Company Overview

DuPont Statistics: DuPont de Nemours, Inc. is a global science and technology-driven company specializing in advanced materials and solutions that support transformation across key industries and everyday applications. The company develops and supplies a wide portfolio of products spanning electronics, automotive, water technologies, industrial systems, and various protection-focused applications.

Its major offerings include adhesives, high-performance printing materials, construction solutions, consumer products, speciality fabrics and fibers, nonwovens, healthcare materials, industrial films, packaging solutions, personal protective equipment, and photovoltaic technologies. DuPont’s portfolio includes several well-known brands such as Kevlar, Nomex, Tyvek, and Corian, which are widely used across sectors including healthcare, aerospace, clean energy, defence, construction, and packaging.

The company operates through 3 reportable segments: Water & Protection, Electronics & Industrial, and Corporate & Other. The Electronics & Industrial segment delivers advanced materials and component solutions for high-performance computing, 5G infrastructure, electric vehicles, consumer electronics, and various industries, including healthcare, transportation, aerospace, and defence.

The Water & Protection segment delivers planned products and integrated systems supporting worker safety, water purification and separation, medical packaging, transportation needs, and high-performance building materials. This segment addresses global priorities related to safety, health, sustainability, and infrastructure performance.

DuPont maintains a broad international footprint with operations and customer networks across North America, Asia Pacific, Europe & the Middle East, South America, and Africa, reflecting its strong global reach and diversified market presence.

History of DuPont de Nemours, Inc.

- 1802:I. du Pont founded the company on the banks of the Brandywine Creek, focusing solely on gunpowder production while already demonstrating a forward-thinking commitment to workplace safety.

- Early 1800s: DuPont constructed manufacturing buildings with three granite walls and a fourth, lighter wall facing the river to redirect blast impact outward safely.

- Early 1800s:I. du Pont built his family home within the explosion-risk zone, underscoring his belief that leadership must share the same dangers as employees.

- 1811: The company introduced its first written safety rules, banning strangers, alcohol, matches, sharp metal tools, and any disorderly behavior, with violations leading to immediate dismissal.

- 1815 & 1818: Major explosions resulted in fatalities and injuries, after which DuPont implemented an unprecedented policy offering free housing and lifetime pensions to widows and dependents.

- Mid-1800s: Lammot du Pont developed mechanised systems to replace hazardous manual labour, thereby significantly reducing employee exposure to dangerous tasks.

- Late 1800s–Early 1900s: As DuPont transitioned into chemical processing, its safety protocols became more technical, detailed, and aligned with evolving industrial operations.

Moreover

- Early 1900s: DuPont established its first formal company-wide safety program and hired a full-time company physician, making employee health integral to its organizational strategy.

- 1911: DuPont launched its “Safety First” initiative, organizing employee safety committees, distributing educational materials, and hosting plant-wide campaigns to promote safety awareness.

- 1912: With the formation of the U.S. National Safety Council, DuPont began tracking injury metrics, reducing its major injury rate from 2 in 1912 to 3.40 by 1927, a milestone aligned with its 125th anniversary.

- 1920s: Safety became recognized internally as equal in importance to productivity, quality, and profitability, solidifying its role as a foundational operational value.

- 20th Century Onward: As the company diversified and grew globally, its commitment to health and safety remained central to its operations and continues to inform its culture today.

(Source: Company Website)

