Global Utility Billing Software Market Size, Share and Analysis Report By Deployment Mode (On-premise, Cloud), By End-user Industry (Water Utilities, Electricity and Power Distribution, Gas Utilities, Telecommunications, Multi-service Municipal Utilities, Others), By Utility Type (Electricity, Water, Gas, District Heating and Cooling, Others), By Billing-Function Module (Customer Information System (CIS), Meter Data Management (MDM), Payment Processing and Collections, Analytics and Reporting, Tariff and Rate Management, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171628

- Number of Pages: 340

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- U.S. Market Size

- Deployment Mode Analysis

- End-user Industry Analysis

- Utility Type Analysis

- Billing-Function Module Analysis

- By Organization Size

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

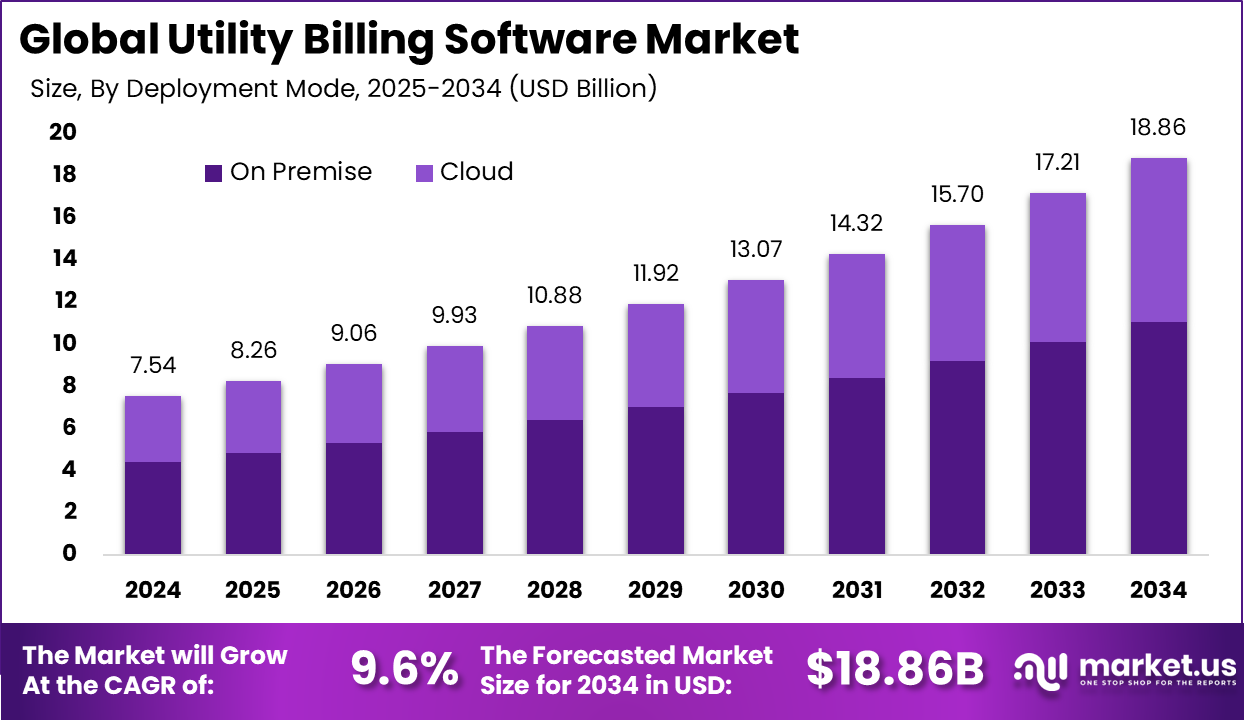

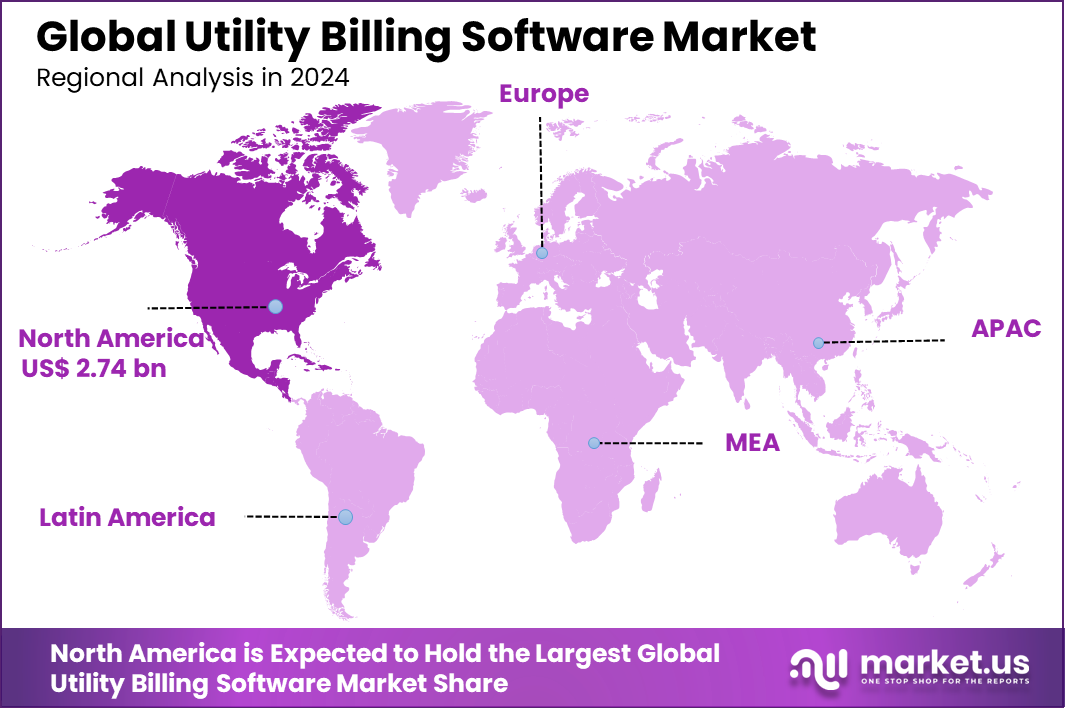

The Global Utility Billing Software Market size is expected to be worth around USD 18.86 billion by 2034, from USD 7.54 billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.4% share, holding USD 2.74 billion in revenue.

The utility billing software market includes digital systems used to manage billing operations for utilities such as electricity, water, gas, and waste services. These platforms support meter data collection, tariff calculation, invoicing, and payment processing. Utilities use billing software to ensure accurate and timely billing for large customer bases. The market plays a central role in utility revenue management.

Utility billing software is adopted by public utilities, private service providers, and municipal authorities. The software supports both residential and commercial customer segments. As utility services expand and become more complex, billing systems must handle higher data volumes. This has increased reliance on advanced billing platforms.

One key driving factor is the growing need for billing accuracy and transparency. Utilities face pressure to reduce billing errors and customer disputes. Manual billing processes are inefficient and prone to mistakes. Software solutions improve calculation accuracy and audit readiness. Another driving factor is regulatory compliance. Utility providers must follow strict billing and reporting regulations. Billing software helps enforce tariff rules and maintain proper records.

Demand for utility billing software is increasing among utilities modernizing legacy systems. Older billing platforms struggle to handle smart meter data and variable pricing models. Utilities seek systems that support flexible billing structures. This drives steady demand for software upgrades. Demand is also rising from growing urban populations and infrastructure expansion. Utilities must manage larger customer bases efficiently. Automated billing reduces administrative burden. These factors continue to strengthen market demand.

Key Takeaway

- In 2024, on-premise deployment led the utility billing software market with a 58.5% share, as utilities continued to prioritize data control, security, and integration with legacy systems.

