Company Overview

Boston Scientific Statistics: Boston Scientific Corporation is a global medical device and biotechnology innovator that designs, develops, and manufactures technologies used across a wide spectrum of interventional medical specialities. The company operates under five core strategic imperatives: strengthening leadership in key categories, expanding into high-growth adjacent markets, accelerating global reach, reinvesting to support long-term growth, and building critical organisational capabilities. Its operations are organized into two primary reportable segments: MedSurg and Cardiovascular.

The company maintains a broad international footprint, operating in more than 40 countries across six continents through an extensive network of manufacturing sites, customer fulfillment centers, and scientific training facilities. This includes the Institute for Advancing Science in Minnesota, Ireland, Puerto Rico, and Coyol, Costa Rica; a manufacturing facility in Malaysia; major fulfillment hubs in Massachusetts, the Netherlands, Malaysia, and Japan; and its global headquarters in Marlborough, Massachusetts. Additional principal manufacturing operations are located in California, Indiana, Brazil, China, and Heredia, Costa Rica, with regional headquarters situated in Singapore and Voisins-le-Bretonneux, France.

As of December 31, 2024, Boston Scientific operated 16 major manufacturing facilities, including eight across the U.S. and Puerto Rico, three in Ireland, two in Costa Rica, and one each in Malaysia, Brazil, and China. Many of these sites support multiple divisions and also conduct research and development activities. Product distribution is supported globally through key fulfillment centers in Massachusetts, the Netherlands, Malaysia, and Japan.

History of Boston Scientific Corporation

- 1979: Boston Scientific is established by John Abele and Pete Nicholas, founded on the mission to advance less-invasive medical treatment options for patients worldwide.

- 1980s: The company experiences strong momentum as it commercializes steerable catheters and other pioneering interventional tools, solidifying its early leadership in minimally invasive procedures.

- 1992: Boston Scientific becomes a publicly traded company on the NYSE (BSX), providing capital to accelerate its global expansion strategy.

- 1995–2000: The company broadens its capabilities in cardiovascular and endoscopy through key acquisitions, including Symbiosis, Microvasive, and EP Technologies.

- 2003: Introduction of the TAXUS drug-eluting stent marks a significant milestone, transforming interventional cardiology and gaining widespread international adoption.

- 2006: Boston Scientific finalizes its landmark acquisition of Guidant Corporation, strengthening its presence in cardiac rhythm management and electrophysiology.

- 2010–2015: The company undergoes strategic restructuring and directs major investments into neuromodulation, structural heart technologies, and next-generation interventional platforms.

- 2016–2019: Expansion continues into urology, oncology, and endoscopy through notable acquisitions, including AMS Men’s Health and BTG plc, as well as enhancements to the LithoVue digital platform.

- 2020: Boston Scientific deepens its capabilities in digital health, emphasizing remote monitoring and connected solutions in CRM and electrophysiology amid global shifts in healthcare delivery.

- 2021–2023: Further strengthens its minimally invasive surgery and electrophysiology portfolio with acquisitions such as Farapulse (pulsed-field ablation) and significant progress in structural heart innovation.

- 2024: Advances continue across interventional cardiology, oncology, and neuromodulation, supported by global clinical programs and investments in next-generation ablation, targeted drug delivery, and catheter-based technologies.

