Global Water and Waste Water Treatment Technologies Market Size, Share, And Business Benefits By Туре (Suspended Solids Removal, Oil/Water Separation, Dissolved Solids Removal, Biological Treatment/Nutrient and Metals Recovery, Others), By Process (Secondary, Primary, Tertiary, Advance), By End-user (Municipal, Industrial (Food and Beverage, Pulp and Paper, Oil and Gas, Healthcare, Chemical and Petrochemical, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153416

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

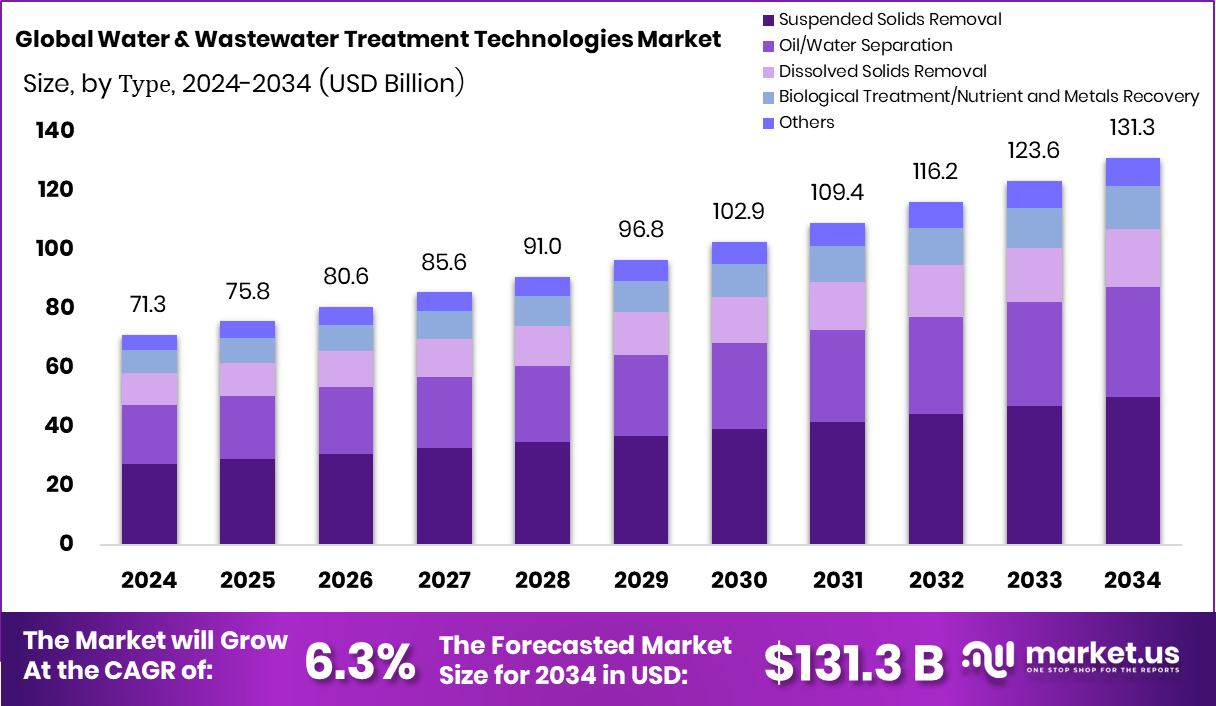

The Global Water and Waste Water Treatment Technologies Market is expected to be worth around USD 131.3 billion by 2034, up from USD 71.3 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034. Strong infrastructure investments boosted Asia-Pacific’s market value to USD 29.8 billion.

Water and Wastewater Treatment Technologies refer to a range of processes and systems designed to remove contaminants from water sources and wastewater, making them safe for human use, industrial processes, or environmental discharge. These technologies include physical, chemical, and biological methods such as filtration, sedimentation, reverse osmosis, ultraviolet disinfection, and biological digestion.

