Global Wood Dust Extraction System Market Size, Share, Growth Analysis By System Type (Centralized Ducted, Portable Collectors, Baghouse (Fabric), Cartridge/HEPA Systems), By Airflow Capacity (≤2,000 m³/h, 2,001-10,000 m³/h, 10,001-30,000 m³/h, 30,000 m³/h), By Filtration Media (Fabric Bags, Cartridge/PLEAT, HEPA/Secondary, Spark/Fire Safe & Other), By End-Use Industry (Furniture Manufacturing, Construction & Woodworking Shops, Cabinet & Joinery Production, Panel Processing & MDF Factories, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175652

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

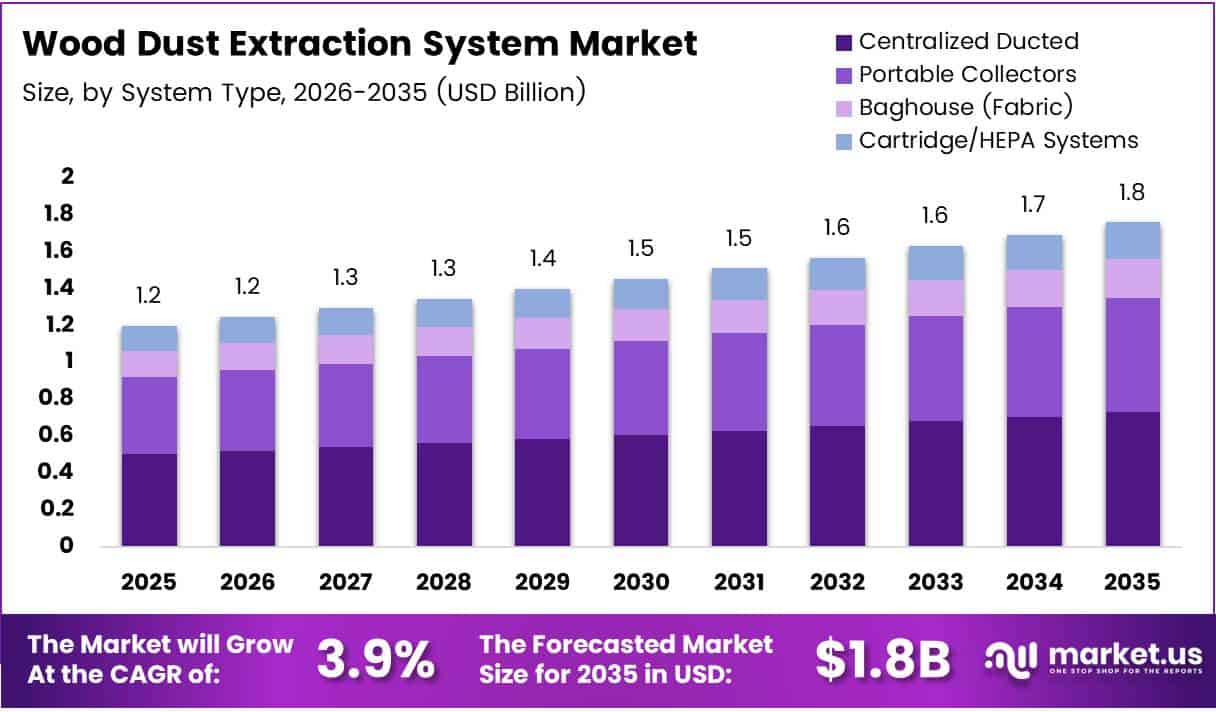

Global Wood Dust Extraction System Market size is expected to be worth around USD 1.8 Billion by 2035 from USD 1.2 Billion in 2025, growing at a CAGR of 3.9% during the forecast period 2026 to 2035.

Wood dust extraction systems capture and filter airborne wood particles generated during cutting, sanding, and processing operations. These systems protect worker health and maintain regulatory compliance in industrial woodworking environments. Moreover, they prevent equipment contamination and reduce fire hazards.

Furniture manufacturers, construction workshops, and panel processing facilities deploy extraction solutions to meet occupational safety standards. Advanced systems integrate automated controls and multi-stage filtration technologies. Therefore, modern installations achieve superior dust capture rates compared to legacy equipment.

Industrial expansion in furniture production and engineered wood manufacturing drives demand for sophisticated extraction infrastructure. Regulatory agencies enforce stricter exposure limits for respirable wood dust across developed and emerging markets. Additionally, automated CNC machinery adoption necessitates integrated dust control capabilities.

