Company Overview –

Bausch Health Statistics: Bausch Health Companies Inc. is a medical device and pharmaceutical company dedicated to improving lives through innovative healthcare solutions. The company develops, manufactures, and markets a broad portfolio of generic, branded, and over-the-counter pharmaceuticals, aesthetic technologies and medical devices. Its therapeutic focus spans gastroenterology, neurology, hepatology, dermatology, and eye health.

Through approximately 88% ownership of Bausch + Lomb Corporation, Bausch Health maintains a strong presence in ophthalmology, offering products such as contact lenses, intraocular lenses, and advanced surgical instruments. Its products are marketed in nearly 90 countries and regions across North America, Europe, Latin America, Asia Pacific, the Middle East, and Africa, positioning it as a key player in global healthcare markets.

The company operates through 5 primary business segments. The Salix segment focuses on gastrointestinal (GI) therapies, with Xifaxan contributing a major portion of revenue. The International segment covers branded and generic pharmaceuticals, OTC products, and Solta Medical aesthetic devices outside the U.S. The Solta Medical segment specializes in aesthetic medical technologies.

The Diversified segment includes neurology, dermatology, dental, and generic products primarily in the U.S. The Bausch + Lomb segment encompasses global sales in vision care, surgical, and pharmaceutical eye health products. Together, these segments reinforce Bausch Health’s strategy of delivering accessible, high-quality medical solutions worldwide.

(Source: Company Website)

Bausch Health Statistics By Financial Analysis

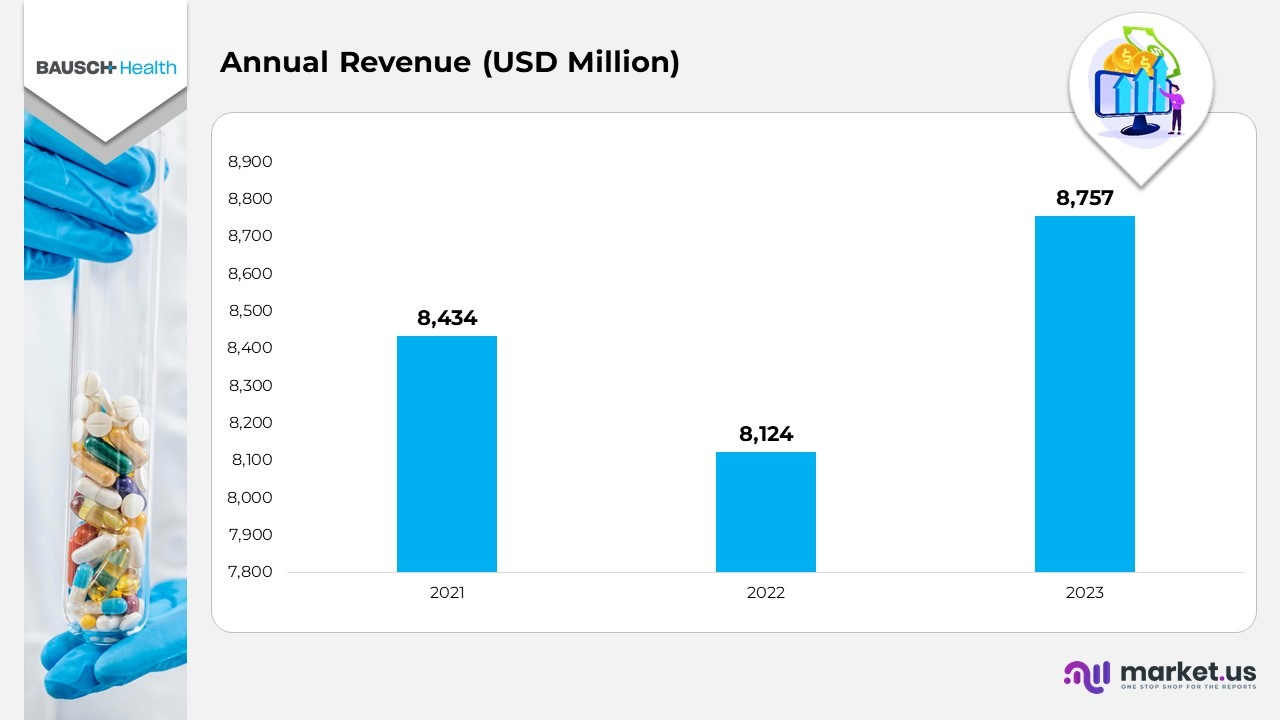

- In 2021, Bausch Health Companies Inc. generated $8,434 million in total revenue, reflecting steady growth across its broad portfolio of branded, generic, and medical device products. The company’s performance was supported by sustained demand in its core therapeutic areas and a balanced contribution from both U.S. and international markets.

