Global Thermoplastic Elastomer Market Size, Share and Report Analysis By Material Type (Polystyrenes, Poly Olefins, Poly Ether Imides, Poly Urethanes, Poly Esters, Poly Amides, and Others), By Application (Automotive, Electrical And Electronics, Healthcare And Medical, Consumer Goods, Building And Construction, Packaging, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178659

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

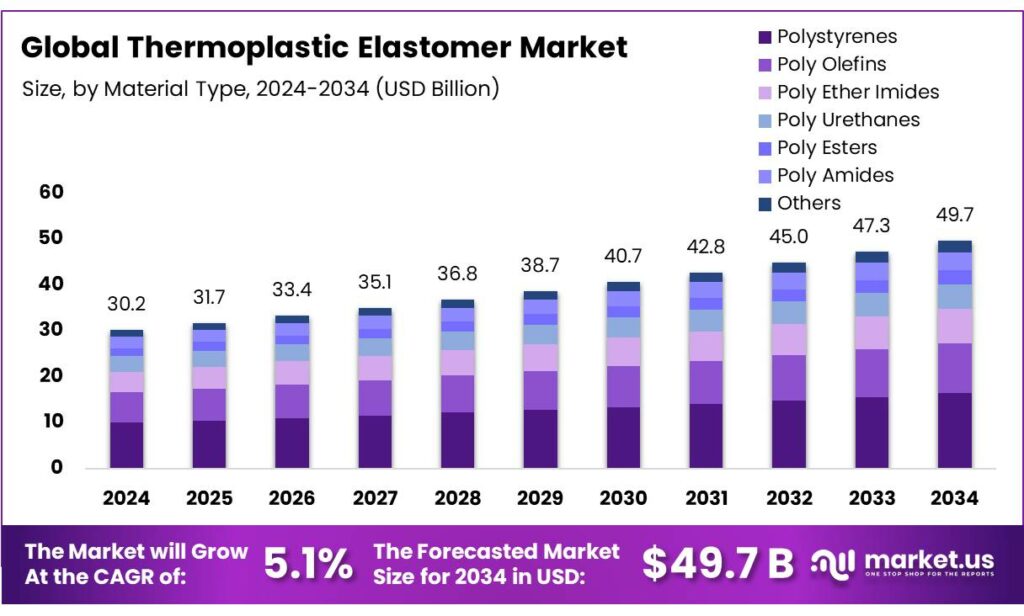

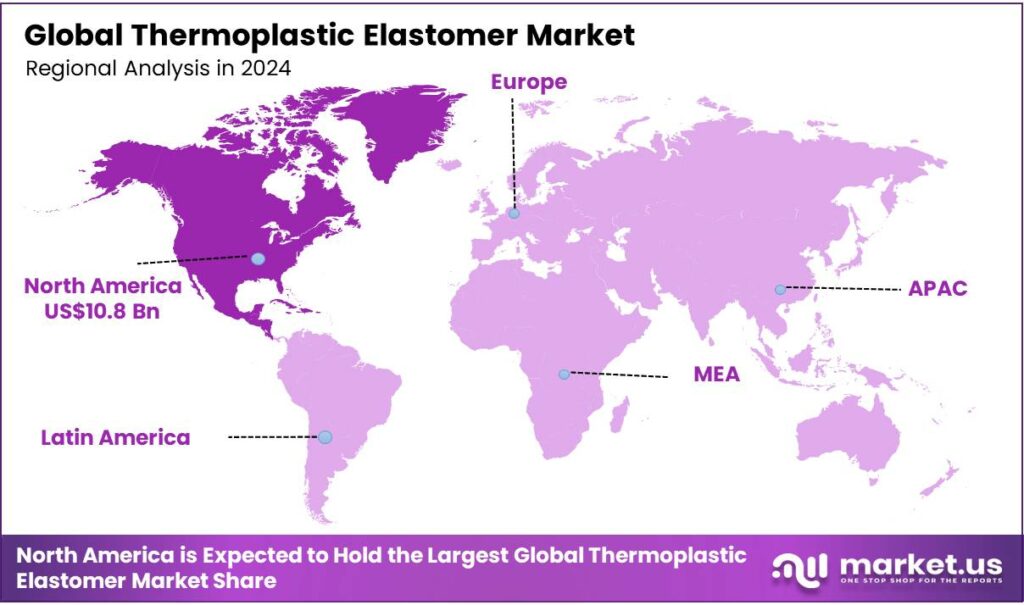

Global Thermoplastic Elastomer Market size is expected to be worth around USD 49.7 Billion by 2034, from USD 30.2 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 42.9% share, holding USD 159.5 Million in revenue.

Thermoplastic Elastomers (TPE) are a unique class of polymers that combine the high elasticity of vulcanized rubber with the efficient processability and recyclability of thermoplastics. Unlike traditional rubber, which requires a permanent chemical curing process, TPEs rely on physical cross-links that can be reversed by heat.

The thermoplastic elastomer market is characterized by its diverse applications across various industries, with the automotive sector being the largest consumer due to TPE’s lightweight, durable, and flexible properties. TPEs are increasingly used in automotive components such as seals, gaskets, and bumpers, driven by regulatory pressure for fuel efficiency and emission reductions.

