Global Ultra Fine Grinding Equipment Market Size, Share Analysis Report By Product Type (Jet Mill, Hammer Mill, Agitated Mill, Cryogenic Mill, and Others), By Operation Mode (Automated and Manual), By Process (Batch Process and Continuous Process), By Grinding Material (Dry Material and Wet Material), By Application (Mining, Pharmaceuticals, Cement, Chemicals And Materials, Food Processing, Institutional Laboratory, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173069

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

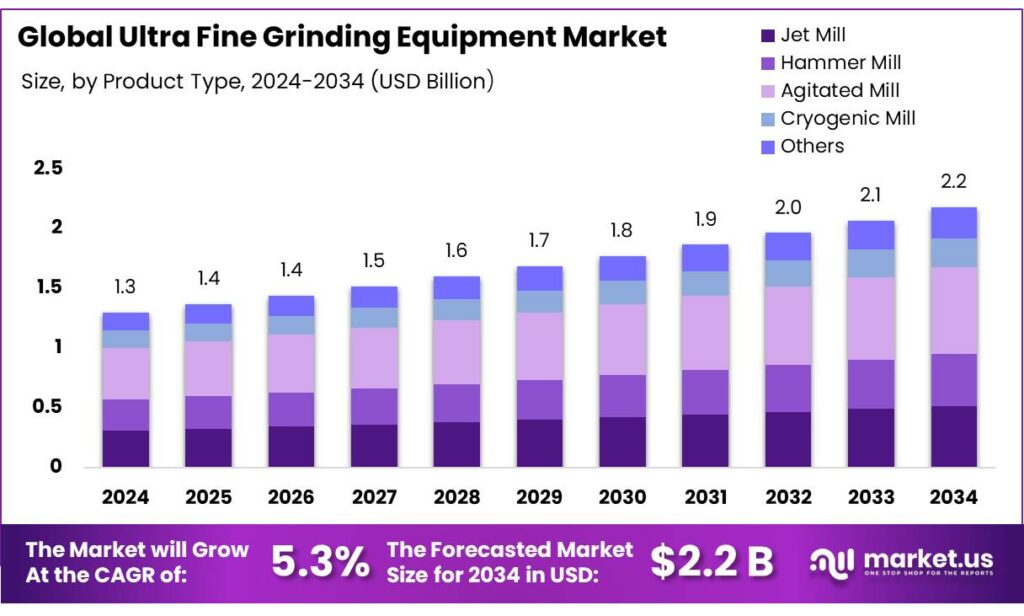

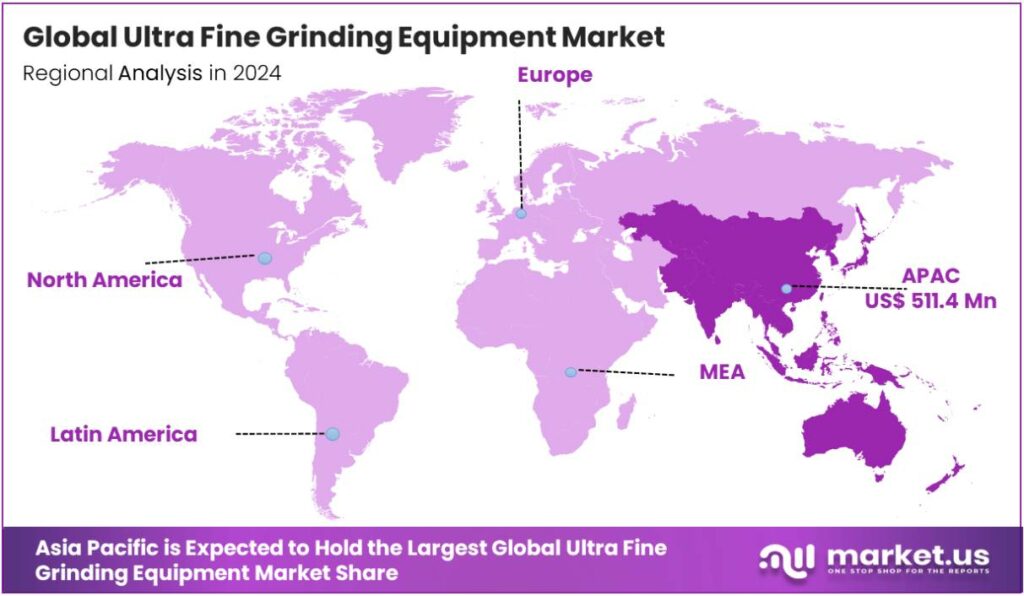

The Global Ultra Fine Grinding Equipment Market size is expected to be worth around USD 2.2 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 40.1% share, holding USD 9 Billion in revenue.