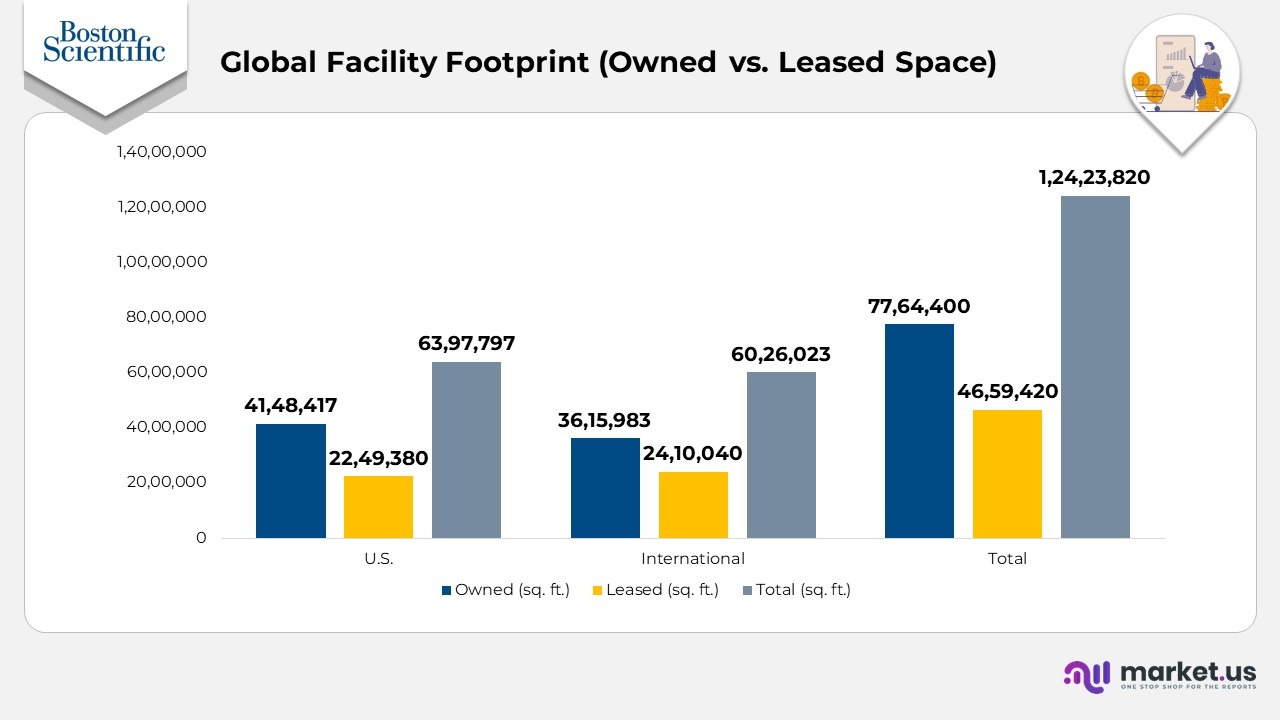

Global Facility Footprint (Owned vs. Leased Space)

- The company’s U.S. footprint includes approximately 6.39 million sq. ft., consisting of 15 million sq. ft. owned property and 2.25 million sq. ft. leased space.

- International operations cover approximately 6.03million sq. ft., split between 3.62 million sq. ft. of owned facilities and 2.41 million sq. ft. of leased

- Collectively, the company manages about 12.42 million sq. ft. of facility space worldwide, of which 76 million sq. ft. is owned and 4.66 million sq. ft. is leased.

- Owned locations include key manufacturing hubs across the U.S., Ireland, Puerto Rico, Costa Rica, Malaysia, Japan, and various fulfilment centres and headquarters.

- Leased facilities span regions such as California, Indiana, Brazil, China, Heredia (Costa Rica), Singapore, and France, supporting manufacturing and regional headquarters operations.

(Source: Texas Instruments Annual Report)

