Global Wellness Real Estate Market Size, Share, Growth Analysis By Features (Physical Wellness, Meditation Room, Nutritional Wellness, Environmental Wellness), By End-user (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171450

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

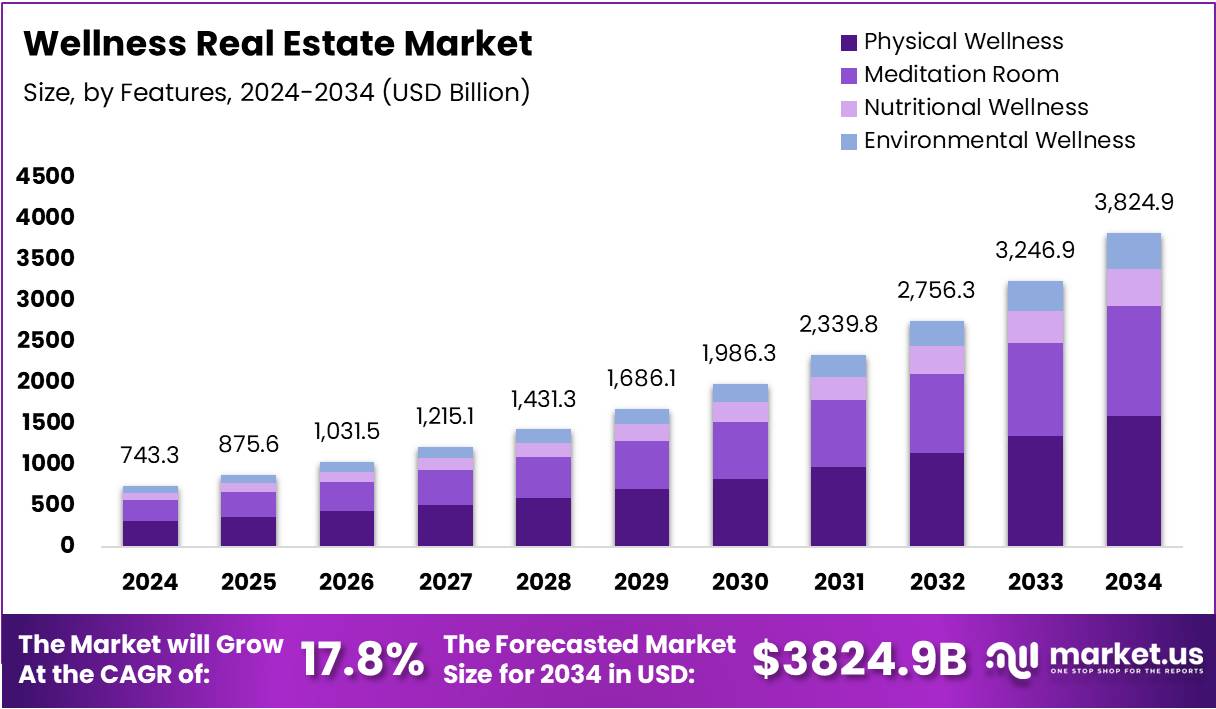

The Global Wellness Real Estate Market size is expected to be worth around USD 3824.9 Billion by 2034, from USD 743.3 Billion in 2024, growing at a CAGR of 17.8% during the forecast period from 2025 to 2034.

Wellness real estate fundamentally transforms traditional property development by integrating health-focused amenities and design principles. These properties prioritize occupant well-being through features like natural lighting, air purification systems, fitness facilities, and biophilic design elements. Essentially, this emerging sector bridges healthcare concepts with residential and commercial spaces, creating environments that actively support physical and mental health.

The wellness real estate market demonstrates remarkable momentum as consumer priorities increasingly shift toward health-conscious living environments. Property developers are responding by incorporating holistic wellness features that extend beyond basic amenities. This transformation reflects a broader societal recognition that built environments profoundly impact daily health outcomes. Consequently, traditional real estate paradigms are evolving to accommodate these wellness-centric expectations across residential, commercial, and mixed-use developments.