Grinding mills are machines that break solid materials into smaller particles or powder using forces such as compression, shear, and friction, essential for several industrial processes. The market is characterized by its critical role in industries requiring precise particle size control, such as cement, pharmaceuticals, chemicals, and mining.

Automation and continuous grinding processes are becoming more prevalent, as they increase operational efficiency and reduce production costs. The demand for ultra-fine grinding has surged due to the need for high-performance materials, such as blended cements, active pharmaceutical ingredients (APIs), and specialty chemicals, which require extremely fine particles for enhanced product performance.

- In 2025 alone, the U.S. Food and Drug Administration approved 44 novel drugs to be utilized and marketed in the United States. Similarly, in 2024, the number of approved novel drugs was 50. Due to these advancements, the demand for nanoparticles in drug formulations has grown significantly, propelling the need for advanced grinding technology.

However, geopolitical uncertainties and skilled labor shortages pose challenges, particularly in supply chains and the availability of expertise for advanced equipment. Despite these hurdles, the market continues to expand, driven by innovations and sector-specific demands.

Key Takeaways

- The global ultra fine grinding equipment market was valued at USD 1.3 billion in 2024.

- The global ultra fine grinding equipment market is projected to grow at a CAGR of 5.3% and is estimated to reach USD 2.2 billion by 2034.

- On the basis of types of ultra fine grinding equipment, the agitated mill dominated the market, constituting 33.5% of the total market share.

- Based on the operation mode of the grinding equipment, automated equipment dominated the market, with a substantial market share of around 52.9%.

- Based on the process, continuous processes led the market, comprising 68.9% of the total market.

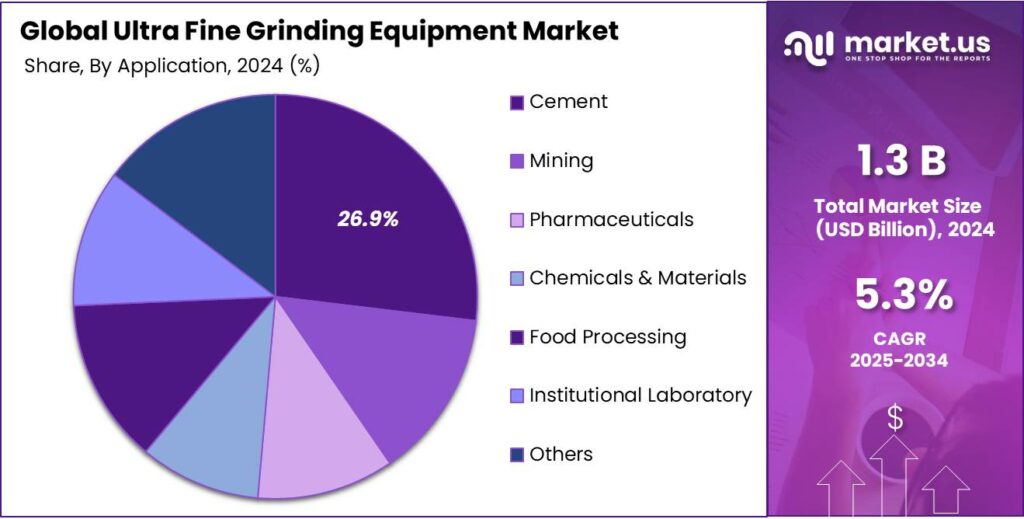

- Among the applications, the cement sector held a major share in the ultra fine grinding equipment market, 26.9% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the ultra fine grinding equipment market, accounting for 40.1% of the total global consumption.