Energy-efficient variable-speed systems and compact modular units address diverse facility requirements. Smart factory initiatives incorporate IoT-enabled monitoring and sensor-based extraction equipment. Consequently, manufacturers prioritize systems offering lower operating costs and predictive maintenance capabilities.

According to Leda Machinery, well-designed dust extraction systems reduce wood dust emissions by over 90%, with advanced implementations achieving 99% effectiveness. This performance improvement demonstrates the critical role extraction technology plays in workplace safety and operational efficiency across woodworking industries.

Fire prevention standards and explosion venting requirements shape system specifications in panel manufacturing and high-volume production environments. HEPA and cartridge filtration technologies gain market share as emission regulations tighten globally. However, installation costs and retrofit complexity remain adoption barriers for smaller workshops.

Key Takeaways

- Global Wood Dust Extraction System Market valued at USD 1.2 Billion in 2025, projected to reach USD 1.8 Billion by 2035

- Market growing at CAGR of 3.9% during forecast period 2026-2035

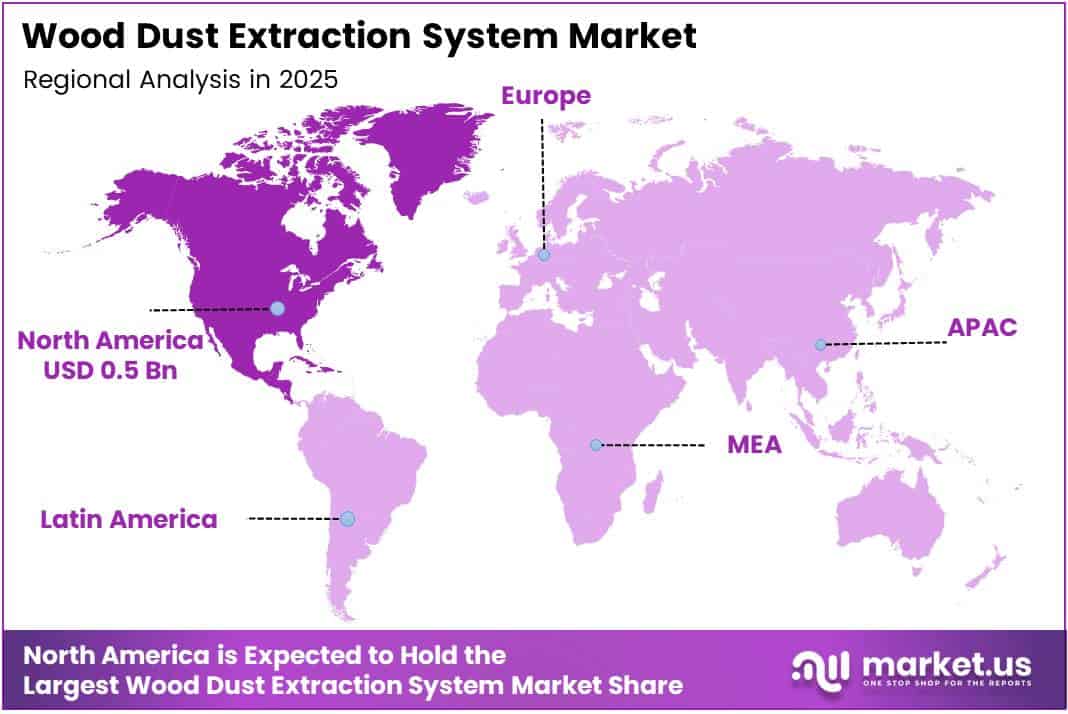

- North America dominates with 44.2% market share, valued at USD 0.5 Billion

- Centralized Ducted systems lead By System Type segment with 45.2% share

- 2,001-10,000 m³/h capacity range holds 37.4% of Airflow Capacity segment

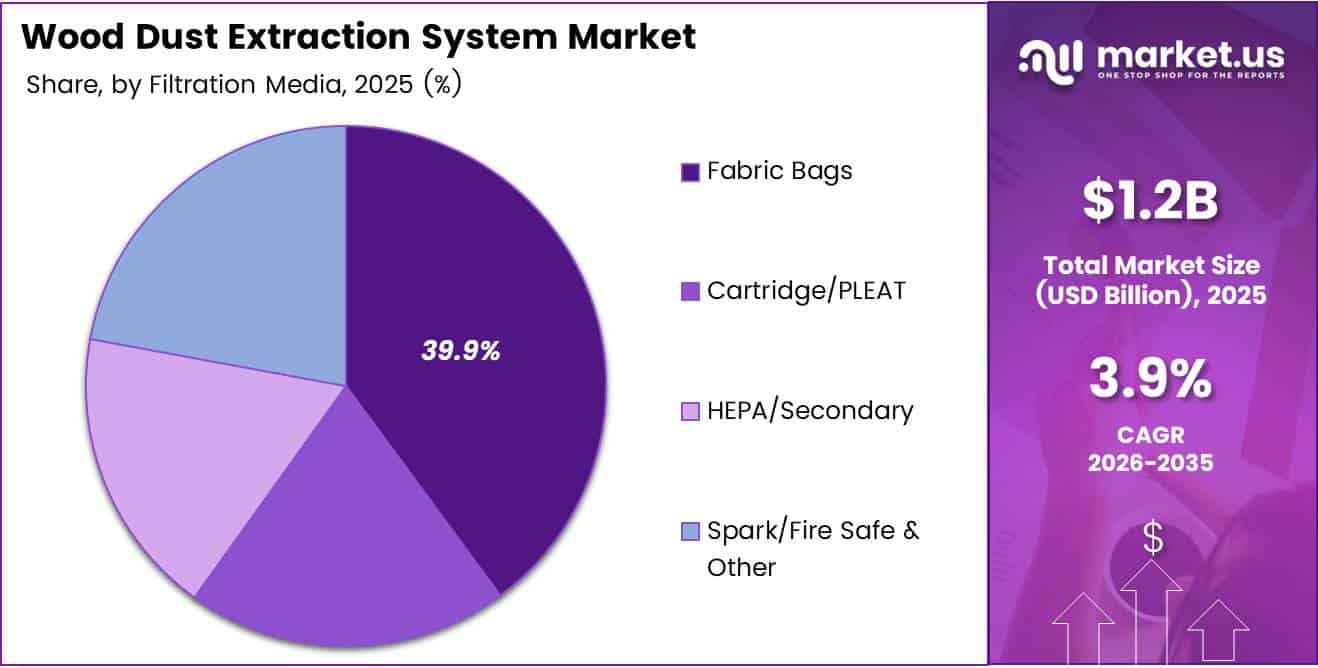

- Fabric Bags dominate Filtration Media segment with 39.9% share

- Furniture Manufacturing accounts for 38.6% of End-Use Industry segment

System Type Analysis

Centralized Ducted dominates with 45.2% due to comprehensive facility coverage and cost efficiency.

In 2025, Centralized Ducted systems held a dominant market position in the By System Type segment of Wood Dust Extraction System Market, with a 45.2% share. These installations connect multiple workstations through permanent ductwork infrastructure, enabling simultaneous dust collection across production floors. Consequently, large-scale furniture manufacturers and panel processing facilities prefer centralized architectures for operational efficiency.

