Company Overview

China Petroleum & Chemical Corporation (Sinopec Corp.) is a fully integrated energy and chemical enterprise engaged across the entire oil and gas value chain. Its core operations span the exploration and extraction of crude oil and natural gas, as well as the production, marketing, storage, and transportation of refined fuels, petrochemicals, coal-chemical derivatives, synthetic fibres, and a broad range of chemical products. The company operates as both a major producer of upstream resources and a large-scale refiner, transforming crude oil and gas into gasoline, diesel, jet fuel, polymers, resins, fertilizers, and other high-value derivatives.

The company operates in 5 business segments namely, Exploration and Production — focuses on exploring and developing oil and gas fields, producing crude oil and natural gas, and supplying these products to the Group’s refining operations as well as external customers, Refining — responsible for processing and refining crude oil sourced from both the Group’s exploration segment and third-party suppliers, and for producing and selling a wide range of petroleum-based products.

Marketing and Distribution — manages oil depots and service stations across the People’s Republic of China (PRC), handling the Distribution and sale of refined petroleum products through an extensive wholesale and retail network. Chemicals — engaged in manufacturing and marketing petrochemical products, downstream chemical derivatives, and a broad portfolio of other chemical products for external clients, and Others — includes the Group’s import and export trading operations and the research and development activities carried out by various subsidiaries.

Further

By the close of 2024, the company had advanced nine overseas refining and storage initiatives across seven countries and regions, including the Hong Kong SAR. These international assets accounted for 7.5 million tonnes of refining capacity, 1.61 million cubic meters of storage capacity, 160 thousand tonnes of lubricant and grease output, and 11.9 thousand tonnes of nitrile rubber production on an annual equity basis. During 2024, Sinopec moved several strategic global projects forward, securing FID and regulatory approvals for its polyethylene project in Kazakhstan. Completing the feasibility study and agreement framework for the Yasref+ Project in Saudi Arabia, and expanding production capabilities at its lubricant facility in Singapore.

In global retail operations, Sinopec managed 239 service stations across five countries and regions by year-end 2024, including Hong Kong SAR. The year also marked its entry into Australia’s refined fuel retail sector and the expansion of its network in Southeast Asia, highlighted by the addition of four new service stations in Singapore and Thailand.

History of China Petroleum & Chemical Corporation (Sinopec Corp.)

- 25/02/2000: Integrated by China Petrochemical Corporation (Sinopec Group) as the sole initiator

- 19/10/2000: Listed on LSE, HKEX, and NYSE with an IPO of 16.78 billion H shares and ADS

- 20/06/2001: Issued 2.8 billion A shares

- 08/08/2001: Listed on the Shanghai Stock Exchange

- 08/2001: Acquired the effects of Sinopec Star Petroleum Co., Ltd.

- 04/2002: Formed Sinopec Hubei Xinghua Co., Ltd. complete asset emergency and equity allocation

- 12/2004: Merged Beijing Yanhua Co., Ltd., Sinopec’s H-share subsidiary

- 10/2005: Formed Wuhan Phoenix Co., Ltd. via asset exchange and equity transfer

- 11/2005: Merged Zhenhai Refining & Chemical Company, another H-share subsidiary

- 04/2006: Launched tender agreement to acquire four A-share subsidiaries: Qilu Petrochemical, Yangzi Petrochemical, Zhongyuan Petrochemical, and Dynamic Group

- 10/2006: Implemented reform of non-tradable A shares

- 01/2007: Formed Shijiazhuang Refining & Chemical Company via equity assignment and asset replacement.

- 04/2007: Issued HKD 11.7 billion convertible bonds

Moreover

- 02/2008: Issued RMB 30 billion warrant bonds in China

- 09/2008: Formed Sinopec Wuhan Petroleum Group Co., Ltd., complete asset acquisition and equity allocation

- 03/2009: Acquired research institutes and related assets from Sinopec Group for RMB 3.946 billion, and continued acquiring refining, chemical, oilfield, and pipeline assets totaling RMB 23.896 billion since 2002

- 03/2010: Acquired 50% interest in Angola Block 18 from Sinopec Group

- 02/2011: Issued 23 billion A-share convertible bonds

- 02/2013: Completed placement of 2.8 billion new H shares

- 03/2013: Acquired partial interests in Sinopec Group’s overseas upstream projects in Kazakhstan (CIR), Russia (UDM), and Colombia (Mansarovar)

- 03/2015: Completed capital increase and investor introduction for Sinopec Marketing Co., Ltd.

