Global Tire Storage Rack Market Market Size, Share, Growth Analysis By Type (Standing Rack, Rolling Rack, Wall Mount Rack), By Material (Steel, Aluminum, Plastic, Others), By Application (MRO Centres, Automobile Assembling Facility), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168404

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

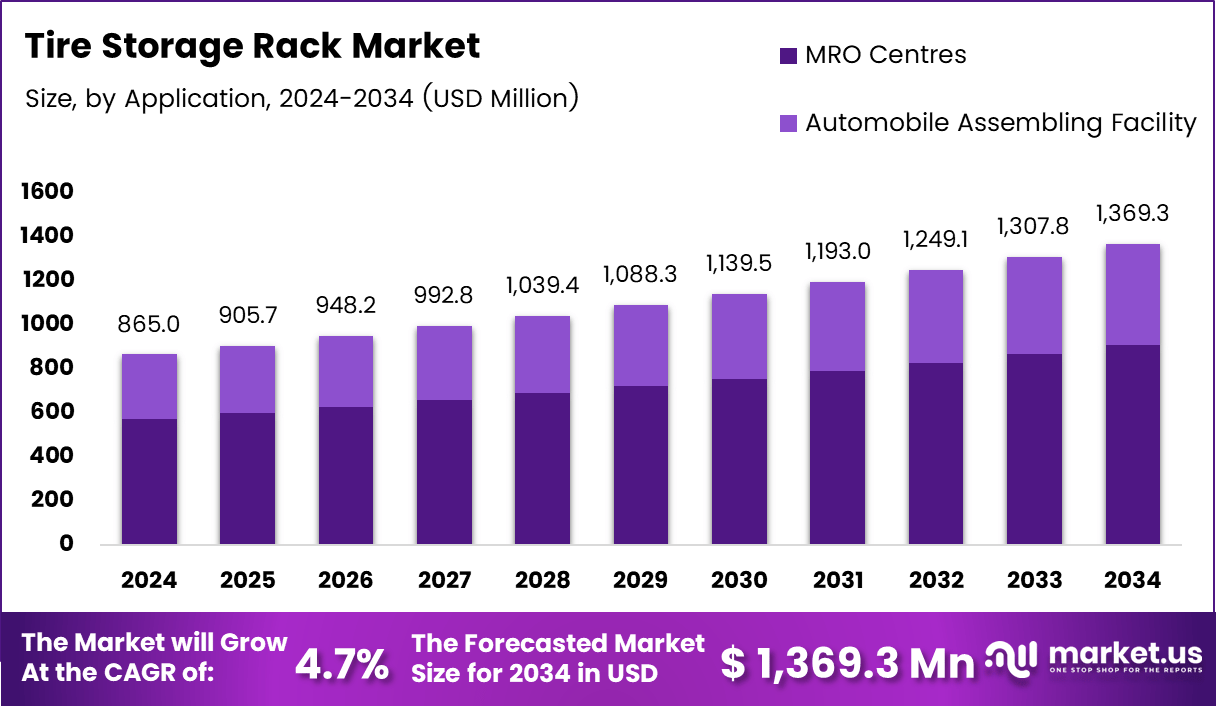

The Global Tire Storage Rack Market size is expected to be worth around USD 1,369.3 Million by 2034, from USD 865.0 Million in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The Tire Storage Rack Market represents a specialized segment supporting organized tire handling across warehouses, automotive service centers, and fleet facilities. It streamlines storage operations, enhances safety standards, and reduces handling inefficiencies in high-volume environments. The market continues to benefit from rising aftermarket activity as consumers increasingly prioritize reliable tire management systems.

Demand expands steadily as automotive fleets grow and maintenance frequency rises across commercial, logistics, and passenger vehicle categories. Additionally, rapid expansion of tire-service infrastructure encourages enterprises to adopt structured storage systems to reduce floor congestion and improve throughput. Growing focus on workplace safety further accelerates product adoption across industrial and automotive settings.

