Company Overview

Abbott Laboratories Statistics: Abbott Laboratories is a global healthcare company committed to enhancing quality of life by developing, manufacturing, and marketing a diverse range of health solutions that support people at every age. The company’s operations are structured into four key business segments—Diagnostic Products, Established Pharmaceutical Products, Medical Devices, and Nutritional Products.

The Established Pharmaceutical Products segment focuses on international sales of branded generic medicines that address a broad spectrum of therapeutic areas, helping expand healthcare access in emerging and developed markets. The Nutritional Products segment delivers comprehensive nutritional solutions for both adults and children, providing clinically designed formulas to support growth, recovery, and overall wellness.

The Diagnostic Products segment encompasses advanced core laboratory, molecular, point-of-care, and rapid testing technologies, enabling hospitals, laboratories, and healthcare providers to make faster and more accurate decisions. The Medical Devices segment includes innovative technologies for cardiac rhythm management, electrophysiology, heart failure, vascular and structural heart conditions, neuromodulation, and diabetes management, improving patient outcomes through precision-driven devices.

Abbott’s global operations span over 150 countries, with a strong presence across Asia Pacific (India, Japan, Singapore, Australia), Greater China, and Europe (France, Germany, the United Kingdom, Italy, among others).

As of December 31, 2024, Abbott employed approximately 114,000 people worldwide, with about 69% of its workforce located outside the United States. Women made up 47% of the U.S. workforce, 46% of the global workforce, and 43% of managerial roles, underscoring the company’s ongoing commitment to diversity and inclusion. As of January 31, 2025, Abbott had approximately 30,768 registered shareholders holding its common stock.

History of Abbott Laboratories

1800’s

- 1888: Dr Wallace C. Abbott, a 30-year-old physician, begins producing “alkaloidal” medicine granules from plants and herbs at his People’s Drug Store in Chicago. His first-year sales reach $2,000.

- 1894: The business is incorporated as the Abbott Alkaloidal Company, expanding into both medical publishing and pharmaceutical manufacturing.

1900’s

- 1907: Abbott begins international expansion by opening its first overseas office in London, England.

- 1916: The company manufactures its first synthetic medicine, Chlorazene, developed by Dr Henry Dakin as a disinfectant for soldiers during World War I.

- 1922: Abbott scientists Dr Ernest Volwiler and Dr Roger Adams develop Butyn, the company’s first breakthrough anesthetic.

- 1929: Abbott becomes a publicly traded company through an initial public offering, which coincides with the stock market crash, but grows in value by roughly 10,000 times over time.

- 1932: Even amid the Great Depression, Abbott expands into vitamins and intravenous solutions, earning recognition for its financial stability and innovation.

- 1935: The company introduces Pentothal, which becomes the world’s leading anesthetic and earns its inventors induction into the U.S. National Inventors Hall of Fame.

- 1942: Abbott collaborates with the U.S. Government and other pharmaceutical firms to mass-produce penicillin, boosting wartime output by more than 20,000%.

- 1959: The iconic Abbott “A” logo is adopted, establishing the foundation of its enduring visual identity.

- 1960: Under President George Cain, Abbott undergoes a major transformation later profiled in Good to Great, as one of only 11 firms—out of 1,435—recognized for exceptional long-term performance.

- 1964: Abbott acquires M&R Dietetics, maker of Similac, positioning itself as a leader in infant and adult nutrition.

- 1972: The company launches the ABA-100 blood analyzer and Ausria, a pioneering hepatitis test, marking the start of its modern diagnostics business.

- 1985: Abbott develops the first FDA-approved HIV blood-screening test, a milestone achievement in global public health.

- 1998: Introduction of Glucerna, a nutritional line tailored for people with diabetes and specific dietary needs.

2000’s

- 2002: FDA approves Humira, the first fully human monoclonal antibody, which later becomes the world’s top-selling pharmaceutical product.

- 2006: Launch of the Xience V drug-eluting stent, which quickly becomes a global market leader in cardiovascular treatment.

- 2010: Abbott becomes the largest pharmaceutical company in India, reflecting its expanding global footprint.

- 2013: Abbott spins off its proprietary pharmaceutical division as AbbVie, reshaping itself into a global consumer-focused healthcare company.

