US Event Management Market Size, Share, Growth Analysis By Event Type (MICE, Weddings, Social Events, Sports Events, Music & Entertainment Events, Art & Cultural Events, Political & Government Events, Festivals & Fairs), By Service (Event Planning & Coordination, Event Production & Technical Services, Event Marketing & Promotion, Venue Sourcing & Logistics Management, Registration, Ticketing & Attendee Management, Others), By Delivery Mode (In-Person, Virtual, Hybrid), By End-User (Corporations, Non-Profit Organizations, Government Agencies, Educational Institutions, Individuals, Others), By Event Size (Medium Events, Small Events, Large Events) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174060

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

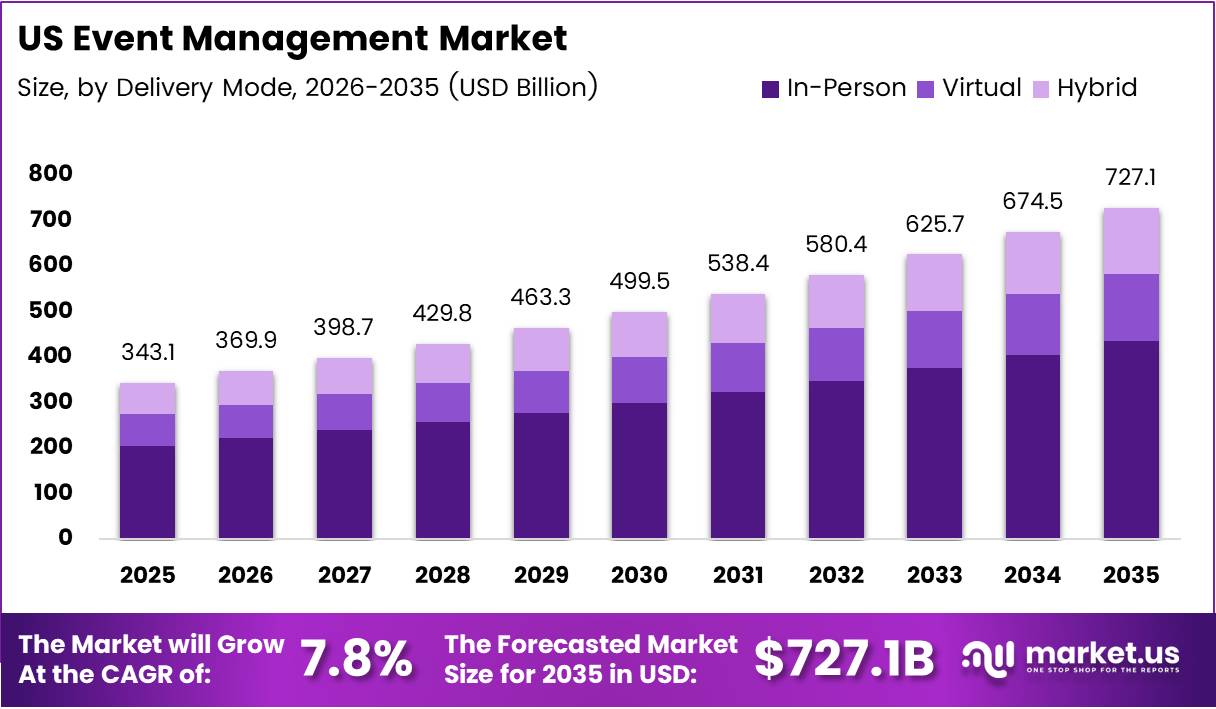

The US Event Management Market size is expected to be worth around $727.1 billion by 2035 from $343.1 billion in 2025, growing at a CAGR of 7.8% during the forecast period from 2026 to 2035. This substantial expansion reflects the increasing importance of professionally managed events across corporate, government, and social sectors.

Event management encompasses the comprehensive planning, coordination, and execution of gatherings ranging from corporate conferences to weddings and entertainment festivals. Moreover, it integrates venue sourcing, technical production, marketing, attendee management, and logistical support to deliver seamless experiences. The industry serves diverse end-users including corporations, educational institutions, non-profit organizations, and individual clients seeking professional event solutions.