Market opportunities are expanding rapidly as developers recognize substantial financial benefits from wellness-focused properties. Notably, homes and communities designed around wellness report resale values 10%–25% higher than conventional properties. This premium valuation underscores strong market demand for health-oriented living spaces. Furthermore, wellness real estate represents approximately 2.9–3.3% of global annual construction output, highlighting its emerging yet significant role in overall property development strategies.

Consumer behavior patterns strongly support continued market expansion across key geographic regions. Research indicates 84% of consumers in major markets habitually regard wellness as a priority when making lifestyle decisions. Additionally, real estate listings reflect this trend dramatically—wellness mentions increased 32% in for-sale descriptions. Specific features like sensory gardens surged 314%, cold plunge pools rose 130%, and pickleball facilities jumped 64%, demonstrating diverse wellness preferences driving market evolution forward.

Key Takeaways

- The Global Wellness Real Estate Market is projected to reach USD 3824.9 Billion by 2034, expanding from USD 743.3 Billion in 2024 at a 17.8% CAGR.

- By features, the Physical Wellness segment dominates the market with a share of 37.8%.

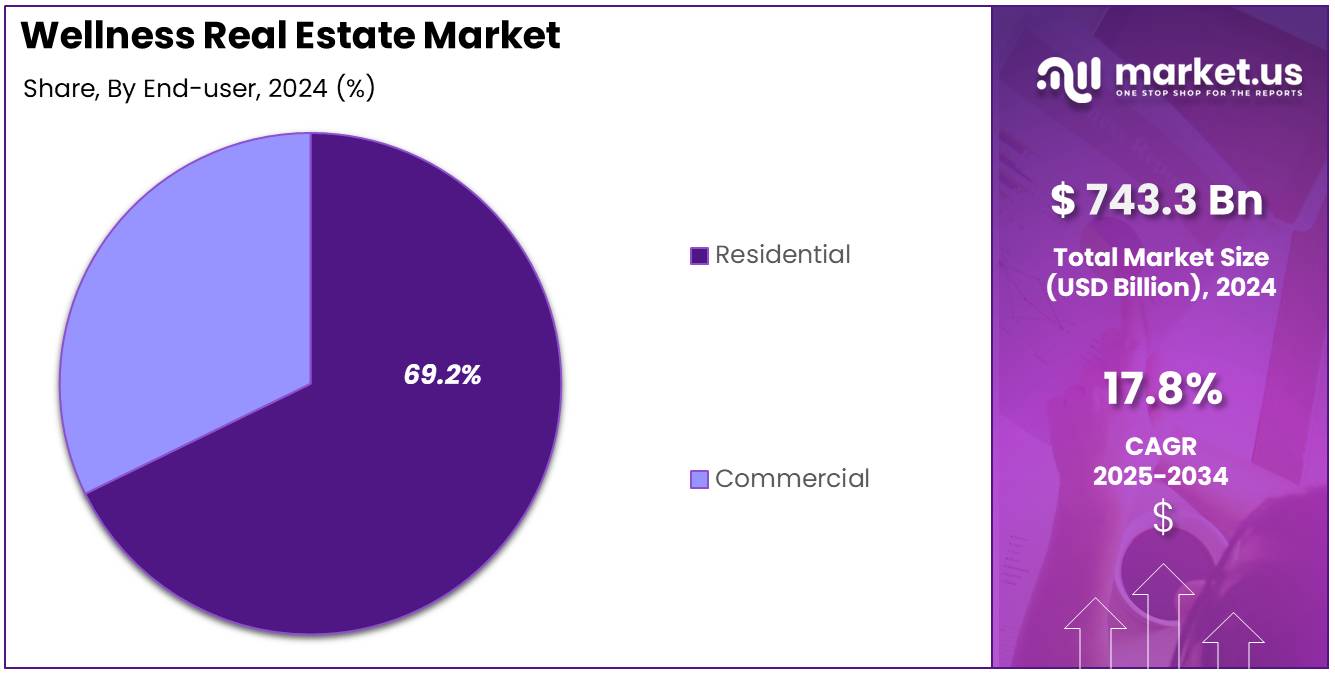

- By end-user, the Residential segment leads with a commanding market share of 69.2%.

