risk, and recommend timely interventions. Through its collaboration with Innovaccer and a network of healthcare providers, the initiative aims to accelerate the adoption of precision diagnostics and support value-based care models that improve patient outcomes.

- In July 2024, Danaher entered into a research collaboration with Stanford University’s Department of Bioengineering to advance “smart microscopy” for cancer drug discovery. The project, led by the Danaher Beacon for Spatialomics, combines artificial intelligence (AI) with spatial biology to enhance cancer drug screening accuracy and reduce risks in the development of oncology therapeutics.

Moreover

- In February 2024, Danaher collaborated with Cincinnati Children’s Hospital Medical Center to improve liver organoid technology as an advanced drug toxicity screening platform. This innovation is intended to boost patient safety, enhance drug development efficiency, and potentially save billions in research and development costs by improving early toxicity detection.

- In January 2024, the company teamed up with the Innovative Genomics Institute to develop gene-editing therapies targeting rare and complex diseases. The partnership seeks to establish a new model for genomic medicine development, leveraging cutting-edge CRISPR technologies to advance next-generation therapies.

- In December 2023, Danaher completed the acquisition of Abcam plc, transforming it into an indirect wholly owned subsidiary of Danaher Corporation. Following the acquisition, Abcam ADSs were delisted from Nasdaq, marking the integration of Abcam’s antibody and protein research capabilities into Danaher’s life sciences portfolio.

(Source: Danaher Corporation Press Releases)