Global AI-Powered Digital Humans Market Size, Share and Analysis Report By Product Type (Interactive Digital Humans, Non-Interactive Digital Humans), By Component (Software Platforms, Services, Hardware Modules), By Deployment Mode (Cloud-based, On-premises), By End-user Industry (Retail and E-commerce, Gaming and Entertainment, BFSI, Education and E-learning, Automotive, Healthcare and Life Sciences, Travel and Hospitality, Telecom and Media, Other Industries), By Technology (Generative-AI Digital Humans, Rule-based / NLP-driven Digital Humans, Real-time Rendering Engine Digital Humans, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172286

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Quick Market Facts

- Demand Analysis

- Increasing Adoption Technologies

- Investment and Business Benefits

- Regulatory Environment

- By Product Type

- By Component

- By Deployment Mode

- By End-User Industry

- By Technology

- By Region

- Emerging Trends Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Industries & Applications

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

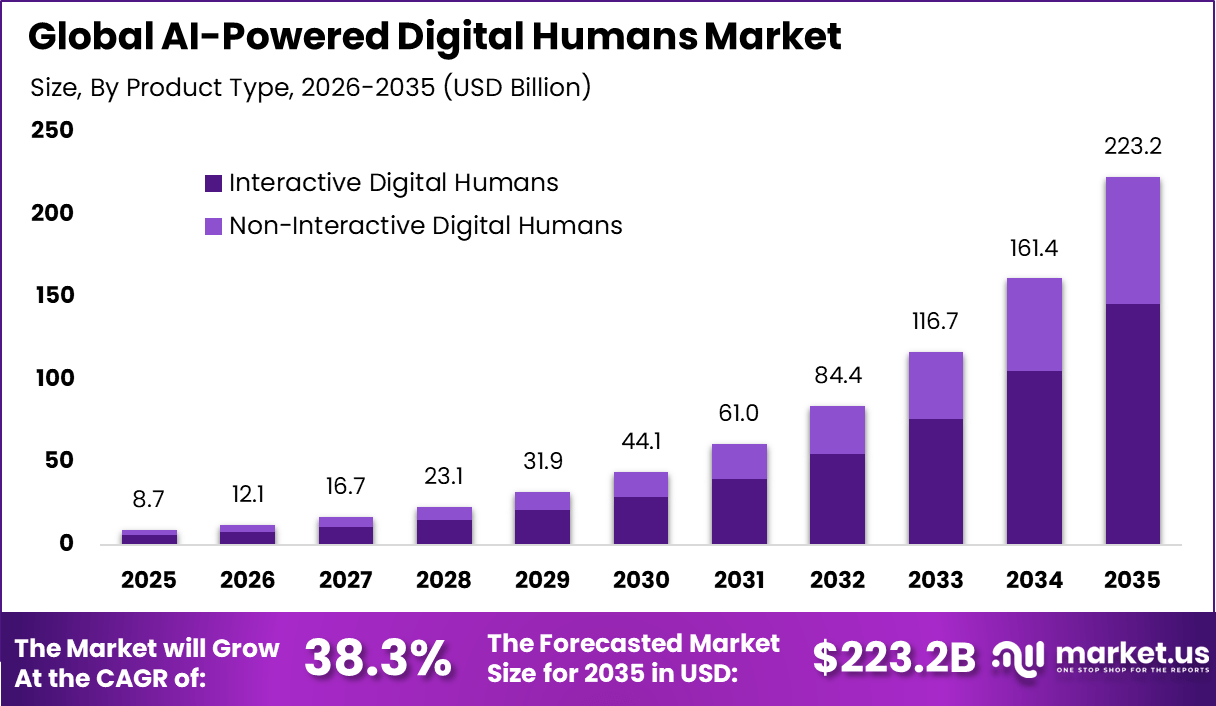

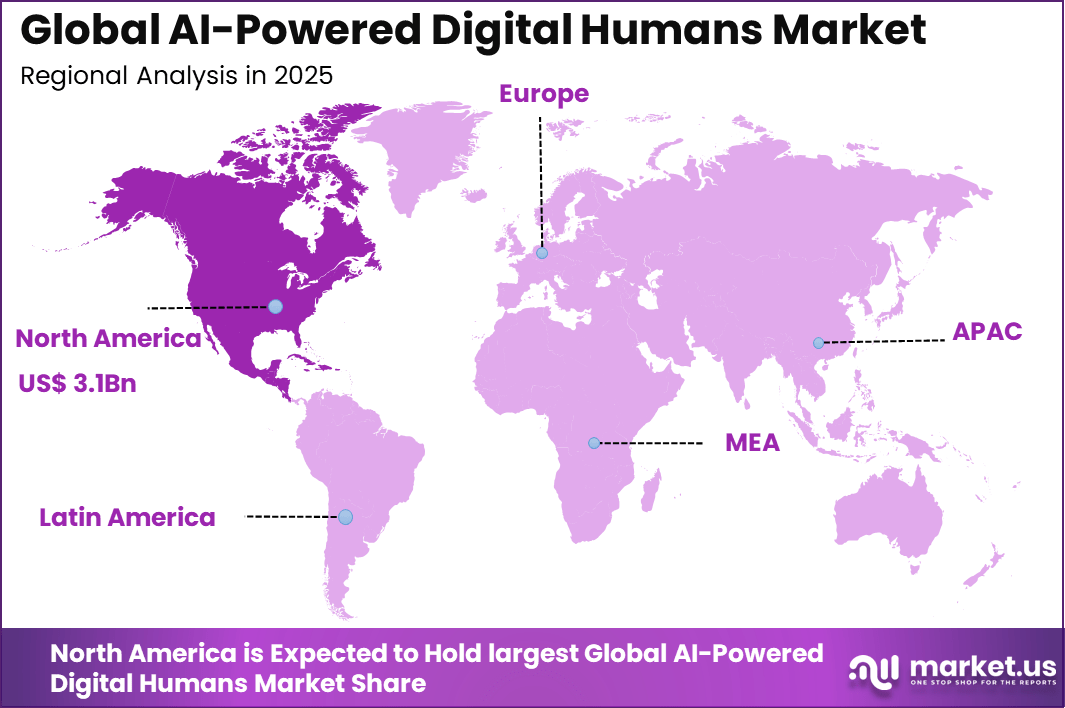

The Global AI-powered digital Humans Market size is expected to be worth around USD 223.2 Billion By 2035, from USD 8.7 billion in 2025, growing at a CAGR of 38.3% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 36.3% share, holding USD 3.1 Billion revenue.

The AI-powered digital Humans Market refers to the ecosystem of technologies and services that create interactive, computer-generated human likenesses capable of engaging with users in real time. These digital humans are driven by artificial intelligence, natural language processing, and advanced graphics to simulate human behavior and communication. They are used in various sectors such as customer service, entertainment, education, and healthcare.

The market includes software platforms, development tools, and implementation services that support digital human creation and deployment. This market is characterized by rapid innovation in AI models, avatar realism, and interaction capabilities. Digital humans can understand and respond to spoken or written language, making them suitable for automated support roles. The growth of this market is tied to improvements in computing power and AI training techniques.

Top Market Takeaways

- Interactive digital humans dominated by product type with a 65.4% share, as businesses increasingly deploy real-time, conversational avatars to enhance customer engagement and support.

- Hardware modules accounted for 53.6%, reflecting strong demand for sensors, cameras, and processing units required to deliver realistic and responsive digital human experiences.