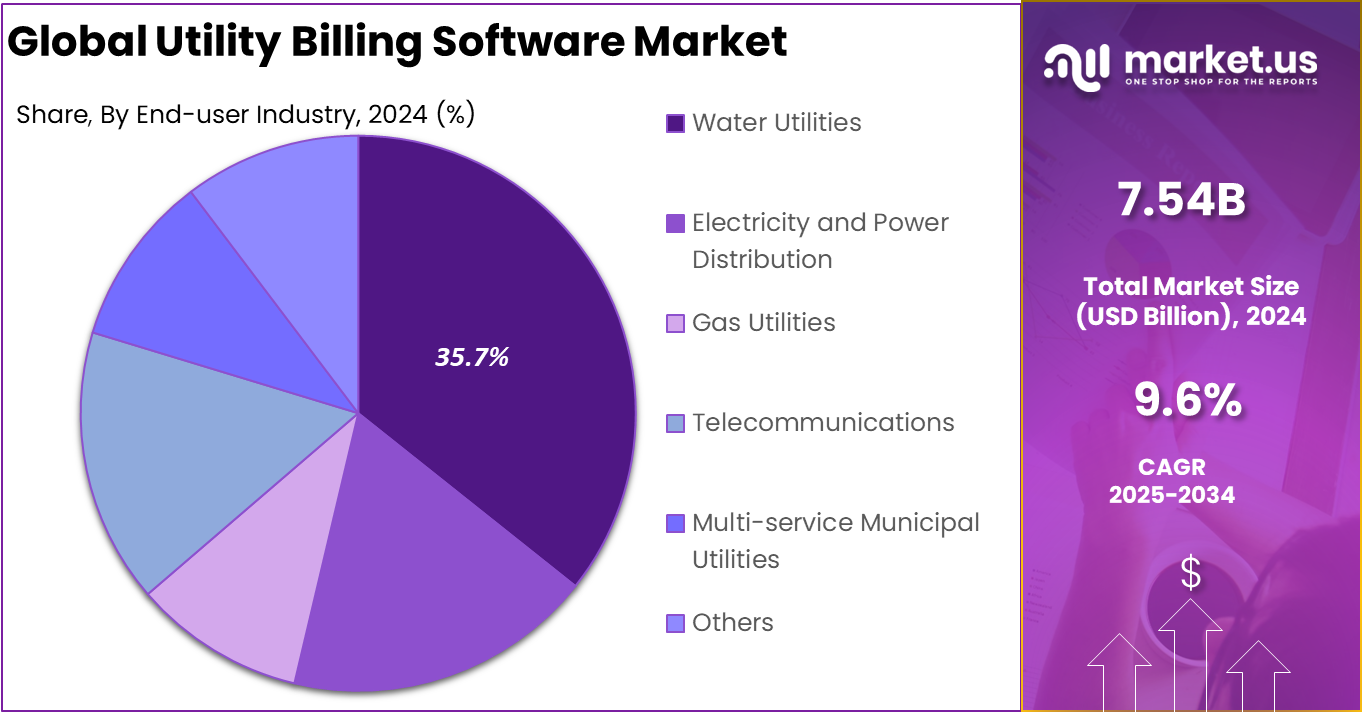

- Water utilities accounted for 35.7%, driven by billing complexity, metering upgrades, and regulatory reporting requirements.

- The electricity segment held 40.2%, reflecting large customer bases, high billing volumes, and the need for accurate consumption-based charging.

- Customer Information Systems represented 38.0%, highlighting their central role in managing customer data, billing cycles, and service interactions.