Additionally, the shift towards bio-based TPEs is gaining traction as manufacturers align with environmental sustainability goals, supported by regulations such as the EU Green Deal and U.S. EPA guidelines. Beyond automotive, TPEs are making inroads in sectors such as construction, medical devices, and consumer goods, due to their versatility and recyclability.

Despite their widespread adoption, TPE producers face challenges related to environmental compliance and raw material sourcing, particularly amid geopolitical tensions that disrupt supply chains. Moreover, the market is further influenced by the rising demand for sustainable and bio-based alternatives.

Key Takeaways

- The global thermoplastic elastomer market was valued at USD 30.2 billion in 2024.

- The global thermoplastic elastomer market is projected to grow at a CAGR of 5.1% and is estimated to reach USD 49.7 billion by 2034.

- Based on the material type, polystyrene thermoplastic elastomers dominated the market, with a market share of around 33.7%.

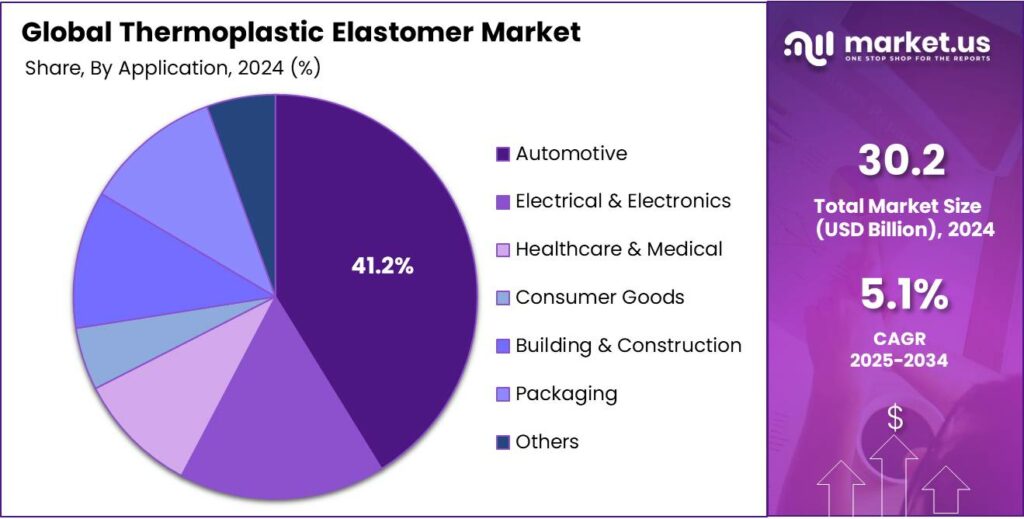

- Among the applications of thermoplastic elastomer, the automotive sector held a major share in the market, 41.2% of the market share.