Government emphasis on warehouse safety regulations strengthens market interest, especially as regulators enforce standardized storage layouts, load-bearing guidelines, and material-handling compliance. Meanwhile, the shift toward electric-vehicle maintenance creates new opportunities because EV service centers require optimized tire-rotation and seasonal-storage capabilities, boosting demand for scalable steel and modular rack designs.

The market also gains traction as e-commerce tire distribution expands, increasing the need for high-density storage solutions across distribution hubs. Growing investment in automated warehousing encourages the integration of pallet-compatible tire racks that align with lift-truck and conveyor specifications. This transformation creates strong prospects for customizable, durable, and corrosion-resistant tire storage racks.

According to the Survey, collected results from more than 150,000 consumer surveys representing over 2.6 billion miles of real-world tire data highlight increasing consumer expectations for reliable tire services. Additionally, Tire Rack reports a diverse in-stock inventory from 17 major tire and 41 wheel brands, deliverable nationwide in two days or less, reinforcing demand for efficient storage infrastructure across distribution locations.

Furthermore, Tire Rack indicates that more than 9,000 independent Recommended Installers support national tire servicing, increasing pressure on service centers to maintain organized tire-handling systems. According to Bridgestone Americas, operations span more than 50 production facilities and employ 55,000 staff across the region, illustrating a strong tire-industry scale that accelerates the need for high-capacity tire storage rack systems.

Key Takeaways

- The Global Tire Storage Rack Market is projected to reach USD 1,369.3 Million by 2034 from USD 865.0 Million in 2024.

- The market grows steadily at a CAGR of 4.7% during the forecast period 2025–2034.

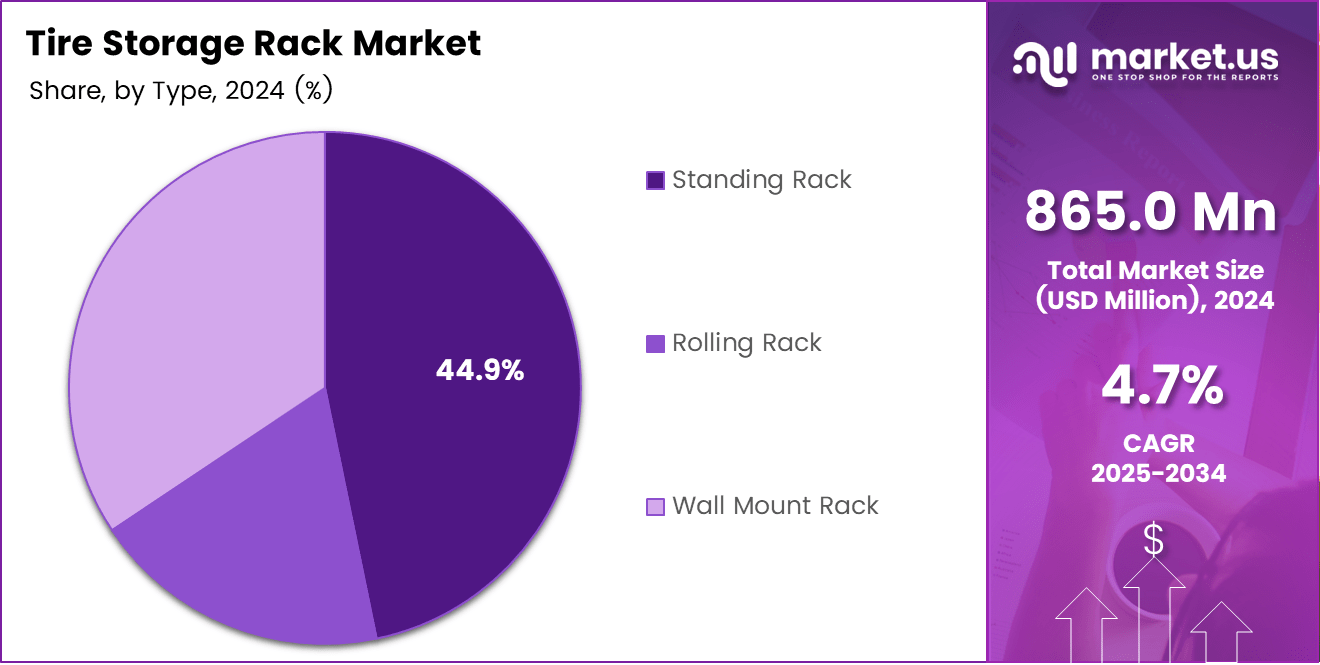

- Standing Rack dominates the By Type segment with a leading share of 44.9% in 2024.

