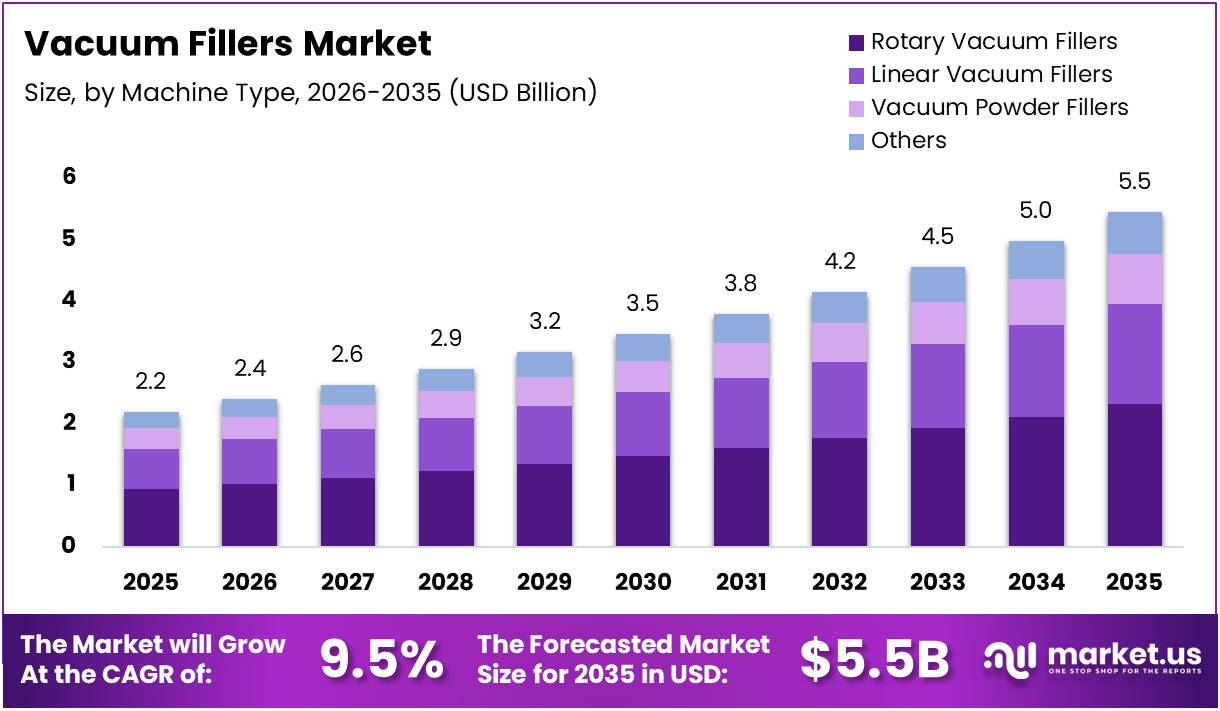

Global Vacuum Fillers Market Size, Share, Growth Analysis By Machine Type (Rotary Vacuum Fillers, Linear Vacuum Fillers, Vacuum Powder Fillers, Others), By Automation Level (Fully Automatic Vacuum Fillers, Manual Vacuum Fillers, Semi-Automatic Vacuum Fillers), By Container Type (Rigid, Flexible), By End Use Industry (Food & Beverage, Pharmaceutical, Chemicals, Cosmetics & Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175780

