Global Wood Sanding Machine Market Size, Share, Growth Analysis By Machine Type (Belt Sanders, Orbital Sanders, Drum Sanders, Disc Sanders), By Operation (Portable/Handheld Professional, Automatic CNC Lines, Semi-Automatic), By End-Use (Furniture Manufacturing, Carpentry & Woodworking Shops, Construction & Renovation, Cabinet & Interior Fittings, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175356

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

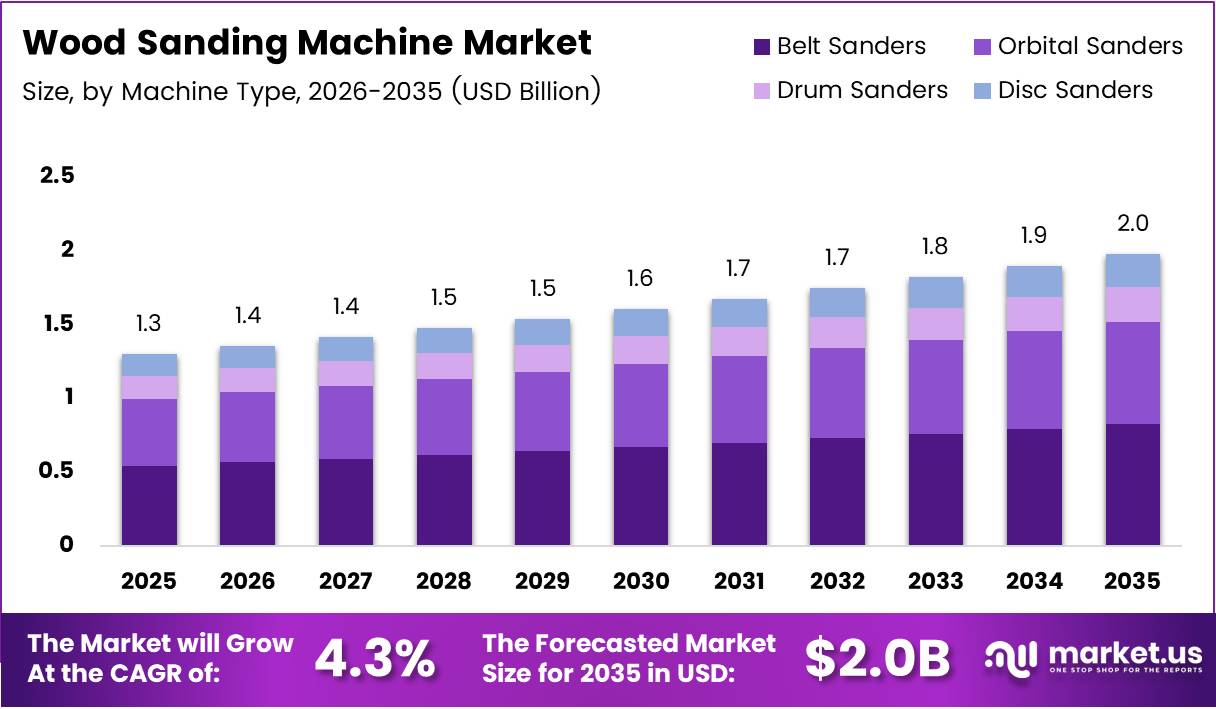

Global Wood Sanding Machine Market size is expected to be worth around USD 2.0 Billion by 2035 from USD 1.3 Billion in 2025, growing at a CAGR of 4.3% during the forecast period 2026 to 2035.

Wood sanding machines represent critical equipment in woodworking operations. These systems remove material from wood surfaces to achieve smooth finishes and precise dimensions. Manufacturers deploy belt sanders, orbital sanders, drum sanders, and disc sanders across furniture production, carpentry, and construction sectors.

Market expansion reflects modernization trends in global furniture manufacturing. Automated finishing lines replace manual sanding processes in high-volume production facilities. Moreover, compact portable sanders continue serving small workshops and renovation contractors requiring flexible equipment solutions.