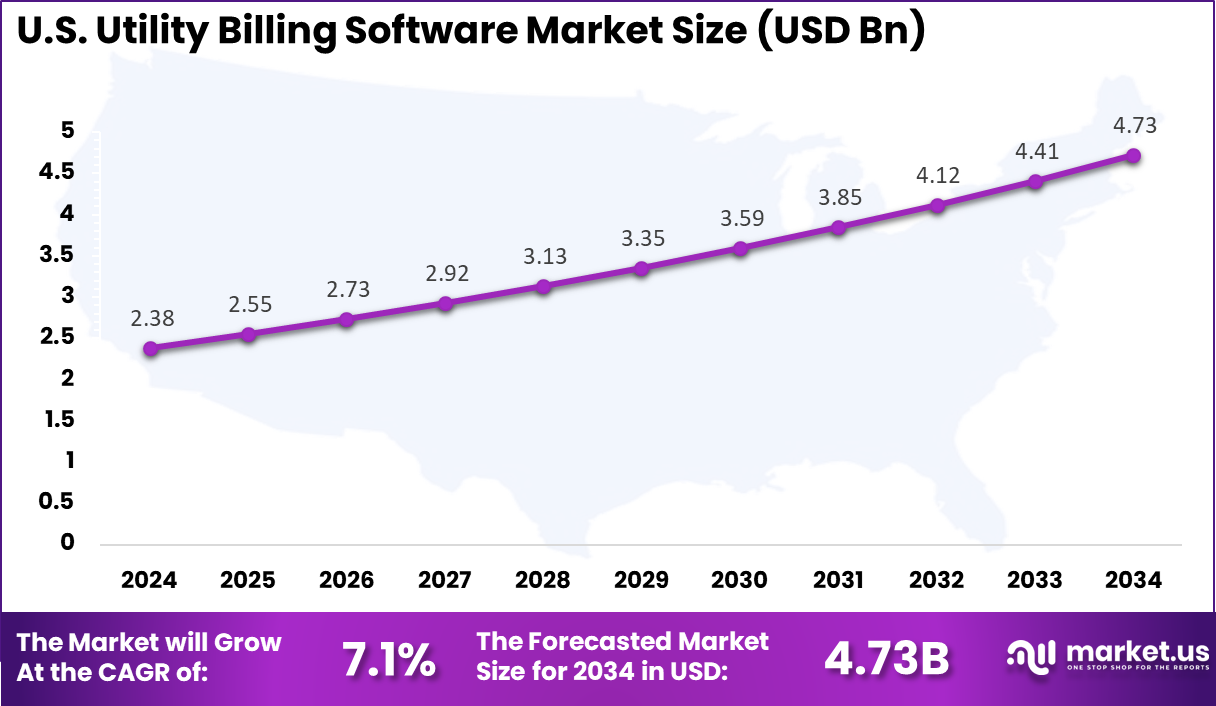

- The U.S. utility billing software market reached USD 2.38 billion in 2024 and is growing at a 7.1% CAGR, supported by grid modernization and digital billing initiatives.

- North America captured over 36.4% share, backed by advanced utility infrastructure, regulatory compliance needs, and steady investment in billing modernization.

U.S. Market Size

The market for Utility Billing Software within the U.S. is growing tremendously and is currently valued at USD 2.38 billion, the market has a projected CAGR of 7.1%. The market expands due to rising demand for smart meters that feed real-time data into billing systems. Utilities face pressure to automate processes amid complex rate structures and customer expectations for online portals. Regulatory pushes for accurate reporting and lower defaults drive adoption.

For instance, in December 2025, Oracle was named a Leader in the IDC MarketScape for Worldwide Utility Meter Data Management on December 10, 2025. The Oracle Utilities Customer Platform integrates metering, billing, sales, service, engagement, and analytics with AI-powered anomaly detection to streamline operations and reduce billing exceptions, reinforcing U.S. leadership in utility billing innovation.

In 2024, North America held a dominant market position in the Global Utility Billing Software Market, capturing more than a 36.4% share, holding USD 2.74 billion in revenue. This dominance stems from advanced smart grid infrastructure that demands precise billing tools.

Strict regulations require detailed audits and customer data protection, pushing utilities toward digital solutions. High adoption of self-service portals meets user needs for anytime access. Investments in IoT meters and AI analytics further speed up real-time billing across the electricity and water sectors.