Portable Collectors serve smaller workshops and job sites requiring flexible positioning and equipment mobility. These units provide standalone extraction capabilities without permanent installation requirements. Therefore, contractors and renovation specialists favor portable solutions for on-site dust management applications.

Baghouse Fabric systems utilize woven filter media to capture fine particulates in high-volume production environments. These collectors handle substantial airflow volumes and maintain consistent filtration performance. Moreover, pulse-jet cleaning mechanisms extend filter service life and reduce maintenance downtime.

Cartridge and HEPA Systems deliver superior fine dust capture efficiency required for stringent regulatory compliance. Advanced filtration media intercepts sub-micron particles that escape conventional fabric filters. Additionally, compact cartridge designs optimize space utilization in facilities with limited installation areas.

Airflow Capacity Analysis

2,001-10,000 m³/h dominates with 37.4% due to optimal performance for mid-sized manufacturing operations.

In 2025, 2,001-10,000 m³/h capacity range held a dominant market position in the By Airflow Capacity segment of Wood Dust Extraction System Market, with a 37.4% share. This capacity range addresses typical extraction requirements for cabinet shops and furniture production lines. Moreover, systems in this bracket balance performance capabilities with energy consumption efficiency.

Systems rated ≤2,000 m³/h serve small woodworking shops and individual machine applications requiring localized dust control. These compact units provide adequate suction for single workstations and portable tools. Therefore, hobbyists and small-scale craftsmen prefer lower-capacity extraction equipment for workshop installations.

The 10,001-30,000 m³/h segment accommodates large manufacturing facilities and centralized extraction networks handling multiple production zones. These high-capacity systems manage substantial dust generation from automated processing lines. Additionally, industrial panel factories and MDF production plants require robust airflow performance for comprehensive facility coverage.

