The US Fulvic Acid Market By Concentration (Up to 15%, 15-30%, 30-45%, and Above 45%), By Form (Solid and Liquid), By Mode Of Application (Foliar Treatment, Soil Treatment, Seed Treatment, and Others), By Crop Type (Cereals And Grains, Oilseed And Pulses, Fruits And Vegetables, Turf And Ornamentals, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174561

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

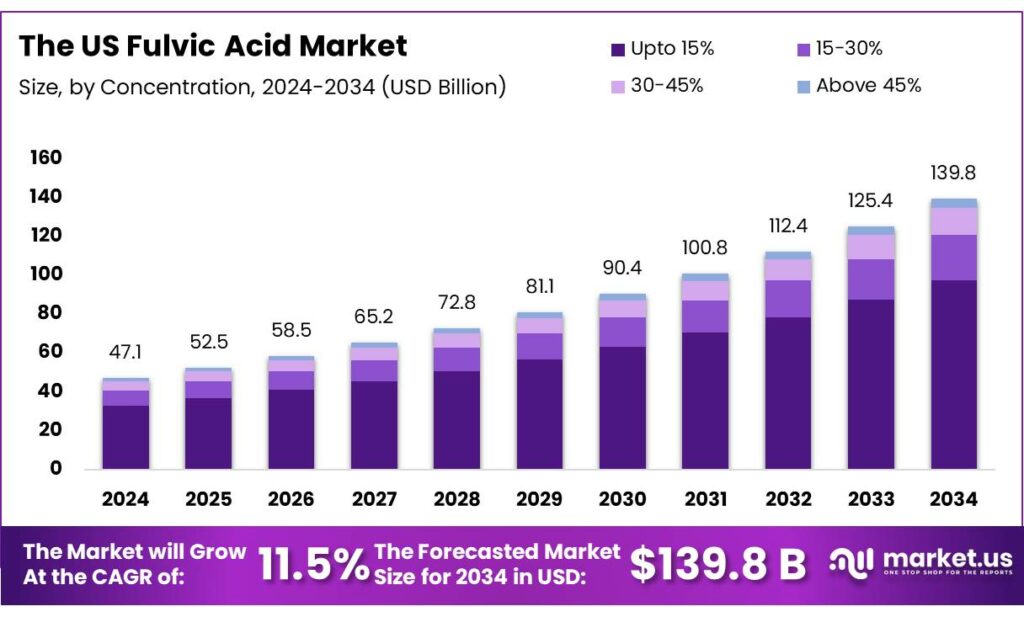

The US Fulvic Acid Market size is expected to be worth around USD 139.8 Billion by 2034, from USD 47.1 Billion in 2024, growing at a CAGR of 11.5% during the forecast period from 2025 to 2034.

Fulvic acid is a naturally occurring, highly soluble organic compound that is a component of humus, a rich, organic matter found in soil, peat, coal, and natural bodies of water. The U.S. fulvic acid market is shaped by the convergence of sustainable agriculture trends, expanding biostimulant adoption, and growing emphasis on soil health and nutrient efficiency. Rising organic and regenerative farming practices have increased demand for natural inputs that improve productivity while aligning with environmental and regulatory expectations.

- According to the US Economic Research Service, agriculture, food, and related industries contributed roughly US$1.537 trillion to the US gross domestic product (GDP) in 2023, a 5.5-percent share.

Fulvic acid is widely applied due to its ability to enhance micronutrient availability, stimulate root development, and improve crop resilience, particularly in cereals and grains, where large acreage amplifies its agronomic impact. Liquid, low-concentration formulations dominate usage, reflecting grower preferences for ease of application, compatibility with modern fertigation and foliar systems, and lower perceived risk. Foliar application remains the preferred method, offering rapid uptake and flexible, in-season management.

- Certified organic cropland grew rapidly from 2011 to 2021, and despite declines in pasture and rangeland, the number of certified organic operations increased by more than 90%, reflecting stronger institutional adoption. Similarly, organic food sales have risen across every category, climbing from an inflation-adjusted US$38.6 billion in 2012 to US$65.4 billion in 2024. Fresh fruits and vegetables, crops that are particularly responsive to soil health inputs, represent roughly one-third of total organic sales.

Market expansion is further supported by technological advances in extraction and purification that improve consistency and safety, while adoption is moderated by regulatory ambiguity, quality variability, and limited awareness among conventional growers.

Key Takeaways

- The US fulvic acid market was valued at USD 47.1 billion in 2024.

