Global Veggie Crisps Market Size, Share, And Enhanced Productivity By Source (Root Vegetable Chips (Carrot Chips, Turnip Chips, Sweet Potato Chips, Others), Leafy Vegetable Chips (Kale Chips, Spinach Chips, Others)), By Type (Vegetable Chips, Extruded Vegetable Chips, Others), By Flavour (Classic Salty, Cheese and Onion, Barbecue, Salt and Pepper, Jalapeno, Others), By End-Use (Household, Food Service), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Specialty Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176260

- Number of Pages: 398

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

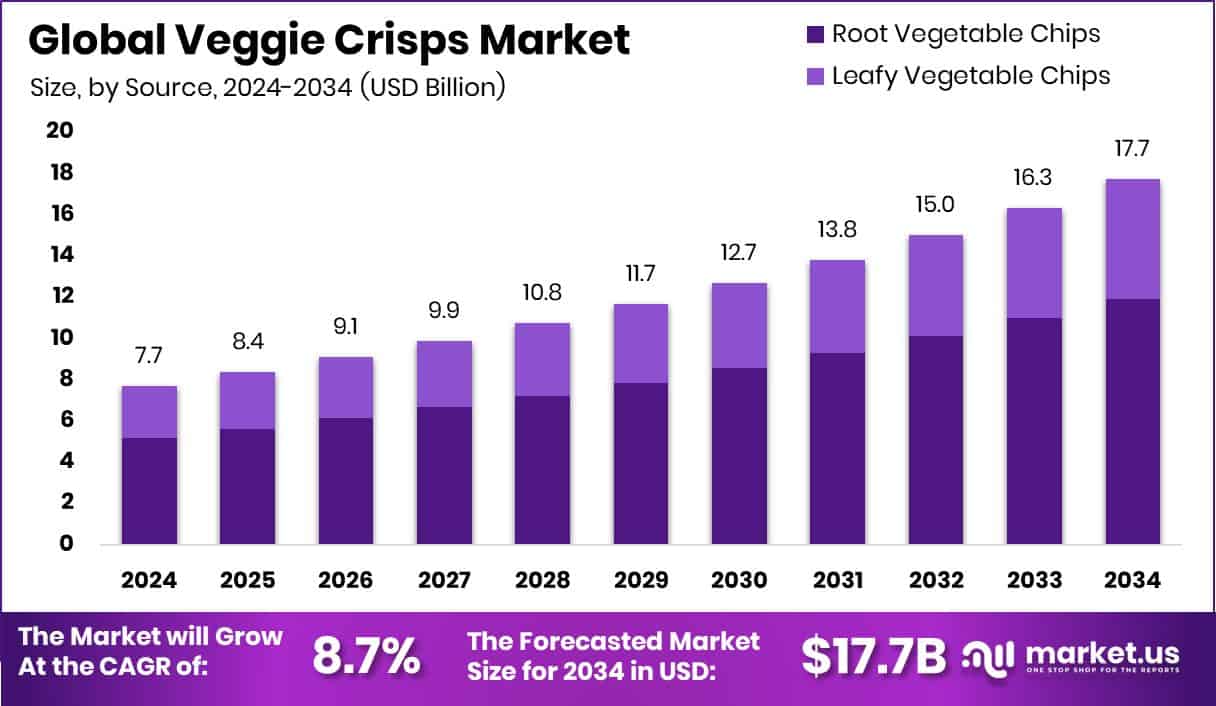

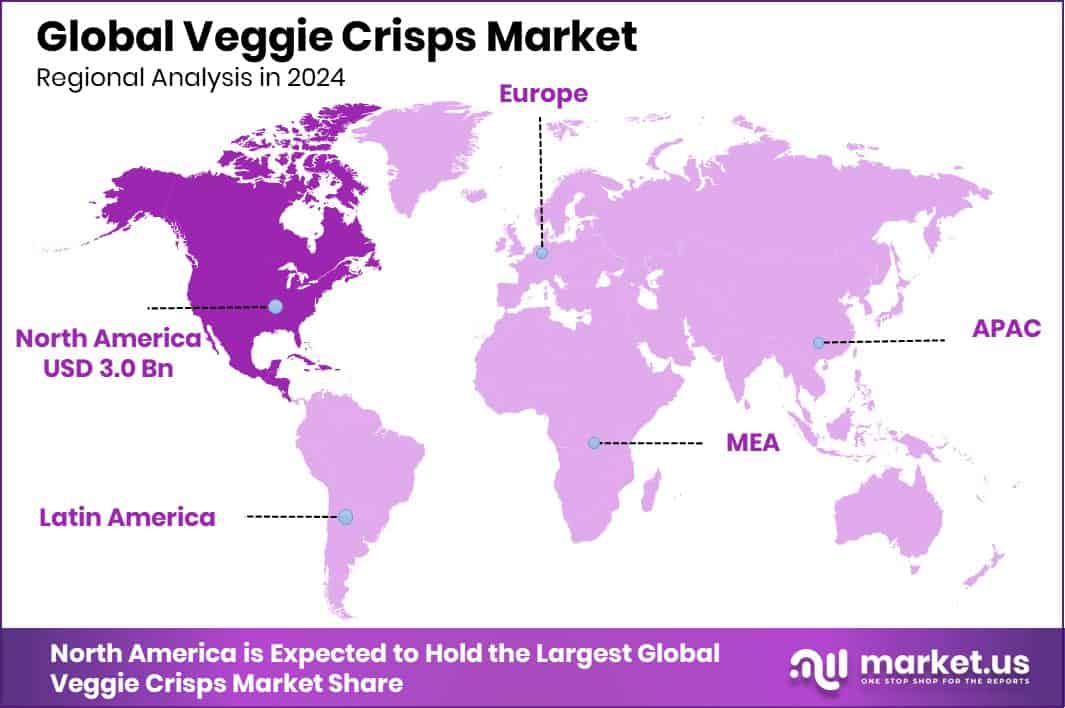

The Global Veggie Crisps Market is expected to be worth around USD 17.7 billion by 2034, up from USD 7.7 billion in 2024, and is projected to grow at a CAGR of 8.7% from 2025 to 2034. The North America market strengthens its dominance at 39.6%, totaling USD 3.0 Bn in revenue.

Veggie crisps are snack products made from vegetables such as roots, leafy greens, and mixed multivitamin blends, processed through baking, frying, or air-drying to create a crunchy, flavorful alternative to traditional potato chips. They appeal to consumers seeking cleaner, plant-forward snacking choices with natural ingredients and reduced guilt. The Veggie Crisps Market represents the global trade, production, and consumption of these vegetable-based snacks across categories like root vegetable chips, leafy vegetable chips, classic salty and flavored variants, household use, and retail channels, including supermarkets, convenience stores, and online stores.

Growth in this market is supported by rising interest in healthy snacking and better-for-you food options. Crowdfunding momentum, such as Veggie Chip Brand Emily Crisps, nearing its £1 million funding target on Seedrs, shows widening investor confidence in vegetable-based snacks.

Demand continues to strengthen as consumers try nutrient-dense snacks for at-home use and on-the-go eating. Additional support comes from small innovators like Nim’s Fruit Crisps, raising £20,000 through its BackIt crowdfunding pitch, reflecting grassroots belief in dried fruit and vegetable snack formats.

Opportunities are expanding as global food and agriculture investment grows. Signals such as SemCap closing a $125 million food fund and Syngenta exploring cleaner energy agreements highlight broader support for sustainable food production. Even unrelated shifts—like a federal government decision to terminate a $285 million contract in the CHIPS manufacturing space—push investors to redirect attention toward fast-growing consumer food categories. Protein snack maker Wilde raising $20 million, further reflects wider appetite for innovative, health-forward snacking, a trend that naturally supports veggie crisps as part of the same movement.