The market demonstrates robust growth driven by corporate experiential marketing strategies and hybrid engagement models. Additionally, rising compliance requirements push organizations toward professional event planning services. Convention center expansions and city-level tourism initiatives further accelerate market momentum, creating substantial opportunities for service providers nationwide.

Corporate budgets increasingly shift from digital-only campaigns to physical brand activations, fueling demand for event expertise. Furthermore, the expansion of startup ecosystems generates recurring requirements for pitch events and product demonstrations. Destination weddings and premium social celebrations contribute significantly to market diversification, particularly in high-income demographic segments.

According to the US Travel Association, group travel including conventions, trade shows, and team events generated $126 billion in 2024, reaching 82% of 2019 levels. This recovery trajectory signals strong post-pandemic momentum. However, volatility in venue rental and catering costs across major metro cities presents pricing challenges for event organizers.

Technology integration transforms operational efficiency through AI-powered registration systems and contactless check-in solutions. Consequently, digital badging and mobile event applications enhance attendee experiences while streamlining event logistics. According to Zippia, over 44,554 event managers are currently employed across the United States, with 63.8% being women and an average age of 38 years old, reflecting a diverse and experienced workforce.

Sustainability initiatives gain prominence as organizations adopt zero-waste and carbon-neutral event programs. Therefore, environmental consciousness influences venue selection, catering choices, and material sourcing decisions. Micro-influencer collaborations create authentic brand experience events, particularly appealing to younger demographic segments seeking personalized engagement opportunities.

Key Takeaways

- US Event Management Market is projected to reach $727.1 billion by 2035 from $343.1 billion in 2025, growing at 7.8% CAGR.

- MICE segment dominates By Event Type with 34.7% market share in 2025.

- Event Planning & Coordination leads By Service segment with 38.1% share.

- In-Person delivery mode holds 78.4% market dominance in 2025.

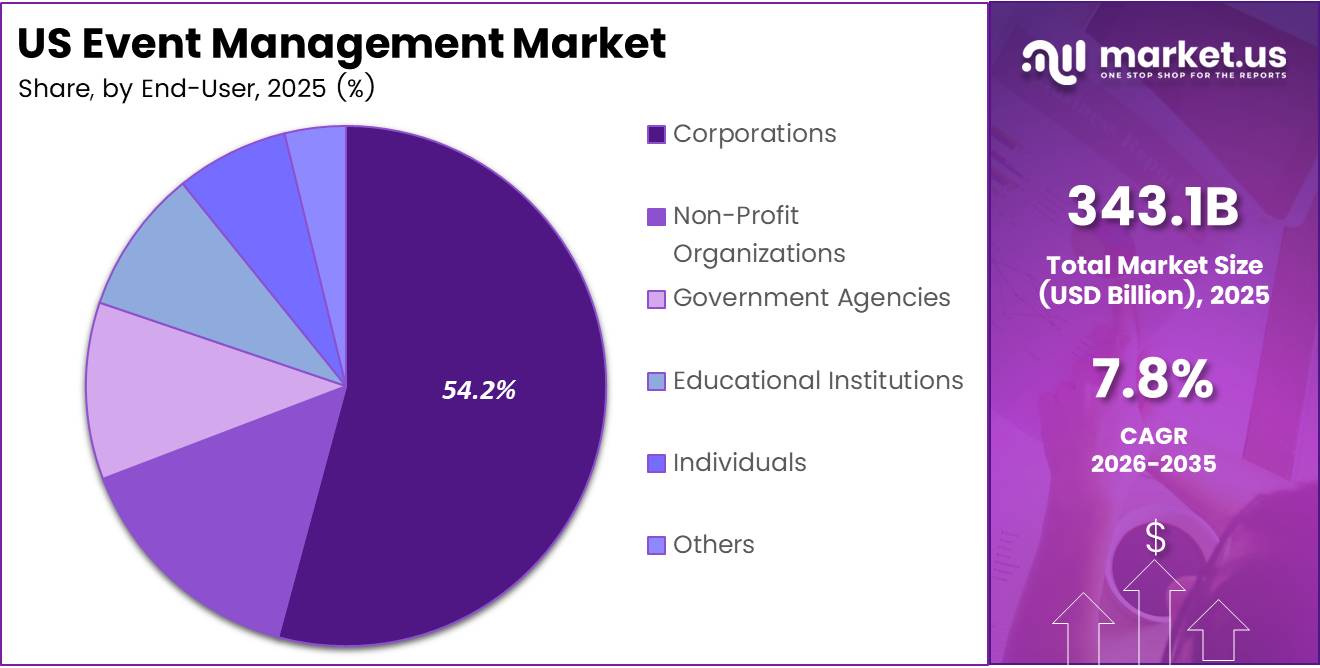

- Corporations represent the largest end-user segment with 54.2% market share.

