Global Trim Tabs Market Size, Share, Growth Analysis By Type (Adjustable Trim Tabs, Fixed Trim Tabs), By Control Type (Hydraulic, Mechanical, Electrical), By Application (Marine, Aviation), By End Users (Commercial, Personal, Military, Sports), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176496

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

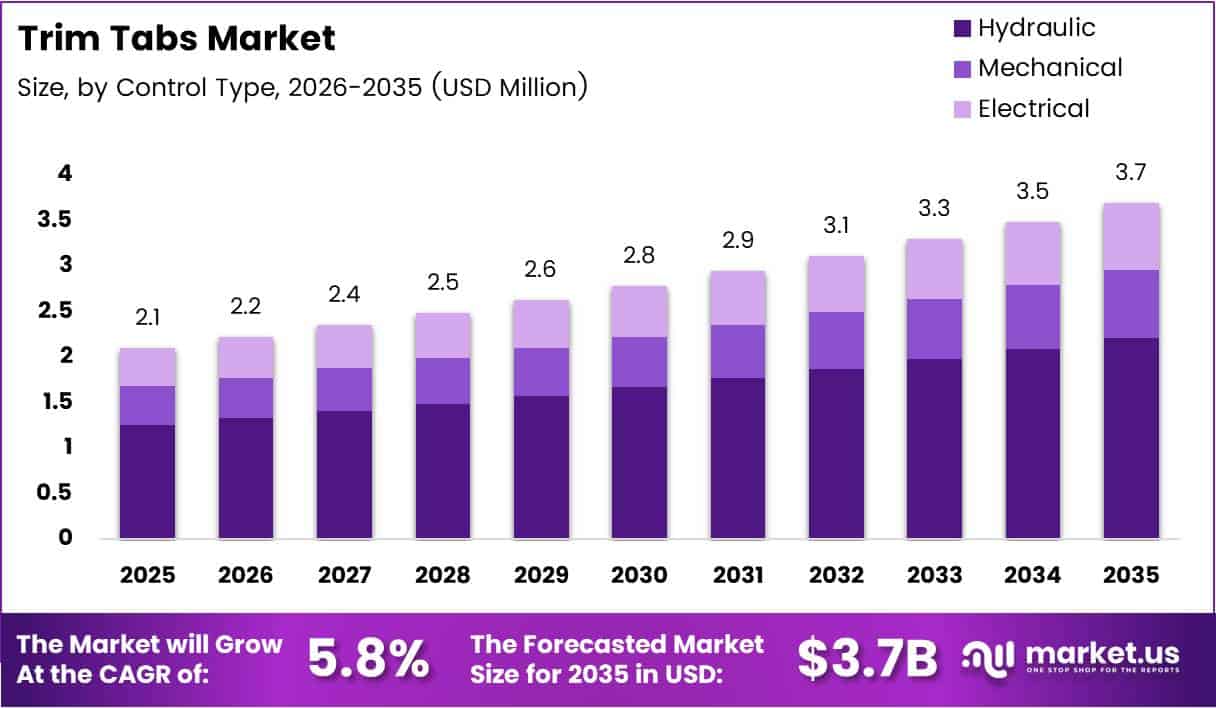

Global Trim Tabs Market size is expected to be worth around USD 3.7 Billion by 2035 from USD 2.1 Billion in 2025, growing at a CAGR of 5.8% during the forecast period 2026 to 2035.

Trim tabs represent adjustable surfaces mounted on vessel transoms. These devices control hull attitude during operation. Marine operators use trim tabs to optimize vessel performance across varying speeds and load conditions. Consequently, boats achieve better stability and handling characteristics.

The marine hardware sector drives significant demand for performance-enhancing equipment. Commercial fleets prioritize fuel efficiency improvements through hull optimization. Additionally, recreational boaters seek enhanced comfort and reduced wave impact. Therefore, trim tab adoption accelerates across multiple vessel categories worldwide.

