Global Transformer Insulation Market By Type (Liquid Insulation Materials, Solid Insulation Materials, and Gas Insulation), By Application (Power Transformer, Distribution Transformer, and Instrument Transformer), By End-Use (Utilities, Industrial, Data Centers, Residential And Commercial, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174814

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

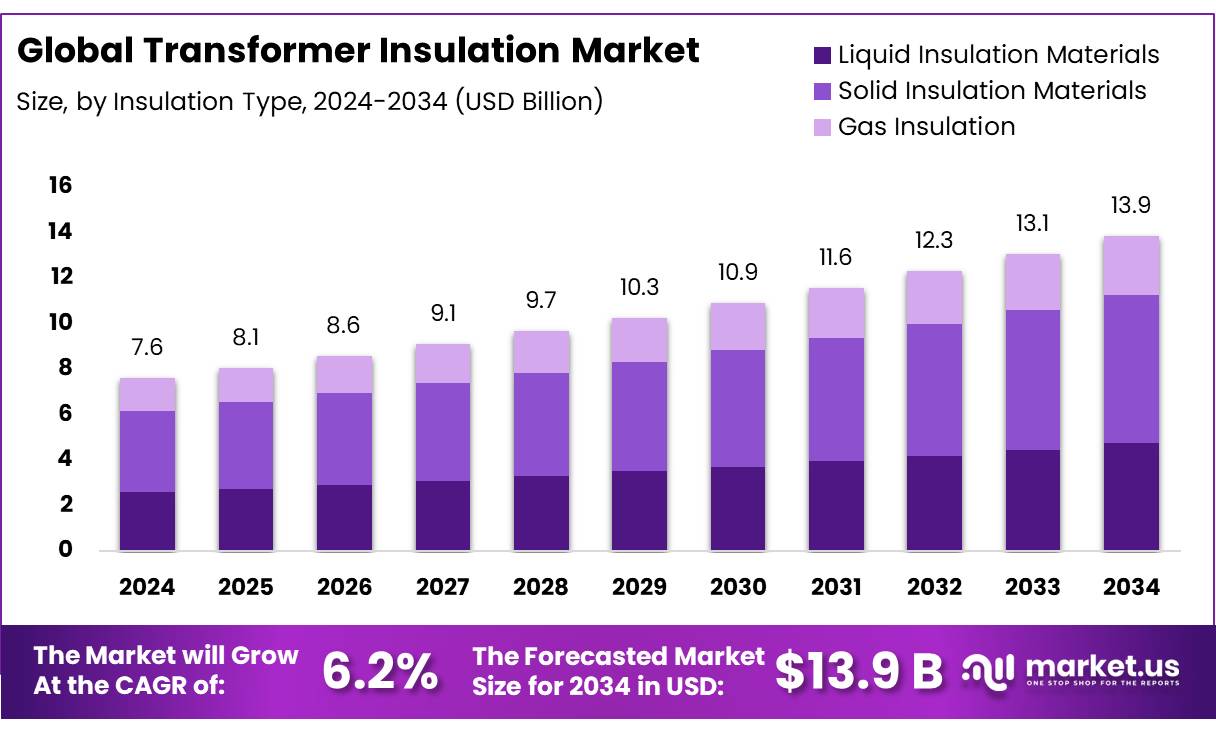

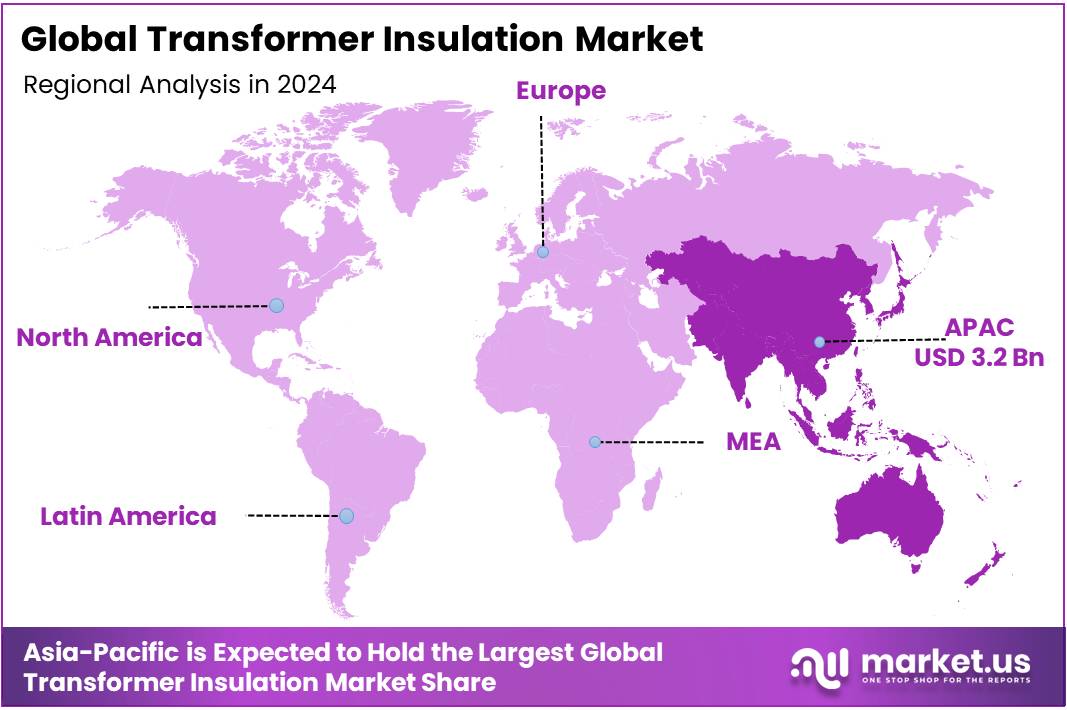

Global Transformer Insulation Market size is expected to be worth around USD 13.9 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 6.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 41.6% share, holding USD 175.3 Million in revenue.

Transformer insulation is a critical system of solid, liquid, and sometimes gaseous materials that electrically isolate conductive parts, provide mechanical support, and manage heat to ensure safe, reliable, and efficient power conversion, preventing short circuits and catastrophic failures in transformers. Its market is driven by the growing demand for reliable, efficient, and sustainable electrical infrastructure across various sectors, including utilities, industrial, and residential applications. The increasing global need for electricity, coupled with the push for grid modernization, renewable energy integration, and electric vehicle adoption, has amplified the demand for advanced transformer insulation solutions.