- 2014: The company redefines its brand with the campaign “Life. To The Fullest.” and becomes the sponsor of the Abbott World Marathon Majors.

- 2014: Abbott transforms diabetes management with the launch of FreeStyle Libre, a continuous glucose monitor that eliminates routine fingersticks.

- 2016: The Alinity diagnostics and informatics systems debut, setting new benchmarks for efficiency and precision in clinical laboratories.

- 2017: Abbott acquires St. Jude Medical, expanding its presence in cardiovascular and neuromodulation technologies, securing top positions in major global markets.

- 2017: The acquisition of Alere Inc. strengthens Abbott’s leadership in point-of-care diagnostics, making it No. 1 in rapid testing for cardiometabolic and infectious diseases.

- 2020: In response to the COVID-19 pandemic, Abbott launches multiple high-throughput and rapid diagnostic tests worldwide, ensuring continuity of care and global health support through its medical devices, diagnostics, and nutrition businesses.

(Source: Company Website)

Financial Analysis

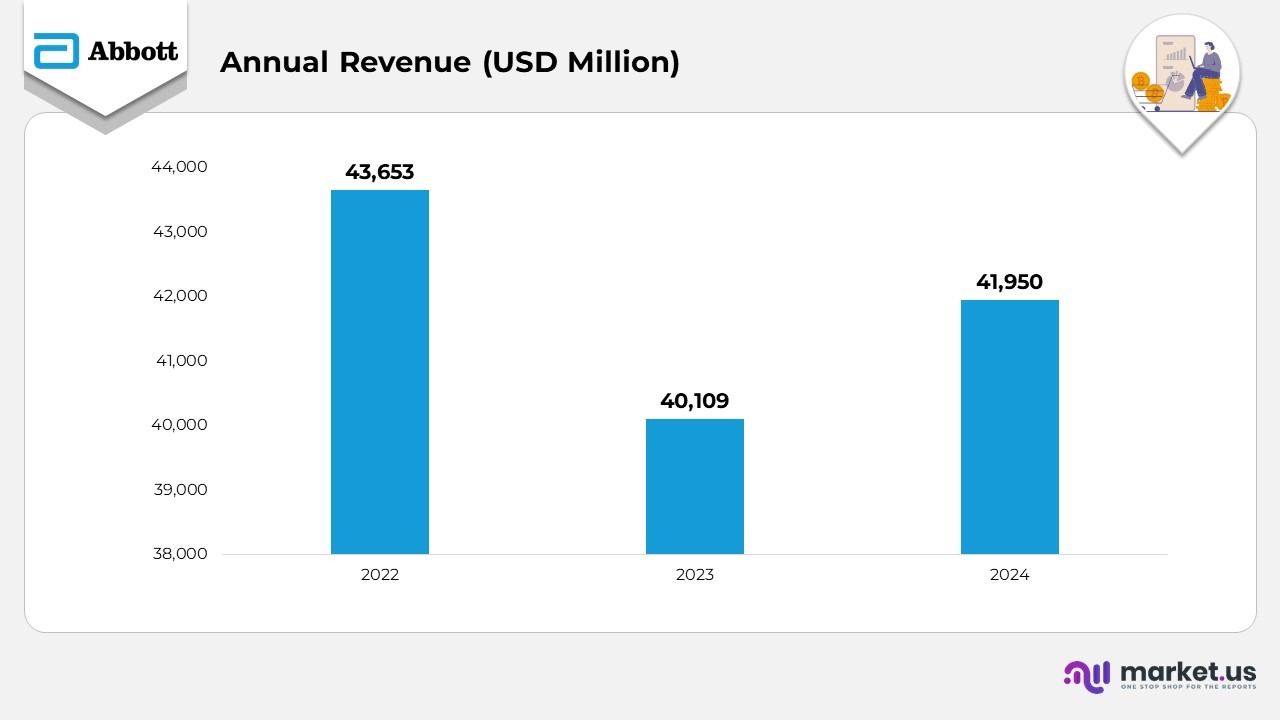

- In 2022, Abbott recorded revenue of $43,653 million, driven by exceptional demand for COVID-19 diagnostics and strong contributions from its core business lines. This year’s performance set a challenging benchmark for subsequent periods.

