Global Wood Processing Machines Market Size, Share, Growth Analysis By Types (Machine Tools, Sanding Machine, Drilling Machine, Pressure Bonding, Paint Spraying, Others), By Application (Furniture Manufacturing, Construction, Flooring, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170447

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

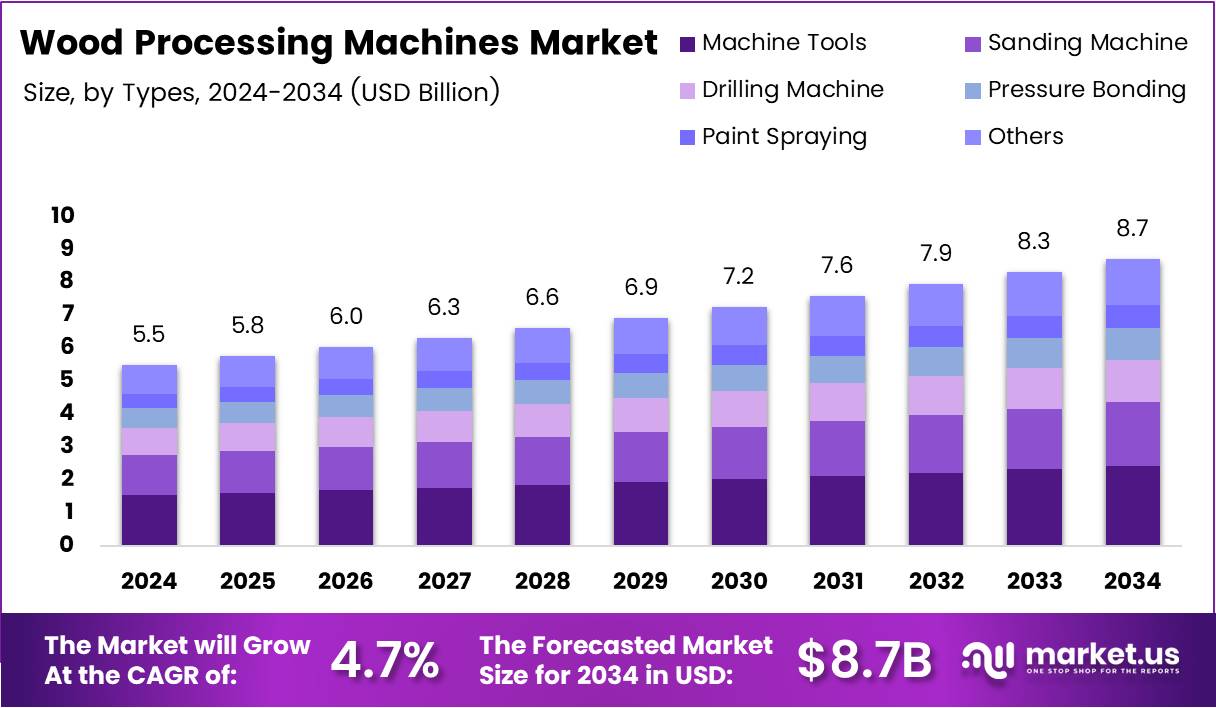

Global Wood Processing Machines Market size is expected to be worth around USD 8.7 Billion by 2034 from USD 5.5 Billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034. This expansion reflects increasing industrial automation and surging demand for precision woodworking equipment worldwide.

Wood processing machines represent specialized industrial equipment designed to cut, shape, sand, drill, and finish timber products efficiently. These machines transform raw wood materials into value-added products for furniture, construction, and flooring applications. Moreover, they enhance manufacturing productivity while reducing labor costs and material wastage significantly.

The market demonstrates strong growth driven by rising construction activities and expanding furniture manufacturing sectors globally. Additionally, technological advancements in CNC machinery and automation solutions continue to revolutionize traditional woodworking operations. Manufacturers increasingly adopt smart equipment featuring IoT connectivity and digital design integration capabilities.

Emerging economies witness rapid expansion of small and medium wood workshops, creating substantial market opportunities. Furthermore, the shift toward sustainable and energy-efficient manufacturing technologies accelerates equipment upgrades across industrial facilities. Modular furniture and ready-to-assemble wood products drive consistent demand for high-precision processing machinery.

Asia Pacific dominates the global landscape, accounting for 44.9% market share valued at USD 2.4 Billion in 2024. The region benefits from robust furniture export industries and large-scale construction projects across developing nations. Government infrastructure investments and urbanization trends further strengthen regional market dynamics consistently.

