Global Tour Operator Software Market Size, Share, Industry Analysis Report By Deployment Mode (Cloud-Based/SaaS, On-Premise), By Application (Booking & Reservation Management, Inventory Management, Customer Relationship Management (CRM), Financial Management & Accounting, Supplier Management, Others), By Subscription Type (One-time Subscription, Monthly Subscription, Annual Subscription), By End-User (Tour Operators & Incoming Agencies (DMCs), Activity & Experience Providers, Travel Agencies), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162953

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

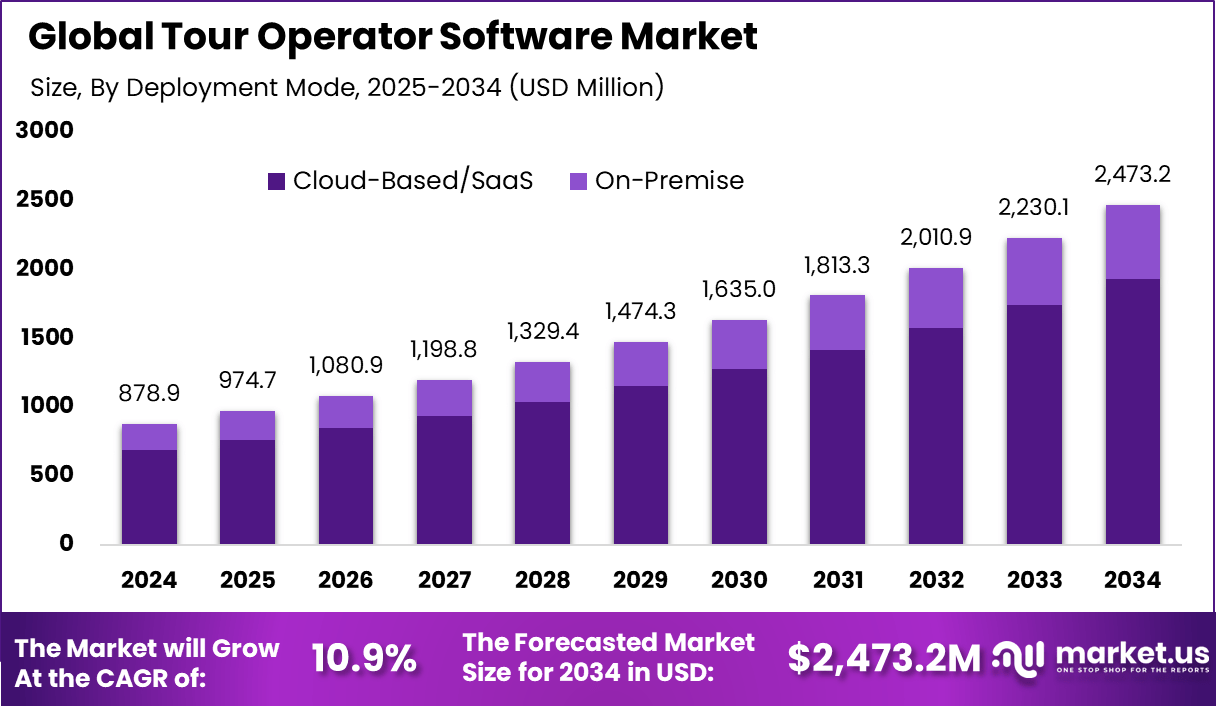

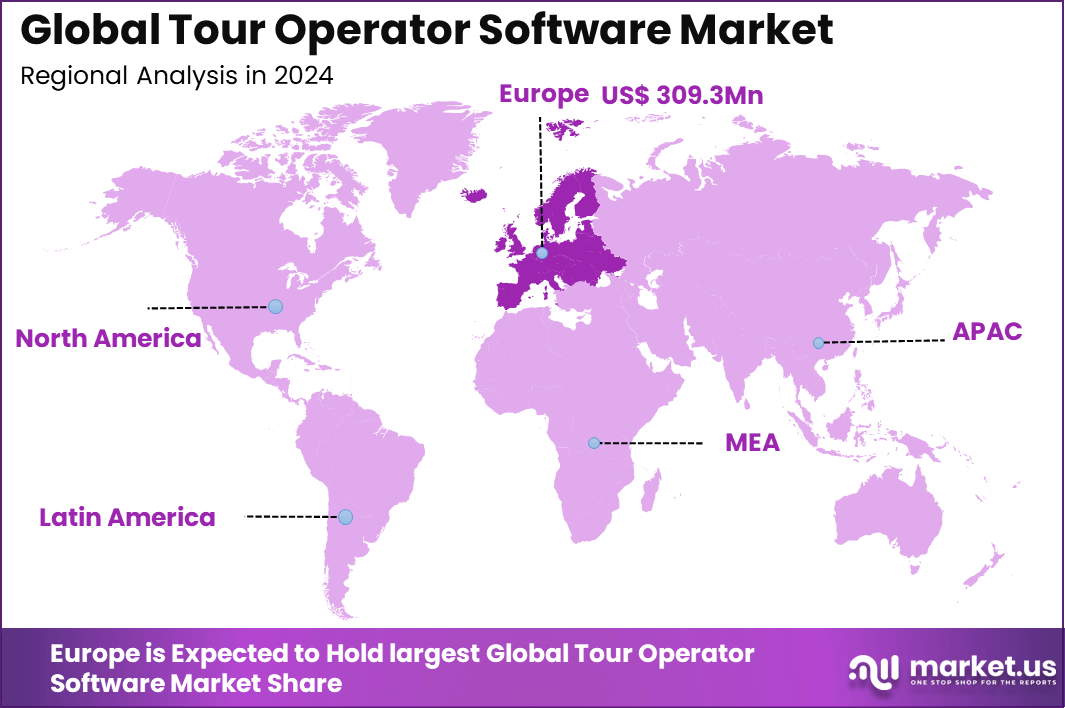

The Global Tour Operator Software Market generated USD 878.9 Million in 2024 and is predicted to register growth from USD 974.7 Million in 2025 to about USD 2,473.2 Million by 2034, recording a CAGR of 10.9% throughout the forecast span. In 2024, Europe held a dominan market position, capturing more than a 35.2% share, holding USD 309.3 Million revenue.

The tour operator software market refers to software platforms that allow travel companies and tour operators to manage booking, inventory, itinerary creation, customer relationship management, payments and reporting in a unified system. These solutions are increasingly delivered via cloud-based architectures, accessible through web and mobile interfaces, and are aimed at improving operational efficiency, cost control and customer experience.

One of the primary driving factors is the increasing digitisation of the travel and tourism sector and the rising volume of online travel bookings. This trend has compelled tour operators to adopt software that can integrate booking channels, manage dynamic pricing, and handle large volumes of itinerary changes. For example, the shift to cloud-based, mobile-friendly systems enables operators to interact with customers in real time and respond to changes in demand.

According to Market.us, The Global Travel Planner App Market is projected to reach USD 1,445.1 billion by 2032, increasing from USD 544.1 billion in 2023, with a strong CAGR of 11.9% during the forecast period. Growth is driven by the rising use of mobile applications for personalized itinerary management, cost comparison, and real-time travel updates.

The Global Online Travel Agencies Software Market is expected to expand from USD 3.2 billion in 2024 to about USD 13.5 billion by 2034, registering a CAGR of 15.5%. In 2024, North America led the market, accounting for more than 37.2% share and generating USD 1.19 billion in revenue. The region’s dominance is supported by strong digital adoption, integration of AI-based booking systems, and advanced analytics tools enhancing customer experience.

