Global Wood Recycling Market Size, Share, And Industry Analysis Report By Product Type (Softwood, Hardwood, Block Board, Plywood, Oriented Strand Board, Others), By Method (Mechanical, Chemical, Thermal), By Application (Wood Panels, Energy Generation, Others), By End-use (Residential, Industrial, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175533

- Number of Pages: 219

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

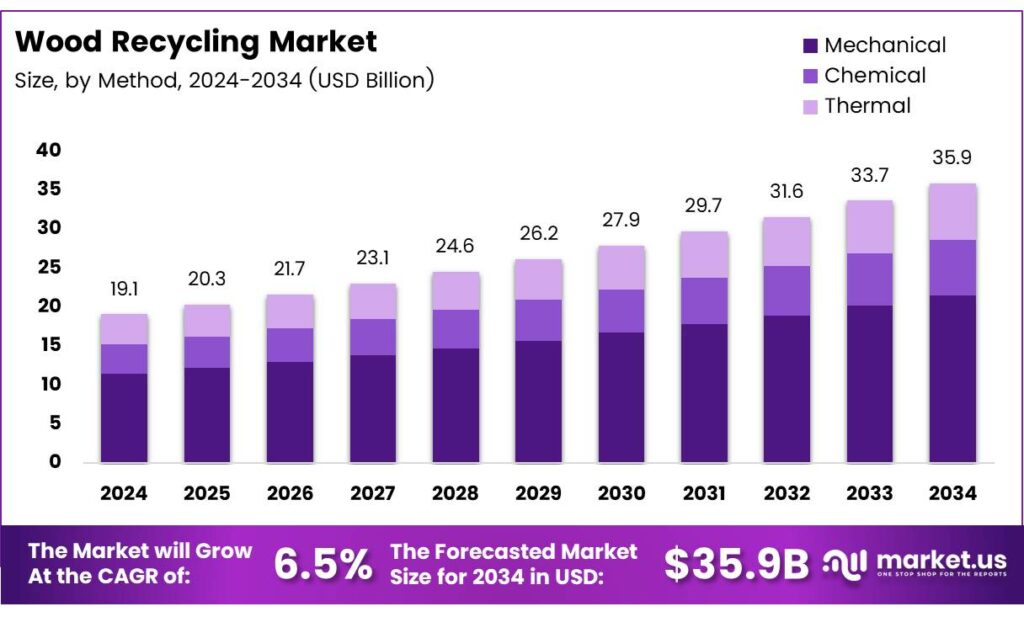

The Global Wood Recycling Market size is expected to be worth around USD 35.9 billion by 2034, from USD 19.1 billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The Wood Recycling Market focuses on collecting, processing, and reusing waste wood generated from construction, demolition, manufacturing, furniture, and household activities. It converts discarded wood into valuable secondary products such as biomass fuel, panel boards, compost additives, and landscaping materials, enabling circular economy practices and reducing pressure on natural forest resources.

The Wood Recycling sector continues to accelerate as sustainability commitments shape industrial strategies and public policy. Companies increasingly adopt recycled wood solutions because they lower material costs, reduce landfill dependency, and support corporate environmental goals. With rising construction waste volumes, the sector gains consistent feedstock, strengthening long-term supply stability and market potential.

- The waste wood market is becoming urgent, with around 4.5–4.6 million tonnes generated each year from construction, demolition, industrial, and household activities. Facilities like Bristol’s ETM MRF, which sorts up to 80 tonnes daily, show how advanced processing keeps materials in circulation and supports near-complete recycling while cutting landfill use.

Transitioning to efficiency, recycled wood also offers notable energy-saving advantages. Virgin materials require higher extraction and processing energy, while recycled materials deliver meaningful reductions. Making paper from pulped recycled paper uses 40% less energy than using virgin wood fibres. Industry environmental assessments, reinforcing the economic case for recycled feedstocks within manufacturing.

Favourable regulations supporting circular economy models continue boosting sector momentum. Policies encouraging waste segregation, extended producer responsibility, and recycling targets create predictable demand for processed wood products. As industries look to reduce carbon footprints, recycled wood emerges as a cost-efficient pathway, reducing reliance on virgin timber while supporting net-zero commitments across manufacturing and construction sectors.