- Medium Events category captures 45.9% share in By Event Size segment.

By Event Type

MICE dominates with 34.7% due to corporate investment in conferences, meetings, incentives, and exhibitions.

In 2025, MICE held a dominant market position in the By Event Type segment of the US Event Management Market, with a 34.7% share. This leadership stems from sustained corporate demand for professional conferences, trade shows, and incentive programs. Moreover, MICE events generate substantial economic impact through multi-day attendee spending on accommodation, dining, and local experiences. Organizations prioritize MICE activities to facilitate networking, knowledge sharing, and business development across industries.

Weddings represent a significant segment driven by high per-event spending and emotional value attached to ceremony planning. Couples increasingly seek professional coordination for venue selection, catering, décor, and entertainment management. Additionally, destination wedding trends expand market opportunities beyond traditional local ceremonies. Premium customization demands support sustained growth in wedding event services nationwide.

Social Events encompass birthday celebrations, anniversaries, reunions, and milestone gatherings requiring professional planning expertise. This category benefits from rising disposable incomes and preferences for memorable experiences. Furthermore, social media influence encourages elaborate event designs that generate shareable content. Professional planners deliver thematic consistency and logistical efficiency for increasingly sophisticated client expectations.

Sports Events include tournaments, marathons, and competitive gatherings requiring specialized venue management and participant coordination. These events demand technical expertise in timing systems, safety protocols, and spectator management. Consequently, professional event services ensure seamless execution of complex sporting activities. Community engagement and sponsorship opportunities drive sustained investment in sports event infrastructure.

Music & Entertainment Events cover concerts, festivals, and live performances necessitating audio-visual production and crowd management capabilities. Artists and promoters rely on specialized technical services for stage design, sound engineering, and lighting arrangements. Moreover, ticketing systems and security coordination require professional oversight. Fan experience enhancement drives continuous innovation in entertainment event delivery.

Art & Cultural Events include exhibitions, theater productions, and heritage celebrations showcasing creative expressions and cultural traditions. Museums, galleries, and cultural institutions depend on event professionals for exhibition launches and fundraising galas. Additionally, these events support community identity and educational objectives. Professional management ensures accessibility, preservation standards, and engaging visitor experiences.

Political & Government Events comprise rallies, town halls, and official ceremonies requiring security coordination and compliance adherence. Government agencies prioritize professional planning for public assemblies, policy announcements, and commemorative functions. Furthermore, these events demand transparent communication and logistical precision. Regulatory requirements necessitate experienced event management to ensure successful execution.

Festivals & Fairs feature community celebrations, food festivals, and seasonal gatherings that attract diverse audiences across multiple days. These events require comprehensive vendor management, entertainment coordination, and public safety measures. Consequently, professional organizers deliver operational efficiency and positive community experiences. Tourism promotion and local economic development objectives sustain festival investment across US regions.

By Service

Event Planning & Coordination dominates with 38.1% due to essential role in comprehensive event design and execution oversight.

In 2025, Event Planning & Coordination held a dominant market position in the By Service segment of the US Event Management Market, with a 38.1% share. This service encompasses strategic design, timeline development, vendor selection, and on-site management critical to event success. Moreover, clients value end-to-end coordination that ensures seamless integration of all event components. Professional planners mitigate risks, manage budgets, and deliver experiences aligned with client objectives.

Event Production & Technical Services provide audio-visual equipment, stage design, lighting systems, and technical crew essential for professional event execution. Corporate conferences, concerts, and large gatherings require specialized production capabilities to deliver engaging experiences. Additionally, technological advancements drive continuous equipment upgrades and technical expertise development. Production quality directly impacts attendee satisfaction and event memorability.

