Company Overview

Smith & Nephew Statistics: Smith & Nephew plc is a global medical technology leader focused on the repair, regeneration, and replacement of hard and soft tissues. The company operates through 3 primary business segments— Sports Medicine & ENT, Orthopaedics, and Advanced Wound Management. The Orthopaedics division features a comprehensive range of hip, knee, and shoulder replacement systems, alongside robotics-assisted and digitally enabled surgical platforms that enhance precision and recovery outcomes.

The Sports Medicine & ENT unit delivers specialized implants and instruments designed for repairing and removing soft tissue, addressing evolving clinical needs through procedural and technological innovation. Meanwhile, the Advanced Wound Management division offers an extensive range of negative pressure systems, advanced dressings, and digital wound solutions, targeting complex wounds and reshaping modern wound care practices.

Regional Data

Operating in over 100 countries, Smith & Nephew maintains a vast global footprint with the United States as its largest market. In Africa, the company serves regions including South Africa, Kenya, Tanzania, Ghana, and Uganda, enabling access to innovative surgical and wound-management solutions. Across the Asia Pacific, its network spans India, Australia, China, Singapore, Japan, and Vietnam, among others, ensuring strong coverage in developed and emerging economies. In Latin America, Smith & Nephew operates in Brazil, Mexico, Argentina, Chile, and Colombia, reinforcing its market presence through robust distribution and clinical partnerships that support sustainable healthcare delivery.

Within Europe, the company’s operations extend across Germany, Italy, the United Kingdom, Spain, France, and other countries such as Poland, Turkey, and Romania, reflecting its deep integration into regional healthcare systems. In the Middle East, Smith & Nephew has established a strong presence across Saudi Arabia, Egypt, Qatar, Kuwait, and the United Arab Emirates, meeting growing demand for advanced surgical and wound care technologies. This broad international reach empowers the company to meet diverse healthcare challenges, drive innovation in treatment technologies, and maintain leadership in regenerative and reconstructive medical solutions worldwide.

Global Healthcare Capabilities of Smith & Nephew in 2024

- In 2024, the S+N Academy programmes conducted by Smith+Nephew successfully delivered 3,874 in-person and virtual training sessions for healthcare professionals, strengthening global clinical education and skill development.

- A total of 106,734 healthcare professionals participated in these training sessions, demonstrating Smith+Nephew’s strong commitment to advancing medical knowledge and procedural excellence across its network.

- The Academy Online platform offered access to 700+ interactive modules, providing continuous learning opportunities in surgical techniques, wound care, and product innovation.

- Through the online learning portal, 20,840 healthcare professionals completed certified training programmes in 2024, supporting the company’s goal of building digital-first medical education initiatives.

- Smith+Nephew introduced 16 new products in 2024, each designed to enhance clinical outcomes and strengthen its innovation-driven portfolio. This key performance indicator reflects the company’s ongoing efforts to accelerate future revenue growth through consistent product development and market readiness.

- More than 380,000 patients benefited from Smith+Nephew product donation programs, reflecting the company’s continued commitment to improving global access to essential healthcare.

- Over 4,500 employees actively supported initiatives through Smith+Nephew’s seven Global Employee Inclusion Groups and various sub-groups, promoting a culture of equity, inclusion, and belonging across its global workforce.

- The company organized 150+ employee engagement activities focused on fostering inclusivity, collaboration, and personal growth, strengthening its internal culture and community impact.

- Across its global sites, Smith+Nephew hosted 68 volunteering events, encouraging employees to contribute their time and expertise toward social impact and healthcare awareness initiatives.

History of Smith & Nephew

1800s

- 1856: Thomas James Smith opened a chemist’s shop in Hull, UK, where he developed an improved method for refining cod liver oil, laying the foundation for future healthcare innovations.

- 1896: Horatio Nelson Smith joined his uncle Thomas James Smith to establish J. Smith & Nephew, marking the formal creation of the company.

1900s

- 1906:N. Smith shifted focus from cod liver oil to wound care, introducing a bandage-cutting and rolling machine. During this time, he also secured supply contracts with Canadian hospitals, signaling the company’s international expansion.

- 1907: Smith & Nephew was officially incorporated as a limited company, setting the stage for future industrial and medical advancements.

1910s – 1930s

- 1914: Following the outbreak of World War I, the company was awarded a major contract to supply £350,000 worth of surgical and field dressings to France. Its workforce expanded from 50 to 1,200 employees within just five months.

- 1921: Smith & Nephew opened its first overseas branch in Canada, reinforcing its growing global footprint.

- 1928: The company introduced its first experimental adhesive bandage, Elastoplast, which became a major success.

- 1937: Smith & Nephew was listed on the London Stock Exchange and developed a pioneering low-temperature plaster later used by the 1953 Everest expedition to preserve camera films.

