Company Overview

Covestro Statistics: Covestro AG is a global chemical manufacturer specializing in advanced polymer materials. The company structures its operations into 2 primary reportable segments: Performance Materials (PM) and Solutions & Specialties (S&S). While Performance Materials operates as an independent business unit, the Solutions & Specialties division is composed of 6 distinct business entities.

The Performance Materials segment focuses on the development, production, and global supply of essential high-performance polymers, including polyurethanes, polycarbonates, and key base chemicals. Its product lineup features MDI, TDI, long-chain polyols, and polycarbonate resins, serving industries such as furniture and wood processing, construction, automotive, and transportation. Typical applications include building insulation, automotive seating, refrigeration systems, mattresses, and structural components.

The Solutions & Specialties segment brings together 6 specialized units: Engineering Plastics, Coatings & Adhesives, Tailored Urethanes, Thermoplastic Polyurethanes, Specialty Films, and Elastomers. This division provides a broad spectrum of high-value polymer solutions, including speciality polycarbonates, coating and adhesive precursors, MDI specialities, polyols, TPU materials, advanced films, and elastomers. These products support a wide range of sectors, including automotive and mobility, electronics and household appliances, construction, and medical technology, with applications such as EV battery housings, solar panel frames, laptop enclosures, lighting components, and protective films.

Covestro maintains a strong global footprint, operating 46 production sites and 13 research and development (R&D) facilities across the EMLA, NA, and APAC regions. Its manufacturing and innovation hubs are located in the United States, Belgium, Mexico, the Netherlands, China, Japan, India, Thailand, Spain, the United Kingdom, Italy, Germany, and France. As of December 31, 2024, the Covestro Group consisted of 55 consolidated companies, compared with 57 in the previous year, reflecting a streamlined global corporate structure.

History of Covestro AG

- 2015 – Covestro AG is founded as an independent materials company specializing in high-performance polymer solutions.

- October 2015 – The company strengthens its global position by completing its initial public offering on the Frankfurt Stock Exchange.

- 2016–2017 – Covestro enhances its international manufacturing network. Expanding production capacities across key regions to support growing demand for advanced polymer materials.

- 2018 – The company establishes itself as a fully autonomous global corporation. With a sharpened strategic focus on innovation and sustainable materials.

- 2019 – Covestro introduces a company-wide circular economy agenda, emphasizing low-carbon production, renewable feedstocks, and closed-loop material systems.

- 2020 – Research and development efforts intensify, with new investments directed toward sustainable coatings, adhesives, elastomers, and lightweight performance plastics.

- 2021–2022 – Digital transformation accelerates, integrating smart manufacturing technologies and data-driven production systems across global sites.

- 2023 – Covestro reorganizes its operations into two main reporting segments, Performance Materials (PM) and Solutions & Specialties (S&S), to better align with evolving market needs.

- 2024 – The company operates 46 manufacturing facilities and multiple R&D centers globally. Supplying essential materials to sectors including construction, mobility, electronics, energy, and healthcare.

(Source: Company Website)