For instance, in September 2024, Harris Systems & Software celebrated its 10-year alliance with InvoiceCloud, extending digital bill payment integration for utilities. This partnership enhances self-service options and operational efficiency, solidifying North American dominance in utility billing accessibility.

Deployment Mode Analysis

In 2024, On-premise deployment accounts for 58.5%, showing that many utilities prefer locally hosted billing systems. These systems allow utilities to maintain direct control over billing data, customer records, and operational processes. On-premise platforms are commonly used by utilities with legacy infrastructure. This approach supports internal security policies.

The preference for on-premise solutions is driven by regulatory and data governance needs. Utilities benefit from customized configurations that align with existing systems. Local deployment also reduces dependency on external connectivity. These factors continue to support steady adoption.

For Instance, in May 2025, Oracle Corporation rolled out AI-powered enhancements to its Utilities Customer Platform. These updates focus on on-premise setups, helping utilities manage billing data securely within their own systems. Agents now get quick call summaries and tags for billing queries, cutting handle times while keeping sensitive info in-house. This strengthens control for on-premise users facing strict data rules.

End-user Industry Analysis

In 2024, Water utilities represent 35.7%, making them a major end-user segment. Billing software is used to manage consumption data, meter readings, and customer billing cycles. Accurate billing is critical for revenue stability in water services. Software platforms support reliable billing operations.

Growth in this segment is driven by infrastructure modernization and efficiency goals. Water utilities use billing systems to reduce errors and improve customer communication. Automation helps streamline billing workflows. This improves operational consistency.

For instance, in October 2024, Hansen Technologies won a contract with the City of Kingsport for water utility billing upgrades. Their Hansen CIS platform replaces old systems, streamlining meter-to-cash for water services. It boosts customer engagement with flexible configs tailored to water usage tracking and seasonal rates.

Utility Type Analysis

In 2024, the Electricity utilities account for 40.2%, reflecting high demand for advanced billing solutions. Electricity billing involves complex tariff structures, variable usage, and regulatory reporting. Software platforms help manage these requirements effectively. Accurate billing supports customer trust.

Adoption is driven by rising electricity consumption and smart meter deployment. Billing software helps process large volumes of usage data. Utilities rely on these systems to ensure timely invoicing. Operational efficiency remains a key focus.

For Instance, in June 2025, VertexOne deployed VXretail billing and CIS for Summer Energy Northeast, an electricity supplier. The cloud-integrated system handles retail electric billing with EDI for smooth operations. It supports growth in competitive electricity markets with accurate usage and payment tracking.

Billing-Function Module Analysis

In 2024, Customer Information Systems hold 38.0%, making them a core billing module. CIS platforms manage customer profiles, service requests, and billing history. These systems act as the central database for utility billing operations. Accurate customer data is essential.

Demand for CIS modules is driven by customer service improvement initiatives. Utilities use CIS to handle inquiries and resolve billing issues faster. Integration with other billing components improves workflow. This supports better customer engagement.

For Instance, in November 2025, the Hansen CIS Q3 release added CIS tools like automated pay-by-check rechecks. Electricity and water utilities get deeper billing insights via new reports. It empowers CIS as the core for customer data and transactions.

By Organization Size

Investor-owned utilities represent 45.4%, highlighting strong adoption among privately operated utility providers. These organizations focus on efficient billing to support revenue and shareholder expectations. Billing software helps manage large customer bases. Consistent billing performance is critical.

Adoption is supported by higher investment capacity and operational scale. IOUs use billing platforms to standardize processes across regions. Automation helps reduce manual workload. This supports long-term efficiency.

Emerging Trends

In the utility billing software market, a key trend is the increasing integration of advanced analytics and reporting capabilities within billing platforms. These analytics tools enable utilities to derive insights from consumption patterns, revenue streams, and customer behaviour, supporting more informed decision making. Real time dashboards and automated reporting help utilities monitor performance, detect anomalies, and adjust pricing or service strategies with greater precision.

