Viral RNA Extraction Kit Market By Sample Type (Nasal Washes & Swab, Saliva, Sputum, Fecal, and Others), By Applications (Disease Diagnosis, Drug Discovery, cDNA Library, Cancer Research, and Others), By End-user (Hospitals, Pharmaceutical & Biotechnology Companies, Forensic Labs, Diagnostic Laboratories, Clinical Research Organizations, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168164

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

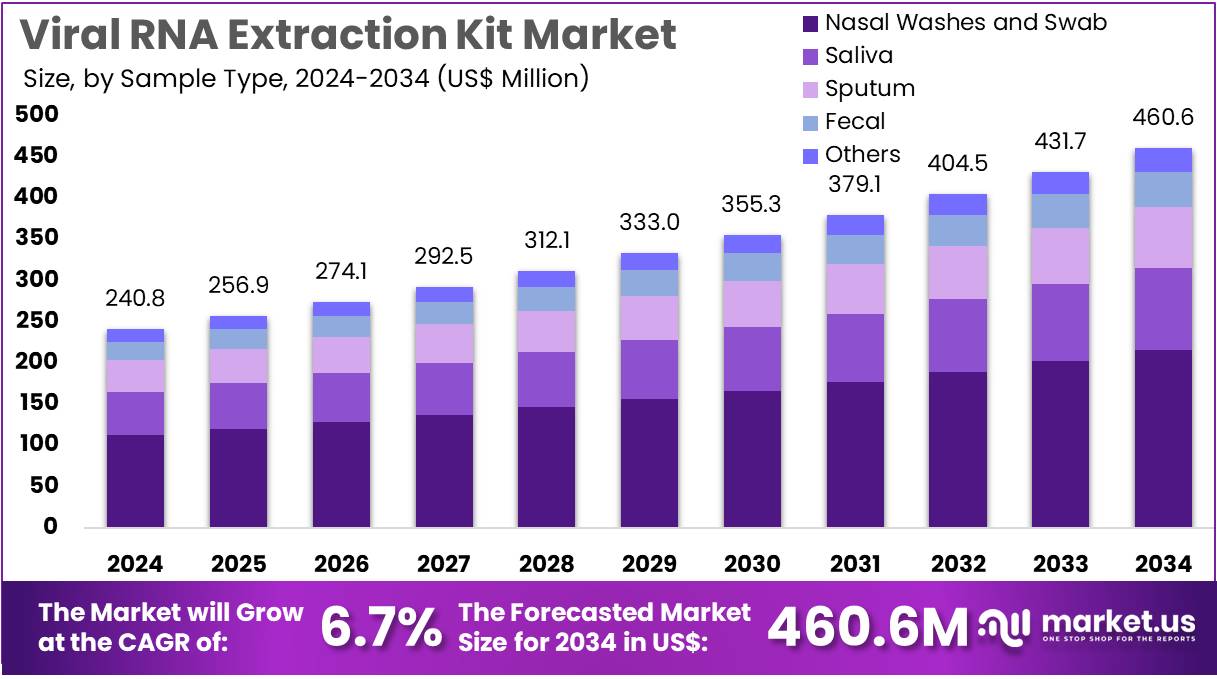

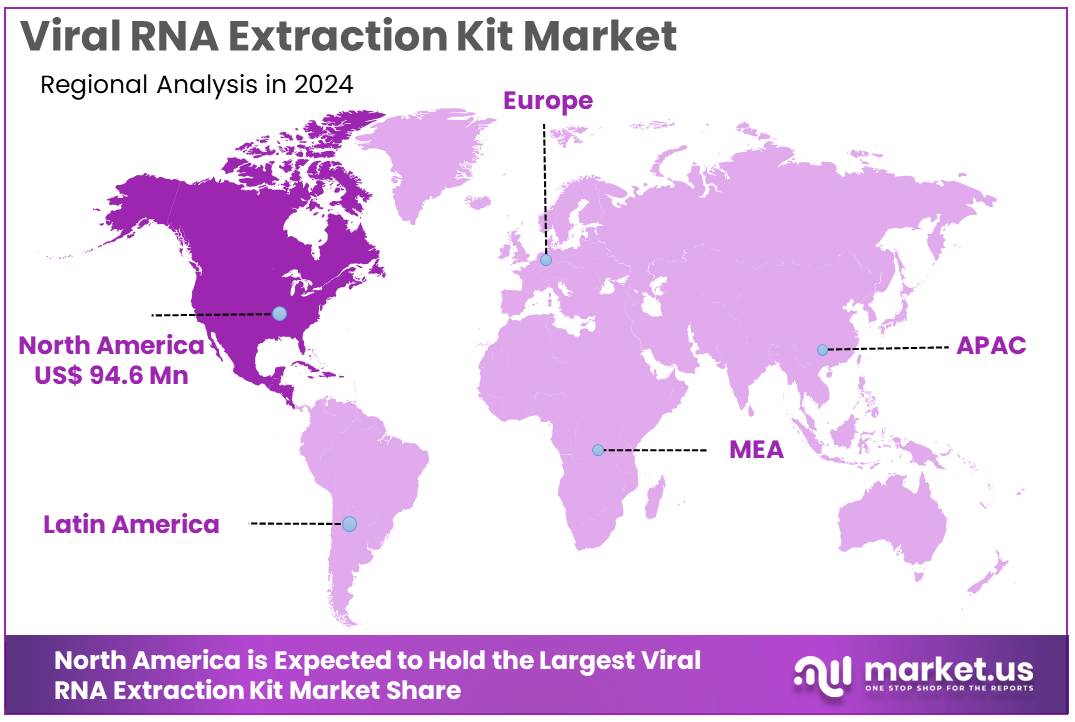

The Viral RNA Extraction Kit Market Size is expected to be worth around US$ 460.6 million by 2034 from US$ 240.8 million in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 39.3% share and holds US$ 94.6 Million market value for the year.

Increasing demand for rapid pathogen identification in clinical diagnostics propels the Viral RNA Extraction Kit market, as laboratories prioritize efficient isolation methods to support real-time PCR and sequencing workflows. Manufacturers engineer magnetic bead-based and silica-column kits that achieve high-purity RNA yields from low-viral-load specimens while removing inhibitors. These kits enable respiratory virus detection in nasopharyngeal swabs for influenza subtyping, enteric pathogen profiling from stool samples for norovirus outbreaks, blood-borne virus quantification in plasma for HIV monitoring, and cerebrospinal fluid analysis for enterovirus meningitis confirmation.

Automation integration creates opportunities for scalable processing in high-volume testing environments. Thermo Fisher Scientific introduced the Applied Biosystems MagMAX Sequential DNA/RNA Kit in December 2024, streamlining combined nucleic acid extraction on KingFisher platforms and enhancing RNA recovery efficiency for viral applications. This innovation reduces manual intervention and boosts throughput for diverse pathogen diagnostics.