DuPont Financial Analysis Statistics

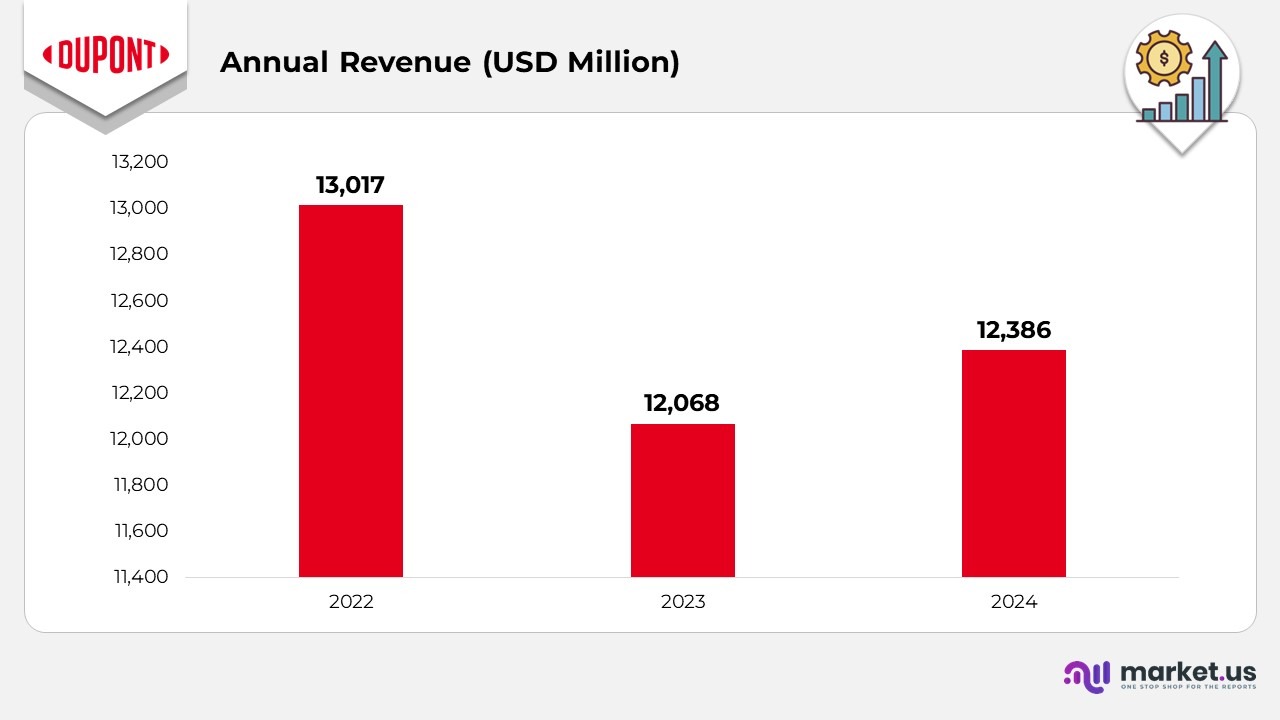

- In 2022, the company generated USD 13,017 million in annual revenue, the highest in the 3 years prior to subsequent fluctuations.

- In 2023, revenue declined to USD 12,068 million, marking a year-over-year decrease of USD 949 million, reflecting a period of demand softness or portfolio adjustments.

- In 2024, revenue recovered moderately to USD 12,386 million, representing a YoY increase of 318 million compared to 2023, indicating early signs of stabilization and renewed market momentum.

(Source: DuPont de Nemours, Inc. Annual Report)