- In 2023, revenue declined to $40,109 million, largely due to a sharp fall in COVID-19 testing-related sales from $8.4 billion in 2022 to $1.6 billion. However, the downturn was partially mitigated by healthy growth in the Medical Devices and Nutritional Products. Emerging markets maintained steady momentum, reporting a 5.4% increase, excluding foreign exchange impact.

- In 2024, Abbott achieved a modest rebound with revenue rising to $41,950 million, supported by robust performances across Medical Devices, Established Pharmaceuticals, and Nutritional Products. The growth was propelled by a strong R&D pipeline, new product introductions, and expanded indications. COVID-19 testing sales continued to taper off, totaling $747 million as the pandemic evolved into an endemic phase. Emerging markets posted a stronger 2% gain, reinforcing Abbott’s international growth.

- Operating margins improved slightly to 3% in 2024 from 16.2% in 2023, reflecting the impact of cost optimization efforts and productivity initiatives. Comparatively, the 2022 margin of 19.2% was higher due to a favourable pandemic-driven product mix. The margin erosion from 2022 to 2023 was primarily linked to the steep decline in high-margin COVID-related sales, inflationary pressures, and adverse currency movements.

Geographical Revenue

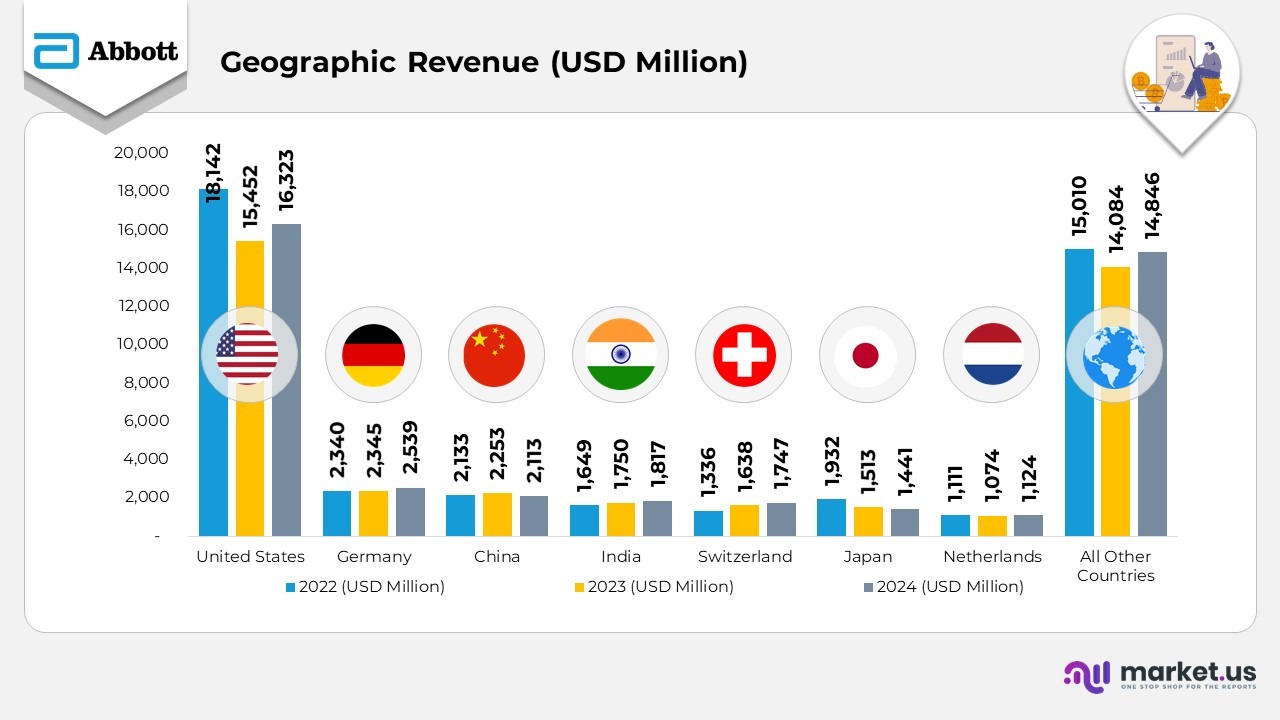

- In 2024, Abbott achieved total consolidated revenue of $41,950 million, a moderate rebound from $40,109 million in 2023, though slightly below $43,653 million in 2022, reflecting overall recovery across key business segments.