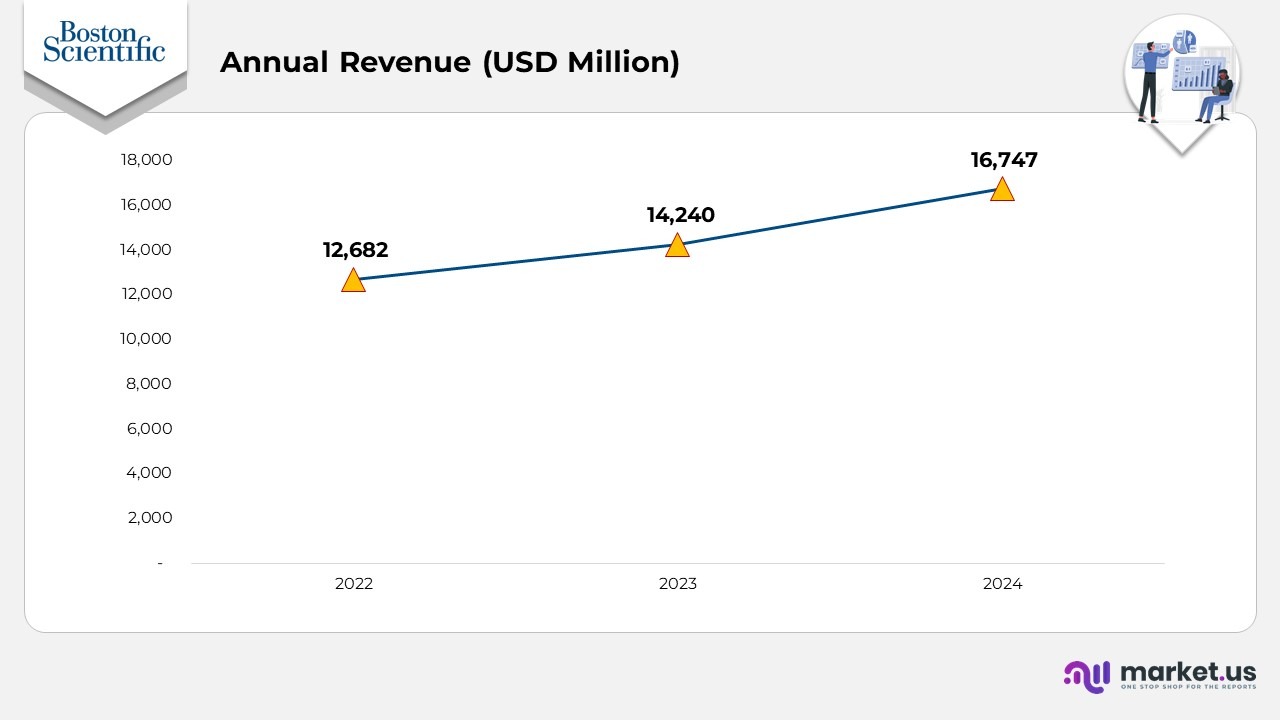

Boston Scientific Statistics By Financial Analysis

- In 2022, the company generated approximately $12,682 million in revenue, establishing its baseline for future growth.

- Revenue rose to $14,240 million in 2023, reflecting a YoY increase of about3% compared to 2022, driven by expanding product demand and strong global operations.

- By 2024, annual revenue reached $16,747 million, marking a YoY growth of roughly6% from 2023, indicating continued commercial momentum and successful execution of strategic initiatives.

(Source: Boston Scientific Annual Report)