The Water and Wastewater Treatment Technologies Market involves the development, manufacturing, and deployment of these treatment systems across municipal, industrial, and residential sectors. This market includes solutions for drinking water purification, sewage treatment, industrial effluent management, and water recycling.

With rising water stress, aging infrastructure, and stringent environmental regulations, the demand for treatment technologies is expanding globally, particularly in urbanizing and industrializing regions. More than €73 million has been allocated to support wastewater infrastructure improvements across key regions.

One major growth factor driving this market is the increasing global water scarcity. With only 0.5% of the Earth’s water being usable and accessible, treatment technologies are essential for preserving and reusing water efficiently. Rising urban populations and rapid industrial growth are further pressuring existing water resources; investing in treatment infrastructure is a necessity. Water treatment initiatives have been selected to receive a share of a £42 million funding round led by the regulatory authority.

Key Takeaways

- The Global Water and Waste Water Treatment Technologies Market is expected to be worth around USD 131.3 billion by 2034, up from USD 71.3 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- Suspended solids removal holds a 38.2% share in the Water and Wastewater Treatment Technologies Market.

- Secondary treatment processes account for 39.4%, emphasizing biological and chemical stages in wastewater purification.

- Municipal sector dominates end-user share with 67.9%, driven by infrastructure upgrades and population growth needs.

- The Asia-Pacific Water and Wastewater Technologies market reached USD 29.8 billion total.

By Туре Analysis

Suspended solids removal dominates with 38.2% market share.

In 2024, Suspended Solids Removal held a dominant market position in the By Type segment of the Water and Waste Water Treatment Technologies Market, with a 38.2% share. This leadership can be attributed to the widespread application of solids removal processes in both municipal and industrial water treatment systems.

Suspended solids, which include silt, organic matter, and other particulate impurities, pose a significant threat to water quality and downstream treatment efficiency if not effectively removed at the primary stage. Technologies such as sedimentation, filtration, and flotation are extensively used to eliminate these particles, making them fundamental in the initial phase of treatment cycles.

The demand for suspended solids removal has grown steadily due to increasing regulatory requirements related to effluent discharge standards and the heightened need for water reuse in water-scarce regions. Municipal wastewater systems prioritize solids removal to protect biological treatment stages and ensure compliance with environmental norms.

In industrial settings, particularly in sectors such as food processing, pharmaceuticals, and chemicals, solids removal is critical for reducing treatment loads and improving operational reliability. Furthermore, the simplicity, scalability, and cost-effectiveness of these systems have contributed to their widespread adoption, reinforcing their dominant market position in 2024 across various end-use applications.

By Process Analysis

Secondary treatment processes lead, capturing 39.4% market share.

In 2024, Secondary held a dominant market position in the By Process segment of the Water and Waste Water Treatment Technologies Market, with a 39.4% share. This dominance was primarily driven by the growing emphasis on biological treatment methods aimed at removing dissolved and suspended organic matter from wastewater.

Secondary treatment, typically involving activated sludge processes, trickling filters, or bio-towers, plays a critical role in breaking down biodegradable contaminants through microbial activity. Its widespread implementation in municipal and industrial wastewater facilities reflects its effectiveness in achieving regulatory discharge standards.

The increasing need for sustainable and environmentally responsible wastewater solutions has made secondary treatment a central component in the overall treatment chain. Municipal bodies across urban areas are prioritizing secondary processes to ensure that treated effluent meets stringent environmental regulations before being discharged or reused.

In the industrial sector, secondary processes are essential for minimizing the environmental footprint and reducing penalties associated with non-compliance. Additionally, advancements in biological treatment efficiency and process control have enhanced the operational performance of secondary systems, encouraging their continued adoption.

By End-user Analysis

Municipal sector drives demand with 67.9% strong dominance.

In 2024, Municipal held a dominant market position in the By End-user segment of the Water and Waste Water Treatment Technologies Market, with a 67.9% share. This commanding position was largely driven by increasing urban population, rising demand for clean drinking water, and stringent regulatory frameworks imposed by public health and environmental agencies.