- The United States remained Abbott’s largest revenue generator, contributing $16,323 million in 2024, up from $15,452 million in 2023, despite the normalization of COVID-related sales from $18,142 million in 2022.

- Germany recorded consistent growth, with revenue reaching $2,539 million in 2024 versus $2,345 million in 2023 and $2,340 million in 2022, supported by strong performance in diagnostics and device categories.

- In China, revenue dipped slightly to $2,113 million in 2024 from $2,253 million in 2023, mainly due to a slower recovery in diagnostics demand, yet remained near the $2,133 million mark of 2022.

- India demonstrated steady upward momentum, rising to $1,817 million in 2024 from $1,750 million in 2023 and $1,649 million in 2022, driven by robust demand in pharmaceuticals and nutritional products.

- Switzerland reported notable growth to $1,747 million in 2024 from $1,638 million in 2023, up sharply from $1,336 million in 2022, attributed to enhanced manufacturing output and global export activity.

- Japan saw revenue decline to $1,441 million in 2024, down from $1,513 million in 2023 and $1,932 million in 2022, reflecting market competition and weaker device sales performance.

- The Netherlands posted stable gains, reaching $1,124 million in 2024 compared to $1,074 million in 2023, slightly above $1,111 million in 2022, showing continued operational resilience.

- Revenue from all other countries totaled $14,846 million in 2024, up from $14,084 million in 2023 but marginally below $15,010 million in 2022, underlining balanced growth across emerging and developed markets globally.

(Source: Abbott Laboratories SEC Filings)