Market expansion reflects growing boat production volumes globally. Manufacturers integrate advanced control systems into modern designs. Moreover, aftermarket installations increase as boat owners upgrade existing vessels. Smart technology integration transforms traditional mechanical systems into automated solutions.

Regulatory frameworks promote fuel-efficient marine technologies. Environmental standards encourage adoption of optimization equipment. Furthermore, naval and patrol vessel procurement supports market growth. Commercial fishing operations invest in stability-enhancing hardware for operational safety.

According to Ship Universe, optimizing vessel trim using advanced systems reduces fuel consumption by approximately 5% depending on vessel type. This efficiency gain demonstrates substantial operational cost savings. Moreover, hull optimization strategies translate to approximately 35 barrels of oil saved daily on 2,000 TEU container feeder vessels when trim optimization occurs.

Research studies indicate trim tabs reduce pitch amplitude by about 50% under certain wave conditions for high-speed craft. This performance improvement enhances passenger comfort significantly. Additionally, commercial fleets reported up to 20% increases in operational efficiency with smart trim integration attributed to improved hull positioning.

In January 2026, Seakeeper Ride and Barletta Boats partnered to bring industry-first stabilization technology to the pontoon market. This collaboration expands trim tab applications into new vessel segments. Therefore, market diversification creates additional growth opportunities across marine categories.

Key Takeaways

- Global Trim Tabs Market valued at USD 2.1 Billion in 2025, projected to reach USD 3.7 Billion by 2035