1940s – 1950s

- 1950s: The company expanded its presence with new subsidiaries in Australia (1950) and New Zealand (1953).

- 1951: Smith & Nephew acquired Herts Pharmaceuticals, adding pharmaceutical and skincare lines, as well as laboratory and R&D resources, to support product innovation and diversification.

1980s – 1990s

- 1986: Two major U.S. acquisitions were completed, Richards Medical in Memphis (orthopaedic products) and DYONICS in Andover (arthroscopy solutions), strengthening its global orthopaedic portfolio.

- 1995: The acquisition of Acufex Microsurgical Inc. positioned the company as a market leader in arthroscopic surgical devices. In the same year, Smith & Nephew was listed on the New York Stock Exchange.

2000s

- 2001: Smith & Nephew became a member of the UK FTSE 100 Index and launched OXINIUM, a new joint replacement material enhancing implant durability and performance.

2010s

- 2011: The company launched PICO, a pocket-sized, single-use negative pressure wound therapy device, revolutionizing portable wound care.

- 2013: Introduction of JOURNEY II BCS, a next-generation knee implant designed for improved mobility and comfort.

- 2014: Acquired ArthroCare Corp., expanding its sports medicine portfolio.

- 2015: Acquired Blue Belt Technologies, advancing its leadership in orthopaedic robotics-assisted surgery.

2019

- 2019: Expanded its technology portfolio through acquisitions of Osiris Therapeutics, Leaf Patient Monitoring System, Ceterix Orthopaedics, and Brainlab Orthopaedic Joint Reconstruction Business.

- 2020: Launched Real Intelligence and the CORI Surgical System, a next-generation handheld robotics platform for orthopaedic procedures.

- 2021: Acquired the orthopaedic extremity business from Integra, further strengthening its foothold in high-growth orthopaedic markets.

- Today, Smith & Nephew employs over 18,000 people and operates in more than 100 countries, continuing its legacy of innovation in global medical technology.

(Source: Company Website)

Financial Analysis

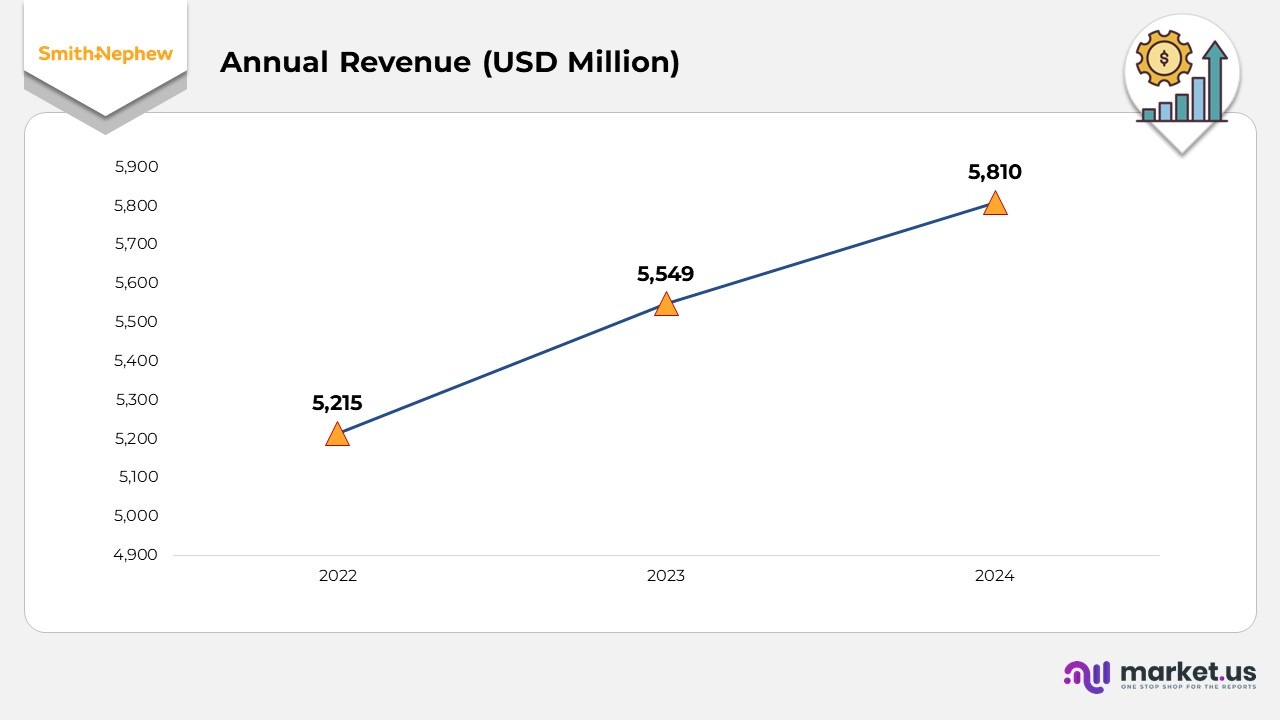

- In 2022, Smith+Nephew achieved revenue of USD 5,215 million, marking the start of its transformation journey toward becoming a higher-growth and more efficient company. The year focused on operational restructuring, digital innovation, and strengthening its product portfolio to build a foundation for sustainable performance.

