US Creatine Supplements Market Size, Share, Growth Analysis By Form (Powder, Liquid, Capsules/Tablets, Others), By End User (Athletes & Sports, Fitness Enthusiasts, Medical/Older Adults, Others), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drug Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174841

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

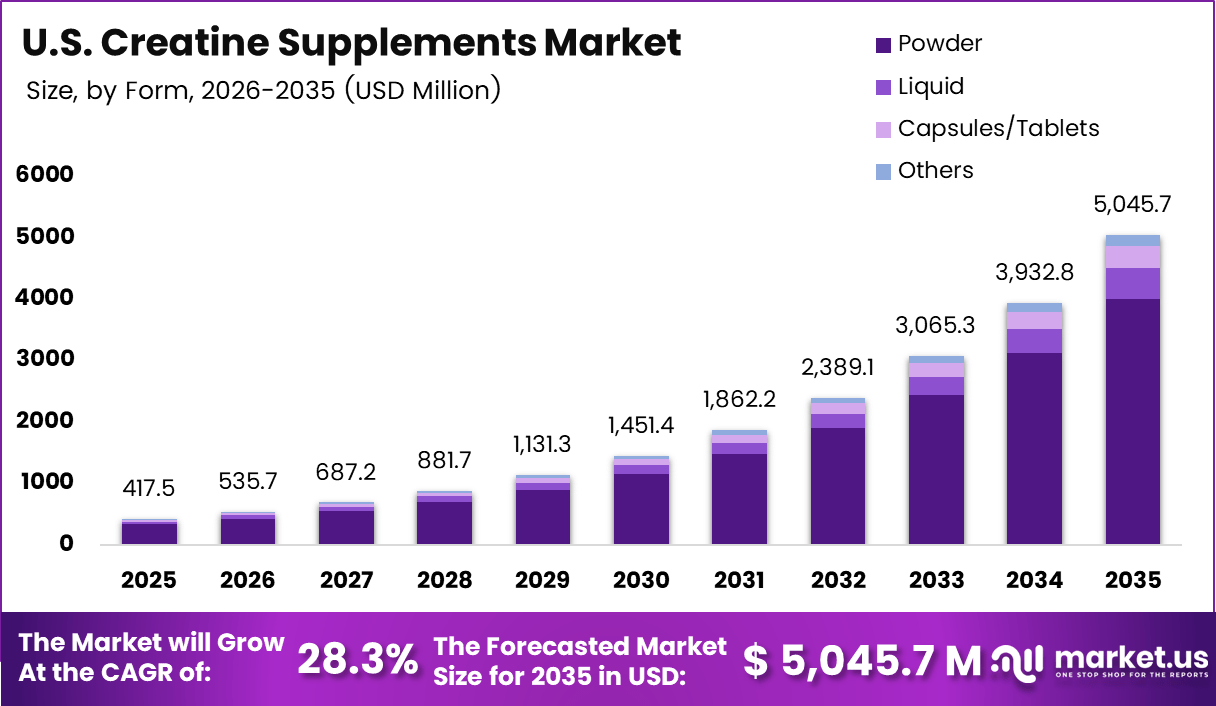

The U.S. Creatine Supplements Market size is expected to be worth around USD 5,045.7 Million by 2035, from USD 417.5 Million in 2025, growing at a CAGR of 28.3% during the forecast period from 2026 to 2035.

The U.S. Creatine Supplements Market represents a mature yet expanding segment within sports nutrition, focused on improving strength, endurance, and muscle recovery. Creatine functions as a naturally occurring compound supporting energy production during intense activity. Consequently, widespread acceptance among fitness enthusiasts and mainstream consumers continues strengthening market fundamentals across the United States.

Growth remains supported by rising participation in recreational fitness, resistance training, and high intensity workouts. Moreover, consumers increasingly seek evidence based supplements with measurable performance benefits. As fitness culture integrates into everyday lifestyles, creatine supplementation gains traction beyond professional athletes, thereby expanding its total addressable consumer base.