- Market grows at CAGR of 5.8% during forecast period 2026-2035

- Adjustable Trim Tabs segment dominates with 72.3% market share in 2025

- Hydraulic control type leads with 48.2% share due to reliability and power

- Marine application segment holds 74.5% share across end-user applications

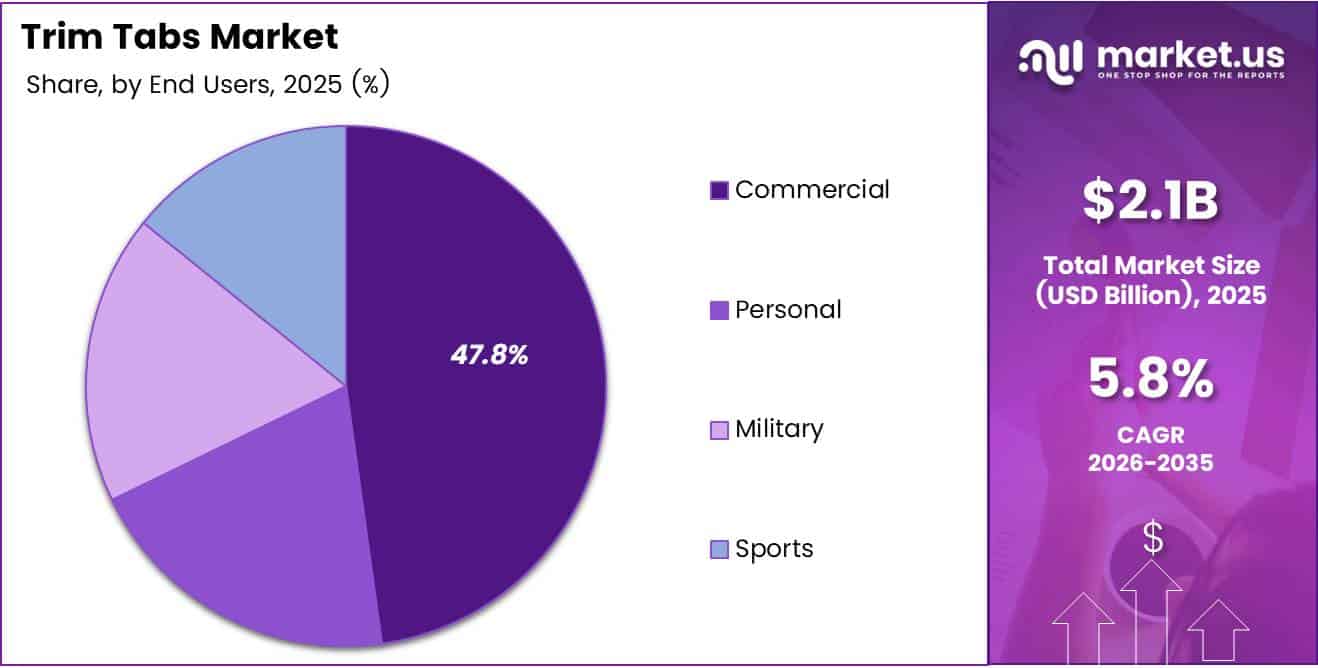

- Commercial end users account for 47.8% of total market demand

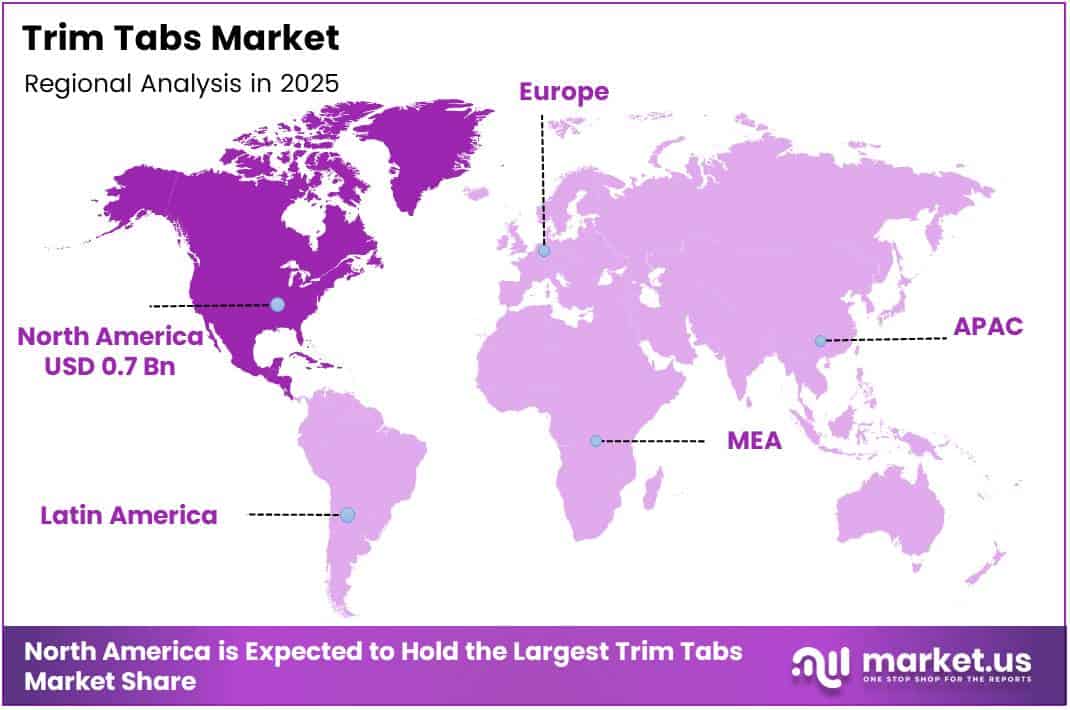

- North America dominates regional market with 36.80% share valued at USD 0.7 Billion

Type Analysis

Adjustable Trim Tabs dominate with 72.3% due to operational flexibility and performance optimization capabilities.

In 2025, Adjustable Trim Tabs held a dominant market position in the By Type segment of Trim Tabs Market, with a 72.3% share. Marine operators prefer adjustable systems for dynamic hull control across varying conditions. These devices allow real-time positioning adjustments during operation. Consequently, vessels achieve optimal performance regardless of speed, load, or sea state changes.

Fixed Trim Tabs serve specific applications where constant hull angle remains sufficient. Commercial operators install fixed systems on vessels with consistent operational profiles. These units offer lower installation costs and minimal maintenance requirements. Therefore, budget-conscious boat owners select fixed trim tabs for basic performance enhancement needs.

Control Type Analysis

Hydraulic systems dominate with 48.2% due to superior power delivery and proven reliability.

