Global Ultra-High-Definition Panel 4K Market Size, Share, Growth Analysis By Technology (LCD, OLED, MicroLED, Others), By Resolution (4K UHD, 8K UHD), By Size (40–60 inches, Below 40 inches, Above 60 inches), By Application (Consumer Electronics, Commercial, Healthcare, Education, Automotive, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178626

- Number of Pages: 394

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

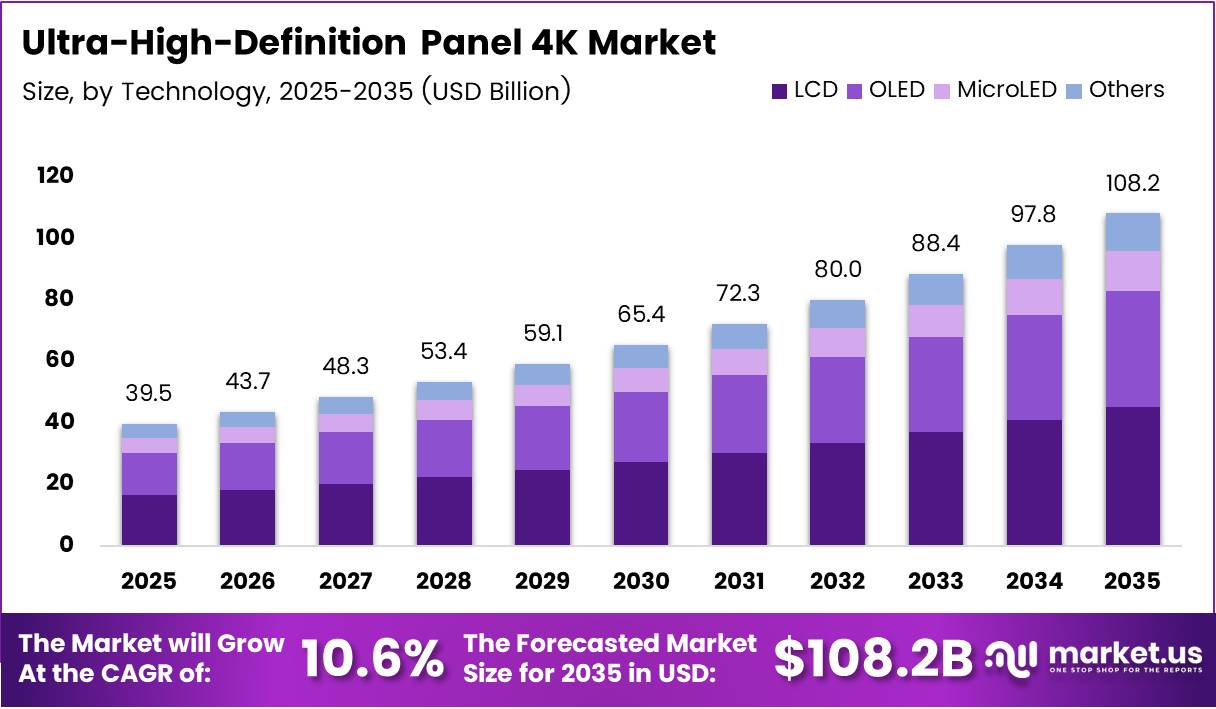

Global Ultra-High-Definition Panel 4K Market size is expected to be worth around USD 108.2 Billion by 2035 from USD 39.5 Billion in 2025, growing at a CAGR of 10.6% during the forecast period 2026 to 2035.

The ultra-high-definition panel 4K market covers display panels delivering 3840 x 2160 pixel resolution across consumer electronics, commercial signage, healthcare imaging, and automotive infotainment. These panels ship in LCD, OLED, and MicroLED form factors. The breadth of end-use cases means that this market touches nearly every vertical that depends on visual information delivery.