Transitioning toward opportunity assessment, innovation around purity, absorption efficiency, and clean label positioning attracts health conscious buyers. Additionally, growing interest from older adults focused on muscle preservation supports sustained demand. Functional nutrition trends further accelerate usage, as creatine aligns well with goals around strength, mobility, and long term physical performance maintenance.

From a regulatory and policy perspective, the U.S. government oversees creatine supplements under dietary supplement frameworks rather than pharmaceutical pathways. Agencies emphasize manufacturing quality, labeling accuracy, and safety substantiation. While direct government investment remains limited, ongoing public funding for sports science and physical health research indirectly supports scientific validation and consumer confidence.

Scientifically, creatine’s mechanism strengthens its market credibility. According to the National Institutes of Health, creatine helps deliver about 95% of available creatine to skeletal muscles during physical activity, enhancing short burst energy performance. This physiological efficiency reinforces creatine’s role as a foundational supplement within strength focused nutritional regimens.

Safety perception further underpins adoption. According to Clinic findings, creatine is possibly safe when taken long term, with doses up to 10 grams daily used safely for up to 5 years. Consequently, long duration usability appeals to consumers prioritizing sustained fitness routines and risk conscious supplementation strategies.

Overall, the U.S. Creatine Supplements Market reflects a balance of scientific credibility, regulatory clarity, and evolving consumer wellness priorities. As demand shifts toward transparent formulations and performance nutrition, creatine maintains relevance across informational and transactional purchase journeys. Keywords such as muscle energy, strength supplements, and performance nutrition increasingly shape market visibility and engagement.

Key Takeaways

- The U.S. Creatine Supplements Market is projected to grow from USD 417.5 Million in 2025 to around USD 5,045.7 Million by 2035, reflecting strong long-term expansion.

- The market is expected to register a robust CAGR of 28.3% during the forecast period from 2026 to 2035, indicating rapid demand acceleration.

- Powder remains the leading segment by form, accounting for 79.3% share, highlighting its dominance in the U.S. Creatine Supplements Market.