DuPont Research and Development Expenditure Statistics

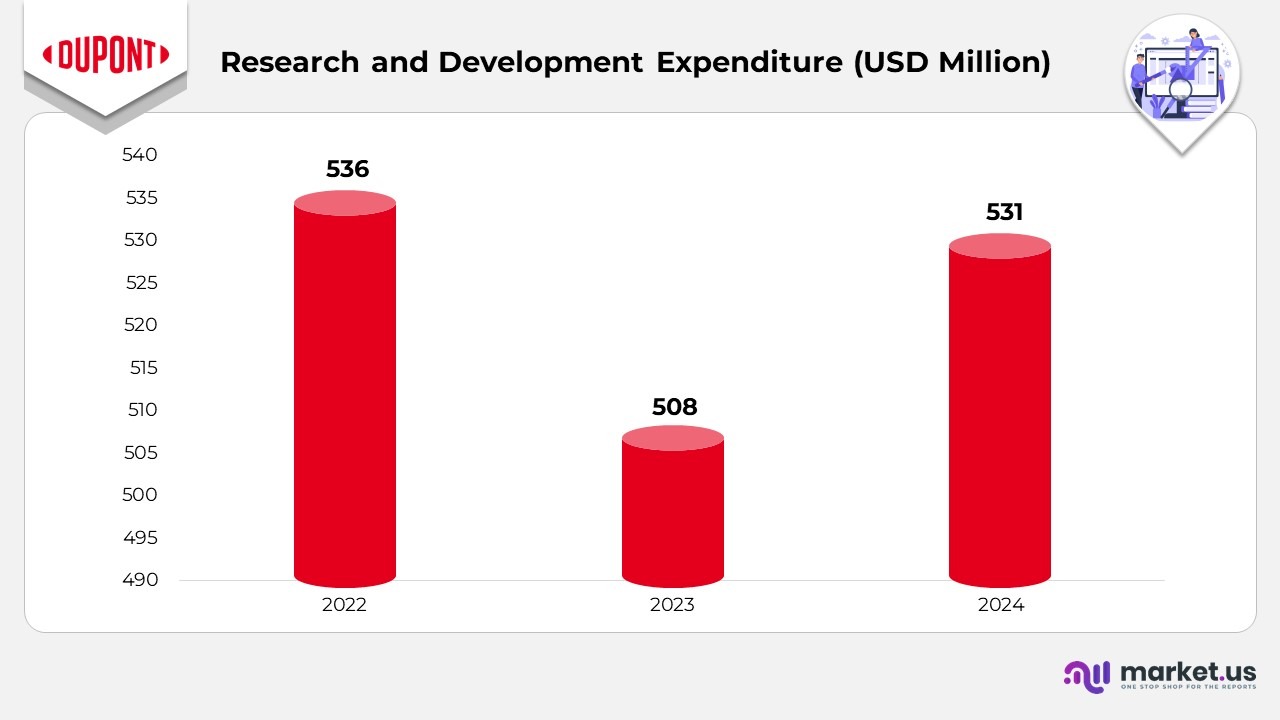

- Research and Development expenses increased to $531 million in 2024, up from $508 million in 2023, driven mainly by higher variable compensation.

- R&D spending in 2023 decreased from $536 million in 2022, largely due to lower personnel-related costs, though this reduction was partially offset by expenses associated with the Spectrum Acquisition.

- R&D intensity remained consistent, with R&D accounting for 4% of net sales in 2024, 2023, and 2022, indicating stable investment levels relative to company revenue across the three years.

(Source: DuPont de Nemours, Inc. Annual Report)

