Global Trams Market Size, Share, Growth Analysis By Type (60-150 Passengers, Below 60 Passengers, Above 150 Passengers), By Operation (Manned Trams, Driverless Trams), By Technology (Electric and Hybrid, Conventional), By Track Type (Double Track, Single Track, Mixed Track), By Infrastructure (Surface, Tunnel, Bridge), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161510

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

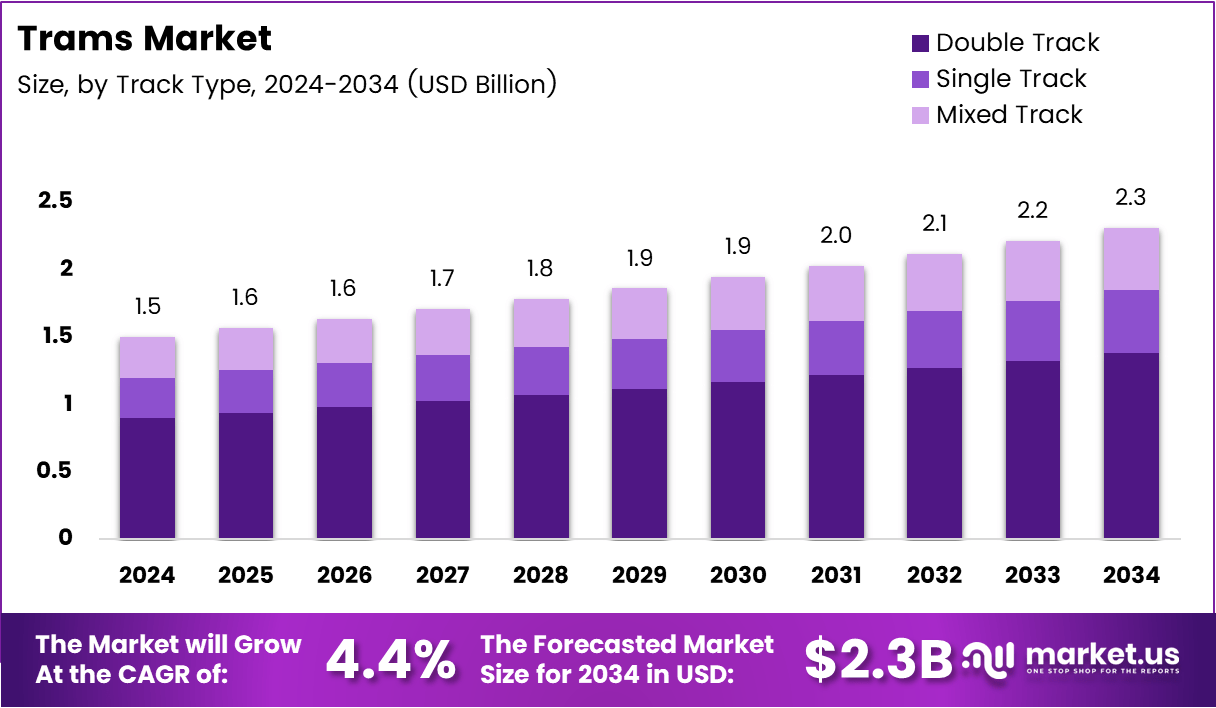

The Global Trams Market size is expected to be worth around USD 2.3 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Trams are an essential mode of sustainable urban transport, offering efficient, low-emission, and high-capacity mobility for growing cities. They connect residential and commercial areas, reducing road congestion and pollution. Moreover, modern tram systems integrate with metro and bus networks, supporting seamless public transport and driving urban development through eco-friendly mobility solutions.

Over the past decade, the tram industry has evolved rapidly, driven by digitalization, smart ticketing, and energy-efficient propulsion technologies. Cities are shifting from fossil fuel–based transit toward electric tramways to meet carbon neutrality targets. Consequently, tram manufacturers are focusing on lightweight materials, automation, and improved passenger comfort to enhance operational efficiency and sustainability.