- In 2023, annual revenue increased to USD 5,549 million, up 6.4% from the previous year. The company recorded higher underlying growth across all segments, supported by improved product demand, successful launches, and steady recovery in global healthcare markets despite economic and supply chain pressures.

- In 2024, revenue climbed to USD 5,810 million, reflecting a 7% increase on a reported basis and a 5.3% increase on an underlying basis, excluding a 60 bps foreign exchange impact. The performance exceeded revised guidance of around 4.5%, driven by stronger sales momentum in the final quarter and consistent demand across key international markets, reinforcing Smith+Nephew’s position as a sustainably growing global medtech leader.

(Source: Smith & Nephew Annual Report)

Research and Development Expenditure

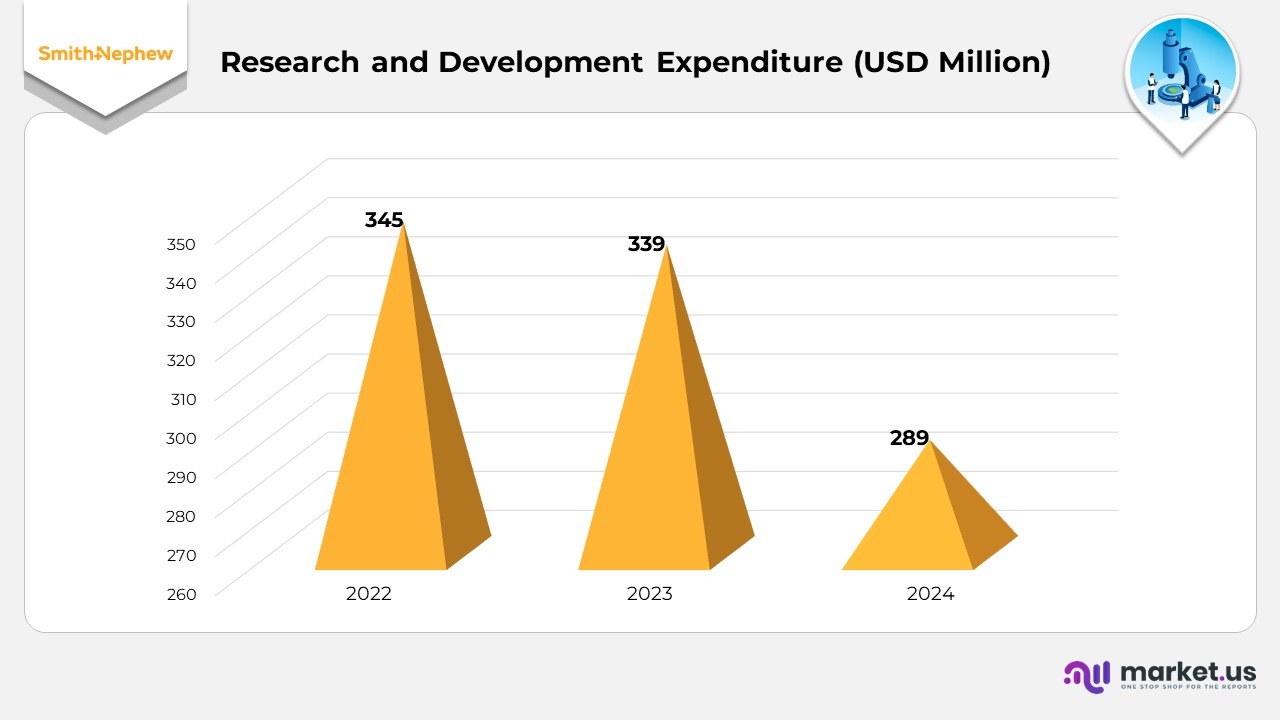

- In 2022, Smith+Nephew invested USD 345 million in research and development, equivalent to 6% of total revenue. The investment primarily targeted the expansion of robotic-assisted surgery systems, enhanced wound management solutions, and advanced orthopaedic technologies, all aimed at reinforcing the company’s innovation-driven growth model.

- In 2023, R&D expenditure totalled USD 339 million, a 1.7% decline from the previous year and about 1% of total revenue. The company strategically balanced innovation spending by channeling resources into the commercialization of existing technologies while maintaining active progress in next-generation surgical platforms and digital healthcare solutions.