Industrial woodworking facilities drive demand for wide-belt automated systems. These machines process large panels and engineered wood products with consistent quality standards. Additionally, CNC-controlled sanding lines integrate with digital manufacturing workflows to optimize throughput and reduce material waste.

Government manufacturing policies accelerate market development globally. Nearshoring initiatives and industrial infrastructure investments create opportunities for equipment suppliers. Furthermore, environmental regulations push adoption of energy-efficient motors and advanced dust collection systems in production environments.

Technology integration transforms traditional sanding equipment capabilities. Smart sensors enable real-time surface quality monitoring during processing cycles. Consequently, manufacturers achieve tighter tolerances while reducing abrasive consumption and energy costs through data-driven process optimization.

In March 2024, WEINIG signed an agreement to acquire Stähle-Hess’ Rotofinish, Gloria, and Saturn sanding machine portfolio. This strategic expansion strengthened WEINIG’s position in woodworking finishing equipment markets. The acquisition demonstrated consolidation trends among leading machinery manufacturers.

According to EU regulatory frameworks, Ecodesign Lot 5 Phase-2 enforcement pushes OEMs to replace high-power sanding motors with IE5-class energy-efficient drives. This compliance requirement creates significant retrofit opportunities across European manufacturing facilities. Additionally, global plywood and MDF capacity expansion in Vietnam and Indonesia drives demand for wide-belt industrial sanding machines.

Key Takeaways

- Global Wood Sanding Machine Market projected to reach USD 2.0 Billion by 2035 from USD 1.3 Billion in 2025

- Market growing at CAGR of 4.3% during forecast period 2026-2035

- Belt Sanders segment dominates By Machine Type with 37.9% market share in 2025

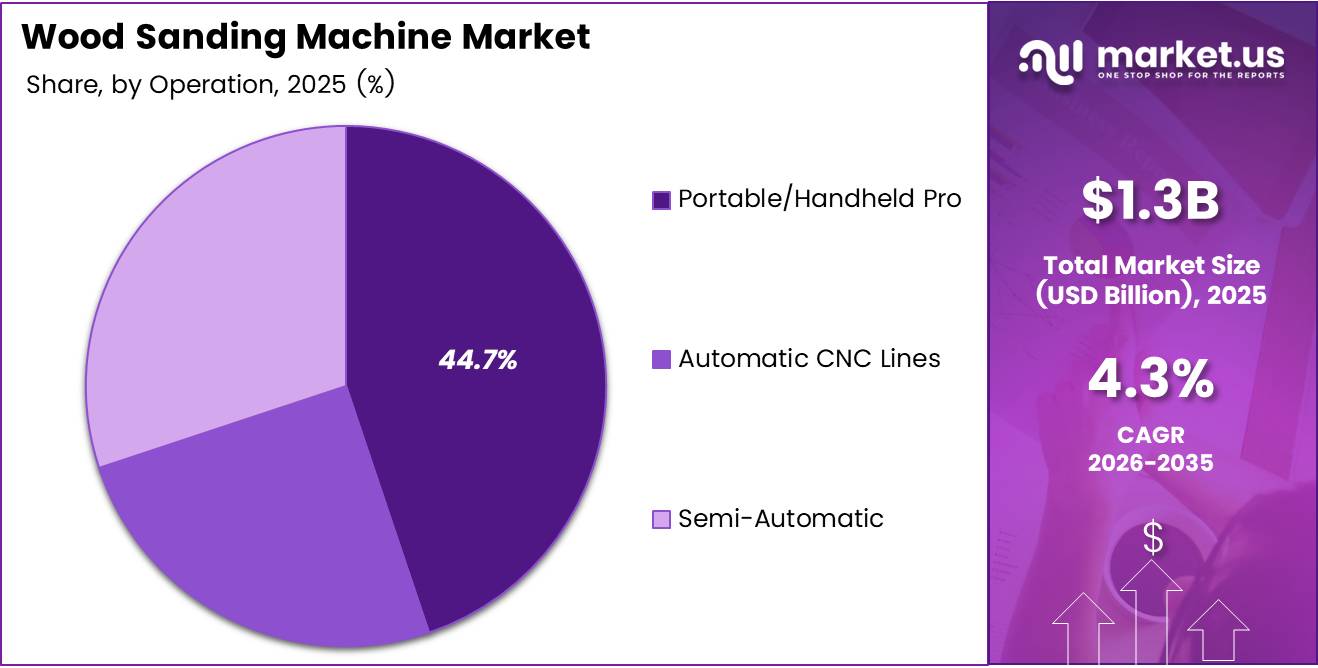

- Portable/Handheld Professional segment leads By Operation with 44.7% share in 2025