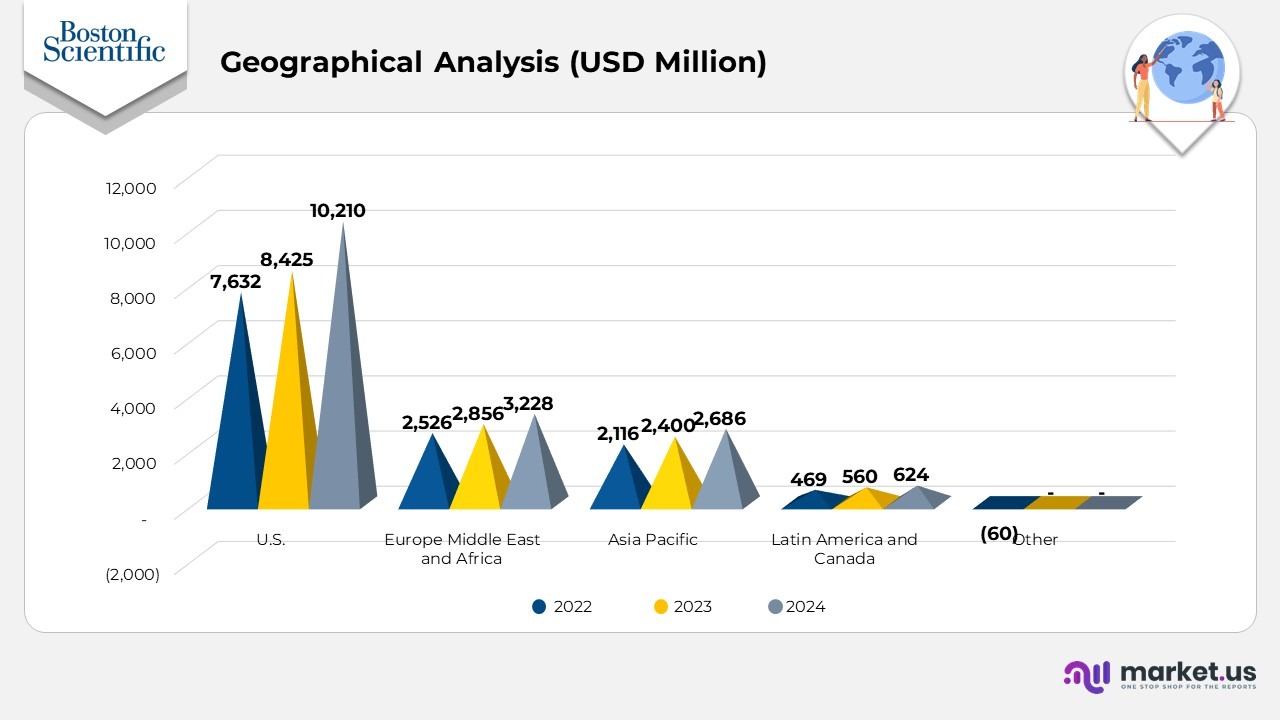

Boston Scientific Statistics By Geographical Analysis

- In 2024, the U.S. recorded $10,210, which is significantly higher than Europe, the Middle East, and Africa at $3,228, Asia Pacific at $2,686, and Latin America and Canada at $624, while Other showed 0

- In 2023, the U.S. achieved $8,425, remaining far ahead of Europe, the Middle East, and Africa at $2,856, Asia Pacific at $2,400, and Latin America and Canada at $560, with Other at 0.

- In 2022, the U.S. led with $7,632, followed by Europe Middle East and Africa at $2,526, Asia Pacific at $2,116, and Latin America and Canada at $469, while Other recorded (60).

- Comparing regions across all 3 years shows the U.S. consistently generating the highest revenue, with a wide gap over the next-largest region each year.

- From 2022 to 2024, U.S. revenue increased from $7,632 to $10,210, Europe, the Middle East, and Africa rose from $2,526 to $3,228, and Asia Pacific increased from $2,116 to $2,686.

- Latin America and Canada also grew steadily from $469 in 2022 to $624 in 2024.

- The Other category shifted from (60) in 2022 to 0 in 2023 and 0 in 2024, reflecting stabilization.

(Source: Boston Scientific Annual Report)