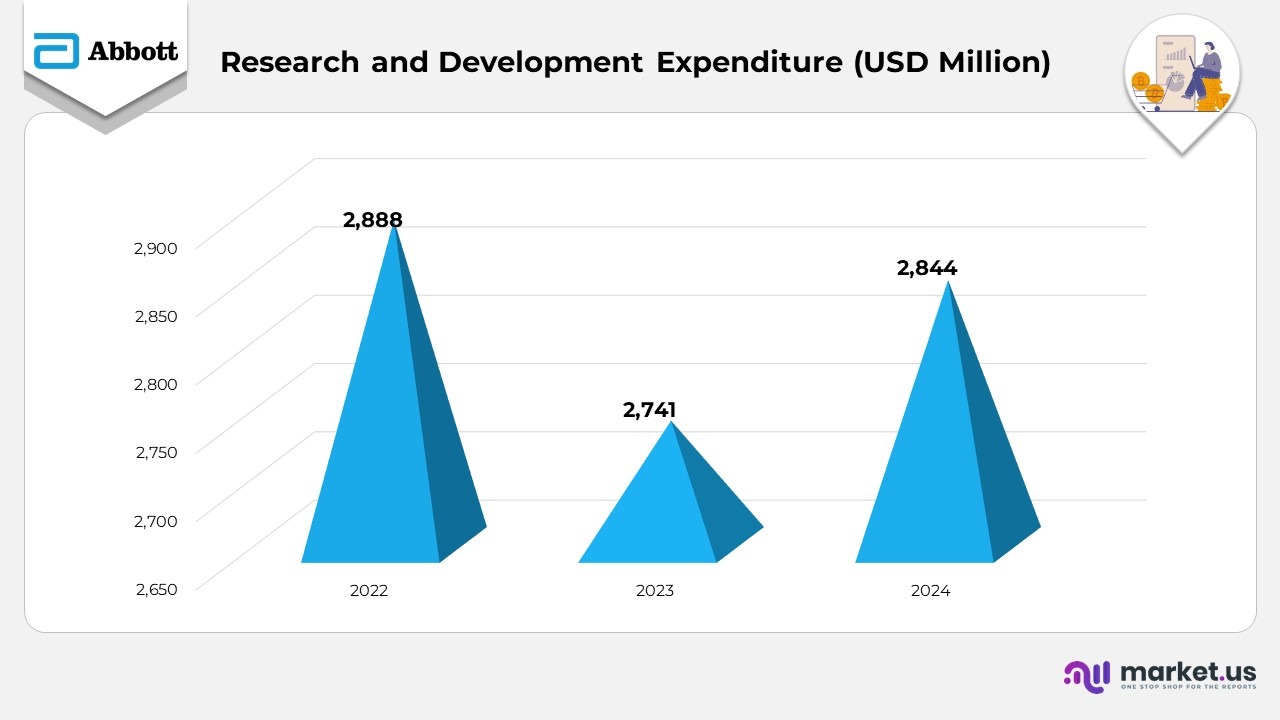

Research and Development Expenditure

- In 2024, Abbott’s research and development (R&D) spending reached $2.8 billion, reflecting a modest increase from $2.7 billion in 2023. The rise was mainly driven by higher investments across multiple ongoing projects, supported by new product development efforts. The increase was partially offset by reduced impairment charges related to previously acquired in-process R&D (IPR&D) assets.

- In 2023, R&D expenses declined to $2.7 billion from $2.9 billion in 2022, primarily due to lower restructuring costs and decreased impairment charges tied to IPR&D assets from earlier acquisitions. Additional cost-optimization initiatives also contributed to the reduction.

- The company’s consistent investment pattern across 2022–2024 demonstrates a balanced approach, emphasizing innovation and long-term pipeline growth while managing costs effectively.

(Source: Abbott Laboratories SEC Filings)

Global Property and Manufacturing Infrastructure of Abbott

- As of December 31, 2024, Abbott managed a global property portfolio spanning approximately 44 million square feet, with nearly 65% of the total area owned by the company and the rest leased to maintain regional operational flexibility.

- The corporate headquarters and key administrative offices are based in Illinois, operating from company-owned premises that serve as the center for strategic management and leadership functions.

- Abbott maintained a network of 89 manufacturing facilities worldwide in 2024, ensuring efficient production, quality control, and global supply coverage across all business divisions.

- The company’s manufacturing infrastructure is distributed strategically across its 4 major business segments:

- Medical Devices: 32 sites dedicated to cardiovascular, neuromodulation, and diabetes care products.

- Diagnostic Products: 21 facilities supporting laboratory, molecular, and rapid diagnostic systems.

- Established Pharmaceutical Products: 23 sites focused on producing branded generic medicines primarily for emerging markets.

- Nutritional Products: 13 facilities manufacturing a comprehensive range of pediatric and adult nutrition formulas.

- Abbott’s extensive and balanced manufacturing footprint underscores its commitment to global reach, operational efficiency, and reliable production capacity across key healthcare categories.

(Source: Abbott Laboratories SEC Filings)

