Global Vessel Traffic Services (VTS) Market By Product Type (Radar Systems, Automatic Identification Systems (AIS), Communication Systems, Data Processing and Management Systems, Others), By Application (Port Management, Traffic Management, Marine Safety, Environmental Protection, Others), By End-Use (Commercial Shipping, Fisheries, Naval Defense, Recreational Boating, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 172157

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Product Type Analysis

- Application Analysis

- End-Use Analysis

- Key Reasons for Adoption

- Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

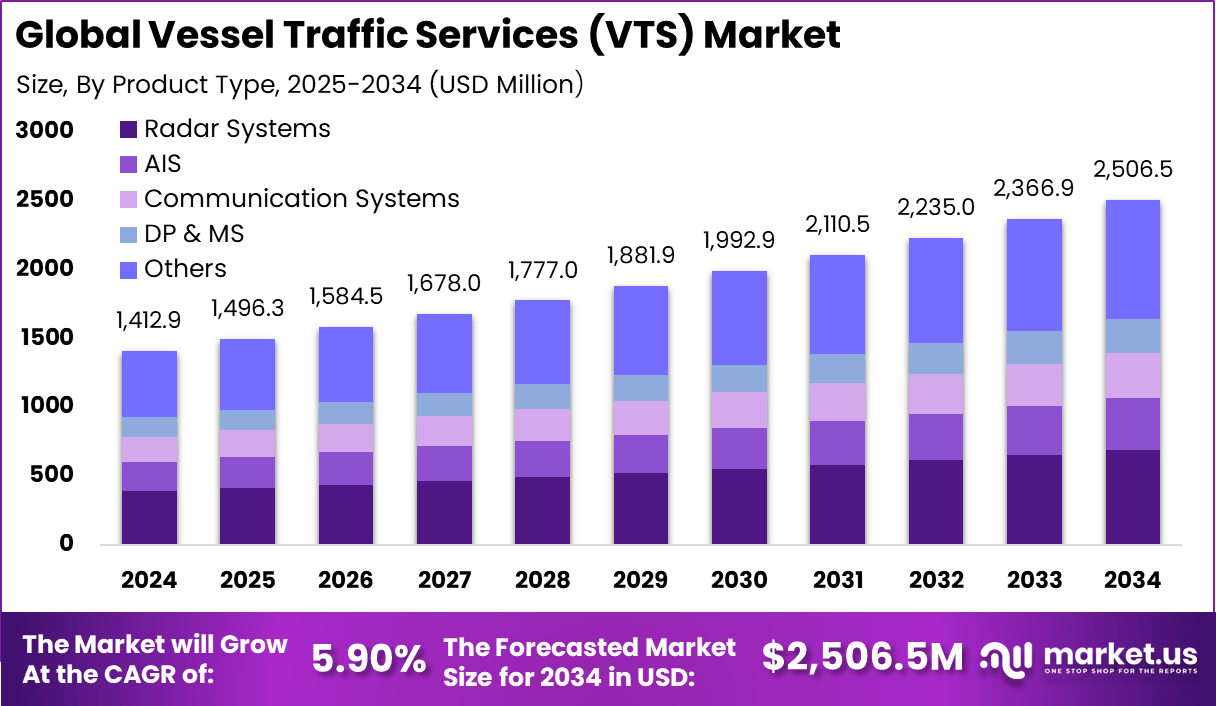

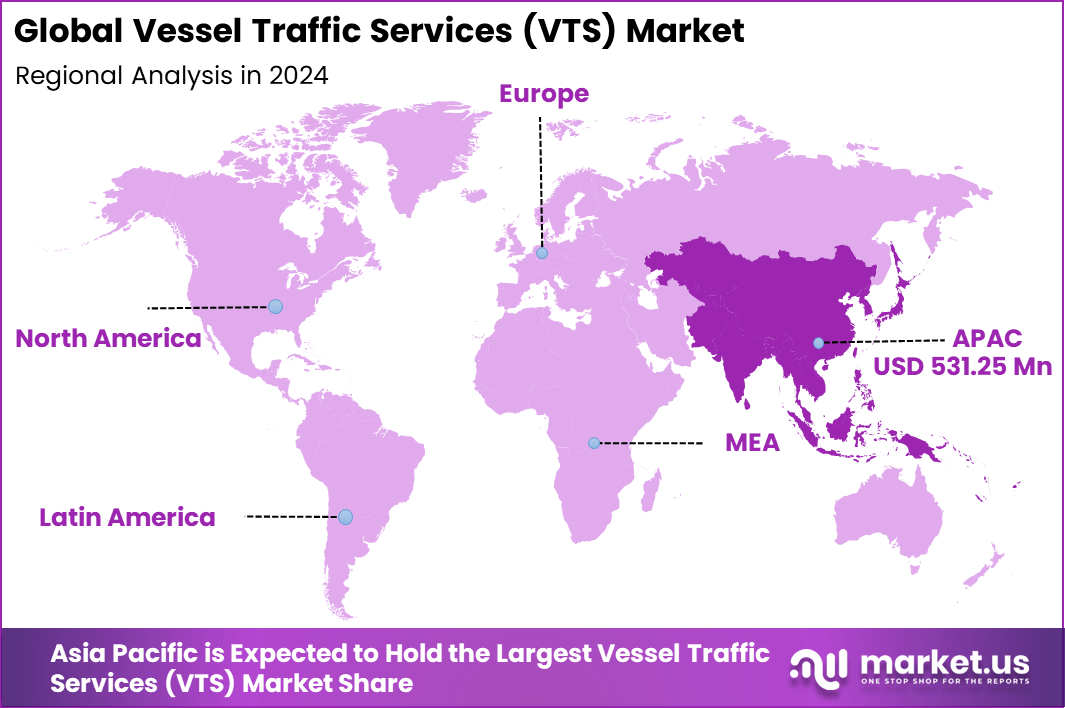

The Global Vessel Traffic Services (VTS) Market generated USD 1,412.9 million in 2024 and is predicted to register growth from USD 1,496.3 million in 2025 to about USD 2,506.5 million by 2034, recording a CAGR of 5.90% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 37.6% share, holding USD 531.25 Million revenue.

The Vessel Traffic Services (VTS) market refers to systems and solutions designed to monitor, manage, and optimise the movement of vessels within ports, harbours, and coastal zones. These systems use radar, automatic identification systems (AIS), communication technologies, and data analytics to enhance maritime safety and operational efficiency. VTS platforms support stakeholders such as port authorities, pilots, ship operators, and maritime regulators by providing real-time situational awareness.