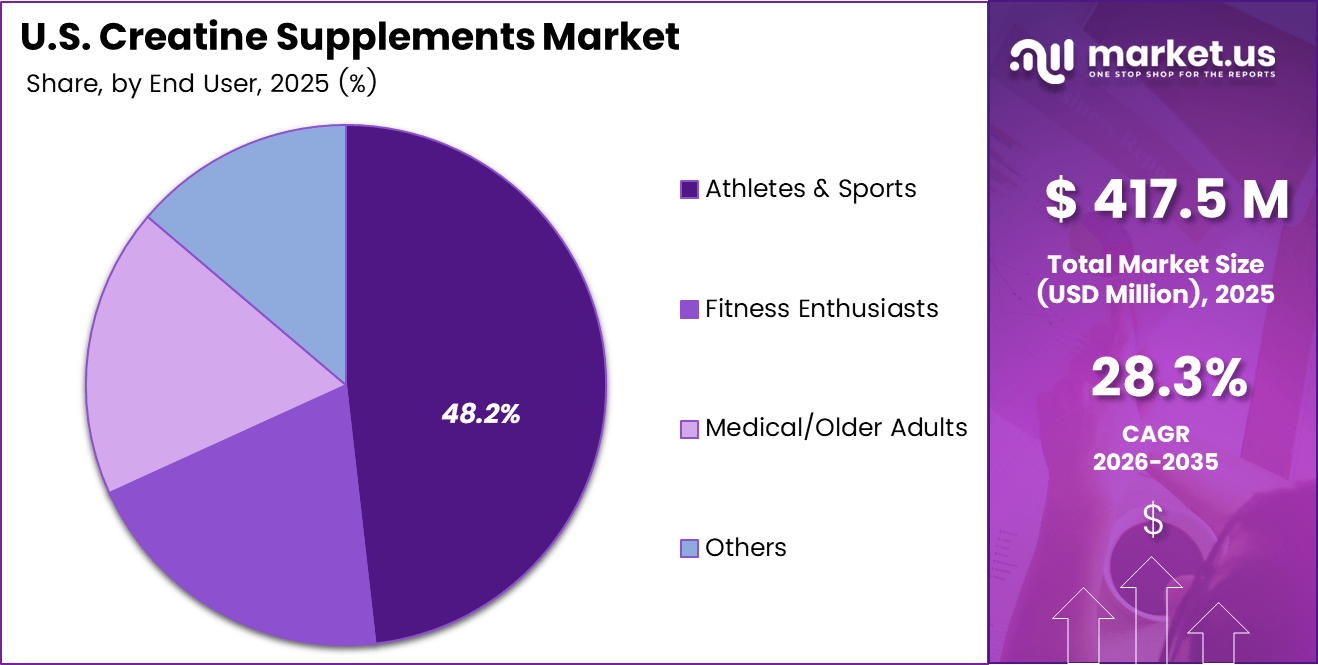

- Athletes & Sports represent the dominant end-user segment with a market share of 48.2%, underscoring performance-driven consumption patterns.

- Hypermarkets & Supermarkets lead the distribution landscape with 42.4% share, emphasizing the importance of large-scale retail access.

- North America, led by the US, continues to represent the primary regional market, driven by widespread fitness adoption and supplement penetration.

By Form Analysis

Powder dominates with 79.3% due to its versatility, ease of dosage customization, and strong acceptance among performance-focused consumers.

In 2025, Powder held a dominant market position in the By Form Analysis segment of the U.S. Creatine Supplements Market, with a 79.3% share. Powdered creatine remains widely preferred due to faster absorption perception and flexible mixing options. Moreover, consumers value its compatibility with shakes and pre-workout routines, supporting sustained demand.

Liquid creatine continues to maintain relevance, driven by convenience and ready-to-consume formats. This form appeals to users seeking portability and faster intake without preparation. Additionally, liquid variants align with on-the-go lifestyles, especially among working professionals integrating supplements into daily wellness habits.

Capsules/Tablets gain traction among consumers prioritizing precise dosing and ease of consumption. This segment benefits from growing demand among first-time users and those sensitive to taste. Furthermore, capsules/tablets support adherence by offering consistent intake without the need for mixing.

Others include innovative formats such as chewable and blends, catering to niche preferences. These products address evolving consumer interest in variety and differentiated delivery methods. Consequently, this segment supports experimentation and incremental innovation within the creatine landscape.

By End User Analysis

Athletes & Sports dominates with 48.2% supported by performance optimization goals and structured supplementation practices.

In 2025, Athletes & Sports held a dominant market position in the By End User Analysis segment of the U.S. Creatine Supplements Market, with a 48.2% share. This group relies heavily on creatine for strength, recovery, and training intensity. Consequently, consistent professional endorsement reinforces adoption.

Fitness Enthusiasts represent a steadily expanding segment, driven by rising gym participation and lifestyle-oriented wellness trends. These consumers increasingly integrate creatine into regular workout routines. Moreover, social media fitness culture continues to normalize supplement usage beyond competitive sports.

Medical/Older Adults adopt creatine for muscle maintenance and functional health support. This segment benefits from growing awareness of age-related muscle loss. Additionally, healthcare-driven guidance encourages cautious yet steady uptake among aging populations.

Others include recreational users and wellness-focused individuals experimenting with performance supplements. This segment reflects broader consumer curiosity and diversification of usage occasions. As a result, it contributes incremental demand across non-traditional user groups.

By Distribution Channel Analysis

Hypermarkets & Supermarkets dominates with 42.4% owing to strong retail visibility and immediate product accessibility.