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

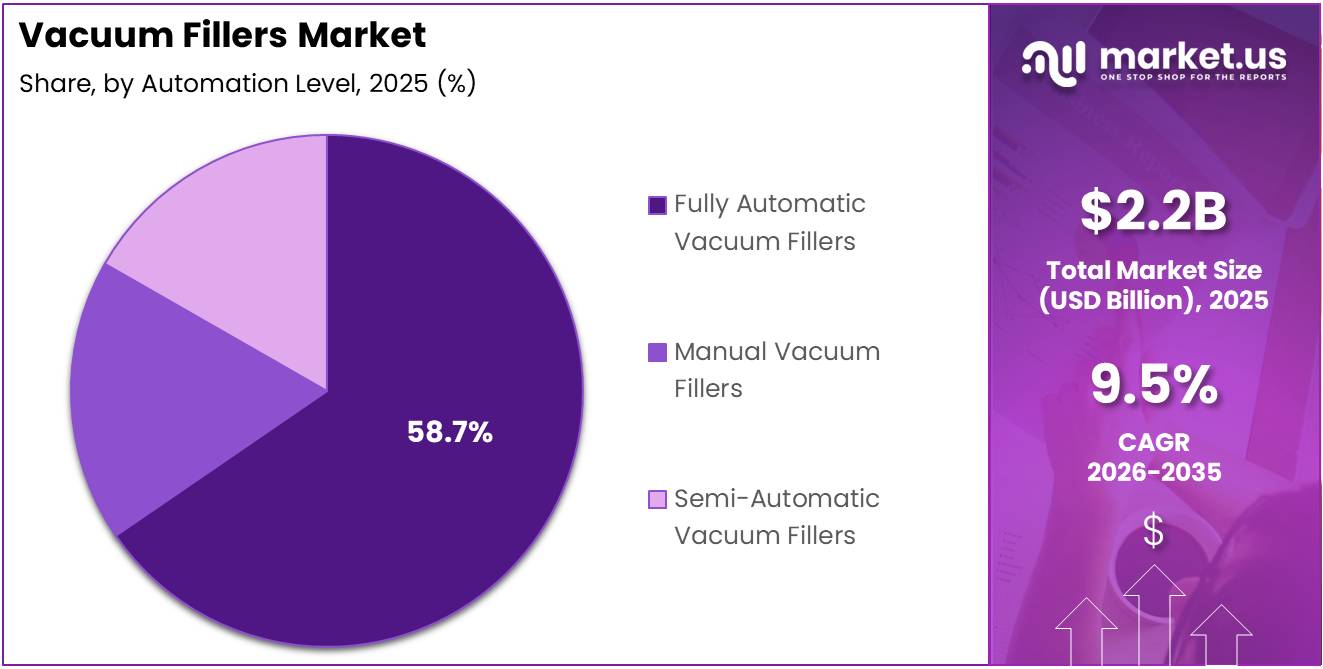

The Global Vacuum Fillers Market size is expected to be worth around USD 5.5 Billion by 2035 from USD 2.2 Billion in 2025, growing at a CAGR of 9.5% during the forecast period 2026 to 2035.

Vacuum fillers are specialized industrial machines designed to fill containers with various products under vacuum conditions. These systems eliminate air from the filling process, ensuring superior product quality, extended shelf life, and improved consistency across food, pharmaceutical, and cosmetic applications.

The market experiences robust growth driven by increasing automation in manufacturing facilities worldwide. Moreover, rising consumer demand for high-quality processed foods with longer shelf life propels adoption. Consequently, manufacturers invest heavily in advanced vacuum filling technologies to meet stringent quality standards.

Expanding food processing industries in developing economies create substantial opportunities for market participants. Additionally, growing emphasis on hygienic processing and contamination prevention drives demand. Therefore, companies develop innovative solutions incorporating digital controls and modular designs to enhance operational efficiency.

Government regulations regarding food safety and quality standards significantly influence market dynamics. Furthermore, investment in sustainable packaging solutions and waste reduction initiatives supports market expansion. However, technical complexities and operator skill requirements present notable challenges for widespread adoption.

According to research, vacuum packaging technologies can extend shelf life by up to approximately 50% and also reduce food waste by approximately 40%, with associated cost savings in supply chain operations. These benefits demonstrate the economic and operational value proposition.

According to Echo-packer, vacuum oxygen removal can reduce aerobic microbial growth by approximately 60-80% compared to non-vacuum packaging. Additionally, vacuum-sealed packaging has been reported to reduce retail food waste by approximately 40-55% compared with standard packaging practices, as oxidation and spoilage are minimized.