DuPont Segmental Analysis Statistics

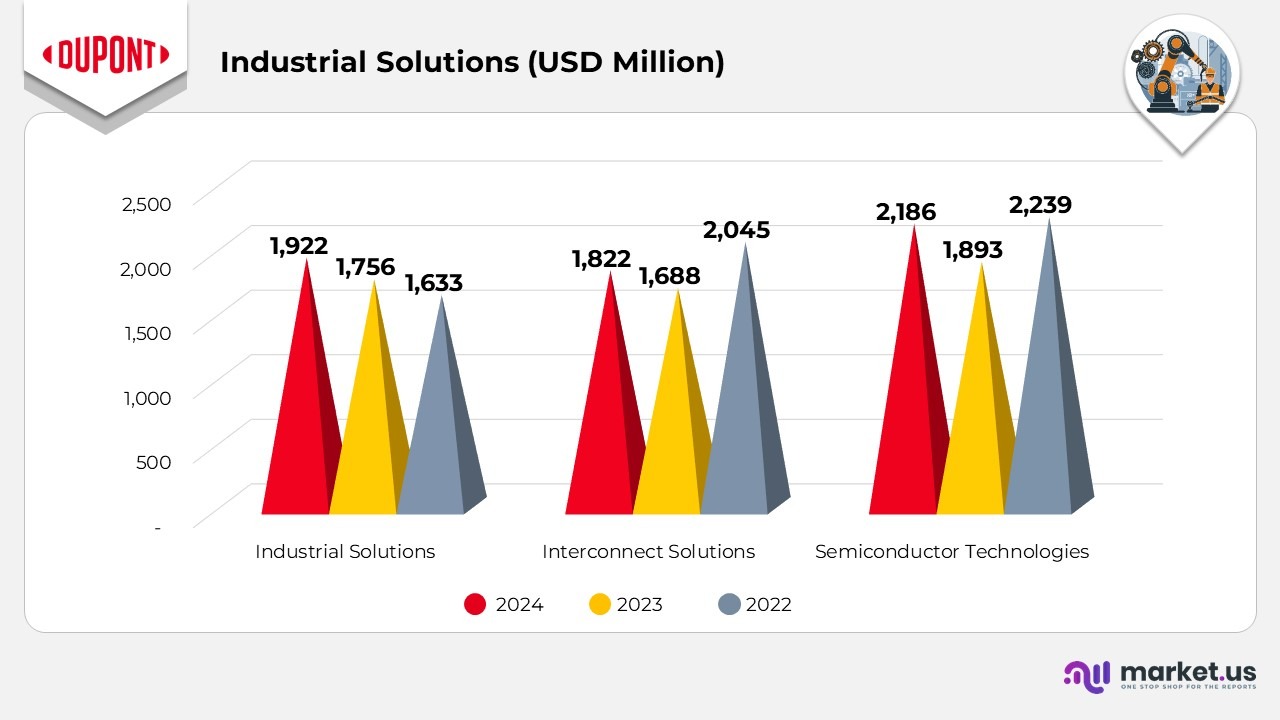

Industrial Solutions

- Industrial Solutions generated $1,922 million in 2024, up from $1,756 million in 2023 and surpassing $1,633 million in 2022, reflecting steady multi-year growth.

- Interconnect Solutions reported $1,822 million in 2024, up from $1,688 million in 2023, though still below $2,045 million in 2022, as the segment continues to recover.

- Semiconductor Technologies delivered $2,186 million in 2024, up from $1,893 million in 2023, but slightly below $2,239 million in 2022, indicating renewed momentum in semiconductor materials.

- The combined Electronics & Industrial division reached $5,930 million in 2024, compared with $5,337 million in 2023 and $5,917 million in 2022, driven by strengthening tech-related demand.

(Source: DuPont de Nemours, Inc. Annual Report)