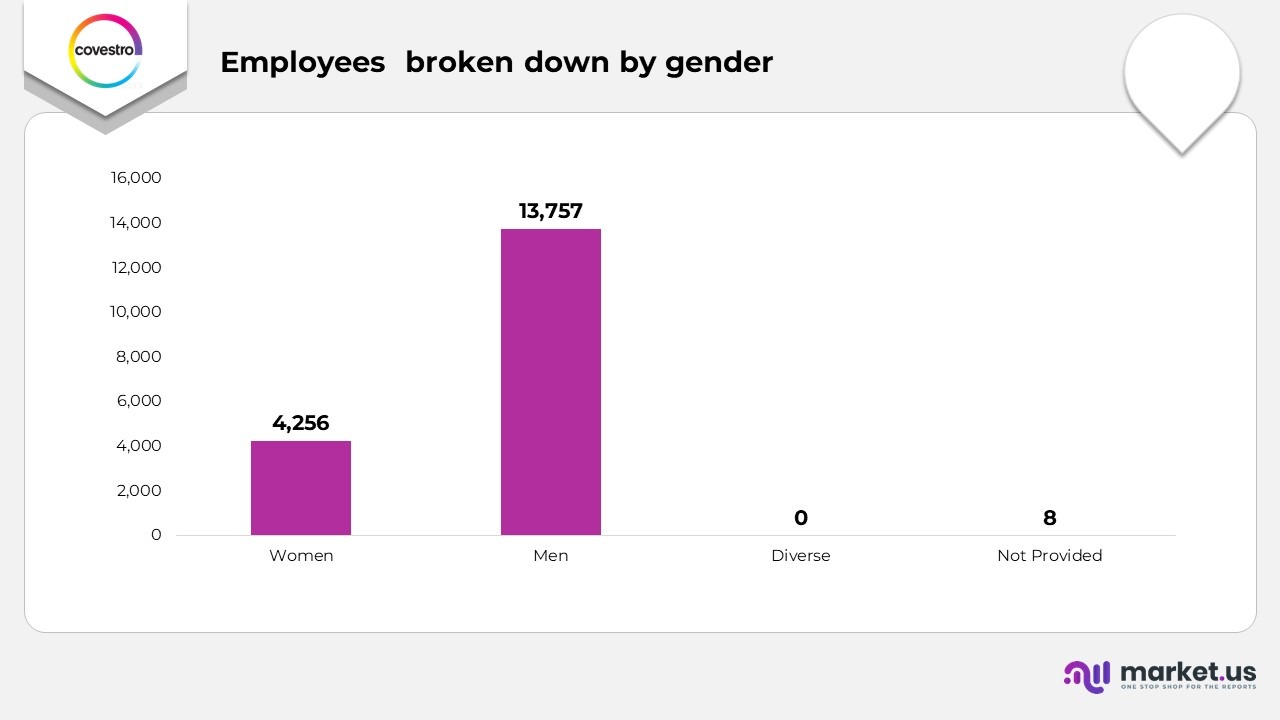

Employee Analysis

- In 2024, Covestro AG reported a workforce of 17,503 full-time equivalents (FTEs), compared with 17,516 in 2023.

- The company’s total headcount translates into 18,021 employees globally across all regions.

- Of this global total, the EMLA region accounted for 10,540 employees, making it the largest contributor.

- The APAC region represented 4,702 employees, reflecting its strong operational footprint.

- The NA region added another 2,779 employees to the overall global workforce.

- Women accounted for 4,256 employees in 2024.

- Men represented 13,757 employees during the same period.

- No entries were reported under the Diverse category, resulting in a recorded value of 0.

- The Not Provided category included 8

- The production workforce increased from 11,955 employees in 2023 to 12,053 employees in 2024, indicating stable operational expansion.

- Marketing and distribution roles declined slightly, moving from 2,881 employees in 2023 to 2,784 in 2024, reflecting streamlined commercial activities.

- Research and development staffing shifted modestly, decreasing from 1,376 employees in 2023 to 1,338 in 2024, showing targeted adjustments in innovation functions.

- General administration saw a reduction in headcount, dropping from 1,403 employees in 2023 to 1,347 in 2024, aligned with organizational efficiency efforts.

- The total average number of employees declined slightly, from 17,615 in 2023 to 17,522 in 2024.

- The number of employees in vocational training increased slightly, rising from 517 in 2023 to 523 in 2024. Reflecting a continued commitment to workforce development.