Systems rated ≥30,000 m³/h address specialized applications in high-volume manufacturing complexes and integrated production facilities. These installations handle extreme dust loads from continuous processing operations. Consequently, major furniture manufacturers and engineered wood producers invest in maximum-capacity extraction infrastructure for compliance assurance.

Filtration Media Analysis

Fabric Bags dominate with 39.9% due to cost-effectiveness and proven performance in industrial applications.

In 2025, Fabric Bags held a dominant market position in the By Filtration Media segment of Wood Dust Extraction System Market, with a 39.9% share. Woven textile filters capture wood particles efficiently while maintaining acceptable pressure drops across collection systems. Moreover, fabric media tolerates heavy dust loading in continuous production environments without frequent replacement requirements.

Cartridge and PLEAT filtration technologies offer enhanced surface area and improved fine dust capture efficiency compared to traditional fabric materials. These systems reduce filter footprint while delivering superior particulate retention. Therefore, manufacturers seeking space optimization and regulatory compliance increasingly specify cartridge-based extraction equipment.

HEPA and Secondary filtration stages provide ultra-fine particle removal necessary for sensitive manufacturing environments and strict emission standards. These advanced media types intercept sub-micron dust fractions that compromise air quality. Additionally, secondary filtration protects exhaust streams and enables recirculation of conditioned air.

Spark and Fire Safe filtration incorporates flame-retardant materials and detection systems to prevent ignition hazards in wood dust collection applications. These specialized media types address explosion prevention requirements in high-risk processing facilities. Consequently, panel manufacturing and MDF production operations mandate fire-safe filtration technologies for workplace safety.

End-Use Industry Analysis

Furniture Manufacturing dominates with 38.6% due to intensive wood processing and high dust generation volumes.

In 2025, Furniture Manufacturing held a dominant market position in the By End-Use Industry segment of Wood Dust Extraction System Market, with a 38.6% share. Furniture producers operate multiple cutting, sanding, and finishing processes that generate substantial airborne particulate emissions. Moreover, these facilities face stringent occupational exposure limits requiring comprehensive extraction infrastructure investments.

Construction and Woodworking Shops utilize portable and semi-permanent extraction systems for diverse project requirements and variable worksite conditions. These operations demand flexible dust control solutions accommodating changing equipment configurations. Therefore, contractors prioritize modular extraction capabilities that adapt to project-specific demands.

Cabinet and Joinery Production facilities install dedicated extraction networks serving precision cutting and assembly operations. These specialized manufacturers require consistent dust removal to maintain product quality and dimensional accuracy. Additionally, custom joinery shops invest in extraction technology to protect skilled workforce health.

Panel Processing and MDF Factories operate high-capacity centralized systems managing extreme dust loads from continuous production lines. These industrial operations generate massive particulate volumes requiring robust extraction infrastructure. Consequently, panel manufacturers implement maximum-capacity collection networks with explosion prevention technologies for regulatory compliance and operational safety.

Key Market Segments

By System Type

- Centralized Ducted

- Portable Collectors

- Baghouse (Fabric)

- Cartridge/HEPA Systems

By Airflow Capacity

- ≤2,000 m³/h

- 2,001-10,000 m³/h

- 10,001-30,000 m³/h

- 30,000 m³/h

By Filtration Media

- Fabric Bags

- Cartridge/PLEAT

- HEPA/Secondary

- Spark/Fire Safe & Other

By End-Use Industry

- Furniture Manufacturing

- Construction & Woodworking Shops

- Cabinet & Joinery Production

- Panel Processing & MDF Factories

- Others

Drivers

Stricter Occupational Exposure Limits for Respirable Wood Dust Drive Market Expansion

Regulatory agencies worldwide implement progressively stricter exposure thresholds for respirable wood dust in manufacturing environments. Industrialized nations enforce comprehensive workplace safety standards requiring continuous air quality monitoring and extraction system upgrades. Moreover, emerging economies adopt international occupational health frameworks, expanding compliance requirements across global woodworking industries.

Automated CNC woodworking machinery proliferates across furniture and panel manufacturing facilities requiring integrated dust control solutions. Modern processing equipment generates higher dust volumes at faster production speeds than legacy manual operations. In February 2025, Festool introduced next-generation CT 26, CT 36, and CT 48 EI mobile dust extractors featuring Bluetooth connectivity and enhanced automatic filter cleaning for professional woodworking environments, demonstrating industry response to automation demands.