Event Marketing & Promotion encompass digital campaigns, social media management, content creation, and attendee acquisition strategies that maximize event visibility. Successful events depend on effective marketing to achieve attendance targets and sponsorship objectives. Furthermore, data analytics inform promotional strategies and audience segmentation approaches. Brand positioning and competitive differentiation require sophisticated marketing execution.

Venue Sourcing & Logistics Management involve location identification, contract negotiation, transportation coordination, and accommodation arrangements supporting event operations. Finding suitable venues matching capacity, location, and budget requirements presents significant planning challenges. Consequently, professional sourcing services save clients time while securing optimal terms. Logistics coordination ensures smooth attendee movement and material delivery.

Registration, Ticketing & Attendee Management systems handle participant enrollment, payment processing, access control, and communication workflows essential for organized events. Digital platforms streamline check-in processes and provide real-time attendance data. Moreover, personalized attendee experiences through mobile applications enhance engagement and satisfaction. Efficient management reduces administrative burdens and improves operational effectiveness.

Others include specialized services such as catering coordination, entertainment booking, security management, and insurance procurement supporting comprehensive event delivery. These ancillary services address specific client needs beyond core planning and production functions. Additionally, customization requirements drive demand for niche service providers. Flexible service combinations allow tailored solutions matching unique event characteristics.

By Delivery Mode

In-Person dominates with 78.4% due to enduring preference for physical interaction and tangible experiences.

In 2025, In-Person held a dominant market position in the By Delivery Mode segment of the US Event Management Market, with a 78.4% share. This dominance reflects fundamental human preferences for face-to-face networking, hands-on experiences, and emotional connections that physical presence facilitates. Moreover, corporate executives prioritize in-person meetings for relationship building and complex negotiations. Sensory engagement through venue atmospheres, culinary experiences, and interpersonal interactions remains irreplaceable.

Virtual events utilize online platforms enabling remote participation through video conferencing, digital content delivery, and interactive tools. This mode gained prominence during pandemic restrictions and continues serving geographically dispersed audiences. Additionally, virtual formats reduce travel costs and environmental impact while expanding accessibility. Technology improvements enhance engagement through gamification, breakout rooms, and networking features.

Hybrid events combine in-person attendance with virtual participation options, maximizing reach while maintaining physical engagement benefits. Organizations adopt hybrid models to accommodate diverse attendee preferences and extend content accessibility. Furthermore, hybrid delivery creates additional revenue streams through expanded ticket sales. Technical complexity requires specialized expertise in simultaneous physical and digital experience management.

By End-User

Corporations dominate with 54.2% due to substantial budgets allocated for conferences, product launches, and team-building activities.

In 2025, Corporations held a dominant market position in the By End-User segment of the US Event Management Market, with a 54.2% share. Corporate entities invest heavily in events supporting sales objectives, employee engagement, customer relationships, and brand visibility initiatives. Moreover, companies recognize events as strategic tools for achieving business outcomes beyond traditional advertising channels. Professional event management ensures corporate brand standards and compliance requirements are met consistently.

Non-Profit Organizations utilize events for fundraising galas, awareness campaigns, volunteer recognition, and community outreach activities advancing their missions. These organizations depend on successful events to generate donations and strengthen stakeholder relationships. Additionally, professional planning maximizes limited budgets through efficient resource allocation. Emotional storytelling and mission alignment drive engagement in non-profit events.

Government Agencies organize public assemblies, policy forums, commemorative ceremonies, and community engagement initiatives requiring transparent planning and security coordination. Regulatory compliance and public accountability standards necessitate professional event management expertise. Furthermore, government events support civic participation and communication between officials and constituents. Budget constraints drive efficiency requirements in public sector event delivery.

Educational Institutions host graduation ceremonies, alumni gatherings, academic conferences, and student recruitment events supporting institutional objectives and community building. Universities and schools rely on professional services for large-scale ceremonies and specialized academic gatherings. Moreover, educational events strengthen institutional identity and donor relationships. Campus facilities and academic calendars influence event planning timelines and logistics.