The market has grown as global trade volumes and maritime traffic complexity have increased, necessitating improved traffic management to reduce collisions and delays. This market comprises hardware, software, integration services, and managed support that enable authorities to visualise traffic flows, issue navigational guidance, and coordinate vessel movements. Adoption is driven by a need for safer navigation, regulatory compliance, and environmental protection, particularly in congested waterways.

A primary driver of the VTS market is the rising volume of maritime trade, which increases vessel density in major ports and straits. As global seaborne cargo grows, the risk of navigational incidents increases, prompting authorities to deploy advanced traffic services to ensure safety. The need to optimise berth scheduling, reduce waiting times, and enhance overall port efficiency further supports VTS investments. Enhanced monitoring capabilities help ports maintain competitive operations by minimising delays and maximising throughput.

Demand for VTS solutions has been robust in regions with high maritime traffic and congested waterways, such as key trade corridors and hinterland gateways. Port authorities seek systems that can handle large volumes of data from radar, AIS, and communication channels to deliver accurate, real-time insight. The trend toward digitalisation in maritime operations reinforces demand for integrated platforms that offer predictive analytics and automated alerts. Maritime operators also emphasise reliability and redundancy to maintain continuous surveillance and service availability.

Top Market Takeaways

- By product type radar systems account for 27.6% share supported by their role in accurate vessel detection and continuous traffic monitoring.