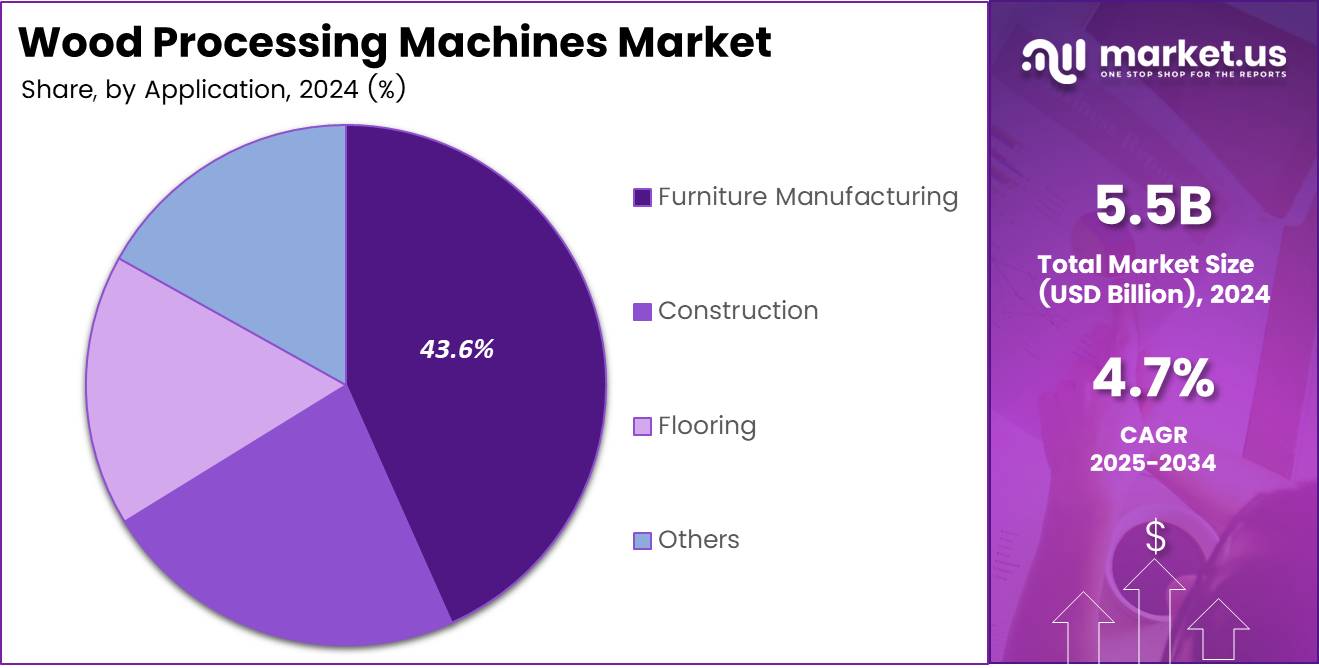

Machine tools segment leads product categories with 37.9% share, while furniture manufacturing applications command 43.6% market dominance. Commercial real estate development and interior fit-out activities boost demand across urban regions substantially. However, high capital costs and timber supply volatility present ongoing challenges for industry participants.

According to FAO, global wood-based panel production increased by 1% to 381 million m³ in 2023, reflecting steady industry expansion. Similarly, global wood pulp trade increased by 3% to 71 million tonnes in 2023, as reported by FAO. These statistics underscore growing raw material processing requirements and expanding wood product manufacturing activities worldwide.

Key Takeaways

- Global Wood Processing Machines Market valued at USD 5.5 Billion in 2024, projected to reach USD 8.7 Billion by 2034

- Market expected to grow at a CAGR of 4.7% during the forecast period 2025 to 2034

- Asia Pacific leads with 44.9% market share, valued at USD 2.4 Billion in 2024

- Machine Tools segment dominates By Types category with 37.9% market share in 2024

- Furniture Manufacturing application holds 43.6% market share in 2024

- Global wood-based panel production reached 381 million m³ in 2023, up 1% year-over-year

- Global wood pulp trade increased by 3% to 71 million tonnes in 2023

Types Analysis

Machine Tools dominate with 37.9% market share due to versatile applications across multiple woodworking operations.

In 2024, Machine Tools held a dominant market position in the By Types segment of the Wood Processing Machines Market, with a 37.9% share. Machine tools represent fundamental equipment for cutting, shaping, and forming wood materials with precision. These versatile systems integrate multiple functionalities including sawing, milling, turning, and planing operations. Moreover, they support diverse production requirements across furniture manufacturing, construction, and specialty woodworking applications.