Content availability is the structural engine behind 4K panel adoption. OTT platforms, live sports broadcasters, and game publishers now release native 4K content as a baseline, not a premium. This content-hardware feedback loop compresses the replacement cycle for 1080p screens, placing steady volume pressure on display manufacturers to scale 4K output. In February 2026, Samsung Display unveiled its QD-OLED Penta-Tandem panel technology, delivering 1.3× higher luminous efficiency and double the operational lifespan versus prior four-layer designs.

Manufacturing cost deflation continues to redefine competitive thresholds. Large-scale LCD and OLED fabrication advancements have reduced per-unit costs, enabling panel makers to target mid-tier price bands that were previously out of reach for 4K technology. Consequently, mass-market smart TVs and commercial monitors now ship with 4K panels at price points that accelerate overall replacement volumes.

The commercial segment is adding strategic weight to overall demand. Digital signage deployments, corporate collaboration displays, and interactive flat panels in education are creating a B2B revenue layer that insulates manufacturers from pure consumer electronics cyclicality. This diversification reduces revenue concentration risk and opens longer procurement cycles with higher average selling prices.

Healthcare and automotive represent the two highest-growth application lanes outside consumer electronics. Surgical imaging, remote diagnostics, and in-vehicle infotainment systems require panels that combine 4K resolution with reliability and color accuracy — specifications that command premium pricing and create defensible supplier relationships.

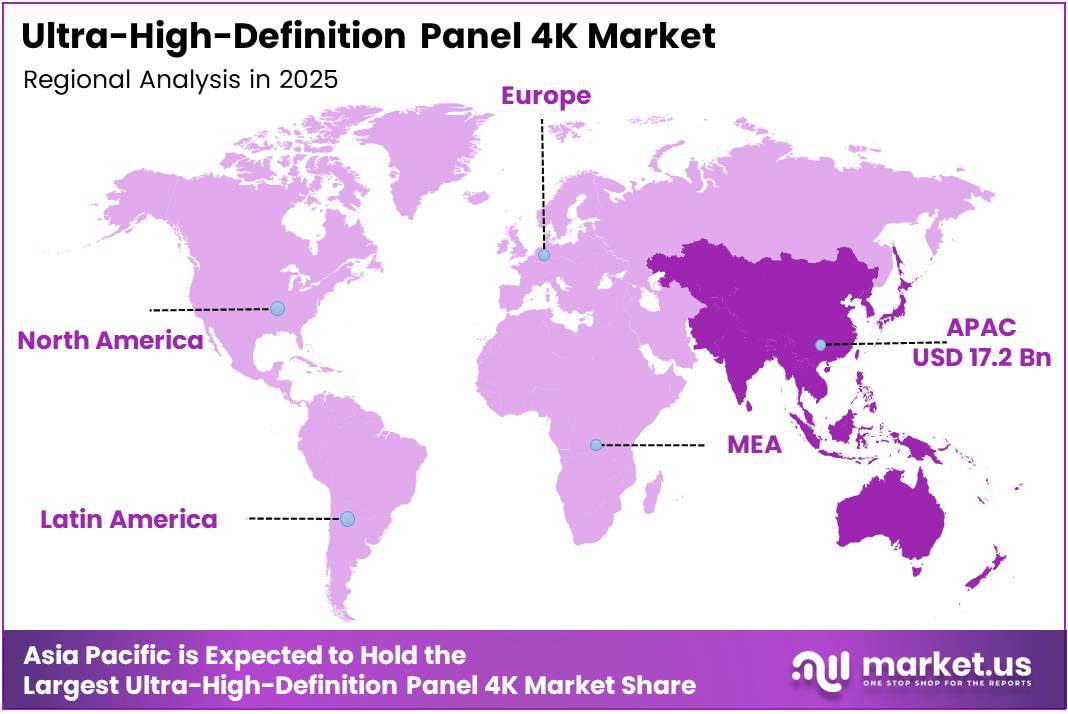

According to the market data, APAC holds a 43.60% share valued at USD 17.2 Billion in 2025. This concentration reflects the region’s dual role as the world’s largest panel manufacturing base and its fastest-expanding consumer electronics retail market — meaning APAC suppliers capture both production margin and end-market volume simultaneously.