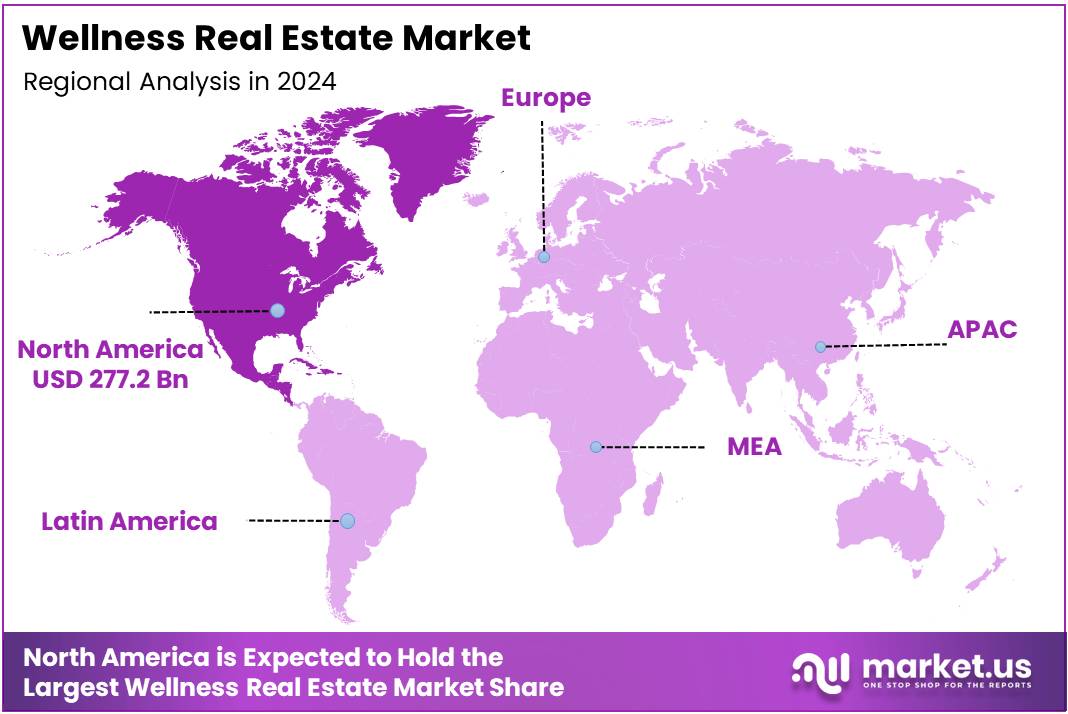

- Regionally, North America holds the largest share at 37.3%, with a market value of USD 277.2 Billion.

Features Analysis

Physical Wellness held a dominant market position in the By Features Analysis segment of Wellness Real Estate Market, with a 37.8% share.

In 2024,Physical Wellness features command the market through integrated fitness centers, yoga studios, and spa facilities within residential and commercial properties. Developers increasingly incorporate state-of-the-art gyms, swimming pools, and dedicated exercise spaces to attract health-conscious buyers. This segment’s dominance reflects growing consumer awareness about active lifestyles and preventive healthcare. Properties featuring physical wellness amenities command premium pricing and faster sales cycles in competitive markets.

Meditation Rooms represent an emerging trend as mindfulness practices gain mainstream acceptance across demographics. These dedicated spaces offer tranquil environments with soundproofing, natural lighting, and calming aesthetics for stress reduction. Real estate projects now designate specific areas for contemplation and mental rejuvenation, responding to urban dwellers’ needs for peaceful retreats. The inclusion of meditation rooms enhances property value while addressing mental health concerns.

Nutritional Wellness features integrate community gardens, organic produce delivery systems, and on-site nutritionists into property developments. Modern projects incorporate teaching kitchens, juice bars, and wellness cafes promoting healthy eating habits. This segment attracts families and professionals prioritizing dietary consciousness and sustainable food sources within their living environments.

