U.S. Camping And Caravanning Market Size, Share, Growth Analysis By Revenue Type (Vehicle Rental, Caravan Rentals, Recreational Vehicle (RV) Rentals, Campervan Rentals, Pitch/Campsite Rental), By Trip Length (Short stay (1 to 3 Nights), Medium stay (4 to 7 Nights), Long stay (8 Nights & Above)), By Age Group (Up to 30 Years, 30 to 54 Years, 55 Years & Above), By Booking Mode (Direct Booking, Online Travel Agencies (OTAs), Peer-to-Peer (P2P) Rental Platforms, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 172738

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

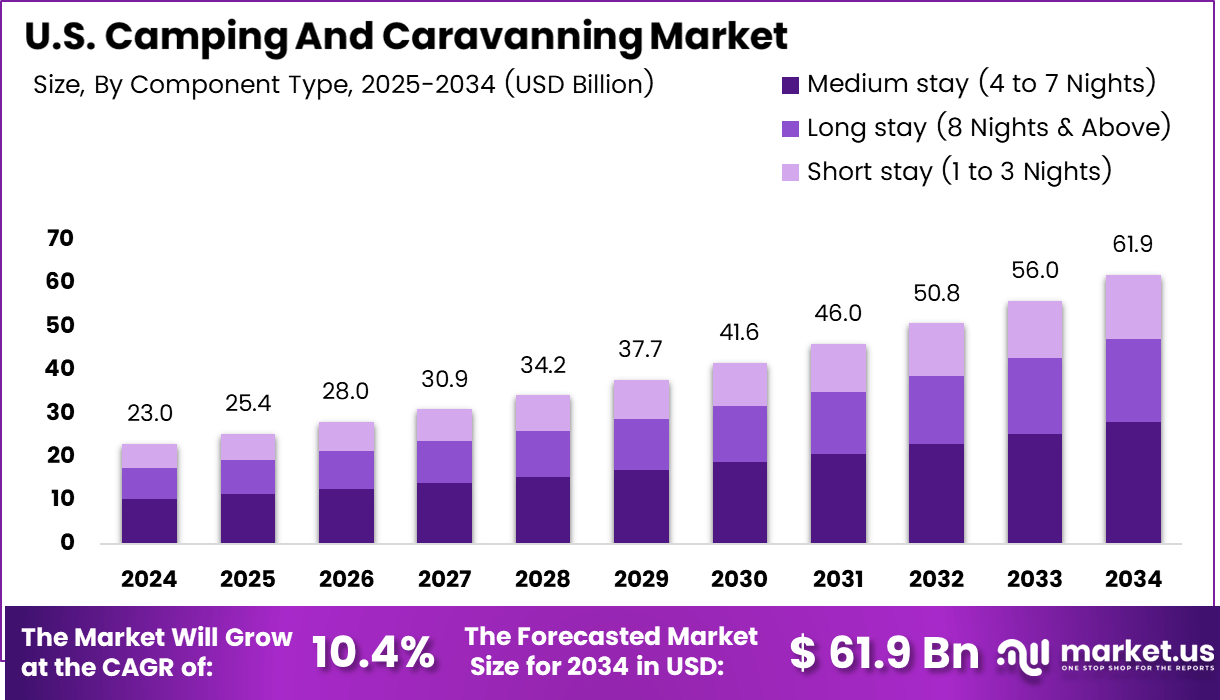

The Global U.S. Camping And Caravanning Market size is expected to be worth around USD 61.9 billion by 2034, from USD 23.0 Billion in 2024, growing at a CAGR of 10.4% during the forecast period from 2025 to 2034.

The U.S. Camping and Caravanning refers to organized and informal outdoor travel involving campsites, caravans, campervans, and recreational vehicles across public and private lands. It includes short leisure stays and extended road trips. Consequently, the market connects travel, outdoor recreation, mobility services, and campground infrastructure into one experiential tourism ecosystem.

From an analyst viewpoint, the U.S. Camping and Caravanning Market is expanding steadily due to changing consumer travel preferences. Travelers increasingly favor domestic, flexible, and experience driven vacations. As a result, camping aligns well with affordability, nature access, and customizable travel itineraries. This shift supports consistent demand across national parks, state parks, and private campgrounds.