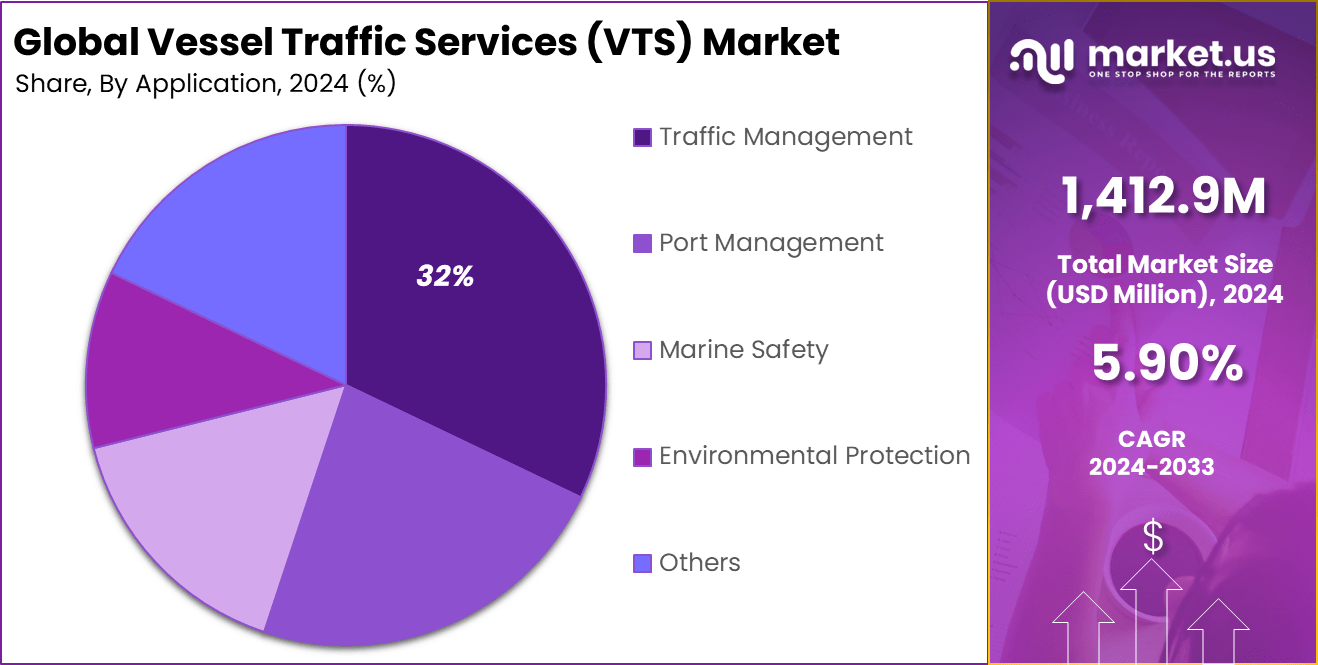

- By application traffic management holds 32.1% share driven by the need to manage increasing vessel movements and reduce collision risks.

- By end use commercial shipping represents 54.7% share due to high cargo volumes and strict maritime safety requirements.

- By region Asia Pacific contributes 37.6% share supported by port expansion and rising regional seaborne trade.