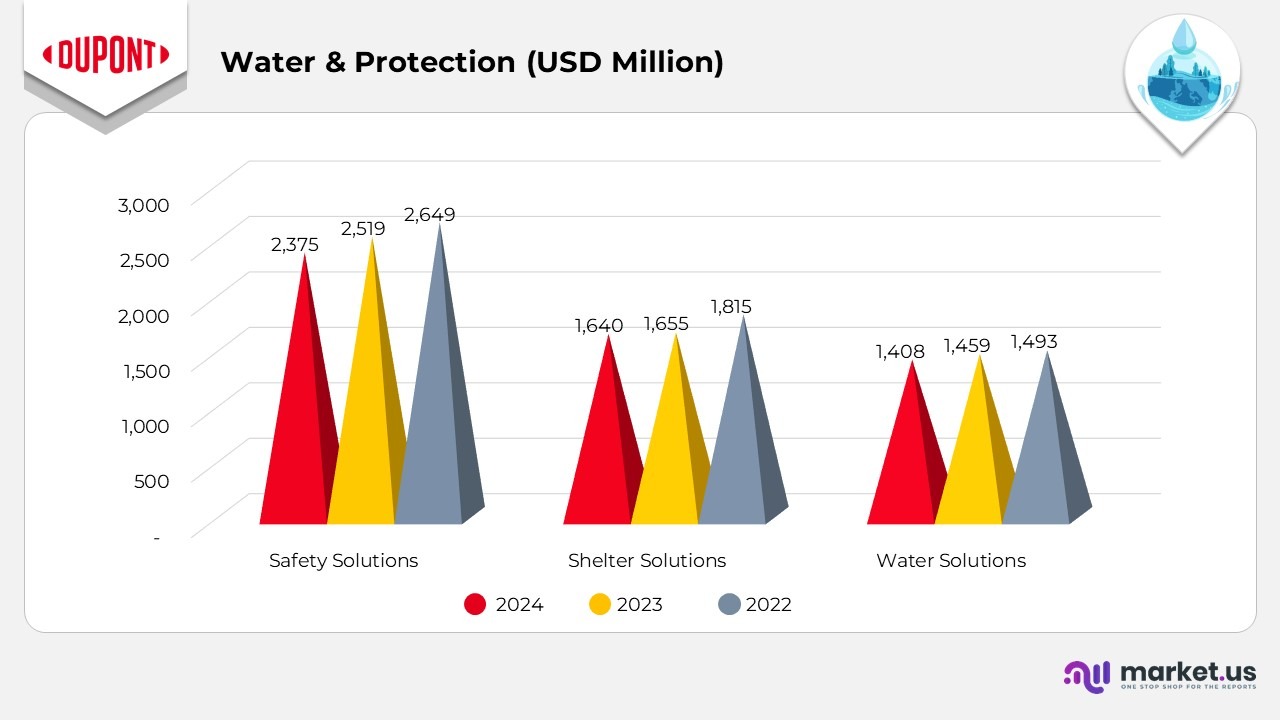

DuPont Safety Solutions Statistics

- Safety Solutions recorded $2,375 million in 2024, a decline from $2,519 million in 2023 and $2,649 million in 2022, reflecting softer protective-equipment orders.

- Shelter Solutions posted $1,640 million in 2024, similar to $1,655 million in 2023, but below $1,815 million in 2022, corresponding with slower construction activity.

- Water Solutions achieved $1,408 million in 2024, down from $1,459 million in 2023 and $1,493 million in 2022, due to a moderation in filtration system demand.

- Water & Protection delivered $5,423 million in 2024, compared to $5,633 million in 2023 and $5,957 million in 2022, marking a gradual normalization after prior elevated demand.

- Retained Businesses contributed $1,033 million in 2024, slightly lower than $1,098 million in 2023, but aligned with $1,067 million in 2022, indicating stable ongoing revenue.

- The other segment reported $0 in 2024, following $76 million in 2022, with 2023 not applicable, reflecting portfolio adjustments.

- Corporate & Other contributed $1,033 million in 2024, compared with $1,098 million in 2023 and $1,143 million in 2022, consistent with restructuring-related impacts.

(Source: DuPont de Nemours, Inc. Annual Report)

