Company Overview

Balfour Beatty Statistics: Balfour Beatty plc is a leading construction and support services group engaged in financing, designing, building, maintaining, and operating essential infrastructure. The company operates through 4 core segments: Construction Services, Support Services, Infrastructure Investments, and Corporate Activities. Companies’ Construction Services division delivers major building and infrastructure projects across the UK, the US, and Hong Kong.

The Support Services division focuses on the management, maintenance, and enhancement of critical assets across power transmission, utilities, transport, and public service networks. Through its Infrastructure Investments arm, the company develops, operates, and manages long-term projects, including military housing, multifamily developments, and student accommodation.

The group’s principal activities span construction delivery, asset support, and infrastructure investment. Balfour Beatty works across multiple asset classes, including energy facilities, railway systems, motorways, and airports, while also providing essential services for electricity networks and public infrastructure. Its customer base includes public-sector bodies, private enterprises, and regulated institutions across industries, including government, commercial real estate, education, healthcare, defence, leisure, retail, and residential development. With established operations in the UK, the US, and Hong Kong, the company contributes to national growth and community development across its key geographies.

History of Balfour Beatty plc.

- 1909: George Balfour and Andrew Beatty opened their first office at 22A College Hill, London, marking the beginning of the company.

- 1909: The firm secured its first major project by constructing the Dunfermline and District Tramways.

- 1917: Completion of the Blackwater gravity dam expanded the company’s involvement in major UK civil engineering.

- WWII: The company contributed to national defence by constructing the Churchill Barriers to protect Scapa Flow.

- 1969: Joined BICC, enabling expansion into motorway construction, building, and property development.

- 1976: Entered the Middle East market with the landmark Jebel Ali Port project in Dubai.

- 1986: Expanded into the US through the acquisition of Heery, strengthening architectural, engineering, and PPP capabilities.

- 1990s: Established the foundations of Balfour Beatty Investments to support project financing and development.

- 2000s: Continued global growth with key acquisitions including GMH’s Military PPP housing business, Centex Construction, Mansell, and Birse.

- 2004: Entered the Hong Kong market through a 50:50 joint venture with Gammon Construction.

- Today, More than 110 years later, the company continues shaping communities through major infrastructure projects worldwide.

(Source: Company Website)

Financial Analysis

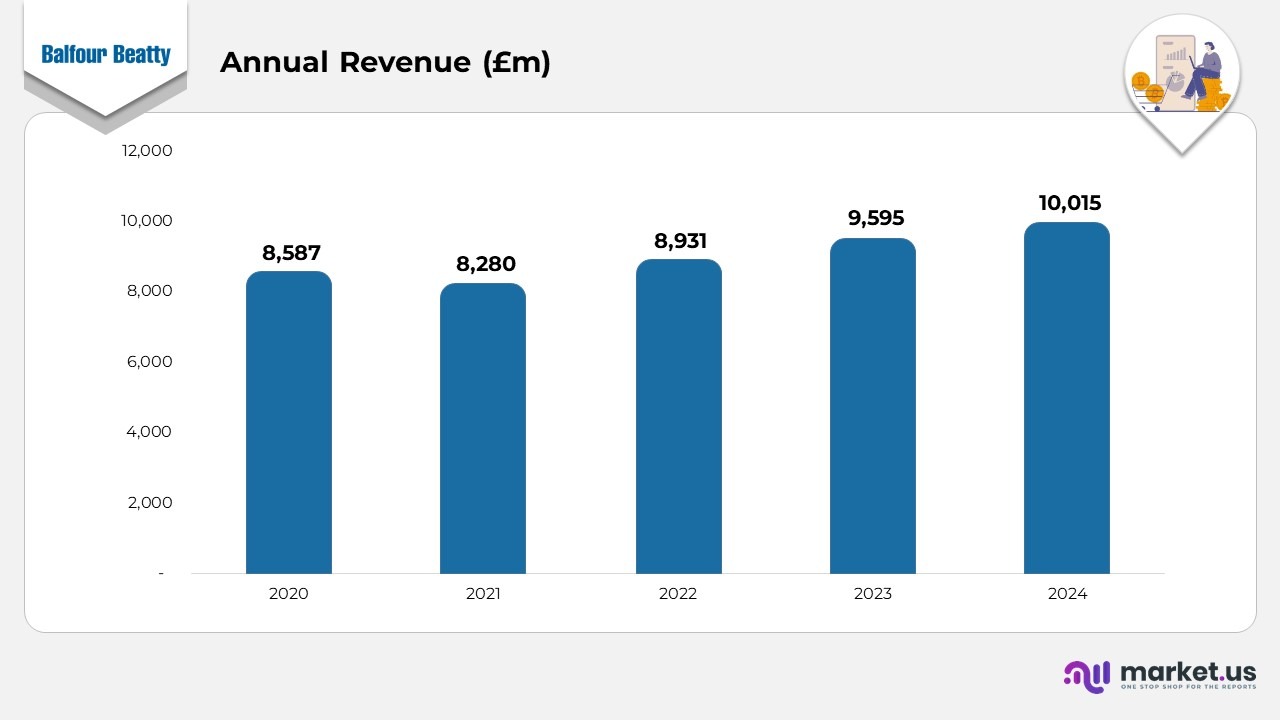

- In 2020, underlying revenue stood at £8,587 million, forming the baseline for the following growth cycle.

