Company Overview

Medtronic Statistics: Medtronic plc is a global healthcare technology leader engaged in the development, manufacturing, distribution, and sale of medical devices and related services. The company supports clinicians, healthcare systems, physicians, and patients across more than 150 countries worldwide. It operates through four key business segments — the Cardiovascular Portfolio, the Medical Surgical Portfolio, the Diabetes Operating Unit, and the Neuroscience Portfolio.

The Cardiovascular Portfolio comprises Heart Failure & Cardiac Rhythm, Structural Heart & Aortic, and Peripheral & Coronary Vascular divisions. These products primarily serve electrophysiologists, cardiologists, heart failure specialists, cardiovascular and vascular surgeons, and interventional radiologists. The Neuroscience Portfolio includes Cranial & Spinal Technologies, Neuromodulation divisions, and Specialty Therapies. These solutions are used by neurosurgeons, spinal and orthopedic surgeons, neurologists, anesthesiologists, urologists, urogynecologists, pain management specialists, and ENT physicians.

Further Insights

The Medical Surgical Portfolio consists of the Surgical & Endoscopy and Acute Care & Monitoring divisions. Its products are mainly used in hospitals, ambulatory care centers, physician offices, and alternative healthcare sites, with limited application in home-care settings. The Diabetes Operating Unit focuses on technologies and therapies for Type 1 and Type 2 diabetes management, primarily serving endocrinologists and primary care physicians.

Medtronic employs over 95,000 full-time employees, with 44% based in Puerto Rico and the U.S. Virgin Islands. As of April 2025, the company maintained six facilities and approximately 1,500 employees in Israel, collectively serving more than 79 million patients worldwide. Medtronic has established a strong global presence with major operations in Argentina, Brazil, Canada, Colombia, Mexico, the United States, Asia, Australia, New Zealand, Europe, Russia, Greater China, Africa, Turkey, and the Middle East. As of June 17, 2025, Medtronic reported approximately 18,895 shareholders of record holding its ordinary shares. During fiscal year 2025, the company declared and distributed ordinary cash dividends of $0.70 per share for each quarter, compared to $0.69 per share in each quarter of fiscal year 2024.

History of Medtronic

1900’s

- 1949: Earl Bakken, an electrical engineering graduate student, and his brother-in-law, Palmer Hermundslie, founded Medtronic in Minneapolis as a small medical electronics repair business. Working from a makeshift garage, their team, known as “the garage gang”, shared a vision of combining engineering and medicine to improve patient lives.

- 1957: During a citywide power outage in Minneapolis, Bakken invented the first battery-powered pacemaker at the request of a local heart surgeon. Within weeks, Medtronic’s portable pacemaker began saving lives and was soon distributed across the U.S. and internationally. A year later, the company created the first implantable pacemaker, marking a breakthrough in cardiac care.

- 1974–1979: Medtronic strengthened its role as a socially responsible company by implementing equal employment and minority-supplier programs. In 1979, it founded the Medtronic Foundation to formalize its corporate citizenship efforts and created the Bakken Society to honor engineers making exceptional contributions to biomedical innovation.

- 1977: The launch of the Medtronic-Hall mechanical heart valve introduced a revolutionary tilting-disc design, which became a global standard and remained in clinical use for nearly 25 years.

- 1987: Building upon expertise in electrical stimulation, Medtronic collaborated with French physicians to develop the world’s first deep-brain stimulation (DBS) system, a transformative therapy for patients with movement disorders such as Parkinson’s disease.

- 1993: After years of focused R&D, Medtronic introduced its first implantable cardioverter-defibrillator (ICD) to treat tachycardia, providing a life-saving solution for dangerously rapid heart rhythms.

2000’s

- 2002: The company pioneered the first remote monitoring system for medical devices, allowing patient data to be securely transmitted to physicians via the internet, setting new standards in connected healthcare.

- 2015: The acquisition of Covidien expanded Medtronic’s global capabilities in surgical and patient monitoring technologies, enhancing its capacity to address major healthcare challenges and reach more patients worldwide.

- 2016: Medtronic achieved a milestone in diabetes care with the introduction of a hybrid closed-loop insulin delivery system, the first FDA-approved device providing automated, 24-hour insulin dosing for type 1 diabetes patients.