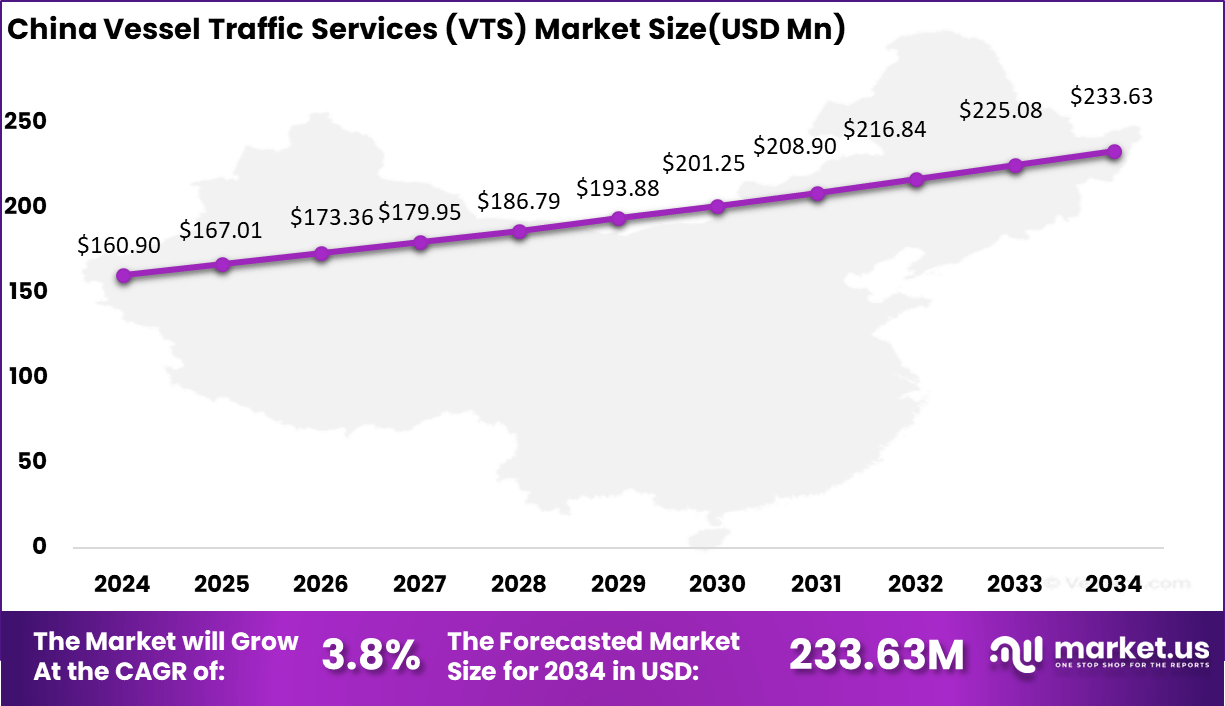

- By country China reached USD 160.9 Million with a 3.8% CAGR supported by port modernization and investment in navigation safety systems.

Product Type Analysis

Radar systems account for 27.6%, reflecting their essential role in vessel traffic monitoring. These systems provide continuous tracking of vessel movements in coastal and port areas. Radar supports safe navigation during poor visibility and adverse weather conditions. It enables authorities to detect potential collisions early. Reliability makes radar a core VTS component.

Adoption of radar systems is driven by the need for accurate situational awareness. Ports and maritime authorities depend on radar for real-time vessel positioning. Integration with other monitoring tools improves decision-making. Radar systems also support regulatory compliance. This sustains consistent demand.

Application Analysis

Traffic management represents 32.1%, making it the leading application area. VTS platforms manage vessel flow to reduce congestion and delays. Coordinated traffic control improves safety in busy waterways. Authorities use traffic management to enforce navigation rules. This supports efficient port operations.

Growth in traffic management is driven by rising maritime trade volumes. Increased vessel density requires structured monitoring. VTS tools help optimize route planning and scheduling. Reduced incident risk benefits shipping operators. This application remains central to VTS deployment.

End-Use Analysis

Commercial shipping holds 54.7%, showing its dominance as the main end-use segment. Cargo vessels rely on VTS for safe entry and exit from ports. Commercial operators prioritize navigation safety and operational efficiency. VTS systems help minimize accidents and delays. This improves overall shipping reliability.

Adoption in commercial shipping is driven by regulatory and operational needs. Shipping companies operate under strict safety standards. VTS support compliance and risk reduction. Real-time monitoring enhances voyage planning. This sustains strong usage among commercial fleets.

Key Reasons for Adoption

Technologies contributing to VTS adoption include advanced radar systems, high precision AIS networks, and satellite-based tracking that extend coverage beyond traditional coastal limits. These technologies improve detection accuracy and enable seamless monitoring of vessels across diverse environmental conditions.

Integration with machine learning and data analytics platforms enhances pattern recognition, anomaly detection, and predictive traffic modelling. The use of digital communication channels such as VHF data exchange and secure IP links ensures timely information flow between vessels and shore-based centres. The integration of sensor fusion technologies allows multiple data sources to be combined into a unified maritime picture that supports decision making.

Cloud computing and edge processing technologies are enabling more scalable and accessible VTS deployments. Augmented reality interfaces and geospatial visualisation tools help operators interpret complex traffic scenarios efficiently. The adoption of these enabling technologies reinforces the evolution of VTS from basic tracking systems to intelligent traffic management platforms.

Benefits

- Improved navigational safety is achieved through coordinated tracking and guidance of ships.

- Operational efficiency is strengthened as vessels move with greater predictability and fewer delays.

- Risk of marine accidents and associated costs is lowered through early detection and response.

- Communication between ships and shore authorities is enhanced, supporting coordinated decision making.

- Port congestion is reduced as traffic flows are optimized and managed systematically.

Usage

- Systems are used to monitor vessel positions through radar, AIS and other sensors.

- Traffic control centers analyze movement patterns to issue alerts and navigational instructions.

- Data from VTS supports emergency responses to incidents such as groundings or equipment failures.

- Authorities use the system to enforce maritime rules and ensure compliance with safety standards.

- Operational planning is supported by historical traffic data to improve scheduling and resource allocation.

Emerging Trends

The Vessel Traffic Services market is currently characterised by a significant shift toward advanced digitalisation and integration of smart maritime technologies. Adoption of real-time data analytics and automated identification systems has increased, enabling more precise vessel monitoring across busy waterways and congested ports.