Individuals seek event planning services for personal milestones including weddings, milestone birthdays, anniversaries, and family celebrations requiring customized experiences. Personal events carry high emotional significance, driving demand for meticulous attention to detail and creative execution. Additionally, social media influence encourages elaborate designs generating shareable moments. Professional planners alleviate stress while ensuring memorable celebrations.

Others encompass associations, trade groups, religious organizations, and special interest communities organizing member gatherings, conventions, and specialized events. These diverse end-users require flexible service offerings matching specific organizational cultures and objectives. Furthermore, niche requirements drive specialized expertise development in event planning sector. Membership engagement and value demonstration influence event investment decisions.

By Event Size

Medium Events dominate with 45.9% due to optimal balance between impact, cost efficiency, and management complexity.

In 2025, Medium Events held a dominant market position in the By Event Size segment of the US Event Management Market, with a 45.9% share. Medium-scale gatherings typically accommodate several hundred attendees, providing meaningful interaction opportunities without overwhelming logistical complexity. Moreover, this size category offers favorable cost-per-attendee ratios while maintaining personalized experiences. Organizations find medium events manageable for budgets while achieving significant impact and engagement.

Small Events include intimate gatherings, workshops, executive meetings, and specialized seminars requiring personalized attention and focused content delivery. These events facilitate deep engagement and meaningful conversations among limited participants. Additionally, small events offer flexibility in venue selection and simplified logistics coordination. Niche audiences and specialized topics drive demand for intimate event formats nationwide.

Large Events encompass major conferences, festivals, conventions, and exhibitions attracting thousands of attendees and requiring extensive infrastructure coordination. These gatherings generate substantial economic impact and media attention for host cities and organizations. Furthermore, large events demand sophisticated crowd management, security protocols, and technical production capabilities. Industry-leading expertise and significant capital investment support successful large-scale event execution.

Key Market Segments

By Event Type

- MICE

- Weddings

- Social Events

- Sports Events

- Music & Entertainment Events

- Art & Cultural Events

- Political & Government Events

- Festivals & Fairs

By Service

- Event Planning & Coordination

- Event Production & Technical Services

- Event Marketing & Promotion

- Venue Sourcing & Logistics Management

- Registration, Ticketing & Attendee Management

- Others

By Delivery Mode

- In-Person

- Virtual

- Hybrid

By End-User

- Corporations

- Non-Profit Organizations

- Government Agencies

- Educational Institutions

- Individuals

- Others

By Event Size

- Medium Events

- Small Events

- Large Events

Drivers

Corporate Brand-Activation Budgets Shifting From Digital-Only to Hybrid Physical Engagement Models Drives Market Growth

Organizations increasingly recognize limitations of purely digital marketing campaigns in creating memorable brand impressions. Consequently, corporate budgets now prioritize experiential marketing combining physical activations with digital amplification strategies. This shift drives demand for professional event management services capable of delivering integrated engagement experiences. Moreover, hybrid approaches maximize reach while maintaining tangible interaction benefits.

Rising demand for experiential marketing at product launches, trade shows, and roadshows accelerates event service requirements. Companies utilize immersive experiences to differentiate products and create emotional connections with target audiences. Additionally, hands-on demonstrations and interactive installations generate stronger purchase intent than traditional advertising methods. Therefore, brands invest substantially in professionally managed activation events nationwide.

Growing corporate compliance requirements drive professional event planning adoption across regulated industries. Organizations face increasing legal and safety obligations when hosting employee gatherings and client events. Furthermore, documentation standards and risk management protocols necessitate experienced planning expertise. Professional services ensure adherence to regulatory frameworks while delivering successful events.

Expansion of convention centers and city-level tourism promotion programs creates favorable infrastructure supporting event industry growth. Municipal investments in modern facilities attract conferences and trade shows generating economic benefits. Consequently, enhanced venue availability encourages organizations to host larger and more frequent events. Tourism boards actively market destinations to event planners, strengthening the overall market ecosystem.

Restraints

Volatility in Venue Rental, Catering, and Logistics Costs Across Major US Metro Cities Restrains Market Growth

Fluctuating costs for essential event components create budgeting challenges for organizers and clients across major metropolitan areas. Venue rental prices vary significantly based on demand cycles, seasonality, and local market conditions. Moreover, catering expenses experience unpredictable increases due to food commodity prices and labor costs. These financial uncertainties complicate pricing strategies and profitability management for event service providers.