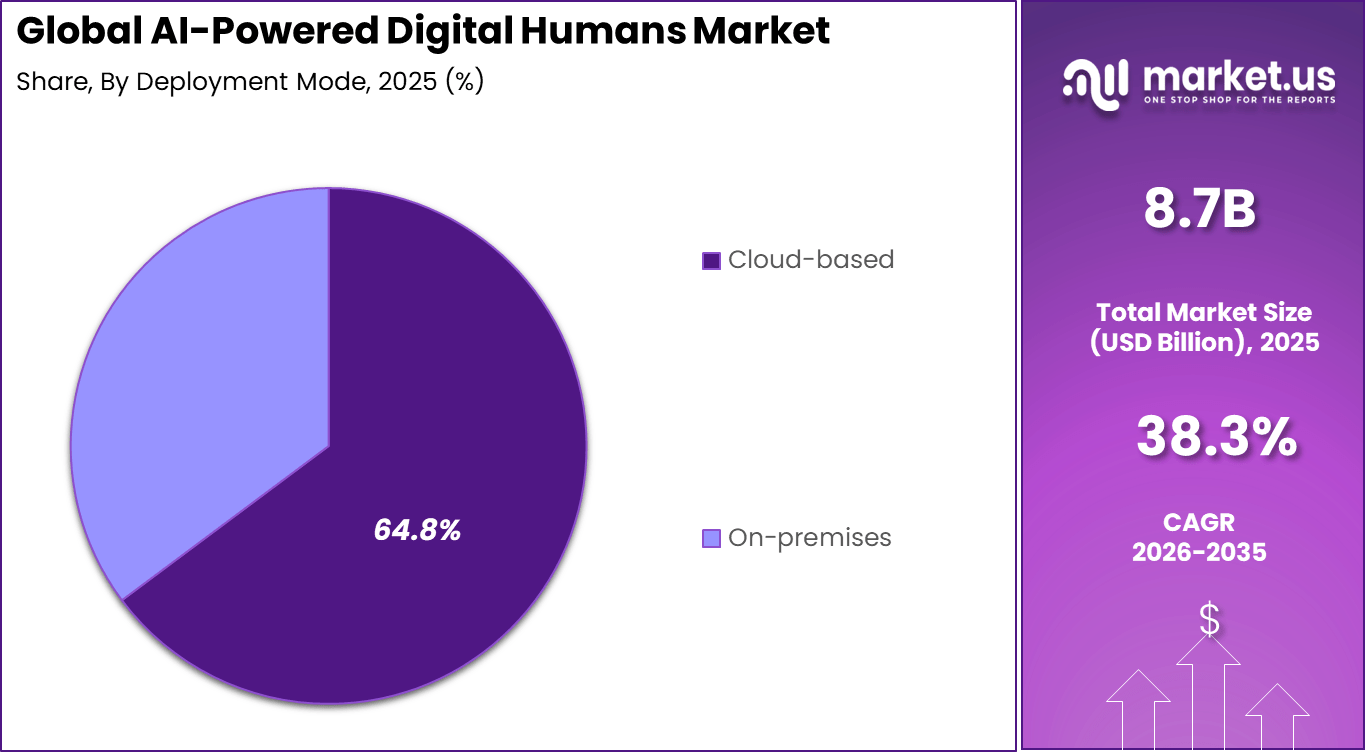

- Cloud-based deployment led with 64.8%, driven by scalability needs, centralized updates, and seamless integration with AI models and enterprise systems.

- Retail and e-commerce represented 32.2% of end-user adoption, supported by use cases such as virtual assistants, digital brand ambassadors, and personalized shopping experiences.

- Generative-AI digital humans captured 48.5%, highlighting growing reliance on advanced AI models for natural language interaction, facial animation, and adaptive behavior.

- North America held 36.3% share, backed by early AI adoption, strong enterprise investment, and advanced digital infrastructure.