The trams market is experiencing notable expansion due to rising urbanization and infrastructure modernization. Governments across Europe and Asia are heavily investing in light rail systems to improve city connectivity. This growth is also supported by public demand for affordable, reliable transport, encouraging operators to expand tram networks and modernize fleets globally.

Furthermore, favorable regulations and public–private partnerships are accelerating market development. Policy support for green mobility and urban regeneration encourages city planners to prioritize tram projects. Additionally, sustainable financing and technology collaborations between OEMs and municipalities are fostering competitive opportunities for both established and emerging tram manufacturers.

According to Industry Report, EU rail passenger-kilometers reached 429 billion in 2023, marking an 11.2% increase from 2022—a record high reflecting strong demand for rail-based urban mobility. Likewise, the UK Department for Transport reported 228.8 million light rail and tram journeys in England by March 2024, up 8% year-on-year.

Moreover, the European Investment Bank (EIB) approved €400 million in April 2025 for Helsinki’s Crown Bridges LRT and €16.5 million in December 2024 for renewing tram systems in Ukrainian cities. These strategic investments highlight sustained confidence in the trams market’s long-term potential and underscore its critical role in advancing sustainable, accessible, and smart urban transportation solutions.

Key Takeaways

- The Global Trams Market is projected to reach USD 2.3 Billion by 2034, growing from USD 1.5 Billion in 2024 at a CAGR of 4.4%.

- 60–150 Passengers segment led the market with a 58.9% share in 2024, favored for medium-density urban routes and operational flexibility.

- Manned Trams dominated the operation segment with an 89.3% share, reflecting strong preference for human-controlled systems in complex city traffic.

- Electric and Hybrid Trams captured a 67.8% share, driven by clean-energy adoption and supportive government policies.

- Double Track Systems accounted for 61.6% share, ensuring higher capacity, reduced delays, and smoother bi-directional flow.