Fire and explosion prevention standards mandate advanced extraction systems in panel manufacturing and high-dust production facilities. Regulatory frameworks require spark detection, explosion venting, and flame-retardant filtration media in high-risk processing operations. Therefore, manufacturers invest in sophisticated extraction infrastructure to meet mandatory safety specifications and protect facility assets.

Restraints

High Initial Capital Investment Limits Market Penetration in Small-Scale Operations

Advanced centralized extraction systems require substantial upfront capital expenditure for equipment procurement, installation, and facility modifications. Comprehensive ducted networks involve extensive engineering design, structural reinforcement, and electrical infrastructure upgrades. Consequently, many small and mid-sized workshops postpone extraction system investments despite regulatory obligations.

Retrofit installations face additional complexity when integrating modern extraction technology into existing production facilities with limited space availability. Older buildings lack adequate power infrastructure to support high-capacity extraction equipment and associated motor loads. Moreover, installation costs frequently exceed initial equipment purchase prices, creating financial barriers for budget-constrained operations.

Small-scale woodworking shops encounter space constraints that prevent centralized system installation and limit extraction equipment placement options. Limited facility footprints accommodate only portable or compact extraction units with reduced performance capabilities. Additionally, inadequate electrical service capacities restrict system sizing and operational efficiency in smaller workshop environments.

Growth Factors

Technological Advancements and Market Diversification Accelerate Industry Expansion

Manufacturers develop modular and compact extraction units specifically designed for small and mid-sized woodworking operations with limited installation space. These systems deliver professional-grade performance in reduced footprints without permanent ductwork requirements. In March 2025, Festool expanded its dust management lineup with the CT MIDI I AC compact dust extractor equipped with automatic cleaning and Bluetooth tool integration for service and renovation work, addressing this market segment.

Energy-efficient variable-speed extraction systems reduce operating costs by adjusting airflow based on real-time production demands and equipment utilization. Smart motor controls and frequency drives optimize power consumption without compromising dust capture effectiveness. Therefore, manufacturers prioritize energy-efficient technologies to lower total ownership costs and improve operational profitability.

Sustainable construction trends and engineered wood product adoption drive new industrial installations requiring comprehensive dust extraction infrastructure. Growing demand for cross-laminated timber, oriented strand board, and other manufactured wood products expands processing capacity. Additionally, green building initiatives mandate responsible manufacturing practices including effective workplace air quality management systems.

Emerging Trends

Digital Integration and Advanced Filtration Technologies Reshape Market Landscape

IoT-based air quality monitoring systems integrate directly with wood dust extraction equipment to provide real-time particulate concentration data and system performance analytics. Connected sensors enable predictive maintenance scheduling and automated filter replacement alerts. In October 2024, Festool launched the SYS-AIR mobile air purifier system designed to filter fine airborne dust particles that escape standard extraction systems, demonstrating technological evolution toward comprehensive air quality management.

Manufacturers shift toward cartridge and HEPA filtration systems to meet increasingly stringent fine dust and emission regulations. Advanced filter media captures sub-micron particulates that penetrate conventional fabric collectors. Consequently, regulatory compliance and indoor air quality requirements drive adoption of superior filtration technologies across manufacturing sectors.

Explosion venting and spark detection technologies become standard components in wood dust extraction systems serving high-risk production environments. Integrated safety features prevent catastrophic dust explosions and facility fires through automated system shutdown protocols. Moreover, manufacturers incorporate flame-retardant materials and grounding systems as baseline safety specifications rather than optional upgrades.

Regional Analysis

North America Dominates the Wood Dust Extraction System Market with a Market Share of 44.2%, Valued at USD 0.5 Billion

North America leads global extraction system adoption with a commanding 44.2% market share, valued at USD 0.5 Billion, driven by stringent OSHA regulations and comprehensive workplace safety enforcement. In May 2025, N.R. Murphy Limited completed the largest and most advanced dust collection system in its 82-year history, a high-capacity pulse-jet collector rated at 56,000 CFM with 680 filter bags. United States and Canadian manufacturers maintain robust compliance with occupational exposure limits, sustaining consistent demand across furniture and panel manufacturing sectors.

Europe Wood Dust Extraction System Market Trends

European markets demonstrate strong regulatory frameworks requiring advanced extraction technologies in woodworking facilities. Germany, France, and UK manufacturers invest heavily in energy-efficient systems meeting EU emission standards. Moreover, Scandinavian furniture producers prioritize sustainable manufacturing practices incorporating comprehensive dust control infrastructure.