- The US fulvic acid market is projected to grow at a CAGR of 11.5% and is estimated to reach USD 139.8 billion by 2034.

- On the basis of concentration, fulvic acid of up to 15% concentration dominated the market, constituting 69.9% of the total market share.

- Based on the form, liquid fulvic acid dominated the market, with a substantial market share of around 77.3%.

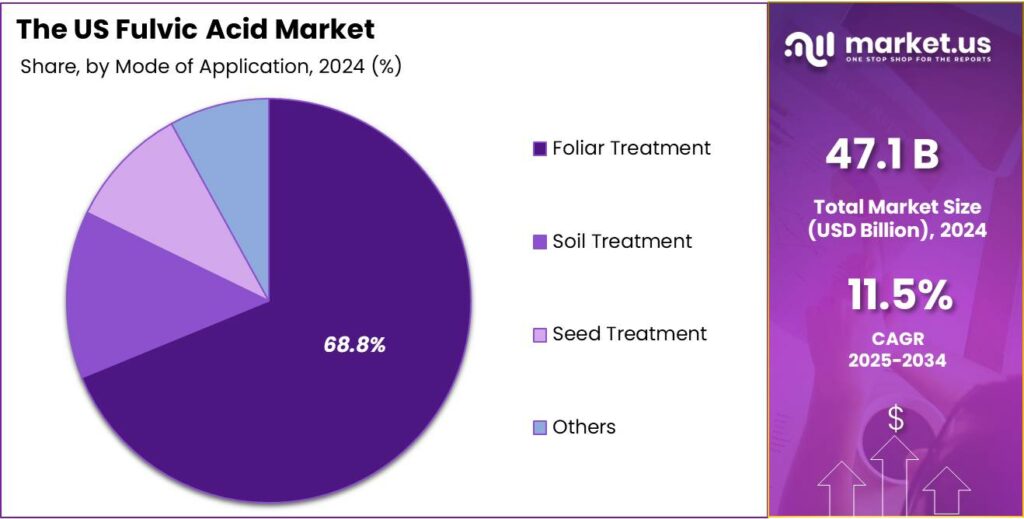

- Based on the mode of application, foliar treatment led the fulvic acid market, comprising 68.8% of the total market.

- Among the crop types, cereals & grains held a major share in the fulvic acid market, 39.5% of the market share.

Concentration Analysis

Fulvic Acid with Concentration Up to 15% is a Prominent Segment in the Market.

The fulvic acid market is segmented based on concentration into up to 15%, 15-30%, 30-45%, and above 45%. The fulvic acid with a concentration up to 15% led the market, comprising 69.9% of the market share, primarily due to practicality, cost efficiency, and ease of application across diverse farming systems. Lower-concentration products are easier to dissolve, handle, and uniformly apply through standard fertigation and foliar spray equipment, reducing the risk of clogging or phytotoxicity.

In addition, they allow more flexible dosing, enabling growers to adjust application rates based on crop stage, soil conditions, and nutrient programs. Furthermore, lower concentrations are perceived as lower risk, particularly in light of concerns about impurities in highly concentrated products. The products at or below 15% concentration are often more affordable and compatible with blended fertilizers and biostimulant formulations, making them accessible to a broader range of conventional and specialty crop growers.

Form Analysis

Liquid Fulvic Acid Dominated the Market.

On the basis of the form, the fulvic acid market is segmented into solid and liquid. The liquid fulvic acid dominated the market, comprising 77.3% of the market share, as it aligns more effectively with modern agricultural application practices and operational efficiency requirements. Liquid formulations are immediately soluble and compatible with fertigation systems, drip irrigation, and foliar spray equipment, allowing uniform distribution and rapid plant uptake without additional mixing or dissolution steps.

Additionally, it reduces labor time and application errors, which is especially important for large-scale and time-sensitive operations. Similarly, liquid products integrate seamlessly with liquid fertilizers and crop protection programs, enabling tank mixing and combined applications. In contrast, solid fulvic acid requires careful dissolution and filtration, increasing the risk of clogging and inconsistent application. Consequently, growers and distributors tend to favor liquid formulations for their reliability, convenience, and predictable field performance.

Mode of Application Analysis

Fulvic Acid Products Are Mostly Utilized through Foliar Treatment.