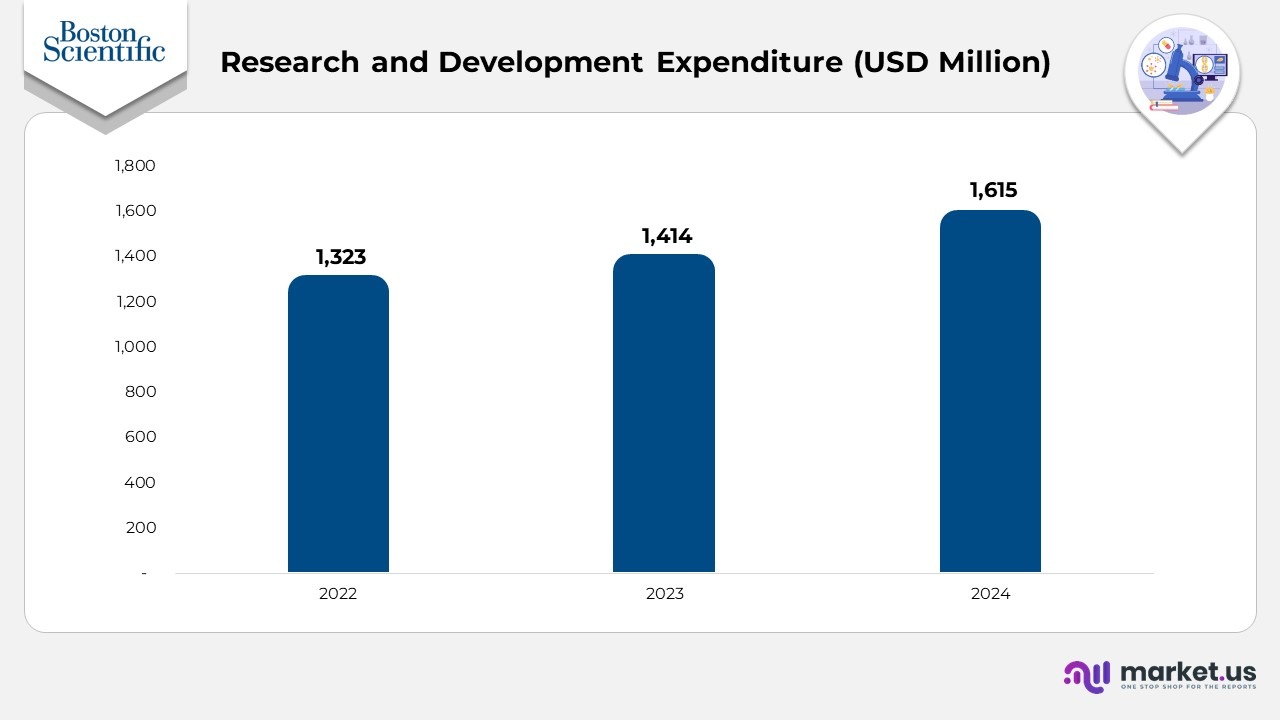

Research and Development Expenditure – Boston Scientific Statistics

- From 2022 to 2023, research and development spending increased from $1,323 million to $1,414 million, reflecting a YoY growth of 6.9% driven by expanded innovation initiatives and ongoing clinical development work.

- From 2023 to 2024, R&D investment rose further from $1,414 million to $1,615 million, representing a YoY increase of 14.2%, highlighting an accelerated commitment to advanced technologies, clinical trials, and next-generation product development.

- Across the full period from 2022 to 2024, total R&D expenditure grew by $292 million, demonstrating a consistent upward trend in the company’s innovation strategy.

(Source: Boston Scientific Annual Report)