- 2020–2021: Guided by its Mission during the COVID-19 pandemic, Medtronic ramped up ventilator production, shared ventilator design specifications publicly, and accelerated telehealth and remote device management solutions to support frontline healthcare workers and patients.

- 2020s: The company advanced into robotic-assisted surgery and artificial intelligence. In 2021, it conducted the first procedure using its Hugo robotic-assisted surgery (RAS) system, followed by regulatory approvals in Japan, Europe, and Canada in 2022, reinforcing Medtronic’s leadership in next-generation surgical innovation.

(Source: Company Website)

Financial Analysis

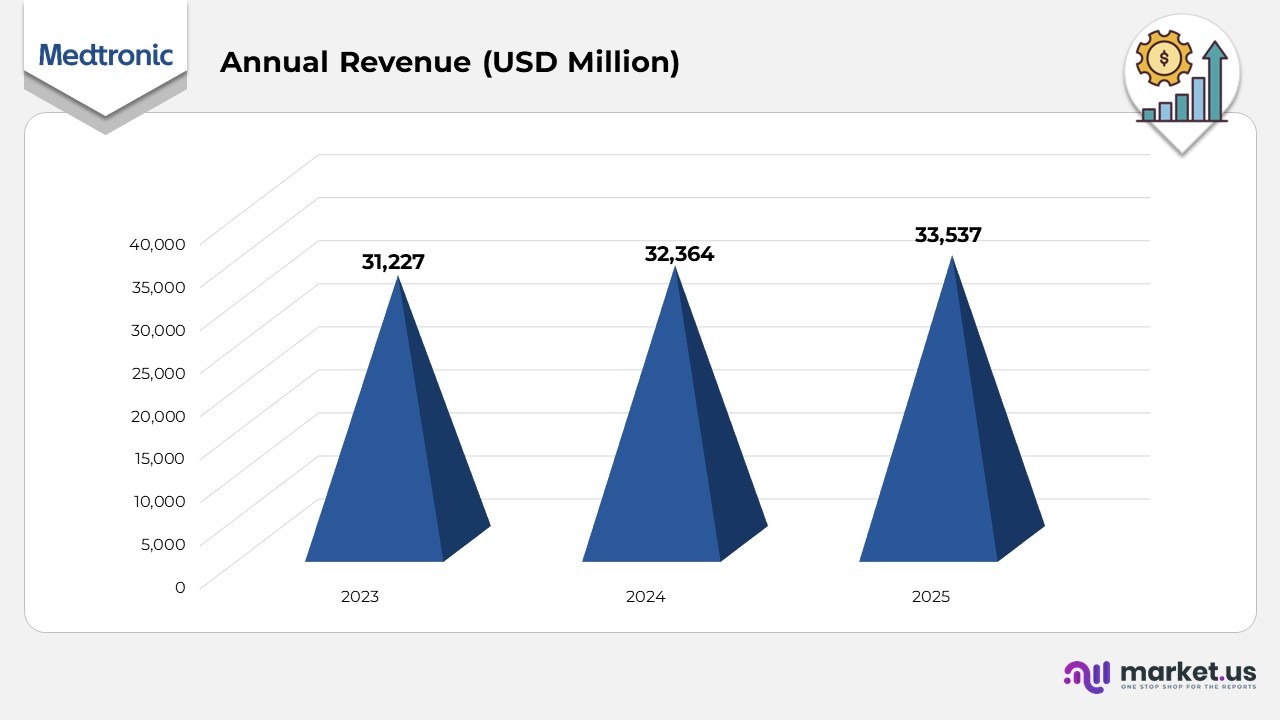

- In 2023, Medtronic reported an annual revenue of USD 31,227 million, laying a strong foundation for its subsequent growth trajectory across core business segments.

- In 2024, the company’s revenue increased to USD 32,364 million, reflecting a 6% year-over-year rise, primarily driven by improved performance in cardiovascular and medical surgical portfolios, as well as expanded access in international markets.

- By 2025, Medtronic’s annual revenue further climbed to USD 33,537 million, indicating continued positive momentum supported by strong demand for advanced therapies, new product launches, and growth in emerging economies.