- Steel leads the By Material segment with a dominant share of 59.7% in 2024.

- MRO Centres account for the largest share of 66.2% in the By Application segment in 2024.

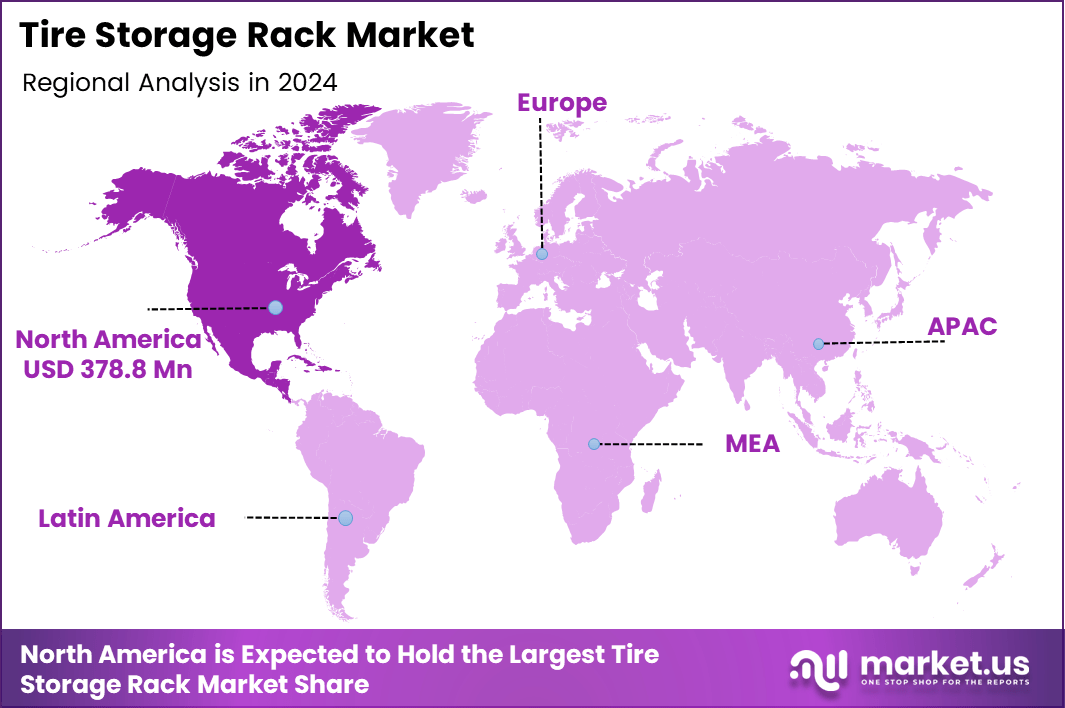

- North America leads the global market with a regional share of 43.8%, valued at USD 378.8 Mn in 2024.

By Type Analysis

Standing Rack dominates with 44.9% due to its stability and high-capacity tire handling efficiency.

In 2024, Standing Rack held a dominant market position in the By Type segment of the Tire Storage Rack Market, with a 44.9% share. This design supports structured vertical storage, reduces floor congestion, and enhances operational flow. Its strong adoption across warehouses and service centers drives consistent market traction.

Rolling Rack expands steadily as facilities adopt mobile tire-handling solutions to improve workflow flexibility. Users prefer this configuration because it reduces manual handling and accelerates tire movement within large storage areas. Growing emphasis on quick operational shifts encourages broader adoption across retail, fleet, and multi-bay service environments.