Key Takeaways

- The Global Veggie Crisps Market is expected to be worth around USD 17.7 billion by 2034, up from USD 7.7 billion in 2024, and is projected to grow at a CAGR of 8.7% from 2025 to 2034.

- The Veggie Crisps Market grows steadily as root vegetable chips dominate with 67.3% consumer preference.

- Strong demand for vegetable chips supports the Veggie Crisps Market, with the segment holding 58.2% share.

- Classic salty flavors continue shaping the Veggie Crisps Market, accounting for 29.4% of overall sales.

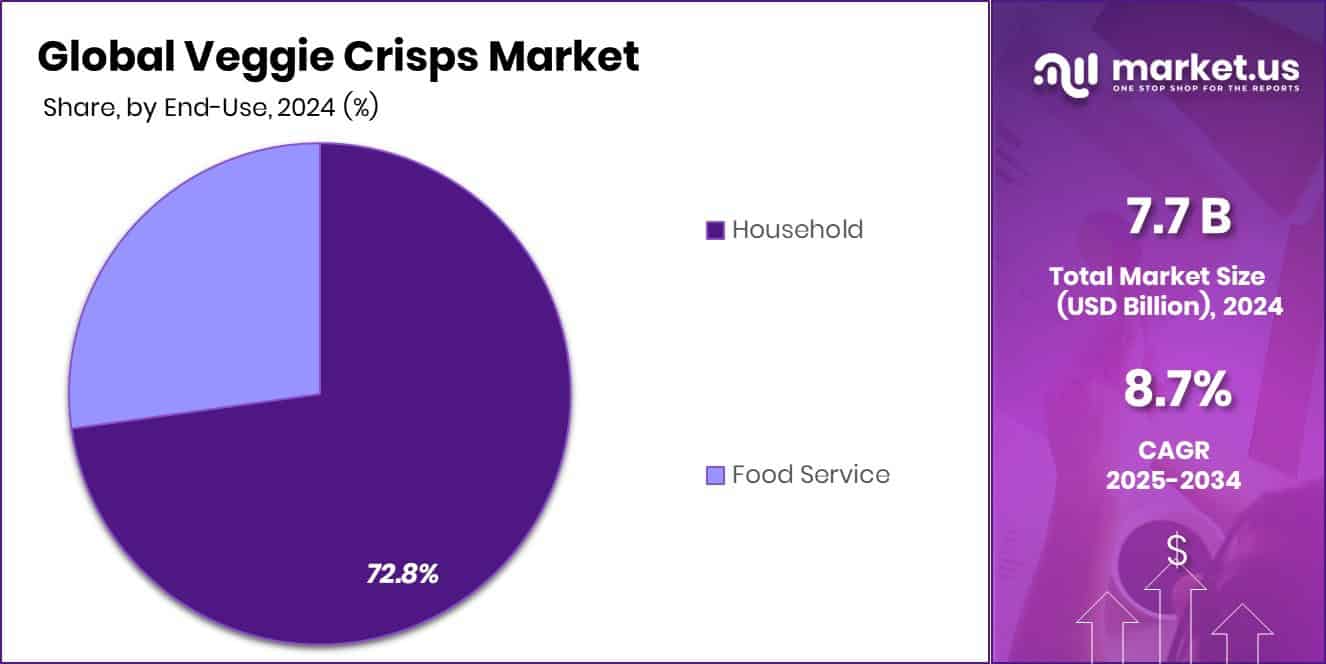

- Household consumption drives the Veggie Crisps Market, with this end-use segment reaching 72.8% demand share.

- Supermarkets and hypermarkets lead the Veggie Crisps Market distribution landscape, capturing 41.7% market share.

- In North America, demand rises as the segment secures 39.6% and USD 3.0 Bn.