LCD technology commands 62.6% of the market by technology type. This dominance signals that cost-sensitive buyer segments — mass-market televisions and commercial displays — still prioritize price per inch over contrast performance. However, OLED and MicroLED are steadily displacing LCD in premium and specialized applications, suggesting that the technology mix will shift materially over the forecast horizon.

Key Takeaways

- The global Ultra-High-Definition Panel 4K Market is valued at USD 39.5 Billion in 2025 and is forecast to reach USD 108.2 Billion by 2035 at a CAGR of 10.6%.

- By Technology, LCD dominates with a 62.6% market share, reflecting cost-driven buyer preference in mass-market segments.

- By Resolution, 4K UHD (3840 x 2160 pixels) holds an 82.9% share, confirming its position as the mainstream resolution standard.

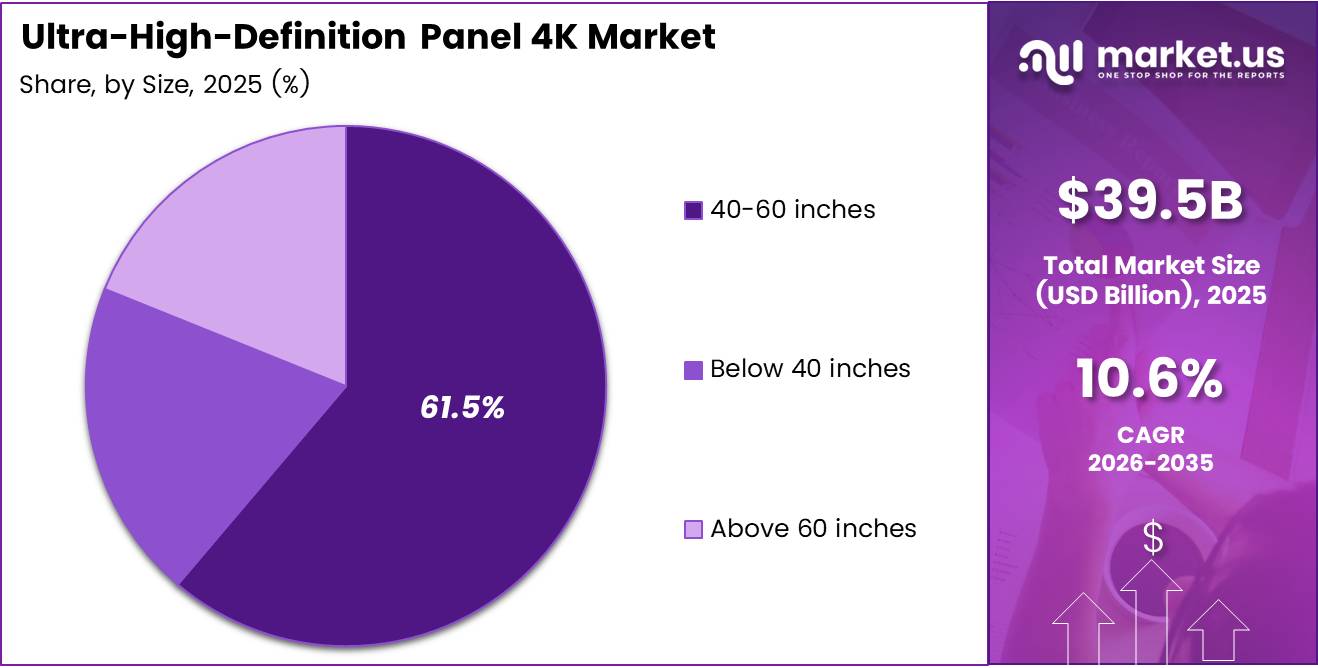

- By Size, the 40–60 inches segment leads with a 61.5% share, aligning with dominant smart TV and commercial display form factors.