Wall Mount Rack gains attention as space-constrained workshops prioritize vertical optimization. It enhances organization in compact garages and service stations while supporting light to medium loads. Continued demand from small independent garages and seasonal-storage providers strengthens growth prospects as facilities seek structured layouts for improved tire accessibility and safety.

By Material Analysis

Steel dominates with 59.7% due to its durability, load-bearing strength, and long operational lifespan.

In 2024, Steel held a dominant market position in the By Material segment of the Tire Storage Rack Market, with a 59.7% share. Its high structural strength and corrosion-resistant coatings support heavy-duty tire storage needs. Growing warehouse expansion and automotive service growth reinforce strong adoption.

Aluminum experiences moderate demand as facilities adopt lightweight storage frames for easier installation and movement. Its resistance to environmental wear increases usage across coastal regions and temperature-sensitive storage areas. Automotive workshops adopting flexible storage systems contribute to steady segment expansion across diverse operational environments.

Plastic racks grow gradually as businesses prioritize low-maintenance and cost-effective storage. These racks support light-duty applications and seasonal tire storage services. Their non-corrosive nature improves suitability for moisture-prone facilities, making them an appealing choice among compact garages and small service providers with limited load-handling requirements.

Others include composite and hybrid materials gaining niche traction. These solutions combine flexible designs with moderate load-bearing capacities suitable for specialized storage areas. Adoption rises as innovative material engineering enhances durability and safety, making them relevant for customized tire-storage environments prioritizing structural efficiency.

By Application Analysis

MRO Centres dominate with 66.2% owing to high tire service volumes and recurring maintenance operations.

In 2024, MRO Centres held a dominant market position in the By Application segment of the Tire Storage Rack Market, with a 66.2% share. High daily tire-handling activity, frequent replacements, and seasonal-storage requirements strengthen demand for heavy-duty rack systems in maintenance-focused facilities.

Automobile Assembling Facility applications grow as manufacturing plants streamline internal logistics. Tire racks enhance production efficiency by organizing tire inflow for vehicle assembly lines. Their consistent integration into OEM storage zones reflects rising automation, optimized floor usage, and standardized component flow across modern automotive production environments.

Key Market Segments

By Type

- Standing Rack

- Rolling Rack

- Wall Mount Rack

By Material

- Steel

- Aluminum

- Plastic

- Others

By Application

- MRO Centres

- Automobile Assembling Facility

Drivers

Expansion of Professional Tire Warehousing Services Across Urban Regions Drives Market Growth

The Tire Storage Rack Market grows steadily as more urban regions develop professional tire warehousing services. These facilities need organized and safe storage layouts, pushing demand for strong and well-structured racking systems. As warehousing networks expand, the need for scalable racks continues to rise.

Safety compliance requirements also boost market growth because automotive service centers must meet strict rules on handling and storing heavy tires. Facilities increasingly invest in racks that decrease risks, improve workflow, and meet regulatory standards. This shift enhances adoption across workshops and fleet service operations.

Another major driver is the rising demand for high-density vertical racking systems in modern workshops. Space optimization becomes essential as service centers handle more tire changes and seasonal storage needs. Vertical racks help maximize available space, reduce clutter, and support faster tire retrieval.

Urban expansion, safety-focused operations, and the need for vertical efficiency together strengthen the market outlook. Businesses prioritize structured layouts that improve productivity while managing large tire inventories. As tire turnover increases across retail and service networks, rack adoption continues to rise, shaping the future of professional tire handling.

Restraints

High Upfront Installation Costs for Heavy-Duty Racking Structures Restrain Market Growth

The Tire Storage Rack Market faces restraints as heavy-duty racks require high upfront installation costs. Many small workshops hesitate to invest in strong and durable racking because budgets remain limited. This slows adoption in early-stage facilities trying to manage expenses carefully.

Space limitations in small and mid-sized automotive service centers create additional barriers. Many locations cannot allocate enough floor area or vertical space for structured racks, leading to continued dependence on basic storage methods. This restricts market penetration in compact urban garages.