(Source: Covestro AG)

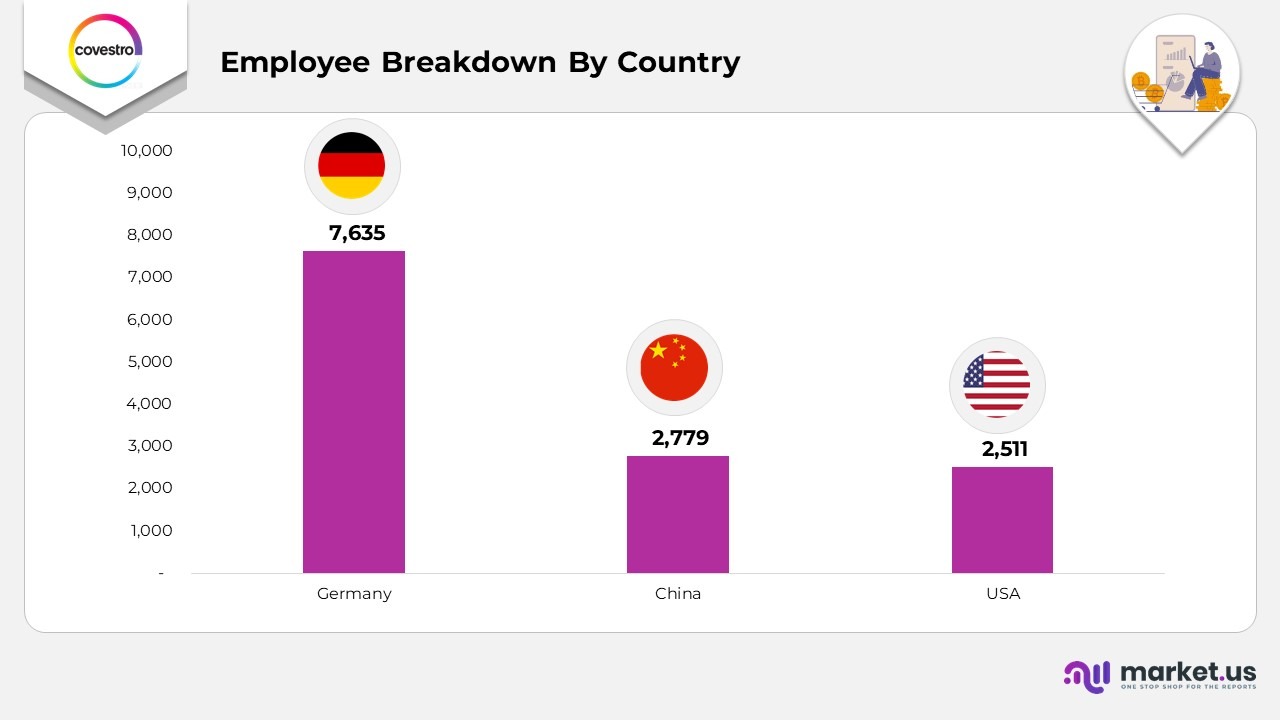

Employee Breakdown By Country

- In 2024, Germany had the largest workforce, employing 7,853 people across its operations.

- China also accounted for a significant share, with 2,778 employees contributing to the company’s activities there.

- In the USA, the employee count reached 2,511, reflecting the company’s established footprint in the region.

(Source: Covestro AG)