- By Application, Consumer Electronics accounts for 62.3% of total market revenue, driven by smart TV and monitor replacement cycles.

- APAC dominates regional markets with a 43.60% share, valued at USD 17.2 Billion in 2025.

Technology Analysis

LCD dominates with 62.6% due to low cost and mature supply chain.

In 2025, LCD held a dominant market position in the By Technology segment of the Ultra-High-Definition Panel 4K Market, with a 62.6% share. LCD manufacturing infrastructure is decades-mature, giving producers unmatched cost efficiency at scale. This makes LCD the default choice for mass-market 4K televisions and commercial flat panels where price per square inch outweighs contrast ratio requirements.

OLED carries the highest margin within the 4K panel technology mix. Premium television brands and high-end monitor manufacturers position OLED as their flagship tier, capturing buyers who prioritize infinite contrast, sub-millisecond response, and ultra-thin form factor over unit price. Samsung’s five-layer Penta-Tandem QD-OLED structure now delivers peak brightness up to 4,500 nits for TV panels, narrowing the brightness gap that previously held OLED back in bright retail environments.

MicroLED differentiates through its self-emissive pixel architecture without organic material degradation. This technology targets large-format commercial installations and ultra-premium residential screens where longevity and serviceability justify elevated upfront cost. MicroLED’s modular tiling capability allows custom screen sizes — an advantage no other panel technology currently replicates at commercial scale.

Others in the technology segment cover emerging hybrid approaches such as mini-LED backlighting combined with advanced quantum dot color conversion. HKC’s announcement of the world’s first RGB Mini-LED 4K monitor featuring 4,788 addressable full-color backlight zones illustrates how this sub-category is pushing zone-control precision well beyond conventional mini-LED systems, creating a performance tier between standard LCD and full OLED.

Resolution Analysis

4K UHD dominates with 82.9% due to broad content availability and ecosystem maturity.

In 2025, 4K UHD (3840 x 2160 pixels) held a dominant market position in the By Resolution segment of the Ultra-High-Definition Panel 4K Market, with an 82.9% share. The near-universal availability of 4K content across streaming platforms, gaming consoles, and broadcast infrastructure makes 4K the path of least resistance for buyers upgrading from 1080p. This content-hardware alignment locks in volume at the 4K tier and limits consumer motivation to skip directly to 8K.

8K UHD (7680 x 4320 pixels) serves as the forward-facing resolution standard for early adopters and premium commercial installations. Native 8K content remains limited, which confines near-term demand to buyers who prioritize future-proofing or require extreme pixel density for professional applications such as medical imaging and large-venue digital art. As content pipelines mature, 8K will transition from a niche premium to a competitive battleground — but that window remains several years out.

Size Analysis

40–60 inches dominates with 61.5% due to mainstream TV and commercial display alignment.

In 2025, 40–60 inches held a dominant market position in the By Size segment of the Ultra-High-Definition Panel 4K Market, with a 61.5% share. This size band maps directly to the sweet spot for living room televisions and mid-size commercial displays, where viewing distance and room dimensions converge. Retailers and brands concentrate their highest-volume SKUs in this range, reinforcing its dominance through promotional pricing and broad model availability.

Below 40 inches serves monitor, automotive display, and healthcare imaging applications where compact form factor and pixel density matter more than screen area. The professional monitor category — including gaming displays and content creation screens — represents the highest-value pocket within this size tier, commanding premiums for high refresh rates and wide color gamut performance.

Above 60 inches addresses premium home theater, large-venue digital signage, and corporate boardroom applications. Sony’s July 2025 launch of the 98-inch BRAVIA 5 4K Mini LED TV confirms that consumer appetite for large-screen 4K is extending well beyond traditional size boundaries. This segment grows faster in revenue than in unit volume because average selling prices scale with panel area.