Growing emphasis on point-of-care molecular testing accelerates the Viral RNA Extraction Kit market, as decentralized labs seek user-friendly, single-use formats compatible with portable thermocyclers. Developers optimize lysis buffers and spin-column designs to handle diverse sample matrices without specialized equipment.

Applications encompass field-deployable Zika virus screening from saliva, Ebola detection in capillary blood for outbreak response, SARS-CoV-2 variant identification in saliva for surveillance, and rotavirus genotyping from fecal extracts in pediatric gastroenteritis cases. Simplified protocols open avenues for non-expert operators in remote or emergency settings. Biotechnology firms increasingly incorporate nuclease-free reagents to preserve fragile RNA integrity during transport.

Rising integration of multi-omic sequencing pipelines invigorates the Viral RNA Extraction Kit market, as researchers combine viral transcriptomics with host response profiling for comprehensive infection insights. Companies formulate kits with broad-spectrum carrier additives that stabilize RNA across enveloped and non-enveloped viruses.

These solutions support metagenomic RNA-seq for unknown pathogen discovery in bronchoalveolar lavage, viral load normalization in hepatitis C liver biopsies, co-infection mapping in immunocompromised patients, and evolutionary tracking of dengue serotypes from serum. High-fidelity extraction creates opportunities for downstream library preparation and deep sequencing. Diagnostic networks adopt these advanced kits to enhance data quality in epidemiological studies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 240.8 million, with a CAGR of 6.7%, and is expected to reach US$ 460.6 million by the year 2034.

- The sample type segment is divided into nasal washes & swab, saliva, sputum, fecal, and others, with nasal washes & swab taking the lead in 2024 with a market share of 46.8%.