The integration of automation technologies and digital monitoring systems transforms traditional filling operations. Consequently, manufacturers achieve higher throughput rates while maintaining consistent product quality. Therefore, the vacuum fillers market continues expanding across diverse industrial applications globally.

Key Takeaways

- Global Vacuum Fillers Market size is projected to reach USD 5.5 Billion by 2035 from USD 2.2 Billion in 2025, at a CAGR of 9.5%

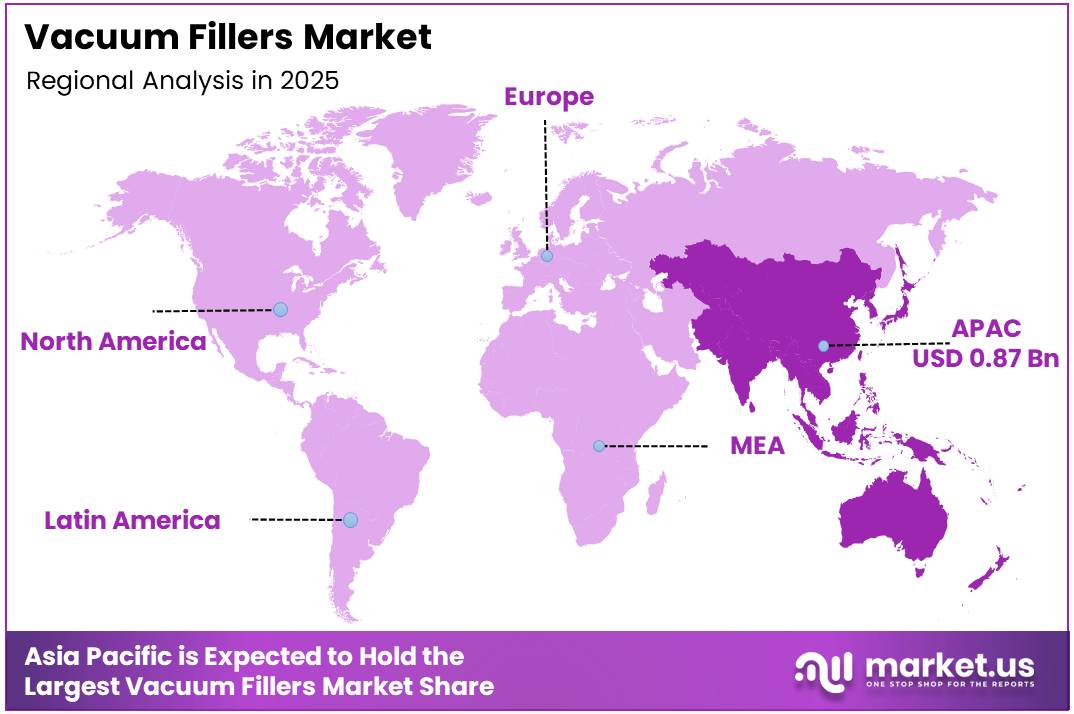

- Asia Pacific dominates the market with 39.6% share, valued at USD 0.87 Billion

- Fully Automatic Vacuum Fillers segment leads with 58.7% market share

- Rigid Container Type segment holds 76.5% market dominance

- Food & Beverage end use industry accounts for 40.6% of market demand

- Rotary Vacuum Fillers segment captures 42.5% share in machine type category

Machine Type Analysis

Rotary Vacuum Fillers dominates with 42.5% due to superior high-speed filling capabilities and operational efficiency.

In 2025, Rotary Vacuum Fillers held a dominant market position in the By Machine Type segment of Vacuum Fillers Market, with a 42.5% share. These systems deliver exceptional throughput rates for large-scale manufacturing operations. Moreover, rotary configurations enable continuous processing with minimal downtime. Consequently, major food processors prefer rotary designs for high-volume production requirements.