Environmental Wellness focuses on sustainable building materials, air purification systems, and biophilic design elements connecting residents with nature. Green certifications, energy-efficient systems, and toxin-free construction materials define this category. Properties emphasizing environmental wellness appeal to eco-conscious consumers seeking healthier indoor environments and reduced ecological footprints.

End-user Analysis

Residential held a dominant market position in the By End-user Analysis segment of Wellness Real Estate Market, with a 69.2% share.

In 2024, Residential developments dominate wellness real estate as homeowners prioritize health-focused living spaces for their families. Luxury apartments, gated communities, and suburban homes increasingly feature comprehensive wellness amenities including fitness centers, meditation spaces, and outdoor recreation areas. The post-pandemic shift toward home-centric lifestyles accelerated demand for properties supporting physical and mental wellbeing. Residential buyers willingly invest premium amounts for integrated wellness features that enhance daily quality of life and long-term health outcomes.

Commercial wellness real estate encompasses office buildings, hotels, and mixed-use developments incorporating employee wellbeing facilities. Corporate spaces now feature on-site gyms, healthy food options, and stress-reduction zones to boost productivity and talent retention. Hotels integrate spa services, fitness centers, and wellness programming to differentiate their offerings. Though smaller than residential, this segment grows as businesses recognize the connection between workplace wellness and organizational performance.

Key Market Segments

By Features

- Physical Wellness

- Meditation Room

- Nutritional Wellness

- Environmental Wellness

By End-user

- Residential

- Commercial

Drivers

Growing Consumer Awareness of Lifestyle-Linked Health Benefits Drives Market Growth

Consumers today understand that their living environment directly impacts their physical and mental health. People are actively seeking homes that promote healthier lifestyles rather than just providing shelter. This awareness has shifted buying preferences toward properties with wellness features like natural lighting, air purification systems, and fitness facilities.

The demand for sustainable and energy-efficient wellness homes continues to rise as buyers recognize long-term health and cost benefits. Green building materials, solar panels, and water conservation systems are becoming standard expectations. Homebuyers increasingly view these features as investments in their wellbeing rather than luxury additions.

Corporate and institutional investors are directing significant capital toward health-oriented real estate projects. Major real estate firms and healthcare organizations recognize the profitable intersection of wellness and property development. This institutional backing provides the financial strength needed to develop large-scale wellness communities. Investment from established players also brings credibility to the wellness real estate concept, encouraging more buyers to consider these properties as viable long-term investments.

Restraints

Limited Availability of Land Suitable for Wellness-Oriented Communities Restrains Market Expansion

Finding appropriate land for wellness communities presents significant challenges for developers. Wellness-focused properties require specific environmental conditions like access to nature, clean air quality, and peaceful surroundings. Urban areas with high demand often lack suitable plots that meet these wellness criteria. This scarcity drives up land costs and limits project locations.

The absence of standardized wellness features across different regions creates confusion and inconsistency in the market. What qualifies as a wellness home varies significantly between countries and even cities. Developers struggle to implement uniform wellness standards due to differing building codes, climate conditions, and cultural preferences. This lack of standardization makes it difficult for buyers to compare properties and understand what wellness certifications actually mean.

Regional variations in regulations further complicate development efforts. Some areas have strict zoning laws that restrict wellness-oriented amenities, while others lack any framework for wellness real estate altogether. These inconsistencies slow market growth and increase development costs as builders must customize approaches for each location.

Growth Factors

Expansion of Wellness Communities in Suburban and Secondary Cities Creates Growth Opportunities

Suburban areas and secondary cities offer significant expansion potential for wellness real estate developers. These locations provide affordable land with natural surroundings that urban centers cannot match. As remote work becomes permanent for many professionals, people are relocating to quieter areas where wellness communities can thrive. This geographic shift opens new markets previously overlooked by developers.