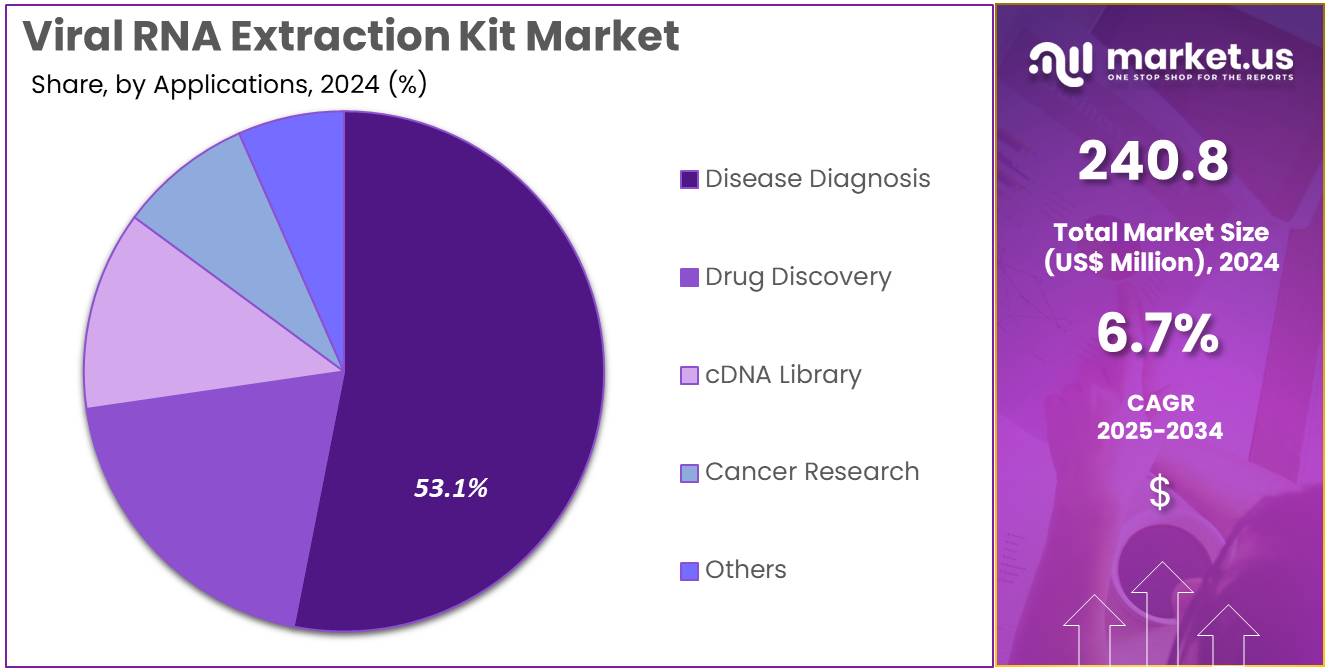

- Considering applications, the market is divided into disease diagnosis, drug discovery, cDNA library, cancer research, and others. Among these, disease diagnosis held a significant share of 53.1%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, pharmaceutical & biotechnology companies, forensic labs, diagnostic laboratories, clinical research organizations, and academic & research institutes. The hospitals sector stands out as the dominant player, holding the largest revenue share of 41.5% in the market.

- North America led the market by securing a market share of 39.3% in 2024.

Product Type Analysis

Nasal washes and swab samples, holding 46.8%, are expected to dominate due to their superior viral-load capture rate and broad acceptance in respiratory infection testing. Clinical teams prefer these samples as they provide reliable RNA yields for influenza, RSV, SARS-CoV-2, and other viral pathogens. Public-health screening programs rely heavily on swab-based sampling for high-volume surveillance, strengthening market demand.

Manufacturers develop improved viral-preservation buffers optimized for swab samples, increasing extraction consistency. Nasal swab kits show strong adoption across emergency departments, mobile testing units, and community clinics. Airborne viral outbreaks increase global reliance on upper-respiratory sampling strategies.

Laboratories choose swab-based samples for automated extraction workflows, supporting faster turnaround times. Self-collection kits expand user accessibility and raise testing volumes. Research programs investigating new respiratory viruses add long-term demand. These factors keep nasal washes and swab anticipated to remain the leading sample type.

Application Analysis

Disease diagnosis, holding 53.1%, is anticipated to remain dominant as healthcare systems prioritize rapid and accurate identification of viral infections. Diagnostic laboratories depend on extraction kits that provide high-purity RNA for PCR and sequencing workflows. Rising prevalence of respiratory, gastrointestinal, and emerging viral diseases increases adoption in routine clinical testing. Hospitals integrate extraction kits into automated diagnostic platforms to support faster patient management.