Application Analysis

Consumer Electronics dominates with 62.3% due to high-volume smart TV replacement cycles.

In 2025, Consumer Electronics held a dominant market position in the By Application segment of the Ultra-High-Definition Panel 4K Market, with a 62.3% share. Smart TV upgrades from 1080p remain the single largest demand driver by unit volume, supported by a global installed base of aging screens and accelerating content incentives. The combination of falling panel prices and richer streaming catalogs keeps replacement intent high across income brackets.

Commercial applications span digital signage, retail point-of-sale screens, and corporate meeting room displays. This segment generates lower unit volumes than consumer electronics but substantially higher revenue per panel, as commercial buyers specify brightness, durability, and warranty terms that push average selling prices upward. Procurement cycles are also more predictable, providing display manufacturers with visible order pipelines that consumer channels cannot match.

Healthcare applications prioritize color accuracy, brightness consistency, and regulatory compliance over refresh rate or contrast ratio. Surgical visualization, radiology workstations, and telemedicine endpoint screens each require panel specifications that differ materially from entertainment displays. This creates a defensible niche where qualified suppliers face limited price competition from consumer-grade panel makers.

Education deployments center on interactive flat panels replacing traditional projectors in classrooms and lecture halls. School districts and universities are upgrading to 4K interactive displays to support hybrid learning models, creating a multi-year installation pipeline. Panel suppliers that combine 4K resolution with embedded touch processing and collaboration software integrations hold a structural advantage in education procurement.

Automotive applications integrate 4K panels into infotainment clusters, rear-seat entertainment, and digital instrument panels. The move toward software-defined vehicles accelerates interior display investment, as automakers differentiate on cabin experience. Panel specifications in automotive demand thermal stability, vibration resistance, and wide operating temperature ranges — criteria that favor specialized display suppliers over mass-market panel makers.

Others within the application segment include industrial monitoring, broadcast production, and military visualization systems. These verticals consume low volumes but require panels with extended operational lifespans and compliance certifications, sustaining above-average margins for suppliers who invest in qualification programs.

Key Market Segments

By Technology

- LCD

- OLED

- MicroLED

- Others

By Resolution

- 4K UHD (3840 x 2160 pixels)

- 8K UHD (7680 x 4320 pixels)

By Size

- 40–60 inches

- Below 40 inches

- Above 60 inches

By Application

- Consumer Electronics

- Commercial

- Healthcare

- Education

- Automotive

- Others

Drivers

Expanding 4K Content Ecosystem and Falling Manufacturing Costs Accelerate Mass-Market Panel Adoption

OTT platforms, gaming publishers, and live sports broadcasters now deliver native 4K content as a standard offering. This content-hardware alignment removes the adoption barrier that historically slowed display upgrade cycles. Buyers no longer need to justify a 4K purchase on future content potential — the content already exists at scale, making the upgrade decision straightforward. According to the market data, 4K UHD resolution holds an 82.9% share, confirming that the market has already converged on this standard. This concentration signals that buyers and content producers have reached a stable consensus, which reduces uncertainty for both panel manufacturers scaling production and retailers managing inventory.

Large-scale LCD and OLED fabrication advancements have structurally reduced per-unit manufacturing costs. In September 2024, LG Display agreed to sell its large LCD plant in Guangzhou to TCL’s CSOT unit for approximately CNY 10.8 billion (~$1.5 billion), reflecting a broader strategic consolidation where Chinese manufacturers absorb legacy LCD capacity at scale. This transfer of high-volume LCD production to lower-cost operators will further compress LCD panel pricing, widening the addressable market for 4K displays in mid-tier consumer and commercial segments.

The integration of 4K panels into smart TVs and commercial digital signage infrastructure creates a self-reinforcing demand cycle. Retailers and venue operators deploy 4K signage to match the visual quality of consumer environments, which in turn raises baseline resolution expectations for all buyers. Commercial procurement cycles run on multi-year refresh schedules, providing panel manufacturers with forward revenue visibility that consumer channels alone cannot deliver. This structural diversification of the buyer base stabilizes revenue against short-term consumer spending fluctuations.