Another emerging trend is the adoption of cloud-based utility billing solutions that offer scalable infrastructure and remote accessibility. Cloud environments facilitate continuous updates, reduce reliance on local hardware, and allow utilities to manage billing, customer accounts, and payment processing from virtually any location. The transition to cloud models supports operational flexibility and lowers upfront technology investment for service providers.

Growth Factors

A primary growth factor in the utility billing software market is the rising emphasis on customer experience and engagement. Consumers now expect transparent billing, multiple payment options, and convenient account management features. Utility billing software that offers secure online portals, bill explanation tools, and automated reminders improves customer satisfaction and reduces service centre workload.

Another important growth factor is the increasing regulatory focus on accuracy and compliance in billing processes. Utilities must adhere to standards related to tariff structures, meter accuracy, and consumer protections. Billing platforms that can automate compliance checks, maintain audit trails, and generate reports aligned with local requirements help reduce errors and support regulatory obligations.

Key Market Segments

By Deployment Mode

- On-premise

- Cloud

By End-user Industry

- Water Utilities

- Electricity and Power Distribution

- Gas Utilities

- Telecommunications

- Multi-service Municipal Utilities

- Others

By Utility Type

- Electricity

- Water

- Gas

- District Heating and Cooling

- Others

By Billing-Function Module

- Customer Information System (CIS)

- Meter Data Management (MDM)

- Payment Processing and Collections

- Analytics and Reporting

- Tariff and Rate Management

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Need for Billing Accuracy and Customer Service Improvement

A key driver of the utility billing software market is the need for accurate and timely billing. Errors in usage measurement or bill calculation can lead to customer disputes, revenue loss, and regulatory penalties. Advanced billing platforms reduce these risks by integrating directly with metering systems and supporting precise rate calculations. Improved accuracy enhances trust between utilities and customers.

Another driver is the demand for enhanced customer service. Utility customers increasingly expect online access to usage data, detailed billing history, and self-service payment options. Billing systems that include customer portals, mobile access, and automated communications help service providers respond more quickly to inquiries and reduce workload for customer support teams.

Restraint Analysis

High Implementation Costs and Integration Complexity

A significant restraint is the cost associated with deploying modern billing software. Implementation often requires customization, data migration, and integration with existing metering, customer service, and financial systems. These costs can be prohibitive for smaller utility providers or cooperatives with limited budgets, slowing adoption rates in certain segments.

Another restraint arises from integration complexity. Billing systems must connect with smart meters, enterprise resource planning platforms, and customer relationship management systems. Ensuring seamless data flow across these systems requires technical expertise and careful planning. Integration challenges can delay deployment and increase project risk.

Opportunity Analysis

Support for Multiple Service Lines and Value-Added Services

There is strong opportunity in offering billing platforms that support multiple utility services in a unified system. Many providers deliver electricity, water, gas, and waste services to the same customer base. A single billing solution that handles all service lines reduces operational complexity and improves internal coordination. Vendors offering unified systems can appeal to multi-service utilities.

Another opportunity lies in value-added services such as usage analytics, budget planning tools, and personalized billing options. Customers increasingly seek insights into their consumption patterns and options for payment flexibility. Billing platforms that support these analytics and service modules can help utilities differentiate their offerings and enhance customer engagement.

Challenge Analysis

Data Security Requirements and Legacy System Dependence

A major challenge is ensuring data security and privacy. Billing systems handle sensitive customer information and financial transactions. Protecting this data from unauthorized access or breaches requires robust security controls, encryption, and compliance with data protection regulations. Implementing and maintaining these measures increases system complexity and cost.

Another challenge involves legacy system dependence. Many utilities have long-established systems for metering, customer accounts, and financial reporting. Replacing or upgrading these systems to integrate with modern billing platforms can be difficult due to outdated interfaces or data formats. This slows adoption and may require phased migration strategies.

Key Players Analysis

Oracle, SAP, and Hansen Technologies lead the utility billing software market with enterprise platforms that manage complex billing, metering, and customer information across electricity, gas, and water utilities. Their solutions support large customer bases, regulatory compliance, and multi tariff billing structures. These companies focus on scalability, accuracy, and integration with utility operations systems. Ongoing grid modernization and digital transformation continue to reinforce their leadership.