- In 2024, research and development spending further decreased to USD 289 million, a 14.7% year-over-year decline, accounting for approximately 0% of revenue. Despite the lower allocation, around 60% of total revenue growth during the year originated from products introduced in the past 5 years, highlighting the lasting impact of earlier innovation cycles and a stronger focus on commercial execution and portfolio optimization.

(Source: Smith & Nephew Annual Report)

Segmental Analysis

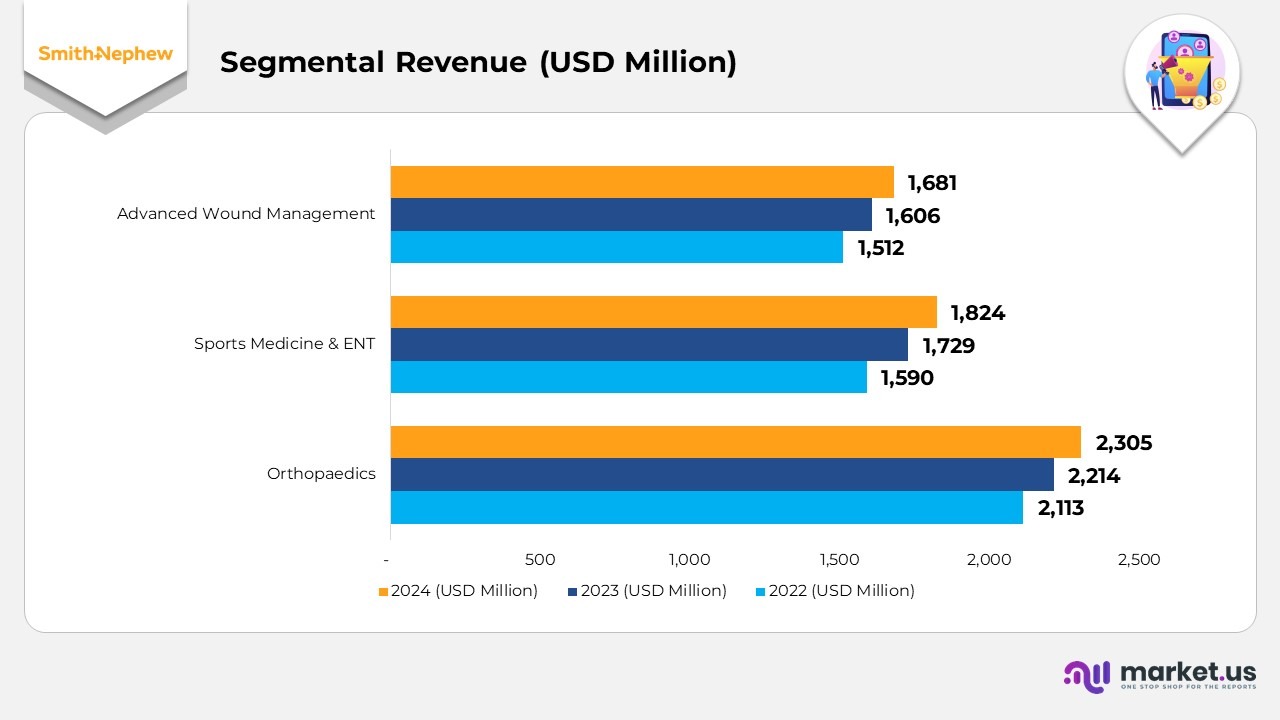

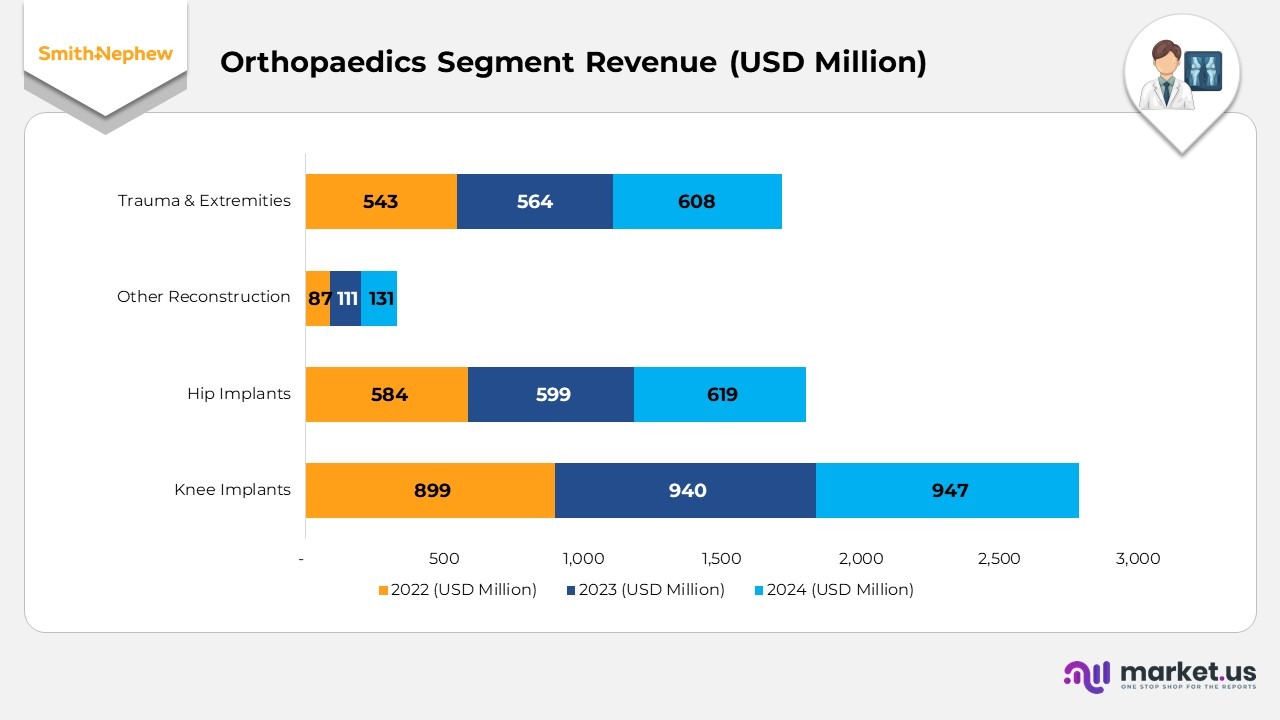

- In 2024, the Orthopaedics segment generated USD 2,305 million, representing a 4.1% year-over-year (YoY) increase from USD 2,214 million in 2023 and a 9.1% rise from USD 2,113 million in 2022. This consistent growth was supported by rising demand for joint reconstruction systems, wider adoption of robotics-assisted surgeries, and recovery in elective orthopaedic procedures across major markets.