Based on the mode of application, the fulvic acid market is divided into foliar treatment, soil treatment, seed treatment, and others. The foliar treatment dominated the fulvic acid market, with a notable market share of 68.8%, as it delivers faster, more visible results and offers greater control over nutrient efficiency. When applied to leaves, fulvic acid is rapidly absorbed through stomata and cuticular pathways, allowing it to immediately chelate micronutrients and transport them into plant tissues. The rapid uptake is particularly valuable for correcting in-season nutrient deficiencies and mitigating abiotic stress during critical growth stages.

Additionally, it requires lower application rates than soil treatment, making it more cost-effective and reducing losses from soil fixation, leaching, or microbial degradation. In contrast to seed treatment, foliar use is more flexible, as it can be timed and repeated based on crop condition, weather, and stress events, aligning well with precision nutrient management practices.

Crop Type Analysis

Cereals & Grains Held a Major Share of the Fulvic Acid Market.

Among the crop types, 39.5% of the total US consumption of fulvic acid is for cereals and grains, primarily due to the vast acreage devoted to these crops and the strong focus on improving nutrient use efficiency at scale. Corn, wheat, and other grains are highly responsive to micronutrient availability and nitrogen efficiency, areas where fulvic acid delivers consistent agronomic benefits.

In contrast, fruits, vegetables, and ornamentals rely on more intensive, customized input programs, where fulvic acid represents a smaller incremental change. Oilseeds and pulses often receive fewer foliar applications overall, limiting integration opportunities. Additionally, cereal and grain production increasingly emphasizes soil health and resilience, positioning fulvic acid as a practical, easily integrated tool within large-scale nutrient management systems.

Key Market Segments

By Concentration

- Up to 15%

- 15-30%

- 30-45%

- Above 45%

By Form

- Solid

- Granules

- Powder

- Liquid

By Mode of Application

- Foliar Treatment

- Soil Treatment

- Seed Treatment

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Turf & Ornamentals

- Others

Drivers

Shift Towards Natural and Organic Farming Practices Drives the Fulvic Acid Market.

The shift toward natural and organic farming practices continues to strengthen demand for fulvic acid in the United States, as growers seek compliant, performance-driven inputs that support both productivity and sustainability.

- With U.S. organic food sales exceeding USD 60 billion in 2022, according to a report by the Organic Trade Association (OTA, producers are increasingly required to optimize soil health without synthetic fertilizers.

Fulvic acid has gained traction due to its documented ability to enhance nutrient uptake efficiency by up to 30-40% in certain crops, according to USDA-supported agronomic studies, thereby reducing fertilizer dependency. The fulvic acid improves root development, higher microbial biomass, and measurable yield stability under drought and salinity stress.

- According to the US Department of Agriculture (USDA), the certified organic U.S. land for growing crops or livestock increased from 1.8 million in 2000 to 4.9 million in 2021.

Furthermore, government-backed initiatives, including USDA organic transition programs and soil health grants, have further encouraged the adoption of biologically derived amendments. As fertilizer prices have risen sharply after 2022 due to geopolitical tensions, many organic and transitioning farmers view fulvic acid as a cost-effective tool that supports regenerative practices while maintaining commercial viability and long-term soil resilience.

Restraints

Adoption Barriers of Fulvic Acid Dampen the Demand for Fulvic Acid.

Adoption barriers continue to suppress fulvic acid demand in the United States by constraining scale, confidence, and cost competitiveness across agricultural segments. Additionally, regulatory ambiguity remains a central challenge, as fulvic acid products are variably classified as soil amendments or biostimulants, leading to inconsistent oversight and prolonged compliance timelines. Furthermore, government advisories highlighting instances of elevated heavy metals in poorly processed humic products have intensified scrutiny, prompting growers to favor established synthetic inputs perceived as lower risk.

Moreover, quality inconsistency further undermines adoption as it is observed that fulvic acid concentrations in commercial products can vary by more than 50% depending on raw material source and extraction method, complicating performance expectations. Similarly, cost sensitivity is significant, as high-purity fulvic acid products can be priced higher than conventional fertilizers on a per-acre basis. Limited long-term, multi-crop field trials and low awareness among conventional producers further restrict uptake, despite university research demonstrating measurable improvements in nutrient efficiency and soil microbial activity under controlled conditions.

Opportunity

Advancements in Extraction and Purification Methods for Fulvic Acid Create Opportunities in the Fulvic Acid Market.

Advancements in extraction and purification technologies are creating growth opportunities for fulvic acid adoption across U.S. agriculture by improving product reliability, safety, and agronomic performance. Producers utilizing membrane filtration and ion-exchange systems report reductions of heavy metal content by more than 70%, directly addressing regulatory and farmer concerns highlighted by federal and academic studies on humic substances.

