Global Third-party Logistics Market By Service (Domestic Transportation Management, Dedicated Contract Carriage and Freight forwarding, Warehousing and Distribution, International Transportation Management, Value Added Logistics Services), By Transport (Roadways, Waterways, Airways, Railways), By End-use (Manufacturing, Healthcare, Automotive, Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132076

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

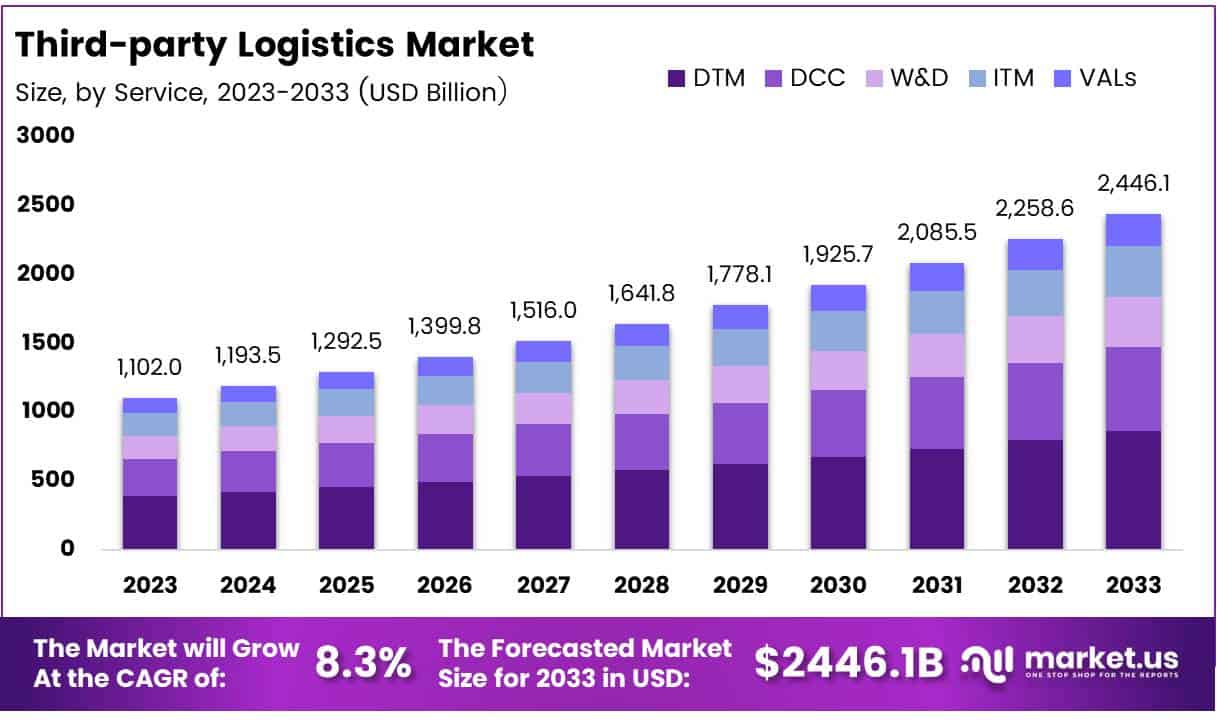

The Global Third-party Logistics Market size is expected to be worth around USD 2446.1 Billion by 2033, from USD 1102 Billion in 2023, growing at a CAGR of 8.3% during the forecast period from 2024 to 2033.

Third-party logistics (3PL) involves outsourcing logistics and distribution functions to specialized firms. These providers handle transportation, warehousing, inventory management, packaging, and freight forwarding, allowing businesses to concentrate on their core operations and strategic goals.

The 3PL market is growing as companies across various sectors aim to cut costs and enhance service delivery amid globalization and the rise of e-commerce. These providers bring expertise in logistics strategy and technology, essential for adapting to fast-evolving market demands.

The expansion of online shopping has underscored the need for effective logistics solutions that support extensive distribution networks and rapid delivery expectations. Additionally, the trend toward environmental sustainability is prompting 3PL providers to innovate in eco-friendly packaging and optimized transport routes, reducing carbon footprints and costs.