Segmental Analysis By Boston Scientific Statistics

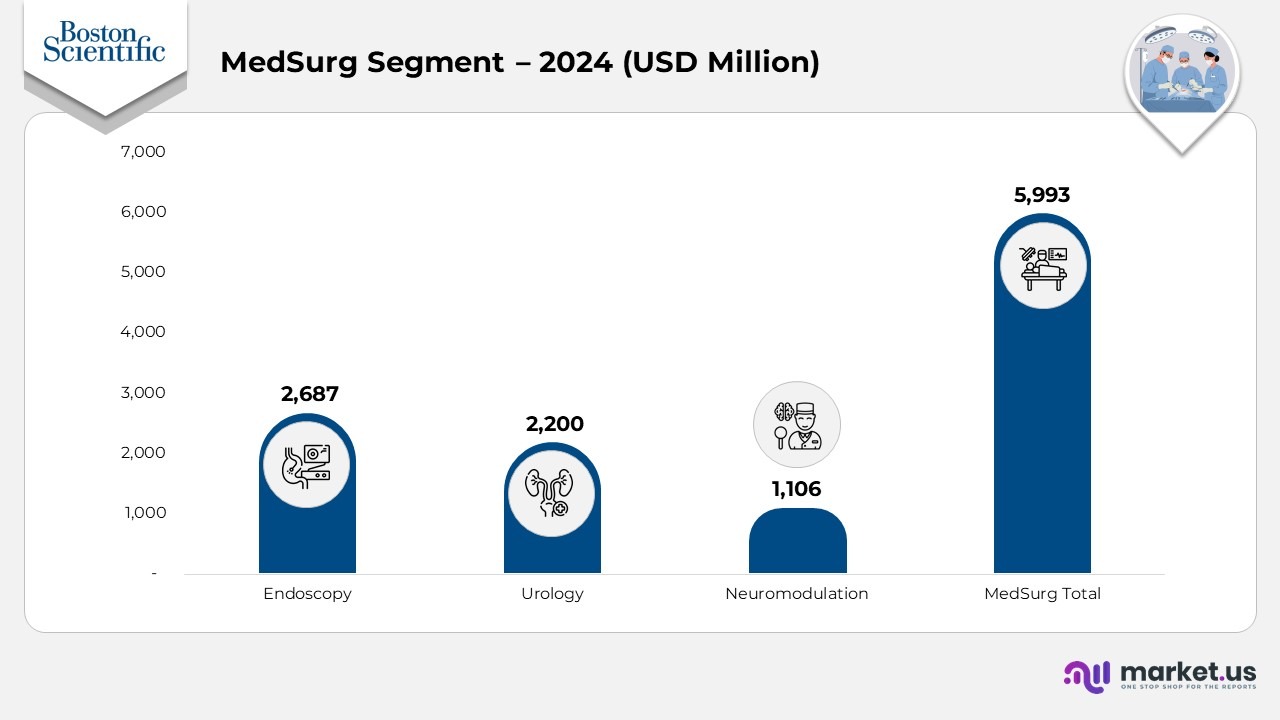

MedSurg

- In 2024, Endoscopy generated $1,651 in the U.S. and $1,036 internationally, for a total of $2,687. This reflects steady growth from 2023, when totals were $2,482, and from 2022, when the segment posted $2,221.

- Urology revenue in 2024 rose to $1,557 in the U.S. and $643 internationally, totaling $2,200. This compares with $1,964 in 2023 and $1,773 in 2022, indicating consistent year-over-year growth.

- Neuromodulation delivered $847 in U.S. revenue and $259 in international revenue in 2024, totalling $1,106. This is up from $976 in 2023 and $917 in 2022, indicating a steady upward trend driven by rising therapy adoption.

- The overall MedSurg category recorded $4,054 in U.S. revenue and $1,939 in international revenue in 2024, for a total of $5,993. This is an increase from $5,422 in 2023 and $4,911 in 2022, marking continuous portfolio-wide growth.

- When comparing the three-year performance, Endoscopy shows the strongest total revenue among the three subsegments each year, while Urology consistently ranks second and Neuromodulation third.

- Endoscopy added $466 in total revenue from 2022 to 2024, Urology increased by $427, and Neuromodulation improved by $189, demonstrating varied but positive growth trajectories.

- MedSurg overall expanded by more than $1,082 between 2022 and 2024, outperforming the individual subsegments in total incremental growth, driven by combined contributions across Endoscopy, Urology, and Neuromodulation.

(Source: Boston Scientific Annual Report)

