US Sex Toys Market Size, Share, Growth Analysis By Product (Vibrators, Sex Dolls, Dildos, Bondage, Penis Rings, Masturbation Sleeve, Others), By End-user (Female, Male, Others), By Distribution Channel (E-commerce, Specialty Stores, Mass Merchandizers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164059

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

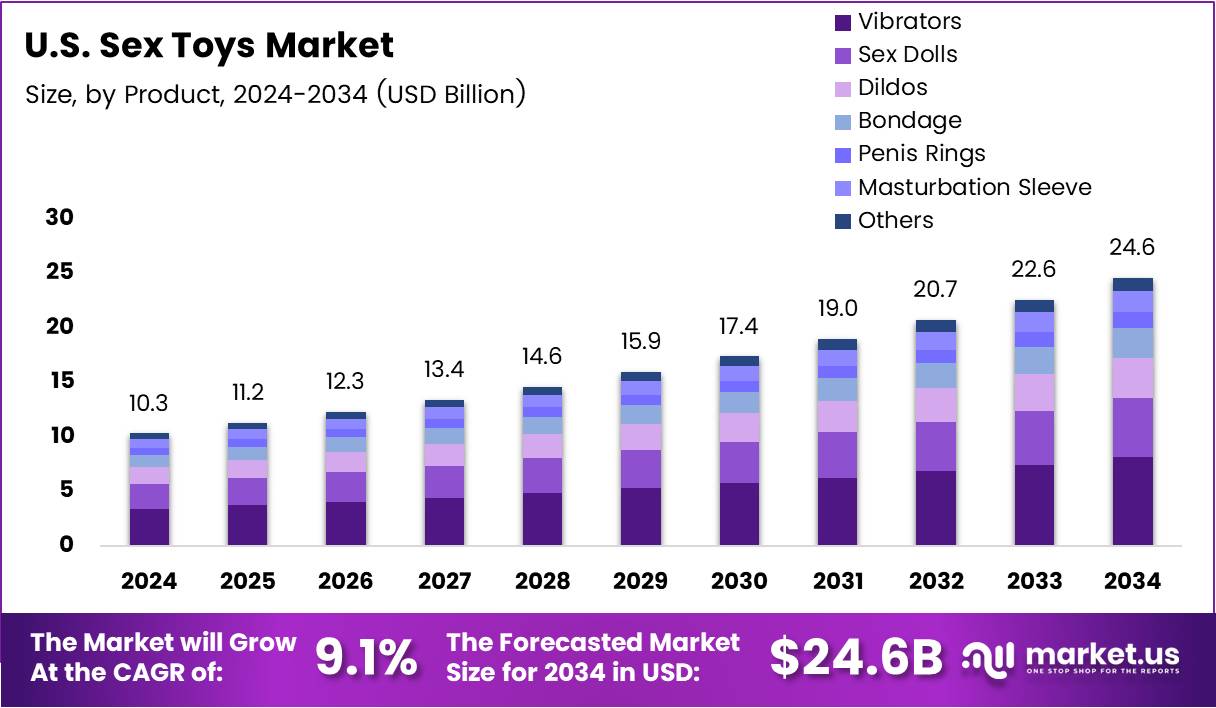

The US Sex Toys Market size is expected to be worth around USD 24.6 Billion by 2034, from USD 10.3 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

The U.S. Sex Toys Market represents a rapidly evolving segment within the wellness and personal care industry. It encompasses a wide range of products designed to enhance sexual health, intimacy, and personal pleasure. Driven by changing social attitudes and increasing consumer openness, this market continues to shift toward mainstream retail and digital platforms.

Moreover, rising awareness regarding sexual wellness and inclusivity has fueled demand across diverse demographic segments. Consumers are now viewing sex toys not as taboo products but as lifestyle and health-enhancing tools. This transformation has opened new growth pathways for manufacturers, retailers, and e-commerce distributors in the U.S. Sex Toys Market.