Governments globally are investing in infrastructure, such as ports and roads, and advancing digital technologies to support efficient logistics operations. New regulatory frameworks are being implemented to ensure operational efficiency, security, and sustainability in the logistics sector.

According to data from Freight Center, a significant 76% of 3PL users affirm that third-party logistics providers introduce innovative and effective methods to enhance logistics operations. This statistic underscores the value-added nature of 3PL services in today’s market, highlighting their role in not just maintaining but actively improving supply chain efficiencies.

The 3PL sector represents a nearly $150 billion industry in the United States alone, as noted by the Kenco Group. It is extensively utilized across various market verticals, notably by major automotive manufacturers in Detroit who engage over 30 different 3PL providers.

The growing reliance on these services is evidenced by the fact that 72% of shippers are increasing their use of third-party logistics. This trend reflects the broadening acceptance and integration of 3PL services in mainstream business operations and their critical role in enhancing logistical efficiencies.

Furthermore, the UK’s 3PL market remains highly fragmented with around 14,900 active providers, predominantly small to medium-sized enterprises focusing on local operations and specific supply chain functions.

This fragmentation suggests a significant potential for consolidation, providing an opportunity for larger providers to expand their influence and for smaller players to specialize further or merge to enhance their competitive positioning.

In the US, the logistics infrastructure supports these expansive operations with 13 million registered trucks, of which 2.9 million are semi-trucks, according to St. Onge. This extensive vehicular foundation not only supports existing logistics needs but also presents opportunities for expanding logistics capabilities through advanced fleet management and technological integration.

Key Takeaways

- The global 3PL market is projected to reach USD 2446.1 billion by 2033, growing at a CAGR of 8.3% from 2024 to 2033.

- Domestic Transportation Management held a 33% market share in 2023, crucial for optimizing supply chains.

- Roadways led transport options with a 58.5% share, favored for its flexibility and infrastructure.