- In 2021, revenue dipped slightly to £8,280 million, a £307 million decline from 2020, indicating a temporary slowdown.

- In 2022, the figure improved to £8,931 million, up £651 million from 2021, signalling a return to growth.

- In 2023, revenue increased further to £9,595 million, up £664 million from 2022, marking one of the strongest annual jumps in the period.

- In 2024, underlying revenue reached £10,015 million, a year-on-year rise of £420 million versus 2023, pushing the company above the £10 billion threshold for the first time.

- Underlying revenue rose to £10,015 million in 2024, up from £9,595 million in 2023, marking a clear year-on-year improvement in Group performance.

- The Group recorded a 4% increase in underlying revenue, or 6% at constant exchange rates, reflecting stronger activity levels in Gammon and Support Services.

- Statutory revenue reached £8,234 million in 2024, compared with £7,993 million in 2023, showing consistent progress even without joint ventures and associates.

- The underlying revenue uplift of £420 million demonstrates higher project delivery volumes across key operating regions.

- YoY growth in 2024 accelerated from the previous year, indicating stronger business momentum and improved operational conversion.

- Both underlying and statutory figures show a broad-based improvement, supported by diversified operations across the UK, US, and Hong Kong.

(Source: Balfour Beatty plc Annual Report)

Shareholder & Investor Engagement Highlights

- In 2024, the Company conducted 83 dedicated meetings with shareholders and investors across the year, strengthening direct dialogue and transparency.

- Participation in 8 investor conferences hosted by leading London-based investment banks broadened engagement with the global investment community.

- Additional investor roadshows were organized in Edinburgh, Jersey, Boston, and Montreal, expanding outreach across both UK and international hubs.

- Regular regulatory announcements ensured shareholders continued to receive timely updates on the Company’s news and financial performance.

- A LinkedIn post featuring Leo’s half-year results garnered 33,000 views, reflecting strong digital engagement and stakeholder interest.

(Source: Balfour Beatty plc Annual Report)

Customer Satisfaction and Employee Engagement Achievements

- In 2024, the Group completed over 1,800 customer satisfaction reviews, reinforcing its commitment to delivering trusted, high-quality service across all projects.

- The Company achieved a 96% customer satisfaction score, reflecting consistently strong performance and positive client feedback.

- Employee engagement remained the defining measure of the Group’s Expert value, with engagement reaching its highest level since 2017.

- The Group’s employee engagement score climbed to 84% in 2024, an improvement from 81% in 2023, marking the 7th consecutive year of growth.

- Overall engagement levels were 11% above the wider industry average, highlighting the success of ongoing cultural and people-focused initiatives.

(Source: Balfour Beatty plc Annual Report)