Transportation and logistics expenses demonstrate similar volatility, particularly during peak demand periods and fuel price fluctuations. Additionally, accommodation costs in popular event destinations surge during high-season periods. Consequently, clients experience sticker shock when receiving event proposals, potentially delaying or canceling planned gatherings. Cost unpredictability undermines confidence in event investment returns and long-term planning.

Skilled event workforce shortages during peak seasonal demand cycles constrain service delivery capacity and quality standards. Experienced coordinators, technical crew, catering staff, and security personnel become scarce during concentrated event seasons. Furthermore, competition for qualified professionals drives wage inflation and turnover challenges. Therefore, service providers struggle to maintain consistent staffing levels needed for simultaneous event execution.

Training requirements and industry certification processes limit rapid workforce expansion during demand spikes. Moreover, seasonal employment patterns discourage individuals from pursuing event management careers, perpetuating talent shortages. Companies invest heavily in employee retention programs and cross-training initiatives. However, fundamental workforce limitations continue restraining market growth potential across the United States.

Growth Factors

Rapid Expansion of Corporate Hybrid Conferences and Multi-Location Simulcast Events Creates Growth Opportunities

Organizations increasingly adopt hybrid event formats accommodating both in-person and remote participants simultaneously. This approach maximizes attendance while respecting diverse preferences and geographic constraints. Moreover, multi-location simulcasts enable companies to engage regional offices and global teams through coordinated programming. Professional event services develop specialized capabilities in hybrid technology integration and audience engagement across formats.

Increasing demand for turnkey event technology platforms covering registration, virtual networking, and attendee analytics drives service innovation. Companies seek comprehensive solutions eliminating the need for multiple vendor coordination and technical integration challenges. Additionally, user-friendly interfaces and mobile applications enhance participant experiences while streamlining organizer workflows. Therefore, technology-enabled service packages create competitive differentiation and revenue expansion opportunities.

Rising startup ecosystem activity generates recurring requirements for pitch events, demo days, and networking sessions supporting entrepreneurship. Accelerators, incubators, and venture capital firms regularly host gatherings connecting founders with investors and mentors. Furthermore, startup communities value professionally managed events that reflect innovation culture and brand positioning. Consequently, specialized event services targeting startup clientele represent significant growth opportunities.

Growth of destination weddings and premium social celebrations expands market opportunities beyond traditional metropolitan concentrations. Affluent clients increasingly choose scenic locations for multi-day wedding experiences combining ceremony, entertainment, and tourism elements. Moreover, destination events require comprehensive coordination of travel, accommodation, and local vendor relationships. Professional planners specializing in destination management capture high-value contracts with substantial profit margins.

Emerging Trends

AI-Powered Guest Registration, Badge Printing, and Attendance Analytics Tools Transform Event Operations

Artificial intelligence applications revolutionize event management through automated registration processes and predictive attendance modeling. Smart systems analyze historical data to forecast participant behavior and optimize resource allocation. Moreover, AI-driven badge printing reduces check-in wait times while collecting valuable attendee flow data. Consequently, event organizers achieve operational efficiency gains and enhanced participant satisfaction simultaneously.

Contactless check-in systems and digital badging technologies minimize physical touchpoints while accelerating venue entry processes. Mobile applications enable participants to register, receive credentials, and access event information through smartphones. Additionally, contactless solutions reduce environmental waste associated with traditional printed materials. Therefore, sustainability-conscious organizations increasingly mandate digital credential systems for all corporate events.

Sustainability-focused zero-waste and carbon-neutral event programs gain prominence as organizations address environmental responsibility expectations. Clients demand transparent reporting on event environmental impact and mitigation strategies. Furthermore, venue selection increasingly prioritizes LEED-certified facilities and renewable energy usage. Consequently, event planners develop expertise in sustainable sourcing, waste reduction, and carbon offset programs.