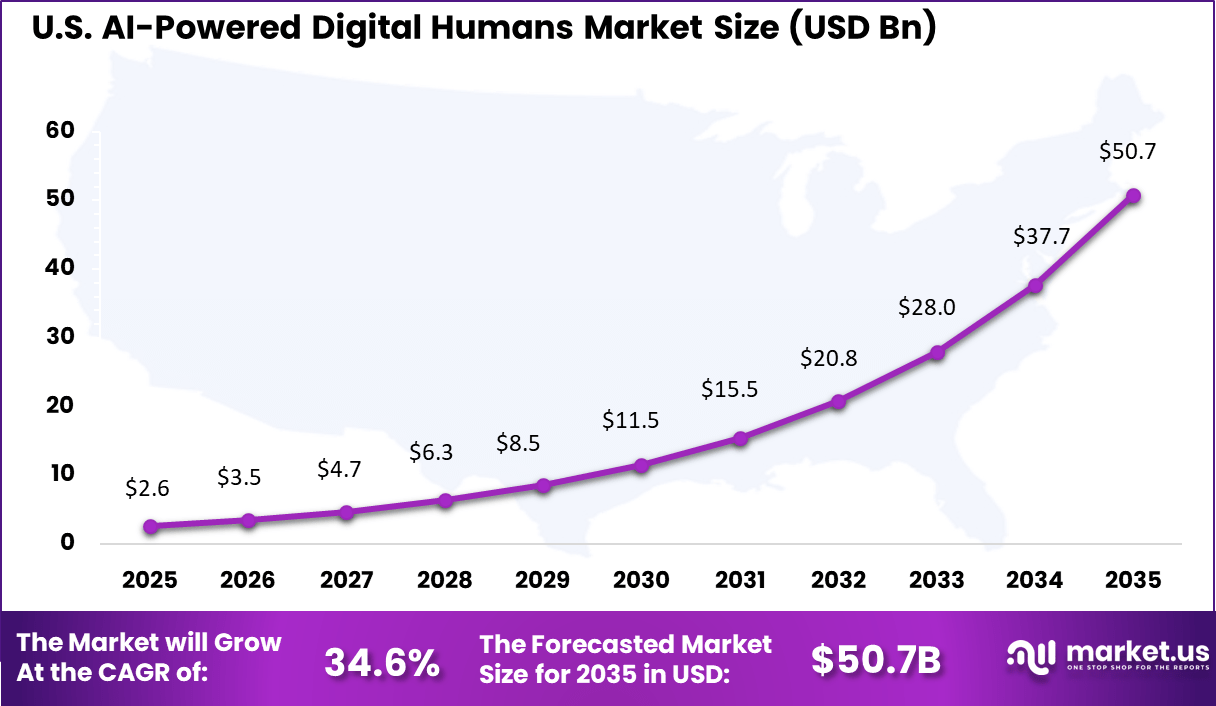

- The U.S. market reached USD 2.69 billion in 2024 and is expanding at a rapid 34.6% CAGR, driven by increasing commercialization of AI-powered avatars across industries.

Quick Market Facts

Corporate Adoption Rates

- 88% of organizations report regular AI use in at least one business function, up from 78% in 2024.

- The Global AI Avatar Market size is expected to be worth around USD 63.5 Billion By 2034, from USD 2.5 billion in 2024, growing at a CAGR of 38.2% during the forecast period from 2025 to 2034.

- In 2024, North America held a dominant market position, capturing more than a 39.2% share, holding USD 0.9 Billion revenue.

- By the end of 2025, around 95% of customer interactions are expected to involve AI technologies.

- 62% of organizations are experimenting with autonomous AI agents for multi step workflows.

Usage Statistics by Industry 2025

- Gaming and entertainment hold 37.4% of total adoption driven by real time avatar usage.

- 80% of retail leaders plan to adopt AI automation by 2025.

- Virtual try ons and digital shopping assistants are used by 32.6% of leading retailers.

- Around 70% of healthcare organizations have implemented or are pursuing generative AI.

- Patient engagement accounts for 62% of healthcare AI use, while administrative efficiency accounts for 60%.

- Over 92% of U.S. banks have deployed AI in some capacity.

- Digital assistants are a priority for 80% of finance leaders.

Consumer Engagement and Sentiment

- 54% of consumers are likely to use AI assistants in retail settings.

- 60% of users prefer voice interaction over typing on mobile devices.

- 75% of users are comfortable with bots for simple queries.

- Only 33% trust bots for complex or sensitive issues.

- Businesses using conversational agents report open rates of 85%.

- Average click through rates reach 40%.

Demand Analysis

Demand for AI-powered digital humans is rising due to the need for scalable and consistent customer engagement solutions. Many industries seek automated but human-like interfaces to handle high volumes of user interactions without long wait times. This demand is particularly strong in sectors like retail, banking, and online services where 24/7 support is valued. End users appreciate immediate responses and conversational experiences that feel natural.

Another driver of demand is the shift toward digital transformation within organizations. Companies are investing in technologies that improve customer experience and operational efficiency. Digital humans are seen as a next step beyond traditional chatbots because they provide richer, more natural interactions. Additionally, post-pandemic trends toward remote service delivery have accelerated interest in virtual engagement tools.