Sanding machines address critical surface finishing requirements in wood processing workflows. These specialized systems remove imperfections, smooth surfaces, and prepare wood materials for coating applications. Additionally, automated sanding equipment enhances consistency while reducing manual labor requirements. Manufacturers increasingly adopt advanced sanding technologies featuring dust collection systems and variable speed controls for improved operational efficiency.

Drilling machines enable precise hole creation for joinery, assembly, and hardware installation applications. These systems support various drilling patterns and depths required in furniture construction and cabinetry production. Furthermore, CNC-controlled drilling equipment delivers exceptional accuracy and repeatability for high-volume manufacturing operations. Multi-spindle configurations accelerate production cycles while maintaining stringent quality standards across manufactured components.

Pressure bonding equipment facilitates lamination and veneer application processes in wood product manufacturing. These machines apply controlled heat and pressure to create strong adhesive bonds between wood layers. Consequently, they enable production of engineered wood products with enhanced strength and dimensional stability. Advanced pressure bonding systems incorporate automated loading mechanisms and precise temperature control for consistent bonding quality.

Paint spraying systems deliver uniform coating application on wood surfaces for protection and aesthetic enhancement. These machines atomize paint or finish materials to achieve smooth, professional-quality results. Additionally, HVLP and airless spraying technologies minimize material waste while ensuring thorough coverage. Automated spray booths with proper ventilation systems support safe and efficient finishing operations in modern wood processing facilities.

Application Analysis

Furniture Manufacturing dominates with 43.6% market share driven by global furniture production growth and design innovations.

In 2024, Furniture Manufacturing held a dominant market position in the By Application segment of the Wood Processing Machines Market, with a 43.6% share. Furniture production demands diverse wood processing capabilities for creating components ranging from basic frames to intricate decorative elements.

This application segment drives consistent equipment demand as manufacturers expand capacity to meet growing consumer preferences. Moreover, rising popularity of customized and modular furniture solutions requires flexible processing equipment supporting varied production requirements.

Construction applications utilize wood processing machines for structural components, framing materials, and architectural woodwork elements. These machines prepare lumber for residential, commercial, and industrial building projects requiring precise dimensional accuracy.

Additionally, prefabricated construction methods increase demand for automated wood processing solutions enabling efficient component manufacturing. Green building initiatives further promote engineered wood products requiring specialized processing equipment for production and assembly operations.

Flooring production represents a significant application segment requiring specialized wood processing equipment for manufacturing hardwood flooring, laminates, and engineered flooring products. These machines perform precision milling, tongue-and-groove profiling, and surface finishing operations essential for quality flooring materials.

Furthermore, growing preference for sustainable flooring options drives investment in advanced processing technologies. Automated systems enable consistent dimensional tolerances and surface quality meeting stringent industry standards for residential and commercial installations.

Other applications encompass diverse woodworking sectors including cabinetry, millwork, packaging, and specialty wood products manufacturing. These segments utilize various processing equipment for custom fabrication and niche market requirements.

Additionally, craft furniture makers and artisanal workshops increasingly adopt compact processing machines supporting small-batch production. Wood processing equipment serves musical instrument manufacturing, boat building, and decorative woodworking applications requiring specialized cutting and shaping capabilities.

Key Market Segments

By Types

- Machine Tools

- Sanding Machine

- Drilling Machine

- Pressure Bonding

- Paint Spraying

- Others

By Application

- Furniture Manufacturing

- Construction

- Flooring

- Others

Market Drivers

Rising Global Demand for Engineered Wood Products Drives Market Expansion

Engineered wood products gain widespread acceptance across construction and furniture sectors due to superior performance characteristics. These materials offer enhanced strength, dimensional stability, and sustainable resource utilization compared to solid wood alternatives.

Consequently, manufacturers invest in specialized processing equipment capable of handling composite wood materials. Laminated veneer lumber, cross-laminated timber, and oriented strand board production require advanced machinery supporting precise cutting and bonding operations.

Modular furniture and ready-to-assemble products transform residential and commercial furnishing markets globally. These solutions offer cost-effective, convenient options for consumers seeking flexible interior designs.

Therefore, furniture manufacturers expand production capacities utilizing automated wood processing systems for component fabrication. Standardized parts production demands consistent quality and dimensional accuracy achievable through modern processing equipment. This trend accelerates adoption of CNC machines and automated assembly systems across furniture manufacturing facilities.

Industrial automation revolutionizes traditional woodworking operations by introducing precision, repeatability, and efficiency improvements. Manufacturers integrate robotic systems, CNC controls, and automated material handling into their production workflows.