By Source Analysis

The Veggie Crisps Market grows strongly as Root Vegetable Chips reach 67.3% dominance.

In 2024, the Veggie Crisps Market experienced strong momentum as root vegetable chips dominated with 67.3%, supported by rising consumer interest in nutrient-dense snacking options. Root vegetables such as sweet potatoes, beetroot, taro, and carrots remained popular due to their natural flavor profiles and higher fiber content. Consumers gravitated toward these ingredients as clean-label and minimally processed snacks gained preference.

Brands increasingly highlighted antioxidant-rich formulations and baked alternatives to appeal to health-conscious demographics. Retailers also expanded shelf space for root-based variants in response to growing trial purchases. The segment further benefited from the trend of plant-based snacking, where root vegetables provide both taste familiarity and nutritional reassurance, driving solid adoption across global markets.

By Type Analysis

Rising demand boosts the Veggie Crisps Market as vegetable chips capture a 58.2% share.

In 2024, vegetable chips accounted for the largest share in product type, contributing 58.2% to the Veggie Crisps Market as consumers increasingly replaced traditional potato chips with vegetable-based alternatives. The category expanded across mainstream retail channels as manufacturers introduced multi-vegetable blends combining kale, zucchini, beetroot, and parsnip. This shift aligned with the widespread pursuit of guilt-free snacking and balanced diets.

Product reformulation focused on lowering oil content, adopting air-frying technologies, and incorporating natural seasonings to enhance market acceptance. The growth of vegan lifestyles and transparent labeling further influenced consumer choices. As innovation accelerated, vegetable chips secured a strong competitive edge across both premium and mass-market product lines globally.

By Flavour Analysis

Flavor preferences shape the Veggie Crisps Market, with Classic Salty holding 29.4%.

In 2024, the Classic Salty flavour dominated the Veggie Crisps Market, holding 29.4% and reaffirming that traditional taste profiles continue to resonate strongly with consumers. Despite an influx of bold and experimental flavours, many shoppers preferred simple, familiar salty notes, especially when trying vegetable snacks for the first time. The flavour helped bridge the taste gap between conventional potato chips and plant-based alternatives, improving repeat purchase rates.

Brands capitalized on this by enhancing natural salt blends and reducing sodium without compromising flavour. Retail data also indicated higher turnover for classic variants, particularly in multipack formats and family-sized packaging, reinforcing the flavour’s universal appeal across age groups.

By End-Use Analysis

Household consumption leads the Veggie Crisps Market as usage hits 72.8% globally.

In 2024, household consumption remained the leading end-use segment in the Veggie Crisps Market, capturing 72.8% as families increasingly sought healthier snack choices at home. The pandemic-driven shift toward home snacking continued, with consumers stocking up on long-lasting, nutritious alternatives to satisfy daily cravings. Households also preferred veggie crisps for kids’ lunchboxes, evening snacking, and guilt-free weekend treats, supporting stable year-round demand.

E-commerce platforms facilitated bulk purchases and subscription models, making home consumption more convenient. Brands targeted this segment through value packs, reduced-sodium formulations, and organic ingredient offerings. As wellness consciousness strengthened, households consistently drove higher sales, reinforcing their position as the largest and most influential consumer group.

By Distribution Channel Analysis

Supermarkets dominate the Veggie Crisps Market distribution with a strong 41.7% share.

In 2024, supermarkets and hypermarkets dominated the Veggie Crisps Market distribution, securing 41.7% of total sales due to their strong product visibility and extensive brand variety. These retail chains provided consumers with the opportunity to compare nutritional profiles, flavours, and price points across multiple brands, boosting impulse purchases. Promotional strategies, including in-store sampling, bundled offers, and prominent shelf placements, significantly contributed to segment expansion.

Supermarkets also expanded their private-label veggie crisp lines, making healthier snacks more affordable. With rising footfall and consumer trust in organized retail, supermarkets/hypermarkets remained the primary channel for both premium and mainstream veggie crisp products, supporting consistent market penetration across urban and semi-urban regions.

