Global Wheat Starch Derivatives Market Size, Share and Report Analysis By Form (Powder, Granules, Liquid), By Product Type (Wheat Starch, Modified Wheat Starch, Wheat Starch Sugars, Wheat Starch Derivatives, Others), By End Use (Food Industry, Industrial Applications, Personal Care Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175725

- Number of Pages: 370

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

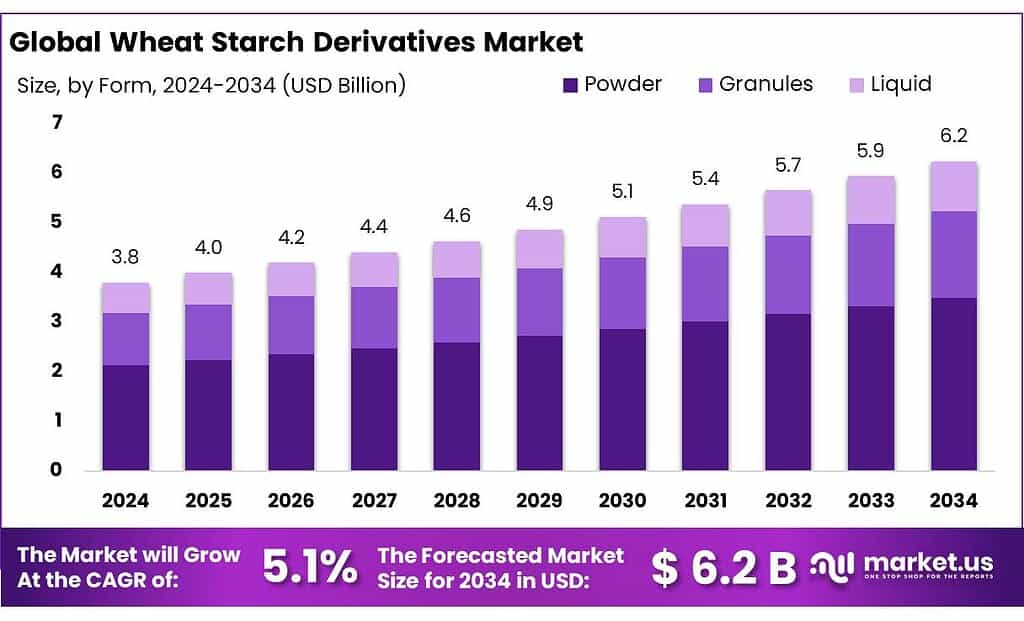

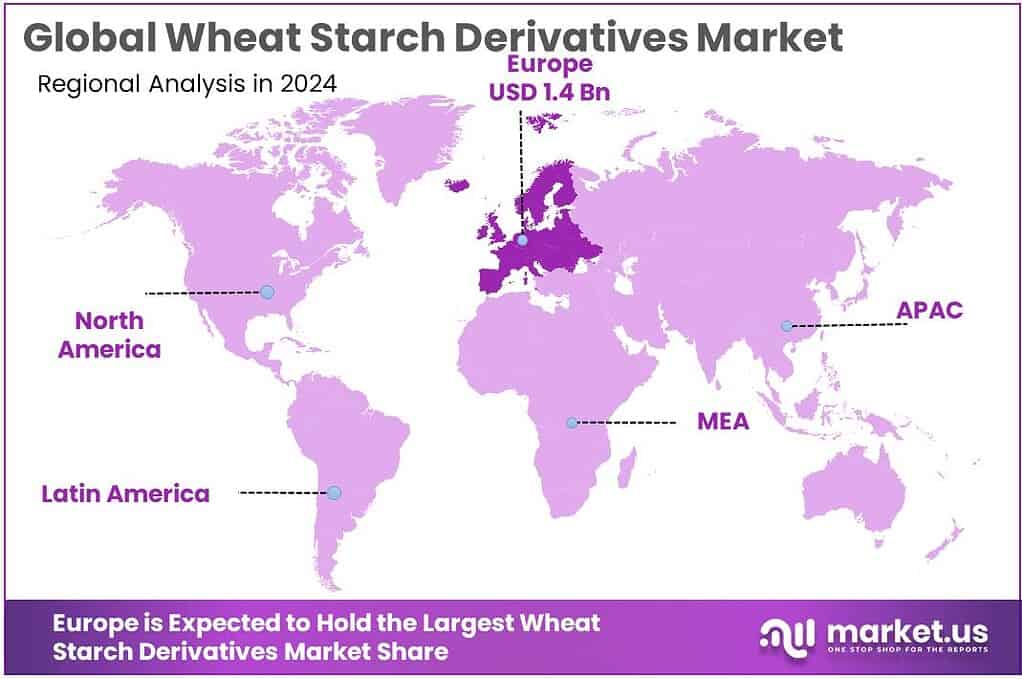

Global Wheat Starch Derivatives Market size is expected to be worth around USD 6.2 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 38.3% share, holding USD 1.4 Billion in revenue.