- Furniture Manufacturing segment commands 46.2% share in By End-Use segment in 2025

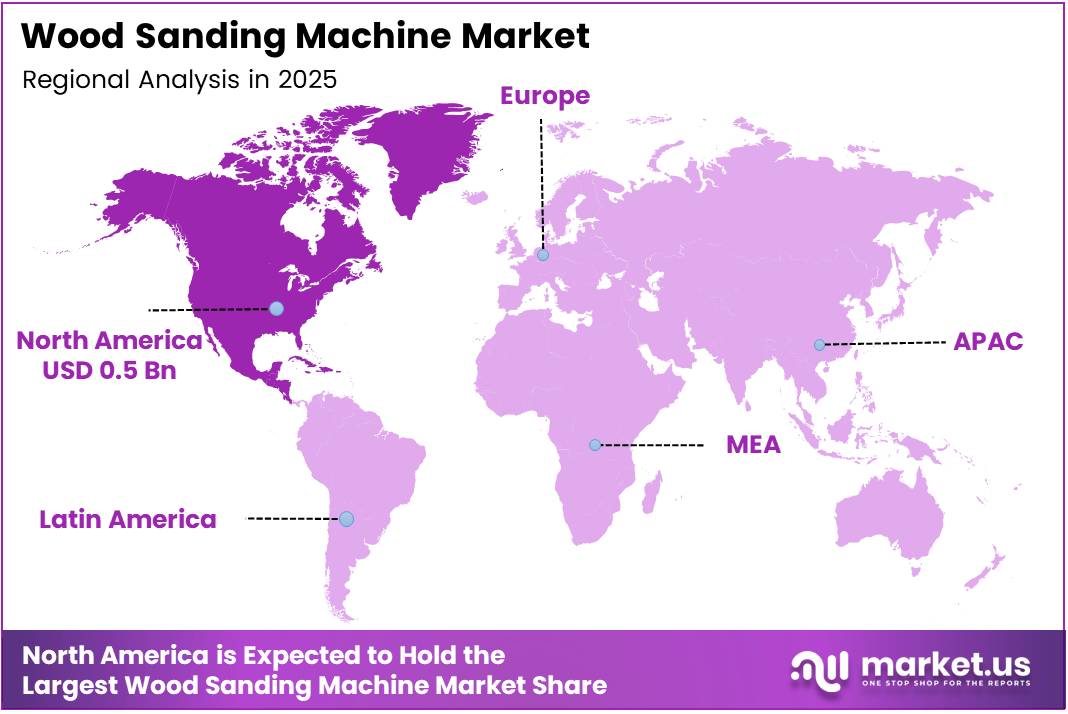

- North America dominates regional market with 45.1% share, valued at USD 0.5 Billion in 2025

Machine Type Analysis

Belt Sanders dominate with 37.9% due to versatile wide-surface processing capabilities and industrial-scale throughput efficiency.

In 2025, Belt Sanders held a dominant market position in the By Machine Type segment of Wood Sanding Machine Market, with a 37.9% share. Belt sanders deliver continuous abrasive action across wide surfaces, making them essential for panel processing and furniture manufacturing. Industrial facilities prefer belt sanding systems for consistent material removal rates and superior finish quality.

Orbital Sanders capture significant market presence through precision finishing applications. These machines employ circular sanding patterns that minimize cross-grain scratching on delicate wood species. Consequently, cabinet makers and furniture refinishers choose orbital sanders for final surface preparation before coating operations.

Drum Sanders serve specialized heavy-duty applications in millwork operations. These systems excel at dimensioning solid wood planks and reducing thickness variations in large timber pieces. Therefore, lumber processing facilities and hardwood flooring manufacturers rely on drum sanders for aggressive stock removal requirements.