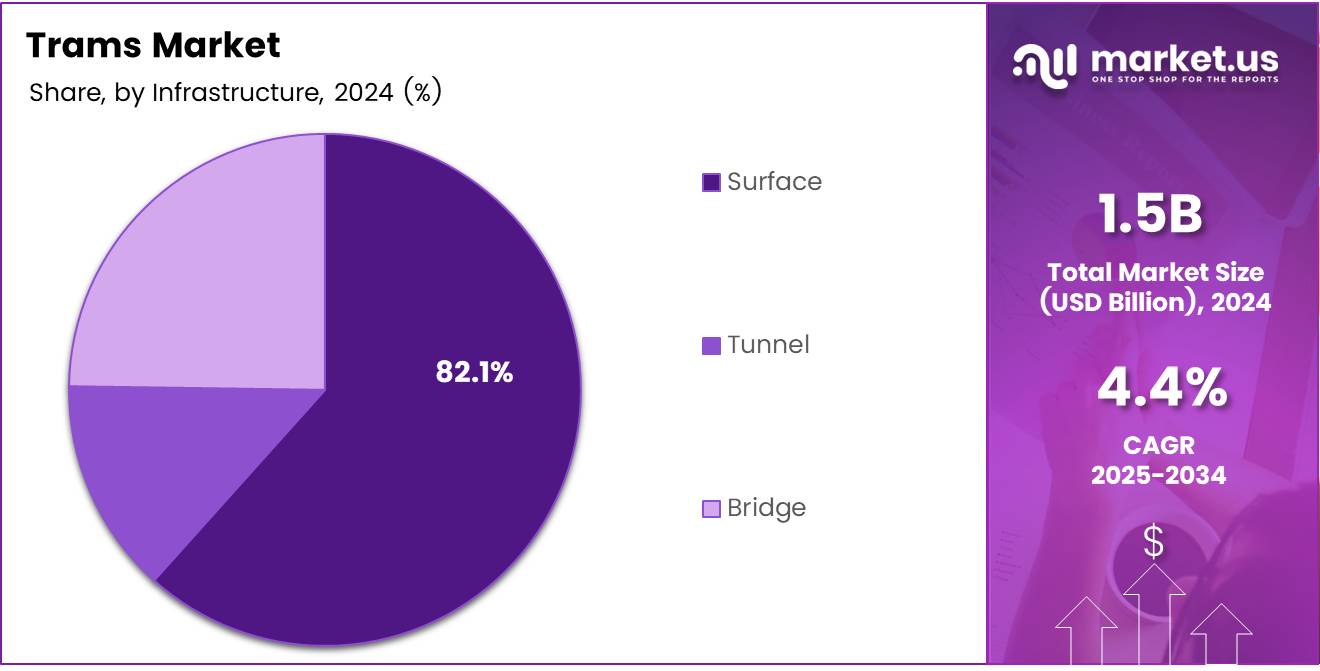

- Surface Trams remained dominant with an 82.1% share, due to cost efficiency, easier access, and compatibility with urban layouts.

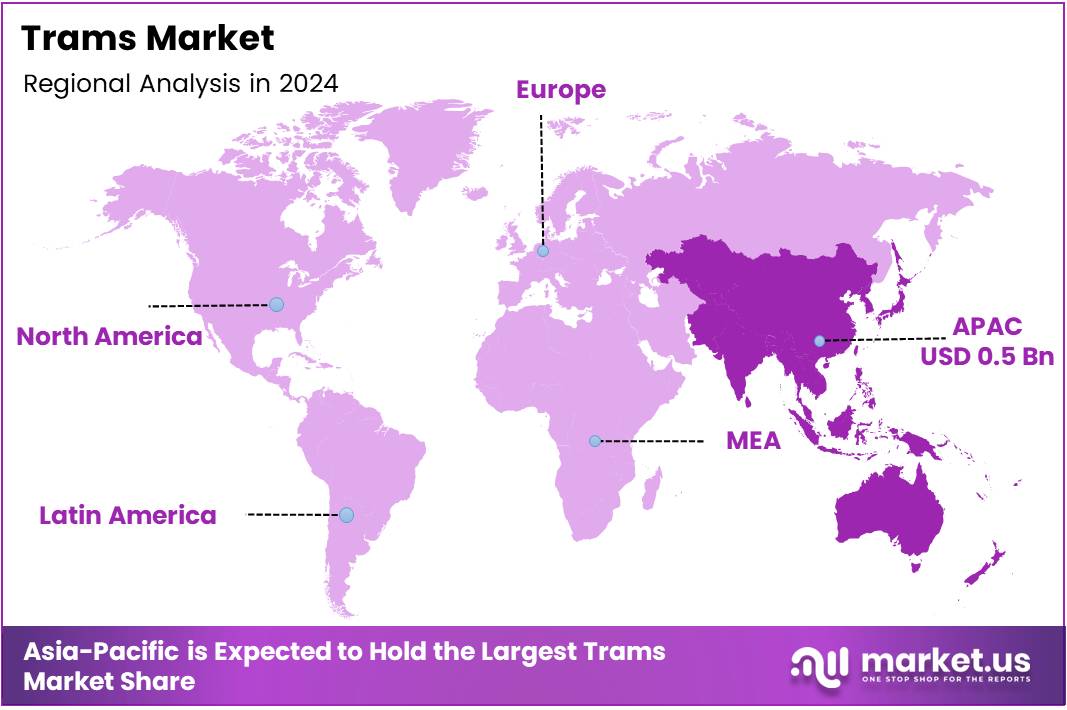

- Asia Pacific led the global market with 35.8% share, valued at USD 0.5 Billion, supported by rapid urbanization and sustainable transport initiatives.

By Type Analysis

60–150 Passengers dominates with 58.9% due to its balanced capacity and adaptability for urban transit systems.

In 2024, 60–150 Passengers held a dominant market position in the By Type Analysis segment of the Trams Market, with a 58.9% share. This segment’s dominance is attributed to its efficiency in serving medium-density urban routes, providing an ideal mix of passenger capacity, cost-effectiveness, and operational flexibility.