Linear Vacuum Fillers provide precise filling accuracy for specialized applications requiring exact dosing control. These machines excel in small to medium-batch production environments. Additionally, linear systems offer simplified maintenance and operator training advantages. Therefore, pharmaceutical and cosmetics manufacturers frequently utilize linear configurations for quality-sensitive products.

Vacuum Powder Fillers address specific requirements for dry ingredient processing applications. These specialized systems prevent dust contamination and ensure consistent powder dispensing. Furthermore, vacuum technology minimizes product waste during filling operations. However, powder fillers represent niche applications within the broader market landscape.

Others category encompasses emerging hybrid designs and specialized filling technologies. These solutions combine multiple filling methodologies for versatile production capabilities. Moreover, customized configurations serve unique industry-specific requirements. Consequently, innovation in alternative filling technologies continues expanding market diversification opportunities.

Automation Level Analysis

Fully Automatic Vacuum Fillers dominates with 58.7% due to enhanced productivity and reduced labor dependency.

In 2025, Fully Automatic Vacuum Fillers held a dominant market position in the By Automation Level segment of Vacuum Fillers Market, with a 58.7% share. These advanced systems integrate complete process automation from container loading through final sealing. Moreover, automated operation ensures consistent quality while minimizing human error. Consequently, large manufacturers prioritize fully automatic solutions for maximizing production efficiency.

Manual Vacuum Fillers serve small-scale operations and artisanal production environments effectively. These systems require skilled operator intervention throughout the filling process. Additionally, manual configurations offer lower initial investment costs compared to automated alternatives. Therefore, small businesses and specialty producers continue utilizing manual vacuum filling equipment.

Semi-Automatic Vacuum Fillers balance automation benefits with operational flexibility and cost considerations. These hybrid systems automate critical filling functions while maintaining manual control for setup and changeovers. Furthermore, semi-automatic designs accommodate varying production volumes efficiently. However, mid-sized manufacturers represent the primary adoption segment for these intermediate automation solutions.

Container Type Analysis

Rigid dominates with 76.5% due to widespread use in food and pharmaceutical packaging applications.

In 2025, Rigid held a dominant market position in the By Container Type segment of Vacuum Fillers Market, with a 76.5% share. Rigid containers include bottles, jars, cans, and trays requiring precise volumetric filling. Moreover, these containers provide superior product protection and extended shelf life. Consequently, food and pharmaceutical industries predominantly utilize rigid packaging for vacuum-filled products.

Flexible container types encompass pouches, bags, and flexible packaging materials gaining market traction. These lightweight alternatives reduce material costs and transportation expenses significantly. Additionally, flexible packaging aligns with sustainability initiatives reducing plastic consumption. Therefore, emerging applications in ready-to-eat foods and liquid products drive flexible container adoption growth.

End Use Industry Analysis

Food & Beverage dominates with 40.6% due to extensive processed food manufacturing requirements.

In 2025, Food & Beverage held a dominant market position in the By End Use Industry segment of Vacuum Fillers Market, with a 40.6% share. This sector encompasses meat processing, dairy products, sauces, and prepared meals requiring vacuum filling. Moreover, stringent food safety regulations mandate hygienic processing equipment. Consequently, food manufacturers invest heavily in advanced vacuum filling technologies.

Pharmaceutical industry demands precision filling for medications, ointments, and sterile products under controlled conditions. These applications require compliance with strict regulatory standards and quality protocols. Additionally, vacuum filling prevents contamination and oxidation in sensitive pharmaceutical formulations. Therefore, pharmaceutical manufacturers prioritize equipment validation and documentation capabilities.

Chemicals sector utilizes vacuum fillers for industrial compounds, adhesives, and specialty chemical products. These applications benefit from air-free filling preventing unwanted reactions and maintaining product stability. Furthermore, chemical processing requires robust equipment handling corrosive or hazardous materials safely. However, specialized construction materials increase equipment costs.