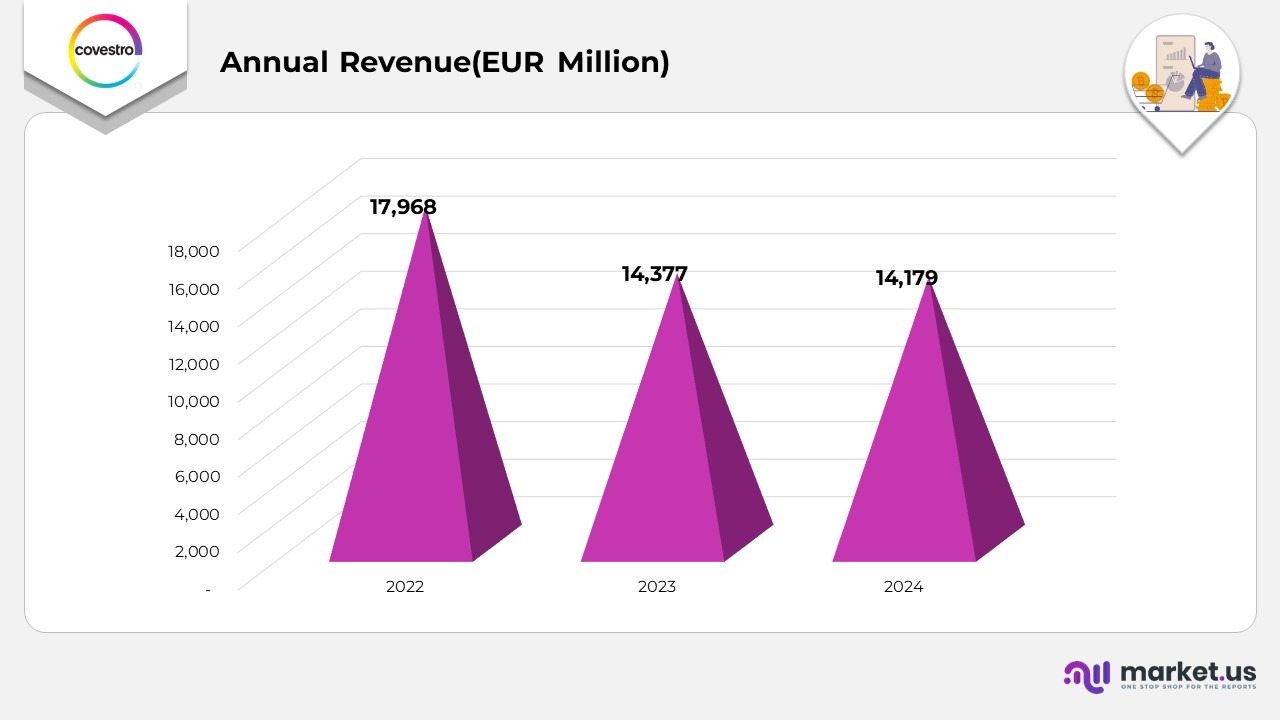

Financial Analysis

- In 2022, Covestro reported annual revenue of €17,968 million, marking the highest level in the three years.

- Revenue declined in 2023 to €14,377 million, reflecting a YoY drop of €3,591 million, equivalent to roughly s20% compared with 2022.

- In 2024, revenue further decreased to €14,179 million, showing a YoY decline of €198 million, or approximately –1.4%, compared with 2023.

- Covestro faced a challenging market environment in fiscal year 2024, with sales declining 4% to €14,179 million. Compared with €14,377 million in the previous year.

- This decline was primarily due to a lower selling price, which was only partly offset by reduced raw material costs, despite increased volumes sold.

- EBITDA eased by 8%, reaching €1,071 million, slightly down from €1,080 million a year earlier. As negative pricing effects outweighed positive volume contributions.

- Free operating cash flow fell significantly to €89 million, versus €232 million in the prior year, mainly due to lower cash flows from operating activities.

- ROCE above WACC came in at 4 percentage points, up from 6.1 previously, driven by a sharp decline in NOPAT and a higher WACC.

- GHG emissions were reduced to 4.7 million metric tons of CO₂ equivalents, down from 4.9 million metric tons. Mainly due to lower emission factors at major sites in Germany and Baytown, Texas (United States).