Moreover, growth is supported by demographic diversification and evolving lifestyles. Younger professionals, families, and retirees increasingly participate in camping and caravanning. Additionally, remote work adoption allows longer trips and weekday stays. Therefore, demand spreads beyond peak seasons, improving utilization rates for campgrounds and caravan friendly destinations nationwide.

Government investment further strengthens market fundamentals. Federal and state agencies continue funding campground modernization, park accessibility, and conservation programs. Regulations increasingly focus on environmental protection, land use planning, and safety compliance. Consequently, operators adapt toward sustainable practices, improved amenities, and regulated capacity management while maintaining long term ecosystem preservation.

Opportunities remain strong across premium and technology enabled camping formats. Glamping, upgraded RV parks, and digitally managed campsites attract higher spending visitors. Furthermore, online booking systems and dynamic pricing enhance occupancy optimization. Therefore, the market benefits from higher revenue per stay while maintaining broad appeal for budget conscious travelers.

Globally, structured campsite models demonstrate scalable potential for organized camping environments. According to Minjerribah Camping, its operations span 6 beachfront campgrounds across Dunwich, Amity Point, and Point Lookout. This highlights how location driven planning and regulated site allocation can sustain high visitor volumes without compromising environmental balance.

Additionally, Minjerribah Camping reports 200 foreshore campsites at Flinders Beach and 300 campsites at the southern end of Main Beach. These figures illustrate how capacity segmentation supports diversified visitor needs. Similarly, U.S. campground planners increasingly balance density, access control, and infrastructure investment to support long term camping and caravanning growth.

Key Takeaways

- The U.S. Camping And Caravanning Market is projected to grow from USD 23.0 billion in 2024 to USD 61.9 billion by 2034, expanding at a CAGR of 10.4%.

- Vehicle Rental is the leading segment, accounting for a dominant 62.7% share of the U.S. Camping And Caravanning Market in 2024.

- Medium stay trips of 4 to 7 nights represent the largest trip length segment with a 45.2% market share in 2024.

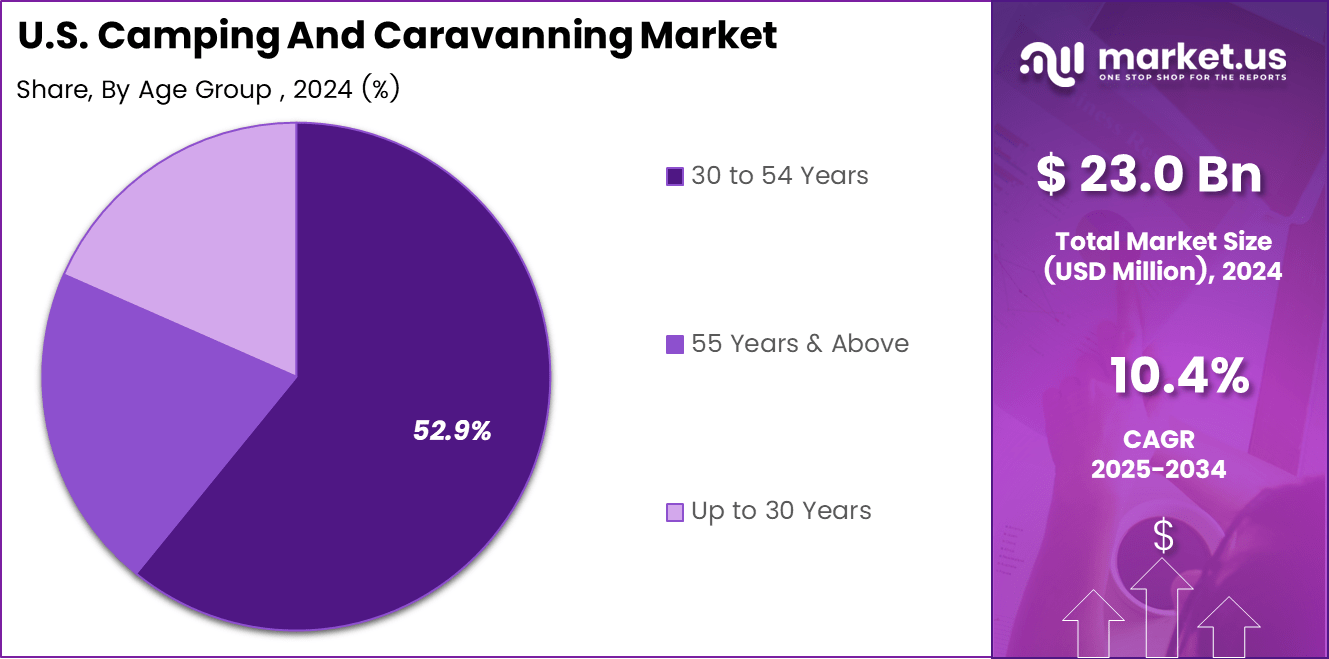

- The 30 to 54 years age group dominates participation, contributing 52.9% of total market demand in 2024.