Cosmetics & Personal Care industry employs vacuum filling for creams, lotions, and beauty products requiring consistent quality. These applications emphasize aesthetic presentation and contamination prevention throughout production. Additionally, vacuum technology ensures precise dosing for expensive cosmetic formulations. Consequently, premium beauty brands adopt advanced vacuum filling systems.

Others category includes diverse applications across automotive, construction, and industrial sectors. These niche markets require customized filling solutions for specialized products. Moreover, emerging applications in plant-based alternatives and sustainable products expand market opportunities. Therefore, manufacturers develop versatile equipment serving multiple industry segments effectively.

Key Market Segments

By Machine Type

- Rotary Vacuum Fillers

- Linear Vacuum Fillers

- Vacuum Powder Fillers

- Others

By Automation Level

- Fully Automatic Vacuum Fillers

- Manual Vacuum Fillers

- Semi-Automatic Vacuum Fillers

By Container Type

- Rigid

- Flexible

By End Use Industry

- Food & Beverage

- Pharmaceutical

- Chemicals

- Cosmetics & Personal Care

- Others

Drivers

Rising Demand for Automated and High-Throughput Food Filling Equipment

Manufacturing facilities increasingly prioritize automation to enhance production capacity and operational efficiency. Moreover, labor shortages in developed markets accelerate adoption of automated filling solutions. Consequently, food processors invest in high-speed vacuum fillers capable of processing thousands of units hourly while maintaining consistent quality standards.

Consumer preferences for processed and convenience foods drive manufacturers to scale production capabilities. Additionally, automated systems reduce per-unit production costs through improved efficiency and reduced waste. Therefore, return on investment calculations favor automated vacuum filling equipment despite higher initial capital requirements.

Technological advancements enable seamless integration of vacuum fillers with upstream and downstream processing equipment. Furthermore, digital controls and monitoring systems optimize production workflows and minimize downtime. However, successful implementation requires comprehensive operator training and ongoing technical support ensuring maximum equipment utilization rates.

Restraints

High Technical Complexity in Equipment Setup and Operation

Advanced vacuum filling systems incorporate sophisticated mechanical, pneumatic, and electronic components requiring specialized knowledge. Moreover, proper calibration and adjustment demand technical expertise beyond basic operator capabilities. Consequently, manufacturers face challenges implementing vacuum fillers without adequate technical infrastructure and support systems.

Equipment complexity translates to extended commissioning periods and potential production delays during installation phases. Additionally, troubleshooting operational issues requires trained technicians familiar with specific system architectures. Therefore, smaller manufacturers may hesitate adopting advanced vacuum filling technologies due to technical support limitations.

Maintenance requirements for vacuum filling equipment demand regular servicing schedules and replacement of specialized components. Furthermore, unexpected breakdowns disrupt production schedules impacting delivery commitments and customer satisfaction. However, manufacturers offering comprehensive service agreements and remote diagnostics help mitigate these operational challenges effectively.

Growth Factors

Expanding Use of Vacuum Fillers in Plant-Based and Alternative Protein Processing

Rising consumer adoption of plant-based meat alternatives creates new applications for vacuum filling technology. Moreover, these products require precise moisture control and air removal maintaining texture and appearance. Consequently, manufacturers develop specialized vacuum fillers optimized for alternative protein formulations expanding market opportunities significantly.

Small and mid-sized food processing units increasingly recognize vacuum filling benefits for product quality and shelf life extension. Additionally, equipment manufacturers introduce compact, cost-effective models targeting smaller production volumes. Therefore, market penetration expands beyond large industrial facilities into regional and specialty food producers.

Technological innovations enable multi-product flexibility allowing rapid changeovers between different formulations and container sizes. Furthermore, modular designs support incremental capacity expansion aligned with business growth trajectories. However, successful adoption requires comprehensive training programs ensuring operators maximize equipment capabilities across diverse product applications.