- In 2024, North America was the most dominant region in the thermoplastic elastomer market, accounting for around 35.6% of the total global consumption.

Material Type Analysis

Polystyrene Thermoplastic Elastomers Held the Largest Share in the Market.

The thermoplastic elastomer market is segmented based on material type into polystyrenes, polyolefins, polyether imides, polyurethanes, polyesters, polyamides, and others. The polystyrene thermoplastic elastomers dominated the market, comprising around 33.7% of the market share, due to their balance of performance, cost-efficiency, and ease of processing. Polystyrene-based TPEs offer transparency, good processability, and a broad range of hardness, making them highly versatile for applications across various industries.

Additionally, they are more readily compatible with conventional processing methods such as injection molding and extrusion. Similarly, polystyrene TPEs exhibit better compatibility with additives and fillers, which improves their mechanical properties, such as flexibility and durability. In contrast, alternatives such as polyurethanes or polyamides may offer higher performance but are more expensive or require more complex processing, limiting their widespread adoption.

Application Analysis

The Thermoplastic Elastomers Are Mostly Utilized in the Automotive Sector.

Based on the applications of thermoplastic elastomer, the market is divided into automotive, electrical & electronics, healthcare & medical, consumer goods, building & construction, packaging, and others. The automotive sector dominated the market, with a market share of 41.2%, due to the unique demands of vehicle components, such as lightweight, durability, flexibility, and resistance to extreme temperatures and chemicals. TPEs are ideal for automotive applications as they offer superior performance in harsh environments while being cost-effective and easy to process.

Furthermore, the automotive sector’s focus on fuel efficiency and regulatory requirements for reducing emissions drives the need for lightweight materials that reduce vehicle weight, a key advantage of TPEs. While TPEs are used in other industries such as electronics and healthcare, their widespread use in automotive applications is primarily driven by the sector’s high demand for durable, versatile, and sustainable materials.

Key Market Segments:

By Material Type

- Polystyrenes

- Poly Olefins

- Poly Ether Imides

- Poly Urethanes

- Poly Esters

- Poly Amides

- Others

By Application

- Automotive

- Electrical & Electronics

- Healthcare & Medical

- Consumer Goods

- Building & Construction

- Packaging

- Others

Drivers

Rising Adoption of Thermoplastic Elastomers in the Automotive Industry Drives the Market.

The adoption of thermoplastic elastomers in the automotive industry has been rising due to their versatile properties, such as durability, flexibility, and recyclability. TPEs are increasingly replacing traditional materials like thermoset rubbers and metals in various automotive components, including seals, gaskets, bumpers, and interior parts. The shift is partly driven by regulatory pressure for lower emissions and the increasing demand for lightweight materials.

- For instance, the European Union’s regulations on vehicle weight reduction and fuel efficiency have encouraged automakers to use TPEs, which offer reduced weight without compromising on performance. Similarly, according to the U.S. Department of Energy (DOE), reducing vehicle weight by 10% can improve fuel economy by 6% to 8%.

The expansion of the automotive sector itself further drives this trend. Global vehicle production increased by 2.5% in 202 than 2023, reaching 74.6 million units, reflecting a significant demand. This has created a greater need for efficient, sustainable materials. Companies such as Ford and Volkswagen have integrated TPEs in key vehicle components, citing both cost-effectiveness and improved performance. Furthermore, the automotive industry’s push for electric vehicles (EVs) has heightened the demand for TPEs in battery packs and other critical parts.

Restraints

Environmental and Regulatory Compliance and Approvals Might Pose Challenges to the Thermoplastic Elastomer Market.