Increasing Adoption Technologies

Several technologies are enabling the adoption of digital humans, including natural language processing and machine learning. These technologies allow digital humans to understand context and provide more accurate responses. Advances in 3D modeling and animation engines also contribute to more realistic and expressive virtual characters. Integration with cloud computing offers scalable infrastructure for deployment across platforms.

Speech synthesis and recognition technologies are key components of digital humans, enabling spoken interaction with users. Improvements in real-time rendering make digital humans appear more lifelike across devices, including mobile and web platforms. AI-based sentiment analysis can help digital humans adjust tone and response style based on user emotions. These combined technologies support richer and more adaptive user experiences.

Organizations adopt AI-powered digital humans to improve customer satisfaction through personalized and immediate interactions. Digital humans can handle routine queries, allowing human staff to focus on more complex tasks. This results in operational efficiency and reduced response times. Users benefit from continuous availability, removing constraints of business hours.

Another reason for adoption is brand differentiation. Companies aim to create memorable and engaging digital touchpoints that strengthen user relationships. Digital humans can represent brand values consistently and deliver tailored information to individual users. Adoption is also driven by cost considerations, as automation can reduce long-term support expenses while maintaining service quality.

Investment and Business Benefits

Investment opportunities in this market include platform development for creating and managing digital humans. Solutions that simplify integration with existing enterprise systems are attractive to potential investors. Tools that enhance natural interaction, such as emotion recognition or multi-language support, present further value. Investors are also exploring analytics capabilities that measure engagement and optimize interactions over time.

Another area for investment is industry-specific digital human applications, such as virtual health assistants or educational tutors. Startups focusing on niche use cases can capture segments where tailored digital human solutions are needed. Partnerships between technology providers and service industries may unlock additional funding and development pathways. The increasing adoption of AI infrastructure also supports investment in scalable and cloud-based digital human services.

A key business benefit of digital humans is improved customer engagement through personalized conversations. Users experience more natural and intuitive interactions compared to traditional interfaces. This can lead to higher satisfaction rates and stronger loyalty. Digital humans can also support multilingual communication, expanding business reach to diverse audiences.

Cost savings and efficiency gains are additional benefits. Automated interaction reduces dependency on large human support teams for routine tasks. Digital humans can operate around the clock, offering consistent service without fatigue. Data collected from interactions can further inform business decisions and optimize service strategies.

Regulatory Environment

The regulatory environment for AI-powered digital humans focuses on data privacy and ethical use of AI. Organizations must comply with laws that protect user information, including how conversation data is stored and processed. Regulations may require clear disclosure when users are interacting with an AI rather than a human. Transparency in data handling practices is essential to meet legal requirements.

Ethical considerations also shape regulatory guidelines, particularly concerning deepfake-like visual representations. Standards may be introduced to prevent misuse of digital human likenesses or unauthorized replication of real individuals. Governments and industry bodies are evaluating frameworks that balance innovation with user protection. Compliance with evolving regulations is a core consideration for businesses deploying digital human solutions.

By Product Type

Interactive digital humans account for 65.4%, showing strong demand for responsive and conversational virtual entities. These digital humans are designed to interact with users through speech, gestures, and facial expressions. They are widely used for customer engagement, guidance, and digital assistance. High realism improves user trust and engagement. Interactive formats deliver more value than static avatars.

Adoption of interactive digital humans is driven by demand for personalized digital experiences. Businesses use them to improve customer interaction across digital channels. These solutions help reduce dependency on human staff for repetitive tasks. Continuous improvement in interaction quality supports wider usage. This product type remains central to market growth.

By Component

Hardware modules hold 53.6%, highlighting the importance of physical infrastructure in digital human deployment. These modules include sensors, cameras, processing units, and display systems. Hardware enables real-time interaction and accurate motion rendering. Reliable hardware is essential for smooth performance. High-quality components improve system responsiveness.

The dominance of hardware modules is driven by increasing demand for realism and performance. Organizations invest in advanced hardware to support complex AI models. Hardware upgrades enhance visual quality and interaction speed. Long-term deployment requires durable and scalable components. This sustains consistent investment in hardware.