DuPont Geographical Analysis Statistics

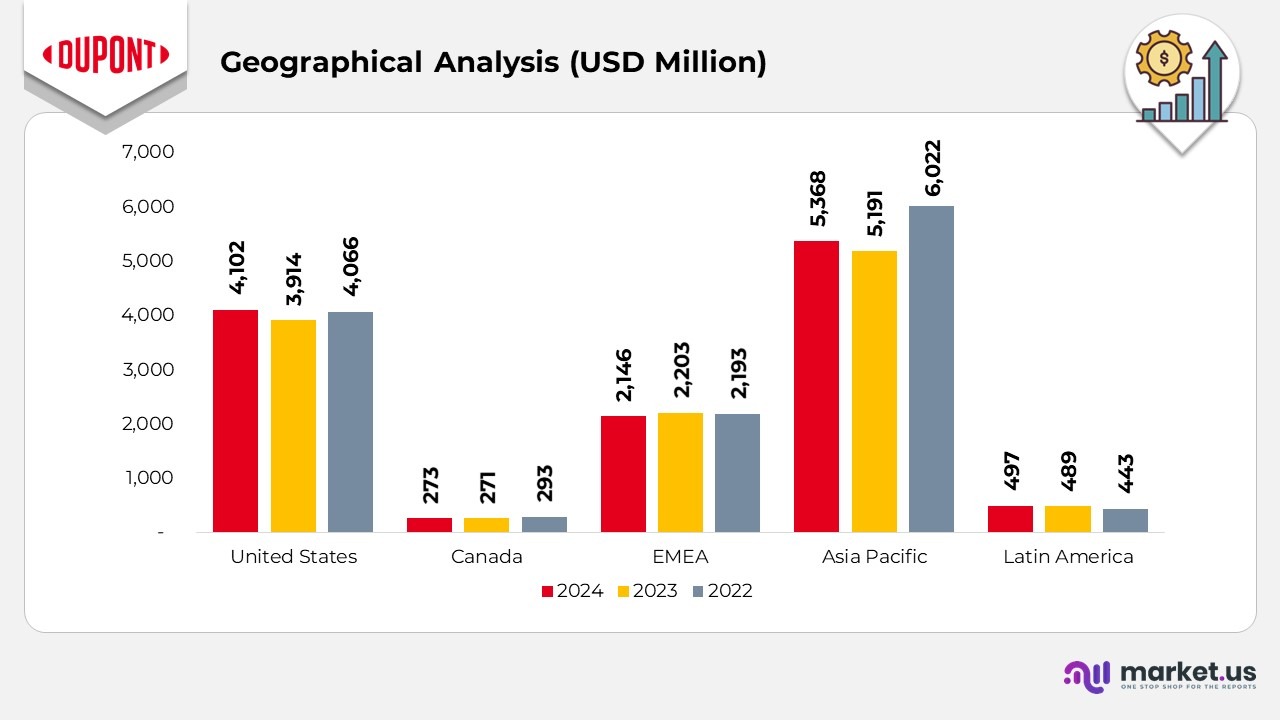

- The United States generated $4,102 million in 2024, up from $3,914 million in 2023, and nearly matching $4,066 million in 2022, reflecting stable performance in its largest market.

- Canada recorded $273 million in 2024, slightly above $271 million in 2023 but below $293 million in 2022, indicating mild year-to-year variation.

- The EMEA region reported $2,146 million in 2024, compared with $2,203 million in 2023 and $2,193 million in 2022, indicating steady results across Europe, the Middle East, and Africa.

- Asia Pacific delivered $5,368 million in 2024, an increase from $5,191 million in 2023, though still below $6,022 million in 2022, reflecting both ongoing recovery and prior-year highs.

- Latin America achieved $497 million in 2024, improving from $489 million in 2023 and exceeding $443 million in 2022, highlighting consistent growth in the region.

(Source: DuPont de Nemours, Inc. Annual Report)

Consolidated Sales Variance Overview for 2024

- Electronics & Industrial demonstrated strong momentum with a 1% uplift from pricing and product mix, offset by a 1% currency decline. In comparison, an impressive 8% volume increase combined with a 6% boost from portfolio factors delivered an overall 11% gain.

- Water & Protection recorded a 1% rise in local price & product mix but faced a 1% currency drop, alongside a 2% volume decline and a further 2% contraction from portfolio changes, resulting in a total 4% decrease.

- Corporate & Other experienced a 1% reduction in pricing and mix, no currency impact, a 3% decline in volume, and a 1% positive contribution from portfolio actions, resulting in a 3% overall decline.

- S. & Canada maintained stable pricing and currency results, saw a 1% reduction in volume, and benefited from a significant 6% portfolio-driven gain, achieving 5% total growth.

- EMEA was affected by a 2% decline in pricing, a 2% currency headwind, and a 1% volume improvement, with flat portfolio effects, resulting in a 3% decrease overall.

- Asia Pacific posted a 2% decline in pricing and a 1% currency drop, countered by a strong 7% volume increase and a 1% negative portfolio impact, resulting in a 3% net increase.