Outbreak preparedness programs strengthen demand for reliable viral-RNA workflows. Public-health agencies run mass-screening campaigns that rely on extraction efficiency for high sensitivity. Pharmaceutical companies evaluate infection status in clinical trials, raising usage in diagnostic contexts.

Advancements in kit chemistry improve yield from low-viral-load samples, boosting diagnostic accuracy. Expansion of point-of-care molecular testing increases kit consumption. These trends keep disease diagnosis projected to remain the most influential application.

End-User Analysis

Hospitals, holding 41.5%, are expected to dominate end-user adoption as they manage the highest volume of viral testing across emergency, inpatient, and outpatient departments. Clinicians depend on rapid RNA extraction to guide treatment decisions and infection-control strategies.

Hospitals expand molecular diagnostic laboratories to handle rising case loads of influenza, RSV, and novel viral outbreaks. Automated extraction platforms support faster and more accurate detection, strengthening demand for compatible kits.

Infection-prevention protocols increase testing frequency during seasonal surges. Pediatric and geriatric departments use extraction kits extensively as viral illnesses affect vulnerable populations more severely. Hospitals participate in public-health surveillance networks, raising testing throughput.

Integration of high-throughput extraction systems supports continuous workflow efficiency. Procurement teams prioritize validated, high-yield kits to maintain diagnostic accuracy. These factors keep hospitals anticipated to remain the dominant end-user in the viral RNA extraction kit market.

Key Market Segments

By Sample Type

- Nasal Washes & Swab

- Saliva

- Sputum

- Fecal

- Others

By Applications

- Disease Diagnosis

- Drug Discovery

- cDNA Library

- Cancer Research

- Others

By End-user

- Hospitals

- Pharmaceutical & Biotechnology Companies

- Forensic Labs

- Diagnostic Laboratories

- Clinical Research Organizations

- Academic & Research Institutes

Drivers

Persistent Global Burden of Viral Infections is Driving the Market

The enduring high burden of viral infections globally continues to drive the viral RNA extraction kit market, as these kits are indispensable for isolating high-quality RNA from clinical specimens to enable accurate downstream molecular analyses. This necessity arises from the need to detect and quantify viral genomes in conditions such as HIV and hepatitis, where timely diagnosis directly impacts treatment outcomes and public health strategies.

Health authorities worldwide are emphasizing expanded surveillance programs, which rely on efficient extraction kits to process large sample cohorts during routine screening. Manufacturers are innovating to improve kit compatibility with automated platforms, reducing processing times and minimizing contamination risks in busy laboratories.

Regulatory standards for kit performance ensure reliability across diverse sample matrices, supporting their integration into national diagnostic guidelines. Collaborative international efforts facilitate technology transfers to high-burden regions, enhancing local testing capacities. The economic benefits of effective RNA extraction include lower rates of misdiagnosis and optimized resource allocation in outbreak responses.

Professional training initiatives underscore the kits’ role in maintaining assay sensitivity for low-viral-load detections. This driver promotes ongoing research into stabilizer-enhanced formulations for field use in remote settings. Ultimately, the market’s expansion is tied to sustained investments in molecular infrastructure. According to the World Health Organization, 254 million people were living with chronic hepatitis B and 50 million with chronic hepatitis C in 2022. These figures highlight the continuous diagnostic demands propelling kit development and deployment.

Restraints

Supply Chain Vulnerabilities in Reagent Production is Restraining the Market

Persistent vulnerabilities in the supply chains for essential reagents and consumables are significantly restraining the viral RNA extraction kit market, causing delays and increasing costs for end-users. These disruptions, stemming from concentrated manufacturing dependencies and logistical bottlenecks, have led to periodic shortages that interrupt laboratory operations.

Affected facilities often face extended wait times for restocking, compromising testing throughput during peak demand periods. This restraint heightens reliance on alternative, less efficient methods, potentially degrading RNA quality and assay results. Developers encounter challenges in diversifying suppliers, as quality certifications prolong qualification processes.

Policy responses, including strategic stockpiling mandates, aim to buffer impacts but strain storage and inventory management. The overall effect inflates kit pricing, deterring adoption in budget-constrained public health systems. International trade fluctuations further exacerbate availability issues in import-reliant regions. These constraints collectively undermine market stability, favoring established players with robust networks.