Restraints

Power Consumption, Thermal Challenges, and Supply Chain Volatility Constrain 4K Panel Scaling

High power consumption and thermal management challenges become acute as panel sizes scale above 60 inches and brightness targets exceed 1,000 nits. Larger panels require more powerful backlighting arrays and more complex heat dissipation systems, which increase bill-of-materials costs and reduce reliability in continuous-use commercial environments. This thermal constraint directly limits the addressable market for high-brightness large-format 4K panels in retail and outdoor signage applications where ambient temperatures are difficult to control.

Supply chain volatility in semiconductor and display driver IC components creates structural pricing instability for panel manufacturers. Display driver ICs are concentrated among a small number of specialized semiconductor suppliers, making the entire panel industry vulnerable to capacity constraints at any single chokepoint. When driver IC supply tightens, panel makers face a binary choice: accept higher component costs and compress margins, or reduce output and cede volume to competitors with secured supply agreements.

Together, these constraints disproportionately affect mid-size manufacturers who lack the procurement leverage to lock in long-term component supply agreements at competitive prices. Larger vertically integrated players can absorb thermal engineering costs and negotiate priority IC allocations — advantages that are difficult for smaller panel makers to replicate. This dynamic reinforces market concentration at the top and pressures mid-tier suppliers to find niche application focus rather than competing on volume.

Growth Factors

Automotive, Healthcare, and Hybrid Work Applications Open High-Value Revenue Channels Beyond Consumer Electronics

Automotive infotainment and Advanced Driver Assistance Systems represent a structural expansion of 4K panel demand into a vertical with distinct procurement dynamics. Automakers specify multi-year supply contracts, require panels certified to automotive temperature and vibration standards, and pay premium prices for reliability guarantees. According to the market data, Consumer Electronics holds 62.3% of application revenue — which means that automotive, healthcare, education, and commercial together account for the remaining 37.7%. As these non-consumer verticals scale, they reduce overall market dependence on consumer spending cycles and improve average selling price per unit.

Healthcare imaging and remote diagnostic applications require 4K panels with precisely calibrated color accuracy and sustained brightness uniformity — specifications that justify premium pricing structures unavailable in consumer channels. Telemedicine infrastructure investment accelerated post-pandemic and continues to expand as health systems invest in permanent remote-care capabilities. In June 2025, OLED Works GmbH received approximately €4 million in regional grant funding to expand OLED panel production capacity in Aachen, Germany, enabling annual output of approximately 40,000 m² of OLED panels — a development that expands supply for specialized healthcare and commercial display applications in Europe.

The hybrid work transition permanently expanded demand for 4K monitors and interactive flat panels beyond corporate campuses. Content creators, e-sports professionals, and remote workers each represent distinct buyer segments with above-average willingness to pay for pixel density, color gamut, and refresh rate. Smart classroom deployments add institutional procurement volume on top of individual buyer demand. These overlapping demand sources in education and professional work create a multi-year pipeline that panel manufacturers can address with a common 4K platform, improving amortization of tooling and certification costs.

Emerging Trends

High Refresh Rate Panels, AI Upscaling, and Advanced Backlighting Redefine the 4K Performance Baseline

Mini-LED and quantum dot backlighting are repositioning LCD as a premium technology rather than a commodity. HKC announced the world’s first RGB Mini-LED 4K monitor featuring 4,788 addressable full-color backlight zones — a zone count that significantly exceeds conventional mini-LED systems and delivers local dimming precision approaching OLED contrast performance. This innovation extends LCD’s competitive relevance in premium segments where it was previously losing share to self-emissive technologies, effectively widening the price-performance band that LCD can address.