- Latin America reported a 1% decrease in pricing mix, a 1% currency rise, a 2% volume gain, and a 3% portfolio-driven improvement, finishing with 2% overall growth.

(Source: DuPont de Nemours, Inc. Annual Report)

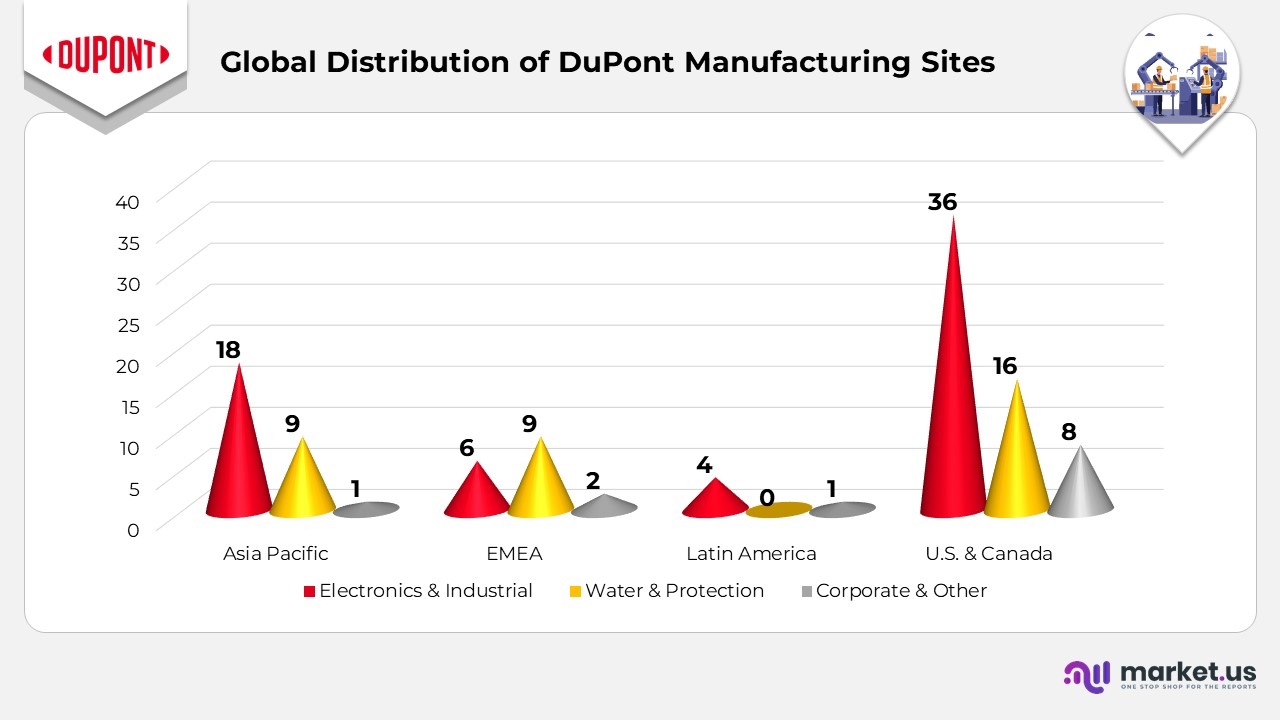

Global Distribution of DuPont Manufacturing Sites Statistics

- In 2024, the Asia Pacific recorded 28 manufacturing sites, including 18 under Electronics & Industrial, 9 under Water & Protection, and 1 under Corporate & Other.

- EMEA operated 17 facilities, comprising 6 Electronics & Industrial sites, 9 Water & Protection locations, and 2 Corporate & Other units.

- Latin America maintained 5 manufacturing sites, with 4 in Electronics & Industrial and 1 serving Corporate & Other operations.

- S. & Canada had the largest footprint, with 60 sites, including 36 Electronics & Industrial, 16 Water & Protection, and 8 Corporate & Other facilities.

- Across all regions, DuPont operated 110 manufacturing sites in 2024, reflecting a diversified operational presence that supports its worldwide production network.