Wheat starch derivatives sit in the middle of the “farm-to-formulation” chain: they start with a high-volume crop and end as functional inputs that control texture, stability, shelf-life, binding, and process efficiency in foods and industrial products. The industry’s supply base is supported by very large wheat harvests—FAO forecasts 800.1 million tonnes of global wheat production in 2025—which helps keep starch derivatives commercially relevant even when end-use demand shifts between food and non-food applications.

- Europe is one of the most transparent regions on industry capacity and structure: Starch Europe notes the EU starch sector operates 70 production facilities across 18 Member States and produces about 9.8 million tonnes of starch and starch-derivatives each year, plus more than 5 million tonnes of proteins and fibres.

It also states this output is primarily extracted from about 22 million tonnes of EU-grown feedstocks, including wheat. Outside Europe, wheat availability remains a key anchor: USDA estimates U.S. farmers produced 1.97 billion bushels of wheat in 2024/25 from 38.5 million acres, underlining how large origin markets can support ingredient manufacturing ecosystems.

Demand dynamics are driven by both food performance needs and non-food industrial requirements. A practical example is gluten-management: the Codex standard for foods for special dietary use sets a maximum gluten content of 20 mg/kg for certain “gluten-free” products, which supports the use of specially processed ingredients when they meet strict thresholds and labelling rules.

- Reuters reported European starch makers running at only 70–75% of capacity amid weaker demand, noting the paper and cardboard sector saw a 13% production drop in 2023, which directly pressured starch derivative offtake.

In Europe—one of the world’s major starch-processing hubs—the European starch industry reports output of 9.8 million tonnes of starch and starch-derivatives from 70 production facilities across 18 EU Member States, using about 22 million tonnes of EU-grown crops. EU-level industry dialogue has also cited that EU starch production originates roughly 40% from wheat, with about 60% of total starch volume destined for the food sector.

Key Takeaways

- Wheat Starch Derivatives Market size is expected to be worth around USD 6.2 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 5.1%.

- Powder held a dominant market position, capturing more than a 56.2% share.

- Modified Wheat Starch held a dominant market position, capturing more than a 42.5% share.

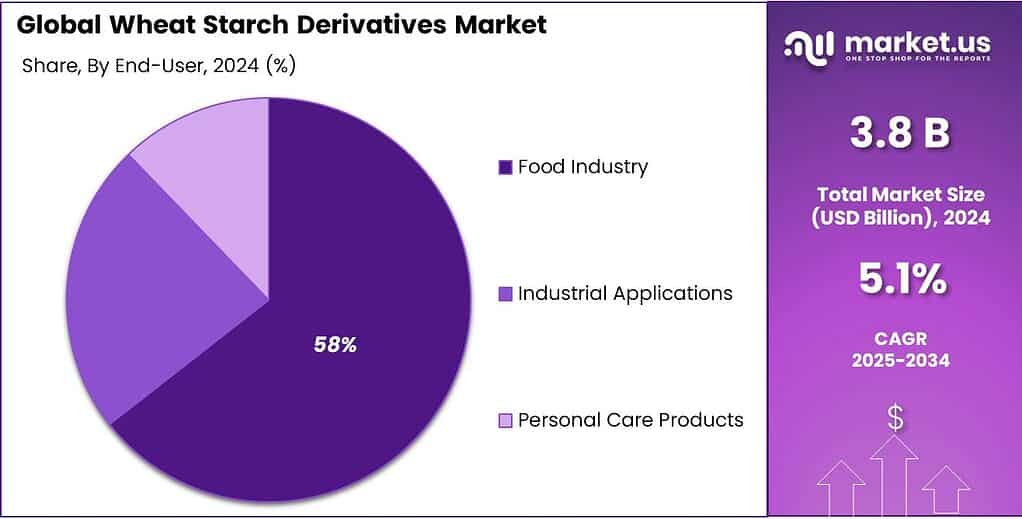

- Food Industry held a dominant market position, capturing more than a 58.1% share in the Wheat Starch Derivatives Market.