High refresh rate 4K panels operating at 120 Hz to 240 Hz are transitioning from niche gaming products to a broader performance standard. A 27-inch 4K 240 Hz QD-OLED monitor unveiled in early 2025 improves panel drive efficiency by up to approximately 30% over previous generations, demonstrating that performance gains no longer require proportional energy cost increases. E-sports and fast-paced content consumption are the near-term volume drivers, but the technology will cascade into professional video production and medical imaging applications over the forecast period.

AI-based upscaling and picture optimization embedded directly into 4K TV processing engines are changing buyer value perception. Consumers purchasing 4K displays increasingly evaluate on-device intelligence as a differentiating feature alongside panel specification. Ultra-slim, bezel-less, and flexible display designs further shift competitive positioning from pure resolution specs toward industrial design and integration flexibility. These trends collectively raise the engineering complexity of 4K panel products, which favors manufacturers capable of co-developing display hardware and software processing pipelines simultaneously.

Regional Analysis

APAC Dominates the Ultra-High-Definition Panel 4K Market with a Market Share of 43.60%, Valued at USD 17.2 Billion

Asia Pacific commands a 43.60% share of the Ultra-High-Definition Panel 4K Market, valued at USD 17.2 Billion in 2025. This position reflects the region’s structural advantage as both the world’s largest panel fabrication base and the largest consumer electronics retail market. China, Japan, South Korea, and Taiwan collectively house the majority of global display manufacturing capacity, allowing APAC producers to capture production margin while simultaneously selling into their home consumer markets.

North America Ultra-High-Definition Panel 4K Market Trends

North America represents the most mature end-market for premium 4K display consumption, with high household penetration of smart TVs and accelerating commercial display deployments. Enterprise buyers in retail, corporate, and education sectors drive substantial panel volume on multi-year refresh cycles. The region’s established content distribution infrastructure — anchored by major streaming platforms — sustains replacement demand across consumer and commercial channels.

Europe Ultra-High-Definition Panel 4K Market Trends

Europe benefits from strong consumer spending on premium electronics in Western markets and an active commercial display sector driven by retail modernization. In June 2025, the European Investment Bank provided a €30 million financing package to OLEDWorks to support expanded OLED manufacturing and R&D in Germany, signaling institutional commitment to building domestic display production capacity and reducing supply chain dependence on Asian panel imports.

Latin America Ultra-High-Definition Panel 4K Market Trends

Latin America’s 4K panel adoption accelerates as import tariff structures ease and regional retail chains expand their smart TV assortments. Brazil and Mexico serve as the primary volume markets, supported by urban middle-class income growth and expanding broadband infrastructure that enables 4K content streaming. Commercial display deployments in retail and hospitality add incremental B2B volume on top of consumer replacement demand.

Middle East and Africa Ultra-High-Definition Panel 4K Market Trends

The Middle East and Africa region sees 4K panel demand concentrated in GCC countries, where high per-capita income supports premium consumer electronics spending. Large-venue digital signage for hospitality, retail, and public infrastructure projects drives commercial panel procurement. South Africa represents the primary sub-Saharan market, with 4K adoption pacing behind GCC due to infrastructure constraints and import cost sensitivity.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Samsung Display Co., Ltd. positions itself at the apex of the 4K panel technology hierarchy through its QD-OLED Penta-Tandem architecture, which achieves 1.3× higher luminous efficiency and double the operational lifespan versus previous four-layer designs. Peak brightness of up to 4,500 nits for TV panels and 1,300 nits for monitors closes the brightness gap that previously confined OLED to low-ambient-light environments. This performance advantage reinforces Samsung Display’s premium pricing power in both consumer and professional display markets.

LG Display Co., Ltd. executes a deliberate strategic pivot away from large LCD toward OLED production. Its announced investment of approximately 700 billion won (~$515 million) in OLED production facilities and R&D reflects a calculated bet that OLED will displace LCD in mid-premium segments faster than the broader industry anticipates. LG Display’s 2026 OLED panels claim peak brightness up to 4,500 nits with reflections reduced to an industry-low approximately 0.3%, making direct-view performance in high-ambient retail and commercial environments viable for the first time.