Product Type Analysis

Agitated Mills are a Prominent Segment in the Ultra-Fine Grinding Equipment Market.

The ultra-fine grinding equipment market is segmented based on product types into jet mill, hammer mill, agitated mill, cryogenic mill, and others. The agitated mill led the ultra-fine grinding equipment market, comprising 33.5% of the market share, due to its ability to achieve higher energy efficiency and finer particle sizes compared to other mills, such as jet, hammer, or cryogenic mills.

The design of the agitated mill, which features a high-speed rotating stirrer, allows for continuous interaction between grinding media and material, providing more effective and uniform grinding, and better control over particle size distribution. In contrast, jet mills, while efficient, require high gas pressures and are more energy-intensive, making them less cost-effective for large-scale operations. Similarly, hammer mills are less effective for producing ultra-fine particles due to their coarse grinding mechanism. Cryogenic mills, while useful for heat-sensitive materials, are expensive and energy-consuming.

Operation Mode Analysis

Automated Ultra Fine Grinding Equipment Dominated the Market.

On the basis of the operation mode of the grinding equipment, the market is segmented into automated and manual. The automated grinding equipment dominated the market, comprising 52.9% of the market share, due to its ability to enhance efficiency, consistency, and safety in production. Automated systems allow for precise control of grinding parameters such as speed, pressure, and duration, ensuring a uniform particle size distribution and higher product quality.

The precision reduces the likelihood of human error, which is more prevalent in manual operations. Furthermore, automation enables continuous operation, reducing downtime and labor costs while increasing throughput. In industries such as pharmaceuticals and chemicals, where strict quality control and compliance are required, automated mills ensure better reproducibility and regulatory adherence, making them the more reliable choice.

Process Analysis

Ultra-fine grinding Equipment is Mostly Utilized in Continuous Processes.

Based on the process, the market is divided into batch processes and continuous processes. The continuous processes dominated the market, with a notable market share of 68.9%. Ultra-fine grinding is often done in continuous processes rather than batch processes as it offers higher efficiency, greater consistency, and better scalability for large-scale production. Continuous processes allow for uninterrupted material flow, which ensures a steady production rate and more consistent particle size distribution throughout the grinding cycle.

This uniformity is particularly crucial for product performance in industries such as cement and pharmaceuticals. In addition, continuous grinding systems reduce the need for frequent equipment downtime and cleaning, making them more cost-effective over time. In contrast, batch processes are often slower and less efficient, as they require halting production to load and unload materials, making them less suitable for large-volume or high-throughput operations.

Application Analysis

The Cement Manufacturing Sector Held a Major Share of the Ultra-Fine Grinding Equipment Market.

Among the applications, 26.9% of the total global consumption of ultra-fine grinding equipment is for the cement manufacturing sector, due to the industry’s high demand for finely ground materials and its large-scale production volumes. The cement industry requires ultra-fine grinding to produce high-strength, high-performance cement products, which necessitate precise control over particle size and distribution. Cement plants operate continuously at high capacities, making them a consistent and significant source of demand for grinding mills.

In contrast, industries such as mining, pharmaceuticals, chemicals, and food processing, while requiring ultra-fine grinding, typically involve smaller production volumes or more specialized applications. The relatively lower throughput in these industries, compared to cement, leads to less frequent and smaller-scale purchases of grinding equipment. Institutional laboratories use ultra-fine grinding mills at much smaller scales, focusing more on research and development rather than large-scale commercial production.

Key Market Segments

By Product Type

- Jet Mill

- Hammer Mill

- Agitated Mill

- Cryogenic Mill

- Others

By Operation Mode

- Automated

- Manual

By Process

- Batch Process

- Continuous Process

By Grinding Material

- Dry Material

- Wet Material

By Application

- Mining

- Pharmaceuticals

- Cement

- Chemicals & Materials

- Food Processing

- Institutional Laboratory

- Others

Drivers

The Cement Manufacturing Industry Drives the Ultra-Fine Grinding Equipment Market.