By Deployment Mode

Cloud-based deployment accounts for 64.8%, reflecting preference for scalable and flexible infrastructure. Cloud platforms allow digital humans to operate across multiple locations. They support real-time updates and centralized management. Cloud deployment reduces local infrastructure requirements. This improves deployment efficiency.

Growth in cloud-based deployment is driven by ease of access and cost management. Organizations can scale usage based on demand. Cloud environments also support integration with analytics and AI systems. Remote access enables faster rollout across regions. These benefits strengthen adoption.

By End-User Industry

Retail and e-commerce represent 32.2%, making them the leading end-user industry. Digital humans are used as virtual assistants, brand representatives, and shopping guides. They improve customer engagement and product discovery. Visual interaction enhances the buying experience. Retailers value continuous availability.

Adoption in retail and e-commerce is driven by demand for personalized customer interaction. Digital humans help handle large volumes of customer queries. They also support multilingual engagement. Improved interaction quality increases conversion potential. This supports continued industry adoption.

By Technology

Generative-AI digital humans hold 48.5%, showing strong adoption of advanced AI-driven capabilities. These digital humans generate natural responses, expressions, and behaviors in real time. Generative models improve realism and adaptability. This enhances conversational quality. Continuous learning improves performance over time.

Growth in this segment is driven by advances in AI model development. Organizations use generative systems to reduce scripted interactions. These systems support dynamic and context-aware communication. Improved natural language generation supports user satisfaction. This technology remains a key innovation driver.

By Region

North America accounts for 36.3%, supported by strong adoption of AI-driven digital solutions. The region shows high acceptance of virtual interaction technologies. Businesses invest in digital engagement platforms to improve customer experience. Advanced cloud and AI infrastructure supports deployment. The region remains a leading adopter.

The United States reached USD 2.69 Billion with a CAGR of 34.6%, reflecting rapid market expansion. Growth is driven by retail innovation and digital transformation initiatives. Enterprises adopt digital humans to improve scalability and engagement. High investment in AI supports long-term growth. The market shows strong momentum.

Emerging Trends Analysis

The market is being shaped by the increasing adoption of natural language processing and contextual AI to create digital human avatars that interact with users intuitively. These digital humans can understand complex queries, respond with human-like fluency, and maintain continuity across extended interactions.

As voice recognition and generative AI models improve, digital humans are becoming more realistic and engaging for customer support and virtual assistance. This shift is leading to broader deployment across sectors that require personalized and interactive experiences.

Another emerging trend is the integration of visual realism with adaptive emotional intelligence. AI-powered digital humans are now being equipped with facial expressions, tone modulation, and contextual responsiveness that mimic human social cues.

This ability enhances user trust and satisfaction, particularly in settings like online sales, training simulations, and virtual collaboration. The rise of this trend reflects a broader push toward empathetic AI systems that can adapt to individual user needs in real time.

Driver Analysis

Growth in this market is driven by enterprises seeking to improve customer engagement and operational efficiency. Digital humans can handle repetitive inquiries around the clock, reducing reliance on human agents while maintaining high levels of service quality.

Businesses are using these AI avatars to streamline support workflows, personalize user interaction, and optimize resource allocation. As companies expand digital transformation initiatives, demand for advanced conversational and interactive platforms continues to rise.

Another driver is the expanding capability of underlying AI technologies like large language models and computer vision. These systems enable richer, more context-aware interactions that were not previously possible.

Enhanced machine understanding supports complex problem solving and emotional recognition, making digital humans more valuable in real applications. As research and development in core AI components advances, the practical utility of digital humans grows accordingly.

Restraint Analysis

One restraint facing this market is the high development and implementation cost associated with advanced AI models and graphical rendering systems. Crafting lifelike digital humans requires substantial computational resources, specialized talent, and ongoing model training. These factors create entry barriers for smaller enterprises and limit adoption rates outside well-funded organizations. As a result, market growth may remain concentrated among larger players with deeper technology budgets.