Mitigation strategies, such as regional production hubs, remain nascent amid regulatory hurdles. A 2021 Scientific Reports article noted that the COVID-19 pandemic caused disruptions to global supply chains for commercial RNA extraction kits, a challenge persisting into 2022-2024 as reported in related studies. Such ongoing issues necessitate resilient sourcing frameworks to restore confidence.

Opportunities

Genomic Surveillance Capacity Building in Africa is Creating Growth Opportunities

The rapid build-up of genomic surveillance infrastructure in African nations is presenting substantial growth opportunities for the viral RNA extraction kit market, as enhanced sequencing labs require consistent, high-purity RNA inputs. This development supports continent-wide monitoring of emerging pathogens, demanding scalable kits for diverse viral extractions. Opportunities lie in customizing formulations for tropical storage conditions, appealing to field-deployable applications in endemic zones.

Regulatory alignments with international standards facilitate tender participations, securing long-term supply agreements. Partnerships with regional health alliances enable pilot distributions, generating validation data for broader rollouts. The initiative diversifies market segments beyond traditional diagnostics into epidemiological research. Economic incentives from donor funding offset initial scaling costs, promising volume-driven efficiencies.

Training programs for local technicians integrate kit protocols, fostering sustained usage. These advancements position suppliers for exports to similar emerging contexts globally. In the long term, they cultivate innovation in low-cost, kit-free alternatives as complementary offerings. From 2018/19 to 2022, the number of African countries with next-generation sequencing capacity in public health labs grew from 7 to 31, with over 410 individuals trained in viral sequencing. This expansion signals a fertile landscape for diagnostic tool integrations.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces boost the Viral RNA Extraction Kit market as laboratories worldwide increase spending on molecular diagnostics to combat infectious diseases and advance genomic research. Companies capitalize on this momentum by rolling out automated, high-yield kits that speed up viral detection and support outbreak responses. Persistent inflation, however, strains research budgets and prompts labs to postpone bulk purchases of reagents and spin-column consumables in cost-conscious regions.

Geopolitical strains, particularly US-China rivalries, sever supply lines for essential enzymes and purification beads, compelling manufacturers to grapple with export curbs and erratic delivery schedules. These frictions escalate compliance demands and stall joint ventures critical for kit innovation. Current US tariffs on imported diagnostic reagents and lab kits sharpen these pressures by driving up raw material expenses, which suppliers relay to buyers and briefly stall adoption in hospital networks.

Firms, though, pivot swiftly by expanding US-based assembly, tapping incentives for onshoring, and linking with North American vendors to fortify logistics. Ultimately, the market gains lasting fortitude from these adaptations, solidifying viral RNA extraction kits as vital pillars in agile, innovative public health frameworks.

Latest Trends

Approval of mRNA-1345 RSV Vaccine is a Recent Trend

The U.S. Food and Drug Administration’s approval of innovative mRNA-based vaccines has emerged as a notable trend in 2024, indirectly boosting demand for viral RNA extraction kits through heightened research and quality control needs. This trend emphasizes the role of extraction kits in validating vaccine efficacy via viral load assessments in clinical trials. Developers are adapting kits for mRNA stability testing, aligning with trend-specific purity requirements.

The focus on respiratory syncytial virus platforms accelerates kit validations for enveloped RNA viruses. Regulatory pathways prioritize kits supporting vaccine manufacturing oversight, streamlining approvals. Adoption in biotech labs enhances kit throughput for batch consistency checks. This evolution intersects with synthetic biology, where extraction supports vector optimizations. Competitive pressures drive enhancements in inhibitor-resistant buffers for complex matrices.

Broader implications include applications in pandemic preparedness stockpiles. The trend fosters collaborations between vaccine producers and diagnostic suppliers. On May 31, 2024, the U.S. Food and Drug Administration approved Moderna’s mRNA-1345, the first mRNA vaccine for respiratory syncytial virus in older adults. This milestone underscores the trend’s influence on upstream diagnostic technologies.

Regional Analysis

North America is leading the Viral RNA Extraction Kit Market

North America accounted for 39.3% of the overall market in 2024, and the region recorded strong growth as laboratories increased high-throughput testing volumes across respiratory infection surveillance programs. Public health agencies expanded genomic monitoring initiatives, and this expansion directly lifted the demand for rapid and contamination-resistant RNA isolation tools.

The Centers for Disease Control and Prevention strengthened wastewater-based epidemiology networks in 2024, and these programs required consistent RNA extraction capacity for viral load quantification. Hospitals scaled molecular panels for RSV and influenza, which increased the procurement of automated purification systems.