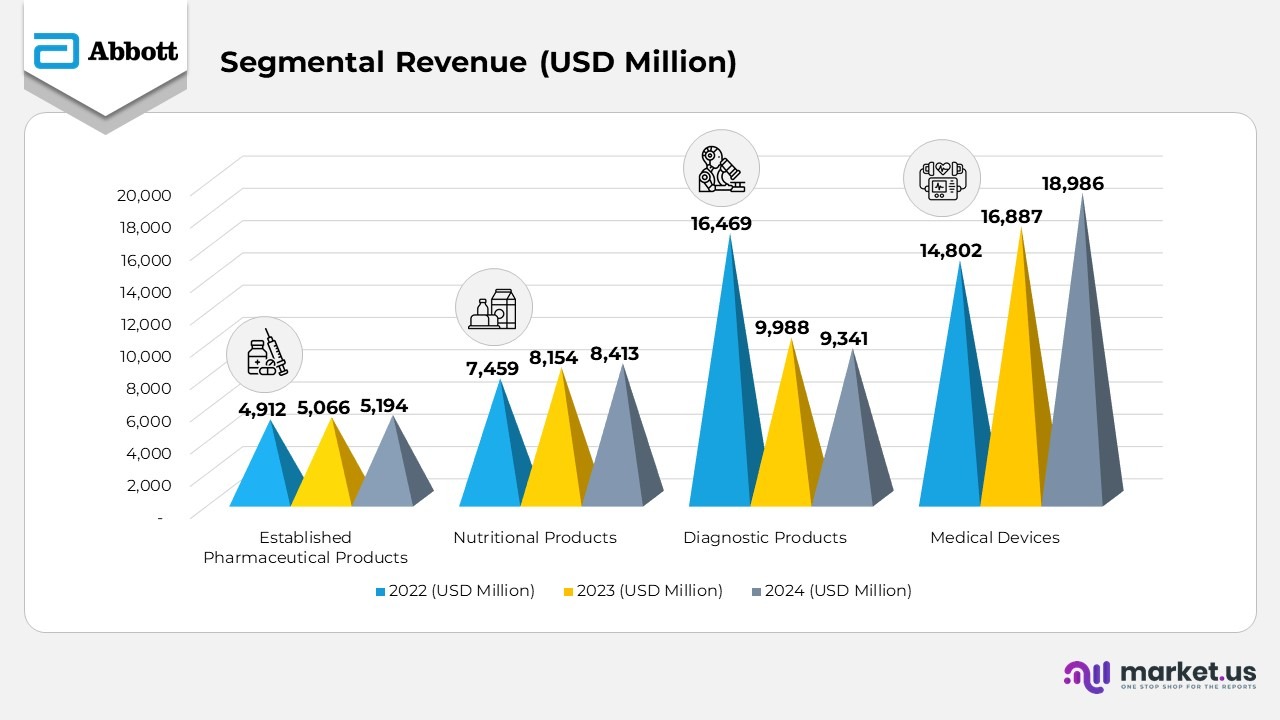

Segmental Analysis

- The Established Pharmaceutical Products segment posted stable year-over-year growth, with revenue reaching $5,194 million in 2024, up from $5,066 million in 2023 and $4,912 million in 2022. This growth was primarily driven by solid performance in emerging markets and a diversified branded generics portfolio.

- The Nutritional Products business maintained strong upward momentum, recording $8,413 million in 2024 compared to $8,154 million in 2023 and $7,459 million in 2022. The rise reflects robust sales of both pediatric and adult nutrition products and the success of new product innovations.

- The Diagnostic Products segment reported $9,341 million in 2024, slightly down from $9,988 million in 2023 and significantly lower than $16,469 million in 2022. The decline was expected as COVID-19 testing demand continued to taper following the pandemic’s shift to an endemic phase.

- The Medical Devices division emerged as the strongest contributor, generating $18,986 million in 2024, compared to $16,887 million in 2023 and $14,802 million in 2022. Growth was fueled by expanding adoption of Abbott’s cardiovascular, diabetes care, and neuromodulation technologies across major markets.

(Source: Abbott Laboratories SEC Filings)

Sub-Segmental and Regional Breakdown of Abbott’s Revenue

- The Established Pharmaceutical Products segment operated entirely across international markets, earning $5,194 million in 2024, up from $5,066 million in 2023 and $4,912 million in 2022. Within this, key emerging markets contributed $3,858 million, marking steady growth, while other international markets added $1,336 million, reflecting rising global demand for branded generics.

- The Nutritional Products division maintained balanced regional performance. Pediatric Nutritionals generated $4,023 million in 2024 (U.S.: $2,208 million; International: $1,815 million), up from $3,934 million in 2023 and $3,481 million in 2022, supported by innovation in pediatric formulations. Adult Nutritionals delivered $4,390 million in 2024 (U.S.: $1,481 million; International: $2,909 million), showcasing growth driven by health-conscious consumers and expanding product lines.

- The Diagnostic Products segment recorded $9,341 million in 2024 (U.S.: $3,830 million; International: $5,511 million), a slight decrease from $9,988 million in 2023 and a sharp decline from $16,469 million in 2022 due to the normalization of COVID-19 testing. Subsegment performance included Core Laboratory ($5,235 million), maintaining stability, Molecular Diagnostics ($521 million) normalizing post-pandemic, Point of Care ($588 million) showing outpatient demand resilience, and Rapid Diagnostics ($2,997 million) remaining a major contributor despite lower testing volumes.

- The Medical Devices segment demonstrated robust and consistent growth, achieving $18,986 million in 2024 compared to $16,887 million in 2023 and $14,802 million in 2022. Among subcategories, Rhythm Management ($2,390 million) and Electrophysiology ($2,467 million) benefited from higher global device adoption, while Heart Failure ($1,279 million) and Vascular ($2,837 million) showed solid expansion through new technologies. Structural Heart ($2,246 million) advanced with increased surgical procedures, and Neuromodulation ($962 million) continued to grow, supported by expanding use in chronic pain and neurological therapies.