Key Market Segments

By Source

- Root Vegetable Chips

- Carrot Chips

- Turnip Chips

- Sweet Potato Chips

- Others

- Leafy Vegetable Chips

- Kale Chips

- Spinach Chips

- Others

By Type

- Vegetable Chips

- Extruded Vegetable Chips

- Others

By Flavour

- Classic Salty

- Cheese and Onion

- Barbecue

- Salt and Pepper

- Jalapeno

- Others

By End-Use

- Household

- Food Service

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Driving Factors

Growing demand for healthy vegetable snacks

Growing demand for healthy vegetable snacks continues to strengthen the Veggie Crisps Market as consumers shift toward natural, minimally processed foods. This momentum is further encouraged by rising engagement with snack innovation, highlighted when Lay’s received more than 700,000 submissions from fans during its flavor contest, which offered a $1 million reward.

Although potato-chip focused, the enthusiasm reflects a wider appetite for creative, plant-based snacking experiences, indirectly benefiting veggie crisps. Brands offering root, leafy, and mixed-vegetable chips now attract shoppers who associate vegetables with wellness and variety. As households increase interest in guilt-free snacks, vegetable crisps gain visibility across supermarkets, convenience stores, and online platforms, supporting long-term category expansion globally.

Restraining Factors

Higher production costs reduce affordability

Higher production costs continue to challenge the Veggie Crisps Market, especially as vegetable sourcing, dehydration, and air-drying technologies remain more expensive than conventional snack processing. These cost pressures influence pricing and affect affordability for mainstream buyers. The broader food ecosystem also illustrates how capital-intensive sustainable models can be, such as GoodSAM Foods, a woman-led regenerative brand that raised $9 million in Series A funding to scale farmer-focused supply chains.

Although unrelated to veggie crisps directly, it highlights the financial weight behind ethical, regenerative, and vegetable-focused production. As suppliers aim for quality and sustainability, operational costs stay elevated, slowing expansion into lower-priced markets and restricting adoption in cost-sensitive regions.

Growth Opportunity

Expanding online sales channels support growth

Expanding online sales channels continue to create strong opportunities for the Veggie Crisps Market as consumers increasingly buy snacks through e-commerce, subscription services, and quick-commerce platforms. Wider digital availability allows niche vegetable-based products to reach households beyond major retail centers.

Growth prospects are echoed across the broader fresh-food and plant-forward ecosystem, where Gotham Greens raised $310 million while also completing its first acquisition, demonstrating investor confidence in sustainable, vegetable-driven food models. While not a veggie crisps company, this investment signals strong market appetite for produce-centered innovation. As digital grocery adoption rises, veggie crisps benefit from improved visibility, targeted marketing, broader assortment display, and nationwide direct-to-home distribution.

Latest Trends

Air-dried veggie crisps are gaining popularity

Air-dried veggie crisps are gaining popularity as consumers seek snacks with natural flavors, lower oil content, and minimal processing. This trend aligns with the shift toward lighter, nutrient-preserving drying techniques that highlight the original texture of vegetables. Interest in sustainable and technologically advanced food sectors also expands globally, illustrated by investment activity such as Laxey raising $146 million in aquaculture and Hoofprint Biome securing $15 million for microbial-based food solutions.

While these investments operate outside veggie crisps, they reflect a shared consumer movement toward better-for-you and science-supported food innovation. Air-dried veggie crisps fit naturally into this space, appealing to shoppers prioritizing clean ingredients, authentic vegetable identity, and lower-fat snacking alternatives.

Regional Analysis

North America leads the Veggie Crisps Market with 39.6%, reaching a USD 3.0 Bn in value.