- 12/2016: Completed capital increase and investor introduction for Sinopec Natural Gas Pipeline (Sichuan–East China Transmission)

- 07/2018: Financed RMB 4.9 billion to co-create Sinopec Capital Co., Ltd. with a total capital of RMB 10 billion

- 04/2020: Completed asset reorganization of Sinopec Zhanjiang Dongxing Petrochemical Co., Ltd. and Zhongke (Guangdong) Refining Chemical Co., Ltd.

- 09/2020: Sold oil and gas pipeline-related assets to China Oil & Gas Piping Network Corp.

(Source: Company Website)

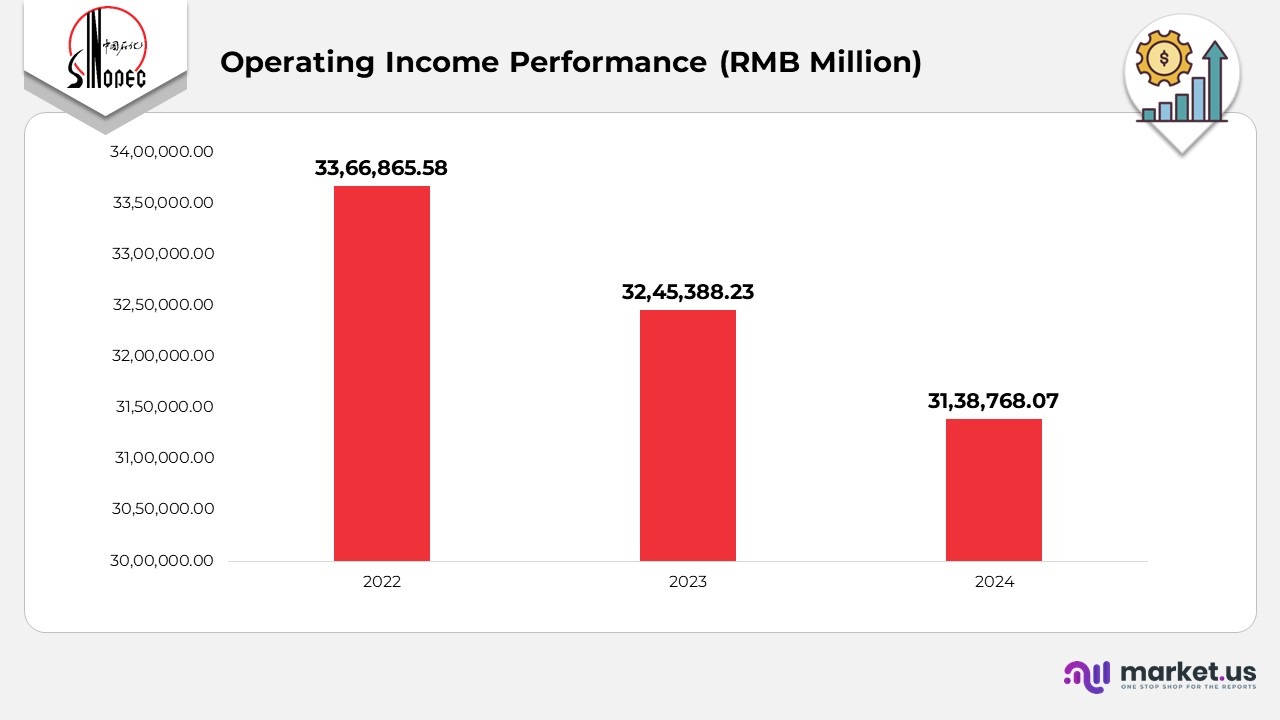

Operating Income Performance

- The company recorded operating income of RMB 3,138,768.07 million in 2024, reflecting a notable improvement in operational activity.

- Operating income for 2023 totalled RMB 3,245,388.23 million, indicating stable revenue growth compared to the prior cycle.

- In 2022, the firm achieved an operating income of RMB 3,366,865.58 million, the highest in the three years.

(Source: China Petroleum & Chemical Corporation (Sinopec Corp.) Annual Report)

Oil and Gas Exploration and Development

- Overseas equity crude oil production reached 1,810.42 × 10,000 tonnes in 2024, reflecting a multi-year decline from 2,409.67 (2023), 2,699.57 (2022), 2,829.21 (2021), and 2,838.76 (2020).