- In 2022, revenue moderated to $8,124 million, representing a 3.7% decline from the previous year. The dip was primarily attributed to unfavorable currency movements and a normalization in market activity following a period of elevated demand in 2022. Despite this, Bausch Health maintained stability through strategic cost management and focused investments in key growth segments.

- In 2023, the company posted a strong recovery, recording $8,757 million in annual revenue, a 7.8% year-over-year increase compared to 2023. The rebound was driven by revitalized performance in the eye health and gastrointestinal portfolios, enhanced international market traction, and consistent product innovation across its therapeutic lines.

- Taken together, the 2022–2024 financial period highlights Bausch Health’s operational resilience and ability to navigate market fluctuations effectively. The company’s return to growth in 2024 underscores its strategic focus on innovation, global expansion, and leadership within the specialty pharmaceuticals and medical device sectors.

(Source: Bausch Health SEC Filings)

Bausch Health Statistics Research and Development Expenditure

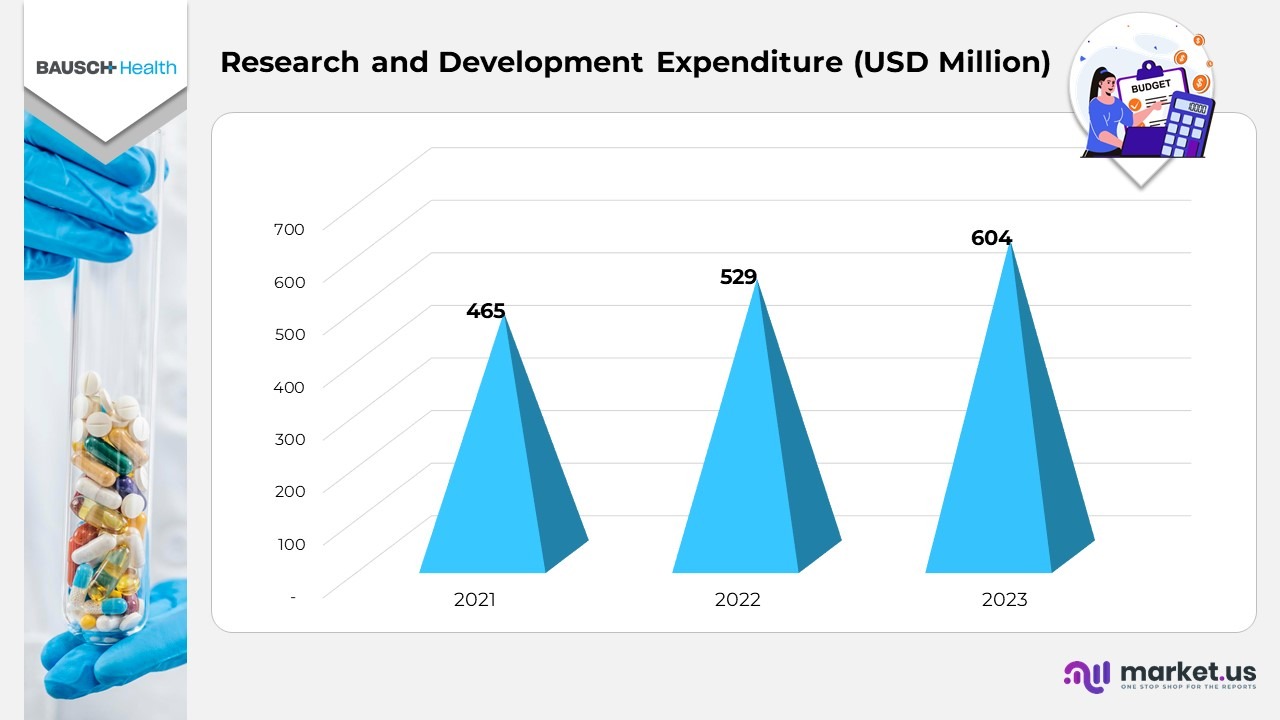

- The R&D division of Bausch Health Companies Inc. focuses on advancing innovative products through clinical trials. As of December 31, 2023, the company managed over 90 active R&D projects supported by approximately 1,450 R&D and quality assurance employees across 24 global facilities, reflecting a strong commitment to scientific innovation.