Environmental and regulatory compliance remain significant challenges for the thermoplastic elastomer market. Increasingly stringent regulations on materials’ environmental impact, particularly in the European Union and North America, require manufacturers to meet specific sustainability standards. For instance, the EU’s REACH regulation mandates the registration, evaluation, authorization, and restriction of chemicals, which applies to raw materials in TPE formulations. Compliance with these regulations necessitates costly testing and documentation processes, potentially delaying product development.

In addition, TPE production involves petrochemical-based materials, which raises concerns over carbon footprints and environmental sustainability. The European Commission’s Green Deal and other global sustainability initiatives encourage reducing reliance on fossil-based feedstocks. Companies such as BASF and Dow have announced initiatives to use renewable resources for TPE production to address these challenges. Furthermore, the approval process for new TPE materials in various automotive and consumer goods applications often requires extensive testing for performance, safety, and recyclability, adding complexity to the supply chain.

Opportunity

Application of Thermoplastic Elastomer in the Construction and Medical Industries Creates Opportunities in the Market.

The application of thermoplastic elastomers in the construction and medical industries presents a growing opportunity. In construction, TPEs are increasingly used in applications such as weatherproofing, insulation, seals, and gaskets due to their durability, flexibility, and resistance to harsh environmental conditions. The U.S. Green Building Council’s LEED certification system has driven demand for more sustainable and recyclable materials, which TPEs provide.

For instance, TPE-based sealing materials are used in energy-efficient window frames, supporting global trends toward green building standards. Similarly, in roofing, TPE-based membranes are preferred for their cool roof properties, reflecting up to 80% of solar radiation depending on the formulation. Furthermore, in the medical industry, TPEs are finding applications in devices such as catheters, surgical gloves, and drug delivery systems. Their biocompatibility, moldability, and ease of sterilization are critical attributes driving adoption.

Additionally, regulatory bodies such as the U.S. Food and Drug Administration (FDA) have approved TPEs for use in medical applications, citing their safety and performance. The increasing focus on disposable medical devices, spurred by healthcare demands in response to global health challenges, further enhances the role of TPEs in this sector.

Trends

Shift Towards Bio-Based Thermoplastic Elastomers.

The shift towards bio-based thermoplastic elastomers is gaining momentum in response to growing environmental concerns and regulatory pressures. The European Commission’s Green Deal and the Circular Economy Action Plan emphasize the need for sustainable materials, which has accelerated the adoption of bio-based alternatives. TPEs derived from renewable resources, such as bio-based polyols, are becoming increasingly common in automotive and consumer products, where traditional petrochemical-based TPEs have been dominant.

For instance, BASF indicates that bio-based TPE variants can reduce the product carbon footprint (PCF) by 40% to 50% compared to fossil-based equivalents, primarily by sequestering atmospheric carbon dioxide during feedstock growth.

In addition, the U.S. Environmental Protection Agency (EPA) supports bio-based innovations through initiatives such as the BioPreferred Program, which encourages the use of renewable materials in manufacturing. This trend reflects market demand for eco-friendly products and the regulatory push for sustainable solutions.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Thermoplastic Elastomer Market Due to Disrupted Petroleum Markets.

The geopolitical tensions, notably the conflict between Russia and Ukraine, as well as ongoing trade disputes between the U.S. and China, have had a notable impact on the thermoplastic elastomer market, particularly in terms of supply chain disruptions and material costs. The war in Ukraine has significantly disrupted global energy markets, affecting the cost and availability of feedstocks used in the production of petrochemical-based TPEs. For instance, the EU’s reliance on Russian natural gas has led to higher energy prices, increasing production costs for chemical manufacturers, including TPE producers.

Simultaneously, U.S.-China trade tensions have led to fluctuating tariffs on raw materials, which have directly impacted the price competitiveness of TPEs in various regions. The tariffs on imports of Chinese chemicals have raised costs for manufacturers relying on these materials.