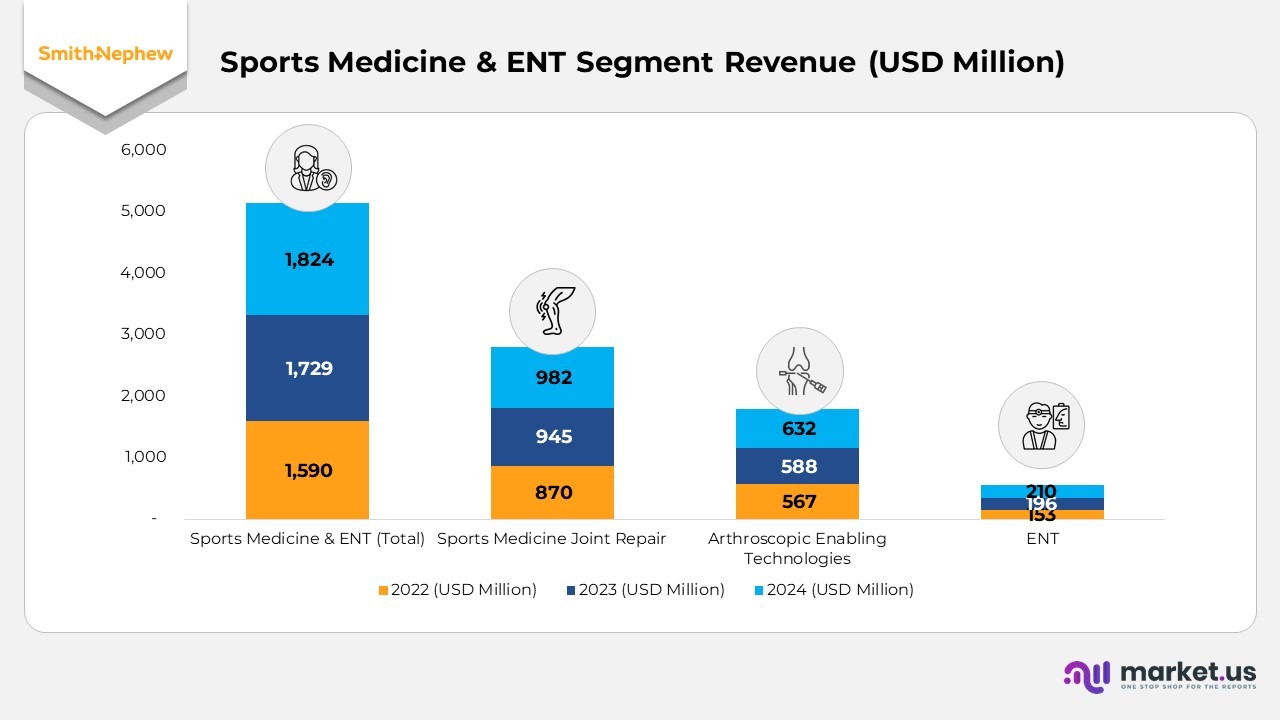

- The Sports Medicine & ENT segment reported USD 1,824 million in revenue in 2024, up 5.5% YoY from USD 1,729 million in 2023 and 14.7% from USD 1,590 million in 2022. The segment’s performance was driven by greater utilization of minimally invasive surgical tools, advanced arthroscopy systems, and strong traction in soft tissue repair solutions across hospitals and sports medicine centers.

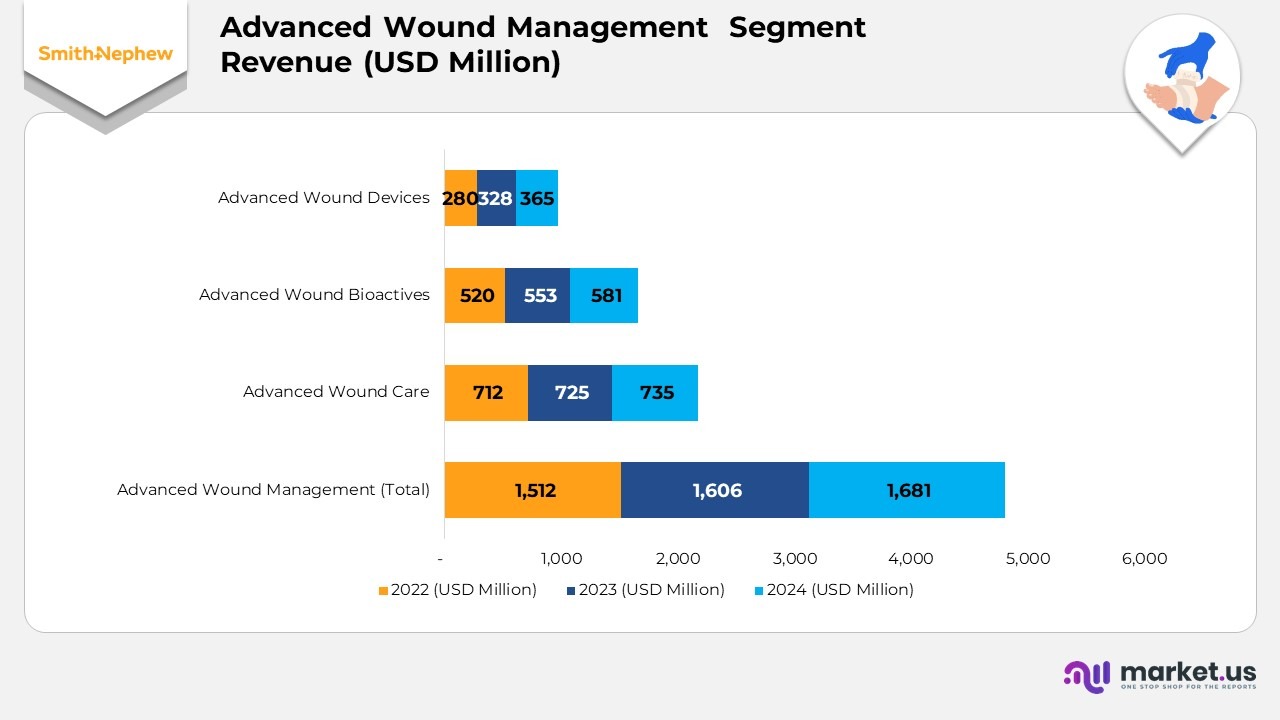

- The Advanced Wound Management segment reached USD 1,681 million in 2024, up 4.7% YoY from USD 1,606 million in 2023 and 11.2% from USD 1,512 million in 2022. Growth was fueled by rising demand for negative-pressure wound therapy, high-performance dressings, and the expanding use of digital wound care platforms, reinforcing Smith+Nephew’s leadership in complex wound management solutions.

(Source: Smith & Nephew Annual Report)

Orthopaedics Business Unit

- The Orthopaedics division recorded USD 2,305 million in revenue for 2024, reflecting a 1% reported increase and 4.6% underlying growth, despite a 50 bps foreign exchange headwind. This outcome highlights the continued progress under Smith+Nephew’s 12-Point Plan focused on operational recovery and execution within the “Fix Orthopaedics” initiative.