- Insulation deterioration remains one of the leading causes of failure of outdated transformers, accounting for more than 40% of major outages in high-voltage networks. This creates an opportunity for advanced insulation materials, such as high thermal class aramid-based solid insulation, biodegradable and fire-safe ester fluids, nano-enhanced composites, and hybrid insulation systems designed to extend service life, improve temperature endurance, and reduce environmental impact compared with conventional cellulose and mineral oil systems.

Solid insulation materials, such as paper, resin, and fiberglass, are widely used due to their reliability, ease of handling, and cost-effectiveness. In contrast, the adoption of liquid and gas-based insulation is growing, particularly with the rise of natural ester oils that offer better environmental safety. The utility sector, being the largest consumer of transformer insulation materials, drives the majority of market demand due to the need for extensive transformer networks to support large-scale power distribution. While challenges such as environmental concerns and geopolitical tensions impact supply chains, technological advancements in hybrid insulation systems and eco-friendly materials are opening new opportunities for growth in the market.

Key Takeaways

- The global transformer insulation market was valued at USD 7.6 billion in 2024.

- The global transformer insulation market is projected to grow at a CAGR of 6.2% and is estimated to reach USD 13.9 billion by 2034.

- Based on the type of transformer insulation, solid insulation materials dominated the transformer insulation market, with a substantial market share of around 46.9%.