- Direct Booking is the leading booking mode in the U.S. region, holding a 41.8% share of total bookings in 2024.

By Revenue Type Analysis

Vehicle Rental dominates with 62.7% due to its affordability, flexibility, and strong demand from first time campers.

Vehicle Rental held a dominant market position in the By Revenue Type Analysis segment of U.S. Camping And Caravanning Market, with a 62.7% share. This dominance reflects growing preference for temporary access over ownership, supported by rising fuel costs and urban lifestyles. Consequently, rentals reduce upfront commitments while enabling flexible travel planning.

Caravan Rentals served travelers seeking compact towing options for family oriented trips. These rentals supported comfort focused camping experiences while maintaining lower operating complexity. As a result, caravan rentals remained relevant among suburban households seeking controlled travel durations and predictable accommodation formats.

Recreational Vehicle (RV) Rentals addressed demand for self contained travel, combining transport and accommodation. Moreover, RV rentals benefited from improved campground infrastructure and full hookup availability. This sub segment continued attracting retirees and remote workers prioritizing comfort, privacy, and longer mobility based travel experiences.

Campervan Rentals supported adventure focused and solo travelers prioritizing mobility and minimalism. Additionally, campervans enabled access to smaller campsites and urban parking flexibility. This segment aligned with experiential travel trends, emphasizing spontaneity, scenic routes, and cost controlled overnight stays.

Pitch and Campsite Rental revenues reflected demand for designated outdoor spaces without vehicle dependency. These rentals supported tent based camping and budget conscious travelers. Gradually, campsite rentals benefited from state park expansions and improved amenities enhancing safety, hygiene, and reservation accessibility.

By Trip Length Analysis

Medium stay (4 to 7 Nights) dominates with 45.2% due to balanced vacation planning and work life schedules.

Medium stay (4 to 7 Nights) held a dominant market position in the By Trip Length Analysis segment of U.S. Camping And Caravanning Market, with a 45.2% share. This reflects preference for extended weekends and planned vacations. Consequently, travelers balanced relaxation, travel costs, and time off constraints efficiently.

Short stay (1 to 3 Nights) trips remained popular among urban residents seeking quick outdoor escapes. These stays supported spontaneous travel decisions and proximity based destinations. Moreover, short stays aligned with rising micro vacation trends and limited leave availability among working professionals.

Long stay (8 Nights and Above) trips catered to retirees, digital nomads, and seasonal travelers. These extended stays emphasized immersive experiences and cost optimization through longer campsite bookings. Gradually, long stays benefited from remote work flexibility and expanded RV friendly campground networks.

By Age Group Analysis

30 to 54 Years dominates with 52.9% driven by family travel, income stability, and lifestyle flexibility.

30 to 54 Years held a dominant market position in the By Age Group Analysis segment of U.S. Camping And Caravanning Market, with a 52.9% share. This group combined financial capacity with family oriented travel preferences. Consequently, camping served as a cost efficient alternative to traditional vacations.

Up to 30 Years travelers supported growth through adventure driven and experience focused camping. This group favored campervans, shared rentals, and short stays. Additionally, social media influence and sustainability awareness strengthened participation among younger outdoor enthusiasts.

55 Years and Above campers emphasized comfort, safety, and longer duration travel. This segment favored RV rentals and full service campsites. Gradually, retirement flexibility and health conscious outdoor activities sustained steady participation within this age group.

By Booking Mode Analysis

Direct Booking dominates with 41.8% due to pricing transparency and direct operator engagement.

Direct Booking held a dominant market position in the By Booking Mode Analysis segment of U.S. Camping And Caravanning Market, with a 41.8% share. Consumers preferred direct channels for clearer policies and customized support. Consequently, operators strengthened loyalty programs and direct digital platforms.

Online Travel Agencies (OTAs) supported comparison driven consumers seeking bundled travel options. These platforms enhanced visibility for smaller operators. Moreover, OTAs simplified itinerary planning, contributing to broader market accessibility and discovery of regional camping destinations.