The Below 60 Passengers segment focuses on smaller trams designed for short routes and limited ridership areas. These trams are ideal for small cities or suburban zones where demand for public transport is moderate. Their compact design and lower maintenance costs continue to support adoption in developing transit networks.

The Above 150 Passengers segment caters to high-capacity routes, often in large metropolitan cities. These trams are built for efficiency and speed, helping manage peak-hour passenger volumes. Despite their potential, higher infrastructure costs and space constraints limit their deployment compared to medium-capacity models.

By Operation Analysis

Manned Trams dominate with 89.3% due to operational reliability and safety control advantages.

In 2024, Manned Trams held a dominant market position in the By Operation Analysis segment of the Trams Market, with a 89.3% share. Human-operated trams ensure better adaptability to real-time traffic conditions and passenger management, which supports their continued dominance in both developed and emerging cities.

The Driverless Trams segment is emerging with advancements in autonomous technologies. These systems reduce operational costs and improve scheduling precision. However, limited regulatory frameworks and public safety concerns currently restrict large-scale adoption, though steady innovation is expected to enhance their future market share.

By Technology Analysis

Electric and Hybrid dominates with 67.8% due to sustainability goals and lower emissions.

In 2024, Electric and Hybrid trams held a dominant market position in the By Technology Analysis segment of the Trams Market, with a 67.8% share. Their increasing popularity is driven by growing environmental awareness, efficient power usage, and government initiatives promoting clean transportation.

The Conventional segment, although declining, remains relevant in regions where modernization is gradual. These trams use traditional energy sources and require less technical expertise for maintenance. However, environmental regulations and fuel costs continue to shift focus toward more sustainable alternatives.

By Track Type Analysis

Double Track dominates with 61.6% due to enhanced capacity and improved service frequency.

In 2024, Double Track held a dominant market position in the By Track Type Analysis segment of the Trams Market, with a 61.6% share. Double tracks enable smoother, bi-directional operations, reducing delays and supporting higher traffic volumes across major urban routes.

The Single Track segment is used primarily in smaller towns or areas with budget constraints. It provides cost-effective installation and maintenance but limits operational flexibility, leading to slower service and lower frequency.

The Mixed Track segment combines both single and double track configurations, offering adaptable solutions for cities transitioning their tram networks. It allows incremental upgrades while managing urban space efficiently, though complexity in scheduling can be a drawback.

By Infrastructure Analysis

Surface dominates with 82.1% due to ease of construction and lower infrastructure costs.

In 2024, Surface trams held a dominant market position in the By Infrastructure Analysis segment of the Trams Market, with a 82.1% share. Surface-level trams are favored for their accessibility, affordability, and integration with existing city layouts. They continue to be the backbone of most urban tram systems worldwide.

The Tunnel segment supports high-density urban areas where surface congestion is a challenge. Although expensive, underground tramways offer faster routes and reduced interference with road traffic, making them suitable for advanced urban planning.

The Bridge segment includes tram lines constructed over elevated structures, connecting regions divided by rivers or roads. These systems enhance connectivity and urban aesthetics but require significant capital investment and regular maintenance to ensure long-term safety and performance.

Key Market Segments

By Type

- 60-150 Passengers

- Below 60 Passengers

- Above 150 Passengers

By Operation

- Manned Trams

- Driverless Trams

By Technology

- Electric and Hybrid

- Conventional

By Track Type

- Double Track

- Single Track

- Mixed Track

By Infrastructure

- Surface

- Tunnel

- Bridge

Drivers

Rising Urbanization and Expansion of Public Transit Infrastructure Drives Tram Market Growth

The growth of cities and the rise in urban populations are major drivers for the tram market. As cities become more crowded, there is a stronger need for efficient, reliable, and eco-friendly public transport. Trams offer a convenient solution by reducing road congestion and providing smooth mobility in densely populated areas.

Governments across the world are expanding their public transit networks to meet rising commuter demand. Many cities are investing in modern tram systems as part of their sustainable urban mobility plans. This expansion not only improves connectivity but also supports the shift toward low-emission transportation.