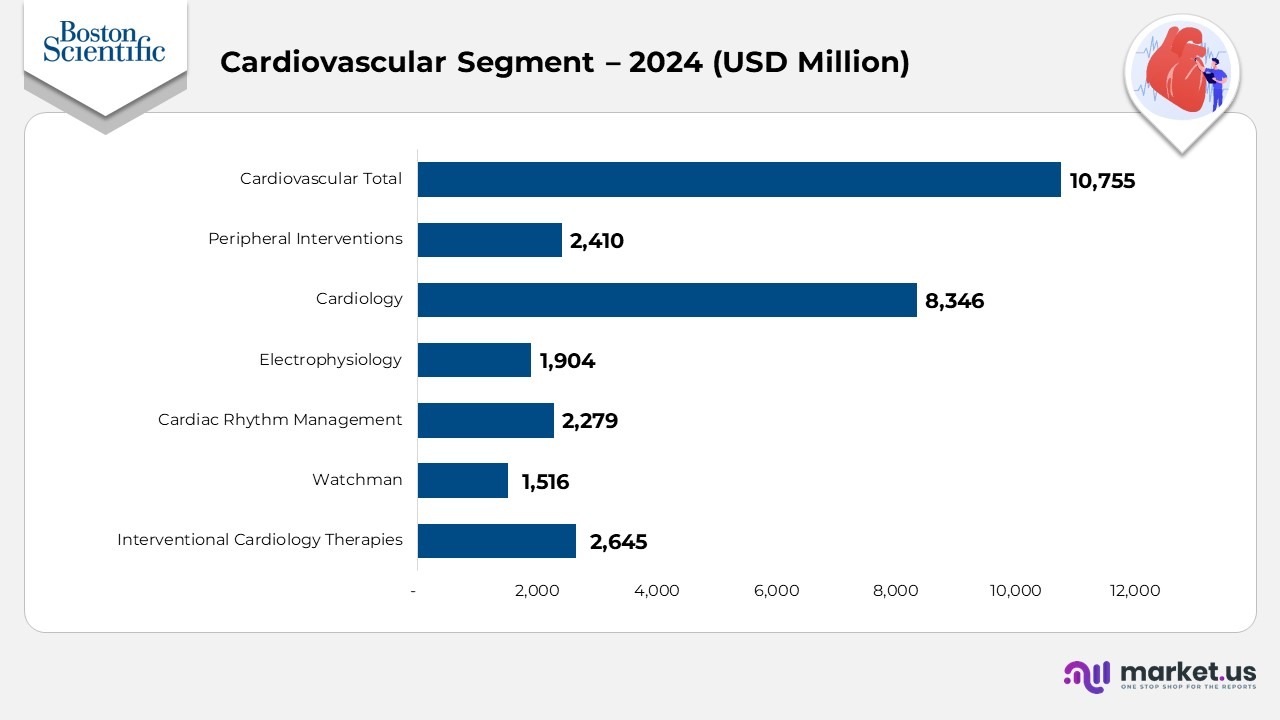

Cardiovascular

- The Cardiovascular segment recorded $10,755 in total revenue in 2024, up from $8,819 in 2023 and $7,831 in 2022, demonstrating sustained year-over-year momentum across all product categories.

- Interventional Cardiology Therapies generats $2,645 in 2024, rising from $2,417 in 2023 and $2,229 in 2022, indicating growing procedure volume in both the U.S. and international markets.

- Watchman contributed $1,516 in 2024, compared with $1,274 in 2023 and $1,019 in 2022, reflecting strong adoption in left-atrial appendage closure solutions and expanded clinician utilization.

- Cardiac Rhythm Management delivered $2,279 in 2024, up from $2,218 in 2023 and $1,900 in 2022, showing steady worldwide demand for pacing and ICD technologies.

- Electrophysiology posted $1,904 in 2024, increasing from $1,700 in 2023 and a much lower $585 in 2022, marking one of the most significant 2-year expansions in the entire cardiovascular portfolio.

- Cardiology reached $8,346 in 2024, compared with $6,709 in 2023 and $5,932 in 2022, reinforcing its position as the largest revenue generator within the overall cardiovascular lineup.

- Peripheral Interventions generated $2,410 in 2024, up from $2,110 in 2023 and $1,899 in 2022, driven by consistent global demand for vascular and peripheral solutions.

- Across all cardiovascular subcategories, every line item shows upward progress from 2022 to 2024, with the U.S. market providing the strongest contribution and international regions adding steady incremental gains.

- Electrophysiology shows the most dramatic multi-year growth, while Cardiology remains the segment’s highest-revenue contributor in each year.