Peer to Peer (P2P) Rental Platforms expanded access to privately owned vehicles and campsites. This model supported asset sharing and competitive pricing. Gradually, trust mechanisms and insurance frameworks strengthened adoption among cost sensitive and flexible travelers.

Other booking modes included walk ins, travel clubs, and corporate partnerships. These channels supported niche demand segments and group travel. Although smaller in scale, they contributed to overall market diversity and localized demand fulfillment.

Key Market Segments

By Revenue Type

- Vehicle Rental

- Caravan Rentals

- Recreational Vehicle (RV) Rentals

- Campervan Rentals

- Pitch/Campsite Rental

By Trip Length

- Short stay (1 to 3 Nights)

- Medium stay (4 to 7 Nights)

- Long stay (8 Nights & Above)

By Age Group

- Up to 30 Years

- 30 to 54 Years

- 55 Years & Above

By Booking Mode

- Direct Booking

- Online Travel Agencies (OTAs)

- Peer-to-Peer (P2P) Rental Platforms

- Others

Drivers

Rising Preference for Domestic Road Travel Drives U.S. Camping and Caravanning Market Growth

The U.S. camping and caravanning market is strongly driven by a rising preference for domestic road travel and outdoor leisure activities. Travelers across families, retirees, and young professionals increasingly choose local destinations that offer flexibility, safety, and cost control. Camping allows people to explore national parks, beaches, and rural areas without relying on flights or crowded urban centers, supporting steady participation growth.

Another key driver is the expanding availability of RVs and campervans through rental and sharing platforms. These services lower entry barriers for first time users by removing ownership commitments. As a result, occasional travelers can access modern vehicles, fueling higher trip frequency and broader market reach across income groups.

The growth of flexible work models also supports longer camping trips. Remote work and hybrid schedules allow travelers to combine work with extended stays at campgrounds. This shift increases weekday occupancy and length of stay, improving utilization rates for operators.

In addition, strong investment in public and private campground infrastructure across US states supports market expansion. Upgraded facilities, improved road access, and added utilities make camping more comfortable and accessible, reinforcing sustained demand growth nationwide.

Restraints

High Ownership and Operating Costs Restrain U.S. Camping and Caravanning Market Expansion

One major restraint in the U.S. camping and caravanning market is the high upfront cost associated with RV ownership and rentals. Purchasing an RV requires significant capital, while rental fees remain high during peak seasons. Campground fees, insurance, and maintenance further increase total travel expenses for consumers.

Seasonal demand volatility also limits consistent market performance. Camping activity remains highly dependent on weather conditions and regional travel seasons. Cold winters, hurricanes, and wildfire risks reduce travel during off peak months, creating uneven revenue cycles for operators.

Environmental regulations and land use restrictions present additional challenges. Many protected areas limit new campsite development to preserve ecosystems. Approval processes for new campgrounds can be lengthy and complex, slowing supply expansion even when demand rises.

Fuel price fluctuations further restrain market growth by increasing travel and operating costs. RVs consume more fuel than standard vehicles, making trips sensitive to energy price changes. Higher fuel expenses often reduce trip distances or discourage travel altogether, impacting overall participation levels.

Growth Factors

Rising Demand for Premium and Experiential Camping Creates New Growth Opportunities

The U.S. camping and caravanning market offers strong growth opportunities through rising demand for premium campsites. Travelers increasingly expect reliable internet access, clean facilities, and modern amenities. Campgrounds that invest in digital connectivity and comfort features attract longer stays and higher spending visitors.

Peer to peer RV rental platforms also create growth opportunities by expanding vehicle availability. These platforms allow private owners to rent unused RVs, increasing supply while improving affordability. This model supports flexible access and encourages trial usage among new customer segments.

Growing interest in eco friendly and sustainable camping presents another opportunity. Travelers increasingly seek low impact travel options that reduce environmental footprints. Solar powered RVs, waste reduction practices, and nature focused experiences align with changing consumer values and support premium pricing strategies.

Younger travelers also drive opportunity growth as they prioritize experiences over ownership. Adventure tourism, social sharing, and unique destinations make camping appealing to this group. Their participation supports long term market expansion and product innovation.