- Europe remained the leading regional market for wheat starch derivatives, holding 38.3% share and reaching USD 1.4 Bn.

By Form Analysis

Powder form leads the market with a strong 56.2% share, reflecting its versatile use across food and industrial applications.

In 2024, Powder held a dominant market position, capturing more than a 56.2% share in the Wheat Starch Derivatives Market. This leadership comes from its ease of handling, long shelf stability, and compatibility with large-scale food manufacturing.

Powdered derivatives blend smoothly into dry mixes, bakery fillings, confectionery bases, instant foods, and texturizing systems, making them a preferred option for producers who need consistent quality during high-speed processing. In 2024, many food processors continued shifting toward powdered stabilizers because they allow better portion control and predictable hydration during production.

By Product Type Analysis

Modified Wheat Starch leads the category with a solid 42.5% share, driven by its functional stability and wide food-industry use.

In 2024, Modified Wheat Starch held a dominant market position, capturing more than a 42.5% share in the Wheat Starch Derivatives Market. Its strong performance comes from its ability to withstand heat, acidity, and mechanical stress during modern food processing.

Manufacturers prefer modified wheat starch because it helps maintain texture, thickness, and stability in products like soups, sauces, bakery fillings, dairy items, snacks, and ready meals. In 2024, demand rose as more companies focused on improving shelf stability and achieving a consistent mouthfeel across global product lines.

By End Use Analysis

Food Industry leads the market with a strong 58.1% share, reflecting its extensive use of wheat-based functional ingredients.

In 2024, Food Industry held a dominant market position, capturing more than a 58.1% share in the Wheat Starch Derivatives Market. This leadership comes from the sector’s constant need for stabilizers, thickeners, binders, and texture enhancers in a wide range of products—soups, sauces, confectionery, bakery items, dairy alternatives, and ready-to-eat meals.

Wheat starch derivatives offer clean taste, smooth texture, and predictable performance, making them a preferred choice for manufacturers looking to improve product consistency and maintain quality during large-scale production. In 2024, growing demand for packaged and convenience foods supported steady growth in this segment.

Key Market Segments

By Form

- Powder

- Granules

- Liquid

By Product Type

- Wheat Starch

- Modified Wheat Starch

- Wheat Starch Sugars

- Wheat Starch Derivatives

- Others

By End Use

- Food Industry

- Industrial Applications

- Personal Care Products

- Others

Emerging Trends

Clean-label reformulation with tighter additive scrutiny is reshaping how wheat starch derivatives are specified

One of the most visible latest trends in wheat starch derivatives is the shift toward clean-label style reformulation—but with a new twist: brands want familiar, simple ingredient statements and they want stronger regulatory confidence that the functional ingredients behind those labels are well supported. Wheat starch derivatives are increasingly being selected not only for performance in soups, sauces, bakery fillings, and ready meals, but also for how clearly they fit into modern labeling expectations and how robust their compliance files are.

- In the United States, total food sales across foodservice and food retailing outlets reached $2.58 trillion in 2024, showing how large the system is where consistency and shelf stability are non-negotiable. In the same year, foodservice alone was $1.52 trillion, with full-service at $552.7 billion and limited-service at $550.7 billion—segments that depend heavily on sauces, coatings, fillings, and prepared components where starch derivatives help deliver repeatable texture.

At the same time, the regulatory environment is pushing companies to keep documentation tighter, which is influencing purchasing decisions. A clear signal came from the European Commission in April 2024, when it published a call for business operators to submit technical and scientific data for several modified starches used as food additives—including oxidised starch (E1404), various phosphated and acetylated starches (E1410–E1422), hydroxypropyl starches (E1440–E1442), and others—specifically to address issues identified during safety re-evaluation work.

Inflation and value-engineering are also shaping this “clean-label + compliance” trend. USDA’s Economic Research Service reports that overall food prices rose 2.3% in 2024 and 2.9% in 2025. Within that, food-at-home prices increased 1.2% in 2024 and 2.3% in 2025, while food-away-from-home rose 4.1% in 2024 and 3.8% in 2025. Those numbers matter because they keep pressure on brands to protect margins without damaging eating quality. Wheat starch derivatives often become a “smart formulation lever” here—helping maintain viscosity, freeze-thaw stability, and mouthfeel while manufacturers adjust recipes and manage cost swings.