Municipal authorities across developed and developing regions have been actively investing in water and wastewater treatment infrastructure to manage growing water consumption and ensure safe discharge of treated effluent into the environment.

The significant market share of municipal end-users reflects the scale and necessity of centralized water treatment systems in urban areas. These systems typically manage both water supply and sewage treatment for large populations, requiring comprehensive treatment technologies to meet quality and safety standards.

Additionally, the rise in government-funded projects and public-private partnerships aimed at upgrading aging water infrastructure further contributed to the expansion of this segment. The municipal sector’s focus on water reuse, conservation, and sustainable resource management also supported its growth in 2024.

With growing concerns about water security and environmental protection, municipal water treatment continues to be a priority area for investment, maintaining its lead in the overall market landscape.

Key Market Segments

By Туре

- Suspended Solids Removal

- Oil/Water Separation

- Dissolved Solids Removal

- Biological Treatment/Nutrient and Metals Recovery

- Others

By Process

- Secondary

- Primary

- Tertiary

- Advance

By End-user

- Municipal

- Industrial

- Food and Beverage

- Pulp and Paper

- Oil and Gas

- Healthcare

- Chemical and Petrochemical

- Others

Driving Factors

Rising Water Pollution Levels Drive Treatment Demand

One of the biggest reasons for the growth of the Water and Waste Water Treatment Technologies Market is the rapid rise in water pollution levels across the world. As industrial activities, urban expansion, and agricultural practices continue to increase, they release more harmful pollutants into water bodies.

These include chemicals, sewage, heavy metals, and microplastics that make water unsafe for human use and harmful to the environment. Governments and local authorities are under pressure to make sure wastewater is treated before being discharged.

As a result, there is a growing need for efficient treatment technologies that can remove these contaminants. This increasing pollution level is making both public and private sectors invest more in advanced water and wastewater treatment solutions.

Restraining Factors

High Installation Costs Limit Widespread Technology Adoption

A key challenge holding back the growth of the Water and Wastewater Treatment Technologies Market is the high cost of setting up these systems. Installing advanced treatment technologies requires a large investment in equipment, infrastructure, and skilled labor.

Many small towns, rural areas, and developing regions often struggle to afford these upfront costs. Even when there is a need for clean water or wastewater management, limited budgets make it hard for public authorities and private operators to adopt modern solutions.

In addition to the initial investment, ongoing maintenance and energy expenses further increase the financial burden. As a result, cost concerns continue to slow down the adoption of treatment technologies, especially in cost-sensitive or underfunded regions.

Growth Opportunity

Smart Technologies Open New Market Growth Avenues

A major growth opportunity in the Water and Waste Water Treatment Technologies Market lies in the rising use of smart technologies. Digital tools like sensors, automation systems, and real-time data monitoring are making water treatment more efficient and less expensive to run.

These technologies help plant operators track water quality, detect leaks, and manage energy use—all in real time. This not only reduces operating costs but also improves the reliability of treatment systems. With growing interest in sustainable and cost-effective solutions, smart water treatment is gaining attention worldwide.

Governments and utilities are starting to invest in these systems to modernize infrastructure. This shift toward intelligent water management is expected to create strong opportunities for innovation and expansion in the coming years.

Latest Trends

Decentralized Treatment Units Reshape Market Trends

Decentralized treatment units are emerging as a leading trend in the Water and Waste Water Treatment Technologies Market. These compact systems are installed close to the point of water use—such as in remote villages, residential complexes, or industrial facilities—enabling localized treatment and reuse.

This trend is driven by the need for flexible solutions where centralized infrastructure is impractical or too costly. Decentralized units reduce the stress on big treatment plants, lower transportation costs, and enable faster deployment. Advances in modular design and easy-to-manage operations have made these systems more accessible.

Additionally, as water scarcity increases, decentralized treatment offers a practical way to reclaim and reuse water locally. Adoption of these systems is broadening rapidly, especially in regions seeking sustainable and adaptable water management solutions.