Additionally, increasing product innovation and material safety standards are reshaping consumer expectations. Companies are investing in body-safe materials, app-enabled devices, and discreet packaging to appeal to modern buyers. As awareness around self-care and mental wellness expands, sexual health products are becoming integral to holistic well-being trends.

Furthermore, government regulations emphasizing product safety, consumer protection, and transparent labeling are strengthening industry credibility. While regulatory oversight varies across states, greater compliance standards are encouraging legitimate players to enhance quality assurance. These measures indirectly boost consumer trust and drive sustainable market growth in the U.S. Sex Toys sector.

The growing digitalization of retail has also played a pivotal role in market expansion. According to industry reports, the U.S. Census recorded a +43% jump in nationwide e-commerce sales in 2020, rising from $571.2B to $815.4B, reflecting a major channel shift that benefited intimate-product categories. This surge underscores the importance of online accessibility and discreet purchasing options.

Consumer adoption metrics further highlight growing acceptance. According to an industry report, 52.5% of U.S. women report lifetime vibrator use in a national probability sample, while among men, it’s 44.8% lifetime and 10% past-month use. These figures signify a mature, high-engagement market with expanding repeat purchase potential and social normalization of sexual wellness.

Key Takeaways

- The US Sex Toys Market is projected to reach USD 24.6 Billion by 2034, from USD 10.3 Billion in 2024, growing at a CAGR of 9.1% during 2025–2034.

- Vibrators dominated the market with a 32.8% share in 2024, driven by innovation and broad online availability.