- In 2023, R&D expenses totaled $604 million, compared to $529 million in 2022 and $465 million in 2021. These figures represented approximately 7%, 7%, and 6% of annual revenue, respectively, indicating a sustained focus on research-driven growth.

- The company strategically rebalanced its R&D portfolio to align with long-term objectives, emphasizing core therapeutic areas and innovation-led growth. This investment underscores its dedication to organic expansion through the development of new products and pipeline advancement.

- In addition to internal development, Bausch Health continues to pursue co-promotions, licensing partnerships, and targeted acquisitions to strengthen its innovation ecosystem and maintain a competitive position in global healthcare markets.

(Source: Bausch Health SEC Filings)

Bausch Health Statistics By Segmental Analysis

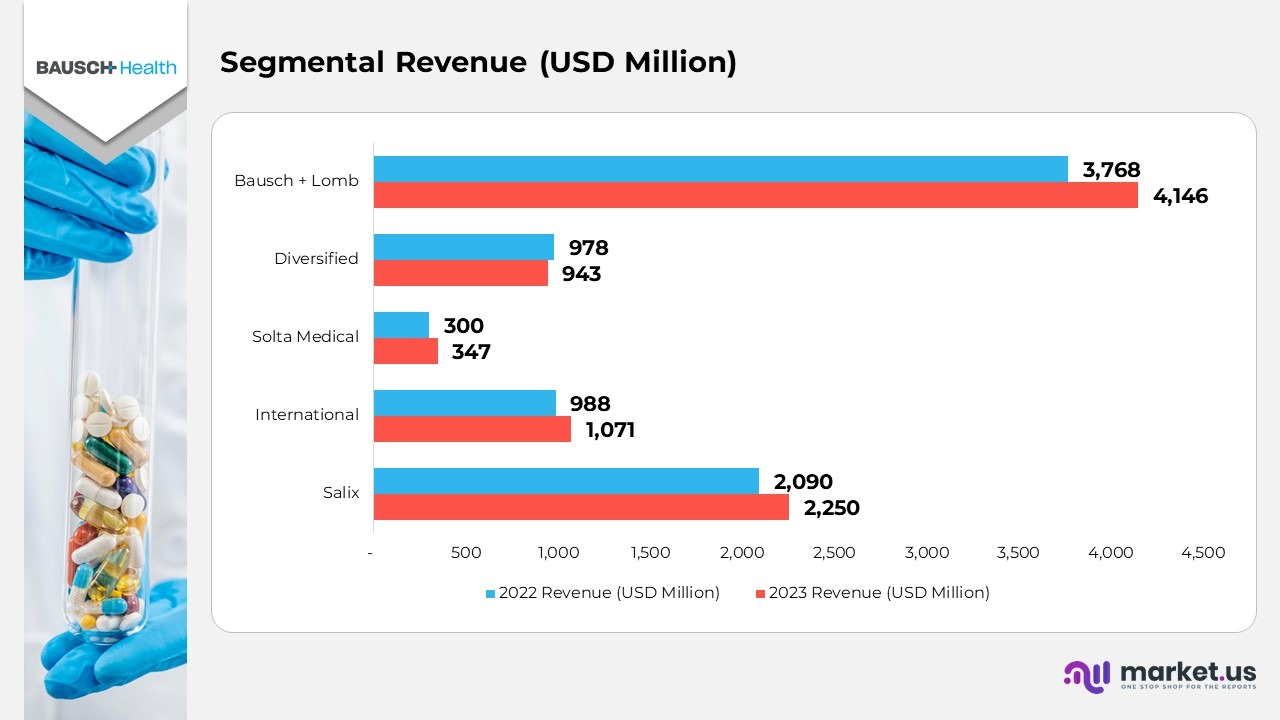

- The Salix segment contributed significantly to overall performance, with the Xifaxan product line accounting for nearly 80% of segment revenue and 21% of total company revenue in both 2023 and 2022. Segment revenue reached $2,250 million in 2023, rising from $2,090 million in 2022, marking an 8% increase. Growth was driven by strong demand, favourable pricing adjustments of $53 million, and improved wholesaler stocking patterns for key GI products.