In 2024, North America dominated the Veggie Crisps Market with 39.6% and USD 3.0 Bn, supported by strong consumer preference for clean-label snacks across the U.S. and Canada. Retail chains expanded shelf space for vegetable-based crisps as healthier snacking habits accelerated.

In Europe, demand grew steadily as households shifted toward low-fat, plant-based alternatives, particularly in Germany, France, and the U.K., where regulatory emphasis on reduced salt and clean ingredients encouraged product uptake. The Asia Pacific region showed rising interest driven by urban consumers in India, China, and Japan adopting vegetable snacks as convenient packaged foods.

In the Middle East & Africa, gradual market expansion continued as premium supermarket formats introduced imported veggie crisp variants to health-focused buyers. Latin America recorded increasing acceptance across Brazil and Mexico, where households increasingly experimented with vegetable-based snack options due to growing awareness of alternative snacking choices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the Veggie Crisps Market continued to evolve as consumer demand shifted toward clean-label, minimally processed snacking, positioning Bare Snacks as a key influencer in the category. The brand’s focus on baked, oil-free fruit and vegetable snacks aligned strongly with the growing preference for ingredient transparency. Its consistent emphasis on simple formulations helped reinforce trust among health-conscious buyers, strengthening its competitive edge in major retail channels.

Meanwhile, Terra Chips maintained a solid presence through its strong association with premium vegetable blends and visually distinct root-based crisps. The company’s diversified mix of taro, beet, sweet potato, and yucca chips continued to attract consumers seeking gourmet-style alternatives to traditional potato snacks. Terra’s ability to differentiate through color, texture, and authentic vegetable profiles supported its retention among mature and new customers.

Sensible Portions also played an important role by appealing to family-oriented shoppers. Its portion-controlled packs and focus on lighter, airy vegetable-based snacks catered well to households looking for balanced snacking. The brand’s accessible pricing and wide availability made it an attractive option for mainstream buyers. Collectively, these companies shaped competitive dynamics by prioritizing health, taste, and convenience, reinforcing the market’s shift toward natural vegetable crisps.

Top Key Players in the Market

- Bare Snacks

- Terra Chips

- Sensible Portions

- Calbee

- Utz Quality Foods

- Brad’s Plant-Based

- Kettle Foods

- Popchips

- Good Health Natural Products

- Simply 7 Snacks

Recent Developments

- In November 2025, Calbee introduced Noriyan, a new seaweed-like snack made from upcycled potato starch, offered in flavors like Dashi Soy Sauce and Wasabi Salt at its Tokyo Station store.

- In November 2025, Utz expanded its presence in the U.S. West Coast by acquiring direct-store delivery routes and related assets in California from Insignia International. This move is designed to help Utz grow distribution and sales in one of the largest snack markets in the country.

- In October 2025, Brad’s Plant-Based continued positioning itself as a plant-based snack maker of air-dried kale, veggie chips, and similar healthy snacks, emphasizing its ongoing product work in this category.

Report Scope

Report Features Description Market Value (2024) USD 7.7 Billion Forecast Revenue (2034) USD 17.7 Billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Root Vegetable Chips (Carrot Chips, Turnip Chips, Sweet Potato Chips, Others), Leafy Vegetable Chips (Kale Chips, Spinach Chips, Others)), By Type (Vegetable Chips, Extruded Vegetable Chips, Others), By Flavour (Classic Salty, Cheese and Onion, Barbecue, Salt and Pepper, Jalapeno, Others), By End-Use (Household, Food Service), By Distribution Channel (Supermarket/Hypermarket, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bare Snacks, Terra Chips, Sensible Portions, Calbee, Utz Quality Foods, Brad’s Plant-Based, Kettle Foods, Popchips, Good Health Natural Products, Simply 7 Snacks Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bare Snacks

- Terra Chips

- Sensible Portions

- Calbee

- Utz Quality Foods

- Brad's Plant-Based

- Kettle Foods

- Popchips

- Good Health Natural Products

- Simply 7 Snacks