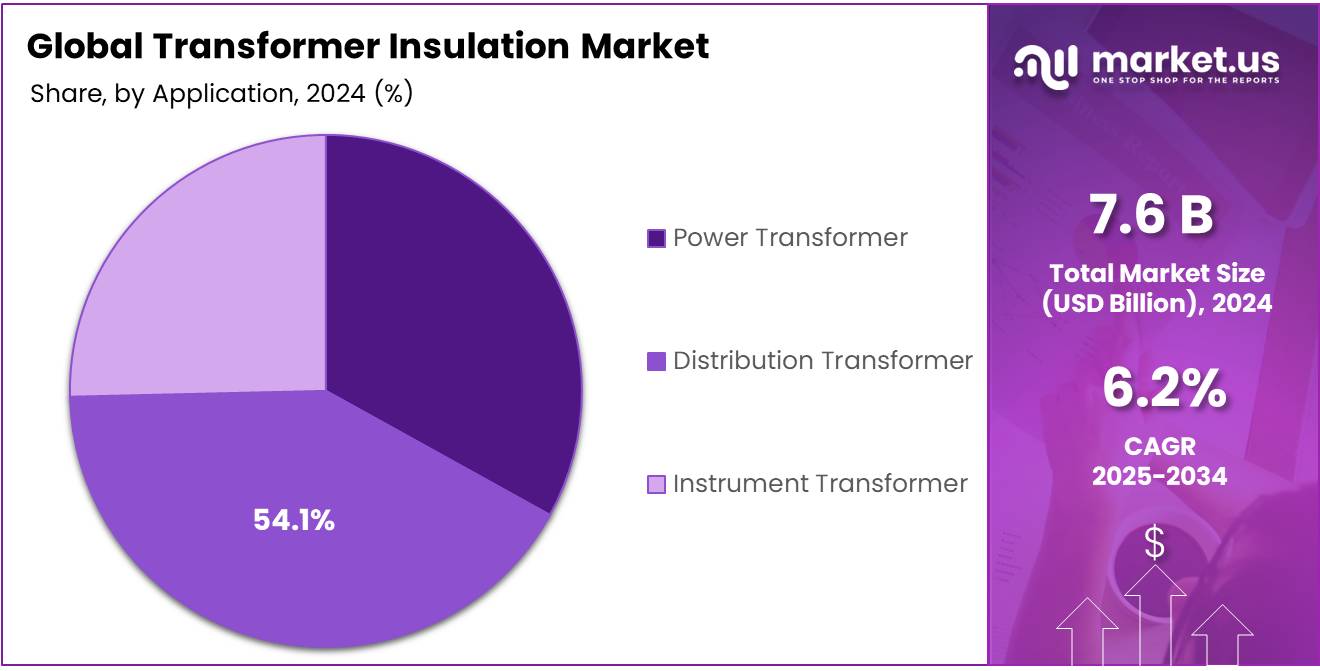

- On the basis of applications, the transformer insulation market is dominated by distribution transformers, comprising 54.1% share of the total market.

- Among the end-uses, the utility sector held a major share in the market, 47.5% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the transformer insulation market, accounting for around 41.6% of the total global consumption.

Type Analysis

Solid Insulation Materials are a Prominent Segment in the Transformer Insulation Market.

The transformer insulation market is segmented based on type as liquid insulation materials, solid insulation materials, and gas insulation. The solid insulation materials dominated the market, comprising around 46.9% of the market share, primarily due to their reliability, ease of handling, and cost-effectiveness. Solid insulation, such as paper, resin, or fiberglass, offers dielectric properties and is highly stable under a wide range of operating conditions.

In addition, it is less prone to leakage or contamination compared to liquid or gas insulation, reducing maintenance requirements and operational risks. Similarly, solid insulation is often easier to manufacture and integrate into transformer designs, making it a preferred choice for many applications. Furthermore, it provides effective thermal management, ensuring that transformers operate efficiently without the complexity of managing fluids or gases, which may require more intricate containment systems and additional safety measures.

Application Analysis

Distribution Transformers Dominated the Transformer Insulation Market.