Drivers

Convenience-food scale and value-focused reformulation are pushing demand for wheat starch derivatives.

One major driving factor for wheat starch derivatives is the steady expansion of high-volume, processed, and convenience food manufacturing—where texture, stability, and cost control must stay consistent from batch to batch. In large retail-driven food systems, manufacturers rely on starch derivatives to keep sauces smooth, bakery fillings stable, and ready meals consistent after heating, cooling, or long storage. This demand is closely tied to the size of the food channel itself: in the U.S. alone, total supermarket sales in 2024 reached $1 trillion, showing how much product moves through standardized, high-throughput supply chains where functional ingredients matter.

A second layer of the same driver is “value pressure” in grocery—consumers want affordable food, and retailers push private-label growth, which increases the need for dependable, cost-effective texture systems. Private brands reached about 23% unit share and 20% dollar share, with an estimate that store-brand revenue could surpass $250 billion in 2024 if trends held. When private-label volumes rise, producers typically tighten formulations to protect margins while meeting consistency targets. Wheat starch derivatives fit that need because they can improve viscosity.

This demand driver is also supported by the scale and reliability of wheat supply and starch-processing infrastructure. The UN FAO forecast global wheat production at 800.1 million tonnes in 2025, which underpins the availability of wheat-based feedstock for derivative production. On the processing side, the European starch industry reports production of 9.8 million tonnes of starch and starch-derivatives from 70 production facilities across 18 EU Member States, using about 22 million tonnes of EU-grown crops.

Government-backed innovation programs are further reinforcing this driver by accelerating new starch-derivative routes and broader bio-based ingredient development. In Europe, the Circular Bio-based Europe Joint Undertaking (CBE JU) states that, since 2014, it has provided €1.3 billion in public funding to support 220 projects, resulting in 100+ bio-based products and 250+ new materials and ingredients.

Restraints

Growing gluten-free preferences and wheat avoidance create a restraint on wheat starch derivative demand

One of the most influential factors holding back the growth of wheat starch derivatives is the rising trend of gluten-free diets and wheat avoidance among consumers. In many food markets around the world, a substantial share of people are cutting back on wheat-based ingredients due to gluten sensitivity concerns, dietary preferences, or perceived health benefits. Even though wheat starch derivatives themselves can be processed to contain minimal gluten, the association with wheat continues to influence purchasing decisions and formulation choices at both retail and industrial levels.

For example, studies on eating habits show that in the United States nearly 25% of the population consumes gluten-free products, a figure that far exceeds the actual number of people with medically diagnosed gluten intolerance or celiac disease. This means that a significant proportion of consumers are avoiding wheat or gluten-associated ingredients out of choice or health perception, rather than necessity.

Historically, avoidance of gluten isn’t merely confined to those with medical conditions. Data indicates that roughly 30% of adults in the U.S. avoided gluten foods or eliminated them entirely from their diets in earlier years of the trend’s rise, pointing to a broader shift in consumer attitudes toward wheat as an ingredient.

This shift has knock-on effects for the wheat starch derivatives industry. Manufacturers serving food formulators must now contend with both the real and perceived risks associated with wheat and gluten. Even when derivatives are technically safe for gluten-free products, the association with wheat can lead brands to prefer alternative starches to avoid consumer confusion or negative perceptions.

Opportunity

Bio-based materials and circular-economy programs are opening a strong growth runway for wheat starch derivatives

A major growth opportunity for wheat starch derivatives is the expanding push toward bio-based materials and circular production models, where starch-based inputs can replace or reduce petro-based components in selected applications. Governments and regulators are actively shaping this space, and that policy direction matters because it influences what brand owners can claim, what materials buyers can specify, and what kinds of projects get funding.

In the European Union, the European Commission states there is currently no single EU law that comprehensively applies to biobased, biodegradable, and compostable plastics, but it has issued an EU policy framework that clarifies definitions and sets conditions to ensure environmental benefit.

This opportunity becomes more real when it is backed by industrial capacity and structured investment. Europe already has a large starch and starch-derivatives manufacturing base: Starch Europe reports production of 9.8 million tonnes of starch and starch-derivatives from 70 production facilities across 18 EU Member States, with primary extraction from about 22 million tonnes of EU-grown crops.