- The Salix segment profit stood at $1,548 million in 2023, compared to $1,489 million in 2022, reflecting a $59 million (4%) increase. This improvement was supported by higher contribution margins but partially offset by increased advertising and R&D investments under the global RED-C program.

- The International segment generated $1,071 million in 2023, up from $988 million in 2022, reflecting an 8% year-over-year growth. The increase was mainly driven by $37 million in improved pricing and $31 million in higher sales volumes, particularly across Latin America and Europe.

- The International segment profit rose to $335 million in 2023, compared with $324 million in 2022, a gain of $11 million (3%). Growth was supported by favourable manufacturing variances and positive foreign currency impacts, though partially offset by higher advertising and promotional spending.

- The Solta Medical segment, which includes the Thermage product line, achieved $347 million in 2023, up from $300 million in 2022, showing 16% growth. The gain was driven by $50 million in higher volumes and $5 million in stronger pricing, partially offset by $8 million in currency headwinds.

Moreover

- The Solta Medical segment profit reached $161 million in 2023, compared to $135 million in 2022, an increase of $26 million (19%). The growth reflected stronger sales performance and improved operational efficiency, although it was tempered by currency challenges and increased marketing costs.

- The Diversified segment posted $943 million in 2023, down from $978 million in 2022, representing a 4% decline. The reduction was linked to $42 million in lower volumes, especially in neurology and dermatology, and $2 million in divestitures, partly balanced by improved pricing conditions.

- The Diversified segment profit declined to $586 million in 2023 from $612 million in 2022, marking a $26 million (4%) drop. The decline resulted from reduced revenue contributions and higher administrative, promotional, and R&D expenditures.

- The Bausch + Lomb segment continued to be the largest contributor, generating $4,146 million in 2023, up from $3,768 million in 2022, reflecting a 10% growth or $378 million increase. The improvement was fueled by $205 million in higher volumes, $141 million from acquisitions, and $110 million in price gains, offset slightly by $68 million in adverse currency impact and $10 million from product divestitures within the surgical and vision care portfolio.

(Source: Bausch Health SEC Filings)

Recent Developments

- In September 2025, Bausch Health completed the acquisition of DURECT Corporation for $1.75 per share in cash, amounting to an upfront payment of about $63 million. The agreement also included potential milestone payments of up to $350 million, contingent upon meeting net sales targets before December 31, 2045, or the 10th anniversary of the first U.S. commercial sale.

- In September 2025, the company introduced the YUN ACN skincare line in Poland, featuring probiotic and prebiotic formulations aimed at improving acne-prone skin health and promoting balanced microbiome care.

- In July 2025, Bausch Health announced the acquisition of DURECT Corporation, reinforcing its commitment to developing innovative therapies for liver disease and expanding its biopharmaceutical research portfolio.

- In June 2025, the company entered into a strategic partnership with YUN NV, a pioneer in microbiome skincare technology. The collaboration focused on bringing probiotic-based acne care products to the Polish market, reflecting the company’s interest in science-driven skincare innovation.

- In March 2025, Bausch Health launched the syndication of new senior secured credit facilities totaling at least $3.8 billion, enhancing financial flexibility and supporting future growth initiatives.

- In December 2024, the company collaborated with the U.S. Pain Foundation (USPF), International Foundation for Gastrointestinal Disorders (IFFGD), and American Chronic Pain Association (ACPA) to raise awareness about opioid-induced constipation (OIC). This initiative, known as OIC Awareness Day, aimed to reduce stigma, foster open discussions, and provide education and support for patients managing the condition.

(Source: Bausch Press Releases)