Meanwhile, the Global AI in Travel Market is anticipated to grow from USD 131.7 billion in 2023 to approximately USD 2,903.7 billion by 2033, advancing at a remarkable CAGR of 36.25%. This growth is driven by the integration of artificial intelligence in travel planning, chatbots, dynamic pricing engines, and predictive analytics, enabling travel companies to deliver more efficient, customized, and seamless user experiences.

The increasing adoption of advanced technologies such as AI, machine learning, blockchain, and IoT is transforming the sector. These technologies help automate routine tasks like itinerary planning and resource management, reducing manual labor by up to 60%. Blockchain is emerging to improve payment security and transparency, while IoT integration supports real-time activity tracking and health safety monitoring, critical in the post-pandemic travel environment.

Top Market Takeaways

- Cloud-Based/SaaS deployment dominated with 78.3%, driven by the growing demand for flexible, cost-efficient, and easily accessible travel management platforms.

- Booking & Reservation Management applications accounted for 30.5%, reflecting their importance in automating itinerary planning, real-time availability, and payment integration.

- The Monthly Subscription model held 62.7%, highlighting user preference for predictable pricing and reduced upfront costs.

- Tour Operators and Incoming Agencies (DMCs) captured 55.1%, emphasizing their reliance on digital tools for handling large customer bases and complex travel operations.

- Small and Medium Enterprises (SMEs) led with 80.6%, as smaller operators increasingly adopt SaaS-based platforms to streamline operations and enhance competitiveness.

- Europe represented 35.2% of the global market, supported by a mature tourism sector and strong digital transformation across travel services.

- Germany reached a valuation of USD 45.79 Million in 2024, expanding at a steady 8.5% CAGR, driven by the adoption of cloud-based systems for efficient tour management and customer engagement.

Role of Generative AI

Generative AI is becoming a vital tool in tour operator software, changing how travel companies design and deliver personalized experiences. Around 46% of travel companies cite Generative AI as their top priority for 2025, showing its growing importance in operational strategies.

This technology enables the automation of complex tasks like itinerary planning, which can reduce time spent by nearly 40%, while also helping companies create tailored travel recommendations that meet unique traveler needs.

The adoption trend is strongest in Asia Pacific, with 61% of firms prioritizing Generative AI, highlighting regional leadership in this innovation. With more than 50% of travel technology leaders acknowledging Generative AI’s significant presence in the industry already, the technology is transforming customer service and marketing approaches.

It helps generate personalized content quickly, improving customer engagement and satisfaction. AI also supports dynamic pricing and real-time itinerary changes, adapting to traveler preferences and market conditions. Therefore, generative AI does not just streamline backend processes but also enhances the overall travel experience by making it more customized and responsive.

Investment and Business Benefits

Investment opportunities in the Tour Operator Software Market are significant due to growing demand for innovative features and expanding travel sectors worldwide. Investors and software developers are focusing on AI-driven analytics, cloud computing, and mobile applications. The increasing number of travel operators moving towards digital transformation opens up chances for new entrants to capture market share by delivering cost-effective and modular software solutions.

Moreover, the emphasis on sustainability presents opportunities for software that supports eco-friendly tourism practices through carbon footprint tracking and resource optimization. The business benefits of adopting tour operator software are substantial. Operators see improved operational efficiency, better customer engagement, and reduced manual work that cuts down on errors and costs.

Automated billing, real-time inventory management, and integrated CRM systems help companies streamline workflows and increase revenue. About 45% of small to mid-sized operators still struggle with initial setup costs, but those who invest in these platforms report up to 40% reduced planning time and higher customer retention rates. These efficiencies also empower businesses to scale rapidly and adapt to market changes.

Europe Market Size

Europe holds approximately 35.2% of the tour operator software market, supported by advanced digital adoption and strong tourism infrastructure. European operators use specialized tools to handle multilingual content, cross-border payments, and regulation-compliant travel management.

Cloud integration in this region has been vital for maintaining customer engagement across online travel platforms and traditional agencies. Germany, contributing about 45.79 million in market value, stands out for its rapid adoption rate, with an estimated CAGR of 8.5%.