Disc Sanders address edge finishing and detail work requirements. These compact machines provide localized material removal for curved profiles and intricate woodworking projects. Additionally, small workshops utilize disc sanders for sharpening, deburring, and precise edge preparation tasks.

Operation Analysis

Portable/Handheld Professional segment dominates with 44.7% due to contractor flexibility requirements and small workshop operational preferences.

In 2025, Portable/Handheld Professional held a dominant market position in the By Operation segment of Wood Sanding Machine Market, with a 44.7% share. Portable sanding equipment enables on-site finishing work at construction locations and renovation projects. Moreover, contractors value cordless battery-powered models that eliminate power supply constraints during field operations.

Automatic CNC Lines represent advanced manufacturing automation solutions. These integrated systems combine multiple sanding operations with robotic material handling and digital process control. Furthermore, high-volume furniture manufacturers invest in CNC sanding lines to achieve consistent quality across thousands of identical components.

Semi-Automatic equipment bridges manual processes and full automation. These machines require operator intervention for loading and positioning while automating the sanding cycle itself. Consequently, medium-sized woodworking shops deploy semi-automatic sanders to increase productivity without complete production line restructuring investments.

End-Use Analysis

Furniture Manufacturing dominates with 46.2% due to mass production volumes and stringent surface quality standards across residential and commercial segments.

In 2025, Furniture Manufacturing held a dominant market position in the By End-Use segment of Wood Sanding Machine Market, with a 46.2% share. Furniture factories require sanding equipment for every production stage from rough dimensioning through final finishing. Additionally, increasing demand for engineered wood furniture accelerates adoption of automated wide-belt sanding systems in manufacturing facilities.

Carpentry and Woodworking Shops utilize diverse sanding equipment for custom fabrication projects. These specialized businesses demand versatile machines capable of handling varied wood species and project scales. Therefore, professional workshops invest in multiple sander types to address different finishing requirements efficiently.

Construction and Renovation sectors drive portable sander demand significantly. Contractors perform on-site floor refinishing, trim preparation, and surface restoration work requiring mobile equipment solutions. Moreover, residential remodeling activity directly correlates with handheld sander sales in regional markets.

Cabinet and Interior Fittings manufacturers require precision finishing capabilities. These producers focus on high-quality surface preparation for stains, lacquers, and decorative treatments. Consequently, orbital and detail sanders dominate equipment purchases in cabinetry production environments.

Key Market Segments

By Machine Type

- Belt Sanders

- Orbital Sanders

- Drum Sanders

- Disc Sanders

By Operation

- Portable/Handheld Professional

- Automatic CNC Lines

- Semi-Automatic

By End-Use

- Furniture Manufacturing

- Carpentry & Woodworking Shops

- Construction & Renovation

- Cabinet & Interior Fittings

- Others

Drivers

Manufacturing Modernization and Regulatory Compliance Drive Wood Sanding Equipment Adoption

Industrial manufacturing policies accelerate equipment investments across global woodworking sectors. According to US reshoring initiatives, furniture manufacturing expansion under CHIPS-adjacent industrial grants boosts domestic demand for automated finishing lines. These government programs incentivize domestic production capacity development, creating substantial opportunities for advanced sanding system suppliers.

Energy efficiency regulations transform motor technology requirements in sanding equipment. European manufacturers upgrade legacy machines to comply with IE5-class motor standards mandated by environmental directives. In March 2024, WEINIG confirmed integration of acquired sanding machine portfolios into its product lineup from 2025 onward, responding to market consolidation and compliance-driven upgrade cycles.

Emerging manufacturing hubs in Southeast Asia expand industrial sanding equipment demand significantly. Vietnam and Indonesia develop massive plywood and engineered wood production facilities serving global furniture supply chains. Therefore, wide-belt sanding machine manufacturers focus expansion strategies on these high-growth Asian markets with substantial capacity additions.