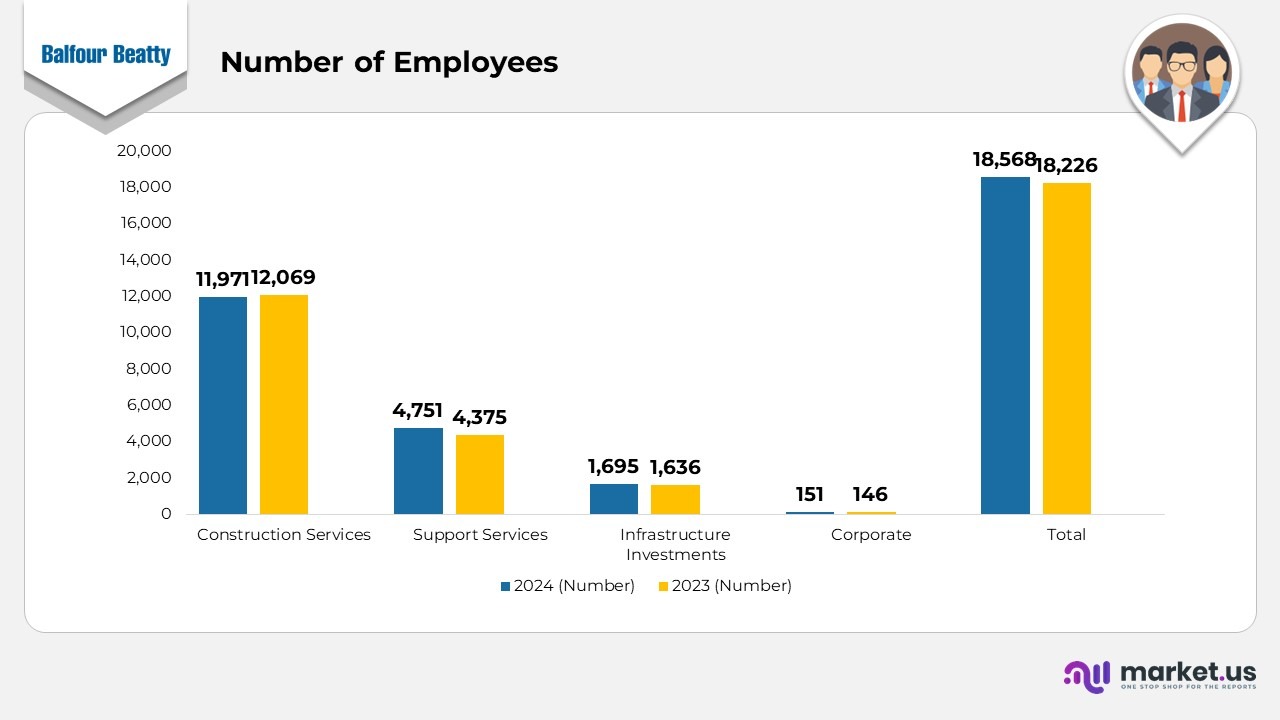

Employee Analysis

- The Construction Services division recorded an average of 11,971 employees in 2024, compared with 12,069 in 2023, reflecting a modest reduction as major project cycles shifted.

- The Support Services segment expanded its workforce to 4,751 employees in 2024, rising from 4,375 in 2023, driven by increased activity across utilities, power networks and transport services.

- The Infrastructure Investments team averaged 1,695 employees in 2024, slightly higher than 1,636 in 2023, aligning with continued growth in asset development and PPP management.

- The Corporate division supported operations with 151 employees in 2024, up from 146 in 2023, reinforcing central functions and governance capacity.

- In total, the Group’s average workforce reached 18,568 employees in 2024, compared with 18,226 in 2023, indicating a net year-on-year increase across the organisation.

(Source: Balfour Beatty plc Annual Report)

Segmental Analysis

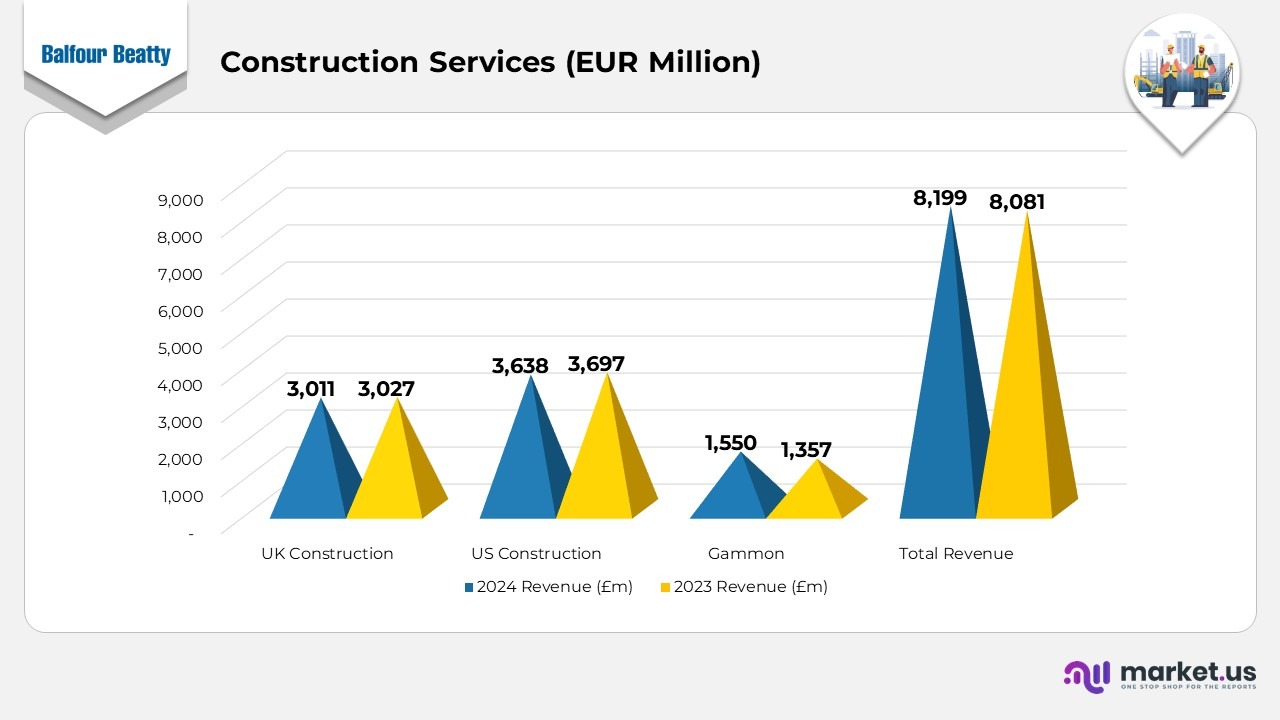

Construction Services

- Revenue for the Construction Services division rose to £8,199 million in 2024, compared with £8,081 million in 2023, representing a 1% increase (or 3% at CER) driven mainly by stronger activity levels at Gammon.