Furthermore, a case study has revealed that higher-purity fulvic acid can improve micronutrient uptake efficiency by 25-40% compared with conventionally extracted products, particularly in high-value crops such as fruits, vegetables, and tree nuts. Additionally, improved extraction yields have increased usable fulvic acid recovery per ton of leonardite, helping stabilize supply despite finite raw material availability. Consequently, these innovations are elevating fulvic acid from a low-cost soil additive to a scientifically validated, performance-driven input within sustainable farming systems.

Trends

Growth in the Adoption of Biostimulants.

The accelerating adoption of biostimulants in U.S. agriculture is materially strengthening demand prospects for fulvic acid by normalizing biological inputs across specialty and mass crops. As biostimulants gain recognition as tools that enhance nutrient efficiency and stress tolerance, fulvic acid benefits from its long-standing use and well-documented functionality.

- Awareness regarding the acid among large-scale row-crop growers is still relatively low, estimated at 38% for corn and 28% for soybeans; however, there is a strong uptake in specialty crops. For instance, 56% of almond grower’s report awareness of biostimulants, with adoption approaching 32%.

A case study indicates yield and quality improvements of 5-15% in specialty crops such as almonds, berries, and vegetables when fulvic-acid-based biostimulants are integrated into fertigation and foliar programs. Distribution trends further support expansion, as more than four out of five U.S. agricultural input distributors now carry biostimulant products, increasing farmer exposure and trial rates. As federal agencies advance clearer definitions and evaluation pathways for plant biostimulants, regulatory risk declines, enabling fulvic acid to scale from specialty crops into row-crop systems where modest adoption delivers substantial volume growth.

Key Players Analysis

Manufacturers of fulvic acid pursue several strategic activities to strengthen their competitive position and expand market share. Investments in advanced extraction and purification technologies enable the production of higher-purity, consistent products that meet regulatory requirements and reduce heavy-metal content, enhancing credibility among growers. In addition, companies focus on product formulation innovation, creating liquid, low-concentration, and application-specific variants optimized for foliar sprays, fertigation, and blended biostimulant programs.

Similarly, strategic partnerships with distributors and input retailers expand market reach and facilitate product trials. Additionally, some manufacturers leverage proprietary extraction processes and functional fractionation to differentiate offerings, emphasizing performance reliability, safety, and alignment with organic or regenerative farming standards.

- In August 2025, as a leading producer of fulvic and humic acid raw materials, Mineral BioSciences invested in a turnkey liquid bottling line capable of handling 16 oz and 32 oz bottles, offering private-labeling opportunities.

- In May 2024, FMC announced a multi-year collaboration with AgroSpheres to develop and commercialize biological crop protection products.

The Major Players in The Industry

- Syngenta AG

- The Andersons Inc.

- United Phosphorus Ltd

- FMC Corporation

- HGS BioScience

- AgroLiquid

- Mycsa Ag, Inc

- Faust Bio-Agricultural Services, Inc. (BioAg)

- Live Earth Products, Inc.

- Mineral Logic, LLC

- Western Nutrients Corporation

- Huma, Inc.

- Humates USA

- Fulvic

- Koppert

- Other Key Players

Report Scope

Report Features Description Market Value (2024) USD 47.1 Bn Forecast Revenue (2034) USD 139.8 Bn CAGR (2025-2034) 11.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Concentration (Up to 15%, 15-30%, 30-45%, and Above 45%), By Form (Solid and Liquid), By Mode Of Application (Foliar Treatment, Soil Treatment, Seed Treatment, and Others), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Turf & Ornamentals, and Others) Competitive Landscape Syngenta AG, The Andersons Inc., United Phosphorus Ltd., FMC Corporation, HGS BioScience, AgroLiquid, Mycsa Ag, Inc., Faust Bio-Agricultural Services, Inc. (BioAg), Live Earth Products, Inc., Mineral Logic, LLC, Western Nutrients Corporation, Huma, Inc., Humates USA, Mr. Fulvic, Koppert, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Syngenta AG

- The Andersons Inc.

- United Phosphorus Ltd

- FMC Corporation

- HGS BioScience

- AgroLiquid

- Mycsa Ag, Inc

- Faust Bio-Agricultural Services, Inc. (BioAg)

- Live Earth Products, Inc.

- Mineral Logic, LLC

- Western Nutrients Corporation

- Huma, Inc.

- Humates USA

- Fulvic

- Koppert

- Other Key Players