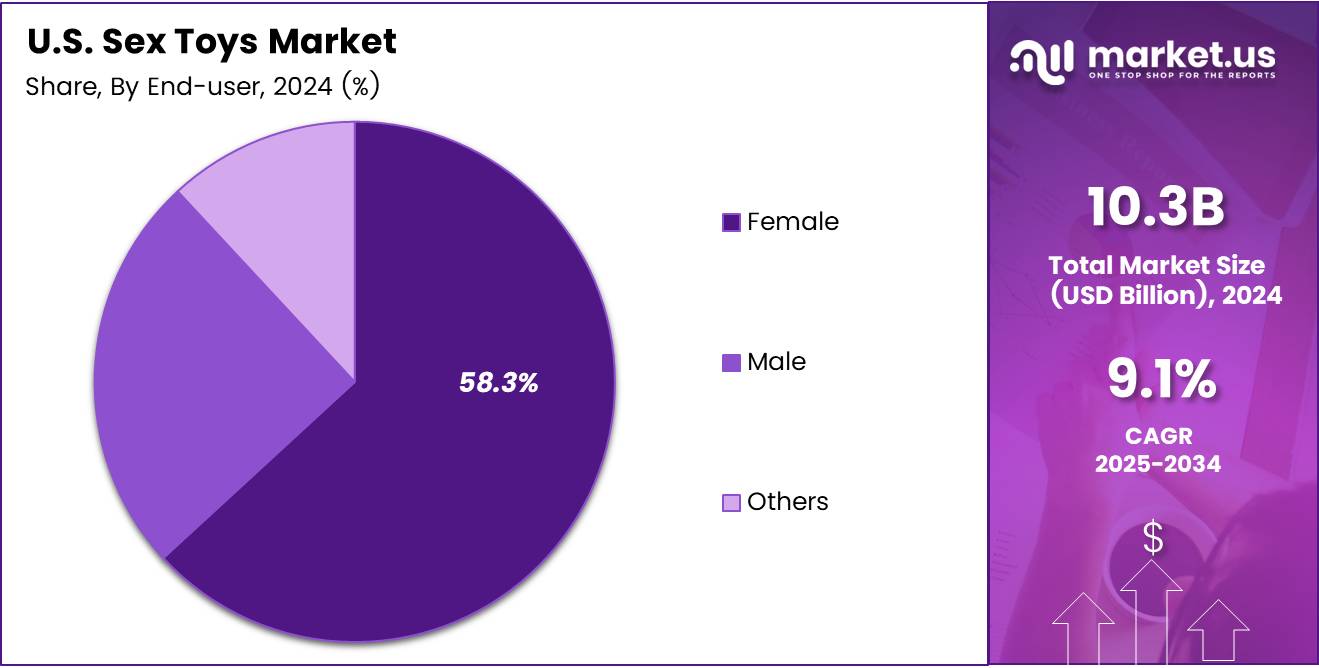

- Female end-users accounted for the largest market share of 58.3% in 2024, supported by growing awareness of sexual wellness.

- E-commerce channels led distribution with a 57.2% share in 2024 due to convenience and discreet purchasing options.

By Product Analysis

Vibrators dominate with 32.8% due to their widespread availability and technological innovation.

In 2024, Vibrators held a dominant market position in the By Product segment of the US Sex Toys Market, with a 32.8% share. Their popularity is driven by a wide range of designs, enhanced functionalities, and discreet availability online. Increasing openness about sexual wellness has further supported vibrator sales nationwide.

Sex Dolls are witnessing steady growth, supported by innovations in lifelike materials and customizable options. Consumers seeking companionship and realism are increasingly adopting high-end models. Moreover, the integration of artificial intelligence is expected to drive future demand among male users in particular.

Dildos continue to represent a core category in the market. They appeal to both male and female users due to simplicity, affordability, and easy usability. Available in various shapes and materials, dildos maintain relevance through continuous innovation and consumer comfort preference.

Bondage products cater to users exploring BDSM lifestyles. Rising acceptance of alternative sexual practices and increased media portrayal have popularized bondage items. Brands are introducing safe, durable, and beginner-friendly kits to make this segment more approachable for new consumers.

Penis Rings have become popular among men seeking performance enhancement and prolonged pleasure. Affordable pricing and availability in multiple materials make them attractive. Increasing awareness regarding sexual satisfaction has resulted in steady adoption across age groups.

Masturbation Sleeves are gaining traction among men due to improved designs and realistic sensations. The introduction of soft, skin-like materials and portable models has expanded the user base. Additionally, discreet packaging and online retailing continue to promote sales in this sub-segment.

Others include niche items such as anal toys and couples’ products. These appeal to a broad range of consumers exploring intimacy enhancement. Market growth in this category is supported by innovative product launches and growing comfort with adult products among millennials.

By End-user Analysis

Female dominates with 58.3% due to growing awareness and social acceptance of female sexual wellness.

In 2024, Female users held a dominant market position in the By End-user segment of the US Sex Toys Market, with a 58.3% share. The surge in female self-pleasure awareness, along with the influence of social media and wellness movements, has propelled demand for premium and discreet products.

Male users represent a significant portion of the market. Increasing focus on men’s sexual health and availability of specialized toys like masturbation sleeves and penis rings have contributed to adoption. Growing openness toward sexual exploration continues to enhance market potential for male-oriented products.

Others include LGBTQ+ consumers and gender-fluid users who seek inclusive products. Brands are increasingly designing gender-neutral and couple-friendly toys to address diverse needs. Rising inclusivity and representation in advertising are fostering market growth across this user category.

By Distribution Channel Analysis

E-commerce dominates with 57.2% due to convenience, privacy, and vast product variety.

In 2024, E-commerce held a dominant market position in the By Distribution Channel segment of the US Sex Toys Market, with a 57.2% share. The rise of online shopping, discreet packaging, and customer reviews make digital platforms the most preferred purchasing channel for adult products.

Specialty Stores continue to play an important role by providing personalized shopping experiences and expert guidance. These stores focus on maintaining a comfortable and educational environment, which attracts customers seeking informed product choices and immediate availability.