(Source: Covestro AG)

Geographical Analysis

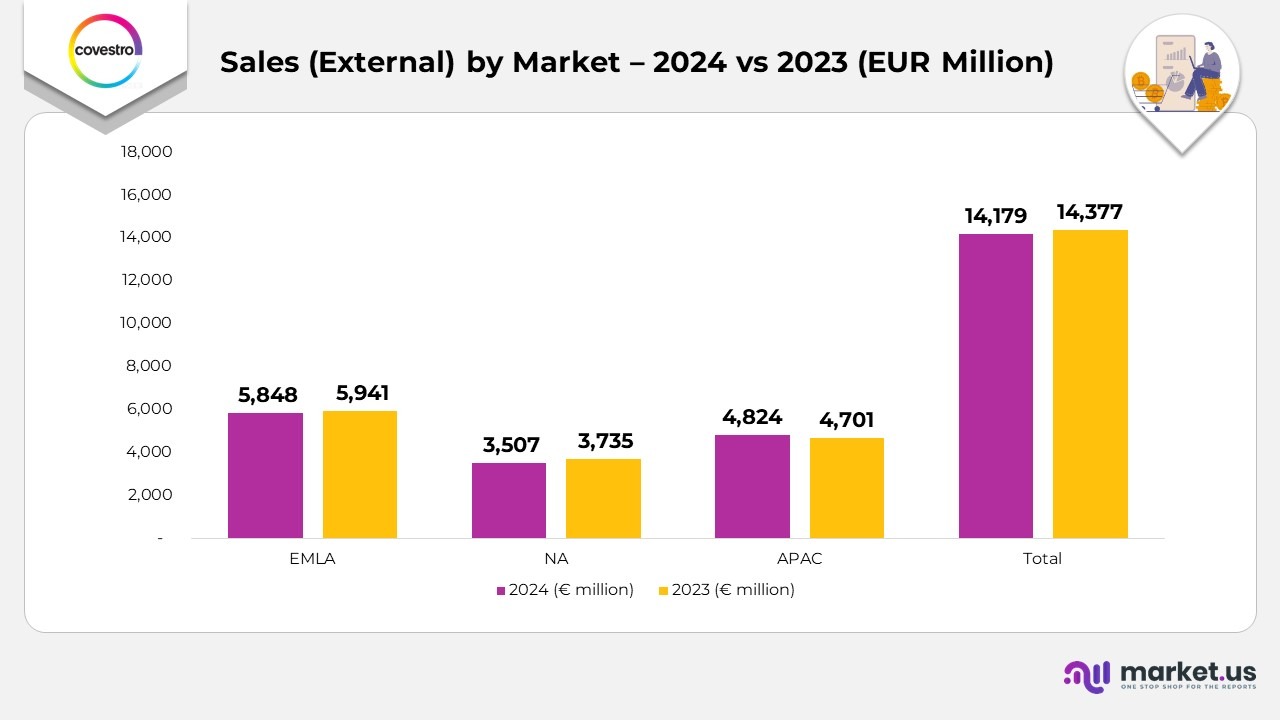

Covestro Regional Sales Comparison (External Sales by Market) – 2024 vs. 2023 Statistics

- EMLA recorded €5,848 million in 2024, down from €5,941 million in 2023, indicating a slight year-on-year decline.

- NA generated €3,507 million in 2024, down from €3,735 million in 2023, reflecting a notable contraction in market demand.

- APAC delivered €4,824 million in 2024, higher than €4,701 million in 2023, indicating improved performance in the region.

- Total external sales by market reached €14,179 million in 2024, slightly below €14,377 million in 2023, driven by weaker results in EMLA and NA.