BOE Technology Group Co., Ltd. holds strategic importance as the world’s largest LCD panel producer by area output, giving it unmatched cost leverage in volume segments. BOE’s scale in large-generation fab lines enables it to serve mass-market 4K TV brands at price points that smaller manufacturers cannot match. Its vertical integration across glass, array, and module production minimizes supply chain exposure and allows margin capture across multiple production stages — a structural cost advantage that competitors cannot easily replicate without multi-billion-dollar capital commitments.

Sharp Corporation differentiates through its proprietary UV2A LCD alignment technology and an established track record in professional-grade display systems. Sharp’s customer base spans commercial signage, broadcast monitors, and healthcare imaging — segments that prioritize color consistency and operational reliability over consumer entertainment refresh rate specifications. In March 2025, TCL CSOT completed its equity acquisition of LG Display’s Guangzhou factories, reshaping the competitive LCD supply landscape in ways that create both pressure and potential white-space opportunities for established Japanese panel producers like Sharp.

Key Players

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Sharp Corporation

- AU Optronics Corp. (AUO)

- Innolux Corporation

- Japan Display Inc.

Recent Developments

- September 2024 — TCL Group announced plans to acquire an 80% stake in LG Display’s 8.5-generation LCD panel plant in Guangzhou, along with 100% of the accompanying module factory, through its subsidiary CSOT. This acquisition represents one of the largest single LCD asset transfers in the display industry and positions CSOT as a dominant low-cost LCD supplier for the global 4K TV market.

- March 2025 — TCL CSOT completed the equity acquisition of LG Display’s Guangzhou panel and module factories, securing full operational control of former LG LCD production lines. The transaction directly transfers high-volume 4K LCD manufacturing capacity to a Chinese operator with a significantly lower cost structure than the previous owner.

- June 2025 — LG Display announced a planned investment of approximately 700 billion won (~$515 million) to expand OLED production facilities and related R&D capabilities. This capital commitment signals LG Display’s formal transition from LCD to OLED as its primary technology platform and strengthens its position in the premium 4K panel segment.

- June 2025 — The European Investment Bank provided a €30 million financing package to OLEDWorks GmbH to support expanded manufacturing and R&D for advanced OLED lighting technologies in Aachen, Germany. This public financing enables OLEDWorks to scale annual output to approximately 40,000 m² of OLED panels, strengthening European domestic display manufacturing capacity.

- July 2025 — Sony India launched the 98-inch BRAVIA 5 4K Mini LED TV, expanding its 4K Ultra HD product portfolio with a premium large-screen option featuring 4K resolution, 120 Hz panel refresh, HDR support, and AI-enhanced image processing. This launch demonstrates that consumer appetite for very large-format 4K displays is extending well beyond the conventional 65-inch ceiling.

Report Scope

Report Features Description Market Value (2025) USD 39.5 Billion Forecast Revenue (2035) USD 108.2 Billion CAGR (2026-2035) 10.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (LCD, OLED, MicroLED, Others), By Resolution (4K UHD, 8K UHD), By Size (40–60 inches, Below 40 inches, Above 60 inches), By Application (Consumer Electronics, Commercial, Healthcare, Education, Automotive, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Samsung Display Co., Ltd., LG Display Co., Ltd., BOE Technology Group Co., Ltd., Sharp Corporation, AU Optronics Corp. (AUO), Innolux Corporation, Japan Display Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ultra-High-Definition Panel 4K MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Ultra-High-Definition Panel 4K MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Samsung Display Co., Ltd.

- LG Display Co., Ltd.

- BOE Technology Group Co., Ltd.

- Sharp Corporation

- AU Optronics Corp. (AUO)

- Innolux Corporation

- Japan Display Inc.