In addition, there is a growing push for smart and connected tram networks. With the use of digital systems, real-time data, and automation, cities are enhancing passenger safety and operational efficiency. These smart features attract more passengers and reduce service delays.

Renewable energy adoption in tram operations is another major trend supporting market growth. Many tram networks are now powered by solar and wind energy, helping cities reduce their carbon footprint. Together, these factors are creating a strong foundation for the continued growth of the global tram market.

Restraints

High Capital and Maintenance Costs for Tram Infrastructure Limit Market Expansion

One of the major challenges in the tram market is the high initial investment needed for building infrastructure. Setting up tram tracks, power lines, and stations requires significant financial resources, which can be difficult for many cities to manage.

Maintenance costs also remain high, as trams require regular servicing of tracks, vehicles, and electrical systems to ensure safety and performance. These recurring expenses can burden local authorities, especially in regions with limited budgets.

Another restraint is the lower flexibility of trams compared to buses and metro systems. Since trams operate on fixed tracks, any disruption or maintenance work can easily cause service delays. This limitation makes them less adaptable in rapidly changing urban environments.

Moreover, tram development projects often face delays due to dependence on government funding and lengthy procurement processes. Such financial and bureaucratic hurdles slow down the expansion of new tram lines, affecting overall market growth.

Growth Factors

Integration of Trams with Multimodal Smart Mobility Platforms Creates Growth Opportunities

The global tram market is witnessing new growth opportunities through the integration of trams with smart mobility platforms. By connecting trams with other public transport modes like buses, metros, and shared mobility, cities can offer seamless and efficient travel options for passengers.

Emerging economies and secondary cities are increasingly adopting tram systems to improve urban connectivity. These regions present huge opportunities for manufacturers and service providers as they work to develop cost-effective and sustainable transit systems.

Technological innovations such as wireless power transfer and battery-operated trams are transforming the industry. These systems reduce the need for overhead cables, lower operational costs, and make trams more energy-efficient.

Collaboration between tram manufacturers (OEMs) and municipal authorities is also creating a pathway for green transit development. Joint projects are helping cities upgrade infrastructure while ensuring environmental goals are met. This growing cooperation will play a key role in expanding the global tram market in the coming years.

Emerging Trends

Shift Toward Autonomous and Driverless Tram Technologies Shapes Market Trends

The tram market is experiencing a technological shift with the rise of autonomous and driverless trams. These innovations aim to enhance safety, reduce human error, and lower operational costs. Automated trams are already being tested in several cities, setting the stage for next-generation urban mobility.

Real-time passenger information systems and IoT solutions are also becoming common in modern tram networks. These technologies allow passengers to access live updates, track routes, and improve travel experiences, making trams a more convenient and reliable transport option.

Manufacturers are focusing on lightweight materials and modular designs to make trams more energy-efficient and easier to maintain. Lighter vehicles consume less power, while modular construction enables easier upgrades and customization.

Finally, the development of hybrid and hydrogen-powered trams is gaining attention as cities move toward zero-emission transport. These advanced models combine sustainability with performance, helping reduce dependence on fossil fuels. Together, these trends are reshaping the future of the global tram industry.

Regional Analysis

Asia Pacific Dominates the Trams Market with a Market Share of 35.8%, Valued at USD 0.5 Billion

The Asia Pacific region holds the largest share of the global trams market, accounting for 35.8%, valued at USD 0.5 Billion. The growth is driven by rapid urbanization, expanding metro networks, and significant investments in sustainable public transportation across major economies such as China, Japan, and India. Government initiatives promoting low-emission mobility and the modernization of transport infrastructure continue to strengthen the region’s dominance in the trams market.

North America Trams Market Trends

The North American trams market is experiencing steady growth, supported by increasing investments in urban mobility solutions and the revitalization of existing rail systems. The United States and Canada are focusing on integrating smart technologies and expanding light rail transit to reduce traffic congestion and carbon emissions. Rising public preference for efficient and eco-friendly transportation further propels regional market growth.