Restraints

Component Cost Volatility and Regulatory Compliance Expenses Limit Market Growth

Raw material price fluctuations impact sanding equipment manufacturing economics substantially. Rare earth magnet price volatility affects high-torque servo motors used in smart sanding machines. These essential components represent significant cost factors in advanced automated systems, forcing manufacturers to absorb margin pressure or pass costs to customers.

Workplace safety regulations impose costly retrofitting requirements on existing equipment installations. EU worker exposure limits on wood dust force expensive upgrades of dust extraction systems for legacy machines. Additionally, compliance costs create financial barriers for small workshops considering equipment modernization investments.

Technology integration complexity raises initial capital requirements for advanced sanding systems. Manufacturers must invest in training, software integration, and production line reconfiguration when adopting automated solutions. Consequently, smaller woodworking operations delay equipment purchases due to implementation challenges and upfront investment burdens.

Growth Factors

Automation Technology and Smart Manufacturing Standards Accelerate Market Expansion

Digital manufacturing transformation drives sanding equipment technology advancement rapidly. AI-based surface defect detection integration becomes standard in CNC sanding systems after 2024 patent expiries. This technology enables real-time quality monitoring and automatic process adjustments, reducing waste while improving finish consistency across production runs.

Compliance-driven upgrade cycles create sustained replacement demand for connected equipment. ISO 23223 smart manufacturing standards push adoption of IoT-enabled sanding machines in industrial facilities. Moreover, rising integration of robotic sanding cells in modular housing factories across GCC smart city projects expands automation equipment opportunities.

Circular economy business models generate new equipment demand in refurbishing sectors. Battery-powered cordless sanding equipment gains traction among European circular furniture businesses performing restoration work. In December 2025, Motimac showcased wide-belt sanding machines and surface sanding solutions at WOODex 2025, highlighting industry innovation in sustainable manufacturing technologies.

Emerging Trends

Digital Integration and Service Business Models Transform Equipment Market Dynamics

Artificial intelligence integration revolutionizes sanding process control capabilities. OEM partnerships with industrial AI firms embed real-time surface analytics into sanding control software systems. These collaborations enable predictive quality management and automated parameter optimization based on material characteristics and production requirements.

Equipment ownership models shift toward subscription-based leasing arrangements. Manufacturers offer sanding machines through service agreements that include predictive maintenance SLAs and performance guarantees. Therefore, customers reduce capital expenditure burdens while accessing latest technology through flexible upgrade paths.

Digital twin simulation tools optimize sanding operations in high-throughput manufacturing environments. Factories deploy virtual modeling software to test process parameters before physical implementation. In May 2025, Karl Heesemann Maschinenfabrik exhibited advanced industrial sanding machines and surface finishing automation solutions at LIGNA 2025, demonstrating next-generation smart manufacturing capabilities.

Regional Analysis

North America Dominates the Wood Sanding Machine Market with a Market Share of 45.1%, Valued at USD 0.5 Billion

North America commands the wood sanding machine market through robust furniture manufacturing infrastructure and construction activity. The region held a 45.1% market share in 2025, valued at USD 0.5 Billion. US reshoring policies and infrastructure investments drive equipment modernization across domestic woodworking facilities, creating sustained demand for automated sanding systems.

Europe Wood Sanding Machine Market Trends

Europe demonstrates strong market growth driven by stringent environmental regulations and advanced manufacturing adoption. EU Ecodesign directives mandate energy-efficient motor upgrades, accelerating replacement cycles for legacy sanding equipment. Additionally, circular economy initiatives promote refurbishing operations that require specialized portable sanding tools.

Asia Pacific Wood Sanding Machine Market Trends

Asia Pacific experiences rapid expansion through furniture manufacturing capacity investments in Vietnam, Indonesia, and China. Regional plywood and engineered wood production growth fuels demand for industrial wide-belt sanding systems. Moreover, rising domestic furniture consumption in India and Southeast Asian markets supports equipment sales across multiple end-use segments.

Latin America Wood Sanding Machine Market Trends

Latin America shows steady growth as Mexico develops contract furniture manufacturing hubs under US nearshoring strategies. Brazilian woodworking industries modernize equipment to serve domestic construction markets and export opportunities. Furthermore, regional forestry resources support local furniture production requiring comprehensive sanding equipment solutions.