Key Takeaways

- The Global Wood Recycling Market is projected to reach USD 35.9 billion by 2034, rising from USD 19.1 billion in 2024 at a 6.5% CAGR.

- Softwood leads the product type segment with a dominant 44.2% market share in 2025.

- Mechanical Recycling remains the top recycling method, holding 41.7% share in 2025.

- Wood Panels dominate application use with a strong 67.8% market share in 2025.

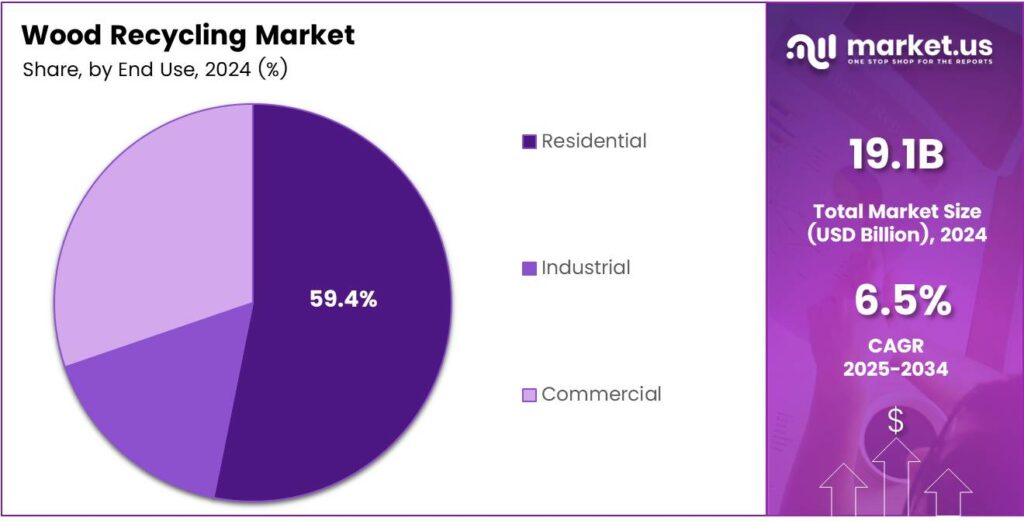

- The Residential sector leads end-use adoption, accounting for 59.4% of the market in 2025.

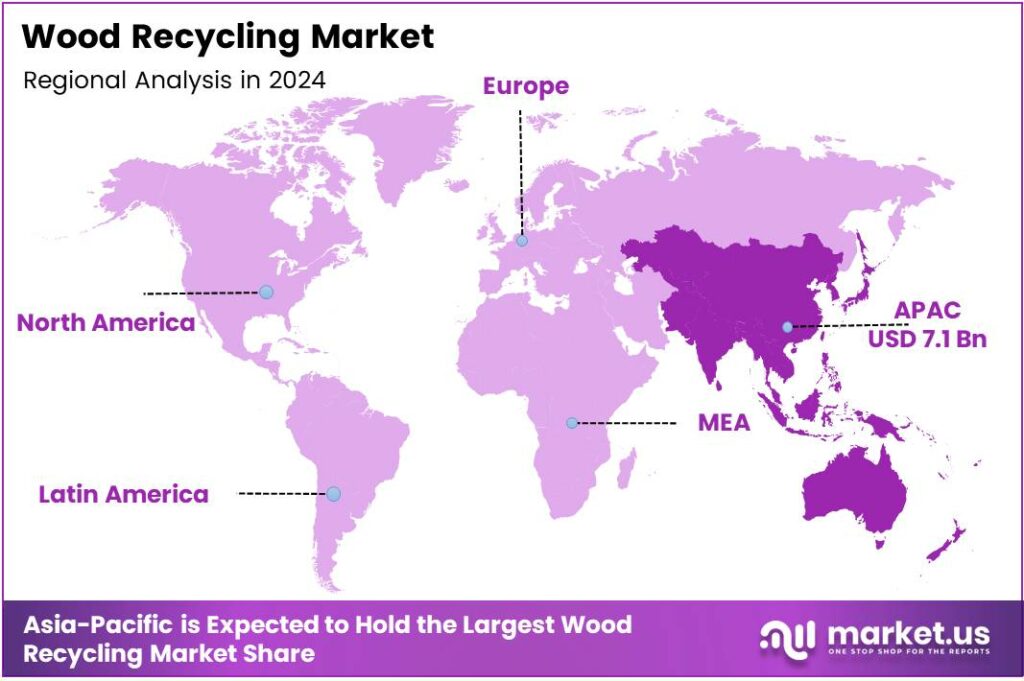

- Asia Pacific stands as the leading regional market with 37.2% share, valued at USD 7.1 billion.