- Public funding and innovation programs are also building a pipeline for new starch-adjacent products that can turn into “real contracts” for derivative suppliers. The Circular Bio-based Europe Joint Undertaking notes that since 2014, it has provided €1.3 billion in public funding supporting 220 projects, delivering outcomes including 100+ bio-based products and 250+ new materials and ingredients.

On the raw-material side, wheat supply remains structurally large, helping this opportunity look feasible over multiple years rather than a short trend. FAO forecast global wheat production at 800.1 million tonnes in 2025, supporting the idea that wheat-derived feedstocks can remain available for both food and non-food derivative routes. Reuters reported European starch makers running at 70–75% of capacity during a demand downcycle, showing why many processors value adjacent growth pockets that can stabilize utilization.

Regional Insights

Europe dominates the Wheat Starch Derivatives Market with a 38.3% share, valued at USD 1.4 Bn, supported by strong starch-processing capacity and a large packaged-food base.

In 2024, Europe remained the leading regional market for wheat starch derivatives, holding 38.3% share and reaching USD 1.4 Bn in value, largely because the region combines mature food manufacturing with well-established starch conversion infrastructure.

- The EU’s starch industry operates at industrial scale: Starch Europe states that the European starch industry produces 9.8 million tonnes of starch and starch-derivatives annually from 70 production facilities across 18 EU Member States, extracting primarily from about 22 million tonnes of EU-grown crops.

Demand is reinforced by the sheer size of Europe’s food manufacturing economy. FoodDrinkEurope’s “Data & Trends 2024” reports the EU food and drink industry employs 4.7 million people and generates €1.2 trillion in turnover, underlining the scale of industrial food output that routinely depends on texture and stability systems such as starch derivatives. On the supply side, wheat availability remains strong: USDA’s production dashboard lists the European Union at 122.15 million metric tons of wheat in 2024/2025, supporting steady feedstock access for wheat-based ingredient processing.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ingredion plays a central role in specialty wheat starch derivatives, focusing on texture systems, clean-label starches, and process-tolerant ingredients. Operating in 120+ countries with 12,000 employees, the company reported $8.2 billion revenue (2023). Its innovation centers across the U.S., Europe, and Asia help customers improve viscosity, stability, and sensory performance in packaged foods and beverages.

Roquette, a global plant-based ingredients leader, maintains a strong foothold in wheat starch derivatives through its European processing base. With 8,000+ employees and operations in 100+ countries, Roquette generates revenue above €5 billion. Its expertise in plant proteins, starch chemistry, and pharmaceutical-grade excipients supports high-quality modified starches for food, nutrition, and industrial applications.

Südzucker, through its subsidiary BENEO, is a key European producer of wheat-based starch derivatives. The Südzucker Group employs around 20,000 people and posted €9.5 billion revenue (2023/24). BENEO’s wheat-processing facilities support functional starches used in bakery, confectionery, dairy alternatives, and clean-label formulations, giving the group a strong innovation presence in the starch-derivatives segment.

Top Key Players Outlook

- Cargill, Incorporated

- ADM

- Ingredion Incorporated

- Roquette Frères

- Südzucker AG

- Agrana Beteiligungs-AG

- Tate & Lyle PLC

- Manildra Group

- Tereos Group

Recent Industry Developments

In 2024, ADM reported total revenue of approximately USD 85.5 billion, even as overall earnings declined to USD 1.8 billion, which reflected broader challenges in commodity markets and food ingredient segments.

In 2024, Ingredion reported annual net sales of about USD 7.4 billion, even as revenue dipped from prior years, showing resilience amid commodity price shifts.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Bn Forecast Revenue (2034) USD 6.2 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Granules, Liquid), By Product Type (Wheat Starch, Modified Wheat Starch, Wheat Starch Sugars, Wheat Starch Derivatives, Others), By End Use (Food Industry, Industrial Applications, Personal Care Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Incorporated, ADM, Ingredion Incorporated, Roquette Frères, Südzucker AG, Agrana Beteiligungs-AG, Tate & Lyle PLC, Manildra Group, Tereos Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wheat Starch Derivatives MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Wheat Starch Derivatives MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill, Incorporated

- ADM

- Ingredion Incorporated

- Roquette Frères

- Südzucker AG

- Agrana Beteiligungs-AG

- Tate & Lyle PLC

- Manildra Group

- Tereos Group