N. Harris Computer Corporation, VertexOne, Tyler Technologies, Gentrack Group, and Itineris strengthen the market with billing and customer care solutions tailored for regulated utilities and municipalities. Their platforms support flexible pricing, customer self service, and advanced reporting. These providers emphasize reliability, faster deployment, and support for evolving utility regulations. Growing focus on customer experience supports wider adoption.

EnergyCAP, Bynry Technologies, Fluentgrid, Open International, Paymentus Holdings, Utilibill, Exceleron Software, and other players expand the landscape with cloud based billing, prepaid metering, and digital payment integration. Their offerings target small and mid sized utilities seeking cost efficient modernization. Increasing demand for real time billing and digital channels continues to drive steady market growth.

Top Key Players in the Market

- Oracle Corporation

- SAP SE

- Hansen Technologies Limited

- Harris Computer Corporation

- VertexOne, LLC

- Tyler Technologies, Inc.

- EnergyCAP, LLC

- Bynry Technologies Pvt. Ltd.

- Starnik Systems, Inc.

- MuniBilling, LLC

- Gentrack Group Limited

- Itineris NV

- Fluentgrid Limited

- Open International LLC

- Paymentus Holdings, Inc.

- ePsolutions, Inc.

- Utilibill Pty. Ltd.

- Jayhawk Software, Inc.

- Banyon Data Systems, Inc.

- Exceleron Software, Inc.

- Others

Recent Developments

- In April 2025, CivicPlus snapped up Beehive Industries’ asset management and utility billing software, integrating these solutions to streamline operations for local governments handling water, sewer, and other utility services. The acquisition highlights the push toward comprehensive platforms that cut manual work and boost efficiency in U.S. public sector billing.

- In June 2025, Caselle grew its nationwide reach by acquiring Dallas Data Systems, enhancing integrated software support for local governments’ utility billing needs. This deal lets Caselle deliver more robust financial and billing tools, helping utilities manage everything from invoicing to reporting with greater accuracy.

Report Scope

Report Features Description Market Value (2024) USD 7.5 Bn Forecast Revenue (2034) USD 18.8 Bn CAGR(2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (On-premise, Cloud), By End-user Industry (Water Utilities, Electricity and Power Distribution, Gas Utilities, Telecommunications, Multi-service Municipal Utilities, Others), By Utility Type (Electricity, Water, Gas, District Heating and Cooling, Others), By Billing-Function Module (Customer Information System (CIS), Meter Data Management (MDM), Payment Processing and Collections, Analytics and Reporting, Tariff and Rate Management, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle Corporation, SAP SE, Hansen Technologies Limited, N. Harris Computer Corporation, VertexOne, LLC, Tyler Technologies, Inc., EnergyCAP, LLC, Bynry Technologies Pvt. Ltd., Starnik Systems, Inc., MuniBilling, LLC, Gentrack Group Limited, Itineris NV, Fluentgrid Limited, Open International LLC, Paymentus Holdings, Inc., ePsolutions, Inc., Utilibill Pty. Ltd., Jayhawk Software, Inc., Banyon Data Systems, Inc., Exceleron Software, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Utility Billing Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Utility Billing Software MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle Corporation

- SAP SE

- Hansen Technologies Limited

- Harris Computer Corporation

- VertexOne, LLC

- Tyler Technologies, Inc.

- EnergyCAP, LLC

- Bynry Technologies Pvt. Ltd.

- Starnik Systems, Inc.

- MuniBilling, LLC

- Gentrack Group Limited

- Itineris NV

- Fluentgrid Limited

- Open International LLC

- Paymentus Holdings, Inc.

- ePsolutions, Inc.

- Utilibill Pty. Ltd.

- Jayhawk Software, Inc.

- Banyon Data Systems, Inc.

- Exceleron Software, Inc.

- Others