Integration with e-Navigation frameworks is gaining traction, allowing VTS platforms to share critical navigational data with vessels and shore stations, which supports improved route planning and collision avoidance. There is also an observable movement toward utilising cloud-based infrastructure and machine learning engines to enhance predictive analytics for vessel movements, which can reduce human workload and improve situational awareness.

Autonomous and semi-autonomous vessel navigation is emerging as a complementary driver, where VTS systems are being adapted to interact with next-generation vessels that rely on digital control systems. These trends are fostering a more connected, resilient maritime traffic environment with a focus on both safety and operational efficiency.

Growth Factors

Growth in the Vessel Traffic Services market can be attributed to multiple interlinked factors. Expansion of global maritime trade has increased vessel traffic density, creating a demand for more sophisticated traffic monitoring and control systems to ensure safety and prevent maritime accidents.

The need to comply with stricter safety and environmental regulations has prompted port authorities and governments to invest in VTS infrastructure to mitigate risks of collisions, groundings, and oil spills. Technological advancements in radar, automatic identification systems, and digital communication platforms have reduced the cost and complexity of deploying VTS solutions, encouraging wider adoption across emerging and established ports.

Furthermore, investments in port modernisation and digital port initiatives by regional governments have supported the replacement of legacy systems with integrated VTS platforms that can manage larger volumes of data and support decision-making in real time. Together, these factors are creating a robust environment for sustained market development in vessel traffic monitoring and management.

Key Market Segments

By Product Type

- Radar Systems

- Automatic Identification Systems (AIS)

- Communication Systems

- Data Processing and Management Systems

- Others

By Application

- Port Management

- Traffic Management

- Marine Safety

- Environmental Protection

- Others

By End-Use

- Commercial Shipping

- Fisheries

- Naval Defense

- Recreational Boating

- Others

Regional Analysis

Asia-Pacific holds a leading position in the Vessel Traffic Services market, accounting for 37.6% of the global share. Growth in the region is mainly supported by rising maritime trade, increasing port traffic, and ongoing investments in port modernization.

Coastal nations across Asia-Pacific are strengthening vessel monitoring systems to improve navigational safety and reduce congestion in busy sea routes. Government focus on maritime security, along with the expansion of smart ports, continues to support steady demand for VTS solutions.

China represents a key country market within the region, with a market value of USD 160.9 Million and an expected CAGR of 3.8%. Market growth is driven by high cargo volumes, large scale port operations, and continuous upgrades in coastal surveillance infrastructure.

Authorities are increasingly adopting advanced VTS platforms to support traffic control, accident prevention, and environmental monitoring. Long term investments in digital maritime systems are expected to maintain consistent growth across major Chinese ports.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The market is driven by increasing global maritime trade that places pressure on existing port infrastructure and navigational systems. As cargo volumes grow, managing vessel movements safely and efficiently becomes more critical for ports and coastal authorities. VTS systems support real time monitoring and guidance, which helps prevent accidents and minimize costly disruptions. The drive for operational excellence in busy waterways continues to increase investment in traffic services.

Another driver is the rising concern over maritime safety and environmental protection. Collisions, groundings, and uncontrolled movements can lead to oil spills, habitat damage, and loss of life. Authorities are investing in enhanced vessel traffic services to strengthen oversight and reduce human error. Improved safety outcomes and reduced environmental risks are motivating adoption of advanced VTS solutions.

Restraint Analysis

One restraint on market growth is the high cost associated with upgrading legacy VTS infrastructure. Modern systems require investment in sensors, communication networks, and software platforms. Smaller ports and less developed maritime regions may lack the financial resources to implement advanced services. Budget limitations can delay modernization and restrict adoption in some parts of the world.

Another restraint is the technical complexity of integrating VTS systems with diverse maritime communication protocols. Vessels use varied technologies and national standards for navigation and reporting. Ensuring seamless interoperability with a unified service platform often requires extensive customization. This complexity can increase implementation timelines and add to deployment costs.

Opportunity Analysis

There is significant opportunity in expanding VTS solutions to support unmanned and autonomous vessel operations. As autonomous shipping experiments progress, traffic services will need to provide guidance and monitoring that accommodate vessels without onboard crew. Enhanced tracking, communication interfaces, and automated decision support functions can enable safe navigation for autonomous fleets. This evolution presents new demand for adaptive service capabilities.

Another opportunity exists in combining VTS data with broader port management and logistics systems. Integrating traffic service insights with cargo handling, berth scheduling, and supply chain planning can improve overall port efficiency. Unified platforms allow operators to prioritize vessel movements based on cargo urgency, weather conditions, or berth availability. This operational integration supports coordinated decision making and reduces turnaround times.