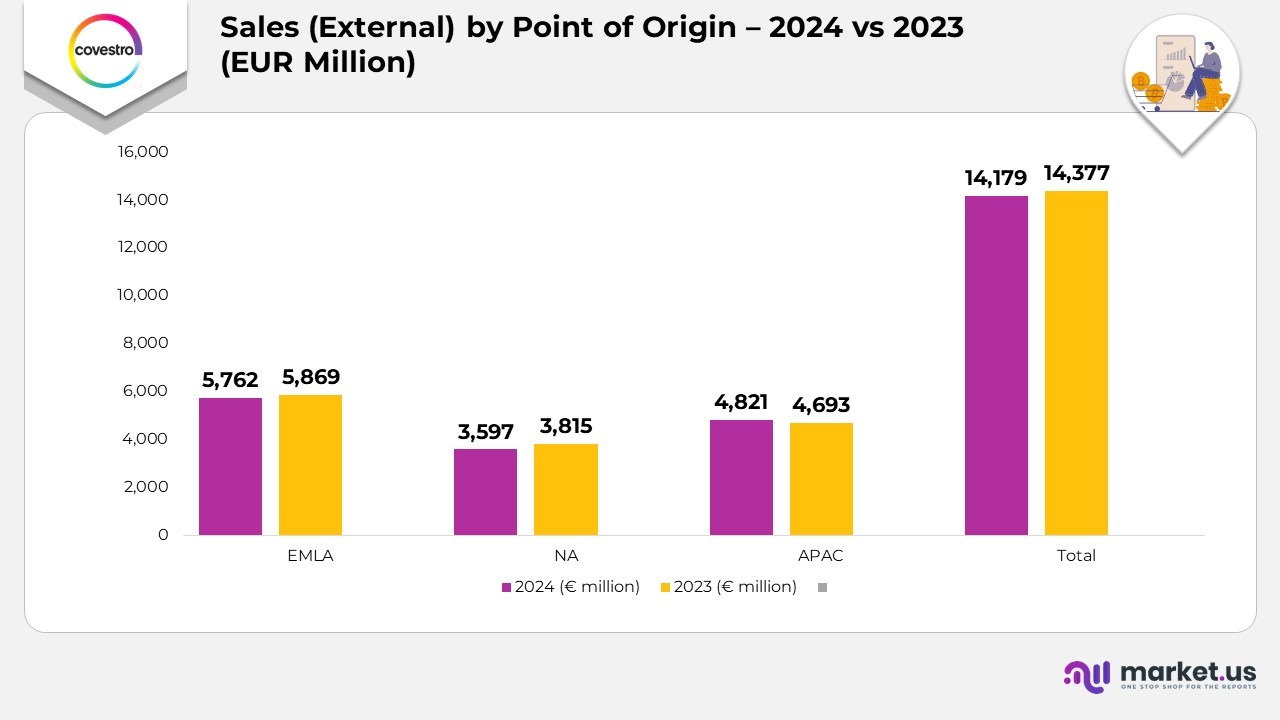

Covestro Regional Sales Comparison (External Sales by Point of Origin) – 2024 vs. 2023 Statistics

- EMLA achieved €5,762 million in 2024, down from €5,869 million in 2023, indicating a marginal decline in origin-based sales.

- NA posted €3,597 million in 2024, below €3,815 million in 2023, reflecting reduced production-related sales.

- APAC reported €4,821 million in 2024, up from €4,693 million in 2023, showing stronger operational output.

- Total external sales by point of origin amounted to €14,179 million in 2024, down from €14,377 million in 2023, indicating a slight overall decrease.

(Source: Covestro AG)

Covestro Country-Wise Market Contribution Statistics

- In 2024, external sales in Germany reached €1,609 million, a slight decline from the previous year.

- The United States generated €2,943 million in 2024, down from € 3,000 million in 2023.

- China contributed €3,200 million in 2024, marking a small improvement over the prior year.

- Other countries collectively accounted for €6,427 million in external sales in 2024.

- Total external sales for 2024 amounted to €14,179 million, slightly below the previous year’s performance.

- In 2023, Germany reported higher sales of €1,742 million, exceeding the 2024 figure.

- The United States achieved €3,128 million in 2023, also higher than the following year’s result.

- China generated €3,076 million in 2023, slightly lower than its 2024 contribution.

- Other markets delivered €6,431 million in 2023, maintaining similar year-over-year levels.

- The overall total for 2023 stood at €14,377 million, representing higher consolidated revenue than in 2024.