Biotechnology firms accelerated vaccine-platform research, and their workflows relied heavily on reproducible nucleic acid recovery. Regional funding for outbreak preparedness encouraged laboratories to upgrade extraction instruments. These combined advancements reinforced the region’s dominant share during the year.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience sustained expansion during the forecast period as healthcare systems increase molecular diagnostics adoption across emerging economies. Governments continue strengthening infectious-disease genomic surveillance, which boosts demand for scalable nucleic acid isolation workflows. Research institutes expand virology programs, raising the need for reliable extraction consumables in high-volume academic laboratories.

Local manufacturers increase production capacity, allowing faster and more cost-efficient supply across hospitals. Diagnostic chains add automated sample preparation systems to support broader test menus. Rising investments in vaccine development push biotechnology companies to adopt dependable RNA purification stages. Growing awareness of early pathogen detection encourages clinicians to integrate molecular workflows more widely. Together, these factors position the region for robust forward-looking growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading manufacturers strengthen their competitive position by expanding molecular diagnostic portfolios, accelerating reagent innovations, and deepening collaborations with hospitals and biotech firms to secure consistent demand. They enhance operational scale through automated workflows, faster sample-processing chemistries, and region-specific product customization that aligns with regulatory expectations. They invest in cold-chain resilience and digital inventory systems to ensure uninterrupted laboratory supply.

They reinforce clinical credibility through university partnerships that validate extraction performance across emerging pathogens. They penetrate new markets by building distribution networks in high-testing-volume regions and by offering training programs that improve laboratory adoption.

Thermo Fisher Scientific exemplifies this strategy because it builds value through diversified life-science platforms, strong global manufacturing, and continuous investment in nucleic-acid technologies that support reliable research and clinical-use testing.

Top Key Players in the Viral RNA Extraction Kit Market

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- F. Hoffmann‑La Roche Ltd.

- Bio‑Rad Laboratories Inc.

- Promega Corporation

- Agilent Technologies Inc.

- Norgen Biotek Corp

- Takara Bio Inc.

- Zymo Research Corporation

- PerkinElmer Inc.

Recent Developments

- In May 2025: RevoluGen signed a distribution agreement with ProteoQuest Technology Co., Ltd. to supply Fire Monkey High Molecular Weight (HMW) DNA extraction kits throughout China, Hong Kong, and Taiwan. While Fire Monkey specializes in HMW DNA, the distribution expansion underscores rising expectations for simplified, rapid, and high-purity nucleic acid isolation across the region. This commercial momentum encourages diagnostic suppliers to introduce comparable user-friendly RNA workflows, indirectly boosting uptake of viral RNA extraction kits as laboratories seek harmonized solutions for both DNA and RNA recovery to support large-scale infectious disease testing.

- In May 2024: QIAGEN launched the QIAseq Multimodal DNA/RNA Library Kit, enabling dual library preparation from the same sample. This innovation boosts the value of upstream extraction steps because researchers must obtain high-quality viral RNA alongside DNA to support integrated genomic and transcriptomic sequencing. As multi-omics viral surveillance programs expand—especially those monitoring mutation dynamics—demand increases for extraction kits capable of delivering intact RNA suitable for sensitive NGS workflows, thereby pushing growth in the viral RNA extraction segment.

Report Scope

Report Features Description Market Value (2024) US$ 240.8 million Forecast Revenue (2034) US$ 460.6 million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Sample Type (Nasal Washes & Swab, Saliva, Sputum, Fecal, and Others), By Applications (Disease Diagnosis, Drug Discovery, cDNA Library, Cancer Research, and Others), By End-user (Hospitals, Pharmaceutical & Biotechnology Companies, Forensic Labs, Diagnostic Laboratories, Clinical Research Organizations, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific Inc., QIAGEN N.V., F. Hoffmann‑La Roche Ltd., Bio‑Rad Laboratories Inc., Promega Corporation, Agilent Technologies Inc., Norgen Biotek Corp, Takara Bio Inc., Zymo Research Corporation, PerkinElmer Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Viral RNA Extraction Kit MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Viral RNA Extraction Kit MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific Inc.

- QIAGEN N.V.

- F. Hoffmann‑La Roche Ltd.

- Bio‑Rad Laboratories Inc.

- Promega Corporation

- Agilent Technologies Inc.

- Norgen Biotek Corp

- Takara Bio Inc.

- Zymo Research Corporation

- PerkinElmer Inc.