In 2025, Hydraulic control type held a dominant market position in the By Control Type segment of Trim Tabs Market, with a 48.2% share. Heavy-duty marine applications require robust actuation systems capable of withstanding harsh conditions. Hydraulic mechanisms deliver consistent force across large trim tab surfaces. Moreover, commercial vessels prioritize reliability over electronic complexity in demanding environments.

Mechanical control systems provide simple, cost-effective trim adjustment solutions. Small boat owners appreciate straightforward manual operation without electrical dependencies. These systems eliminate power consumption concerns during operation. Additionally, mechanical controls offer easy maintenance and long-term durability for recreational users.

Electrical control types represent emerging technology in trim tab actuation systems. Modern vessels integrate electronic controls for automated hull optimization. Digital systems enable precise positioning with minimal operator intervention. Furthermore, electrical mechanisms support smart sensor integration and advanced performance monitoring capabilities.

Application Analysis

Marine applications dominate with 74.5% due to extensive vessel adoption and performance requirements.

In 2025, Marine held a dominant market position in the By Application segment of Trim Tabs Market, with a 74.5% share. Boats require trim tabs for stability, fuel efficiency, and comfort enhancement. Commercial fishing vessels, recreational boats, and patrol craft utilize these systems extensively. Therefore, marine applications represent the primary market driver across all geographical regions.

Aviation applications utilize trim tabs for aircraft control surface adjustments. Pilots employ these devices to maintain proper flight attitudes during various phases. Aircraft manufacturers integrate trim systems into wing and tail surfaces. Consequently, aviation represents a specialized but significant market segment for trim tab technology.

End Users Analysis

Commercial end users dominate with 47.8% due to fleet operations and efficiency demands.

In 2025, Commercial held a dominant market position in the By End Users segment of Trim Tabs Market, with a 47.8% share. Fishing fleets, cargo vessels, and passenger boats prioritize operational efficiency improvements. Companies invest in performance-enhancing equipment to reduce fuel costs. Moreover, commercial operators require reliable systems capable of continuous operation under demanding conditions.

Personal boat owners adopt trim tabs for recreational vessel performance enhancement. Individual users seek improved comfort during cruising and water activities. Aftermarket installations grow as owners upgrade existing boats. Additionally, personal users value ease of operation and minimal maintenance requirements.

Military applications demand high-performance trim control for naval vessels. Defense contractors specify robust systems for patrol boats and support craft. Combat vessels require reliable performance under extreme operational conditions. Furthermore, military specifications drive innovation in materials and actuation technology.

Sports applications focus on high-speed vessel performance optimization. Racing boats and performance craft require precise hull control capabilities. Competitive users demand rapid response times and minimal weight additions. Therefore, sports segment drives development of lightweight, high-efficiency trim tab systems.

Key Market Segments

By Type

- Adjustable Trim Tabs

- Fixed Trim Tabs

By Control Type

- Hydraulic

- Mechanical

- Electrical

By Application

- Marine

- Aviation

By End Users

- Commercial

- Personal

- Military

- Sports

Drivers

Rising Adoption of Performance-Enhancing Marine Hardware Drives Market Growth

Recreational and commercial vessel operators increasingly prioritize performance optimization equipment. Trim tabs deliver measurable improvements in fuel efficiency and handling characteristics. Boat manufacturers integrate these systems as standard equipment on new models. Consequently, market demand accelerates across multiple vessel categories and user segments globally.

Global boat production volumes continue expanding with rising maritime activities. Manufacturers produce diverse vessel types requiring stability enhancement solutions. Aftermarket sales grow as existing boat owners upgrade their equipment. According to First Choice Marine, over 65% of new recreational boats in 2025 come with electronic trim systems as standard equipment, enhancing hull positioning significantly.

High-speed craft and heavy-load applications demonstrate particular need for trim control. Commercial fishing vessels operate under varying load conditions requiring dynamic adjustments. Racing boats demand precise hull attitude control for competitive performance. Therefore, specialized applications drive continued innovation and market expansion opportunities.