- Overseas equity natural gas output was 82 × 100 million m³ in 2024, remaining close to the previous four-year range of 94.85 (2023), 98.39 (2022), 99.55 (2021), and 102.09 (2020)

- By the end of 2024, Sinopec managed 48 overseas oil and gas exploration and development projects distributed across 23 countries, sustaining a globally diversified mix of onshore, offshore, conventional, and unconventional assets.

- During 2024, the company intensified its reserve-growth initiatives, completing 1,006 km of 2D seismic surveys and drilling 44 exploration wells, which contributed an additional 11 million tonnes of oil-equivalent to 2P reserves and 2C contingent resources.

- Sinopec advanced its development programs by drilling 466 development wells. Resulting in an incremental 18 million tonnes of new equity production capacity.

- Total overseas equity output reached 52 million tonnes of oil equivalent, comprising 18.10 million tonnes of crude oil and 9.78 billion cubic meters of natural gas, reinforcing the company’s international production footprint.

- Continuous portfolio optimization remained a priority, with Sinopec securing seven new overseas projects through agreements or acquisitions in 2024 to strengthen its long-term growth pipeline.

- Operational streamlining included divesting lower-performing assets, notably the exit from the Kazakhstan ARMAN project, thereby improving portfolio efficiency and capital allocation.

(Source: China Petroleum & Chemical Corporation (Sinopec Corp.) Annual Report)

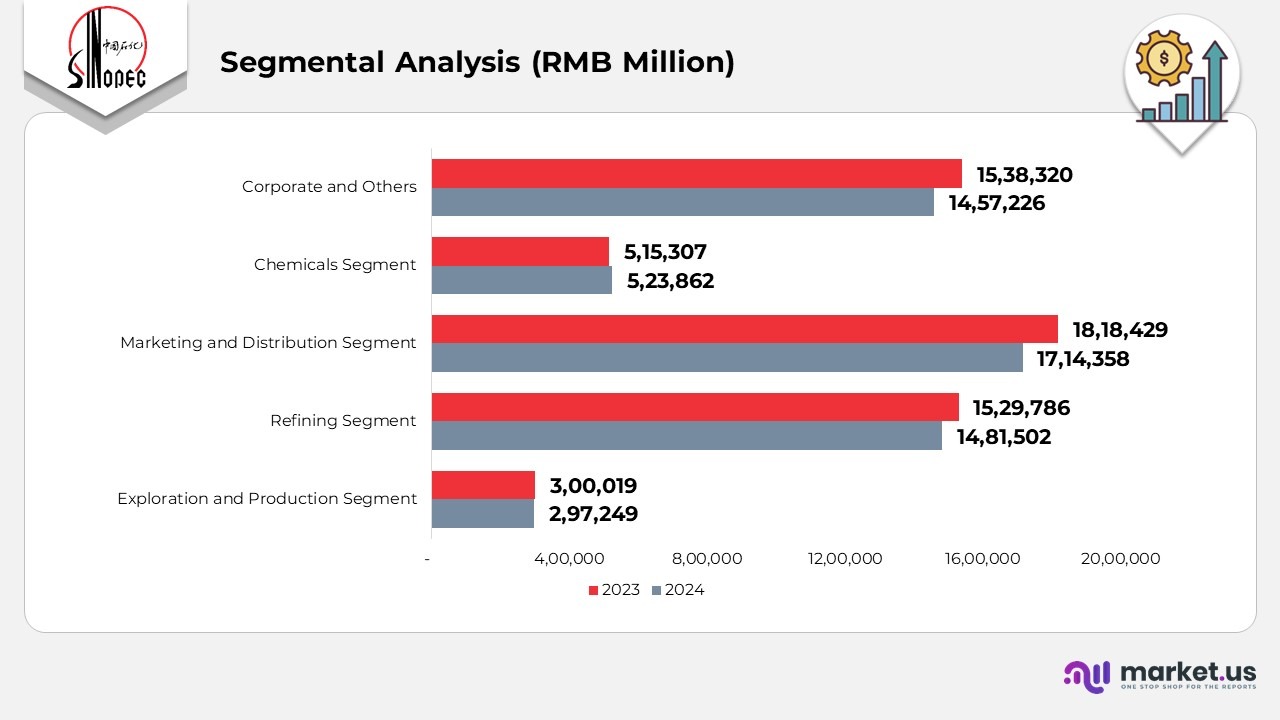

Segmental Analysis

Refining Segment

- Total operating revenue reached RMB 1,481,502 million in 2024, supported by strong processing runs and higher conversion rates in major refineries.