Asia Pacific Wood Dust Extraction System Market Trends

Asia Pacific experiences rapid growth in furniture manufacturing and construction sectors driving extraction system demand. China and India expand industrial woodworking capacity requiring modern dust control installations. Additionally, Japan and South Korea implement strict occupational health standards accelerating technology adoption.

Latin America Wood Dust Extraction System Market Trends

Latin American markets show gradual adoption of extraction systems as regulatory frameworks strengthen across Brazil and Mexico. Growing furniture export industries invest in compliance infrastructure to meet international buyer requirements. Therefore, regional manufacturers upgrade facilities with modern dust collection technologies.

Middle East & Africa Wood Dust Extraction System Market Trends

Middle East construction boom and African furniture manufacturing growth create emerging opportunities for extraction system providers. GCC nations implement workplace safety standards aligned with international best practices. However, market development remains constrained by limited regulatory enforcement and infrastructure investment in certain territories.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Festool dominates the professional woodworking dust extraction segment through continuous innovation in mobile and stationary collection systems. The company integrates Bluetooth connectivity and automatic filter cleaning technologies into its product portfolio. Moreover, Festool addresses diverse market segments from compact portable units to comprehensive workshop air purification solutions.

Bosch leverages its extensive power tool ecosystem to deliver integrated dust extraction solutions for professional contractors and industrial users. The company’s extraction systems feature tool-synchronization capabilities and advanced filtration technologies. Additionally, Bosch maintains strong distribution networks across residential and commercial woodworking markets.

DeWalt serves construction and industrial woodworking segments with rugged portable extraction equipment designed for demanding jobsite conditions. The company emphasizes durability and high-performance suction capabilities in its product designs. Therefore, DeWalt extraction systems appeal to professional contractors requiring reliable mobile dust control solutions.

Makita provides comprehensive extraction system portfolios spanning portable shop vacuums to industrial-grade collection units for manufacturing facilities. The company integrates extraction technologies with its cordless and corded power tool platforms. Consequently, Makita addresses both small workshop operators and large-scale production environments through diversified product offerings.

Key players

- Festool

- Bosch

- DeWalt

- Makita

- Jet Tools

- Laguna Tools

- Grizzly Industrial

- Donaldson Company, Inc.

- Nederman Holding AB

- Camfil AB

Recent Developments

- October 2024 – Festool launched the SYS-AIR mobile air purifier system designed to filter fine airborne dust particles that escape standard dust extraction systems, improving overall air quality in workshops and on job sites with advanced secondary filtration capabilities.

- February 2025 – Festool introduced the next-generation CT 26, CT 36, and CT 48 EI mobile dust extractors featuring built-in Bluetooth connectivity, intuitive touch control, and enhanced automatic filter cleaning (AUTOCLEAN) for professional woodworking environments requiring advanced system management.

- March 2025 – Festool expanded its dust management lineup with the new CT MIDI I AC compact dust extractor equipped with automatic cleaning (AUTOCLEAN), robust suction performance, and Bluetooth tool integration, aimed at service, assembly, and renovation work applications.

- May 2025 – N.R. Murphy Limited completed the largest and most advanced dust collection system in its 82-year history, a high-capacity pulse-jet collector rated at 56,000 CFM with 680 filter bags, setting a new benchmark for industrial woodworking dust extraction installations.

Report Scope

Report Features Description Market Value (2025) USD 1.2 Billion Forecast Revenue (2035) USD 1.8 Billion CAGR (2026-2035) 3.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System Type (Centralized Ducted, Portable Collectors, Baghouse (Fabric), Cartridge/HEPA Systems), By Airflow Capacity (≤2,000 m³/h, 2,001-10,000 m³/h, 10,001-30,000 m³/h, 30,000 m³/h), By Filtration Media (Fabric Bags, Cartridge/PLEAT, HEPA/Secondary, Spark/Fire Safe & Other), By End-Use Industry (Furniture Manufacturing, Construction & Woodworking Shops, Cabinet & Joinery Production, Panel Processing & MDF Factories, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Festool, Bosch, DeWalt, Makita, Jet Tools, Laguna Tools, Grizzly Industrial, Donaldson Company, Inc., Nederman Holding AB, Camfil AB Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wood Dust Extraction System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Wood Dust Extraction System MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Festool

- Bosch

- DeWalt

- Makita

- Jet Tools

- Laguna Tools

- Grizzly Industrial

- Donaldson Company, Inc.

- Nederman Holding AB

- Camfil AB