(Source: DuPont de Nemours, Inc. Annual Report)

DuPont de Nemours, Inc. Patents

| Publication Number | Title | Type | Filed Date | Publication / Patent Date |

|---|---|---|---|---|

| 7001951 | Process aid for melt processable polymers | Grant | February 11, 2003 | February 21, 2006 |

| 6992143 | Curable perfluoroelastomer composition | Grant | June 8, 2004 | January 31, 2006 |

| 6946511 | Plasma-resistant elastomer parts | Grant | October 20, 2003 | September 20, 2005 |

| 6932354 | Valve seal assembly | Grant | February 6, 2003 | August 23, 2005 |

| 6927259 | Curable base-resistant fluoroelastomers | Grant | April 1, 2003 | August 9, 2005 |

| 6924344 | Curable base-resistant fluoroelastomers | Grant | November 24, 2003 | August 2, 2005 |

| 6916887 | Curable base-resistant fluoroelastomers | Grant | April 1, 2003 | July 12, 2005 |

| 6906137 | Process aid masterbatch for melt processable polymers | Grant | January 21, 2004 | June 14, 2005 |

| 6894118 | Process aid for melt processable polymers | Grant | June 23, 2003 | May 17, 2005 |

| 6887959 | Curable base-resistant fluoroelastomers | Grant | September 24, 2003 | May 3, 2005 |

| 6875820 | Chlorinated polyolefin impact modifier | Grant | April 18, 2001 | April 5, 2005 |

| 6875814 | Process aid for melt processable polymers | Grant | June 23, 2003 | April 5, 2005 |

| 6852417 | Adhesion-improving primer for fluoroelastomers | Grant | May 5, 2003 | February 8, 2005 |

| 6849694 | PVC impact modifier compositions | Grant | January 15, 2003 | February 1, 2005 |

| 6830808 | Perfluoroelastomer articles with improved surface properties | Grant | July 2, 2003 | December 14, 2004 |

| 6825389 | Process for manufacturing diiodoperfluoroalkanes | Grant | November 21, 2002 | November 30, 2004 |

| 6803417 | Polyolefin powder for slush molding | Grant | September 25, 2002 | October 12, 2004 |

| 6803391 | UV-curable elastomer composition | Grant | September 20, 2002 | October 12, 2004 |

| 6794455 | Coagents for fluoroelastomer curing | Grant | December 12, 2002 | September 21, 2004 |

| 6774186 | Rheology-modified thermoplastic elastomers | Grant | February 10, 2003 | August 10, 2004 |

(Source: Justia Patents)

Recent Developments

- In November 2025, the company advanced the expansion of its new MOLYKOTE specialty lubricants plant in Zhangjiagang, Jiangsu Province, reinforcing capacity, innovation, and customer responsiveness, with the site expected to be operational by early 2027.

- In November 2024, the company partnered with Habitat for Humanity International, committing product donations and cash support to facilitate employee-led volunteer housing initiatives globally.

- In November 2024, the company launched Tyvek with Renewable Attribution (RA), enabling lower-carbon healthcare packaging solutions through sourcing reduced-footprint materials.

- In October 2024, the company was honored with Samsung Electronics’ 2024 Best Partner Award in the Innovation category for advancements in semiconductor polishing pad technology.

- In October 2024, the company entered a collaboration with Zhen Ding Technology Group to accelerate the development of high-performance printed circuit board technologies.

- In October 2024, the company expanded photoresist production capacity at its Sasakami facility in Niigata, Japan, marking the start of the project with a traditional ceremony.

- In September 2024, the company introduced a digital tool for estimating the sustainability impact of water treatment technologies.

- In August 2024, the company launched two new commercial construction accessories, DuraGard WD LiquidArmor FJ Flashing and Self-Adhered Flashing Tape & Joint Compound, to enhance barrier continuity and integrate with the ArmorWall system.

(Source: DuPont de Nemours, Inc. Press Release)