Smart home technology integration presents transformative opportunities for personalized wellness experiences. Advanced systems can monitor air quality, adjust lighting based on circadian rhythms, and track sleep patterns automatically. Technology enables homes to adapt to individual health needs, creating customized living environments. This technological capability attracts tech-savvy buyers willing to pay premium prices for intelligent wellness features.

Mixed-use developments combining residential wellness spaces with commercial amenities represent the future of community planning. These projects include wellness-focused apartments alongside healthy restaurants, fitness centers, and medical clinics. Residents enjoy convenient access to wellness services without leaving their community. This integrated approach creates vibrant neighborhoods while maximizing land use efficiency and developer returns.

Emerging Trends

Surge in Biophilic and Nature-Inspired Design in Residential Projects Shapes Market Trends

Biophilic design incorporating natural elements into buildings has become a dominant trend in wellness real estate. Developers are adding indoor gardens, living walls, and large windows that maximize natural light exposure. These nature-inspired features reduce stress and improve resident mood and productivity. The biophilic approach transforms ordinary buildings into healing environments that reconnect people with nature.

Mental health amenities are receiving unprecedented attention in new residential projects. Developers now include dedicated meditation rooms, mindfulness gardens, and quiet zones specifically designed for mental wellness. The pandemic heightened awareness about mental health importance, making these spaces essential rather than optional. Properties offering mental health-focused amenities command higher prices and faster sales.

Multi-generational wellness housing solutions are gaining popularity as families seek to live together while maintaining independence. These designs accommodate elderly parents, adult children, and grandchildren with separate living areas connected by shared wellness spaces. Features like accessibility-friendly designs, varied activity areas, and flexible layouts appeal to families prioritizing togetherness and health across all ages.

Regional Analysis

North America Dominates the Wellness Real Estate Market with a Market Share of 37.3%, Valued at USD 277.2 Billion

North America commands the wellness real estate market with a dominant position, accounting for 37.3% of the global market share and valued at USD 277.2 billion. The region’s leadership is driven by high consumer awareness regarding health and wellbeing, significant disposable income levels, and the proliferation of wellness communities featuring LEED-certified buildings and integrated amenities. The United States particularly leads through residential developments that incorporate fitness centers, meditation spaces, biophilic design elements, and air purification systems, catering to the growing demand for sustainable and health-focused living environments.

Europe Wellness Real Estate Market Trends

Europe represents a significant market for wellness real estate, driven by stringent environmental regulations and strong sustainability commitments. Countries such as Germany, the United Kingdom, and the Nordic nations lead the adoption of wellness-certified buildings incorporating natural lighting optimization, indoor air quality monitoring, and access to green spaces. The region’s emphasis on urban regeneration projects reflects the European commitment to combining heritage preservation with modern health-conscious design principles.

Asia Pacific Wellness Real Estate Market Trends

The Asia Pacific region is experiencing rapid growth in the wellness real estate sector, fueled by urbanization, rising middle-class populations, and increasing health awareness. Markets such as China, India, Australia, and Singapore are witnessing substantial investments in wellness communities and eco-friendly residential towers. The region’s growth is characterized by the integration of traditional wellness practices with contemporary design, including yoga studios, spa facilities, and spaces designed according to principles like Vastu Shastra and Feng Shui.

Middle East and Africa Wellness Real Estate Market Trends

The Middle East and Africa region is emerging as a promising market for wellness real estate, particularly in the Gulf Cooperation Council countries where luxury developments increasingly incorporate comprehensive wellness amenities. The United Arab Emirates and Saudi Arabia are leading through visionary projects that blend cutting-edge wellness technology with resort-style living, including temperature-controlled outdoor spaces and advanced water purification systems. In Africa, growing urban centers are beginning to embrace wellness-oriented development concepts, though the market remains in nascent stages.