- Underlying profit from operations improved to £159 million in 2024, up from £156 million in 2023, supported by better profitability in UK Construction and increased work volumes at Gammon, partly offset by weaker returns in US Construction.

- Statutory profit for the year stood at £87 million, lower than £143 million in 2023, reflecting a change in non-underlying items and market-specific pressures.

- The order book grew by 11% (or 9% at CER) to £15.2 billion in 2024, compared with £13.7 billion in 2023, boosted by a strong intake of new projects in US Construction.

- UK Construction revenue increased to £3,011 million in 2024 from £3,027 million in 2023, while PFO reached £81 million, compared to £69 million, with the order book rising slightly to £6.2 billion from £6.1 billion.

- US Construction recorded revenue of £3,638 million in 2024, marginally below £3,697 million in 2023, with PFO dropping to £40 million from £51 million, although the order book expanded significantly to £7.1 billion from £5.6 billion.

- Gammon delivered revenue of £1,550 million in 2024, up from £1,357 million in 2023, while PFO increased to 38 million, compared with 36 million, and the order book moved to £1.9 billion from £2.0 billion.

- Overall, underlying revenue for Construction Services was £8,199 million, up from £8,081 million, and underlying PFO was £159 million, increasing from £156 million year-on-year.

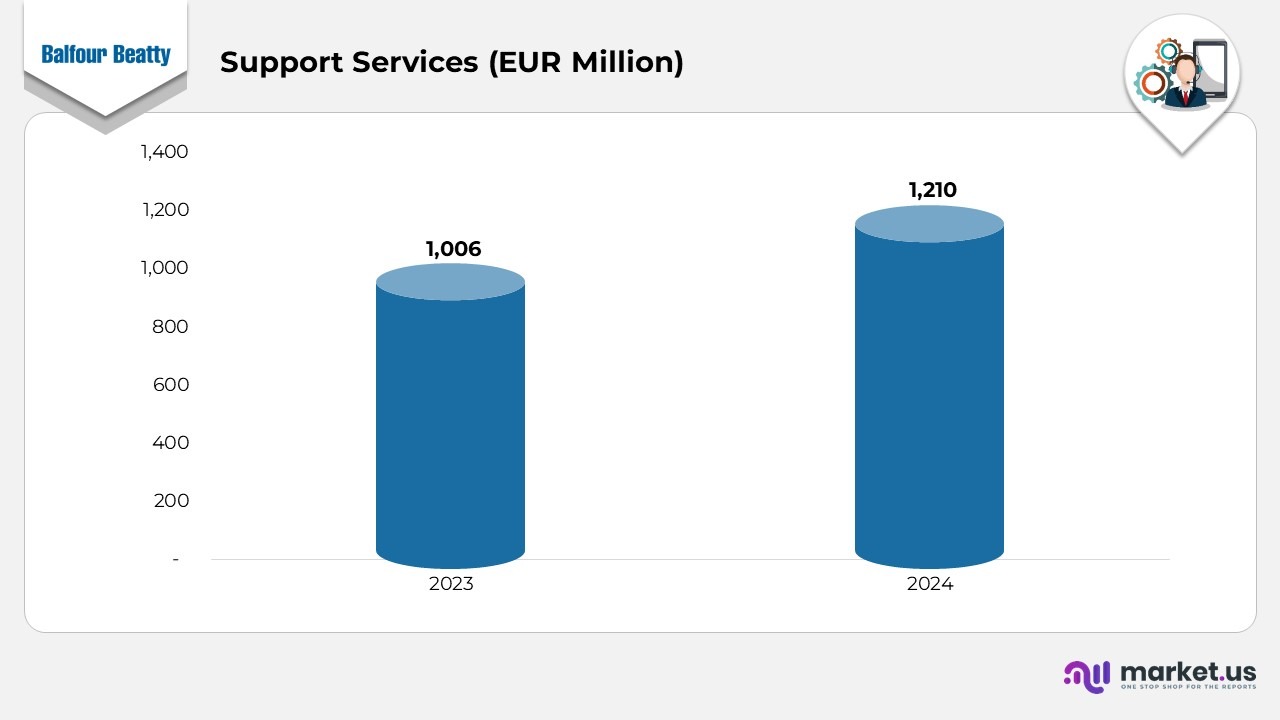

Support Services

- Support Services delivered strong growth in 2024, with revenue rising 20% to £1,210 million, up from £1,006 million in 2023, largely supported by increased road maintenance activity.