- Overall, between 2023 and 2025, the company achieved steady revenue expansion, underpinned by innovation, portfolio diversification, and a consistent focus on operational excellence.

Segment Revenue Analysis

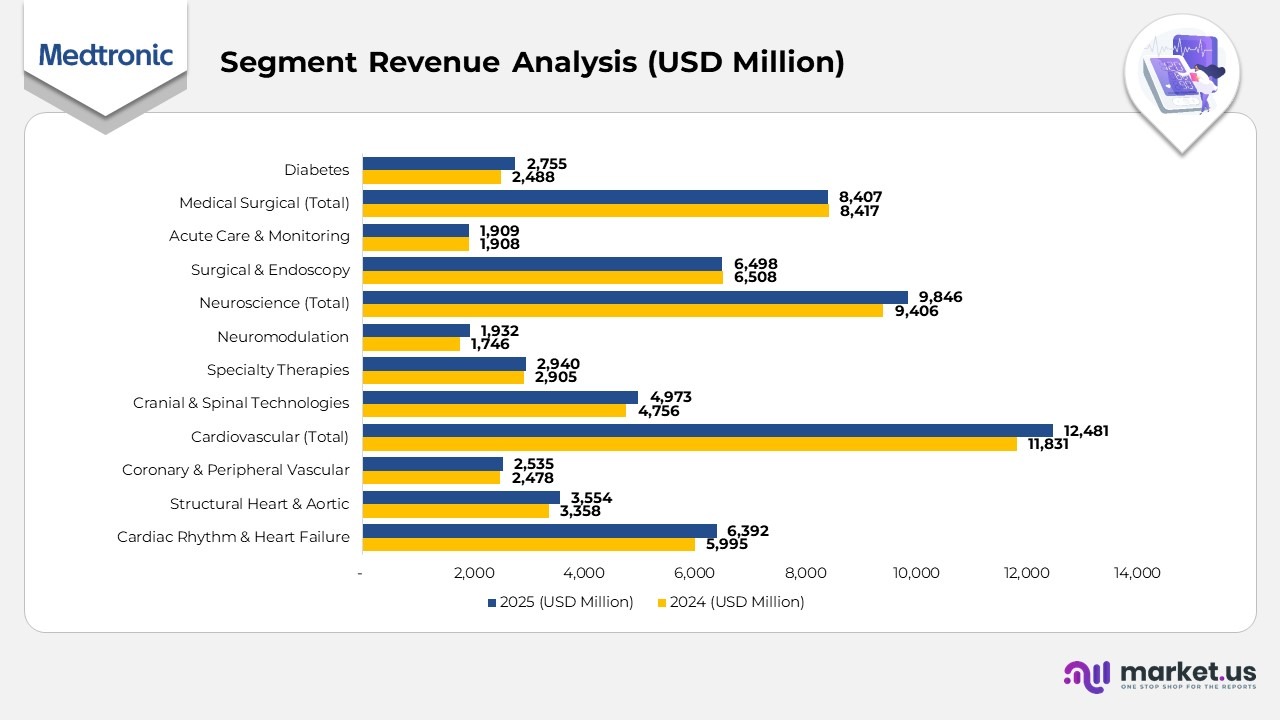

- The Cardiac Rhythm & Heart Failure division generated $6,392 million in 2025, up from $5,995 million in 2024, representing a 7% increase driven by solid demand for implantable cardiac devices and advanced pacing systems.

- The Structural Heart & Aortic business reported $3,554 million in 2025, compared with $3,358 million in 2024, reflecting a 6% growth supported by expanding adoption of transcatheter and valve replacement technologies.

- The Coronary & Peripheral Vascular segment recorded $2,535 million in 2025, slightly above $2,478 million in 2024, a modest 2% rise attributed to stable procedural volumes and product upgrades.

- Overall, the Cardiovascular Portfolio achieved $12,481 million in 2025, increasing from $11,831 million in 2024, showing a 5% growth underpinned by consistent performance across cardiac care divisions.

- The Cranial & Spinal Technologies division reached $4,973 million in 2025, up from $4,756 million in 2024, marking a 5% increase fueled by innovation in spinal implants and surgical navigation systems.

- The Specialty Therapies business grew marginally to $2,940 million in 2025, compared to $2,905 million in 2024, reflecting a 1% increase driven by procedural recovery and global therapy expansion.