Further complicating the landscape, trade sanctions and regulatory changes, such as export controls, on technology and material supplies have strained production timelines and led to stock shortages. These disruptions have created uncertainty in the raw material market, forcing manufacturers to seek alternative suppliers, sometimes resulting in delays and increased lead times for TPE products.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Thermoplastic Elastomer Market.

In 2024, North America dominated the global thermoplastic elastomer market, holding about 35.6% of the total global consumption, driven by robust demand from industries such as automotive, construction, and medical devices. The manufacturers are increasingly turning to TPEs for their lightweight, durable, and recyclable properties, particularly in automotive components such as seals and gaskets, in response to fuel efficiency and emission standards.

The region’s regulatory framework, such as the Environmental Protection Agency’s (EPA) focus on reducing emissions and promoting sustainable materials, supports the adoption of TPEs. In addition, the U.S. leads in innovations in bio-based TPE formulations, encouraged by various federal programs, which mandate the use of renewable materials in government purchasing.

Furthermore, North America benefits from a well-established supply chain infrastructure, particularly in the U.S., where proximity to major petrochemical production facilities provides consistent access to key raw materials for TPE manufacturing. These factors collectively position North America as the largest consumer of TPEs globally.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of thermoplastic elastomers focus on several strategic activities, including innovation in material formulations to meet evolving regulatory and consumer demands for sustainability and performance. Additionally, manufacturers prioritize partnerships with automotive and medical sectors, where TPEs are in high demand for their durability, flexibility, and lightweight properties.

Similarly, investment in advanced production technologies is another focus, improving efficiency and reducing production costs. Moreover, expanding geographically, particularly in emerging markets, and securing a strong local supply chain infrastructure enable manufacturers to enhance their market reach. Furthermore, customer-focused service improvements, such as tailored solutions and technical support, help build stronger relationships with key industries.

The Major Players in The Industry

- BASF SE

- Arkema

- DuPont

- Covestro AG

- China Petrochemical Corporation

- Dynasol Elastomers

- EMS-CHEMIE HOLDING AG

- Evonik Industries

- Kraton Polymers LLC

- LG Chem

- LCY Chemical Corporation

- Lubrizol Corporation

- LyondellBasell Industries

- Tosoh Corporation

- Other Key Players

Key Development

- In September 2025, with the introduction of Ultramid H33 L, BASF presented the world’s first thermoplastic polyamide with high water permeability, which is an innovative material for artificial casings, which are used for smoking and drying sausages.

- In July 2025, Arkema and its subsidiary, PI Advanced Materials, announced the introduction of a brand for their flagship high-performance polyimide product, Zenimid, in efforts to enhance the global presence of its product range across a variety of industries, including aerospace, automotive, electronics, and industrial sectors.

Report Scope

Report Features Description Market Value (2024) US$30.2 Bn Forecast Revenue (2034) US$49.7 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polystyrenes, Poly Olefins, Poly Ether Imides, Poly Urethanes, Poly Esters, Poly Amides, and Others), By Application (Automotive, Electrical & Electronics, Healthcare & Medical, Consumer Goods, Building & Construction, Packaging, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Arkema, DuPont, Covestro AG, China Petrochemical Corporation, Dynasol Elastomers, EMS-CHEMIE HOLDING AG, Evonik Industries, Kraton Polymers LLC, LG Chem, LCY Chemical Corporation, Lubrizol Corporation, LyondellBasell Industries, Tosoh Corporation, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Thermoplastic Elastomer MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Thermoplastic Elastomer MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample- BASF SE

- Arkema

- DuPont

- Covestro AG

- China Petrochemical Corporation

- Dynasol Elastomers

- EMS-CHEMIE HOLDING AG

- Evonik Industries

- Kraton Polymers LLC

- LG Chem

- LCY Chemical Corporation

- Lubrizol Corporation

- LyondellBasell Industries

- Tosoh Corporation

- Other Key Players