Latin America Wellness Real Estate Market Trends

Latin America’s wellness real estate market is gradually gaining momentum, driven by growing health consciousness and the region’s natural advantages including abundant sunlight and rich biodiversity. Countries such as Brazil, Mexico, and Costa Rica are witnessing increased development of eco-resorts and wellness-centered residential communities that leverage natural resources. The market growth is supported by rising demand for properties offering outdoor living spaces and connection to nature, though adoption rates remain moderate due to economic constraints.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Wellness Real Estate Company Insights

CBRE Group Inc. plays a strategic role in scaling wellness real estate through advisory, valuation, and investment services. In 2024, its strength lies in translating wellness features into measurable asset value, rental premiums, and long-term portfolio resilience for institutional investors. CBRE’s market intelligence and global reach help normalize wellness as a core real estate performance driver rather than a lifestyle concept.

Delos Living LLC remains a thought leader in wellness-centric residential and mixed-use development. Its focus on health standards, indoor environmental quality, and resident well-being positions it as a benchmark for premium wellness communities. In 2024, Delos influences both consumer expectations and developer design choices across luxury and upper-mid segments.

DPZ CoDesign LLC contributes from a planning and urban design perspective, emphasizing walkability, community health, and human-centric development. The firm’s approach aligns wellness with long-term urban resilience, making it relevant for large-scale master-planned projects. Its role is critical in integrating wellness at the neighborhood level rather than only within buildings.

EFFEKT Arkitekter ApS brings architectural innovation focused on sustainability, social well-being, and environmental harmony. In 2024, its design philosophy supports the convergence of wellness and climate-responsive real estate. EFFEKT’s projects highlight how architecture itself can actively promote physical and mental well-being while enhancing long-term asset relevance.

Top Key Players in the Market

- CBRE Group Inc.

- Delos Living LLC

- DPZ CoDesign LLC

- EFFEKT Arkitekter ApS

- Gamuda Berhad

- GOCO HOSPITALITY

- Humaniti Montreal Inc.

- Jones Lang LaSalle Inc.

- Sansiri Public Co. Ltd.

- Tata Housing Development Co. Ltd.

- Tokyu Land Corp.

Recent Developments

- In January 2025, Welltower launched a new private funds management platform to raise and deploy third-party capital into healthcare and wellness real estate, supported by up to $400 Million from an Abu Dhabi Investment Authority affiliate.The initiative targets scalable wellness and senior housing assets, with initial deployment into a dedicated seniors housing portfolio.

- In June 2025, CVC Capital Partners and Therme Group formed a €1 Billion joint venture named Therme Horizon to develop large-scale wellness destination real estate across Europe.The partnership combines thermal wellness, lifestyle hospitality, and integrated real estate concepts to accelerate pan-European expansion.

- In December 2024, Terra and The Well announced The Well Coconut Grove, a wellness-focused residential and membership community in Miami, Florida.The project blends holistic design, health-centric living spaces, and premium amenities, expanding branded wellness residential offerings in the U.S. market.

- In March 2025, Therme Group unveiled plans for Therme Dallas, a large-scale European-style wellbeing resort in Dallas, marking its first major U.S. entry.The development will feature extensive thermal baths, saunas, pools, and immersive wellness facilities designed for high-volume urban engagement.

Report Scope

Report Features Description Market Value (2024) USD 743.3 Billion Forecast Revenue (2034) USD 3824.9 Billion CAGR (2025-2034) 17.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Features (Physical Wellness, Meditation Room, Nutritional Wellness, Environmental Wellness), By End-user (Residential, Commercial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape CBRE Group Inc., Delos Living LLC, DPZ CoDesign LLC, EFFEKT Arkitekter ApS, Gamuda Berhad, GOCO HOSPITALITY, Humaniti Montreal Inc., Jones Lang LaSalle Inc., Sansiri Public Co. Ltd., Tata Housing Development Co. Ltd., Tokyu Land Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wellness Real Estate MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Wellness Real Estate MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CBRE Group Inc.

- Delos Living LLC

- DPZ CoDesign LLC

- EFFEKT Arkitekter ApS

- Gamuda Berhad

- GOCO HOSPITALITY

- Humaniti Montreal Inc.

- Jones Lang LaSalle Inc.

- Sansiri Public Co. Ltd.

- Tata Housing Development Co. Ltd.

- Tokyu Land Corp.