Emerging Trends

Growing Shift Toward Fully Automated and Digitally Controlled Vacuum Fillers

Industry transformation emphasizes integration of digital technologies including IoT sensors, predictive analytics, and machine learning algorithms. Moreover, connected equipment enables real-time monitoring and remote diagnostics improving operational efficiency. Consequently, manufacturers adopt Industry 4.0 principles incorporating smart vacuum filling systems into automated production lines.

Modular equipment designs facilitate faster product changeovers reducing downtime between production runs significantly. Additionally, quick-change components and simplified cleaning procedures enhance operational flexibility. Therefore, manufacturers serving diverse product portfolios prioritize modular vacuum fillers maximizing equipment utilization across multiple production requirements.

Global food safety regulations including Hazard Analysis and Critical Control Point, FDA, and EU standards drive investment in compliant processing equipment. Furthermore, vacuum filling technology inherently supports contamination prevention and hygienic processing requirements. However, documentation and validation capabilities become critical selection criteria as regulatory scrutiny intensifies across international markets.

Regional Analysis

Asia Pacific Dominates the Vacuum Fillers Market with a Market Share of 39.6%, Valued at USD 0.87 Billion

Asia Pacific leads global vacuum fillers adoption driven by rapid industrialization and expanding food processing sectors. The region holds 39.6% market share valued at USD 0.87 Billion in 2025. Moreover, rising middle-class populations and changing dietary preferences accelerate processed food consumption. Consequently, manufacturers invest heavily in modern filling technologies meeting quality and safety standards.

North America Vacuum Fillers Market Trends

North America demonstrates strong demand for advanced vacuum filling systems across food, pharmaceutical, and cosmetic industries. Moreover, stringent regulatory frameworks mandate hygienic processing equipment in production facilities. Additionally, labor cost pressures drive automation adoption improving operational efficiency. Therefore, manufacturers prioritize high-capacity automated systems maximizing productivity while ensuring regulatory compliance.

Europe Vacuum Fillers Market Trends

Europe maintains significant market presence supported by established food processing infrastructure and quality standards. Moreover, sustainability initiatives promote efficient packaging technologies reducing waste throughout supply chains. Additionally, premium food segments demand advanced filling capabilities maintaining product integrity. Therefore, European manufacturers lead innovation in eco-friendly and energy-efficient vacuum filling solutions.

Latin America Vacuum Fillers Market Trends

Latin America experiences growing adoption driven by modernization of food manufacturing facilities and export-oriented production. Moreover, increasing foreign investment supports technology upgrades across processing industries. Additionally, rising domestic consumption of packaged foods creates market opportunities. Therefore, manufacturers balance cost considerations with quality requirements selecting appropriate vacuum filling technologies.

Middle East & Africa Vacuum Fillers Market Trends

Middle East and Africa region shows emerging potential as food processing infrastructure develops supporting population growth. Moreover, government initiatives promoting food security drive investment in modern manufacturing capabilities. Additionally, expanding retail sectors demand consistent product quality and extended shelf life. Therefore, gradual technology adoption occurs primarily in urban centers and industrial zones.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Albert Handtmann Maschinenfabrik GmbH & Co. KG maintains industry leadership through continuous innovation in vacuum filling and portioning technologies. The company delivers comprehensive solutions serving meat processing, bakery, and prepared food sectors globally. Moreover, Handtmann emphasizes precision engineering and operational reliability maximizing customer productivity. Consequently, their equipment portfolio addresses diverse applications from artisanal production to large-scale industrial operations.

Vemag Maschinenbau GmbH specializes in advanced vacuum filling systems for food processing applications worldwide. Their technology portfolio includes rotary and linear fillers optimized for various product viscosities and production volumes. Additionally, Vemag focuses on hygienic design principles ensuring compliance with stringent food safety regulations. Therefore, the company maintains strong market presence across European and international markets.