Its tourism firms are actively digitizing distribution networks and enhancing personalized tour offerings using software-driven solutions. As a mature travel hub with strong outbound and inbound tourism, Germany continues to lead innovation in automation, customer analytics, and integrated online booking platforms in Europe.

Emerging Trends

One emerging trend is the rise of AI-powered personalization, where nearly 98% of travel executives expect AI to transform the sector significantly in the coming years. This shift supports travelers growing demand for bespoke itineraries and seamless booking processes.

Mobile-first booking solutions also dominate, with 60% of online travel activity now happening on mobile devices, pushing operators to prioritize mobile-friendly interfaces and apps. Another trend focuses on ecosystem integration, where tour operators are increasingly connected to multiple sales channels including online travel agencies and local resellers.

Real-time inventory management and API integrations are crucial, with software platforms automating 50–60% of itinerary planning processes. These trends reflect the increasing complexity and sophistication of booking systems that cater to both consumer needs and operational efficiency.

Growth Factors

A key growth factor is the surge in online travel bookings, with 70% of travelers preferring digital platforms to manage their trips and payments. This shift drives demand for advanced software capable of handling volume spikes and diverse travel products like tours, activities, and transport.

Increased traveler confidence and pent-up demand post-pandemic have expanded the market beyond previous levels, reinforcing the need for scalable, cloud-based solutions. Another vital driver is the growing use of automation and AI in streamlining operations.

Tour operator software now integrates features like chatbots, automated confirmations, and resource allocation algorithms to enhance efficiency. Approximately 45% of operators report that lower setup and licensing costs would encourage wider adoption, signaling that affordability and ease of use are important factors for market expansion.

Technology and Implementation Trends

- Cloud-based deployment: More than 65% of tour operators prefer cloud-based systems because they provide accessibility, cost-effectiveness, and scalability.

- AI and personalization: Artificial intelligence is increasingly integrated into booking platforms. AI-powered chatbots and personalized recommendations are enhancing customer service and delivering tailored experiences.

- Mobile-first platforms: With the growing dominance of mobile bookings, responsive and mobile-friendly interfaces are now essential for sustaining conversion rates and meeting customer expectations.

- Integration with marketplaces: Leading systems connect with major platforms such as Viator and GetYourGuide, enabling direct inventory synchronization and expanded global reach.

- Sustainable travel: In response to consumer demand, booking software is incorporating features to highlight eco-friendly options and track the environmental impact of tours, supporting sustainability goals.

Benefits for Operators

- Reduced manual workload: Automation of bookings, invoicing, and customer communications can cut down on administrative tasks, enabling staff to focus on higher-value activities.

- Improved efficiency: Centralized management systems streamline workflows. Automated scheduling and reporting improve operational efficiency, allowing teams to redirect efforts toward strategic initiatives.

- Enhanced customer experience: A seamless digital journey that includes instant confirmations and personalized communications leads to higher customer satisfaction and stronger brand loyalty.

- Wider market reach: A continuous 24/7 online presence, combined with integration into online travel agencies (OTAs), enables operators to capture both local and international audiences more effectively.

- Data-driven decisions: Analytics dashboards provide operators with insights into sales, customer preferences, and booking trends, supporting evidence-based decision-making.

- Scalability: Cloud-based platforms and API integrations give businesses the flexibility to expand their offerings and scale operations efficiently without proportionate increases in overhead.

Key Market Segments

By Deployment Mode

- Cloud-Based/SaaS

- On-Premise

By Application

- Booking & Reservation Management

- Inventory Management

- Customer Relationship Management (CRM)

- Financial Management & Accounting

- Supplier Management

- Others

By Subscription Type

- One-time Subscription

- Monthly Subscription

- Annual Subscription

By End-User

- Tour Operators & Incoming Agencies (DMCs)

- Activity & Experience Providers

- Travel Agencies

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Growing Demand for Personalized Travel Experiences

The surge in traveler demand for personalized and seamless travel experiences is a major growth driver for the tour operator software market. Tour operators increasingly rely on advanced software platforms that utilize AI and machine learning to tailor itineraries to individual preferences. This ability to offer customized trips elevates customer satisfaction and loyalty, encouraging service providers to invest more in robust digital tools.