Additionally, these technologies reduce labor dependency while minimizing human error in critical processing operations. Real-time monitoring capabilities enable proactive maintenance and quality control throughout manufacturing processes. Smart factory concepts drive continued investment in advanced wood processing equipment supporting digital transformation initiatives.

Market Restraints

High Capital Investment Requirements Limit Market Accessibility for Small Enterprises

Advanced CNC woodworking machines require substantial upfront capital investment that challenges smaller manufacturers and workshops. These sophisticated systems incorporate complex mechanical components, electronic controls, and software interfaces commanding premium pricing.

Furthermore, installation costs, training expenses, and facility modifications add to total ownership costs. Many small and medium enterprises struggle to justify these investments given limited production volumes and tight profit margins.

Maintenance requirements for modern wood processing equipment demand specialized technical expertise and regular service interventions. Complex machinery with electronic components, hydraulic systems, and precision mechanics requires ongoing attention to maintain optimal performance.

Additionally, replacement parts for advanced equipment often carry significant costs and extended lead times. Unplanned downtime resulting from equipment failures severely impacts production schedules and delivery commitments, creating operational and financial pressures.

Timber supply volatility and fluctuating raw material prices create uncertainty for wood processing businesses and equipment investments. Global timber markets experience price variations driven by supply chain disruptions, environmental regulations, and changing forestry policies.

Consequently, manufacturers face challenges in maintaining consistent material costs affecting production economics. These uncertainties make capital equipment investments riskier as business projections become less predictable. Trade restrictions and logging limitations in certain regions further complicate raw material procurement strategies.

Growth Opportunities

Smart Manufacturing Technologies Create New Market Opportunities

IoT-enabled wood processing equipment offers transformative capabilities for modern manufacturing operations through connected systems. These smart machines provide real-time performance data, predictive maintenance alerts, and remote monitoring capabilities.

Consequently, manufacturers achieve improved uptime, reduced maintenance costs, and optimized production efficiency. Integration with enterprise resource planning systems enables seamless production planning and inventory management. Cloud-based analytics platforms deliver actionable insights supporting continuous improvement initiatives across manufacturing facilities.

Sustainable and energy-efficient manufacturing technologies gain importance as environmental regulations tighten globally. Manufacturers seek wood processing equipment featuring reduced energy consumption, minimal waste generation, and lower emissions. Additionally, eco-friendly machines align with corporate sustainability goals and green building certifications.

Energy recovery systems, dust collection technologies, and water-based finishing processes represent growing market segments. Government incentives for sustainable manufacturing practices further encourage investment in environmentally responsible processing equipment.

Wood-based housing and prefabricated building solutions experience accelerating adoption across residential and commercial construction sectors. These construction methods offer faster project completion, reduced labor requirements, and improved quality control compared to traditional building approaches.

Therefore, demand increases for specialized wood processing equipment supporting modular construction component manufacturing. Precision cutting, automated assembly, and quality inspection systems enable efficient prefabricated building production. This trend creates substantial opportunities for equipment manufacturers serving the construction industry.

Emerging Trends

Advanced Automation Technologies Transform Wood Processing Operations

CNC systems, robotics, and artificial intelligence integration revolutionize traditional wood cutting and shaping operations. These technologies enable lights-out manufacturing capabilities with minimal human intervention while maintaining exceptional quality standards.

Machine learning algorithms optimize cutting patterns, reduce material waste, and improve overall equipment effectiveness. Vision systems coupled with AI provide automated quality inspection and defect detection throughout production processes.

Multi-function and compact wood processing machines gain popularity among manufacturers seeking space-efficient production solutions. These versatile systems combine multiple operations including cutting, drilling, sanding, and edge banding in single platforms. Consequently, smaller workshops access advanced capabilities without investing in separate specialized machines.

Modular machine designs allow configuration flexibility adapting to changing production requirements. Space-constrained urban manufacturing facilities particularly benefit from these compact multi-purpose processing solutions.

Dust-free and low-emission woodworking equipment addresses growing health, safety, and environmental concerns in manufacturing environments. Advanced dust collection systems capture airborne particles at source, improving air quality for workers. Additionally, enclosed processing chambers with efficient filtration minimize environmental impact of woodworking operations.

Regulatory compliance requirements drive adoption of clean manufacturing technologies across developed markets. Manufacturers prioritize equipment investments supporting safe, healthy workplace conditions while meeting environmental standards.

Digital design-to-manufacturing workflows utilizing CAD/CAM systems streamline production processes from concept to finished product. These integrated solutions enable direct translation of digital designs into machine instructions eliminating manual programming steps.

Furthermore, parametric modeling capabilities support rapid design iterations and customization. Cloud-based collaboration tools facilitate communication between designers, engineers, and production teams. This digital transformation reduces lead times, minimizes errors, and enhances overall manufacturing agility.