- Knee Implants revenue reached USD 947 million in 2024, showing steady improvement supported by strong adoption of the JOURNEY II Total Knee System and increased demand for cementless and revision systems. Growth was led primarily by the US and other established markets, offsetting reduced volumes in China, where distributors slowed orders amid inventory realignment.

- Hip Implants generated USD 619 million in 2024, up from USD 599 million in 2023, driven by strong demand for the POLAR3 Total Hip Solution and the R3 Acetabular System. Improved product supply, coupled with stronger commercial execution in key markets, contributed to this positive performance.

- Other Reconstruction achieved USD 131 million in 2024, reflecting double-digit growth from the prior year. This was largely driven by the expanding adoption of the CORI Surgical System and its associated consumables. By year-end, the installed base of CORI systems surpassed 1,000 units globally, underscoring Smith+Nephew’s growing leadership in robotic-assisted surgery.

- Trauma & Extremities delivered USD 608 million in 2024, up from USD 564 million in 2023. The increase was supported by stronger demand for fixation and reconstruction systems, particularly in Western Europe and North America, where surgical volumes and procedural activity continued to recover.

(Source: Smith & Nephew Annual Report)

Sports Medicine & ENT

- The Sports Medicine & ENT division recorded a 5% revenue increase on a reported basis in 2024, despite a 70 bps foreign exchange impact. On an underlying basis, revenue growth stood at 6.2%, reflecting continued momentum in core surgical solutions and solid demand recovery across major global markets.

- Excluding China, the segment achieved stronger reported growth of 9.3% and underlying growth of 10.0%, demonstrating robust performance across developed markets. The business faced headwinds from China’s Volume-Based Procurement (VBP) program, which came into effect in May 2024, impacting product pricing and sales volumes in the region.

- The Sports Medicine Joint Repair segment showed resilience, with overall growth tempered by the VBP headwind in China. Outside of China, the division achieved 6% growth on a reported basis and 11.3% on an underlying basis, driven by the success of its knee repair portfolio and strong global demand for the REGENETEN Bioinductive Implant.

- Arthroscopic Enabling Technologies delivered a performance well ahead of 2023, supported by increased adoption of the company’s arthroscopic tower systems and COBLATION technologies. However, growth may moderate in 2025–2026 due to the expected rollout of China’s VBP program for mechanical resection blades and COBLATION wands in the second half of 2025.

- The ENT business reported a solid year of growth, driven by rising volumes of tonsillectomy and adenoidectomy procedures, reflecting higher surgical activity across key markets.

- The Sports Medicine & ENT division’s trading profit rose by 0% in 2024, with the trading profit margin improving by 120 bps to 24.0%. This uplift was driven by operating leverage, enhanced cost efficiency, and ongoing productivity improvements across manufacturing and distribution operations.

(Source: Smith & Nephew Annual Report)

Advanced Wound Management

- Advanced Wound Management generated 7% revenue growth in 2024 on a reported basis, despite an FX headwind of 40 bps. On an underlying basis, growth reached 5.1%, supported by strong execution and increased adoption of advanced wound treatment solutions across global markets.

- Advanced Wound Care achieved notable progress, with revenue growth driven by higher demand for foam dressings and infection management products, strengthening its position in core wound care applications.

- Advanced Wound Bioactives delivered consistent gains, led by the continued success of SANTYL, which maintained full-year growth despite quarter-to-quarter variability. The skin substitutes business achieved double-digit growth following the launch of GRAFIX PLUS, reinforcing innovation-led momentum in biologic wound therapies.

- Advanced Wound Devices recorded robust expansion across 2024, supported by rising adoption of the RENASYS Negative Pressure Wound Therapy System and the PICO single-use system. Additional contribution came from the LEAF Patient Monitoring System, which continued to expand its market presence in pressure injury prevention.

- The Advanced Wound Management trading profit increased by 3% in 2024, with a 50 bps improvement in profit margin to 23.7%, reflecting enhanced operating leverage, improved productivity, and stronger cost management efficiency.

(Source: Smith & Nephew Annual Report)

Sports Medicine Coblation Wands and Controllers – Patent Coverage

| Product Name | Associated U.S. Patents and Foreign Counterparts |

|---|---|

| AMBIENT Wands | 8,696,699; 9,452,008; 10,420,601; 11,510,721 |

| COBLATION FASTSEAL 6.0 | D106226 |

| WEREWOLF FLOW 50 COBLATION Wand | 8,192,428; 8,710,866; 9,254,146; 9,333,024; 9,713,489; 10,237,173; 10,582,395; 10,579,523; 10,875,008; 11,939,253 |

| WEREWOLF FLOW 90 COBLATION Wand | 8,192,428; 8,710,866; 9,254,146; 9,333,024; 9,713,489; 10,237,173; 10,582,395; 10,579,523; 10,875,008; 11,939,253; USD889347 |