- External sales of RMB 168,774 million reflect growing demand for refined fuels and petrochemical feedstocks across Asian markets.

- Inter-segment sales of RMB 1,312,728 million underline the segment’s role as the primary supplier of fuels and intermediates to downstream units.

- Refinery upgrades, energy-efficiency improvements, and the expansion of high-value chemical integration units reinforced performance.

- Activities include crude procurement from both third parties and the Company’s upstream division. As well as processing crude into fuels and chemical feedstocks.

- Operating revenue reached RMB 1,481.5 billion in 2024, down 2% year-on-year. Due to lower refined product prices amid declining international crude prices.

- Most gasoline, diesel, and kerosene were supplied to the marketing and distribution segment, while chemical feedstock supported the chemicals segment; additional refined products were sold domestically and internationally.

Marketing and Distribution Segment

- The segment generated RMB 1,714,358 million in 2024, backed by a wide retail network and expanding regional fuel demand.

- External revenue of RMB 1,707,021 million highlights the dominance of direct retail and wholesale sales within the portfolio.

- Inter-segment contributions remained minimal at RMB 7,337 million, reflecting the segment’s outward-facing commercial nature.

- Growth momentum stemmed from retail network expansion, competitive pricing strategies, and increasing adoption of premium fuel products.

- The segment purchases refined fuels from the refining division and third parties, selling them through wholesale, direct sales, and a large retail network while offering convenience-store goods and new energy services.

- Operating revenue totalled RMB 1,714.4 billion in 2024, a 7% decline driven by softer demand and lower refined fuel prices.

- Gasoline revenue totalled RMB 813.8 billion, down 2.1% year on year.

- Diesel revenue reached RMB 562.8 billion, falling 1% from 2023.

- Kerosene revenue was RMB 153.0 billion, a 1% decline year-on-year.

- Natural gas revenue increased sharply to RMB 29.5 billion, up 8% year on year.

Chemicals Segment

- Operating revenue reached RMB 523,826 million in 2024, supported by higher output of synthetic resin, rubber, and polymer materials.

- External sales of RMB 425,937 million reflect stable global demand for petrochemical derivatives used in packaging, automotive, and construction industries.

- Inter-segment sales of RMB 97,925 million indicate strong internal consumption of intermediates across integrated chemical complexes.

- Performance benefited from cost-optimized feedstock sourcing, expansion of high-margin specialty chemical lines, and rising export orders.

- The segment converts feedstocks from Refining and third-party suppliers into petrochemicals and inorganic chemicals.

- Operating revenue reached RMB 523.9 billion in 2024, up 1.7% from the prior year, driven by higher prices and sales volumes of chemical products.

- Revenue from the six major chemical categories totalled RMB 485.4 billion, up 0%, representing 92.7% of segment revenue.

- Growth was supported by stronger demand for polymers, synthetic rubber, fertilizers, and basic organic chemicals.

Corporate and Others

- Total operating revenue amounted to RMB 1,457,226 million in 2024, supported by trading activities, logistics operations, and R&D contributions.

- External sales contributed RMB 592,878 million, driven by international trading volumes and diversified product flows.

- Inter-segment sales stood at RMB 864,348 million, reflecting internal supply of services, logistics support, and consolidated procurement benefits.

- Key supporting factors included stronger global trade engagement, digitalization of supply-chain processes, and continuous technology development by group research units.

- This segment covers import/export trading operations, R&D activities, and corporate management functions.

- Operating revenue totalled RMB 1,457.2 billion in 2024, down 5.3% due to lower crude oil trading volumes and lower prices.

- Operating expenses totalled RMB 1,457.7 billion, down 2% year on year.

- The segment recorded an operating loss of RMB 0.4 billion in 2024.