Rise of micro-influencer led brand experience events creates authentic engagement opportunities targeting niche audience segments. Companies collaborate with content creators possessing dedicated followings to design intimate brand activations. Moreover, influencer partnerships generate organic social media amplification extending event reach beyond physical attendees. Therefore, experiential marketing strategies increasingly integrate influencer collaborations into event design and execution frameworks.

Key US Event Management Company Insights

MKG Productions, LLC. operates as a leading experiential marketing and event production agency delivering brand activations and immersive experiences for major corporate clients. The company specializes in creating memorable brand interactions through innovative design, technical production, and strategic audience engagement. Moreover, MKG Productions maintains a strong reputation for executing high-profile product launches and entertainment industry events. Their creative approach combines storytelling with technical expertise, positioning them competitively in premium market segments.

Maritz Holdings Inc. provides comprehensive event management, travel services, and employee motivation programs serving Fortune 500 companies and global enterprises. The organization delivers integrated solutions encompassing meetings, incentive programs, and strategic events designed to achieve specific business objectives. Additionally, Maritz leverages extensive industry experience and proprietary technology platforms to optimize event outcomes and participant engagement. Their full-service capabilities and global reach enable them to manage complex multi-location events efficiently.

EA Collective, LLC focuses on corporate event strategy, design, and production services emphasizing innovation and creative excellence. The company partners with brands seeking differentiated event experiences that generate lasting impressions and measurable business impact. Furthermore, EA Collective’s collaborative approach involves deep client partnership throughout planning and execution phases. Their portfolio spans conferences, trade shows, and brand experiences across diverse industry verticals.

BCD Travel Services B.V. delivers corporate travel management and meetings services supporting business event logistics and attendee coordination globally. The company provides technology-enabled solutions streamlining travel booking, expense management, and event registration processes for corporate clients. Moreover, BCD Travel’s extensive supplier network and negotiating power secure favorable rates for accommodation and transportation services. Their integrated platform approach simplifies complex event logistics while providing visibility and cost control capabilities.

Key Players

- MKG Productions, LLC.

- Maritz Holdings Inc.

- EA Collective, LLC

- BCD Travel Services B.V.

- EGG Events

- George P. Johnson Company

- Event Solutions

- Eventive LLC

- TeamOut

- AMP Event Group

Recent Developments

- January 2026 – Cvent’s $700 million December buying spree signals event tech’s consolidation era. This significant acquisition demonstrates increasing industry consolidation as technology platforms expand capabilities through strategic purchases. Moreover, the investment reflects growing recognition of event technology’s critical role in modern event management.

- December 2025 – Encore Announces Acquisition of FIRST, a Leading Global Brand Experience Agency. This strategic acquisition expands Encore’s service portfolio into brand experience design and activation capabilities. Additionally, the combination strengthens their competitive position in corporate experiential marketing segments.

- July 2024 – Grip acquires event management product to help commercial organizers generate more revenue. The acquisition enhances Grip’s platform capabilities in revenue optimization and attendee engagement features. Furthermore, this development reflects ongoing technology integration trends transforming event planning operations.

Report Scope

Report Features Description Market Value (2025) USD 343.1 Billion Forecast Revenue (2035) USD 727.1 Billion CAGR (2026-2035) 7.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Event Type (MICE, Weddings, Social Events, Sports Events, Music & Entertainment Events, Art & Cultural Events, Political & Government Events, Festivals & Fairs), By Service (Event Planning & Coordination, Event Production & Technical Services, Event Marketing & Promotion, Venue Sourcing & Logistics Management, Registration, Ticketing & Attendee Management, Others), By Delivery Mode (In-Person, Virtual, Hybrid), By End-User (Corporations, Non-Profit Organizations, Government Agencies, Educational Institutions, Individuals, Others), By Event Size (Medium Events, Small Events, Large Events) Competitive Landscape MKG Productions, LLC., Maritz Holdings Inc., EA Collective, LLC, BCD Travel Services B.V., EGG Events, George P. Johnson Company, Event Solutions, Eventive LLC, TeamOut, AMP Event Group Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- MKG Productions, LLC.

- Maritz Holdings Inc.

- EA Collective, LLC

- BCD Travel Services B.V.

- EGG Events

- George P. Johnson Company

- Event Solutions

- Eventive LLC

- TeamOut

- AMP Event Group