| AMBIENT HIPVAC 50 | 11234753 |

| STARVAC, TURBOVAC, SUPER TURBOVAC, MULTIVAC, MEGAVAC, COVAC, and COVATOR | 8,192,428; 8,710,866; 9,254,146; 9,333,024; 9,713,489; 10,237,173; 10,582,395; 10,675,080 |

| QUANTUM and QUANTUM 2 System | 8,696,699; 9,358,063; 9,452,008 |

| WEREWOLF SYSTEM CONTROLLER | 8,192,428; 8,710,866; 9,254,146; 9,333,024; 9,452,008; 9,597,142; 9,713,489; 10,237,173; 10,582,395; 10,579,523; 10,875,008; 11,106,057; 11,329,864; 11,579,253 |

| INTELLIO SHIFT | D957113; 8,194,248; 8,794,246; 8,799,048; 9,254,146; 9,333,024; 9,452,008; 9,713,489; 10,237,173; 10,582,395; 10,579,523; 11,106,057; 11,329,864; 11,579,253; 11,939,253 |

(Source: Company Website)

ENT Products – Patent Coverage

| Product Name | Associated U.S. Patents and Foreign Counterparts |

|---|---|

| COBLATION HALO Wand | 10,448,992; 11,116,569; 12,016,616 |

| EXCISE PDW Wand | 9168082 |

| PROCISE MLW Wand | 9,011,428; 9,839,468 |

| TURBINATOR | 9,254,166; 9,649,144 |

| COBLATION HALO WEREWOLF System | 9,254,166; 9,333,024; 9,649,148; D712031; D711905; D711904; 10,420,607; 10,448,992; 11,523,864; 12,016,616 |

| COBLATOR II Surgery System | 9168082 |

| ENTACT Septal Stapler | 7,438,208; 8,579,179; 9,241,726; 9,427,229; 10,716,561 |

| NASASENT | 10,227,478; 10,800,905 |

| TULA System | 8,192,420; 7,708,226; 8,746,787; 9,011,363; 9,211,362; 9,354,684; 9,538,146; 9,706,366; 9,707,900; 10,106,336; 10,430,808; 10,539,795; 10,749,165; 10,874,348; 10,776,422; 10,822,418; 10,620,271; 10,751,531; 10,987,512; 11,456,182; 11,633,588; 11,656,854 |

| Product Name | Associated U.S. Patents and Foreign Counterparts |

| COBLATION HALO Wand | 10,448,992; 11,116,569; 12,016,616 |

| EXCISE PDW Wand | 9168082 |

| PROCISE MLW Wand | 9,011,428; 9,839,468 |

| TURBINATOR | 9,254,166; 9,649,144 |

| COBLATION HALO WEREWOLF System | 9,254,166; 9,333,024; 9,649,148; D712031; D711905; D711904; 10,420,607; 10,448,992; 11,523,864; 12,016,616 |

| COBLATOR II Surgery System | 9168082 |

| ENTACT Septal Stapler | 7,438,208; 8,579,179; 9,241,726; 9,427,229; 10,716,561 |

| NASASENT | 10,227,478; 10,800,905 |

| TULA System | 8,192,420; 7,708,226; 8,746,787; 9,011,363; 9,211,362; 9,354,684; 9,538,146; 9,706,366; 9,707,900; 10,106,336; 10,430,808; 10,539,795; 10,749,165; 10,874,348; 10,776,422; 10,822,418; 10,620,271; 10,751,531; 10,987,512; 11,456,182; 11,633,588; 11,656,854 |

(Source: Company Website)

Recent Developments

- In October 2025, Smith+Nephew expanded its partnership with the UFC to foster meaningful engagement with the combat sports community, focusing on advancements in athlete health and safety through Smith+Nephew technology. The initiative aims to make the sport safer for both athletes and fans.

- In October 2025, Smith+Nephew introduced CORIOGRAPH Pre-Op Planning and Modeling Services for total shoulder arthroplasty, now available in the United States, enhancing precision and improving pre-surgical planning.

- In September 2025, the company shared new clinical evidence and market insights highlighting the strong performance of the REGENETEN Bioinductive Implant, supporting its growing adoption across sports medicine applications.

- In September 2025, Smith+Nephew launched the CENTRIO Platelet-Rich Plasma (PRP) System, developed to assist in treating chronic exuding wounds such as diabetic foot ulcers (DFUs), venous leg ulcers (VLUs), pressure ulcers, and tunneling wounds, broadening its advanced wound care portfolio.

- In December 2024, the company launched CORIOGRAPH Pre-Op Planning and Modeling Services for total hip arthroplasty, enabling greater surgical accuracy and improved clinical outcomes through advanced preoperative planning.

(Source: Smith & Nephew Press Releases)