Another restraint is user trust and privacy concerns related to AI interactions. Some users may resist engaging with digital humans due to fears around data security, miscommunication, or impersonation. Ensuring transparent governance, data protection, and ethical AI behavior is necessary before wider user acceptance can be achieved. These concerns require careful policy development and clear communication from solution providers.

Opportunity Analysis

Significant opportunities exist in sectors such as healthcare, education, and retail, where personalized interaction can drive stronger user engagement. In healthcare, AI powered digital humans can assist with patient queries, mental health support, and remote consultation workflows.

Education platforms can use these avatars for tailored tutoring and student engagement. These application areas present fertile ground for adoption due to the high value placed on personalized service and support. Another opportunity is the integration of digital humans within enterprise knowledge ecosystems.

Organizations can embed these AI avatars into intranets, customer portals, and collaboration platforms to improve knowledge access and reduce internal friction. Digital humans can serve as interactive knowledge agents that deliver contextual expertise and guidance in real time. This capability enhances productivity and supports digital workforce evolution.

Challenge Analysis

A key challenge is achieving consistent emotional intelligence across diverse user contexts. While digital humans can mimic emotional responses, calibrating these systems to interpret cultural nuances, sentiment subtleties, and dynamic conversational cues remains difficult. Without sophisticated contextual understanding, interactions may feel awkward or misaligned with user expectations. Continuous refinement and training are required to overcome this limitation.

Another challenge lies in ecosystem integration and interoperability. Many organizations operate heterogeneous technology stacks, and embedding AI powered digital humans across platforms often requires complex integration work. Ensuring compatibility with existing CRM, content management, and security frameworks is essential for seamless deployment. Integration challenges can delay implementation timelines and increase project costs.

Key Industries & Applications

Customer Service

- AI powered digital humans act as virtual assistants to handle customer questions across digital channels.

- They provide consistent responses, guide users through processes, and support basic problem resolution.

- Service availability is maintained at all times, improving response speed and customer experience.

- Personalized interactions help customers receive relevant recommendations and clear guidance.

Healthcare

- Digital humans support patients by answering basic health related questions and explaining care steps.

- They assist in patient monitoring by providing reminders and tracking engagement with care plans.

- In mental health settings, they offer structured conversations and emotional support.

- Healthcare staff benefit from reduced routine workload while maintaining patient engagement.

Retail and E commerce

- AI powered digital humans function as virtual shopping assistants for online customers.

- They explain product features, compare options, and guide purchase decisions.

- In physical stores, they act as digital concierges to assist with navigation and promotions.

- This support improves customer confidence and reduces friction during shopping.

Education and Training

- Digital humans are used as virtual tutors to deliver personalized learning experiences.

- Lessons adapt based on learner progress and response patterns.

- In corporate training, they enable practice in controlled and risk free environments.

- Training consistency is improved across teams and locations.

Entertainment and Media

- Digital humans are used as virtual influencers and brand representatives.

- They engage audiences through interactive content and digital storytelling.

- In gaming, they act as responsive characters that interact in real time.

- Media engagement is enhanced through scalable and consistent digital presence.

Key Market Segments

By Product Type

- Interactive Digital Humans

- Non-Interactive Digital Humans

By Component

- Software Platforms

- Services

- Hardware Modules

By Deployment Mode

- Cloud-based

- On-premises

By End-user Industry

- Retail and E-commerce

- Gaming and Entertainment

- BFSI

- Education and E-learning

- Automotive

- Healthcare and Life Sciences

- Travel and Hospitality

- Telecom and Media

- Other Industries

By Technology

- Generative-AI Digital Humans

- Rule-based / NLP-driven Digital Humans

- Real-time Rendering Engine Digital Humans

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Microsoft Corporation, NVIDIA Corporation, Meta Platforms, Inc., Samsung Electronics Co., Ltd., Tencent Holdings Ltd., and Alibaba Group Holding Ltd. lead the AI powered digital humans market by combining advanced AI models, graphics processing, and large scale cloud platforms. Their technologies support real time avatars, conversational agents, and immersive digital experiences. These companies focus on realism, scalability, and integration with enterprise and consumer platforms.