Moreover

- The Neuromodulation division delivered $1,932 million in 2025, a significant jump from $1,746 million in 2024, recording an 11% rise supported by higher demand for pain and movement disorder therapies.

- Combined, the Neuroscience Portfolio generated $9,846 million in 2025, up from $9,406 million in 2024, translating to a 5% overall growth.

- The Surgical & Endoscopy segment brought in $6,498 million in 2025, nearly unchanged from $6,508 million in 2024, indicating stable surgical procedure volumes.

- Similarly, the Acute Care & Monitoring business posted $1,909 million in 2025, almost identical to $1,908 million in 2024, reflecting flat year-over-year performance.

- Together, the Medical Surgical Portfolio totaled $8,407 million in 2025, maintaining consistency compared to $8,417 million in 2024.

- The Diabetes Operating Unit saw strong momentum with $2,755 million in 2025, up from $2,488 million in 2024, marking an 11% increase driven by higher adoption of insulin delivery systems and glucose monitoring solutions.

- Total reportable segment net sales rose to $33,489 million in 2025, from $32,142 million in 2024, reflecting a 4% year-over-year growth.

- The Other Operating Segment declined to $137 million from $221 million, a 38% decrease, while Other Adjustments accounted for ($90 million) compared to none in the prior year.

- Overall, total net sales reached $33,537 million in 2025, compared with $32,364 million in 2024, representing a consolidated 4% annual growth, demonstrating Medtronic’s steady performance across diversified portfolios.