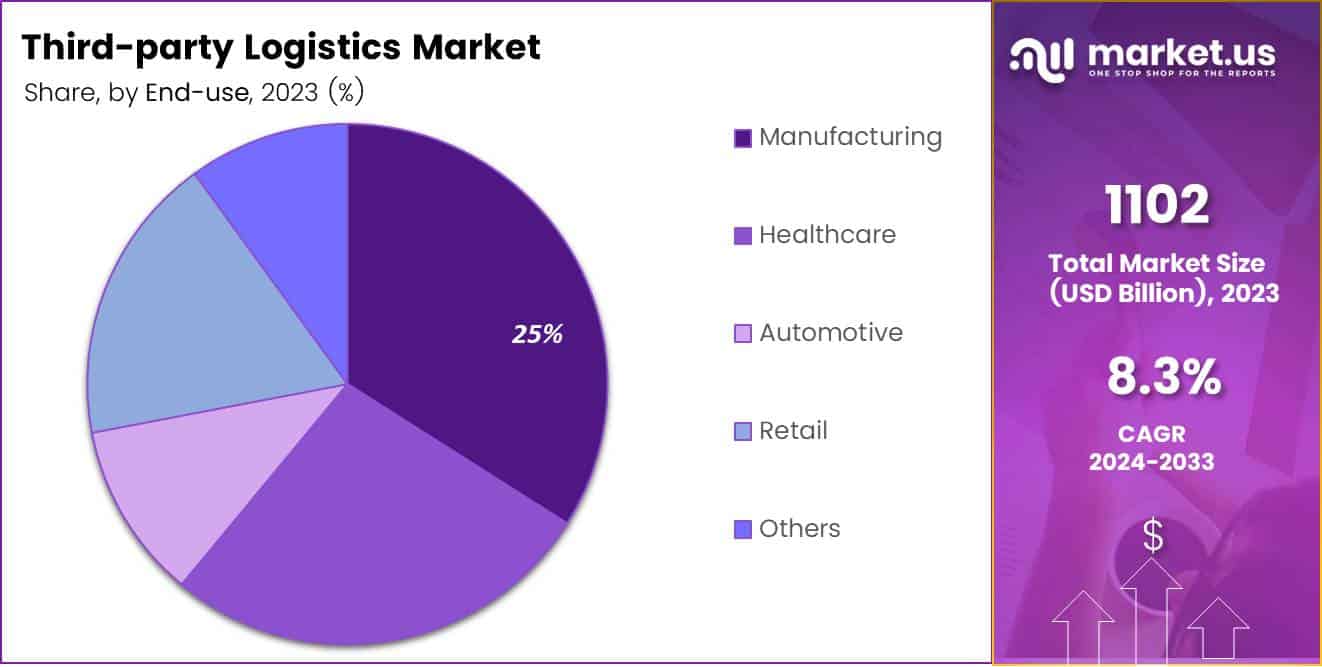

- Manufacturing held a 25% share in 3PL, essential for streamlined logistics and cost efficiency.

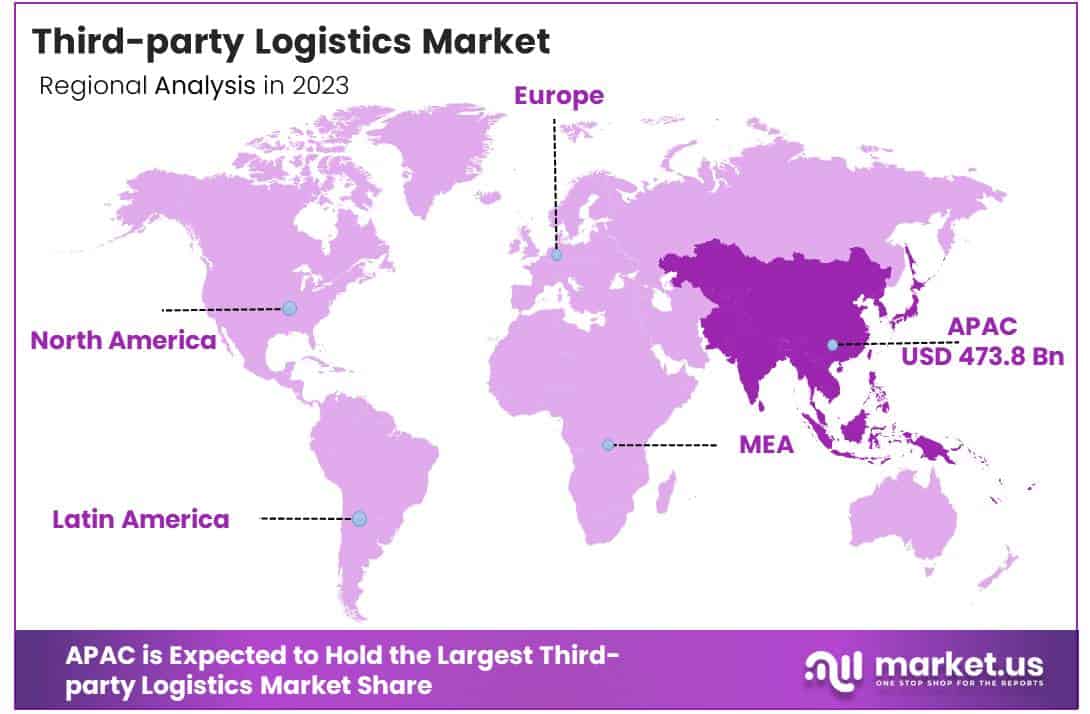

- Asia Pacific led with 43% market share, driven by industrialization and e-commerce growth.

- E-commerce growth accelerates demand for 3PL, crucial for handling orders and inventory.

Service Analysis

Third-party Logistics: Domestic Transportation Leads with 33% Market Share

In 2023, Domestic Transportation Management (DTM) held a dominant market position in the By Service Analysis segment of the Third-party Logistics Market, with a 33% share. This leadership underscores the critical role DTM plays in optimizing logistics and supply chain operations across various industries.

Following closely, Dedicated Contract Carriage (DCC)/Freight Forwarding, which integrates extensive transportation management with specific logistical needs, has also shown substantial engagement within the sector.

The segment of Warehousing & Distribution (W&D) continues to evolve, driven by the increasing demand for efficient inventory management and rapid delivery services, reflecting a growing need for sophisticated logistical solutions.