Additionally, cloud-based solutions enable real-time updates and streamlined booking processes that enhance operational efficiency and customer service quality. These capabilities address evolving traveler expectations and support business growth in a competitive tourism landscape. At the same time, heightened digital literacy and smartphone penetration across key regions facilitate easier adoption and usage of these software solutions by both operators and travelers.

Governments supporting digital infrastructure upgrades in high-growth markets further bolster this trend, creating a conducive environment for wider software deployment. As a result, the market benefits from a positive feedback loop where improved technology meets rising consumer demands, driving steady expansion.

Restraint

High Initial Implementation Costs

Despite the growing need for sophisticated tour operator software, the high upfront costs of implementation act as a restraint. Small and medium-sized enterprises (SMEs), which form a large part of the tour operator segment, often face budget constraints that deter them from adopting new technology. Additional costs arise from integrating these software solutions with existing legacy systems, requiring specialized technical expertise and ongoing training.

Such financial and operational challenges reduce scalability for smaller operators and slow overall market penetration. Moreover, continuous software updates and maintenance demand consistent investment, which can be challenging for operators balancing tight margins amid fluctuating tourism trends.

These high entry costs create a significant barrier especially in developing regions where operators are reluctant or unable to allocate sufficient resources, negatively impacting market growth rates. This restraint emphasizes the need for cost-effective, modular solutions that can cater to a wider range of operator sizes and financial capabilities.

Opportunity

Expansion in Emerging Markets

Emerging markets present a substantial growth opportunity for the tour operator software industry. Regions such as Southeast Asia, Sub-Saharan Africa, and Latin America are experiencing rapid digital transformation fueled by rising mobile internet usage and expanding tourism sectors. Local operators in these markets are increasingly adopting digital solutions to improve efficiency and reach a growing base of tech-savvy travelers.

This creates fertile ground for software providers to introduce tailored, scalable platforms designed for regional needs and budget levels. In addition, government initiatives in many emerging economies actively promote tourism recovery and growth through digital infrastructure investments and supportive regulatory frameworks.

These efforts spur technology adoption in travel-related industries, encouraging partnerships and innovation. Software companies that can successfully localize their offerings to meet language, regulatory, and cultural needs stand to capture significant market share in these high-potential areas.

Challenge

Data Security and Privacy Concerns

Data security and privacy present a critical challenge for the tour operator software market. These platforms handle extensive personal and payment data, making them attractive targets for cyberattacks. Tour operators must comply with strict data protection regulations like GDPR, which requires robust safeguards to avoid legal penalties and reputational damage.

Ensuring ongoing cybersecurity compliance demands significant resources and expertise often beyond the reach of smaller businesses. Furthermore, rising customer awareness about data privacy increases pressure on providers to demonstrate transparent and secure data handling practices. Any breach or perceived inadequacy can undermine trust, resulting in loss of clientele and business opportunities.

The complex and fragmented nature of tourism regulations across different countries adds layers of operational difficulty, forcing software developers and operators to navigate diverse compliance landscapes carefully. This challenge requires continuous investment in security technologies and staff training to maintain market credibility and foster sustainable growth.

Competitive Analysis

The Tour Operator Software Market is led by major global travel technology providers such as Amadeus IT Group SA, Sabre, and Traveltek. These companies offer advanced travel management platforms that automate booking, pricing, and itinerary creation for tour operators and travel agencies. Their cloud-based systems enable real-time inventory tracking, customer management, and multi-channel distribution, improving efficiency and enhancing the traveler experience.