Geographical Analysis

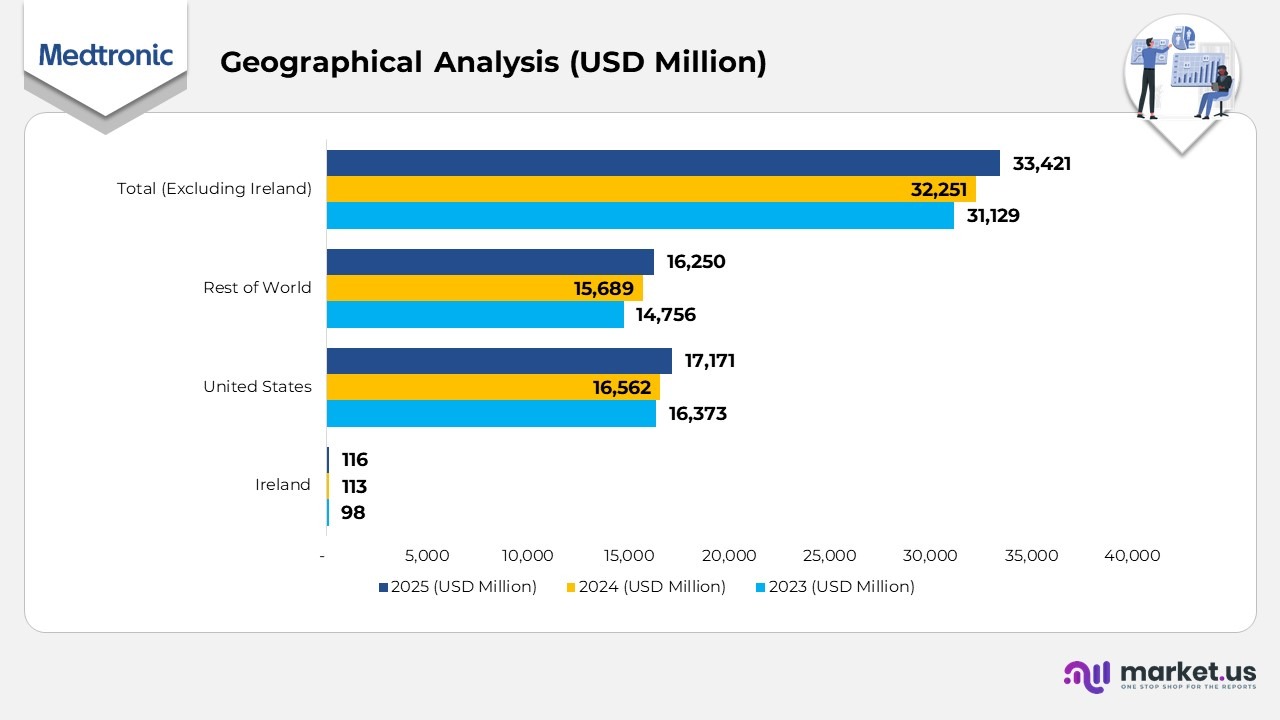

- In 2025, Medtronic’s business operations in Ireland recorded revenue of $116 million, marking a steady increase from $113 million in 2024 and $98 million in 2023. The company’s total assets in Ireland reached $291 million as of April 25, 2025, compared with $252 million a year earlier, reflecting sustained local growth and investment.

- The United States continued to be Medtronic’s primary revenue driver, generating $17,171 million in 2025, up from $16,562 million in 2024 and $16,373 million in 2023. As of April 25, 2025, U.S. assets stood at $5,133 million, compared to $4,593 million on April 26, 2024, highlighting consistent expansion within the domestic market.

- The rest of the world contributed $16,250 million in 2025, an improvement over $15,689 million in 2024 and $14,756 million in 2023, supported by increasing demand across Europe, Asia, and emerging regions. Total assets in these markets rose to $1,414 million as of April 25, 2025, up from $1,286 million in the previous fiscal year.

- Altogether, countries excluding Ireland accounted for $33,421 million in 2025, compared with $32,251 million in 2024 and $31,129 million in 2023. Total assets across these regions reached $6,547 million as of April 25, 2025, up from $5,879 million in April 2024, demonstrating Medtronic’s strong international performance and continued global asset growth.

(Source: Medtronic SEC Filings)

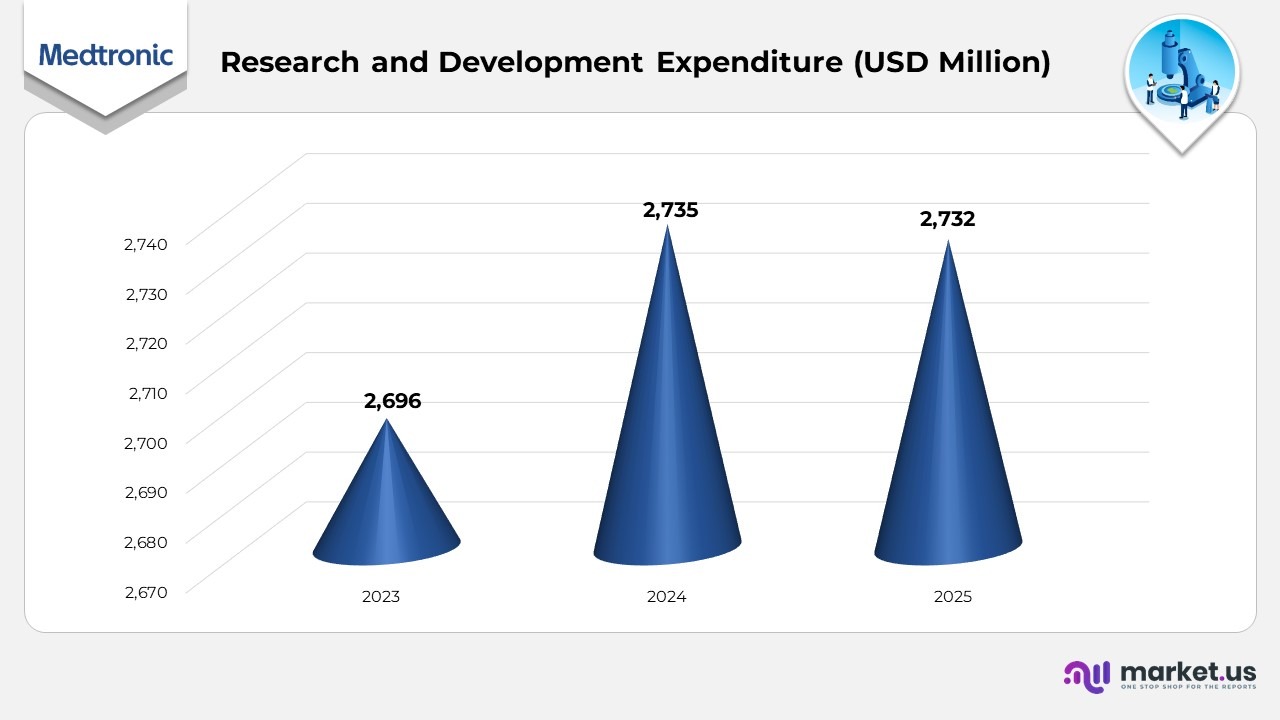

Medtronic Research and Development Expenditure Statistics

- In 2023, Medtronic allocated USD 2,696 million to research and development, reinforcing its dedication to advancing medical technology and driving innovation across its therapy portfolios.