Middle East & Africa Wood Sanding Machine Market Trends

Middle East and Africa exhibit emerging opportunities through GCC construction projects and African furniture manufacturing development. Smart city developments incorporate modular housing factories requiring robotic sanding cells and automated finishing systems. Consequently, regional equipment suppliers focus on establishing service networks supporting advanced technology adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Bosch maintains a leading position in portable sanding equipment through extensive distribution networks and professional-grade product lines. The company serves contractors and woodworking professionals with battery-powered cordless sanders featuring brushless motor technology. Moreover, Bosch integrates smart connectivity features enabling tool tracking and performance monitoring through mobile applications.

DeWalt dominates North American construction markets with rugged handheld sanding equipment designed for demanding job site conditions. The manufacturer focuses on ergonomic design improvements and dust collection efficiency in portable sanders. Additionally, DeWalt’s extensive service center network provides competitive advantages in contractor equipment segments requiring rapid repair support.

Makita delivers comprehensive sanding solutions across residential and industrial applications through global manufacturing footprint. The company emphasizes battery platform compatibility across power tool lines, enabling contractors to utilize existing battery investments. Furthermore, Makita advances motor efficiency technologies to extend runtime performance in cordless professional sanding equipment.

Festool targets premium woodworking markets with precision-engineered sanding systems featuring advanced dust extraction capabilities. The manufacturer commands strong loyalty among professional cabinet makers and fine furniture craftsmen valuing superior finish quality. Consequently, Festool maintains premium pricing while delivering comprehensive accessory systems and integrated vacuum solutions.

Key Players

- Bosch

- DeWalt

- Makita

- Festool

- Grizzly Industrial

- Biesse S.p.A.

- SCM Group

- HOMAG Group AG

- Timesavers, Inc.

- Costa Levigatrici S.r.l.

Recent Developments

- February 2025 – Vention launched its Rapid Sanding Solution, a turnkey robotic sanding work cell designed for cabinetmakers and woodworkers. This automated system integrates collaborative robotics with adaptive sanding tools to streamline finishing operations in furniture manufacturing facilities.

- March 15, 2024 – Mirka introduced Mirka AIROS robotic sanding heads, AIOS sanding heads, and AIROP polishing heads for automated surface finishing. These modular components enable manufacturers to build customized robotic sanding cells addressing specific production requirements and material characteristics.

- March 18, 2024 – Mirka launched the Mirka AutoChanger system enabling automatic abrasive replacement in robotic sanding operations. This innovation reduces downtime and labor costs by automating grit changes during multi-stage finishing processes in high-volume manufacturing environments.

- April 29, 2025 – Mirka announced showcasing next-generation sanding and polishing systems at LIGNA 2025, including DEROS RS rotary sanders. The exhibition demonstrated advancements in cordless battery technology and smart connectivity features for professional woodworking applications.

- June 6, 2025 – PolishStyl showcased a flexible sanding cobot with interchangeable sanding brushes at LIGNA 2025. This collaborative robot system enables small and medium woodworking shops to automate finishing operations without extensive production line reconfiguration investments.

Report Scope

Report Features Description Market Value (2025) USD 1.3 Billion Forecast Revenue (2035) USD 2.0 Billion CAGR (2026-2035) 4.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Belt Sanders, Orbital Sanders, Drum Sanders, Disc Sanders), By Operation (Portable/Handheld Professional, Automatic CNC Lines, Semi-Automatic), By End-Use (Furniture Manufacturing, Carpentry & Woodworking Shops, Construction & Renovation, Cabinet & Interior Fittings, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Bosch, DeWalt, Makita, Festool, Grizzly Industrial, Biesse S.p.A., SCM Group, HOMAG Group AG, Timesavers, Inc., Costa Levigatrici S.r.l. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wood Sanding Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Wood Sanding Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bosch

- DeWalt

- Makita

- Festool

- Grizzly Industrial

- Biesse S.p.A.

- SCM Group

- HOMAG Group AG

- Timesavers, Inc.

- Costa Levigatrici S.r.l.