International Transportation Management (ITM) and Value Added Logistics Services (VALs) further delineate the expansive scope of third-party logistics. ITM addresses the complexities of global trade, facilitating international shipping and regulatory compliance, while VALs enhance the logistical process by offering additional services such as packaging, assembly, and product customization, which are pivotal for companies looking to add a competitive edge to their supply chain strategies.

Collectively, these segments represent a diversified approach in the third-party logistics market, catering to a wide array of logistical requirements and establishing a robust foundation for market growth and operational efficiency.

Transport Analysis

Roadways Lead in Third-party Logistics Market with 58.5% Share

In 2023, Roadways held a dominant market position in the By Transport Analysis segment of the Third-party Logistics Market, boasting a 58.5% share. This substantial market share is primarily due to the extensive road infrastructure and the flexibility that road transport offers for door-to-door deliveries, making it a preferred choice for various industries.

Waterways, also significant, are chosen for their cost-efficiency and capability to transport large volumes, particularly in regions rich in navigable rivers and coastlines.

Meanwhile, Airways, although less dominant, are favored for time-sensitive shipments, offering the fastest transport option across vast distances. Railways round out the transport modes with their reliability and high capacity for bulk shipments.

This diversity in transport options reflects the adaptiveness of the Third-party Logistics Market to serve a broad spectrum of supply chain requirements, ensuring that each mode plays a vital role in the integrated logistics approach. As global trade dynamics evolve, these segments adjust in prominence, but roadways continue to lead due to their unrivaled reach and convenience.

End-use Analysis

Manufacturing Leads with 25% in Third-party Logistics Market

In 2023, Manufacturing held a dominant market position in the By End-use Analysis segment of the Third-party Logistics Market, with a 25% share. This substantial portion underscores the critical role of third-party logistics (3PL) services in supporting the complex supply chains typical in manufacturing sectors. The integration of 3PL services allows manufacturers to streamline operations, reduce costs, and enhance logistical efficiencies.

Following closely, the Healthcare sector also leverages 3PL for efficient management of medical supplies, equipment, and pharmaceuticals, which is crucial for maintaining the integrity and timely delivery of healthcare products. The Automotive industry, known for its intricate supply chain networks, relies on these logistics services to manage parts inventory and ensure just-in-time delivery to production lines.

Retail businesses use 3PL to adapt to fluctuating demand patterns and manage widespread distribution channels effectively. The ‘Others’ category, encompassing various smaller industries, utilizes 3PL to gain competitive advantages through improved logistical operations.

Overall, third-party logistics providers are pivotal in enabling end-use industries like Manufacturing to maintain operational efficiency and meet consumer demands swiftly and effectively.

Key Market Segments

By Service

- Domestic Transportation Management (DTM)

- Dedicated Contract Carriage (DCC)/Freight forwarding

- Warehousing & Distribution (W&D)

- International Transportation Management (ITM)

- Value Added Logistics Services (VALs)

By Transport

- Roadways

- Waterways

- Airways

- Railways

By End-use

- Manufacturing

- Healthcare

- Automotive

- Retail

- Others

Drivers

E-commerce Drives Third-party Logistics Growth

The expansion of e-commerce has significantly accelerated the demand for third-party logistics (3PL) services, as businesses seek efficient solutions to manage increased order volumes and distribution complexities. The growth of online shopping platforms requires robust logistics to ensure timely delivery and inventory management, positioning 3PL providers as essential partners in the e-commerce ecosystem.

Additionally, globalization has expanded international trade, necessitating intricate supply chains that rely on 3PLs to navigate diverse regulations and market dynamics effectively. Moreover, technological advancements like the Internet of Things (IoT), artificial intelligence (AI), and blockchain have transformed logistics operations.

These technologies enhance tracking, efficiency, and transparency, making 3PL services more appealing by providing smarter, data-driven logistics solutions. As a result, the integration of these technologies continues to propel the 3PL market forward by meeting the evolving needs of global commerce and supply chain management.