- In 2024, R&D expenditure increased slightly to USD 2,735 million, reflecting a measured investment rise as the company pursued next-generation device development and digital integration in healthcare solutions.

- In 2025, research and development spending amounted to USD 2,732 million, remaining nearly consistent with the previous year as Medtronic optimized its resources through strategic portfolio management and efficiency programs.

- Across the 2023–2025 period, Medtronic maintained stable R&D investment levels, underscoring its sustained focus on innovation, clinical research, and the continuous enhancement of patient-centered technologies.

(Source: Medtronic SEC Filings)

Medtronic Patent Portfolio Statistics

- Medtronic holds an extensive intellectual property portfolio of approximately 85,999 patents worldwide, with around 43,648 already granted and more than 49,911 still active, reflecting its strong innovation footprint across multiple medical technology domains.

- The company’s patent assets are organized into roughly 19,945 distinct patent families, indicating a broad and diversified research and development pipeline.

- The United States serves as Medtronic’s primary hub for patent filings, accounting for nearly 31,198 applications, followed by Japan (≈6,181), Europe (≈12,297), China (≈5,448) and Australia (≈5,743)— demonstrating its balanced global innovation presence.

- At the S. Patent and Trademark Office (USPTO), Medtronic has submitted approximately 13,157 applications, with 9,285 successfully granted, representing a strong grant rate of about 78.3%, underscoring the quality and success rate of its inventions.

- Within the medical device industry, Medtronic stands among the leading innovators in robotics-related technologies, having filed nearly 314 patents and secured 158 approvals since 2020, solidifying its leadership in next-generation surgical and automation solutions.

(Source: Medtronic, GlobalData Plc)

Recent Developments

- In September 2025, Medtronic received U.S. FDA approval for the MiniMed 780G system portfolio, including clearance of the SmartGuard algorithm as an interoperable automated glycemic controller (iAGC). This clearance enables integration with Abbott’s Instinct sensor for type 1 diabetes and extends the system’s use to adults aged 18 and above with insulin-requiring type 2 diabetes.

- In July 2025, the company earned CE Mark certification in Europe, expanding indications for the MiniMed 780G system to include patients aged 2 years and older, pregnant individuals, and those with insulin-requiring type 2 diabetes.

- In April 2025, Medtronic expanded its URO Investigational Device Exemption (IDE) clinical study, the largest trial ever conducted in robotic-assisted urologic surgery, achieving primary safety and effectiveness endpoints.

- In April 2025, the company obtained U.S. FDA approval for the OmniaSecure defibrillation lead, designed for placement in the right ventricle, enhancing safety and reliability in cardiac rhythm therapies.

- In April 2025, Medtronic submitted an application to the U.S. FDA for clearance of an interoperable insulin pump that will integrate with Abbott’s latest continuous glucose monitoring (CGM) platform, advancing connected diabetes care.

- In February 2025, Medtronic secured U.S. FDA approval for BrainSense Adaptive deep brain stimulation (aDBS) and the BrainSense Electrode Identifier (EI), reinforcing its leadership in precision neuromodulation technology.

- In January 2025, the company received CE Mark approval in the European Union (EU) and the United Kingdom (UK) for BrainSense Adaptive deep brain stimulation (aDBS) and Electrode Identifier (EI), meeting EU Medical Device Regulation (MDR) requirements.

- In November 2024, Medtronic obtained U.S. FDA clearance for its upgraded InPen app, featuring missed meal dose detection, supporting the rollout of its Smart MDI system integrated with the Simplera continuous glucose monitor (CGM) for improved insulin dosing accuracy.

(Source: Medtronic Press Releases)