By Product Type Analysis

Softwood dominates with 44.2% due to its wide availability and high recycling suitability.

In 2025, Softwood held a dominant market position in the By Product Type Analysis segment of the Wood Recycling Market, with a 44.2% share. The segment benefits from lighter density, easier processing, and strong demand in construction waste recycling. Its versatility continues driving large-scale recovery volumes across regional recycling facilities.

Hardwood recycling grew steadily as industries increasingly recovered long-lasting wooden structures. Recycled hardwood is reused for premium furniture, flooring, and decorative applications. Its durability ensures higher material value, and rising sustainability mandates encourage better segregation and collection practices, strengthening its contribution to the overall recycled wood stream.

Block Board recycling expanded as renovation and remodeling activities increased. Waste block boards offer strong reuse potential in interior partitions and lightweight furniture. Manufacturers actively integrate recycled components to reduce production costs and meet green-building norms. This drives consistent demand for recovered block board materials across both residential and commercial sectors.

Plywood recycling gained traction with higher recovery from packaging, pallets, and construction sites. Recycled plywood is used in low-load applications and secondary furniture items. Growing circular economy initiatives motivate companies to refurbish and repurpose plywood waste, improving material efficiency and reducing landfill pressure.

By Method Analysis

Mechanical Recycling dominates with 41.7% due to its efficiency and cost-effectiveness.

In 2025, Mechanical recycling held a dominant market position in the By Method Analysis segment of the Wood Recycling Market, with a 41.7% share. This method uses shredding, grinding, and sorting technologies, making it affordable and widely adopted. It supports large-scale processing for panels, mulch, and particleboard applications.

Chemical recycling strengthened its presence as industries explored advanced processes to extract fibers and recover valuable compounds from wood waste. Although costlier, it delivers high-purity outputs suitable for specialty materials. Growing research investments continue to enhance its efficiency, encouraging broader acceptance among high-value wood product manufacturers.

Thermal recycling grew through rising demand for biomass energy. Waste wood is increasingly used in combustion systems and gasification plants to generate heat and power. This method supports renewable energy targets and reduces landfill dependency, making it an important pillar in the sustainability-driven recycling ecosystem.

By Application Analysis

Wood Panels dominate with 67.8% due to their wide industrial adoption.

In 2025, Wood Panels held a dominant market position in the By Application Analysis segment of the Wood Recycling Market, with a 67.8% share. Recycled wood is a core feedstock for particleboard, MDF, OSB, and plywood manufacturing. Strong construction, refurbishment, and furniture demand reinforce this large market share.

Energy Generation applications expanded as industries increasingly used biomass for heat and power. Recycled wood fuels offer cost advantages and support carbon-neutral energy initiatives. Growing renewable energy adoption encourages energy firms to integrate waste wood pellets, chips, and briquettes into their operational mix.

Others include landscaping mulch, animal bedding, soil improvement additives, and filler materials for composites. These applications continue gaining traction as industries adopt eco-friendly substitutes. Better collection systems and cleaner sorting processes improve material suitability, helping this segment maintain steady growth.

By End-use Analysis

The residential sector dominates with 59.4% owing to rising remodeling and furniture adoption.

In 2025, Residential held a dominant market position in the By End-use Analysis segment of the Wood Recycling Market, with a 59.4% share. Home renovations, furniture refurbishments, and interior upgrades generate substantial recyclable wood volumes. Increasing consumer awareness of sustainable materials further strengthens residential recycling activity.

Industrial end-use expanded with rising manufacturing waste recovery. Industries reuse recycled wood for pallets, packaging, biomass energy, and secondary production materials. Regulatory pressure and cost benefits continue driving adoption, making industrial recycling a vital contributor to the circular materials market.