Mass Merchandizers are expanding their offerings with selective inclusion of discreet adult products. Their wide customer base and affordability enhance accessibility. However, limited shelf space and public shopping settings restrict the segment’s overall dominance compared to online platforms.

Others include pharmacies, vending machines, and boutique retailers. These channels cater to localized markets and niche audiences. Increasing presence in health-focused outlets and experiential stores is gradually helping this segment find new opportunities for growth.

Key Market Segments

By Product

- Vibrators

- Sex Dolls

- Dildos

- Bondage

- Penis Rings

- Masturbation Sleeve

- Others

By End-user

- Female

- Male

- Others

By Distribution Channel

- E-commerce

- Specialty Stores

- Mass Merchandizers

- Others

Drivers

Rising Acceptance of Sexual Wellness and Intimacy Products in the U.S. Drives Market Growth

The U.S. sex toys market is witnessing strong growth as consumers become more open about sexual wellness and intimacy. Changing social attitudes and the growing focus on self-care are helping normalize discussions about sexual health. This shift has led to a higher demand for personal pleasure products among both men and women.

The expansion of e-commerce platforms offering discreet packaging and delivery services has made purchasing such products more convenient. Consumers now prefer the privacy and wide selection available online, which is fueling online sales.

Millennials, in particular, are more aware of the importance of sexual wellbeing. Their willingness to explore and discuss these topics openly has strengthened market acceptance. Educational content and influencer marketing further support this trend.

In addition, innovations in technology are transforming the industry. Smart and app-connected devices allow users to personalize their experiences, adding value and driving repeat purchases. These advancements are expected to continue attracting tech-savvy consumers in the coming years.

Restraints

Limited Availability in Offline Retail Channels Due to Conservative Regulations Restrains Market Expansion

Despite growing demand, the U.S. sex toys market faces several challenges. Conservative regulations and social stigma still restrict the availability of these products in physical stores. Many mainstream retailers remain cautious about stocking sexual wellness items, limiting consumer access.

Another major restraint is the presence of counterfeit and low-quality imports. These products often fail to meet safety standards, reducing consumer trust and satisfaction. They also harm the reputation of legitimate brands that prioritize quality and safety.

Additionally, smart sex toys that connect through apps raise data privacy concerns. Consumers are becoming more aware of cybersecurity risks, such as data leaks and misuse of personal information. This can discourage adoption of advanced devices, slowing overall market growth.

Growth Factors

Expansion of LGBTQ+ and Inclusive Product Lines Across U.S. Brands Creates New Growth Opportunities

The U.S. sex toys market is evolving with the growing demand for inclusivity. Many brands are expanding product lines to better serve LGBTQ+ consumers and those seeking gender-neutral designs. This approach not only promotes diversity but also attracts a wider audience looking for personalized experiences.

Subscription-based models and wellness platforms are also driving growth. These services offer regular deliveries, educational content, and personalized recommendations, creating ongoing customer relationships and steady revenue streams.

Consumers are increasingly seeking premium, body-safe, and eco-friendly materials. Sustainable production and high-quality materials appeal to health-conscious buyers who value safety and environmental responsibility.

Furthermore, integrating AI and sensor technologies is opening doors for hyper-personalized experiences. Smart devices that learn user preferences enhance satisfaction and loyalty, giving innovative brands a competitive edge in this expanding market.

Emerging Trends

Surge in Female Empowerment and Sexual Wellness Campaigns Shapes Market Trends

The rise of female empowerment movements and wellness campaigns is reshaping the U.S. sex toys market. Open discussions around women’s pleasure and sexual health have reduced stigma and encouraged more women to explore sexual wellness products confidently.

The introduction of Virtual Reality (VR) and Augmented Reality (AR) is revolutionizing user experiences. These immersive technologies allow users to enjoy interactive and realistic pleasure experiences, adding a modern dimension to intimacy.

Celebrity endorsements and social media have also boosted product visibility. Influencers and public figures promoting sex-positive messages help normalize product use and build trust among younger consumers.