On the basis of application, the transformer insulation market is segmented into power transformer, distribution transformer, and instrument transformer. The distribution transformer dominated the market, comprising around 54.1% of the market share, due to the higher volume and widespread use of distribution transformers in urban and industrial settings. Distribution transformers are typically smaller and more numerous, as they are essential in stepping down high-voltage electricity for local distribution to residential, commercial, and industrial consumers.

The demand for insulation materials in these transformers is driven by the demand for cost-effective, durable, and reliable solutions across a vast network of units. In contrast, power transformers, used in high-voltage transmission systems, are fewer in number and more specialized, while instrument transformers, which serve measurement and monitoring purposes, are used in smaller quantities. Consequently, the larger market for distribution transformers results in higher overall consumption of insulation materials.

End-use Analysis

The Utility Sector Held a Major Share in the Transformer Insulation Market.

Based on the end-uses, the transformer insulation market is divided into utilities, industrial, data centers, residential & commercial, and others. The utility sector held a major share in the market, with a market share of 47.5%, due to the sheer scale and critical nature of power generation, transmission, and distribution networks. Utilities are responsible for maintaining and expanding vast electrical grids that span large geographic areas, requiring a high volume of transformers at various stages of power delivery. These transformers are essential for the safe and efficient distribution of electricity, particularly in high-voltage transmission systems.

In addition, the utility sector prioritizes reliability and longevity, leading to a demand for premium insulation materials that ensure optimal transformer performance over extended periods. In contrast, while industrial and commercial sectors use transformers, their need is relatively smaller and more localized, resulting in less overall consumption of insulation materials compared to utilities.

Key Market Segments

By Type

- Liquid Insulation Materials

- Mineral Oil

- Silicone Oil

- Esters

- Solid Insulation Materials

- Cellulose Paper

- Resins

- Aramid Paper

- Others

- Gas Insulation

By Application

- Power Transformer

- Distribution Transformer

- Instrument Transformer

By End-use

- Utilities

- Industrial

- Data Centers

- Residential & Commercial

- Others

Drivers

High Demand for Electricity Drives the Transformer Insulation Market.

The increasing global demand for electricity is a primary driver of the transformer insulation market, as power generation and distribution networks expand to meet growing energy needs. According to a report by the International Energy Agency (IEA), global electricity demand increased by 4.3% in 2024, a step change from the 2.5% growth seen in 2023. Almost all regions saw an acceleration in the rate of electricity consumption growth in 2024 compared with the annual average from 2012 to 2022.

Globally, electricity consumption increased by 1,080 TWh, nearly two times the annual average of the past decade. As countries develop, the demand for reliable and efficient electrical infrastructure rises, creating a need for high-performance transformers, which in turn creates a demand for high-performance transformer insulation materials.

Additionally, electricity generation from solar PV grew by a record 475 TWh (30%). Similarly, in 2024, 121,305 megawatt new wind turbine installations took place. This shift towards renewable energy sources, such as wind and solar, necessitates advanced transformer designs to handle fluctuating loads and diverse operational conditions, creating demand for insulation materials.

Furthermore, industries such as electric vehicles (EVs), with sales hitting over 17 million in 2024, are contributing to heightened energy consumption, further propelling the demand for upgraded transformer insulation solutions to support grid stability and reliability in the face of changing electrical loads.

Restraints

The Environmental Impact of Transformers Might Delay the Growth of the Transformer Insulation Market.

The environmental impact of transformers may significantly delay the growth of the transformer insulation market. The transformers, particularly oil-transformers that are outdated or are leaking, while efficient, pose several risks, such as soil contamination, groundwater pollution, and fire hazards due to oil leaks. For instance, even small oil leaks can lead to long-term soil toxicity, with the potential to harm local ecosystems.