Commercial applications included offices, retail spaces, and institutional buildings, generating reusable wood from fixtures and interiors. Recycling supports waste reduction goals and offers cost-effective material sourcing for refurbishment projects. Continued expansion in commercial real estate boosts future recovery potential.

Key Market Segments

By Product Type

- Softwood

- Hardwood

- Block Board

- Plywood

- Orientated Strand Board

- Others

By Method

- Mechanical

- Chemical

- Thermal

By Application

- Wood Panels

- Energy Generation

- Others

By End-use

- Residential

- Industrial

- Commercial

Emerging Trends

Growing Adoption of Circular Economy Practices Influences Market Trends

A key trend shaping the wood recycling market is the rapid shift toward circular economy models. Companies are increasingly reusing, refurbishing, and recycling materials to reduce waste and carbon emissions. This approach strengthens the demand for recycled wood across industrial applications.

- Digital tools for waste tracking and sorting are emerging as another strong trend. Smart sensors, automated sorting lines, and AI-based identification systems help improve material recovery rates. The pallet sector estimated that about 508 million new pallets were manufactured, while only 25 million were landfilled—supporting an overall recovery/recycling rate of nearly 95% for wooden pallets.

Eco-friendly construction practices are also influencing market behavior. Builders are using recycled wood to meet green building certifications, reduce project costs, and lower environmental impact. Sustainable architecture is driving higher adoption in both residential and commercial projects.

Drivers

Growing Focus on Sustainable Waste Management Drives Market Growth

The wood recycling market is gaining momentum as governments and industries push for sustainable waste management. Many countries are reducing landfill use and promoting material recovery, which encourages the recycling of construction and demolition wood waste. This shift helps reduce environmental impact and supports a circular economy.

- EPA reports 18.1 million tons of wood generated in MSW, but only 3.1 million tons recycled—equal to a 17.1% recycling rate. The EPA estimates 12.2 million tons of wood went to landfills, showing how much recoverable material is still being lost when wood is not separated early.

The rising demand for recycled wood is in industries such as furniture, packaging, landscaping, and bioenergy. Recycled wood is affordable, easy to process, and widely available, making it attractive for manufacturers looking to cut costs without compromising quality. This increases its adoption across multiple sectors.

Restraints

High Processing Costs and Quality Concerns Limit Market Growth

One significant restraint for the wood recycling market is the high cost of sorting and processing mixed wood waste. Contaminants such as paint, nails, adhesives, and chemicals require additional cleaning and treatment, increasing operational expenses. Smaller recyclers often struggle to manage these costs, limiting market expansion.

- Wood waste from demolition sites may be damaged or contain hazardous materials, lowering its suitability for high-value applications. The EU generated 79.7 million tonnes of packaging waste, equal to 177.8 kg per inhabitant. Wood made up 15.8% of that packaging mix, which implies roughly 12.6 million tonnes of wood packaging waste in one year.

Limited awareness and weak recycling infrastructure in developing regions further restrict market growth. Many areas still depend heavily on landfills or open burning, reducing the availability of properly collected wood waste. This gap limits the supply of recyclable material.

Growth Factors

Rising Demand for Recycled Wood in Bioenergy Creates New Market Opportunities

The growing interest in renewable energy presents a major opportunity for the wood recycling market. Recycled wood is increasingly used as a biomass fuel in power plants, heating systems, and industrial boilers. Its low cost and steady availability make it a viable substitute for fossil fuels, supporting the global shift toward cleaner energy.

Another expansion opportunity lies in the furniture and interior design industries. Eco-friendly home décor and sustainable construction materials are becoming popular among consumers and businesses. Recycled wood can be used for flooring, paneling, landscaping mulch, and decorative items, allowing companies to meet green building standards.

Technological improvements in shredding and screening systems also unlock new possibilities. Modern equipment can separate contaminants more effectively, enabling the production of higher-quality recycled wood fibers suitable for particleboard and composite materials.

Regional Analysis

Asia Pacific Dominates the Wood Recycling Market with a Market Share of 37.2%, Valued at USD 7.1 Billion

Asia Pacific leads the global wood recycling market, driven by rapid industrial expansion, construction growth, and strong government emphasis on sustainable waste management. The region’s dominance, holding 37.2% share and reaching USD 7.1 billion, is supported by large-scale urban development and increasing recycling infrastructure. Rising environmental regulations and circular economy initiatives further accelerate wood recovery, reuse, and biomass conversion across developing economies.