In 2025, Hypermarkets & Supermarkets held a dominant market position in the By Distribution Channel Analysis segment of the U.S. Creatine Supplements Market, with a 42.4% share. These outlets benefit from high foot traffic and consumer trust. Additionally, in-store comparisons support informed purchasing decisions.

Pharmacy & Drug Stores maintain significance due to credibility and professional oversight. This channel appeals particularly to cautious consumers and older adults. Furthermore, pharmacist recommendations enhance confidence in product safety and proper usage.

Online distribution continues expanding, supported by convenience and broad product selection. Digital platforms enable access to reviews, subscriptions, and home delivery. Consequently, this channel aligns strongly with younger, tech-savvy consumers.

Others include specialty nutrition stores and direct sales formats. These channels cater to informed buyers seeking expert advice and niche formulations. As a result, they complement mainstream distribution by addressing targeted consumer needs.

Key Market Segments

By Form

- Powder

- Liquid

- Capsules/Tablets

- Others

By End User

- Athletes & Sports

- Fitness Enthusiasts

- Medical/Older Adults

- Others

By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy & Drug Stores

- Online

- Others

Drivers

Expansion of Recreational Fitness Participation Drives Market Growth

The U.S. creatine supplements market continues to grow as fitness participation expands beyond competitive bodybuilding. More consumers now engage in gym workouts, home fitness programs, and recreational sports. This broad user base increasingly adopts creatine to support strength, stamina, and everyday fitness goals, not just elite performance.

Rising clinical and sports science validation further supports market growth. Research-backed evidence around creatine’s role in muscle strength, recovery, and energy output has improved consumer trust. As an analyst, this scientific support reduces hesitation and encourages repeat usage across both athletic and non-athletic groups.

Another strong driver is demand from aging consumers focused on muscle recovery and strength retention. Older adults increasingly seek supplements that help maintain mobility and muscle mass. Creatine fits well into this need, supporting healthy aging and functional fitness.

Broad retail penetration also plays a major role. Mass merchandisers and direct-to-consumer platforms make creatine easy to access nationwide. Strong shelf presence and online availability simplify purchase decisions and expand reach across diverse demographics.

Restraints

Consumer Concerns Around Long-Term Health Limit Market Expansion

Despite strong demand, the U.S. creatine supplements market faces restraints linked to consumer health concerns. Some users remain cautious about long-term kidney health and hydration safety. As an analyst, these concerns slow adoption among first-time users and older populations.

Misinformation and mixed public perception continue to influence buying behavior. Although scientific research supports safe usage, lingering doubts remain among consumers unfamiliar with proper dosing. This limits penetration in mainstream wellness segments.

Regulatory scrutiny also presents challenges for manufacturers. Sports nutrition brands must meet strict labeling and ingredient compliance standards. Any misstep increases the risk of recalls or reputational damage.

Additionally, evolving regulations increase operational complexity. Brands must invest in testing, documentation, and compliance processes. These pressures can raise costs and slow product launches, especially for smaller companies trying to scale within the U.S. Market.

Growth Factors

Product Innovation Creates New Growth Opportunities

The U.S. creatine supplements market shows strong growth opportunities through targeted product innovation. Brands increasingly develop formulations for women, seniors, and endurance athletes. This personalization expands creatine usage beyond traditional strength training audiences.

Integration of creatine into functional foods and ready-to-drink beverages also opens new avenues. Convenient formats fit busy lifestyles and attract consumers who avoid powders or capsules. This shift supports everyday consumption rather than workout-only use.

Clean label, vegan, and micronized creatine formulations gain traction as consumers seek transparency and digestibility. As an analyst, this aligns with broader health-conscious trends across the U.S. nutrition market.

Strategic partnerships further strengthen opportunities. Collaborations with gyms, collegiate sports programs, and trainers improve credibility and direct engagement. These relationships enhance brand visibility and encourage long-term customer loyalty.