The cement and pharmaceutical industries are key drivers of the ultra-fine grinding equipment market, as both sectors require precise particle size reduction for improved product quality and efficiency. In the cement industry, ultra-fine grinding is crucial for the production of high-performance materials such as blended cements, which demand finely ground components to enhance durability and strength. Similarly, the pharmaceutical industry utilizes ultra-fine grinding to ensure active pharmaceutical ingredients (APIs) are finely processed for optimal bioavailability, enabling faster absorption and effectiveness in treatment.

- According to the US Geological Survey, the world cement production in 2024 reached approximately 4 billion metric tons, and clinker capacity totaled around 3.8 billion metric tons. As the cement manufacturing industry grows, there is a consistent demand for high-performance grinding equipment in the industry.

Restraints

Trade Policy Uncertainties Might Delay the Growth of the Ultra-Fine Grinding Equipment Market.

Trade policy uncertainties, along with skilled labor shortages, pose significant challenges to the growth of the ultra-fine grinding equipment market. Trade tensions, tariffs, and regulatory changes can disrupt the supply chain, increasing the cost of raw materials and components essential for manufacturing grinding equipment. Also, a shortage of skilled labor, particularly in the areas of mechanical engineering and machine maintenance, hampers the ability to design, install, and operate complex grinding equipment effectively. As technologies become more sophisticated, the demand for highly trained personnel grows.

- For instance, according to the National Association of Manufacturers, 409,000 manufacturing jobs remained unfilled in August 2025 in the US alone. Similarly, 3.8 million manufacturing jobs will likely be needed by 2033, and 1.9 million are expected to be unfilled.

Opportunity

Expansion of the Chemical Industry Creates Opportunities in the Ultra-Fine Grinding Equipment Market.

The expansion of the chemical industry presents substantial opportunities for the ultra-fine grinding equipment market. As the demand for specialty chemicals, agrochemicals, and advanced materials continues to grow, the need for precise particle size control becomes increasingly critical. Ultra-fine grinding plays a pivotal role in the production of materials such as pigments, catalysts, and coatings, where uniformity and fine particle distribution are essential for product performance.

The production of high-performance catalysts in the chemical industry requires finely ground materials to enhance their surface area and reactivity. Similarly, in agrochemicals, ultra-fine grinding improves the dispersion and bioavailability of active ingredients, ensuring better efficacy in pesticide formulations. As chemical companies innovate and diversify, the demand for advanced grinding solutions to meet these new requirements is expected to rise.

Trends

Shift Towards Automation.

The ongoing shift towards automation is a prominent trend in the ultra-fine grinding equipment market, as industries seek to enhance efficiency, reduce labor costs, and improve product consistency. Automated grinding systems, which incorporate advanced technologies such as artificial intelligence (AI), machine learning, and Internet of Things (IoT) integration, enable real-time monitoring and control of the grinding process.

The automation allows for precise adjustments in particle size distribution, optimizing energy consumption and throughput. For instance, in the cement industry, automated systems can adjust parameters such as grinding speed and pressure, ensuring optimal particle fineness while minimizing energy usage. Similarly, the pharmaceutical industry benefits from automated grinding technologies by ensuring uniformity in the production of APIs and maintaining compliance with stringent regulatory standards.

Geopolitical Impact Analysis

Geopolitical Tensions Have Severely Affected End-Use Industries of Ultra-Fine Grinding Equipment.

Geopolitical tensions have had a significant impact on the ultra-fine grinding equipment market, influencing global supply chains, raw material availability, and manufacturing processes. Trade restrictions, tariffs, and diplomatic conflicts have disrupted the smooth flow of key components required for grinding equipment, such as advanced alloys and electrical components.

For instance, according to the Associated Builders and Contractors, input costs, including cement, in the construction sector rose for the third consecutive month in March 2025 in the United States, reflecting a 9.7% annualized rise in the first quarter of 2025, due to changes in trade policies by increasing tariffs on imported goods. Consequently, there is a decline in the demand for grinding equipment in the construction sector.

Similarly, the pharmaceutical and chemical industries, major consumers of ultra-fine grinding equipment, have been particularly affected, as raw material shortages for APIs and specialty chemicals have delayed production. Consequently, manufacturers have invested in local production capabilities, which, while mitigating risks, increases operational costs. This demand for localized production facilities has driven innovation in automation and self-sufficient grinding systems.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Ultra Fine Grinding Equipment Market.