- Revenue growth was boosted by the first full year of major maintenance contracts in Buckinghamshire and East Sussex, alongside expanded work in power transmission and distribution.

- Underlying profit from operations rose to £93 million from £80 million in 2023, reflecting the positive impact of higher volumes across key service lines.

- The underlying PFO margin stood at 7% in 2024, down from 8.0% in 2023, and remained at the upper end of the targeted 6–8% range.

- Despite top-tier profitability, the slight margin decrease was due to a shift in the mix of work delivered, though performance remained strong across power, road, and rail maintenance.

- The Support Services order book expanded by 14%, reaching £3.2 billion compared with £2.8 billion in 2023, driven by new contract wins in the power transmission and distribution sector.

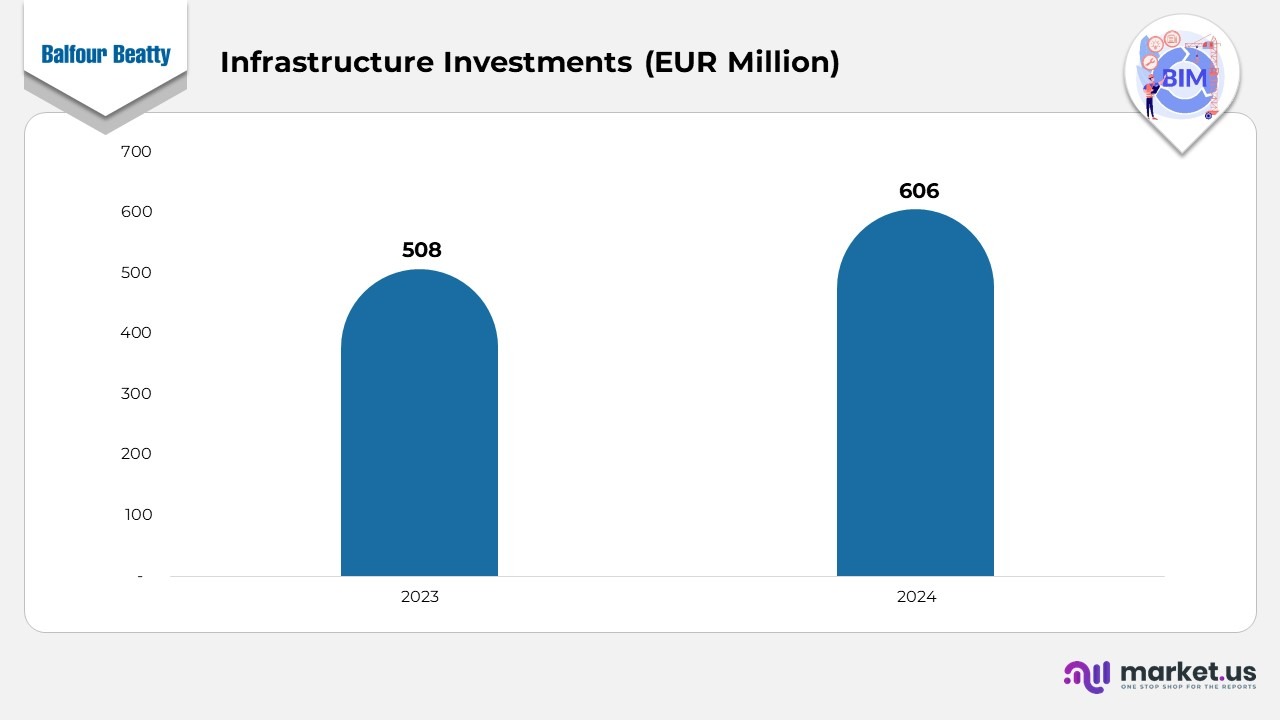

Infrastructure Investments

- Infrastructure Investments recorded an underlying operating loss of £8 million in 2024, compared with a £5 million profit in 2023, reflecting several one-off cost impacts across the portfolio.

- Costs increased in the US military housing portfolio due to the ongoing work of the independent compliance monitor, contributing to the year’s negative operating outcome.

- In the UK, the Group wrote off previously capitalised bidding expenses after the cancellation of a major student accommodation project for which it had held preferred bidder status.

- When including a £43 million gain on disposal (2023: £26 million), underlying profit from operations shifted to £35 million, ahead of £31 million in the prior year.

- The Group continued to deploy capital into high-value, strategically aligned opportunities, investing £28 million into new and existing projects during 2024.

- Two new US projects were added to the portfolio: 1 in student accommodation and 1 in multifamily housing, each expected to meet the Group’s investment threshold returns.

- Asset recycling remains a core strategy, with disposals timed to optimise shareholder value; in 2024, the Group partially exited the Northside student accommodation project at the University of Texas at Dallas.

- This transaction generated a £43 million gain and £43 million of cash proceeds, exceeding the Directors’ valuation and reinforcing the strength of the Group’s investment portfolio.