Europe Trams Market Trends

Europe remains one of the most mature markets for trams, characterized by a well-established rail infrastructure and a strong emphasis on sustainable mobility. Several European nations are upgrading their tram systems to meet modern efficiency and environmental standards. The region’s commitment to reducing carbon footprints and enhancing public transportation accessibility continues to drive market development.

Middle East and Africa Trams Market Trends

The trams market in the Middle East and Africa is gradually expanding, led by infrastructure modernization projects in urban centers. Growing investments in smart city initiatives and tourism-focused transport systems are creating new opportunities. Governments are increasingly recognizing the role of trams in reducing congestion and supporting environmentally sustainable mobility.

Latin America Trams Market Trends

Latin America’s trams market is emerging, driven by efforts to modernize urban transport networks and address growing traffic challenges. Countries in the region are exploring tram systems as cost-effective, sustainable alternatives to road-based transit. Public-private partnerships and government-backed infrastructure programs are expected to stimulate further development in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Trams Company Insights

The Global Trams Market in 2024 is marked by strong competition among established players who are focusing on technological innovation, sustainable design, and expanding their urban mobility solutions. The first four industry leaders—Alstom, Hitachi Rail Italy SpA, Bombardier, and Stadler Rail AG—continue to shape market dynamics through strategic partnerships and modernization initiatives.

Alstom has maintained a leading position by delivering advanced tram systems emphasizing energy efficiency and passenger comfort. The company’s commitment to smart mobility solutions and continuous R&D investment has reinforced its dominance in Europe and emerging urban centers globally.

Hitachi Rail Italy SpA is accelerating innovation in smart rail solutions by integrating digital signaling and automated technologies. Its strong portfolio of electric trams supports the shift toward zero-emission urban transport, aligning with sustainability goals in major European and Asian cities.

Bombardier, now part of Alstom’s portfolio, has continued influencing the tram market with its modular and low-floor tram designs. Its Flexity platform remains widely adopted, offering customizable options for various city infrastructures and contributing to reduced operational costs and energy usage.

Stadler Rail AG has expanded its footprint by focusing on lightweight and energy-efficient tram models tailored for mixed urban environments. The company’s emphasis on modularity, reliability, and passenger safety has enhanced its competitiveness, especially in Central and Eastern Europe.

Collectively, these players are driving advancements in urban transport, supporting global goals of decarbonization, and reshaping city mobility networks through innovation and modernization initiatives.

Top Key Players in the Market

- Alstom

- Hitachi Rail Italy SpA

- Bombardier

- Stadler Rail AG

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A

- Siemens

- LUCCHINI RS S.P.A.

- Others

Recent Developments

- In December 2024, the European Investment Bank (EIB) committed €16.5 million to modernize urban transport across Kyiv, Mykolaiv, Odesa, and Ivano-Frankivsk, supporting the procurement of new trams, spare parts, and maintenance equipment.

- In April 2025, the EIB approved a €400 million financing package to develop a tram line connecting Helsinki’s eastern suburbs, including a new tram and bus depot and vehicle procurement.

- In March 2025, Portugal’s Council of Ministries sanctioned an additional €150 million to advance the Lisbon light-rail/tram extension project covering the Odivelas–Loures corridor.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (60-150 Passengers, Below 60 Passengers, Above 150 Passengers), By Operation (Manned Trams, Driverless Trams), By Technology (Electric and Hybrid, Conventional), By Track Type (Double Track, Single Track, Mixed Track), By Infrastructure (Surface, Tunnel, Bridge) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Alstom, Hitachi Rail Italy SpA, Bombardier, Stadler Rail AG, CAF, Construcciones y Auxiliar de Ferrocarriles, S.A, Siemens, LUCCHINI RS S.P.A., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alstom

- Hitachi Rail Italy SpA

- Bombardier

- Stadler Rail AG

- CAF, Construcciones y Auxiliar de Ferrocarriles, S.A

- Siemens

- LUCCHINI RS S.P.A.

- Others