(Source: China Petroleum & Chemical Corporation (Sinopec Corp.) Annual Report)

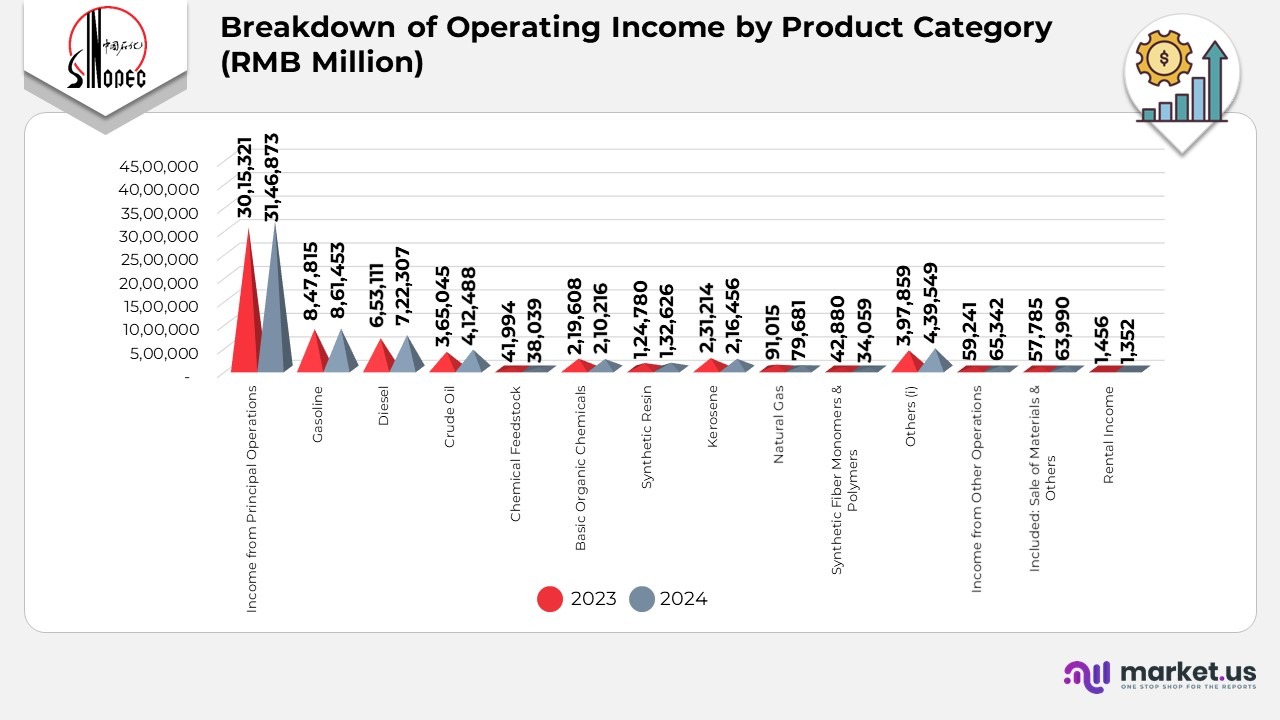

Breakdown of Operating Income by Product Category

- Revenue from principal operations reached RMB 3,015,321 million in 2024, compared with RMB 3,146,873 million in 2023, reflecting softer pricing across several fuel and chemical categories.

- Gasoline contributed RMB 847,815 million, slightly lower than RMB 861,453 million a year earlier, influenced by moderated retail demand.

- Diesel generated RMB 653,111 million, down from RMB 722,307 million, primarily due to weaker industrial consumption and reduced transport activity.

- Crude oil revenue stood at RMB 365,045 million, increasing from RMB 412,488 million in 2023, reflecting shifts in supply allocation and external sales volumes.

- Chemical feedstock revenue amounted to RMB 41,994 million, compared with RMB 38,039 million, supported by increased demand from integrated downstream units.

- Basic organic chemicals recorded RMB 219,608 million, nearly unchanged from RMB 210,216 million, highlighting stable market demand.

- Synthetic resin contributed RMB 124,780 million, rising from RMB 132,626 million, backed by packaging, construction, and manufacturing sectors.

- Kerosene revenue reached RMB 231,214 million, up from RMB 216,456 million, driven by a recovery in aviation activity.

- Natural gas sales rose to RMB 91,015 million, up from RMB 79,681 million, as gas consumption increased across households and industries.

- Synthetic fiber monomers and polymers brought in RMB 42,880 million, compared with RMB 34,059 million, supported by stronger textile and apparel demand.

- Other product categories contributed RMB 397,859 million, nearly matching RMB 439,549 million from the previous year.

- Income from other operations reached RMB 59,241 million, compared with RMB 65,342 million, driven by fluctuations in material sales.