Regional Analysis

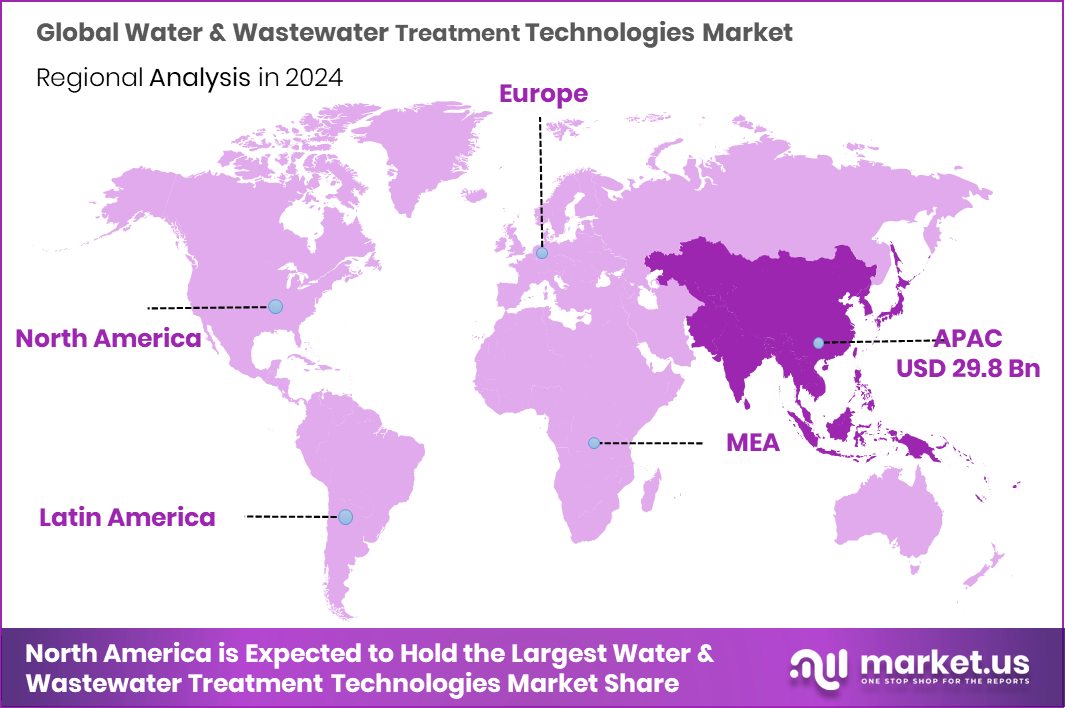

In 2024, Asia-Pacific led the market with a 41.8% share value.

In 2024, Asia-Pacific dominated the Water and Waste Water Treatment Technologies Market, capturing a significant 41.8% share, with a market value of USD 29.8 billion. This regional leadership is primarily attributed to rapid urbanization, growing industrial bases, and increasing government investments in water infrastructure across countries such as China, India, and Southeast Asia.

The demand for clean water and effective wastewater management in these nations has surged due to rising population and industrial discharge, driving the adoption of advanced treatment technologies. North America followed closely, supported by strict regulatory frameworks on water reuse and pollution control, especially in the United States and Canada.

Europe also exhibited strong progress, driven by stringent environmental directives and sustainability goals under the EU Water Framework Directive. Meanwhile, the Middle East & Africa region is witnessing gradual development, particularly in water-stressed nations focusing on wastewater reuse to combat scarcity.

Latin America showed steady momentum, with Brazil and Mexico investing in upgrading municipal water treatment infrastructure. Across these regions, public health priorities and environmental protection goals continue to influence market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AECOM solidified its position as a leading integrator in project delivery and lifecycle management. Its ability to provide end-to-end engineering, procurement, and construction (EPC) services underscored its strength in executing complex municipal and industrial water projects. With a focus on sustainable and resilient infrastructure, AECOM has consistently emphasized the integration of green design and digital modeling, improving operational efficiencies and aligning with global regulatory requirements.