Heinrich Frey Maschinenbau GmbH provides innovative filling and portioning solutions emphasizing flexibility and efficiency. The company serves meat processing, convenience food, and dairy industries with customized equipment configurations. Moreover, Frey integrates automation technologies enhancing production capabilities while reducing operational costs. Consequently, manufacturers value their engineering expertise and responsive customer support services.

RISCO S.p.A. delivers comprehensive food processing equipment including vacuum fillers, mixers, and slicing systems. Their global presence supports diverse customer requirements across multiple food industry segments. Additionally, RISCO emphasizes technological innovation developing next-generation solutions incorporating digital controls and sustainable operation. Therefore, the company continues expanding market share through product excellence and customer-focused service delivery.

Key players

- Albert Handtmann Maschinenfabrik GmbH & Co. KG

- Vemag Maschinenbau GmbH

- Heinrich Frey Maschinenbau GmbH

- RISCO S.p.A.

- Accutek Packaging Equipment Company, Inc.

- Universal Filling Machine Company Ltd.

- Tenco S.r.l.

- Technibag

- Fimer Bottling Technology Srl

- NIKO Nahrungsmittel-Maschinen GmbH & Co. KG

- ULMA Packaging S. Coop.

- Henkelman B.V.

- Multivac Sepp Haggenmüller SE & Co. KG

- GEA Group AG

- Krones AG

- Other Key Players

Recent Developments

- In April 2025, Vemag Maschinenbau GmbH introduced the HPnx Next-Generation Vacuum Filler, featuring a design focused on minimizing residual quantities and increasing machine availability for pasty food products. This innovation enhances operational efficiency and reduces product waste in processing operations.

- In November 2025, Handtmann Processing successfully completed the integration of the Inotec product line into its global corporate structure, optimizing its site structures to better support its vacuum filler and emulsification technology. This strategic consolidation strengthens the company’s comprehensive equipment portfolio.

- In December 2025, Promarksvac Corp., a leading manufacturer of vacuum packaging and food processing equipment, announced a strategic partnership with Introvac Corp. to launch a new generation of high-performance vacuum solutions specifically for the perishable food industry. This collaboration accelerates technological advancement and market expansion.

Report Scope

Report Features Description Market Value (2025) USD 2.2 Billion Forecast Revenue (2035) USD 5.5 Billion CAGR (2026-2035) 9.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Rotary Vacuum Fillers, Linear Vacuum Fillers, Vacuum Powder Fillers, Others), By Automation Level (Fully Automatic Vacuum Fillers, Manual Vacuum Fillers, Semi-Automatic Vacuum Fillers), By Container Type (Rigid, Flexible), By End Use Industry (Food & Beverage, Pharmaceutical, Chemicals, Cosmetics & Personal Care, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Albert Handtmann Maschinenfabrik GmbH & Co. KG, Vemag Maschinenbau GmbH, Heinrich Frey Maschinenbau GmbH, RISCO S.p.A., Accutek Packaging Equipment Company, Inc., Universal Filling Machine Company Ltd., Tenco S.r.l., Technibag, Fimer Bottling Technology Srl, NIKO Nahrungsmittel-Maschinen GmbH & Co. KG, ULMA Packaging S. Coop., Henkelman B.V., Multivac Sepp Haggenmüller SE & Co. KG, GEA Group AG, Krones AG, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Albert Handtmann Maschinenfabrik GmbH & Co. KG

- Vemag Maschinenbau GmbH

- Heinrich Frey Maschinenbau GmbH

- RISCO S.p.A.

- Accutek Packaging Equipment Company, Inc.

- Universal Filling Machine Company Ltd.

- Tenco S.r.l.

- Technibag

- Fimer Bottling Technology Srl

- NIKO Nahrungsmittel-Maschinen GmbH & Co. KG

- ULMA Packaging S. Coop.

- Henkelman B.V.

- Multivac Sepp Haggenmüller SE & Co. KG

- GEA Group AG

- Krones AG

- Other Key Players