Emerging Trends

Digital Integration and Smart Technologies Shape Key Market Trends

Digital booking and mobile first campground management systems represent a major trend in the U.S. camping and caravanning market. Online reservations, dynamic pricing, and app based check ins improve convenience for travelers while helping operators optimize occupancy and revenue.

Glamping and luxury RV parks are also gaining popularity. Travelers increasingly seek unique stays that combine nature with comfort. Themed campsites, high end cabins, and resort style RV parks attract higher income visitors and expand the market beyond traditional campers.

Smart RV technologies are becoming more common across the fleet. Energy management systems, safety monitoring, and connected dashboards improve user experience and operational efficiency. These features appeal to tech aware travelers and reduce maintenance risks.

Overall, technology driven convenience, comfort focused offerings, and digital engagement continue to reshape camping and caravanning trends, supporting gradual modernization and sustained consumer interest across the US market.

Key U.S. Camping And Caravanning Company Insights

The U.S. Camping and Caravanning market in 2024 reflects a structurally evolving landscape shaped by rental flexibility, digital platforms, and changing travel preferences. Demand remains supported by domestic tourism, remote work lifestyles, and rising interest in experience driven outdoor travel. Within this environment, leading operators play distinct roles across vehicle rentals and peer to peer access models, strengthening market depth and consumer reach.

Cruise America continues to hold a strong position as a standardized RV rental provider with nationwide coverage. Its fleet scale, consistent vehicle configurations, and strong presence near major tourist corridors support repeat usage and first time RV travelers. The company benefits from predictable demand tied to national parks and seasonal road travel trends.

El Monte RV serves a more premium and international customer base, focusing on larger RV models and extended rental durations. Its operations benefit from high touch service offerings and locations near major travel hubs. This positioning supports higher per trip revenue and appeals to long haul domestic travelers seeking comfort.

RVshare plays a central role in expanding access through its peer to peer rental marketplace. By enabling private owners to monetize idle RV assets, the platform increases fleet availability without direct ownership. This model improves affordability and choice while supporting rapid geographic scalability across US regions.

Outdoorsy differentiates through experience focused branding and technology driven booking tools. The platform emphasizes ease of use, insurance integration, and trip personalization. Its approach aligns well with younger travelers and flexible travel lifestyles, reinforcing long term participation growth.

Overall, these players collectively shape the competitive structure by balancing fleet ownership, marketplace models, and service differentiation, supporting sustained market maturity in 2024.

Top Key Players in the Market

- Cruise America

- El Monte RV

- RVshare

- Outdoorsy

- RVezy

- Kampgrounds of America (KOA)

- Hipcamp

- Thousand Trails

- Sun Outdoors

- Jellystone Park

Recent Developments

- In December 2024, Modern America Campgrounds announced the acquisition of Lone Oak Campsites in East Canaan, Connecticut, strengthening its footprint in the Northeast RV park market.This transaction marked the company’s 27th park acquisition in the past 24 months, reinforcing its leadership position in the outdoor hospitality and campground ownership space.

- In October 2024, Hipcamp completed the acquisition of BookOutdoors, a digital booking platform serving RV parks, cabins, campgrounds, and glamping resorts.The acquisition expands Hipcamp’s reservation and property management capabilities, supporting broader campground supply integration, although financial terms were not disclosed.

Report Scope

Report Features Description Market Value (2024) USD 23.0 Billion Forecast Revenue (2034) USD 61.9 billion CAGR (2025-2034) 10.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Revenue Type (Vehicle Rental, Caravan Rentals, Recreational Vehicle (RV) Rentals, Campervan Rentals, Pitch/Campsite Rental), By Trip Length (Short stay (1 to 3 Nights), Medium stay (4 to 7 Nights), Long stay (8 Nights & Above)), By Age Group (Up to 30 Years, 30 to 54 Years, 55 Years & Above), By Booking Mode (Direct Booking, Online Travel Agencies (OTAs), Peer-to-Peer (P2P) Rental Platforms, Others) Competitive Landscape Cruise America, El Monte RV, RVshare, Outdoorsy, RVezy, Kampgrounds of America (KOA), Hipcamp, Thousand Trails, Sun Outdoors, Jellystone Park Customization Scope Customization for segments will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  U.S. Camping And Caravanning MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

U.S. Camping And Caravanning MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cruise America

- El Monte RV

- RVshare

- Outdoorsy

- RVezy

- Kampgrounds of America (KOA)

- Hipcamp

- Thousand Trails

- Sun Outdoors

- Jellystone Park