Moreover, the growing popularity of gender-neutral and couple-oriented devices reflects changing relationship dynamics. Products designed for shared experiences are fostering inclusivity and intimacy, making them a key trend in the evolving U.S. market.

Key US Sex Toys Company Insights

Reckitt Benckiser Group plc continues to strengthen its presence in the intimate wellness segment through trusted branding and wide retail reach. The company leverages its strong distribution network across e-commerce and pharmacy channels, ensuring accessibility and credibility. Its focus on sexual health education and product innovation supports consistent growth in the premium wellness category.

Church & Dwight Co., Inc. drives expansion through its established Trojan brand, which enjoys strong consumer loyalty across the U.S. Its marketing emphasizes safety, pleasure, and inclusivity, appealing to younger demographics and couples seeking reliable intimacy solutions. The company benefits from strategic diversification into lubricants and vibrating products that enhance portfolio resilience.

Lovehoney Group Ltd. represents the new generation of digital-first intimacy brands leading the e-commerce revolution. The company’s emphasis on sexual wellness, body positivity, and discreet packaging has resonated strongly with online consumers. Through influencer engagement and personalized offerings, Lovehoney maintains a progressive brand image that aligns with evolving consumer values.

LifeStyles Healthcare Pte Ltd. focuses on safe and sensual experiences through its condoms, lubricants, and pleasure products. The company’s investments in product ergonomics, hypoallergenic materials, and technology-driven enhancements help expand consumer trust. Its growing focus on sustainability and health awareness also aligns with the U.S. market’s preference for body-safe, eco-conscious products.

Top Key Players in the Market

- Reckitt Benckiser Group plc

- Church & Dwight Co., Inc.

- Lovehoney Group Ltd.

- LifeStyles Healthcare Pte Ltd.

- LELO

- Doc Johnson Enterprises

- Unbound

- Tenga Co., Ltd.

- Fun Factory

- BMS Factory

Recent Developments

- In February 2024, Dame Products acquired Emojibator, a playful sexual-wellness brand known for its emoji-inspired vibrator designs. This move expanded Dame’s portfolio with fun, inclusive products appealing to younger consumers.

- In April 2025, Dame Products further diversified its offerings by acquiring Chakrubs, a niche brand specializing in crystal-based intimacy tools. The acquisition strengthened Dame’s position in holistic and mindful wellness categories.

- In March 2024, Lovense introduced the Tenera 2 clitoral suction vibrator, showcasing enhanced suction precision and app-controlled functionality. This product launch emphasized Lovense’s focus on tech-driven and customizable intimacy solutions.

- In July 2025, Pleasing, the lifestyle brand founded by Harry Styles, ventured into sexual wellness with its Pleasing Yourself line. The launch featured a premium double-sided vibrator and luxury lubricant, marking its entry into the intimate-care segment.

Report Scope

Report Features Description Market Value (2024) USD 10.3 Billion Forecast Revenue (2034) USD 24.6 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Vibrators, Sex Dolls, Dildos, Bondage, Penis Rings, Masturbation Sleeve, Others), By End-user (Female, Male, Others), By Distribution Channel (E-commerce, Specialty Stores, Mass Merchandizers, Others) Competitive Landscape Reckitt Benckiser Group plc, Church & Dwight Co., Inc., Lovehoney Group Ltd., LifeStyles Healthcare Pte Ltd., LELO, Doc Johnson Enterprises, Unbound, Tenga Co., Ltd., Fun Factory, BMS Factory Customization Scope Customization for segments. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Reckitt Benckiser Group plc

- Church & Dwight Co., Inc.

- Lovehoney Group Ltd.

- LifeStyles Healthcare Pte Ltd.

- LELO

- Doc Johnson Enterprises

- Unbound

- Tenga Co., Ltd.

- Fun Factory

- BMS Factory