Restraints

Cost Challenges Limit 3PL Market Expansion

In the realm of third-party logistics (3PL), companies face significant hurdles that temper market growth, primarily due to the steep initial investment and ongoing operational expenses required to establish and maintain a competitive 3PL infrastructure. This foundational necessity for substantial capital investment not only inhibits new entrants but also places a strain on existing providers striving to scale operations or update technologies.

Moreover, the escalation of digitalization within the logistics sector further complicates matters, introducing serious data security and privacy concerns. As 3PL services increasingly rely on digital platforms for operations, the risk of data breaches escalates, posing a substantial threat.

This vulnerability to security issues discourages potential clients who prioritize the confidentiality and integrity of their logistical data, impacting the overall adoption and trust in 3PL services. These twin challenges of high initial costs and security vulnerabilities collectively act as formidable barriers, curbing the broader acceptance and integration of third-party logistics solutions within the global market.

Growth Factors

Expanding Last-Mile Delivery Solutions

In the evolving logistics landscape, third-party logistics (3PL) providers are poised for substantial growth, driven primarily by the burgeoning demand for efficient last-mile delivery solutions. This demand is especially pronounced in densely populated urban areas where consumers seek faster delivery times for a wide range of products.

The expansion of last-mile delivery is not just about speed but also involves adapting to changing consumer expectations, which now prioritize reliability and flexibility in delivery services.

Moreover, the rise of digital freight platforms is revolutionizing the 3PL market by enhancing operational efficiencies through technology-driven solutions. These platforms facilitate seamless communication and coordination among shippers, carriers, and logistics providers, leading to optimized route planning and reduced delivery times.

Additionally, there is significant growth potential in the healthcare sector where there is a pressing need for specialized logistics services. This need has been highlighted by the increased urgency for distributing vaccines and other medical supplies amid health crises. By leveraging advanced logistics technology and expanding their capabilities to meet specific industry needs, 3PL providers can not only improve their service offerings but also secure a competitive edge in a rapidly evolving market.

Emerging Trends

AI Enhances 3PL Operations

The third-party logistics (3PL) market is witnessing significant transformations driven by the integration of advanced technologies like artificial intelligence (AI) and machine learning, blockchain, and robotics. AI and machine learning are at the forefront, revolutionizing the sector by enabling predictive analytics for better forecasting and optimizing routes to enhance delivery efficiencies.

This adaptation not only streamlines operations but also reduces costs and improves service delivery, making logistics more agile in response to customer demands. Additionally, blockchain technology is gaining traction, offering unmatched transparency and traceability, which is particularly beneficial for companies needing stringent compliance and accountability.

Meanwhile, robotics and automation are redefining warehousing operations by increasing accuracy and operational speed, thus bolstering overall productivity in supply chain management. These technologies collectively foster a more robust, efficient, and transparent 3PL landscape, appealing to a broader range of industries and driving market growth.

Regional Analysis

Asia Pacific Leads Global Third-Party Logistics Market with 43% Share and USD 473.8 Billion in Revenue

Asia Pacific stands as the dominant region, commanding a 43% market share, valued at USD 473.8 billion. This dominance is fueled by the rapid industrialization in countries like China and India, combined with increasing e-commerce activities. The region benefits from strategic geographic locations and significant investments in infrastructure development, making it a pivotal hub for international trade and warehousing solutions.

Regional Mentions:

The Third-Party Logistics (3PL) Market exhibits significant growth across diverse regions, reflecting the intricate dynamics of supply chain management globally. North America, driven by advanced technological integration and robust trade agreements, continues to leverage its geographic and economic stature in the logistics sector.

Europe’s market thrives on stringent regulatory frameworks and a high demand for eco-friendly logistics solutions, focusing on sustainable practices.

Middle East & Africa region is witnessing a transformative phase with substantial investments in logistics infrastructure, primarily to diversify economies beyond oil reliance. This region is increasingly adopting digital transformation in logistics, thus offering new growth avenues.

Latin America, although smaller in comparison, shows potential for significant growth due to increasing trade agreements and the modernization of transport infrastructure. As these economies stabilize, the demand for efficient and cost-effective logistics solutions is expected to rise, driven by the burgeoning manufacturing and export sectors.