- Rental income rose slightly to RMB 1,456 million, compared with RMB 1,352 million, reflecting expanded asset utilization.

(Source: China Petroleum & Chemical Corporation (Sinopec Corp.) Annual Report)

China Petroleum & Chemical Corporation (Sinopec Corp Patents)

| Patent No. | Title | Type | Filed Date | Patent Date |

|---|---|---|---|---|

| 12473246 | Ethanol-to-Isobutanol Conversion via Dual Catalyst Zones | Grant | 44099 | 45979 |

| 12466778 | CuMn Catalyst for Converting Ethanol/Propanol to Higher Alcohols | Grant | 44088 | 45972 |

| 12344795 | Bio-Chemical Blockage Removal Agent for Oilfield Applications | Grant | 44127 | 45839 |

| 12312302 | Zeolite Catalyst for Enhanced Phenol Transalkylation | Grant | 44104 | 45804 |

| 12129226 | Syngas–Ethanol Integrated Isobutanol Production Process | Grant | 43727 | 45594 |

| 12123661 | Spiral-Fin Heat Transfer Tube for High-Temperature Furnaces | Grant | 43398 | 45587 |

| 12060319 | Cu-Based Catalyst for Acetoin Production | Grant | 44581 | 45517 |

| 12031410 | Percussion-Driven Drilling Tool with Elastic Compression | Grant | 44085 | 45482 |

| 11976891 | Gradient Spiral-Fin Tube for Improved Heat Transfer | Grant | 43398 | 45419 |

| 11952860 | Multi-Stage Cementing Device with Shear-Pin System | Grant | 44228 | 45391 |

| 11946342 | Rotary-Impact Drilling Tool for High-Power Operations | Grant | 44085 | 45384 |

| 11920437 | High-Speed Percussive Drilling Acceleration Tool | Grant | 44085 | 45356 |

| 11885201 | Erosion-Resistant Sliding Sleeve for Downhole Use | Grant | 42748 | 45321 |

| 11820690 | Recovery of Ammonium-Salt Wastewater via Crystallization | Grant | 44103 | 45251 |

| 11767280 | Integrated Aromatic Separation for Phenol & Xylene Production | Grant | 43500 | 45195 |

| 11733421 | Nuclear Logging Method for True Borehole & Formation Sigma | Grant | 44439 | 45160 |

| 11713409 | Substituted Glycosides for High-Performance Drilling Fluids | Grant | 43651 | 45139 |

| 11703611 | AI-Based Borehole Sigma Prediction Method | Grant | 44455 | 45125 |

| 20230119357 | Neural-Network Subsurface Imaging & Velocity Modeling | Application | 44467 | 45036 |

| 20230083045 | Neural-Network Method for Borehole Sigma Prediction | Application | 44455 | 45001 |

(Source: Justia Patents)

Recent Developments

- In March 2025, Sinopec Engineering Group (SEG) Guangzhou achieved a major milestone in its LNG storage tank project in Algeria by completing the gas-lift operation of the steel dome. This represents the largest LNG tank dome lifting executed by a Chinese company in North Africa and supports Algeria’s national energy development plans.

- In February 2025, the company completed its first international shipment of bio-aviation fuel to Hong Kong. Becoming the first Chinese enterprise to supply sustainable aviation fuel outside mainland China.

- In February 2025, the company signed a Memorandum of Understanding to advance geothermal energy development and technology innovation. Supporting clean-energy expansion in Indonesia and the surrounding region.

- In May 2025, Sinopec signed procurement agreements worth USD 40.9 billion during the 7th China International Import Expo (CIIE). The company also hosted the Sinopec Forum, titled “Building Global Energy Partnerships,” which brought together global energy leaders to discuss collaboration and the energy transition.

- In August 2025, Sinopec announced the establishment of the Carbon Footprint Alliance to accelerate sustainable development. Low-carbon development across the energy and chemical sectors.

- July 2025 – Sinopec and ACWA Power signed an MoU to collaborate on global green-energy projects. Including green hydrogen technologies, and to expand cooperation into new regions beyond the Middle East, North Africa, Central Asia, and Southeast Asia.

- April 2024 – Sinopec and Kazakhstan’s KMG signed an agreement to finalize the equity transfer of Silleno. Strengthening bilateral cooperation in petrochemical investment.

(Source: Saudi Basic Industries Corporation Press Release)