Restraints

High Installation and Maintenance Costs Limit Market Adoption

Advanced trim tab systems require significant upfront investment for purchase and installation. Hydraulic systems involve complex plumbing and actuator components increasing total costs. Small boat owners face budget constraints limiting their equipment upgrade decisions. Consequently, price sensitivity restricts market penetration in entry-level vessel segments.

Professional installation services add substantial expenses to trim tab implementation. Marine technicians charge premium rates for skilled fabrication and integration work. Boat owners must also consider ongoing maintenance requirements for system longevity. Moreover, hydraulic systems need periodic fluid changes and seal replacements adding operational expenses.

Limited awareness among small boat owners reduces market demand potential. Many recreational users lack understanding of trim tab benefits and operation. Technical expertise requirements intimidate inexperienced boaters considering system installations. Therefore, education and simplified product offerings remain critical for broader market acceptance.

Growth Factors

Technological Advancements Accelerate Market Expansion

Smart sensor integration transforms traditional trim tabs into automated control systems. Modern vessels employ digital positioning technology for optimal hull management. Real-time data processing enables continuous performance optimization without manual intervention. Consequently, automated systems attract operators seeking enhanced convenience and efficiency gains.

Marine tourism and water sports infrastructure expands globally creating new market opportunities. Coastal regions develop recreational boating facilities supporting leisure activities. Charter operations grow with increasing tourism demand for maritime experiences. In May 2025, Seakeeper Ride introduced five new systems making stabilization solutions available for boats up to 55 feet in length, marking major product line expansion.

Naval forces, coast guard units, and patrol vessel fleets require performance-enhancing equipment. Government procurement programs support marine hardware investments for operational capabilities. Defense contractors specify advanced trim systems for mission-critical applications. According to American Boating Association, optimal trim adjustment improves fuel efficiency by up to 15% in typical cruising scenarios, indicating substantial savings potential.

Emerging Trends

Digital Transformation Reshapes Trim Tab Technology Landscape

Electrically actuated trim tabs replace traditional hydraulic systems in modern vessel designs. Electric mechanisms offer simpler installation without complex hydraulic lines. Digital controls integrate seamlessly with vessel management systems and displays. Therefore, manufacturers increasingly develop electric solutions for new boat production.

Customizable and vessel-specific trim tab designs gain market preference. Boat builders collaborate with manufacturers for tailored performance solutions. Engineers optimize trim tab dimensions for specific hull configurations. In October 2025, Seakeeper Ride released sizing support for power catamarans up to approximately 55 feet, enabling underway stabilization on multihull vessels.

Eco-friendly and energy-efficient marine components attract environmentally conscious operators. Manufacturers develop lightweight composite materials reducing overall vessel weight. Corrosion-resistant materials extend system lifespan in harsh marine environments. Additionally, compact high-response mechanisms improve installation flexibility across diverse vessel types.

Regional Analysis

North America Dominates the Trim Tabs Market with a Market Share of 36.80%, Valued at USD 0.7 Billion

North America leads global trim tabs adoption with extensive recreational boating activity. The United States maintains the world’s largest pleasure boat fleet driving aftermarket demand. Commercial fishing operations along both coastlines require performance-enhancing equipment. Moreover, North American manufacturers produce innovative trim tab technologies serving domestic and international markets. The region’s 36.80% market share valued at USD 0.7 Billion reflects strong marine industry infrastructure and consumer purchasing power.

Europe Trim Tabs Market Trends

European markets demonstrate strong demand for marine performance equipment across coastal nations. Mediterranean countries support vibrant recreational boating and commercial fishing industries. Northern European regions prioritize fuel efficiency due to higher operational costs. Additionally, stringent environmental regulations encourage adoption of optimization technologies reducing emissions and consumption.

Asia Pacific Trim Tabs Market Trends

Asia Pacific experiences rapid growth in boat production and marine tourism development. China emerges as major manufacturing hub for marine hardware components. Southeast Asian nations expand water sports infrastructure attracting international tourism. Furthermore, commercial fishing fleets throughout the region modernize equipment improving operational efficiency.