Epic Games, Inc., Soul Machines Ltd., UneeQ Ltd., Didimo Inc., Reallusion Inc., and Inworld AI, Inc. strengthen the market with real time rendering engines, AI driven personality modeling, and avatar creation tools. Their platforms are widely used in gaming, training, marketing, and virtual assistants. These providers emphasize expressive animation, natural interaction, and fast deployment. Growing demand for engaging digital interfaces supports wider adoption.

Synthesia Ltd., iFLYTEK Co., Ltd., ObEN, Inc., Pinscreen, Inc., Digital Domain Holdings Ltd., Virti Ltd., Hour One AI Ltd., and DeepBrain AI expand the landscape with AI video avatars, voice synthesis, and industry specific digital human solutions. Their offerings support education, healthcare, media, and corporate communications. These companies focus on customization, multilingual support, and cost efficiency.

Top Key Players in the Market

- Microsoft Corporation

- Nvidia Corporation

- Meta Platforms, Inc.

- Samsung Electronics Co., Ltd.

- Tencent Holdings Ltd.

- Alibaba Group Holding Ltd.

- Epic Games, Inc.

- Soul Machines Ltd.

- UneeQ Ltd.

- Didimo Inc.

- Reallusion Inc.

- Inworld AI, Inc.

- Synthesia Ltd.

- iFLYTEK Co., Ltd.

- ObEN, Inc.

- Pinscreen, Inc.

- Digital Domain Holdings Ltd.

- Virti Ltd.

- Hour One AI Ltd.

- DeepBrain AI

- Others

Recent Developments

- September, 2025 – Synthesia integrated Google’s Veo 3 generative video model into its platform, enabling hyperreal digital humans in dynamic environments with real-time conversational responses, gaze tracking and micro-expressions for corporate training and support.

- March, 2025 – Inworld AI showcased production-scale AI characters at GDC partnering with Virtuos on AAA titles, using NVIDIA ACE for low-latency NPC behaviors, multi-player dialogues and developer controls over memory/personality in Unity/Unreal.

- January, 2025 – NVIDIA rolled out generative physical AI models and Cosmos World foundation models in Omniverse at CES, supercharging digital humans with photorealistic synthetic data generation for robotics, avatars and immersive training – RTX 50 Series GPUs now handle NIM-accelerated inference locally.

Report Scope

Report Features Description Market Value (2025) USD 8.7 Bn Forecast Revenue (2035) USD 223.2 Bn CAGR(2026-2035) 38.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Interactive Digital Humans, Non-Interactive Digital Humans), By Component (Software Platforms, Services, Hardware Modules), By Deployment Mode (Cloud-based, On-premises), By End-user Industry (Retail and E-commerce, Gaming and Entertainment, BFSI, Education and E-learning, Automotive, Healthcare and Life Sciences, Travel and Hospitality, Telecom and Media, Other Industries), By Technology (Generative-AI Digital Humans, Rule-based / NLP-driven Digital Humans, Real-time Rendering Engine Digital Humans, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Nvidia Corporation, Meta Platforms, Inc., Samsung Electronics Co., Ltd., Tencent Holdings Ltd., Alibaba Group Holding Ltd., Epic Games, Inc., Soul Machines Ltd., UneeQ Ltd., Didimo Inc., Reallusion Inc., Inworld AI, Inc., Synthesia Ltd., iFLYTEK Co., Ltd., ObEN, Inc., Pinscreen, Inc., Digital Domain Holdings Ltd., Virti Ltd., Hour One AI Ltd., DeepBrain AI, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  AI-Powered Digital Humans MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

AI-Powered Digital Humans MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Nvidia Corporation

- Meta Platforms, Inc.

- Samsung Electronics Co., Ltd.

- Tencent Holdings Ltd.

- Alibaba Group Holding Ltd.

- Epic Games, Inc.

- Soul Machines Ltd.

- UneeQ Ltd.

- Didimo Inc.

- Reallusion Inc.

- Inworld AI, Inc.

- Synthesia Ltd.

- iFLYTEK Co., Ltd.

- ObEN, Inc.

- Pinscreen, Inc.

- Digital Domain Holdings Ltd.

- Virti Ltd.

- Hour One AI Ltd.

- DeepBrain AI

- Others