Emerging Trends

Digital Influence and Convenience Shape Market Trends

The U.S. creatine supplements market is shaped by a surge in single-serve sachets and on-the-go formats. Consumers value portability and easy dosing, especially during travel or busy schedules. This trend supports impulse purchases and trial usage.

Third-party certification and banned substance testing are also gaining importance. Brands highlight quality assurance to build trust among athletes and health-conscious users. This trend improves transparency and strengthens brand reputation.

Digital-first brand building continues to influence the market. Fitness influencers and athletes play a key role in product education and awareness. Their endorsements make creatine more relatable to everyday users.

Finally, stackable creatine blends are trending. Products combined with electrolytes and amino acids appeal to consumers seeking complete performance solutions. This reflects growing interest in multifunctional supplements within the U.S. fitness community.

Key U.S. Creatine Supplements Company Insights

The U.S. creatine supplements market reflects a balance of science-backed credibility, brand trust, and evolving consumer expectations, with leading players shaping competitive dynamics through quality focus and strategic positioning.

NutraBio continues to stand out for its transparency-driven approach and strict quality controls. The company emphasizes fully disclosed labels and in-house manufacturing, which resonates strongly with informed consumers seeking purity and consistency. This positioning supports sustained loyalty among performance-focused and health-conscious buyers.

Allmax Nutrition maintains a strong presence through clinically aligned formulations and broad product availability. Its creatine offerings benefit from alignment with strength and endurance training communities. As an analyst, Allmax’s focus on research validation and athlete-oriented branding strengthens credibility in a crowded supplement landscape.

Nutrex Research, Inc. leverages aggressive branding and performance-centric messaging to capture younger and hardcore fitness users. The company emphasizes results-driven supplementation, appealing to consumers prioritizing muscle strength and workout intensity. This approach supports brand differentiation within competitive retail channels.

Glanbia PLC plays a strategic role through scale, supply chain strength, and established sports nutrition expertise. Its deep understanding of ingredient sourcing and formulation science enhances trust among mainstream consumers. Glanbia’s diversified nutrition portfolio also enables cross-category innovation and wider market reach.

Overall, these players influence the U.S. creatine supplements market by reinforcing scientific credibility, expanding accessibility, and aligning products with evolving fitness and wellness trends.

Top Key Players in the Market

- NutraBio

- Allmax Nutrition

- Nutrex Research, Inc.

- Glanbia PLC

- Weider Global Nutrition

- MuscleTech

- GNC Holdings

- Ajinomoto Co Inc

Recent Developments

- January 2026: In January 2026, GNC launched a next-generation creatine supplement line featuring three science-driven formulations developed for everyday users and elite athletes. The products emphasize rigorous ingredient testing and third-party banned substance verification, reinforcing GNC’s elite quality and safety standards.

- November 2024: In November 2024, Paine Schwartz Partners announced that Paine Schwartz Food Chain Fund VI acquired Promix LLC, a fast-growing brand focused on high-quality protein mixes, nutritional supplements, vitamins, and low-sugar, high-protein bars. The transaction strengthened Paine Schwartz’s position in the sustainable nutrition segment, with financial terms undisclosed.

Report Scope

Report Features Description Market Value (2025) USD 417.5 Million Forecast Revenue (2035) USD 5,045.7 Million CAGR (2026-2035) 28.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid, Capsules/Tablets, Others), By End User (Athletes & Sports, Fitness Enthusiasts, Medical/Older Adults, Others), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drug Stores, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape NutraBio, Allmax Nutrition, Nutrex Research, Inc., Glanbia PLC, Weider Global Nutrition, MuscleTech, GNC Holdings, Ajinomoto Co Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  US Creatine Supplements MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

US Creatine Supplements MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- NutraBio

- Allmax Nutrition

- Nutrex Research, Inc.

- Glanbia PLC

- Weider Global Nutrition

- MuscleTech

- GNC Holdings

- Ajinomoto Co Inc