Regional Analysis

Asia Pacific Dominates the Wood Processing Machines Market with 44.9% Market Share Valued at USD 2.4 Billion

Asia Pacific commands the largest market share driven by rapid industrialization, expanding furniture exports, and robust construction activities. Countries including China, India, Vietnam, and Indonesia represent major manufacturing hubs for furniture and wood products serving global markets.

Additionally, rising middle-class populations fuel domestic demand for residential furniture and housing construction. Government infrastructure investments and urbanization trends support continued market growth throughout the region. Low labor costs and favorable manufacturing policies attract international furniture brands establishing production facilities across Asia Pacific nations.

North America Wood Processing Machines Market Trends

North America exhibits steady market growth supported by advanced manufacturing capabilities and strong construction sector fundamentals. The region emphasizes automation, precision equipment, and sustainable manufacturing practices aligning with environmental regulations. Additionally, renovation activities and custom furniture demand drive equipment investments across small and medium enterprises. Domestic furniture production experiences modest growth while competition from imports influences market dynamics across the region.

Europe Wood Processing Machines Market Trends

Europe maintains significant market presence with established furniture manufacturing industries and advanced woodworking traditions. The region leads in adopting environmentally friendly processing technologies and circular economy principles. Stringent quality standards and skilled labor forces support premium furniture production serving luxury market segments. Additionally, renovation of historic buildings and heritage woodwork preservation create specialized equipment demand across European markets.

Middle East and Africa Wood Processing Machines Market Trends

Middle East and Africa show moderate growth potential fueled by construction boom and hospitality sector expansion. The UAE and Saudi Arabia invest heavily in commercial and residential development projects requiring substantial wood products. Additionally, local furniture manufacturing capabilities expand gradually to reduce import dependence across regional markets.

Latin America Wood Processing Machines Market Trends

Latin America presents emerging opportunities driven by growing middle class and increasing furniture consumption rates. Brazil and Mexico lead regional manufacturing activities with established wood processing industries serving domestic markets. Furthermore, sustainable forestry practices and timber availability support long-term industry development across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Wood Processing Machines Company Insights

Durr maintains a strong global presence through innovative finishing and coating solutions for wood processing applications. The company leverages advanced automation technologies to deliver efficient and environmentally friendly manufacturing systems consistently.

SCM Group offers comprehensive machinery portfolios covering sawing, drilling, edgebanding, and CNC machining operations extensively. Their integrated solutions serve furniture manufacturers and industrial wood processors across diverse market segments effectively.

Biesse specializes in high-performance CNC machining centers and automated production lines for wood and composite materials. The company focuses on digital manufacturing integration and Industry 4.0 solutions for enhanced productivity outcomes.

Weinig provides solid wood processing machinery including planers, molders, and profiling systems for construction applications. Their equipment delivers precision performance for window, door, and structural component manufacturing operations reliably.

These industry leaders continuously invest in research and development to introduce cutting-edge technologies and expand market reach. Furthermore, strategic acquisitions and partnerships strengthen their competitive positions across regional markets. Equipment manufacturers prioritize customer support services and comprehensive training programs to ensure optimal machinery utilization rates.

Key Companies

- Durr

- SCM Group

- Biesse

- Weinig

- IMA Schelling Group

- Stanley Black & Decker

- JPW Industries

- Leademac

- Sawstop

- DELTA Power Equipment

Recent Developments

- In December 2025, Andersen Corporation announced it will acquire Bright Wood Corporation, a major U.S. wood products component manufacturer, to strengthen its supply chain footprint and enhance manufacturing capabilities across North American markets.

- In September 2024, Burton Mill Solutions acquired Industrial Cutting Tools (ICT), expanding its network of reconditioning service centers for sawmill, chip, and pellet operations, thereby improving customer service capabilities throughout the industry.

Report Scope

Report Features Description Market Value (2024) USD 5.5 Billion Forecast Revenue (2034) USD 8.7 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Machine Tools, Sanding Machine, Drilling Machine, Pressure Bonding, Paint Spraying, Others), By Application (Furniture Manufacturing, Construction, Flooring, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Durr, SCM Group, Biesse, Weinig, IMA Schelling Group, Stanley Black & Decker, JPW Industries, Leademac, Sawstop, DELTA Power Equipment Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wood Processing Machines MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Wood Processing Machines MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Durr

- SCM Group

- Biesse

- Weinig

- IMA Schelling Group

- Stanley Black & Decker

- JPW Industries

- Leademac

- Sawstop

- DELTA Power Equipment