(Source: Balfour Beatty plc Annual Report)

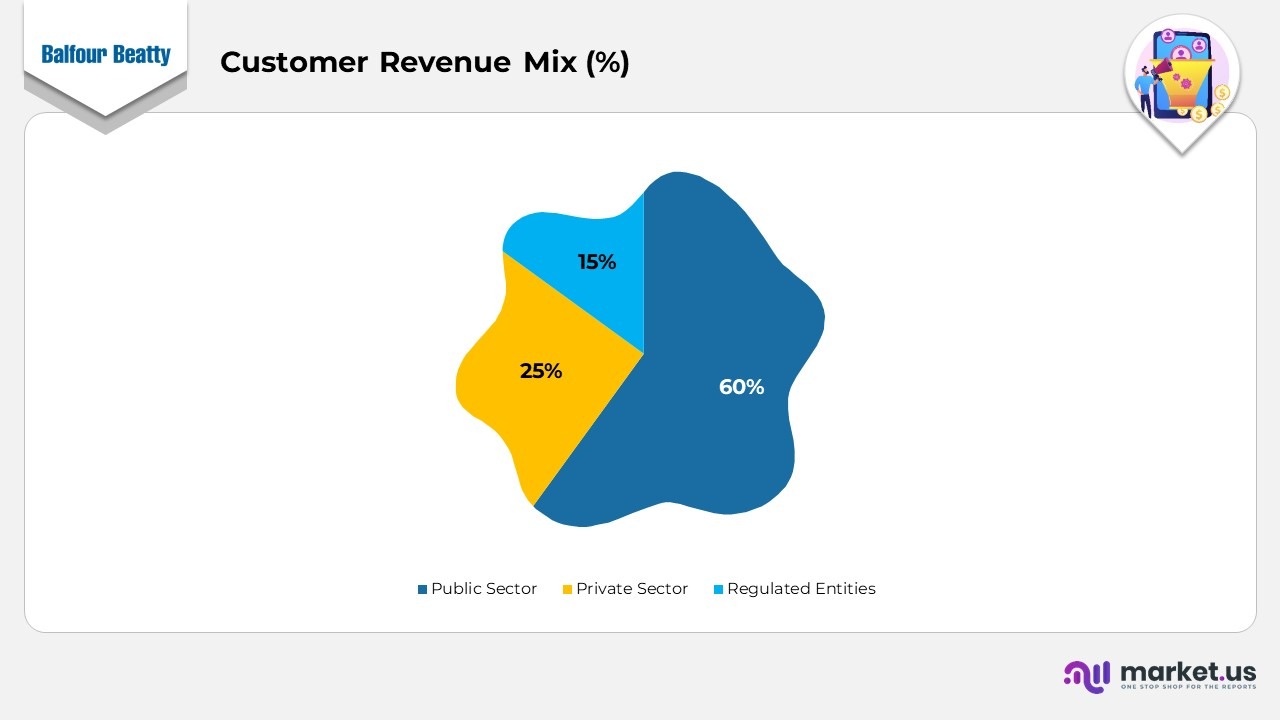

Customer Revenue Mix

- The public sector generated 60% of the Company’s revenue, reaffirming its strong reliance on government-funded and public-service infrastructure programmes.

- Private-sector customers contributed 25% of total revenue, reflecting steady engagement across commercial and investment-driven projects.

- Regulated entities accounted for 15% of revenue, emphasising the Group’s continued role in delivering work for sectors operating under strict regulatory frameworks.

(Source: Balfour Beatty plc Annual Report)