Additionally, regulatory pressure to adopt greener technologies and reduce emissions is increasing, encouraging the use of eco-friendly alternatives such as natural ester fluids and dry-type transformers. Despite advancements in containment and fluid technology, the potential for environmental damage and the rising cost of compliance with stricter regulations could slow market growth. The following are the regulations that strictly monitor the production and consumption of transformer insulation materials:

Standard/Directive Applicable To Environmental Focus Area ISO 14001 Manufacturers Environmental management systems RoHS/REACH Materials and components Hazardous substance control IEC 60296 / 62770 Mineral / Ester oils Fluid purity, safety, and biodegradability Eco Design Tier 2 (EU) All power transformers Efficiency and emission reduction UL 94-V / 1561 / 1741 US-certified transformers Fire resistance, green fluids IEEE C57.147 / NEMA TR 1 Oil-filled eco designs Ester fluid safety, insulation limits Opportunity

Grid Modernization Creates Opportunities in the Transformer Insulation Market.

Grid modernization is a significant driver of innovation in the transformer insulation market, creating new opportunities for advanced materials and designs. As utilities worldwide upgrade their electrical grids to meet the demands of renewable energy integration and increased power distribution efficiency, the demand for reliable, high-performance transformers has grown.

- According to a report by the IEA, around 1.5 million kilometers of new transmission lines have been built worldwide over the last decade. Similarly, Europe, the United States, China, India, and parts of Latin America are leading the investments in grid, and global investment in power transmission grew by 10% in 2023 to reach USD 140 billion.

Modern grids require transformers that can handle higher loads, variable energy sources, and fast fault detection, which places increased pressure on insulation systems. For instance, the adoption of digital technologies such as smart meters and real-time monitoring systems in power grids necessitates the use of advanced insulating materials that can withstand higher voltages and more dynamic operational conditions.

Additionally, the shift toward electric vehicles (EVs) and renewable energy sources demands transformers that are more energy-efficient and environmentally friendly. These factors have sparked the development of newer, more durable insulating fluids such as biodegradable natural esters, which contribute to greater system resilience and sustainability.

Trends

Rapid Adoption of Hybrid Insulation Systems.

The rapid adoption of hybrid insulation systems is an emerging trend in the transformer insulation market, driven by the need for more efficient and reliable power distribution solutions. Hybrid systems, which combine solid and liquid insulation materials, offer significant advantages over traditional designs.

For instance, hybrid systems allow manufacturers to reduce size, weight, and thermal stress, improving operational economics and environmental performance. A key driver behind this trend is the growing demand for transformers capable of handling high voltages in compact designs while maintaining low environmental impact.

For instance, ABB’s RecX mobile transformers use advanced hybrid insulation systems, often featuring Nomex paper with pressboard, to create compact, robust units for rapid grid recovery, combining high thermal/mechanical strength with reduced size and weight for quick deployment during outages, enhancing grid resilience. In addition, hybrid insulation systems are particularly well-suited for renewable energy applications, where transformer reliability and sustainability are paramount.

An instance includes the adoption of hybrid systems in offshore wind farms, where robust insulation is crucial due to harsh environmental conditions and the need for minimal maintenance. The trend reflects a broader shift toward smarter, greener electrical infrastructure. The following are the benefits of utilizing several combinations of insulation materials in the hybrid insulation systems:

System Type Components Key Benefit Aramid + Ester Oil High-temp solid + eco fluid Thermal class 180°C, fire-safe Cellulose + Synthetic Ester Cost-effective + sustainable Longer aging resistance Aramid + Silicone Fluid Extreme temp endurance Used in offshore and tunnels Nano-Composite Epoxy + Air Enhanced dielectric Advanced dry-type designs Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Transformer Insulation Market by Increasing the Raw Material Prices.

The geopolitical tensions have a noticeable impact on the transformer insulation market, particularly in terms of supply chain disruptions, material costs, and market stability. Ongoing conflicts, such as trade disputes and regional conflicts, have led to heightened volatility in the global supply chains of key materials used in transformer insulation, such as copper, steel, and specialized polymers. For instance, the Russia-Ukraine conflict created price surges in various raw materials, particularly steel and iron ore prices, which have been impacted, with the price of steel rising by 40% in some regions.

Similarly, conflicts in trade between the US and China have limited access to certain insulating oils and increased prices of metals, such as copper, increasing production costs of transformers. Furthermore, in a report by the IEA, it was reported that average lead times for large power transformers have increased from 14 to 17 weeks to 1 to 3 years since 2021, and the price of power transformers rose by around 75%.