North America maintains a strong position due to advanced recycling systems, high awareness of sustainable practices, and established waste collection networks. Increased adoption of reclaimed wood in construction, furniture, and energy generation supports steady market growth. The U.S. continues to be the primary contributor, driven by policy focus on landfill reduction and green building standards.

Europe remains a mature and highly regulated market, supported by strict EU waste directives and aggressive recycling targets. Rising demand for engineered wood products and biomass fuels has strengthened wood recovery initiatives. Continuous innovation in recycling technologies and widespread adoption of eco-friendly construction materials further enhance regional growth.

Latin America shows steady growth, supported by the modernization of waste management systems and the rising use of biomass energy. Brazil, Mexico, and Chile are key countries adopting recycled wood for manufacturing and construction uses. Although still developing, the region’s improving regulatory landscape is gradually boosting wood recovery and reuse practices.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, the global Wood Recycling Market continues to advance as regulatory pressure, rising construction waste, and circular economy commitments drive greater adoption of recycled wood products. Among the leading players, each company brings a distinct strategic focus that shapes competitive dynamics and industry progress.

Biffa Group Limited maintains a strong footprint in the U.K., leveraging its integrated waste management network to expand high-quality recovered wood processing. The company’s focus on upgrading recycling infrastructure and boosting material recovery efficiency positions it well to serve growing demand from panelboard manufacturers and biomass plants. Biffa’s operational scale allows it to manage increasing waste volumes with consistent quality standards.

Canfor Corporation continues to strengthen its role in North America by optimizing residual wood streams from sawmills and integrating recycled fibers into sustainable product lines. The company’s emphasis on waste reduction, resource efficiency, and value-added wood recovery enhances its competitiveness in markets prioritizing lower-carbon materials. Canfor’s broad forestry portfolio supports a stable supply for recycling operations.

DS Smith Plc brings strong circular design expertise to the wood recycling segment, supported by its experience in fiber recovery. The company strategically aligns wood recycling with its broader sustainability goals, enabling improved recovery of secondary raw materials for packaging and industrial applications. DS Smith’s innovation in resource optimization strengthens market trust.

Eco Recycling Ltd. continues expanding its presence through specialized wood waste treatments, offering tailored services for commercial and municipal clients. Its commitment to diverting wood waste from landfills and improving recycled wood quality supports the industry transition toward higher-grade applications. The company’s focus on compliance and traceability enhances customer confidence.

Top Key Players in the Market

- Biffa Group Limited

- Canfor Corporation

- DS Smith Plc

- Eco Recycling Ltd.

- Interfor Corporation

- Mondi Group

- Renewi plc

- Republic Services, Inc.

- Sims Limited

- Smurfit Kappa Group

Recent Developments

- In 2024, Biffa has been actively expanding its waste management capabilities, particularly in preparation for the UK’s Simpler Recycling legislation. The company completed the acquisition of Keenan Recycling, enhancing its food waste collection services ahead of mandatory separations starting for businesses and extending to households.

- In 2025, Canfor has emphasized sustainability and community initiatives in its recent activities. The company released its 2024 Sustainability Report, outlining environmental, social, and governance performance, including progress on sustainability targets for forest products and pulp operations.

Report Scope

Report Features Description Market Value (2024) USD 19.1 Billion Forecast Revenue (2034) USD 35.9 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Softwood, Hardwood, Block Board, Plywood, Oriented Strand Board, Others), By Method (Mechanical, Chemical, Thermal), By Application (Wood Panels, Energy Generation, Others), By End-use (Residential, Industrial, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Biffa Group Limited, Canfor Corporation, DS Smith Plc, Eco Recycling Ltd., Interfor Corporation, Mondi Group, Renewi plc, Republic Services, Inc., Sims Limited, Smurfit Kappa Group Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Biffa Group Limited

- Canfor Corporation

- DS Smith Plc

- Eco Recycling Ltd.

- Interfor Corporation

- Mondi Group

- Renewi plc

- Republic Services, Inc.

- Sims Limited

- Smurfit Kappa Group