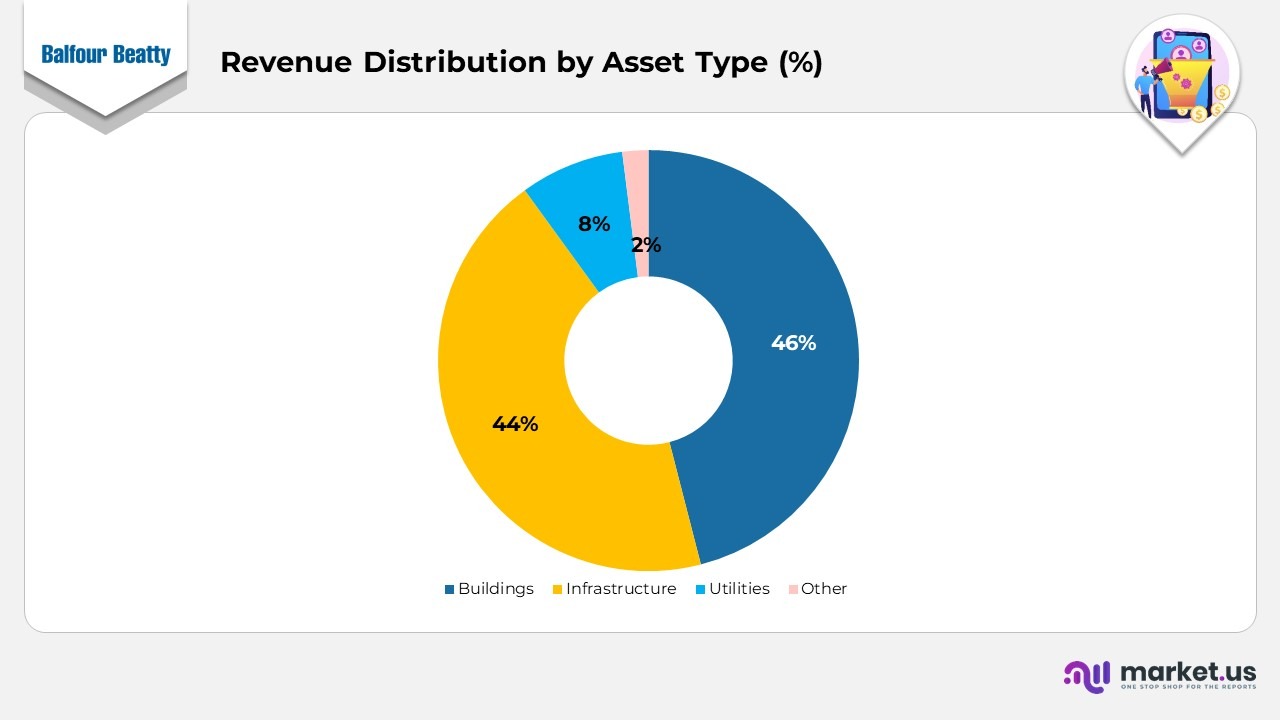

Revenue Distribution by Asset Type

- Buildings represented the largest share of revenue at 46%, reflecting strong activity across commercial, residential, and public building projects.

- Infrastructure contributed 44% of revenue, underscoring the Group’s extensive involvement in major transport, energy, and civil engineering assets.

- Utilities accounted for 8%, highlighting steady work across power networks, water systems, and related essential services.

- Other assets made up the remaining 2%, covering smaller or specialised categories outside core building and infrastructure operations.

(Source: Balfour Beatty plc Annual Report)

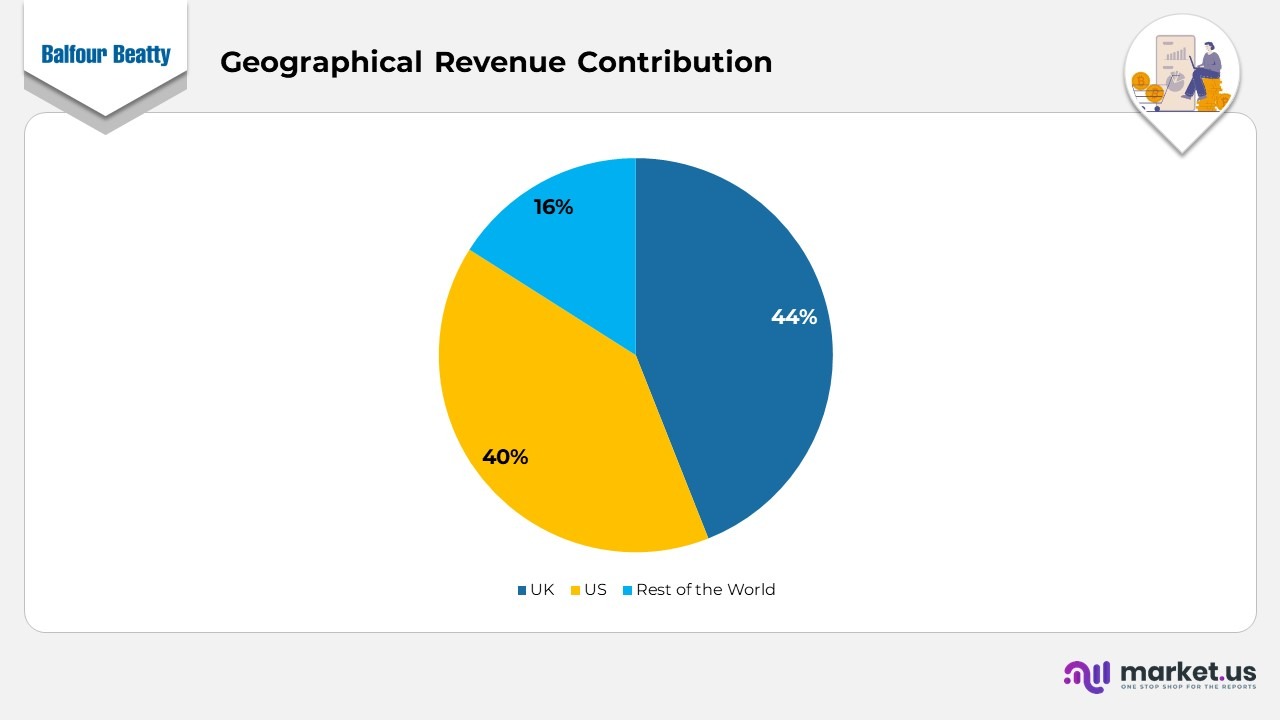

Geographical Revenue Contribution

- In 2024, the UK remained the leading market, generating 44% of total revenue, supported by strong activity across construction, maintenance, and infrastructure programmes.