(Source: Covestro AG)

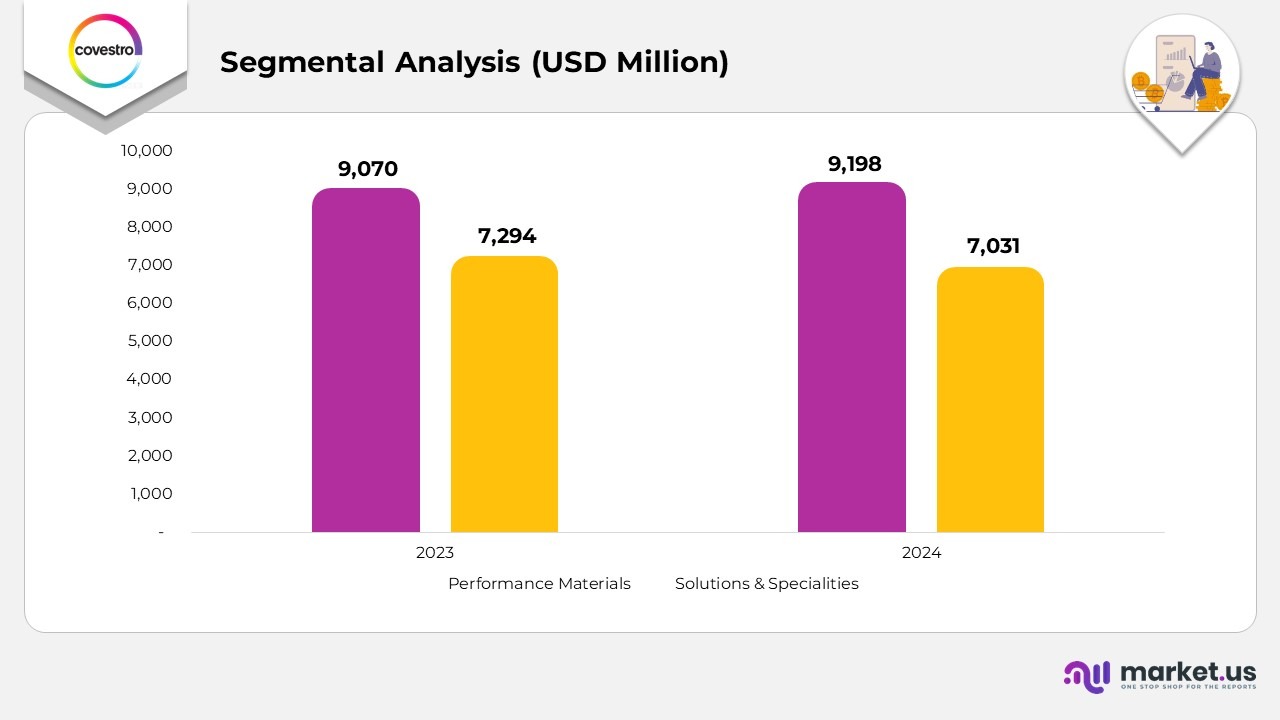

Covestro Segmental Analysis

- The Performance Materials segment posted total sales rising from €9,070 million in 2023 to €9,198 million in 2024, supported by an increase in intersegment sales from €2,194 million to €2,228 million and a rise in external sales from €6,876 million to €6,970 million.

- The Solutions & Specialties segment declined from €7,294 million in 2023 to €7,031 million in 2024. External sales dropped from €7,267 million to €7,004 million, while intersegment sales remained steady at €27 million in both years.

- The All Other Segments category generated €234 million in external sales in 2023, decreasing to €205 million in 2024, indicating lower contributions from ancillary operations.

- Reconciliation adjustments deepened from –€2,221 million in 2023 to –€2,255 million in 2024, reflecting higher internal eliminations in consolidated reporting.