Limited awareness of structured tire-storage solutions in emerging markets further affects growth. Many service providers still use manual or unorganized storage systems due to a lack of knowledge about modern racks. This slows the transition toward safer and more efficient storage environments.

These challenges reduce overall adoption speed, especially in developing regions where cost and space constraints remain significant. Without education, incentives, and better financing support, smaller facilities continue delaying upgrades to structured tire racks. These restraints collectively create hurdles for long-term market expansion.

Growth Factors

Adoption of Modular, Reconfigurable Storage Systems Creates Growth Opportunities

The Tire Storage Rack Market offers strong opportunities as modular, reconfigurable storage systems gain traction. Workshops prefer adjustable designs because they expand or shrink based on seasonal tire volume. This flexibility helps businesses manage costs while improving storage efficiency throughout the year.

The rising penetration of automated tire-handling conveyors in large depots also opens new growth channels. Automated movement reduces labor effort, enhances sorting speed, and supports continuous operations. Racks that integrate smoothly with conveyors become highly valuable for large-scale logistics centers.

Subscription-based seasonal tire-storage services continue expanding as consumers increasingly store winter or spare tires with service providers. These programs require organized and secure racking units, lifting demand for high-capacity systems across service centers and dealership networks.

The development of lightweight corrosion-resistant materials creates additional opportunities. New materials extend rack life, reduce maintenance costs, and maintain structural strength. As manufacturers adopt advanced alloys and composites, modern racks become more attractive for long-term investment, encouraging broader market expansion across automotive facilities.

Emerging Trends

Shift Toward RFID-Enabled Tire Tracking Integrated With Storage Racks Shapes Market Trends

The Tire Storage Rack Market experiences notable trends as facilities shift toward RFID-enabled tire tracking. Integrating RFID with rack systems improves accuracy in inventory handling and speeds up tire identification. Workshops benefit from fewer errors and faster customer service, making this technology a preferred choice.

Growing preference for powder-coated and anti-rust finishes also reshapes product demand. These coatings extend rack life, reduce corrosion, and help facilities maintain clean, professional storage environments. As service centers prioritize long-term durability, coated racks gain stronger market visibility.

Digital tracking systems combined with durable finishes create a modernized storage ecosystem. Facilities increasingly invest in advanced infrastructure that enhances safety, reliability, and workflow efficiency.

These evolving trends show how technology adoption and material improvements work together to modernize tire storage operations. The market benefits from rising customer expectations for organized, transparent, and long-lasting storage solutions, driving continuous upgrades across workshops and warehouses.

Regional Analysis

North America Leads the Tire Storage Rack Market with a Share of 43.8%, Valued at USD 378.8 Mn

North America holds a dominant position in the Tire Storage Rack Market, supported by strong automotive service infrastructure and widespread adoption of structured warehousing systems. The region’s market share of 43.8%, representing revenue of USD 378.8 Mn, reflects steady investments in advanced workshop storage optimization. Growing emphasis on safety compliance and high-density tire handling technologies continues to reinforce regional growth momentum.

Europe Tire Storage Rack Market Trends

Europe shows consistent market expansion driven by strict workplace safety regulations and increased adoption of modular storage systems in automotive service centers. The region benefits from a rising shift toward automation and ergonomic storage equipment across large-scale garages. Growing focus on fleet maintenance and tire lifecycle management enhances the demand landscape.

Asia Pacific Tire Storage Rack Market Trends

Asia Pacific experiences strong growth due to expanding automotive production hubs and rising investments in organized service networks. Rapid urbanization accelerates tire replacement cycles, creating higher storage requirements across repair shops and distribution warehouses. The increasing establishment of EV maintenance facilities further boosts structural storage system deployment.

Middle East & Africa Tire Storage Rack Market Trends

The Middle East & Africa region demonstrates steady adoption as commercial vehicle fleets expand and service stations modernize their storage capacity. Rising construction and logistics activity strengthens demand for structured racking systems. Growth remains supported by gradual investments in automotive infrastructure across Gulf countries and emerging African markets.