Overall, the 3PL market is evolving under the influence of technological advancements, regulatory changes, and shifting economic dynamics, with Asia Pacific leading the way in scale and growth opportunities.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Third-party Logistics (3PL) Market has witnessed significant contributions from leading companies, adapting to shifting supply chain dynamics and heightened demand for logistics efficiency.

Notably, United Parcel Service of America, Inc. (UPS) and FedEx remain pivotal, leveraging their extensive networks and technological advancements to enhance parcel delivery efficiencies amid rising e-commerce demands. UPS, in particular, has focused on expanding its capabilities in automated sorting and real-time tracking systems to ensure timely deliveries and reduce operational costs.

DSV and C.H. Robinson Worldwide, Inc. have also been instrumental in the market, focusing on integrated logistics solutions and expanding their service offerings through strategic acquisitions. DSV’s acquisition strategy, aiming to bolster its global footprint and end-to-end supply chain solutions, underscores a robust approach to capturing emerging market opportunities, particularly in developing regions.

Furthermore, DB Schenker Logistics and Kuehne + Nagel have excelled in streamlining operations and adopting sustainable practices, responding to the increasing consumer and regulatory pressures for greener logistics solutions. Their commitment to sustainability is not only enhancing operational efficiencies but also positioning them favorably among environmentally conscious clients.

XPO Logistics, Inc. and J.B. Hunt Transport, Inc. have emphasized digital transformations, implementing AI and machine learning algorithms to optimize routing and predictive maintenance. This technological pivot is crucial for maintaining competitive advantage in a market driven by speed and accuracy.

Collectively, these key players are shaping the 3PL landscape by integrating innovative technologies and strategic expansions to meet the evolving demands of global supply chains, thereby driving the market’s growth trajectory.

Top Key Players in the Market

- BDP International

- Nippon Express

- United Parcel Service of America, Inc.

- Burris Logistics

- FedEx

- J.B. Hunt Transport, Inc.

- Kuehne + Nagel

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DSV

- DB Schenker Logistics

- XPO Logistics, Inc

- Yusen Logistics Co. Ltd.

Recent Developments

- In August 2024, Governor Glenn Youngkin announced that Camrett Logistics, a third-party logistics provider based in Wytheville, Virginia, will invest $575,000 to expand its warehouse facilities in Wythe County. This expansion aims to enhance service capabilities for local manufacturers and will create 10 new job opportunities.

- In October 2024, IndoSpace announced a substantial investment of $1 billion to acquire new warehousing and logistics assets throughout India. This strategic expansion is aimed at strengthening their market presence and enhancing their operational capabilities across the region.

- In September 2024, East Coast Warehouse & Distribution, a prominent provider of temperature-controlled logistics services, announced the establishment of its first operation in South Carolina, located in Charleston County. The $14.5 million investment is expected to generate 52 new jobs, bolstering the local economy.

- In February 2024, DHL Supply Chain revealed plans for a $200 million investment aimed at expanding its life sciences and healthcare logistics services. This initiative underscores DHL’s commitment to enhancing its infrastructure and capabilities in these critical sectors.

Report Scope

Report Features Description Market Value (2023) USD 1102 Billion Forecast Revenue (2033) USD 2446.1 Billion CAGR (2024-2033) 8.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service(Domestic Transportation Management (DTM), Dedicated Contract Carriage (DCC)/Freight forwarding, Warehousing & Distribution (W&D), International Transportation Management (ITM), Value Added Logistics Services (VALs)), By Transport(Roadways, Waterways, Airways, Railways), By End-use(Manufacturing, Healthcare, Automotive, Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BDP International, Nippon Express, United Parcel Service of America, Inc., Burris Logistics, FedEx, J.B. Hunt Transport, Inc., Kuehne + Nagel, C.H. Robinson Worldwide, Inc., CEVA Logistics, DSV, DB Schenker Logistics, XPO Logistics, Inc, Yusen Logistics Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Third-party Logistics MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Third-party Logistics MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BDP International

- Nippon Express

- United Parcel Service of America, Inc.

- Burris Logistics

- FedEx

- J.B. Hunt Transport, Inc.

- Kuehne + Nagel

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DSV

- DB Schenker Logistics

- XPO Logistics, Inc

- Yusen Logistics Co. Ltd.