(Source: Abbott Laboratories SEC Filings)

Key Patents and Applications in Abbott’s Diagnostics Division

| Product / System | Patent Coverage (U.S. Patents) | Key Focus / Application |

|---|---|---|

| Alinity i System | US6,676,816; US7,615,637; US7,802,467; US7,895,740; US8,033,162; US8,511,147; US8,753,470; USD611,854S; USD646,787S | Automated immunoassay system for laboratory diagnostics. |

| Alinity i 25-OH Vitamin D Kit | US7,802,467; US7,918,012; US8,033,162; USD648,640S; USD686,516S | Measures vitamin D levels in human serum or plasma. |

| Alinity i 2nd Gen Testosterone Kit | US7,905,999; US7,922,883 | Quantifies testosterone for hormone level evaluation. |

| Alinity i Active B-12 Kit | US7,620,438 through US11,213,229 (extensive coverage) | Detects active vitamin B-12 to assess metabolic and nutritional health. |

| Alinity i Anti C-Peptide Kit | US7,620,438 through US11,051,724 | Measures C-peptide levels to monitor insulin production efficiency. |

| Alinity i Anti-CCP Kit | US7,826,382; US8,106,780; US9,000,929; US10,820,842; USD896,836S | Identifies anti-CCP antibodies used for rheumatoid arthritis diagnosis. |

| Alinity m System | US10,775,401; US10,907,147; US11,104,962; D802,156 | Molecular diagnostics system for infectious disease and genetic testing. |

| eCup+ | US11,878,297 | On-site rapid urine drug screening device. |

| i-STAT 6+ System | US7,918,978; US8,241,487 | Portable blood analysis device for use in critical care environments. |

| i-STAT ACT | US6,750,053 | Measures activated clotting time at the point of care. |

| i-STAT b-hCG Test | US7,419,821; US8,084,272 | Detects human chorionic gonadotropin for pregnancy testing. |

| i-STAT BNP Test | US7,419,821; US8,377,669 | Measures B-type natriuretic peptide to support heart failure diagnosis. |

| i-STAT CG4+ and CG8+ Tests | US7,918,978; US8,216,529; US8,449,843 | Performs blood gas and electrolyte analysis for emergency and intensive care. |

(Source: Company Website)

Recent Developments

- In August 2025, Abbott received CE Mark approval in Europe for an expanded indication of its Navitor transcatheter aortic valve implantation (TAVI) system, enabling treatment for patients with symptomatic, severe aortic stenosis who are at low or intermediate risk for open-heart surgery. This regulatory milestone broadens patient accessibility and reinforces Abbott’s leadership in minimally invasive cardiac therapies.

- In April 2025, Abbott introduced the next-generation delivery system under its neuromodulation business, designed to enhance the Proclaim DRG neurostimulation system implantation process. The new system simplifies electrode placement for patients suffering from Complex Regional Pain Syndrome (CRPS) Type 1 and causalgia (CRPS Type 2) in the lower extremities—conditions recognized among the most painful chronic disorders.

- In March 2025, Abbott obtained CE Mark approval for its Volt PFA System in Europe, advancing treatment for patients with atrial fibrillation (AFib). Following the early approval, commercial procedures commenced across the European Union, with initial implementations conducted by physicians experienced in Abbott’s PFA clinical programs. Broader EU market rollout is planned for the second half of 2025.

- In February 2025, Abbott announced a $10 million investment reinforcing its enduring partnership with Shedd Aquarium and the Abbott Fund. The initiative aims to enrich Chicago’s cultural, educational, and environmental landscape, inspiring greater awareness and protection of marine ecosystems.

- In November 2024, Abbott expanded its manufacturing capacity to achieve the world’s highest production levels of FreeStyle Libre sensors, enhancing global supply to meet rising demand for advanced diabetes management solutions.

- Abbott also announced a $100,000 grant to The Ireland Funds to support educational programs for students from three DEIS schools in Kilkenny, underscoring the company’s commitment to youth education and community development.

(Source: Abbott Laboratories Press Releases)