- The US accounted for 40%, reflecting the Group’s significant presence in large-scale civil, building, and investment-led projects across multiple states.

- The Rest of the World contributed the remaining 16%, mainly driven by ongoing project delivery and joint venture activity in regions such as Hong Kong.

(Source: Balfour Beatty plc Annual Report)

Balfour Beatty Patents

| Patent Title | Patent No. | Filed | Patent Date |

|---|---|---|---|

| Method for Repairing Cracks in Artificial or Natural Structures | 4884922 | September 16, 1987 | December 5, 1989 |

| Inflatable Timber-Treatment Receptacle | 4384603 | January 28, 1981 | May 24, 1983 |

| Optical-Guided System for Controlling Tunnelling Shields | 4273468 | March 23, 1978 | June 16, 1981 |

| Vacuum-Impregnation Method for Wooden Structural Components | 4174412 | September 28, 1977 | November 13, 1979 |

| Vacuum-Injection Strengthening of Structures Using Flexible Covers | 4169909 | October 25, 1977 | October 2, 1979 |

| Balfour Beatty – Patent Summary Table | |||

| Patent Title (Rephrased) | Patent No. | Filed | Patent Date |

| Method for Repairing Cracks in Artificial or Natural Structures | 4884922 | September 16, 1987 | December 5, 1989 |

| Inflatable Timber-Treatment Receptacle | 4384603 | January 28, 1981 | May 24, 1983 |

| Optical-Guided System for Controlling Tunnelling Shields | 4273468 | March 23, 1978 | June 16, 1981 |

| Vacuum-Impregnation Method for Wooden Structural Components | 4174412 | September 28, 1977 | November 13, 1979 |

| Vacuum-Injection Strengthening of Structures Using Flexible Covers | 4169909 | October 25, 1977 | October 2, 1979 |

| Balfour Beatty – Patent Summary Table | |||

| Patent Title (Rephrased) | Patent No. | Filed | Patent Date |

| Method for Repairing Cracks in Artificial or Natural Structures | 4884922 | September 16, 1987 | December 5, 1989 |

| Inflatable Timber-Treatment Receptacle | 4384603 | January 28, 1981 | May 24, 1983 |

| Optical-Guided System for Controlling Tunnelling Shields | 4273468 | March 23, 1978 | June 16, 1981 |

| Vacuum-Impregnation Method for Wooden Structural Components | 4174412 | September 28, 1977 | November 13, 1979 |

| Vacuum-Injection Strengthening of Structures Using Flexible Covers | 4169909 | October 25, 1977 | October 2, 1979 |

(Source: Justia Patents)

Recent Developments

- In August 2025, the Balfour Beatty company broadened its specialist building services portfolio, strengthening delivery capabilities for high-profile community projects across Richmond and Hampton Roads, Virginia.

- In July 2025, the company announced a £7.2 million investment in Microsoft 365 Copilot to boost industry-wide productivity and enable smarter, safer, and more efficient project execution across hundreds of active sites.

- Also in July 2025, the company was selected by National Grid as the regional delivery partner for the North East of England under the £8 billion Electricity Transmission Partnership (ETP), accelerating substation infrastructure upgrades and supporting the UK’s clean-energy ambitions.

- In June 2025, the company entered into a partnership with Laing O’Rourke and Bouygues Travaux Publics to deliver major civil works for the new Suffolk power station, reinforcing its position in large-scale energy infrastructure.

- Also in June 2025, the company worked alongside the Gipson Play Plaza project at Dorothea Dix Park, contributing engineering expertise to overcome technical challenges, including complex soil integration and stonework, underscoring its commitment to transformative community development.

- In May 2025, the company expanded its investment portfolio by acquiring River Pointe, adding the asset to its growing real estate and community-focused holdings.

- In April 2025, the company secured an $889 million (£670 million) contract from the Texas Department of Transportation to reconstruct a major stretch of Interstate 30 (I-30) in Dallas, including the construction of nine strategic crossings connecting I-30 with the Southern Gateway, I-35E Lowest Stemmons, and The Horseshoe projects the company has successfully delivered over the past five years.

- In April 2025, the company’s Young People in Construction Hackathon, part of its Strategic Design Partnership, was featured in Design & Build UK, highlighting its ongoing efforts to inspire and engage the next generation of construction talent.

(Source: Balfour Beatty Press Release)