Aquatech International LLC demonstrated specialization in industrial water treatment and desalination solutions. Its technology-driven approach—highlighting zero liquid discharge (ZLD) systems and advanced membrane technologies—enabled tailored solutions for sectors with high water intensity. Through close collaboration with customers in oil and gas, power generation, and semiconductor industries, Aquatech advanced its position as a trusted partner for specialized industrial applications.

Black & Veatch Holding Company continued to leverage deep expertise in municipal water and wastewater systems. Operating globally, the company emphasized comprehensive project delivery—from feasibility and design through commissioning and operations. Black & Veatch’s investment in digital monitoring tools and treatment process optimization reflected market demand for smarter, more adaptive water infrastructure. Their integrated services and advisory capabilities strengthened credibility among public-sector clients.

Doosan Heavy Industries and Construction maintained a strong foothold in large-scale treatment plant construction, especially in the desalination and energy-intensive treatment markets. The company’s engineering and manufacturing competencies, combined with financial resources, allowed it to tackle megaprojects with high technical complexity. In 2024, Doosan’s strategic focus on energy-efficient treatment technologies and modular plant designs positioned it well in markets requiring rapid deployment and resilience under resource constraints.

Top Key Players in the Market

- AECOM

- Aquatech International LLC

- Black and Veatch Holding Company

- Doosan Heavy Industries and Construction

- DuPont

- Ecolab

- Evoqua Water Technologies LLC

- Hindustan Dorr-Oliver Ltd

- Hitachi, Ltd.

- ITT INC.

- Kurita Water Industries Ltd

- Mott MacDonald

- REMONDIS SE and Co. KG

- Siemens

- SLB

- SUEZ

- Thermax Limited

- VA Tech Wabag Ltd.

- Veolia

Recent Developments

- In April 2025, AECOM expanded its water and energy advisory capabilities in the UK & Ireland through the acquisition of Allen Gordon LLP, a technical design and advisory specialist. This move reinforces AECOM’s ambition to double its global water business within five years and positions it strongly ahead of the anticipated £250 billion in regional water and energy investments.

- In January 2025, Black & Veatch was chosen by the American Water Works Association (AWWA) to develop national guidance for pilot testing of PFAS treatment systems. The project will establish standard practices and requirements to support utilities and regulators in accelerating the implementation of reliable PFAS removal methods.

Report Scope

Report Features Description Market Value (2024) USD 71.3 Billion Forecast Revenue (2034) USD 131.3 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Туре (Suspended Solids Removal, Oil/Water Separation, Dissolved Solids Removal, Biological Treatment/Nutrient and Metals Recovery, Others), By Process (Secondary, Primary, Tertiary, Advance), By End-user (Municipal, Industrial (Food and Beverage, Pulp and Paper, Oil and Gas, Healthcare, Chemical and Petrochemical, Others) ) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AECOM, Aquatech International LLC, Black and Veatch Holding Company, Doosan Heavy Industries and Construction, DuPont, Ecolab, Evoqua Water Technologies LLC, Hindustan Dorr-Oliver Ltd, Hitachi, Ltd., ITT INC., Kurita Water Industries Ltd, Mott MacDonald, REMONDIS SE and Co. KG, Siemens, SLB, SUEZ, Thermax Limited, VA Tech Wabag Ltd., Veolia Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Water and Waste Water Treatment Technologies MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Water and Waste Water Treatment Technologies MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AECOM

- Aquatech International LLC

- Black and Veatch Holding Company

- Doosan Heavy Industries and Construction

- DuPont

- Ecolab

- Evoqua Water Technologies LLC

- Hindustan Dorr-Oliver Ltd

- Hitachi, Ltd.

- ITT INC.

- Kurita Water Industries Ltd

- Mott MacDonald

- REMONDIS SE and Co. KG

- Siemens

- SLB

- SUEZ

- Thermax Limited

- VA Tech Wabag Ltd.

- Veolia