Latin America Trim Tabs Market Trends

Latin American markets show increasing interest in marine performance enhancement solutions. Brazil’s extensive coastline supports substantial recreational and commercial boating activity. Coastal tourism development drives demand for passenger vessel equipment upgrades. Moreover, fishing industries invest in efficiency-improving technologies supporting sustainable operations.

Middle East & Africa Trim Tabs Market Trends

Middle Eastern markets demonstrate growing luxury yacht and commercial vessel activity. GCC nations invest heavily in maritime infrastructure and tourism development. African coastal regions develop fishing industries requiring modern equipment. Additionally, patrol and security vessels across both regions adopt advanced trim control systems.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

AB Volvo delivers integrated marine propulsion and control systems for commercial applications. The company combines engine technology with performance-enhancing hardware solutions. Volvo’s marine division serves both recreational and commercial vessel markets globally. Moreover, their engineering expertise supports innovation in automated trim control technologies enhancing operational efficiency.

Bennett Marine Inc. specializes in hydraulic trim tab systems for diverse vessel types. The company pioneered many industry-standard trim tab designs and installation practices. Bennett products serve recreational, commercial, and military applications worldwide. Additionally, their extensive dealer network provides installation support and aftermarket service across major boating markets.

Lenco Marine focuses on electric trim tab systems and advanced control technologies. The company develops automated positioning systems integrating with modern vessel electronics. Lenco’s products emphasize ease of installation and user-friendly operation. Furthermore, their innovative edge-mount designs simplify retrofitting existing boats with performance-enhancing equipment.

Parker Hannifin Corporation manufactures hydraulic and electromechanical control systems for marine applications. The company leverages aerospace engineering expertise for marine hardware development. Parker supplies components to boat manufacturers and aftermarket distributors globally. Consequently, their diversified product portfolio serves multiple market segments requiring precision control solutions.

Key players

- AB Volvo

- Aviat Aircraft Inc.

- Bennett Marine Inc.

- Lenco Marine

- Linear Devices Corporation

- Livorsi Marine Inc.

- Marine Surplus

- Matromarine Products Twin Disc

- McFarlane Aviation

- Parker Hannifin Corporation

Recent Developments

- February 2025 – Parker, Regulator, and SeaHunter added Seakeeper Ride as standard on multiple new boat models mid-model year, expanding integration of underway stabilization technology across three major manufacturers and enhancing market adoption.

- July 2025 – Seakeeper Ride expanded OEM integrations with 43 new standard boat models across 15 manufacturers for the 2026 model year, significantly broadening adoption of automated vessel motion control technology industry-wide.

- June 2025 – Seakeeper Ride launched 3D-printed Pocket Fit Kits for boats with recessed trim tab pockets to simplify and lower the cost of aftermarket installations, addressing installation challenges for existing vessels.

- October 2024 – Sportsman Boats standardized Seakeeper Ride across its entire 2025 model lineup, being the first builder to adopt complete underway stabilization on all models, demonstrating commitment to performance enhancement technology.

Report Scope

Report Features Description Market Value (2025) USD 2.1 Billion Forecast Revenue (2035) USD 3.7 Billion CAGR (2026-2035) 5.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Adjustable Trim Tabs, Fixed Trim Tabs), By Control Type (Hydraulic, Mechanical, Electrical), By Application (Marine, Aviation), By End Users (Commercial, Personal, Military, Sports) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AB Volvo, Aviat Aircraft Inc., Bennett Marine Inc., Lenco Marine, Linear Devices Corporation, Livorsi Marine Inc., Marine Surplus, Matromarine Products Twin Disc, McFarlane Aviation, Parker Hannifin Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AB Volvo

- Aviat Aircraft Inc.

- Bennett Marine Inc.

- Lenco Marine

- Linear Devices Corporation

- Livorsi Marine Inc.

- Marine Surplus

- Matromarine Products Twin Disc

- McFarlane Aviation

- Parker Hannifin Corporation