Prominent solution providers including FareHarbor, GP Solutions GmbH, Qtech Software Pvt Ltd., Rezdy Pty Ltd., and Dolphin Dynamics Ltd. focus on developing scalable, API-driven software designed for both small and large travel operators. Their offerings include online booking engines, dynamic packaging tools, and automated payment solutions, supporting global connectivity across hotels, flights, and local tours.

Emerging and regional players such as WeTravel Inc., Trawex Technologies Private Limited, SAN Tourism Software Group, Checkfront Inc., Techno Heaven Consultancy Pvt Ltd., Tourwriter, Travelogic, Travefy Inc., Vacation Labs Private Limited, Centaur Systems LLC, Adventure Bucket List LLC, ResRequest, and other contributors are driving innovation through mobile integration, AI-powered personalization, and analytics-based customer insights.

Top Key Players in the Market

- Traveltek

- Sabre

- FareHarbor

- Amadeus IT Group SA

- Infotree Solutions Ltd.

- GP Solutions GmbH

- WeTravel Inc.

- TraveloPro Ltd.

- Qtech Software Pvt Ltd.

- Rezdy Pty Ltd.

- Dolphin Dynamics Ltd.

- SAN Tourism Software Group

- Trawex Technologies Private Limited

- Globe Track.

- Checkfront Inc.

- Techno Heaven Consultancy Pvt Ltd.

- Tourwriter

- Travelogic

- Travefy Inc.

- Centaur Systems LLC

- Adventure Bucket List LLC

- Vacation Labs Private Limited

- ResRequest

- Others

Recent Developments

- February 2025, Kingswood Capital Management completed a strategic investment in Infotree Solutions Ltd., a leading international workforce management provider. This deal supports Infotree’s next growth phase while maintaining its unique values and strategy. Infotree remains focused on complex personnel solutions for Fortune 500 clients globally, strengthening its position particularly in Latin America.

- September 2025, GetYourGuide announced a major Fall 2025 product release with enhancements including AI-powered review management, streamlined operations, logistics automation with prescheduled pickups, and significant inventory expansion into shows and events. These improvements aim to boost partner capabilities and traveler experience.

Report Scope

Report Features Description Market Value (2024) USD 878.9 Mn Forecast Revenue (2034) USD 2,473.2 Mn CAGR(2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Mode (Cloud-Based/SaaS, On-Premise), By Application (Booking & Reservation Management, Inventory Management, Customer Relationship Management (CRM), Financial Management & Accounting, Supplier Management, Others), By Subscription Type (One-time Subscription, Monthly Subscription, Annual Subscription), By End-User (Tour Operators & Incoming Agencies (DMCs), Activity & Experience Providers, Travel Agencies), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Traveltek, Sabre, FareHarbor, Amadeus IT Group SA, Infotree Solutions Ltd., GP Solutions GmbH, WeTravel Inc., TraveloPro Ltd., Qtech Software Pvt Ltd., Rezdy Pty Ltd., Dolphin Dynamics Ltd., SAN Tourism Software Group, Trawex Technologies Private Limited, Globe Track, Checkfront Inc., Techno Heaven Consultancy Pvt Ltd., Tourwriter, Travelogic, Travefy Inc., Centaur Systems LLC, Adventure Bucket List LLC, Vacation Labs Private Limited, ResRequest, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tour Operator Software MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Tour Operator Software MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Traveltek

- Sabre

- FareHarbor

- Amadeus IT Group SA

- Infotree Solutions Ltd.

- GP Solutions GmbH

- WeTravel Inc.

- TraveloPro Ltd.

- Qtech Software Pvt Ltd.

- Rezdy Pty Ltd.

- Dolphin Dynamics Ltd.

- SAN Tourism Software Group

- Trawex Technologies Private Limited

- Globe Track.

- Checkfront Inc.

- Techno Heaven Consultancy Pvt Ltd.

- Tourwriter

- Travelogic

- Travefy Inc.

- Centaur Systems LLC

- Adventure Bucket List LLC

- Vacation Labs Private Limited

- ResRequest

- Others