- Collectively, the segment structure shows a slight strengthening in the Performance Materials segment, a softening trend in Solutions & Specialties, and reduced activity in other segments, producing an overall softer consolidated performance in 2024 compared with 2023.

(Source: Covestro AG)

Covestro Patents Statistics

| Patent Title | Patent No. | Filed | Patent Date |

|---|---|---|---|

| Ethylenically unsaturated compounds for coatings | 12428514 | November 26, 2024 | September 30, 2025 |

| HCFO-based reactive compositions for rigid PU foams | 12312465 | January 2, 2024 | May 27, 2025 |

| Continuous processes for polymer polyol production | 12247096 | March 4, 2024 | March 11, 2025 |

| Polymer polyol blends for flexible PU foams | 12195574 | June 24, 2020 | January 14, 2025 |

| Ethylenically unsaturated oligomers for coating uses | 12187852 | March 5, 2024 | January 7, 2025 |

| AI-driven freight cost prediction system | 12175413 | January 13, 2022 | December 24, 2024 |

| BPA-based polyether polyols & foam systems | 12162976 | February 14, 2022 | December 10, 2024 |

| Rigid PU foams for refrigerated transport insulation | 12134676 | April 21, 2020 | November 5, 2024 |

| Recyclable polycarbonate-based drug injection device | 12133970 | Jul 25, 2022 | November 5, 2024 |

| Amine-containing polyethers for flexible PU foams | 12116449 | June 24, 2020 | October 15, 2024 |

| Polyol blends with bisphenol-based polyether polyols | 12104006 | June 29, 2022 | October 1, 2024 |

| ML-assisted blend composition adjustment method | 12102972 | August 27, 2020 | October 1, 2024 |

| HFO-based spray polyurethane foam compositions | 12098545 | June 29, 2021 | September 24, 2024 |

| Polyisocyanate resin formulation | 12054579 | June 20, 2023 | August 6, 2024 |

| PU adhesive without aromatic amine migration | 12036771 | June 27, 2023 | Jul 16, 2024 |

| Flexible polyureas for packaging adhesives | 12037520 | June 15, 2023 | Jul 16, 2024 |

| Polymer polyols for combustion-resistant foams | 12006413 | January 12, 2022 | June 11, 2024 |

| Three-part headlamp assembly design | 12007093 | October 14, 2020 | June 11, 2024 |

| HCFO-reactive PU foam systems for insulation | 11970565 | June 27, 2023 | April 30, 2024 |

| Continuous PMPO production process | 11952454 | February 16, 2022 | April 9, 2024 |

(Source: Justia Patents)

Recent Developments

- In November 2025, the company introduced several locally developed coatings solutions for multiple industries and deployed its new Weighing & Mixing Workstation, an automated lab platform at the Asia-Pacific Innovation Center in Shanghai, reinforcing its focus on precision, speed, and sustainable innovation for fast-growing regional markets.

- In November 2025, the company deepened its collaboration with Nippon Paint to jointly develop high-efficiency, sustainable, and advanced coating systems that accelerate innovation and support modernisation across automotive and industrial applications.

- In April 2025, the company finalized a long-term agreement with INEOS to secure natural gas supplies for up to eight years starting in 2027. Strengthening the reliability of its energy resources and supporting industrial competitiveness in Europe.

- In August 2025, the company expanded its specialty isocyanate portfolio by integrating two former Vencorex facilities in the United States and Thailand, advancing its “Sustainable Future” strategy through growth in high-value coatings and adhesives businesses.

- In June 2025, Covestro acquired Pontacol, enhancing its specialty films portfolio and further reinforcing its commitment to sustainable, innovative material solutions. Additionally, in January 2025, the company broadened its production footprint in Hebron, Ohio, by adding new production lines and infrastructure for customized polycarbonate compounds and blends. Significantly boosting capacity for its Solutions & Specialties segment in the American market.

(Source: Covestro AG Press Release)