In 2024, the Asia Pacific dominated the global ultra-fine grinding equipment market, holding about 40.1% of the total global consumption. The region has consistently held the largest share of the global ultra-fine grinding equipment market, driven by the region’s rapid industrialization, high demand in key sectors, and a robust manufacturing base. Countries such as China and India are prominent consumers, with industries such as cement, pharmaceuticals, and chemicals being major drivers of market growth.

- For instance, China remains the leading global cement producer, representing 51% of global production, which relies heavily on ultra-fine grinding technologies to produce high-strength materials, contributing significantly to the region’s demand.

Similarly, India strengthened its position as the second-largest cement producer, with the country’s share of global production rising to 9% in 2023. Additionally, the growing pharmaceutical industry in India, which is one of the largest global producers of generic drugs, requires advanced grinding equipment for the production of active pharmaceutical ingredients (APIs) in ultra-fine particle sizes. For instance, India manufactures over 500 different APIs and holds a commanding 57% share of all APIs on the World Health Organization (WHO) prequalified list.

Furthermore, the competitive advantage of the region is further enhanced by low labor costs, a large manufacturing ecosystem, and a well-established supply chain, making the Asia Pacific a hub for ultra-fine grinding equipment production and consumption.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the ultra-fine grinding equipment market adopt several strategic activities to expand their market presence and enhance market share. The companies invest in continuous product innovation, where they focus on developing more energy-efficient and automated grinding solutions that cater to evolving industry demands. Additionally, firms invest in strengthening their distribution networks, particularly in emerging markets, by establishing local manufacturing plants or forming strategic partnerships. Furthermore, the players emphasize mergers and acquisitions, allowing them to diversify their product portfolios and tap into new customer bases.

The Major Players in The Industry

- United Grinding Group

- The Jet Pulverizer Company

- Hosokawa Micron Group

- Erich NETZSCH GmbH & Co. Holding KG

- Retsch GmbH

- Atritor Limited

- Schutte Hammermill

- Promas Engineers Private Limited

- Fritsch GmbH

- Erich NETZSCH GmbH & Co. Holding KG

- Air Products and Chemicals, Inc.

- Pulva

- HORIBA

- Quadro

- Bepex International LLC

- Metso Corporation

- Hosokawa Alpine AG

- Other Key Players

Key Development

- In July 2025, United Grinding Groups acquired the GF Machining Solutions Division of Georg Fischer AG, expanding its portfolio to 15 brands.

- In October 2024, NETZSCH Trockenmahltechnik GmbH and Deutsches Institut für Lebensmitteltechnik e.V. agreed on a cooperation aimed at strengthening innovation in food technology and driving the development of new product and process solutions.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 2.2 Bn CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Jet Mill, Hammer Mill, Agitated Mill, Cryogenic Mill, and Others), By Operation Mode (Automated and Manual), By Process (Batch Process and Continuous Process), By Grinding Material (Dry Material and Wet Material), By Application (Mining, Pharmaceuticals, Cement, Chemicals & Materials, Food Processing, Institutional Laboratory, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape United Grinding Group, The Jet Pulverizer Company, Hosokawa Micron Group, Erich NETZSCH GmbH & Co. Holding KG, Retsch GmbH, Atritor Limited, Schutte Hammermill, Promas Engineers Private Limited, Fritsch GmbH, Erich NETZSCH GmbH & Co. Holding KG, Air Products and Chemicals, Inc., Pulva, HORIBA, Quadro, Bepex International LLC, Metso Corporation, Hosokawa Alpine AG, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Ultra Fine Grinding Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Ultra Fine Grinding Equipment MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- United Grinding Group

- The Jet Pulverizer Company

- Hosokawa Micron Group

- Erich NETZSCH GmbH & Co. Holding KG

- Retsch GmbH

- Atritor Limited

- Schutte Hammermill

- Promas Engineers Private Limited

- Fritsch GmbH

- Erich NETZSCH GmbH & Co. Holding KG

- Air Products and Chemicals, Inc.

- Pulva

- HORIBA

- Quadro

- Bepex International LLC

- Metso Corporation

- Hosokawa Alpine AG

- Other Key Players