Challenge Analysis

A key challenge for the market is ensuring cybersecurity and protection of critical maritime infrastructure. VTS platforms rely on continuous data transmission and remote connectivity, which exposes them to potential cyberattacks. Breaches could disrupt navigation services or compromise sensitive information. Robust cybersecurity measures are essential to protect systems and maintain operator confidence.

Another challenge lies in training and retaining skilled personnel who can manage sophisticated VTS technologies. Operators must interpret complex data, respond to evolving sea conditions, and coordinate with multiple stakeholders. As systems become more advanced, the demand for technical expertise increases. A shortage of trained professionals can limit effective utilization of VTS resources.

Competitive Analysis

Signalis, Kongsberg, Saab, and Wärtsilä are leading players in the vessel traffic services market, providing integrated VTS platforms for port authorities and coastal administrations. Their solutions combine radar, AIS, cameras, and communication systems to improve maritime safety and traffic efficiency. These companies focus on system reliability, regulatory compliance, and real time situational awareness. Increasing global seaborne trade supports their strong market position.

Indra Company, Lockheed Martin, Frequentis, and Furuno strengthen the market with advanced surveillance, command and control, and communication technologies. Their offerings support collision avoidance, incident response, and coordinated vessel movement. These providers emphasize interoperability and secure data exchange. Growing investments in port modernization and coastal security continue to drive adoption.

HAVELSAN Inc., ST Engineering, GEM elettronica, Mesemar, and other players expand the landscape with region specific and customized VTS solutions. Their systems address local navigation challenges and budget requirements. These companies focus on flexibility and service support. Rising focus on maritime safety and environmental protection continues to drive steady growth in the VTS market.

Top Key Players in the Market

- Signalis

- Kongsberg

- Indra Company

- Saab

- Wärtsilä (Transas)

- Lockheed Martin

- keiki

- Frequentis

- Vissim AS

- SRT

- Furuno

- GEM elettronica

- Mesemar

- HAVELSAN Inc.

- ST Engineering

- ELMAN Srl

- in-innovative navigation GmbH

- Others

Future Outlook

The future outlook for the Vessel Traffic Services (VTS) market indicates continued expansion supported by increasing maritime traffic and a growing emphasis on port safety and efficiency. Adoption of advanced technologies such as real-time tracking, automation, and data analytics is expected to strengthen operational capabilities and reduce navigational risks.

Investment in digital infrastructure and integration with broader maritime surveillance systems will be key factors driving market development. Increased regulatory focus on maritime security and environmental protection is likely to encourage wider deployment of VTS solutions. Overall, the VTS market is anticipated to advance with technological innovation and rising demand for structured vessel monitoring and management.

Recent Developments

- October, 2025 – Kongsberg announced plans to spin off its Maritime unit as an independent company, aiming for a stock exchange listing in the first half of 2026. This move sharpens focus on maritime tech like VTS systems amid booming demand for naval surveillance solutions.

- February, 2025 – Indra showcased advanced radar tech at IDEX 2025 and inked a partnership for radar systems, bolstering its VTS capabilities through better threat detection in busy waterways.

Report Scope

Report Features Description Market Value (2024) USD 1,412.9 Mn Forecast Revenue (2034) USD 2,506.5 Mn CAGR(2025-2034) 5.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product Type (Radar Systems, Automatic Identification Systems (AIS), Communication Systems, Data Processing and Management Systems, Others),By Application (Port Management, Traffic Management, Marine Safety, Environmental Protection, Others),By End-Use (Commercial Shipping, Fisheries, Naval Defense, Recreational Boating, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Signalis, Kongsberg, Indra Company, Saab, Wärtsilä (Transas), Lockheed Martin, keiki, Frequentis, Vissim AS, SRT, Furuno, GEM elettronica, Mesemar, HAVELSAN Inc., ST Engineering, ELMAN Srl, in-innovative navigation GmbH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Vessel Traffic Services (VTS) MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Vessel Traffic Services (VTS) MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Signalis

- Kongsberg

- Indra Company

- Saab

- Wärtsilä (Transas)

- Lockheed Martin

- keiki

- Frequentis

- Vissim AS

- SRT

- Furuno

- GEM elettronica

- Mesemar

- HAVELSAN Inc.

- ST Engineering

- ELMAN Srl

- in-innovative navigation GmbH

- Others