Latin America Tire Storage Rack Market Trends

Latin America shows gradual market development driven by the modernization of automotive workshops and improved adoption of vertical racking systems. Growing awareness of workplace safety and optimized floor space utilization encourages structured tire storage solutions. Expansion of fleet management servicing operations across key economies supports long-term industry potential.

U.S. Tire Storage Rack Market Trends

The U.S. represents a major contributor within North America, driven by a mature automotive aftermarket and high service throughput in tire retail chains. Strong demand for heavy-duty racking solutions results from increasing replacement rates and strict safety standards. Continued expansion of warehousing and dealership networks sustains market adoption.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tire Storage Rack Market Company Insights

The global Tire Storage Rack Market in 2024 reflects strengthening demand for efficient, high-density storage solutions as automotive workshops, fleets, and distribution centers expand their operational capabilities.

Companies are focusing on structural durability, modular design advancements, and stronger compliance-driven product innovations to serve the growing aftermarket and warehousing ecosystem. Rising service volumes, EV-related tire replacement cycles, and workshop modernization trends continue to influence strategic movements across leading manufacturers.

METSTO strengthens its market position by focusing on precision-engineered racking systems designed for long service life and heavy-duty load performance. Its emphasis on scalability and optimized vertical storage supports increasing adoption among logistics operators and tire distributors seeking space-efficient layouts.

MEK Engineering expands its portfolio with structured, ergonomically designed storage systems that address safety compliance and workshop efficiency needs. The company’s integration of engineered steel assemblies enables better load management and smoother handling operations for high-turnover automotive service environments.

Martins Industries continues to gain visibility through its wide range of tire storage innovations and warehouse optimization products. The company’s focus on global distribution, consistent quality, and user-centric designs helps it serve diverse automotive segments, from small garages to high-volume fleet facilities.

Ajooni enhances its market relevance by offering customizable rack solutions tailored to various tire diameters, load capacities, and workshop layouts. Its emphasis on durable materials and simplified assembly supports increasing demand from regional service centers upgrading aging storage infrastructure.

Overall, these companies collectively contribute to a competitive landscape shaped by higher automation needs, structured warehousing requirements, and rising safety expectations across global automotive service operations.

Top Key Players in the Market

- METSTO

- MEK Engineering

- Martins Industries

- Ajooni

- DONRACKS

- Samishti Industries

- SUMMIT STORAGE

- Slotking India Storage System Pvt. Ltd.

Recent Developments

- In Oct 2024, BendPak introduced the Ranger TSR-2S heavy duty tire rack, engineered for commercial use with a 1,250 lb load capacity and integrated display features.The new rack is designed to support efficient tire storage and merchandising in retail and automotive service environments.

- In Oct 2025, AR Racking completed the installation of its AR PAL racking system at the new B&Q seasonal distribution warehouse in Doncaster. The project enhances warehouse storage efficiency and supports high volume seasonal inventory management for large scale retail distribution.

- In Dec 2025, JK Tyre expanded its material handling portfolio with new product launches at EXCON 2025, addressing the handling requirements of oversized Off the Road (OTR) tires. The launch highlighted growing demand for specialized racking solutions used in mining and construction applications.

Report Scope

Report Features Description Market Value (2024) USD 865.0 Million Forecast Revenue (2034) USD 1,369.3 Million CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Standing Rack, Rolling Rack, Wall Mount Rack), By Material (Steel, Aluminum, Plastic, Others), By Application (MRO Centres, Automobile Assembling Facility) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape METSTO, MEK Engineering, Martins Industries, Ajooni, DONRACKS, Samishti Industries, SUMMIT STORAGE, Slotking India Storage System Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- METSTO

- MEK Engineering

- Martins Industries

- Ajooni

- DONRACKS

- Samishti Industries

- SUMMIT STORAGE

- Slotking India Storage System Pvt. Ltd.