Moreover, geopolitical instability has resulted in increased energy insecurity in several regions, driving some countries to prioritize energy independence and self-sufficiency. This has led to an acceleration in investments towards local grid modernization and infrastructure upgrades, benefiting the transformer insulation market.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Transformer Insulation Market.

In 2024, the Asia Pacific dominated the global transformer insulation market, holding about 41.6% of the total global consumption. The region holds the largest share of the global transformer insulation market due to its rapidly expanding infrastructure, increasing electricity demand, and significant investments in renewable energy. Countries such as China and India, with large populations and industrial sectors, have been driving substantial growth in power consumption.

For instance, according to a report by the IEA, Southeast Asia has accounted for 11% of global energy demand growth since 2010 but is projected to contribute more than 25% of the growth over the period to 2035. Similarly, India successfully met an all-time maximum power demand of 250 GW in 2024. As these nations continue to urbanize and electrify rural areas, the demand for upgraded and efficient power distribution systems has soared.

Additionally, the region is making major strides in renewable energy, with large-scale projects such as solar farms and wind power plants, requiring advanced transformer insulation solutions to ensure reliability and efficiency under dynamic operational conditions. For instance, China was the world’s largest electricity consumer in 2024, accounting for a third of global power demand, and clean generation met more than 80% of its demand growth. Furthermore, in countries such as Japan and South Korea, grid modernization efforts, coupled with a growing focus on sustainability, have contributed to the rising demand for eco-friendly insulating materials such as biodegradable ester oils and hybrid insulation systems.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the transformer insulation market employ a range of strategic activities to boost their sales and enhance market share. The companies focus on innovation in product development, with a focus on advanced and eco-friendly insulation materials such as natural ester oils, biodegradable fluids, and hybrid systems.

Additionally, companies are increasingly investing in expanding their manufacturing facilities to consistently combat the shortages of transformers. Similarly, the players emphasize offering customized solutions based on specific geographic or industry needs to differentiate themselves.

The Major Players in The Industry

- DuPont de Nemours, Inc.

- 3M Company

- Hitachi Group

- Weidmann Electrical Technology AG

- Cargill, Incorporated

- Krempel GmbH

- Elantas

- Huntsman International LLC.

- Ahlstrom

- delfortgroup AG

- Nordic Paper Holding AB

- TOMOEGAWA CORPORATION

- Cottrell Paper Company

- Svenska Lindningsmaterial AB

- Röchling Group

- Other Key Players

Key Development

- In March 2025, Hitachi Energy announced major investments of more than US$250 million by 2027 to expand global production of critical components for transformers, which include bushings and insulation.

- In February 2023, Cargill launched FR3r natural ester, a transformer insulating fluid made from more than 95 % rapeseed oil.

Report Scope

Report Features Description Market Value (2024) US$7.6 Bn Forecast Revenue (2034) US$13.9 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Liquid Insulation Materials, Solid Insulation Materials, and Gas Insulation), By Application (Power Transformer, Distribution Transformer, and Instrument Transformer), By End-Use (Utilities, Industrial, Data Centres, Residential & Commercial, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape DuPont de Nemours, Inc., 3M Company, Hitachi Group, Weidmann Electrical Technology AG, Cargill, Incorporated, Krempel GmbH, Elantas, Huntsman International LLC., Ahlstrom, Delfortgroup AG, Nordic Paper Holding AB, Tomoegawa Corporation, Cottrell Paper Company, Svenska Lindningsmaterial AB, Röchling Group, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Transformer Insulation MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Transformer Insulation MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- DuPont de Nemours, Inc.

- 3M Company

- Hitachi Group

- Weidmann Electrical Technology AG

- Cargill, Incorporated

- Krempel GmbH

- Elantas

- Huntsman International LLC.

- Ahlstrom

- delfortgroup AG

- Nordic Paper Holding AB

- TOMOEGAWA CORPORATION

- Cottrell Paper Company

- Svenska Lindningsmaterial AB

- Röchling Group

- Other Key Players