(Source: Boston Scientific Annual Report)

Boston Scientific – Patent & Application

| Title | Number | Type | Filed |

|---|---|---|---|

| Agent Delivery Device | 20250325792 | Application | June 27, 2025 |

| Instrument Accessory for Endoscopic Procedures | 20250325169 | Application | Jul 2, 2025 |

| Modular Medical Device System | 12447326 | Grant | Jul 12, 2022 |

| Left Atrial Appendage Treatment System | 12446887 | Grant | January 13, 2022 |

| Dynamic Light Control System | 12452545 | Grant | May 2, 2024 |

| Expandable Cap for Endoscopic Closure | 12446885 | Grant | September 20, 2023 |

| Medical Device Delivery System | 20250318718 | Application | April 8, 2025 |

| Tubeless Endoscope Working Channel | 20250318719 | Application | June 24, 2025 |

| Endoscope Suction Valve Actuator | 20250318709 | Application | April 8, 2025 |

| Medical Cleaning Valve | 20250318711 | Application | June 27, 2025 |

| Fluid Flow Detection Device | 20250318712 | Application | June 25, 2025 |

| Rotatable Medical Device | 20250318708 | Application | June 27, 2025 |

| Vapor Therapy for Prostate Cancer | 12440258 | Grant | November 20, 2023 |

| Torque Amplification Medical System | 12440211 | Grant | March 15, 2024 |

| Multi-Fire Stapling System | 12440207 | Grant | November 17, 2021 |

| Tissue Fastening Medical System | 12440210 | Grant | August 8, 2023 |

| Penile Prosthesis Pump Assembly | 12440339 | Grant | November 29, 2023 |

| Medical Device with Extendable Shaft | 20250311919 | Application | June 20, 2025 |

| Endoscopic Tissue Traction System | 20250312086 | Application | April 7, 2025 |

| Tissue Removal Loop Device | 20250312051 | Application | June 16, 2025 |

(Source: Justia Patents)

Recent Developments

- In October 2025, Boston Scientific agreed to acquire Nalu Medical, Inc., aiming to expand its capabilities in peripheral nerve stimulation (PNS) for adults experiencing severe and persistent chronic pain in areas such as the shoulder, knee and lower back.

- In July 2025, the company secured FDA approval to broaden the instructions for use (IFU) for the FARAPULSE Pulsed Field Ablation (PFA) System, now permitting its use in patients with drug-refractory, symptomatic persistent atrial fibrillation, a condition characterised by an abnormal heart rhythm lasting 7 days or longer.

- In January 2025, the company signed an acquisition agreement intended to enhance its ability to support physicians and patients while providing a stronger platform for continued innovation.

- In November 2024, the company agreed with Intera Oncology Inc. to advance hepatic artery infusion (HAI) therapy, a targeted treatment primarily used for liver tumors caused by metastatic colorectal cancer.

- In November 2024, the company completed the acquisition of Axonics, Inc., recognizing the significant advancements the company has made in therapies for overactive bladder and incontinence.

- In November 2024, the company also announced an agreement to acquire Cortex, Inc., strengthening its electrophysiology portfolio with advanced technology designed to support more precise ablation strategies for complex atrial arrhythmia cases.

Moreover

- In October 2024, the company received FDA approval for the FARAWAVE NAV Ablation Catheter, designed for navigation-enabled treatment of paroxysmal atrial fibrillation, and FDA 510(k) clearance for the FARAVIEW Software, which enables enhanced visualisation during ablation procedures with the FARAPULSE PFA System.

- In September 2024, the company obtained PMDA approval in Japan for the FARAPULSE PFA System, a novel alternative to thermal ablation for isolating pulmonary veins in patients with paroxysmal atrial fibrillation.

- In September 2024, the company completed the acquisition of Silk Road Medical, Inc., expanding its vascular portfolio by incorporating the TCAR platform and leveraging its global commercial infrastructure to broaden physician access.

- In September 2024, the company received FDA approval to extend the indication for the INGEVITY+ Pacing Leads to include conduction system pacing (CSP) and sensing within the left bundle branch area, when connected to compatible pacemakers.

- In August 2024, the company earned the CE Mark for the ACURATE Prime Aortic Valve System, offering treatment options, including an additional valve size to support patients with larger anatomical requirements.

(Source: Boston Scientific Press Release)